Where to pay insurance premiums in 2018

- Individual entrepreneur on any taxation system;

- Individual entrepreneurs not conducting activities, but not deregistered;

- Individual entrepreneurs employed by another employer who pays insurance premiums for him;

- Individual entrepreneurs who received a loss at the end of the year.

Some categories of individual entrepreneurs who do not carry out activities may not pay contributions for compulsory personal insurance. These include entrepreneurs:

- Those undergoing military service;

An entrepreneur can confirm his right to be exempt from paying contributions (hereinafter referred to as the benefit) with military IDs, certificates from military commissariats, units and archival institutions.

- Caring for a child under 1.5 years of age;

Confirmation of the benefit may be the child’s birth certificate, parent’s passport, marriage or death certificate (if the child is being raised by one parent after the death of the second).

- Caring for a disabled person of the first group, a disabled child or an elderly person who has reached the age of 80;

Caring for these persons is confirmed by a decision of the social security authority, documents confirming the age of the person being cared for, as well as documents justifying the presence and duration of disability.

- Those living abroad with their spouse when sent to diplomatic missions and consular offices of the Russian Federation, permanent missions of the Russian Federation to international organizations, trade missions, etc. but for a period not exceeding five years in total.

In this case, the benefit is confirmed by a birth certificate, passport and certificates from government agencies that sent employees (spouses of individual entrepreneurs) to the specified organizations, indicating the period of joint stay.

Entrepreneurs, both with and without employees, are required to pay:

- Fixed contributions for pension and health insurance;

- Contributions from excess income over 300 thousand rubles.

As part of fixed contributions, entrepreneurs make payments for compulsory pension (OPS) and health insurance (CHI). Contributions to the Social Insurance Fund (SIF) are made at the discretion of the individual entrepreneur.

Calculation procedure and amount of fixed contributions until 2018

Until 2021, insurance premiums were calculated based on the minimum wage approved annually. In 2021, the minimum wage was 6,204 rubles, in 2021 – 7,500 rubles.

Formula for calculating contributions until 2021

For OPS: minimum wage x 26% x 12

For compulsory medical insurance: minimum wage x 5.1% x12

On OPS: 7500 x 26% x 12 = 23,400 rubles.

For compulsory medical insurance: 7500 x 5.1% x 12 = 4,590 rubles.

The total amount of insurance payments for 2021 was 27,990 rubles. or 6,997.5 rubles. quarterly.

If an individual entrepreneur is registered or deregistered in the middle of the year, then the calculation must be made based on the number of days worked. To do this, first calculate the number of days worked in the month of registration (deregistration), and then the calculation is made based on the number of whole months in which the activity was carried out.

Calculation formula for an incomplete month

Minimum wage x 26% x number of days worked in a month, including the day of registration / Number of days in a given month.

For compulsory medical insurance, contributions are calculated similarly.

Calculation example

IP Stepanov was registered on November 25, 2021.

He must calculate insurance premiums for 6 working days in November (from 25 to 30 November) and one full month (December).

For OPS – 390 rubles. (7,500 x 26% x 6:30)

For compulsory medical insurance – 76.5 rubles. (7,500 x 5.1% x 6:30)

For December, contributions will be equal to 2,332.5 rubles.

For OPS – 1,950 rubles. (7,500 x 26% x 1 (for one month - December))

For compulsory medical insurance – 382.5 rubles. (7,500 x 5.1% x 1)

The total amount of contributions for partial year 2021 will be 2,799 rubles.

Calculation procedure and amount of fixed contributions after 2018

Starting from 2021, fixed contributions are no longer tied to the minimum wage and are not calculated by entrepreneurs themselves (except for cases where an individual entrepreneur has been working for less than a full year). The amount of insurance payments in 2021 is specified in clause 1 of Art. 430 of the Tax Code of the Russian Federation and is equal to:

- For OPS – 26,545 rubles.

- For compulsory medical insurance – 5,840 rubles.

Total contributions for the year will be 32,385 rubles. or 8,096.2 rubles. quarterly.

If an individual entrepreneur works for less than a full year, then the amount of contributions is calculated based on the number of days worked.

For example, individual entrepreneur Skvortsov was registered on February 12, 2021. He must calculate contributions for 17 days of February and for 10 full months (from March to December).

In order to calculate contributions for February, it is necessary to determine the amount of contributions for 1 month.

For OPS it will be 2,212 rubles. (26,545: 12) and for compulsory medical insurance – 486.6 rubles. (5,840 : 12).

Thus, the amount of contributions for February will be equal to 1,638.4 rubles:

- For OPS – 1,343 rubles. (2,212 x 17:28)

- For compulsory medical insurance – 295.4 rubles. (486.6 x 17:28)

For 10 months, the amount of contributions will be equal to 26,986 rubles:

- For OPS – 22,120 rubles. (2,212 x 10)

- For compulsory medical insurance – 4,866 rubles. (486.6 x 10)

The total amount of insurance payments for the period from February 12 to December 31, 2021 will be 28,624.4 rubles.

Until 2021, all insurance payments were paid to extra-budgetary funds: compulsory health insurance in the Pension Fund, compulsory medical insurance in the Federal Compulsory Medical Insurance Fund and social insurance in the Social Insurance Fund. Starting from 2021, the administration of insurance premiums was transferred to the competence of the Federal Tax Service, and therefore, starting from 2021, these payments are transferred according to the details of the tax service.

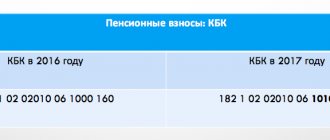

KBK for transfer of insurance payments

- OPS (both fixed and with excess income over 300 thousand rubles) – 182 1 0210

- Compulsory medical insurance – 182 1 0213 160

Please note that if these contributions are transferred using the old details of the Pension Fund, they will not reach the tax office and will “hang” in unclear payments and their clarification will be required, which will require the individual entrepreneur to personally contact the tax authority with the appropriate application.

Individual entrepreneurs who do not have hired employees do not submit any reports on insurance premiums.

Monthly report including information about insured persons. It is submitted at the end of each month to the Pension Fund by the 15th of the next month.

Submitting a report that includes incorrect or incomplete information about employees threatens the individual entrepreneur with a fine of 500 rubles. for each employee listed in this report. Also, additional liability is provided for officials of the organization - a fine in the amount of 300 to 500 rubles.

Annual reporting submitted to the Pension Fund for all employees of the individual entrepreneur and about himself as an insured. This is a new type of reporting that replaced RSV-1, which has become invalid since 2017.

The first time this document must be sent to the Pension Fund before March 1, 2021. For 2021, reporting will be required by March 1, 2021.

- Calculation of insurance premiums (to the Federal Tax Service);

The calculation of insurance premiums also replaced the outdated reports RSV-1, RSV-2, RV and 4-FSS (in the old form). It must be submitted to the Federal Tax Service at the place of registration quarterly, no later than the 30th day of the month following the reporting month.

This report has undergone significant changes in 2021 and from this period it reflects only information on injuries and occupational diseases of workers. 4-FSS must be submitted quarterly to the Social Insurance Fund on time:

- no later than the 20th day of the month, the next quarter if the report is submitted on paper;

- no later than the 25th day of the month, the next quarter if the report is submitted in electronic form.

Paying insurance premiums for your own insurance constantly causes disputes, in which entrepreneurs even reach the Supreme Court. Individual entrepreneurs consider it unfair to be obliged to make these payments if they do not conduct activities or there is no profit from it.

However, the courts see no reason to exempt such entrepreneurs from paying contributions, including when the individual entrepreneur is employed and the employer pays the contributions for him. The Ministry of Finance has also repeatedly spoken about this, for example, in one of the last letters dated 09.21.2017 No. 03-15-05/61112: “Payment of insurance premiums by individual entrepreneurs is carried out regardless of age, type of activity and the fact of receiving income from it in a specific settlement period. period".

The law contains only five situations when the calculation of insurance premiums is temporarily suspended:

- Care for a child up to one and a half years old for each child, but not more than six years in total.

- Caring for a disabled person of group 1, a disabled child, an elderly person over 80 years old.

- Military service by conscription (does not apply to contract soldiers).

- The period of residence outside the Russian Federation with a spouse who is sent to work of a diplomatic, consular, or representative nature, but not more than five years.

- The period of residence with a military spouse in areas where it was not possible to conduct activities, but not more than five years.

The mere occurrence of one of these conditions does not exempt the entrepreneur from charging contributions. During this period, business cannot actually be conducted; in addition, the lack of activity must be documented.

It remains to be said that there are no benefits for pensioners, disabled people, large families and other vulnerable social categories. Payment of insurance premiums by such entrepreneurs is carried out in full.

For the convenience of paying taxes and insurance premiums, we recommend opening a current account. Moreover, now many banks offer favorable conditions for opening and maintaining a current account.

Starting from 2021, entrepreneurs pay their own contributions to the tax office, where they are registered. The Pension Fund no longer accepts payments, although it keeps records of receipts to the account of the insured person. A receipt or payment order is issued using the details of your inspection. You can get a sample form from the Federal Tax Service itself or fill out the document using the Federal Tax Service service.

For failure to pay fees on time, penalties will have to be paid. However, such a soft sanction is allowed only if the entrepreneur correctly accrued them and reflected them in the reporting. If the base for calculating contributions was underestimated intentionally or by mistake, then this situation is interpreted as a tax offense and is punished with a fine under Article 122 of the Tax Code of the Russian Federation - from 20% to 40% of the unpaid amount.

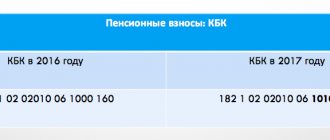

Samples of payment orders

When paying insurance premiums for employees in 2021, enter code 14 in the “Payer Status” field. Individual entrepreneurs in relation to contributions for themselves enter code 09. At the same time, in order to pay insurance premiums for January 2021, which are transferred to the Federal Tax Service, be sure to indicate the new BCC .

| Type of contributions | KBK for January 2021 |

| Pension | 182 1 0210 160 |

| Medical | 182 1 0213 160 |

| Social | 182 1 0210 160 |

As for the contributions “for injuries” that are sent to the Social Insurance Fund, the BCC for contributions for January 2021 remained the same - 39310202050071000160. We will provide samples of payment orders for each type of insurance.

Pension contributions

Medical fees

Social contributions

How to pay insurance premiums in 2018

If the income of an individual entrepreneur from the beginning of the year exceeds 300 thousand rubles. he will need to pay an additional contribution of 1% of the difference between the income received and the limit of 300 thousand rubles.

The procedure for calculating this payment in 2021 has not changed, but the maximum amount of this payment that an individual entrepreneur must pay is calculated differently.

Calculation of excess contribution in 2021

Just like fixed contributions, the maximum payment amount for income over 300 thousand rubles was calculated based on the minimum wage and amounted to 187,200 rubles in 2021. (minimum wage x 8 x 26% x 12). Regardless of how much income the individual entrepreneur received, the specified contribution amount was the maximum and the entrepreneur did not have to pay more than it.

Calculation of excess contribution in 2021

Starting from 2021, the maximum amount of contributions is calculated based on the amount prescribed in clause 1 of Art. 430 Tax Code of the Russian Federation. Thus, the maximum payment amount for income over 300 thousand rubles. in 2021 is 212,360 rubles. (26,545 x 8).

What income is taken for calculation

To calculate the amount of the contribution in excess of 300 thousand rubles. The following income is taken into account:

- STS 6% and 15% – income excluding expenses;

- UTII - income “imputed” by the state;

- PSN – potentially receivable income;

- OSNO (personal income tax) – income reduced by expenses (professional deductions).

For the last few years, individual entrepreneurs’ contributions for themselves have been calculated using this simple formula:

- for pension insurance (PPI) - minimum wage * 12 * 26%;

- for health insurance (CHI) - minimum wage *12* 5.1%.

For the calculation, the minimum wage established at the beginning of the year was taken into account, so the minimum amount of payments made by individual entrepreneurs for themselves in 2021 was 27,990 rubles: 23,400 rubles for compulsory medical insurance and 4,590 rubles for compulsory medical insurance.

The Ministry of Labor promises that by 2021 it will bring the minimum wage to the subsistence level. To do this in stages, it is necessary to raise the minimum wage to 9,489 rubles starting in January 2018. The corresponding bill has already been developed.

If we leave the current calculation formula, then each individual entrepreneur in 2018 will have to pay for himself:

- for pension insurance (PIP) - 9,489 * 12 * 26% = 29,606 rubles;

- for medical insurance (CHI) – 9,489 *12* 5.1% = 6,028 rubles.

The total is 35,634 rubles, which is 7,644 rubles more than in 2017.

At first glance, such an increase in terms of inflation does not look very significant, but just a few years ago a sharp increase in insurance payments caused a wave of massive closure of individual entrepreneurs. The number of those who were deregistered exceeded half a million people.

True, in 2013, contribution rates increased by 2.3 times compared to the previous year - from 14,386 rubles to 32,479 rubles. This time the Government decided to act more carefully and not raise rates sharply.

Insurance premiums for individual entrepreneurs must be paid in a fixed amount at any level of income and even if there is no income at all or there are losses. Taking this into account, we recommend that entrepreneurs who have no income from their activities for a long time deregister from tax registration. Later, if the situation changes for the better, the individual entrepreneur can always be opened again in just three working days.

As for the basis for calculating the additional 1% contribution to pension insurance, entrepreneurs in different taxation systems are in an unequal position.

According to Article 430 of the Tax Code, the income of an entrepreneur is determined depending on the regime:

- UTII - imputed income, calculated taking into account the basic profitability, physical indicator, coefficients K1 and K2;

- PSN – potential annual income established by regional regulations;

- STS – sales and non-sales income excluding expenses;

- OSNO - income minus business deductions;

- Unified agricultural tax - operating and non-operating income excluding expenses.

As we can see, expenses reduce the basis for calculating contributions only for OSNO, and this rule is valid for the first year after the Constitutional Court intervened in the situation.

However, in the case of the simplified tax system Income minus expenses, the position of entrepreneurs does not change, although there is already a Supreme Court Decision dated April 18, 2017 No. 304-KG16-16937. The court indicated that when calculating contributions under this regime, it is impossible to take into account all income, without expenses incurred by the entrepreneur.

Unfortunately, the Ministry of Finance and the Federal Tax Service do not give up their positions and insist on paying contributions on all income received. It is obvious that until appropriate changes are made to the Tax Code (as was done for OSNO), payers of the simplified tax system (USN) Income minus expenses cannot expect justice.

By order of Putin, the Duma adopted law No. 335-FZ of November 27, 2017 with new contribution rates from 2021:

- To the Pension Fund - 26,545 rubles. 1% on individual entrepreneur’s income over 300,000 rubles. (total payment is limited to a limit of RUB 212,360)

- In the Federal Compulsory Medical Insurance Fund - 5,840 rubles.

These are fixed contributions for the year; they are now in no way tied to the minimum wage.

One more news. The Federal Tax Service has officially announced that it is possible for entrepreneurs to return personal contributions for previous years.

Our program “Simplified 24/7” can automatically calculate individual entrepreneur contributions and put them into tax deductions. Consultation on all accounting issues is available to users 24 hours a day, 7 days a week. Go to the program and start working right now. The first year is free.

Go to the program

In 2021 payments are:

- OPS (pension contributions): RUB 26,545;

- Compulsory medical insurance (medical contributions): 5,840 rubles.

It should be borne in mind that entrepreneurs cannot apply reduced tariffs. This benefit is provided only for persons who pay benefits to other individuals - and only in relation to employee contributions, but not individual entrepreneur contributions for themselves.

According to paragraph 2 of Art. 432 of the Tax Code of the Russian Federation, a fixed amount of contributions must be paid before the end of the calendar year.

The recipient of the payment is the tax authority with which the entrepreneur is registered.

KBK in the payment document should indicate:

- 18210202140061110160 - for pension contributions;

- 18210202103081013160—for medical contributions.

If an entrepreneur decides to cease operations and deregister with the tax authority, he must pay the fees within 15 days from the date of deregistration. In this case, the amount of contributions will be adjusted in proportion to the time worked in the calendar year.

Deadline for payment of fixed individual entrepreneur contributions

The deadline for payment of fixed individual entrepreneur contributions is no later than December 31 of the current year. That is, contributions for 2021 must be paid no later than December 31, 2021.

Contributions are paid to the inspectorate at the place of registration of the individual entrepreneur.

However, the maximum amount of such contributions is limited. It cannot exceed the value: 8 x 26,545 rubles. = 212,360 rub.

Deadline for payment of 1% on individual entrepreneur income to the Pension Fund

According to paragraph 2 of Art. 432 of the Tax Code of the Russian Federation, such contributions are paid before July 1 of the year following the reporting year. That is, contributions for 2021 must be paid no later than July 1, 2021.

Contributions are paid to the inspectorate at the place of registration of individual entrepreneurs at KBK 18210202140061110160.

| Amount of additional contributions to the Pension Fund | = | Amount of income | — | 300 000 | X | 1% |

The deadline for paying additional contributions is no later than July 1, 2019.

What income to take for calculation depends on your tax system. For detailed information about this, see the table below.

How to determine income

| Tax regime | How to calculate income |

| Simplified system | Income minus expenses. When determining annual income, take into account all income in accordance with Article 346.15 of the Tax Code of the Russian Federation. That is, income from sales and non-operating income (Articles 249 and 250 of the Tax Code of the Russian Federation). There are two opinions about deducting expenses from income. 1. Individual entrepreneurs do not deduct expenses that reduce the tax base under the simplified tax system. This is stated in paragraph 14 of the review of legal positions reflected in judicial acts of the Constitutional Court of the Russian Federation and the Supreme Court of the Russian Federation, adopted in the fourth quarter of 2021 on taxation issues (the document was approved by the Federal Tax Service of Russia on January 23, 2018). Tax officials refer to the ruling of the Supreme Court of the Russian Federation dated April 18, 2017 No. 304-KG16-16937. You can take specific amounts from the Book of Income and Expenses - the line “Total for the year” in the columns Income and Expenses. 2. Individual entrepreneurs do not deduct expenses from income. The Ministry of Finance has prohibited the accounting of expenses to determine the amount of individual entrepreneur contributions on the simplified tax system, UTII and patent (on personal income tax it is possible). This follows from the letter of the financial department to the Federal Tax Service dated February 12, 2018 No. 03-15-07/8369. Please note that if you choose the second option, you will have to defend your position in court. Income. An individual entrepreneur who takes into account only income does not have the right to deduct expenses from income. That is, to calculate the tax base, you need to take only income from the Accounting Book. If an individual entrepreneur reduces this income for expenses, the tax authorities will sue. |

| Taxation system in the form of UTII | In your calculation, take the amount of imputed income for the year, and not the amount of actual income received. To find annual income, add up all quarterly amounts of imputed income. You can see the quarterly amounts on line 100 of section 2 of the UTII declaration (Article 346.29 of the Tax Code of the Russian Federation). That is, add up the amounts from all declarations |

| Patent system | To calculate this, take into account your potential annual income. You can find it in the patent for conducting a specific type of activity (Articles 346.47 and 346.51 of the Tax Code of the Russian Federation). Do not take into account your actual income. |

| Combination of modes | To calculate, add up the amounts of income for all special modes |

| General system | Entrepreneurs on the general system (pay personal income tax of 13%) must pay insurance premiums for themselves not from income, but from income minus expenses. This decision was made by the Constitutional Court in resolution No. 27-P dated November 30, 2016. It is final and not subject to appeal. This means that entrepreneurs will be able to return contributions for previous years. It follows from the laws and clarifications of the Pension Fund that income is taken without reduction for expenses. The entrepreneurs did not agree with this. After all, if, for example, a businessman earned 10 million rubles and spent 11, then he received a loss. But at the same time, he still had to pay contributions to the Pension Fund with 10 million: (10 million - 300,000) x 1% = 97,000 rubles. Now the court has ruled: the income of individual entrepreneurs is reduced by expenses. |

- retirement (PFR starts paying pension benefits);

- illness, pregnancy (FSS transfers funds according to sick leave).

The procedure for calculating and paying insurance premiums for injuries in 2021

Organizations that have employees are required to pay social security contributions for insurance against work-related injuries and occupational diseases. This type of insurance is regulated by Law No. 125-FZ of July 24, 1998 (hereinafter referred to as the Law).

Contributions for injuries are mandatory regular payments, calculated at a certain rate, taking into account possible discounts or allowances, which employers (insurers) must transfer to the Social Insurance Fund (insurer) (Article 3 of the Law).

Insurers include all Russian legal entities, foreign companies operating in the Russian Federation, and individuals who use in the course of their activities the labor of hired citizens subject to this type of insurance.

Insurance premiums for injuries in 2021 are still subordinate to the FSS. Benefits and rates have not been adjusted. In connection with the transfer of part of the powers of the FSS to tax authorities, the reporting form has changed.

What it is

The object and base for contributions for injuries are determined in accordance with Art. 20.1 of the Law. The object of taxation of contributions for injuries are payments subject to contributions that the insurer accrues to employees working for him under labor and civil law agreements. Remunerations from which contributions for injuries are not deducted are given in Art. 20.2 of the Law.

These include, in particular:

- state benefits (for unemployment, from the Social Insurance Fund and others);

- payments upon reduction or liquidation of a company;

- financial assistance in connection with emergency situations;

- compensation for work in difficult and dangerous conditions;

- payment for advanced training.

The base includes payments in kind; they are accounted for at their value on the date of issue, determined on the basis of the price specified in the contract. This also includes the amounts of VAT and excise taxes, if the product (work, service) provides for them.

Insureds have the right to pay part of their insurance premiums for the prevention of injuries and occupational diseases. This share is determined as the difference between contributions for the previous year and the amount of social security and pension benefits from the Social Insurance Fund for the same period. It cannot exceed 20% of the resulting difference.

What has changed since January 1

2021 has seen significant changes regarding insurance premiums. Some of their types are transferred under the control of the Federal Tax Service. At the same time, a pressing question arose: where to pay the fees for injuries? Contributions from work-related injuries and occupational diseases are still supervised by the Social Insurance Fund, and accordingly it is the recipient of the funds.

The following factors influence the amount of payment for injuries:

- scope of activity of the insured;

- the existence of benefits for this type of contribution;

- current injury rates.

Since this year, social insurance has been vested with a number of powers:

- control over the receipt of amounts;

- calculation of the amount of contributions to be paid;

- requiring policyholders to provide explanations for premiums.

Law No. 125-FZ was supplemented with several articles that regulate the calculation of penalties, the granting of deferments and the collection of arrears. The document contains the necessary standards for conducting desk audits and recording their results.

The legislation specifies the principle of calculating contributions to be paid, and defines the periods: settlement and reporting.

From 2021, companies have the right to reimburse the costs of workwear and personal protective equipment from injury contributions. This innovation applies only to Russian-made goods. Expenses for imported products are not financed.

Quarterly calculations for injuries in 2021 are submitted to the fund on a new form. The form was introduced by FSS Order No. 381 dated September 26, 2016.

Compared to the previous 4-FSS, the new document is smaller in volume; it does not contain information about maternity and being on sick leave.

Insurance premium rates for injuries in 2021

The contribution rate for NS and PP can vary from 0.2% to 8.5%. The greater the risk of the organization's key activities, the higher the percentage. The ratios are approved at the legislative level. There are a total of 32 tariffs, which are designed taking into account various areas of activity. They are regulated by the Law on Tariffs for Injuries No. 179-FZ dated December 22, 2005.

Selected risk classes from Article 1 of the document are reflected in the table:

| Profrisk class | Bid, % | Profrisk class | Bid, % | Profrisk class | Bid, % | Profrisk class | Bid, % |

| 1st | 0,2% | 9th | 1,0% | 17th | 2,1% | 25th | 4,5% |

| 3rd | 0,4% | 11th | 1,2% | 19th | 2,5% | 27th | 5,5% |

| 4th | 0,5% | 12th | 1,3% | 20th | 2,8% | 28th | 6,1% |

| 5th | 0,6% | 13th | 1,4% | 21st | 3,1% | 29th | 6,7% |

| 6th | 0,7% | 14th | 1,5% | 22nd | 3,4% | 30th | 7,4% |

| 8th | 0,9% | 16th | 1,9% | 24th | 4,1% | 32nd | 8,5% |

The employer can determine the risk class according to OKVED or a special classifier approved by Order of the Ministry of Labor No. 851n dated December 30, 2016. This data is in the registration documents from the FSS.

The table below shows an example of determining a tariff according to OKVED:

| Organization | Scope of work | OKVED | Risk class | Tax and payroll rate |

| Firm 1 | Making margarine | 10.42 | I2nd | 0,3 |

| Firm 2 | Production of wool fabrics | 13.20.12 | 15th | 1,7 |

| Firm 3 | Anthracite mining | 05.10.1 | 32nd | 8,5 |

In order to determine at what rate you need to calculate and pay insurance premiums for injuries in 2021, you need to confirm your OKVED for 2021.

To do this, the following documents must be submitted to the Social Insurance Fund by April 17:

- application for confirmation of key activity;

- certificate;

- explanatory note for 2021 (except for small business representatives).

If the above documents are not provided, the fund will not issue sanctions, but the tariff will be set by FSS specialists independently. This procedure is prescribed by the Ministry of Health and Social Development in Order No. 55 of January 31, 2006.

Of all the types of activities reflected in the company’s Unified State Register of Legal Entities, the one with the highest risk class is selected. This is often disadvantageous for the policyholder, so you should promptly confirm your main OKVED.

Source: https://buhuchetpro.ru/strahovye-vznosy-po-travmatizmu/

Where to pay insurance premiums in 2018

Not only companies, but also individual entrepreneurs are required to pay insurance premiums. The rules for an entrepreneur to pay insurance premiums for himself do not depend on whether he has workers or not. An individual entrepreneur is obliged to pay contributions for himself even if he has no employees (Article 430 of the Tax Code of the Russian Federation).

But the list of these contributions is limited: individual entrepreneurs’ contributions for themselves in 2021 are payments only for pension and health insurance.

An individual entrepreneur has the right not to transfer payments for maternity and illness (clause 6 of Article 430 of the Tax Code of the Russian Federation). But he has the right to do this at his own request (Article 4.5 of the Federal Law of December 29, 2006 No. 255-FZ). This will make it possible, if an insured event occurs, to receive benefits.

Individual entrepreneurs are required to make payments in any case, even if the individual entrepreneur’s status is valid, but the activity is suspended. This order has always been and is mandatory in 2021.

Table “Obligation to pay individual entrepreneur contributions for oneself in 2018”

| Types of contributions | Obligation to pay |

| Medical | Yes |

| In case of illness and maternity | At the request of the individual entrepreneur |

| Pension | Yes |

| For "trauma" | No |

To calculate insurance premiums in 2021, the same interest rate is used as before (Article 425 of the Tax Code of the Russian Federation).

- 26% – pensioners;

- 5.1% – medical;

- 2.9% – due to illness or maternity.

Contributions for 2021 must be paid no later than December 31, 2021. Individual entrepreneurs can pay the entire amount of contributions at once or transfer it in installments.

Example.

Entrepreneur A. V. Komarov decided to transfer insurance premiums in installments. That is, for the first quarter of 2021, he needs to transfer them before March 31, 2021, but since this is a day off, no later than April 2, 2021. For the second quarter of 2021, before June 30, 2021, but again This is a holiday, so no later than July 2, 2021.

If this year the entrepreneur’s organization’s income exceeded 300,000 rubles, then the terms for payment of insurance premiums are established by paragraphs. 2 p. 1 art. 419, paragraph 1, art. 423, paragraph 2 of Art. 432 of the Tax Code of the Russian Federation. He must pay the first part of the contributions, which does not depend on the amount of income for the year, no later than December 31, 2021 in the amount of 26,545 rubles. And the second part of contributions, which is calculated from the amount of income exceeding 300,000 rubles, no later than July 1, 2021 (according to Federal Law 335 of November 27, 2017)

Payment of insurance premiums is made to the inspectorate at the place of registration of the individual entrepreneur.

- Fixed insurance premiums must be paid before December 31 of the current year.

The payment procedure, frequency and size of payments do not matter.

The most convenient option for most individual entrepreneurs is to pay quarterly, reducing the tax under UTII or advance (tax) under the simplified tax system by the amount of contributions.

- Contributions from excess income over 300 thousand rubles. for 2021 must be paid by April 1

If income exceeds the established limit in 2021, contributions must be transferred to the budget no later than April 1, 2018.

Please note that in 2021 the deadline for payment of the specified payment is postponed from April 1 to July 1. Thus, for 2021, a contribution of 1% will need to be paid before July 1, 2019.

- Contributions (unlike taxes and advances) are transferred to the budget in rubles and kopecks and are not rounded.

- If an individual entrepreneur is registered (or deregistered) in the middle of the year, then contributions are calculated based on the number of days worked and full months.

- If the individual entrepreneur does not timely pay the amount of contributions for arrears, penalties are charged equal to 1/300 of the refinancing rate of the Central Bank of the Russian Federation for the first 30 days of delay and at a rate of 1/150 for non-payment, starting from the 31st day of delay.

- If an individual entrepreneur on the simplified tax system and UTII does not have employees, he can reduce the tax or advance payment by the entire amount of contributions and, if it exceeds the amount of the calculated advance payment or tax, then it is not subject to payment.

- Individual entrepreneurs on PSN cannot take into account insurance premiums, both for themselves and for employees, when calculating the cost of a patent.

- The obligation to pay contributions ceases only after the citizen is deregistered as an individual entrepreneur.

As mentioned above, for non-payment of insurance premiums, the tax authority has the right to charge a penalty in the amount of 1/300 of the refinancing rate for a delay of up to 30 days and at a rate of 1/150 for a delay of more than 31 days.

Payment of insurance premiums in 2021 is made within the following deadlines:

- fixed individual entrepreneur contributions in the amount of 32,385 rubles - no later than December 31, 2021;

- additional 1% contribution in case of exceeding the annual income limit - no later than July 1, 2021.

The amount of 32,385 rubles is contributions for the full year 2021. If an individual did not have individual entrepreneur status for the entire year, then only the months and days of the registration period are taken into account. This is indicated in Article 430 of the Tax Code of the Russian Federation.

There are no quarterly payments for contributions, so they can be paid once at the end of the year. However, we recommend that our users working on UTII and the simplified tax system pay these amounts in installments in order to be able to immediately reduce tax payments.

The table below shows the amounts of all contribution payments, as well as the due dates for their payment.

Download table

| Where to pay fees | Size per year | Payment due date |

| For pension insurance in the Federal Tax Service from the minimum wage | RUB 26,545 | 31.12.2018 |

| For medical insurance in the Federal Tax Service from the minimum wage | RUB 5,840 | 31.12.2018 |

| For pension insurance in the Pension Fund of the Russian Federation with income exceeding 300,000 rubles for 2021 | 1% of the amount of income exceeding 300,000 rubles. At the same time, the amount of all payments of individual entrepreneurs for themselves is limited to the amount of 212,360 rubles. | 01.07.2019 |

You can pay quarterly or pay the amount immediately at the end of the year. In this case, the payment from the minimum wage must be paid no later than December 31, 2021, and the payment from income must be paid no later than July 1, 2019.

Sample payment order for individual entrepreneurs with 1% income for 2021

Sample payment order for an individual entrepreneur for a fixed payment (for individual entrepreneur contributions for 2021 to the Pension Fund of the Russian Federation)

Download

Sample payment order for individual entrepreneur contributions from 1% income (to the Pension Fund) for 2021

Download

Sample payment order for individual entrepreneurs' contributions to health insurance for 2021

Download

The due dates for payment of insurance premiums in 2021 remain the same and are detailed in the table below. The main payers are budgetary organizations that calculate and pay salaries to employees.

Until the end of 2021, such payments were sent directly to the Pension Fund and Social Insurance Fund and were regulated by 212-FZ. Since January of this year, the system has changed. Now the money is transferred to the regional Federal Tax Service within the established deadlines for payment of insurance premiums (with the exception of “injuries”, which remained under the control of the FSS), and the regulating legal act is now the Tax Code of the Russian Federation, in particular, Chapter 34.

| Billing period | Deadline for payment of insurance premiums in 2021 |

| December 2017 | The deadline for transferring insurance premiums in 2021 is until 01/15/2018 |

| January 2018 | 15.02.2018 |

| February | 15.03.2018 |

| March | 04/16/2018 (15th - Sunday) |

| April | 15.05.2018 |

| May | 15.06.2018 |

| June | 07/16/2018 (15th - Sunday) |

| July | 15.08.2018 |

| August | 09/17/2018 (15th and 16th fall on weekends) |

| September | 15.10.2018 |

| October | 15.11.2018 |

| November | 12/17/2018 (15th and 16th fall on weekends) |

| December | 15.01.2019 |

For employees

As a percentage, the general rate remained at the same level – 30% of accrued wages. Of these, 22% are pension payments, 5.1% are health insurance contributions and 2.9% are social contributions.

But the limit values for reducing rates have changed:

- As soon as the employee’s annual income exceeds 1,021,000 rubles, the pension insurance rate is reduced from 22% to 10%. In 2017, this limit was lower – 876,000 rubles.

- Annual income over 815,000 rubles is not subject to contributions for temporary disability insurance at all. In 2017, the limit amount was 755,000 rubles.

Health insurance premiums are always the same and do not depend on income.

There are also contributions for accident insurance; they remain under the jurisdiction of the Social Insurance Fund and are transferred there. The rate depends on the hazard class of the work, which is assigned by the Social Insurance Fund depending on the main activity according to OKVED.

By the way, do not forget to confirm your main type of activity with the Social Insurance Fund before April 15, otherwise they will choose from your OKVED the one with the highest insurance rate, and you will have to pay exactly at this rate during the year. Even if this activity is non-core. This does not apply to individual entrepreneurs, because they do not need to confirm their main type of activity.

For yourself (for individual entrepreneurs)

Individual entrepreneurs' insurance premiums are no longer tied to the minimum wage. Now a fixed value has been set, which will be indexed every year.

In 2021, each individual entrepreneur will need to pay 32,385 rubles, of which 26,545 rubles are the pension part and 5,840 rubles are medical.

A pleasant innovation for those who are lucky enough to earn more than 300 thousand in a year. They will still need to pay 1% of the excess amount, but later - not until April 1, as before, but until July 1.

And finally, catch a life hack

Do you want to make your life easier and always keep your reports correctly and in a timely manner?

The personal tax calendar in the “My Business” service will not let you forget about any important matter. And you don’t need to remember all the dates and coefficients - insurance premiums for yourself and your employees are calculated automatically according to current rules and are taken into account when calculating taxes.

Simple, convenient, confidential.

We recommend it, we use it ourselves!

Despite the change in the controlled body for payment of insurance premiums, the filing deadlines have not changed. Reporting, as before, is submitted quarterly or monthly, depending on the type of contributions.

| 22% | Pension contributions. |

| 1% | Medical insurance. |

| 9% | Payment of insurance premiums for disability, pregnancy and childbirth. |

Separate units

Where and how does the “isolation” make contributions?

In 2021, the procedure for making contributions to the relevant authorities for separate divisions of companies has been changed. Paragraph 11 of Article 431 of the Tax Code suggests that now all such structures will independently make insurance contributions at their location. You will need to transfer funds in the same way - through the Federal Tax Service.

The letter of the Federal Tax Service dated September 14, 2016 No. BS-4-11/17201 states: organizations will be required to notify the inspectorate in advance about separate divisions empowered to make payments and issue rewards to individuals.

In addition, from 2021, “isolated companies” are no longer required to have a separate balance sheet from the enterprise in order to be able to deduct insurance premiums through the tax authorities. This condition has disappeared.

New calculation procedure

Previously, several mandatory indicators were required for calculation: the minimum wage as of January 1, the calculation period, the tariff, in other words, there was a dependence of payments on the size of the minimum wage at the beginning of the year. As the minimum wage increased, the amount of contributions required to be paid increased. For example, the fixed payment for 2021 was 27,990 rubles, of which pension payments - 23,400 rubles, medical payments - 4,590 rubles.

Federal Law No. 335-FZ dated November 27, 2017 introduced new parameters for calculating fixed insurance premiums. Namely: individual entrepreneur contributions are no longer calculated from the minimum wage. This will significantly reduce the burden on entrepreneurs. After all, by 2021 it is planned to bring the minimum wage to the subsistence level. This means that the amount of payments made by individual entrepreneurs for themselves could increase significantly. Now the Tax Code of the Russian Federation stipulates fixed amounts for individual entrepreneurs’ contributions.

If the income of your organization does not exceed 300,000 rubles, then the fixed payments of individual entrepreneurs in 2021 for themselves for compulsory pension insurance are 26,545 rubles.

If over the past year the organization’s income turns out to be more than 300,000 rubles, then in addition to the contributions indicated above, the individual entrepreneur must pay insurance premiums for pension insurance in the amount of 1% of the amount of income exceeding 300,000 rubles. In this case, the maximum amount of such contributions should not exceed the value: 8 x 26,545 rubles. = 212,360 rub.

Fixed payments of individual entrepreneurs in 2021 for themselves for compulsory health insurance - 5,840 rubles.

After the innovation in 2021, the Tax Code of the Russian Federation still contains a clause about the maximum pension payments. Officials plan to define it as an eight-fold fixed amount, taking into account indexation. But according to the plan, indexation will begin only in 2021. Therefore, the maximum in 2021 is 212,360 rubles. (RUB 26,545 x 8).

Table “Fixed payments for individual entrepreneurs 2021 – 2020”

| Types of contributions | 2018 | 2019 | 2020 |

| Medical | 5840 rub. | 6884 rub. | 8426 rub. |

| Pension | RUB 26,545 | RUB 29,354 | RUB 32,448 |

| Pension benefits over 300,000 rubles. | RUB 212,360 (26,545.00 x  | RUB 234,832 (29,354.00 x  | RUB 259,584 (32,448.00 x |

If an entrepreneur did not register from the beginning of the year or completed his activities in 2021, he does not pay the full amount of contributions, but determines it in proportion to the number of months during which he was registered. And for the first month the amount is determined in proportion to the number of days.

Calculation of insurance contributions of individual entrepreneurs to the Pension Fund of the Russian Federation and the Federal Compulsory Compulsory Medical Insurance Fund for the month

From 2021, when calculating insurance premiums for individual entrepreneurs, the size of the minimum wage does not play a role. Instead, according to Article 430 of the Tax Code of the Russian Federation, fixed contribution amounts are established for 2021, 2021 and 2021 (see table above). To find out the monthly amount, you simply need to divide these amounts by 12.

REFERENCE: until 2021, the amount of insurance premiums depended on the value of the minimum wage and the formula for calculating insurance and medical contributions of individual entrepreneurs was as follows: Pension Fund = minimum wage x 26% x 12 months. FFOMS = minimum wage x 5.1% x 12 months.

If you needed to calculate how much to pay per month to the Pension Fund and the Federal Compulsory Medical Insurance Fund until 2021, simply multiply the amount of the minimum wage approved for a certain year by 0.26 and 0.051, respectively.