Confirmation of travel expenses in 2021

There are still two mandatory travel documents for everyone:

- business trip order;

- advance report to be completed and submitted upon return.

The main document for registration of a business trip in 2021

The main administrative document, on the basis of which an employee sent on a business trip is given an advance before departure, and then all travel expenses subject to reimbursement are taken into account for tax purposes, in 2021 remains the order or instruction of the first person of the organization or the one who replaces this first person in time of absence.

An order or instruction to send an employee on a business trip must contain the following information:

- Employer's OKPO name and code.

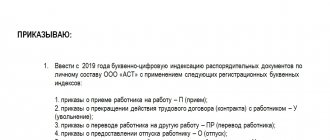

- Number, date and name (order or instruction) of the administrative document.

- FULL NAME.

Includes an explanation of the work done during the trip.

- Journal of employees going on a business trip

- serves to record employees who are going on trips; - Service note

- necessary to pay expenses if the employee uses personal transport.

See How to fill out a work assignment for a business trip, download the form.

Arranging for a business trip in 2021: step-by-step instructions

Employees who have an employment relationship with the employer can be sent on business trips

06/27/2018Russian Tax Portal

In our article we will tell you about the rules for processing business trips that are in effect in 2021. We will explain what documents need to be completed and what amount of daily allowance a company (entrepreneur – employer) is entitled to pay when sending its employee on a business trip.

Travel certificates

This type of document, such as a travel certificate, was abolished back in 2015. The obligation to draw up a job assignment, in which we previously described the purpose of the business trip, has been cancelled.

To be precise, the obligation has been cancelled, but the very right to draw up the above documents has not been canceled. Therefore, if the employer believes that he needs such a document, then he has the right to draw it up.

Daily allowance

Each company has the right to set its own daily allowance. As a rule, the conditions for issuing and the amount of daily allowance are stipulated in the collective labor agreement. But it should be remembered that, based on Article 217 of the Tax Code of the Russian Federation, the maximum amount of daily allowance on which personal income tax is not charged is:

1) for business trips in Russia – 700 rubles,

2) for foreign business trips – 2500 rubles.

As noted in paragraph 3 of Article 217 of the Tax Code of the Russian Federation, when the employer pays the taxpayer expenses for business trips both within the country and abroad, the income subject to taxation does not include daily allowances paid in accordance with the legislation of the Russian Federation, but not more than 700 rubles per day. each day you are on a business trip in the Russian Federation and no more than 2,500 rubles for each day you are on a business trip abroad.

Procedure for issuing travel allowances

Let's present the data in a table to make it easier to see...

| Business trip around Russia | Foreign business trip | |

| Reason for business trip | Written order from the head of the company | Written order from the head of the company |

| Business trip start date | Departure date that appears on the travel document | Date of the stamp about crossing the Russian border |

| End date of the trip | Date of arrival as indicated on the travel document | Date preceding the date of the stamp on crossing the Russian border |

| Daily allowance | 700 rubles | 2500 rubles |

| Documentation | Advance report, travel documents, residence documents | Advance report, travel documents, residence documents |

What is a memo and when is it needed?

As stated in paragraph 7 of the Regulations on Business Travel, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749 (as amended on July 29, 2015), in the absence of travel documents or documents for the rental of residential premises, the employee submits an official note and (or) another document about the actual duration of the employee’s stay on a business trip, containing confirmation of the party receiving the employee (organization or official) about the date of arrival (departure) of the employee to the place of business trip (from the place of business trip).

Additional compensation for foreign business trips

An employee who is sent on a business trip to the territory of a foreign state is additionally reimbursed for:

a) costs for obtaining a foreign passport, visa and other travel documents;

b) mandatory consular and airfield fees;

c) fees for the right of entry or transit of motor transport;

d) expenses for obtaining compulsory medical insurance;

e) other obligatory payments and fees.

Advance report – submission deadline

Upon returning from a business trip, the employee must submit to the employer within 3 working days:

– advance report;

– documents on the rental of residential premises;

– documents on actual travel expenses (including payment for services for issuing travel documents and providing bedding on trains) and other expenses related to the business trip.

When to return to work from a business trip?

The issue of an employee’s attendance at work on the day of departure on a business trip and on the day of arrival from a business trip is resolved by agreement with the employer.

Post:

Comments

What documents do I need to confirm business trip expenses?

The Tax Code of the Russian Federation does not establish requirements for documents confirming travel expenses. The Ministry of Finance decided to fill this gap in Letter dated 08/20/2019 N 03-03-07/63573 - in it the department referred to the position set out in its earlier Letter dated 12/18/2017 N 03-03-РЗ/84409.

Travel expenses are classified as other expenses associated with production and sales (clause 12, clause 1, article 264 of the Tax Code of the Russian Federation). At the same time, they can be taken into account in the calculation of profit if the following conditions are met (clause 1 of Article 252 of the Tax Code of the Russian Federation):

- expenses are reasonable and documented;

- justified expenses - those that are economically justified;

- expenses are confirmed by documents drawn up in accordance with Russian legislation or foreign business customs (if expenses were made abroad), or by those documents that confirm expenses indirectly: a customs declaration, a business trip order, a ticket, a report on the work done, etc.;

- expenses incurred to carry out activities aimed at generating income.

To confirm expenses, you may need not one document, but several related documents. Thus, the Ministry of Finance advises confirming the cost of air travel with an electronic ticket and boarding pass (necessarily with an inspection stamp or other details confirming boarding for the flight). If there is no coupon, it can be replaced by any document that directly or indirectly certifies the fact of the flight - for example, a certificate from the airline. At the same time, an electronic boarding pass, which has recently been used instead of a paper one when boarding an airplane, will not work (Letter dated September 23, 2019 N 03-03-06/1/72906).

Thus, the Ministry of Finance allows travel expenses to be confirmed by any supporting documents if they are drawn up in accordance with the law.

See also:

- Is it possible to take into account consulting services and travel expenses as expenses under the simplified tax system?

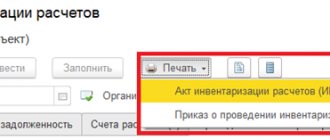

- Registration of a business trip in 1C 8.3 Accounting step by step

- Advance travel report: amenities and limitations

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

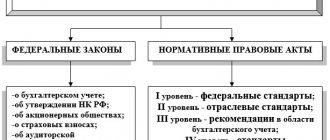

- What documents should be used to confirm expenses in accounting? Every accountant knows: any fact of economic life is subject to primary registration...

- What are the correct documents to use to formulate the cost of a trailer? Good afternoon! We purchased a metal block container BKM 8000*4800*2500/2600 mm for 489,000 rubles (with…

- The carrier transfers money to the individual entrepreneur minus the cost of his services. How and with what documents to reflect in 1C Good afternoon! The carrier, for example PeiYu, transfers to the account of the individual entrepreneur (income...

- What documents should I use to reflect the payment for an individual entrepreneur so that the income is reflected in KUDIR Hello! Tell me how to correctly account for individual entrepreneurs using the simplified tax system (income)…

Features of arranging a business trip for the General Director

There are no exceptions for the CEO. The registration of his official trip is carried out according to the general rules. Accordingly, how to report for a business trip in 2021 does not depend on the position of the person being sent.

The only difference is that an organization can establish increased daily allowances for the director of an enterprise by internal regulations, but the issue of taxation of daily allowances will not change - the entire amount in excess of the norm will be the basis for calculating personal income tax.

Features of a one-day business trip

Documenting a business trip in 2021, if it lasted only one day, has one feature related to the calculation of daily allowances.

For a one-day business trip without crossing the Russian border, daily allowances are not provided.

Regulations No. 749 “On the peculiarities of sending employees on business trips”).

Upon returning from a business trip, the employee must submit to the employer within three working days:

• advance report on the amounts spent in connection with the business trip; • final payment for the advance payment for travel expenses issued to him before leaving on a business trip (clause 26 of the Business Travel Regulations No. 749).

As part of the advance document, the employee is not required to report on daily allowances within Russia, nor on daily allowances outside the Russian Federation, nor on one-day or any other business trips. There are no supporting documents for daily allowance. The employer pays a daily allowance of x rubles, the employee spends it at his own discretion.