The insurer's expenses are an integral part of its activities. In addition to payments aimed at compensating losses of policyholders, insurance companies annually allocate their funds for other purposes. Some of the costs are mandatory and regulated by law, while others can be changed by the insurance company at its discretion.

Grouping expenses

The insurer's expenses are divided into 3 large groups, which can be classified as follows:

- Expenses for carrying out insurance activities.

- Expenses for investment activities.

- Other expenses.

Of all types of expenses of the insurer, the most significant is the article devoted to the company’s insurance activities, since it is a core area of business.

Household

The insurer's business expenses include all expenses associated with the implementation of insurance activities. The most significant of them:

- rental of premises;

- payment for technical personnel services;

- depreciation payments;

- expenses in case of unforeseen circumstances (for example, for the purchase of new equipment or repairs).

When carrying out insurance activities

The most significant type of expenses of the insurer are expenses for carrying out insurance activities. They can take up to 80% of all company expenses. Expenses associated with the provision of insurance services include funds allocated for the following purposes:

- Insurance compensation to beneficiaries. This is the main part of the insurer’s costs, which largely affects the success of the business. If the insurance company's expenses exceed the income from the sale of policies for several months, the company will go bankrupt and lose its license.

- Salaries to employees. The sale of insurance services is carried out by hundreds of agents, managers, and brokers. Each of the sellers must not only compensate for the costs of carrying out insurance activities, but also pay a decent remuneration. In addition to direct sellers, it is necessary to pay for the services of actuaries involved in calculating coefficients and tariffs.

- Contributions to reserve funds. Insurers are required to transfer part of their income to reserve accounts, which are subsequently used to fulfill obligations under insurance, coinsurance, and reinsurance contracts.

- Contributions for risks in reinsurance. Deductions are implied for companies that cooperate under a reinsurance agreement with domestic or foreign reinsurers and their representatives (brokers).

- Various rewards in the reinsurance industry, including bonuses.

- Interest on depository premiums for risks transferred to reinsurance.

- Performance by the co-insurer of its services under the contract.

- Other types of expenses provided for in Art. 294 of the Tax Code of the Russian Federation.

REFERENCE: The Central Bank closely monitors where insurers' funds are spent to implement insurance activities. Since this area is regulated by law, expenses must be reflected in the final financial statements published annually on the insurance company's website. If the actual costs of insurance activities do not correspond to those stated in the report, the Central Bank of the Russian Federation has the right to order an audit.

Investment

Investment costs can account for up to 30% of the insurer's activities. But usually they occupy no more than 10%. By law, the insurance company has the right to invest free capital in securities or other assets in order to make a profit.

The size of investment contributions depends on the success of the company. If the insurance company's profit was zero in the current period, the company will not invest funds that it does not have. This group of costs is mainly found in large, influential organizations that are among the top 20 insurance companies in Russia.

REFERENCE. Investment deductions include the services of depositories - specialists in working with securities.

Others

Other expenses of the insurer include all payments associated with insurance activities. For example, payment for the services of collectors or advertising companies, money for issuing medical certificates and policies (for compulsory medical insurance and voluntary medical insurance).

Regulatory regulation

A detailed description of the types of costs of the insurer is given in Art. 294 Tax Code of the Russian Federation. The law specifies all types of insurance expenses that arise in the course of business. In addition, in Art. 254–269 prescribe other types of costs that the organization also partially faces. These include administrative expenses of the insurer and expenses for paying taxes.

One of the mandatory costs is insurance reserves. These are funds created for the purpose of accumulating funds to meet financial obligations. Details of what they are are stated in Art. 26 of the Law of the Russian Federation of November 27, 1992 No. 4015-1.

Certain types of expenses

Let us consider in more detail certain types of expenses that are the most significant in insurance activities, since they relate directly to the Russian insurance market.

Insurance payments

One of the most significant types of costs for an insurer is insurance payments. They represent deductions to clients who have had an insured event. The amount of deductions is established for each agreement separately.

Insurance payments are used to pay off debts or fulfill obligations under existing contracts. By law, the insurer is obliged to pay clients within 10 days from the date of making a positive decision on the application for the occurrence of an insured event.

Fulfilling obligations to beneficiaries on time is important for the company: this determines the reliability of the company and affects its rating. If the insurer regularly delays compensation or refuses to pay at all after the occurrence of an insured event, clients can appeal the insurer’s decision in court. This threatens even greater damage, as well as loss of reputation.

THIS IS INTERESTING. In the Russian Federation, clients most often receive payments under MTPL, CASCO, and property insurance. In general, the MTPL market is an unprofitable area for many companies in the Russian Federation (for example, for Rosgosstrakh until 2021).

Contributions to insurance reserves

In order to fulfill obligations to clients on time, organizations are required to transfer funds to insurance reserves. But these funds can be used for more than just payments to policyholders. According to Art. 26 of the Law of the Russian Federation of November 27, 1992 No. 4015-1, funds from reserve funds can be invested, including for short-term loans.

To effectively invest reserve fund funds, insurers can engage actuaries. Their services are paid separately, and these costs are also borne by the insurer.

IT IS IMPORTANT. The amount of insurance reserves paid by the insurer is controlled by the Central Bank.

Business expenses

In the process of carrying out insurance activities, the company must constantly allocate funds not only to pay off payments under current contracts or to reserve funds, but also to pay wages to employees, purchase consumables (paper, office supplies, pay for printing costs), update equipment (computers) , office equipment). The costs of conducting insurance activities usually take up no more than 1–2% of other expenses, but they are among the mandatory expenses that the company cannot refuse.

However, the insurer has the right to reduce part of the costs of conducting the business. For example, the number of e-MTPL policies increases every year. Therefore, an insurance company that sells MTPL policies online can gradually reduce the cost of printing original forms, since clients receive copies of the contract in electronic form by email.

Co-insurance and reinsurance

Costs for coinsurance and reinsurance are found only in companies that have entered into appropriate agreements with Russian or foreign insurance companies. If an organization is a reinsurer, it periodically suffers certain losses associated with the financing of another company, which, based on the results of the current period, is not profitable (“in the red”).

This type of expense includes expenses for the transfer and receipt of funds between the parties to the transaction, as well as for the repayment of reinsurance risks. In the Russian market, these expenses apply to the most influential participants who act as reinsurers. This is no more than 2% of the number of all insurance companies in Russia.

Accounting for payments under basic agreements with policyholders

The organization makes insurance payments when insured events occur. They may relate to various areas:

- Property (payments are made in cases of theft, flooding and other damage).

- Medicine (payments in case of illness).

- Auto (payments in case of car theft).

How is accounting carried out when insuring the leased asset by the lessee (sublessee)?

Insurance payments are formed from the totality of all proceeds from people who have entered into an insurance agreement with the organization. Payments are recorded on account 22. Information about them is collected in registers. Analytical accounting is carried out in the context of agreement forms and policyholders. Information is recorded in accounting on the date of occurrence of insurance rights.

Insurance company reporting

Since the activities of insurers are open, they are required to publish their expenses on the official website. If the client does not have the opportunity to view the financial statements of the insurance company online, he can find out about them on the Central Bank website.

Insurance company reporting allows you to find out what financial position the company is in. This is important information for customers. Insurers with an unstable position often delay payments or completely unreasonably refuse to receive insurance compensation.

REFERENCE. Concealing the insurer's reporting, as well as illegally changing the real financial condition of the company, is a violation. Having caught the insurance company in such actions, you can send a complaint to the supervisory authority.

What do expenses affect?

If we consider the insurer's expenses from the perspective of the consumer (client), then the policyholder can use them to track how effectively the company fulfills its obligations to clients. If the insurer regularly refuses payments or underestimates them, or delays the transfer of funds, this indicates its unreliability, which may be associated with the poor financial position of the organization.

Tracking whether an insurer pays compensation to its customers is quite simple. To do this you should:

- Read reviews about the company on the popular portals “Banks.ru”, “Sravni.ru” or other forums dedicated to financial and insurance services in the Russian Federation. If there are a lot of negative reviews about the insurer on the website, it is likely that the company often deceives its customers.

- Analyze financial statements. Go to the company’s official website and see where and in what amount the company’s funds were spent.

- Look at the lists of insurers in the ratings of the Expert RA agency. The company regularly publishes ratings on the financial stability and reliability of insurance companies.

ADVICE. Don't have time to study reports or ratings? Go to the Central Bank website. If the insurance company is not on the list of companies deprived of a license (or under supervision/rehabilitation of the Central Bank of the Russian Federation), it means that the financial position of the insurer in the current period is quite stable.

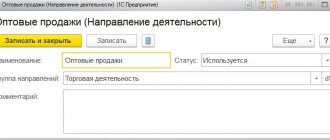

Step-by-step instruction

On April 2, a Ford Mondeo was purchased.

On April 3, the car was insured by PJSC IC Rosgosstrakh: an insurance premium of MTPL was paid in the amount of 14,820 rubles. for the period from April 4 of the current year to April 3 of the next year

Let's look at step-by-step instructions for creating an example. PDF

For the beginning of the example, see the publication:

- Purchasing OS (auto)

conclusions

The company's insurance activities involve regular expenses for various needs. Conclusions on the topic:

- All expenses of the insurer are conditionally divided into 3 groups: aimed at insurance, investment and other activities.

- Some expenses are regulated at the legislative level, the rest the company can change (increase, reduce) at its discretion.

- Monitoring the insurer's expenses will allow the client to know what financial position the company is in. If an organization fulfills its obligations to clients in a timely manner, and income exceeds expenses, then the risk of being left without payment with such an insurer is minimal.

Want to learn more about what insurer costs are? Ask questions to the portal’s duty lawyer. Consultations are free. Don’t forget about likes and reposts: share interesting news about insurance in the Russian Federation with your loved ones.

Read further about the formation and accounting of funds of insurance organizations in 2021.

Primary documents

Primary documentation is the papers on the basis of which accounting is carried out. Primary information for an insurance organization:

- Founding papers: charter, license.

- Insurance contracts.

- Papers confirming the occurrence of the event (application, insurance certificate).

- Papers confirming coverage of losses.

- Tax accounting registers.

The insurance company needs to approve the document flow schedule and document forms that are necessary for accounting needs.

the insurance premium reflected in accounting when terminating a compulsory motor liability insurance contract ?