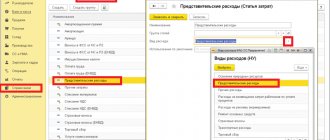

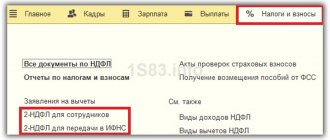

- Indirect costs in 1C

- Depreciation expenses

- Improvement of rental property

- Travel expenses

- Payment to the Plato system

- Car expenses

- Standardized expenses. Advertising expenses

- Standardized expenses. Entertainment expenses

- Software costs

- Subscription costs

- Purchasing a cooler and drinking water

- Expenses not taken into account in NU

Indirect costs in 1C

Indirect costs in 1C

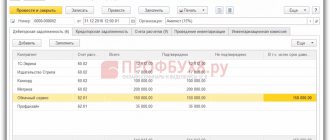

Page 040 – the total amount of indirect expenses is collected from turnover in the NU:

- Dt 90.07.1 “Sales expenses for activities with OSNO” Kt 44.01 (except for the type of expense “Transportation expenses”);

- Dt 90.08.1 “Administrative expenses for activities with OSNO” Kt 20.01, , , 44.02;

- Dt 91.02 “Other expenses” type of expense “Other indirect expenses”, “Taxes and fees”.

Page 040 – total amount of indirect costs, including breakdown of indirect costs:

- page 041 – type of expense “Taxes and fees”;

- lines 042, 043 — type of expense “Depreciation bonus”;

- pp. 052, 054 – type of expense “R&D” “R&D according to the list of the Government of the Russian Federation”.

Page 130 – Total recognized expenses (sum of direct and indirect expenses) →

Topic 10. Expenses, income and financial results of enterprises

Topic questions:

1. Costs and expenses of the enterprise.

2. Income and revenue of the enterprise.

3. Economic content, functions and types of profit of the enterprise.

4. Planning and distribution of profits.

5. Enterprise performance indicators.

The purpose and objectives of studying the topic:

disclosure of the mechanisms and types of the main financial results of the enterprise, consideration of the economic content of the categories of expenses, income and profit of the enterprise.

After studying the topic, the following knowledge should be acquired:

types of expenses, income and profit of the enterprise; composition of costs attributable to the cost of production; mechanisms for the formation and use of revenue and profit of the enterprise; main types of enterprise profitability.

When studying the topic, you need to focus on the following concepts:

expenses; cost price; income; revenue; profit; efficiency; profitability.

Theoretical material of topic 10

Depreciation expenses

Depreciable property is property worth more than 100 thousand rubles. (Article 257 of the Tax Code of the Russian Federation). Property worth less than 100 thousand rubles. is taken into account as part of material expenses (clause 3, clause 1, article 254 of the Tax Code of the Russian Federation).

From 01/01/2017, the new OKOF OK 013-2014 (SNA 2008) came into force, and changes were made to the Decree of the Government of the Russian Federation of 01/01/2002 N 1 “On the Classification of fixed assets included in depreciation groups”.

Fixed assets registered before 01/01/2017 must be reflected in accounting accounts (grouped) in accordance with the old OKOF directory - OK 013-94. The SPI does not change. OKOF OK 013-2014 (SNA 2008), as well as Government Decree dated 01/01/2002 N 1 as amended. Decrees of the Government of the Russian Federation dated July 7, 2016 N 640 apply to fixed assets registered on January 1, 2017 (Letter of the Ministry of Finance of the Russian Federation dated December 27, 2016 N 02-07-08/78243).

Improvement of rental property

We determine what improvements we make:

- separable,

- inseparable.

If the damage is not caused during the separation of the property, then the improvement is considered separable and is the property of the tenant (clause 1 of Article 623 of the Civil Code of the Russian Federation). The tenant organizes accounting for such expenses in accordance with the category the object belongs to in his accounting.

If inseparable improvements are made by the tenant in agreement with the lessor, then (clause 1 of Article 258 of the Tax Code of the Russian Federation):

- capital investments, the cost of which is reimbursed to the lessee by the lessor, are depreciated by the lessor;

- capital investments, the cost of which is not reimbursed to the lessee by the lessor, but were made with his consent, are depreciated by the lessee over the term of the lease agreement. The amount of depreciation is calculated according to the SPI, determined on the basis of the classification of fixed assets approved by the Government of the Russian Federation.

The procedure for calculating depreciation by the tenant for improvements:

- if the lease term is less than the useful life of the improvements: depreciation is accrued until the end of the lease agreement. The under-depreciated part is not taken into account for NU (Letter of the Ministry of Finance of the Russian Federation dated March 21, 2011 N 03-03-06/1/158);

- depreciation continues (Letter of the Ministry of Finance of the Russian Federation dated October 20, 2009 N 03-03-06/1/677);

If inseparable improvements are made by the tenant without the consent of the tenant, then:

- According to the Federal Tax Service, the tenant does not have the right to accept such expenses for NU (Letter of the Federal Tax Service of the Russian Federation for Moscow dated March 24, 2006 N 20-12/25161).

The gratuitous transfer of inseparable improvements at the end of the lease agreement is not subject to income tax, and the cost of the transferred property is not taken into account in expenses (clause 16 of Article 270 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated December 17, 2015 N 03-07-11/74085).

Travel expenses

Documentary confirmation of travel expenses is advance report with duly executed supporting documents attached to it (air or train tickets, hotel bill, etc.) The length of stay on a business trip for calculating daily allowance is confirmed by the dates on travel tickets or the dates indicated in the official a note and in supporting documents (waybills, invoices, receipts, cash receipts, etc.). Travel expenses are taken into account as part of other expenses (clause 12, clause 1, article 264 of the Tax Code of the Russian Federation).

Electronic tickets required documents:

- for air travel (Letters of the Ministry of Finance of the Russian Federation dated 04/06/2015 N 03-03-06/19229, dated 03/26/2014 N 02-07-10/13424): route/receipt of an electronic air ticket (cost indicated);

- boarding pass (confirms the fact of the flight);

- control coupon for an electronic ticket (extract), received in electronic form.

Official clarification posted on the website of the Federal Tax Service (Letter of the Federal Tax Service of the Russian Federation dated 02/05/2014 N ГД-4-3/1897): “additional documents confirming payment for the ticket, including an extract confirming payment by bank card, are not required.” And the Ministry of Finance of the Russian Federation, in its Letter dated 04/06/2015 N 03-03-06/2/19106, stated that in order to confirm the expenses incurred by a posted worker through a bank card, originals of all documents (ATM receipts, slips, etc.) that indicate the last name bank card holder.

When an employee is sent on a business trip for one day, per diem is not paid (clause 11 of the Regulations on the specifics of sending employees on business trips (approved by Decree of the Government of the Russian Federation of October 13, 2008 N 749). If the employee is delayed at the place of business trip for weekends, holidays or vacation, costs for return travel must be justified by operational necessity or not taken into account for NU purposes (Letters of the Ministry of Finance of the Russian Federation dated 04/30/2015 N 03-03-06/1/25283, dated 10/21/2016 N 03-03-06/3/61516).

If a remote worker travels to the office for official reasons, then it is necessary to arrange a business trip (Letter of the Ministry of Labor of the Russian Federation dated 06/09/2017 N 14–2/OOG-4733). If a remote employee returns home on the same day, there is no need to pay per diem.

Payment to the Plato system

The cost of payment to the Platon system can be taken into account on the basis of clause 49 of Art. 264 Tax Code of the Russian Federation. From 2021, paragraph 49 of Art. 246 of the Tax Code of the Russian Federation must be applied in conjunction with clause 48.21 of Art. 270 of the Tax Code of the Russian Federation (valid until December 31, 2018 inclusive), which states that when determining the tax base, expenses are not taken into account: “in the form of the amount of payment ... in the amount for which, in accordance with clause 2 of Art. 362 of this Code, the amount of transport tax calculated for the tax (reporting) period was reduced... The amount of the specified fee, not taken into account when determining the tax base at the end of the reporting periods, is determined based on the amount of advance payments for transport tax calculated by the taxpayer in accordance with Chapter 28 of this Code."

In order for the program to automatically recognize the costs of fees to the Platon system, you must:

- register the vehicle in the transport tax registration card:

- register the document Platon system operator report :

In the program, the reflection of the amount of excess payment for damage to roads in tax expenses is carried out by the routine operation Calculation of transport tax . If the law of a constituent entity of the Russian Federation on transport tax provides for advance payments, then the payment is reflected in the NU quarterly. If not provided, then the fee is taken into account in tax expenses based on the results of closing the tax period (clause 48.21 of Article 270 of the Tax Code of the Russian Federation).

An example of payment calculation for the Platon system accepted for NU purposes:

- fee accrued by the operator of the Platon system for 2021 (Dt 97.21 Kt 76.09) – 17,620 rubles;

- the amount of transport tax on a vehicle registered in the Platon system for 2021 is 6,300 rubles;

- amount included in income tax expenses for 2021 (Dt 20 Kt 97.21): 17,620 – 6,300 = 11,320 rubles.

Car expenses

To recognize expenses for fuel and lubricants, an organization must:

- Pay attention to the compliance of receipts for fuel and lubricants with the criteria of the primary document. The presence of an inscription on the check “Information check” or “Repeat document” prevents the recognition of expenses (Resolution of the Arbitration Court of the Volga-Vyatka District dated August 31, 2016 N A11-980/2015);

- Properly prepare waybills. A “non-motor transport” organization is not required to use the form approved. By Order of the Ministry of Transport of the Russian Federation dated September 18, 2008 N 152 (Letter of the Ministry of Finance of the Russian Federation dated March 6, 2013 N 03-03-06/1/6700). But the data in the waybill should give an idea of fuel consumption and confirm the production nature of the costs (Resolution of the Arbitration Court of the Volga-Vyatka District dated 08/31/2016 N A11-980/2015, Resolution of the Arbitration Court of the Ural District dated 05/16/2016 N F09-4056/16 , Resolution of the Arbitration Court of the North Caucasus District dated June 21, 2016 N F08-3498/2016).

To confirm the reality of the trip, it is important that the current mandatory details of the waybill (approved by Order of the Ministry of Transport of the Russian Federation dated September 18, 2008 N 152) are also present at the non-carrier organization:

- from February 26, 2021 The waybill must contain a note about pre-trip technical inspection. If it is not there, the traffic police will fine you, the Federal Tax Service may question the legality of the trip;

- from December 15, 2021 the waybill must contain the OGRN (OGRNIP) of the company (IP).

To recognize expenses for fuel and lubricants, an organization is recommended to:

- develop a regulation or order to approve fuel consumption standards. The Tax Code of the Russian Federation does not oblige organizations that are not involved in transportation to standardize fuel costs (Letter of the Ministry of Finance of the Russian Federation dated January 27, 2014 N 03-03-06/1/2875). Expenses for fuel and lubricants are taken into account as material expenses (clause 5, clause 1, article 254 of the Tax Code of the Russian Federation) or as other expenses, as costs for maintaining official vehicles (clause 11, clause 1, article 264 of the Tax Code of the Russian Federation);

- To confirm the validity of costs, the company has the right to use Fuel Consumption Standards, approved. Order of the Ministry of Transport of the Russian Federation dated March 14, 2008 N AM-23-r (as amended for 2021 dated July 14, 2015) or be guided by the relevant technical documentation (Letter of the Ministry of Finance of the Russian Federation dated September 4, 2007 N 03-03-06/1/640).

Standardized expenses. Advertising expenses

Advertising expenses are divided into standardized and non-standardized (clause 2 of Article 264 of the Tax Code of the Russian Federation). Non-standardized expenses include expenses that are fully included in expenses - according to a “closed” list:

- expenses for advertising events through the media (including advertisements in print, radio and television broadcasts) and telecommunication networks;

- expenses for illuminated and other outdoor advertising, including the production of advertising stands and billboards;

- expenses for participation in exhibitions, fairs, expositions, for the design of shop windows, sales exhibitions, sample rooms and showrooms, production of advertising brochures and catalogs containing information about goods sold, work performed, services provided, trademarks and service marks, and ( or) about the organization itself, for the discounting of goods that have completely or partially lost their original qualities during exhibition.

Non-standardized expenses also include:

- para. 2 clause 4 art. 264 of the Tax Code of the Russian Federation - expenses for advertising events for film and video services.

Those. expenses for the production and demonstration of advertising videos in shopping centers are not regulated in the same way, but only if you have a rental certificate issued by the Ministry of Culture of the Russian Federation. Non-standardized expenses also include the costs of creating an organization logo (Letter of the Ministry of Finance of the Russian Federation dated September 12, 2014 N 03-03-РЗ/45762).

Examples of non-standardized expenses:

- expenses for banners on social networks (clause 28, clause 1, article 264 of the Tax Code of the Russian Federation, clause 4, article 264 of the Tax Code of the Russian Federation);

- street art, provided that local authorities consider panels on the asphalt or wall to be outdoor advertising (for example, Decision of the Council of Deputies of the Shatursky Municipal District of the Moscow Region dated December 23, 2009 N 10/3).

Standardized expenses include expenses that are taken into account in the NU in an amount not exceeding 1% of sales revenue:

- expenses of the taxpayer for the purchase (production) of prizes awarded to the winners of drawings of such prizes during mass advertising campaigns;

- expenses for other types of advertising not specified as part of non-standardized expenses.

The regulatory authorities recommend that all expenses that are not listed in the closed list of “non-standardized” expenses be rationed , i.e. be taken into account within 1% of revenue.

Examples of standardized expenses:

- expenses for sending advertising SMS messages (Letter of the Ministry of Finance of the Russian Federation dated October 28, 2013 N 03-03-06/1/45479);

- expenses for advertising on receipt tape (Letter of the Ministry of Finance of the Russian Federation dated December 23, 2016 N 03-03-06/77417);

- advertising on company and employee cars.

Advertising is information disseminated in any way, in any form and using any means, addressed to an indefinite circle of people and aimed at attracting attention to the object of advertising, creating or maintaining interest in it and promoting it on the market (Federal Law of March 13, 2006 N 38 -FZ).

Direct mailing of information materials is not advertising.

In this case, the rule of “economic feasibility of expenses” applies, i.e. expenses are any expenses for activities aimed at generating income - Other expenses (clause 49, paragraph 1, article 264 of the Tax Code of the Russian Federation).

How to determine revenue to normalize advertising costs?

Income under the Tax Code of the Russian Federation is divided into:

- proceeds from sales (Article 249 of the Tax Code of the Russian Federation),

- non-operating income (Article 250 of the Tax Code of the Russian Federation).

Revenue is determined according to the rules of the Tax Code of the Russian Federation and represents the sum of all receipts associated with payments for goods sold (work, services) or property rights expressed in cash and in kind (Letter of the Ministry of Finance dated April 21, 2014 N 03-03-06/1/18216 ). Non-operating income , for example, such as interest income, should not be included in the calculation of the standard for rationing advertising costs.

Income and revenue of the enterprise

Let's consider the related concepts of “income” and “revenue”.

PBU 9/99 “Income of an organization” contains the following definition: “Income of an organization is recognized as an increase in economic benefits as a result of the receipt of assets (cash, other property) and (or) repayment of liabilities, leading to an increase in the capital of this organization, with the exception of contributions of participants (owners) property."

Tax Code of the Russian Federation: “Income is recognized as economic benefit in (monetary or in-kind form, taken into account if it is possible to assess it and to the extent that such benefit can be assessed...”).

The legislation does not make a clear distinction between income and revenue, and in economic everyday life they are often used as equivalent concepts. However, income is a more comprehensive category and includes revenue from the sale of goods, products, works and services (income from ordinary activities) and other income.

For accounting purposes, an enterprise independently recognizes receipts as “income from ordinary activities” or “other income” based on the requirements of the law, the nature of its activities, the type of income and the conditions for their receipt.

Income from ordinary activities is revenue from the sale of products and goods, receipts associated with the performance of work, provision of services (hereinafter referred to as revenue).

Operating income

are:

· receipts associated with the provision of enterprise assets for temporary use (temporary possession and use) for a fee;

· receipts related to the provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property;

· income related to participation in the authorized capitals of other enterprises (including interest and other income on securities);

· profit received by enterprises as a result of joint activities (under a simple partnership agreement);

· proceeds from the sale of fixed assets and other assets other than cash (except foreign currency), products, goods;

· interest received for the provision of funds of enterprises for use, as well as interest for the use by banks of funds held in the accounts of enterprises in these banks.

Vnereal

ization incomes are:

· fines, penalties, penalties for violation of contract terms;

· assets received free of charge, including under a gift agreement;

· proceeds to compensate for losses caused to enterprises;

· profit of previous years identified in the reporting year;

· amounts of accounts payable and depositors for which the statute of limitations has expired;

· exchange differences;

· the amount of revaluation of assets (except for non-current assets).

Revenue from sales of products (works, services) is determined by two methods:

· accruals (as shipped);

· payment (upon receipt of cash or other funds).

The choice of accounting method is made by the enterprise independently in accordance with its accounting policies.

There are two methods for determining planned revenue.

Direct counting method

based on guaranteed demand. It is assumed that the entire volume of production is accounted for by a pre-issued batch of orders. This is the most reliable method of revenue planning, when the production plan and sales volume are linked in advance to consumer demand, the required assortment and production structure are known, and appropriate prices are set.

Calculation method

– a method based on the volume of products sold, adjusted for input and output balances.

When planning balances of finished products at the beginning of the planning period, the expected balances of unsold products are taken into account. Their value in sales prices is determined using a conversion factor, which is equal to the quotient of dividing the volume of production in prices of the reporting period by the production cost of production for this period.

The proceeds received into the accounts of the enterprise are used primarily to pay bills from suppliers of raw materials, supplies, purchased semi-finished products, components, spare parts for repairs, fuel, and energy. From the proceeds, wages are paid, depreciation of fixed assets is compensated, and the profit of the enterprise is formed.

Standardized expenses. Entertainment expenses

Entertainment expenses include (clause 2 of Article 264 of the Tax Code of the Russian Federation):

- Expenses for an official reception (breakfast, lunch or other similar event). The location of the reception does not matter;

- Service costs (transportation, catering during negotiations, payment for translators) for representatives of other organizations participating in negotiations in order to establish and maintain cooperation, participants who arrived at meetings of the board of directors and other management. The Ministry of Finance allowed to accept individuals (Letter of the Ministry of Finance of the Russian Federation dated 06/03/2013 N 03−03−06/2/20149).

Expenses for organizing entertainment, recreation, prevention or treatment of diseases are not included in entertainment expenses.

Costs for the buffet, the ship and the artists are not taken into account in entertainment expenses (Letter of the Ministry of Finance of the Russian Federation dated December 1, 2011 N 03-03-06/1/796).

How much are hospitality expenses taken into account for NU?

Representation expenses for NU purposes are taken into account in an amount not exceeding 4% of labor costs for the reporting period. To recognize entertainment expenses in NU, they must be:

- economically justified (signing contracts, attracting new customers, increasing sales volume (Resolution of the Federal Antimonopoly Service of the Ural District dated January 19, 2012 N F09-9140/11);

- documented;

- were taken into account in expenses according to the standard (4%).

Previously, the Federal Tax Service required the following documents to be completed to confirm entertainment expenses (Letter of the Ministry of Finance of the Russian Federation dated March 22, 2010 N 03-03-06/4/26):

- Order on organizing the event;

- Estimate for the event;

- Report on the event;

- Primary documents confirming expenses.

Chapter 25 of the Tax Code of the Russian Federation does not establish a specific list of documents confirming entertainment expenses.

Now the list of documents for confirming entertainment expenses has been reduced (Letter of the Ministry of Finance of the Russian Federation dated 04/10/2014 N 03−03−РЗ/16288, Letter of the Federal Tax Service of the Russian Federation dated 05/08/2014 N ГД-4-3/8852.) A supporting document can be a report on entertainment expenses , approved by the head of the organization. Moreover, all expenses listed in the report must be confirmed by relevant primary documents. It is safer in the report information about the event, date, place, its purpose, representatives of the parties, results achieved as a result of the reception, etc.

An example of calculating the amount of standardized entertainment expenses included in expenses for NU:

Planning and distribution of profits

The object of distribution is the balance sheet profit

enterprises. The distribution of profits is legally regulated in that part of it that goes to budgets of different levels in the form of taxes and other obligatory payments. Determining the directions for spending the profit remaining at the disposal of the enterprise, the structure of the items of its use is within the competence of the enterprise.

At the enterprise, net profit

, i.e., the profit remaining at the disposal of the enterprise after paying taxes and other obligatory payments. The distribution of net profit reflects the process of forming enterprise funds to finance the needs of production and development of the social sphere.

The procedure for the distribution and use of profits at the enterprise is fixed in the enterprise's charter and is determined by regulations, which are developed by the relevant departments of economic services and approved by the governing body of the enterprise. In accordance with the charter, enterprises draw up cost estimates financed from the frequent profits remaining after settlements with the owners.

Reserve for increasing balance sheet profit,

maybe profit received from the sale of fixed assets and other property of the enterprise.

Planned

profit separately by type:

· from the sale of commercial products,

· from the sale of other non-commodity products and services,

· from the sale of fixed assets and other property,

· from non-operating income and expenses.

Let's consider the main ways of planning profit from the sale of commercial products. The main ones are the direct counting method and the analytical method.

Direct counting method

common and most accurate. It is used, as a rule, with a small range of products. Its essence lies in the fact that profit is calculated as the difference between the proceeds from the sale of products at appropriate prices and its full cost minus VAT, excise taxes and sales tax.

The calculation of profit is preceded by determining the output of comparable and incomparable commercial products in the planning year at full cost and in prices, as well as the balance of finished products in the warehouse and goods shipped at the beginning and end of the planning year.

Calculating profit using the direct counting method is simple and accessible. However, it does not allow us to identify the influence of individual factors on the planned profit and, with a large range of products, is very labor-intensive.

Analytical method

Profit planning is used for a large range of products, as well as as an addition to the direct method for the purpose of its verification and control. The advantage of this method is that it allows you to determine the influence of individual factors on planned profit. With the analytical method, profit is determined not for each type of product produced in the coming year, but for all comparable products as a whole.

Calculating profit using the analytical method consists of three successive stages:

1. Determination of basic profitability as the quotient of dividing the expected profit for the reporting year by the full cost of comparable commercial products for the same period;

2. Calculation of the volume of marketable products in the planning period at the cost of the reporting year and determination of profit on marketable products based on basic profitability;

3. Taking into account the influence of various factors on the planned profit: reducing (increasing) the cost of comparable products, improving their quality and grade, changing the range, prices, etc.

With this method, profit on incomparable products is determined separately (usually using the direct calculation method).

Profit from other sales (products and services of subsidiary farming, non-industrial services, etc.) is planned using the direct accounting method. If the share of these products is insignificant, profit from sales is determined based on its planned volume in the planned year and the profitability of the previous year.

Profit (loss) from traditional items of non-operating income and expenses (fines, penalties, penalties, etc.) is determined, as a rule, based on the experience of past years. As for such items as income from equity participation in the activities of other enterprises, from leasing property, dividends, interest on shares, bonds and other securities owned by the enterprise, they are planned depending on forecasts in the development of the business activity of this enterprise.

Software costs

Expenses associated with the acquisition of the right to use computer programs and databases under agreements with the copyright holder are classified as Other expenses (clause 26, clause 1, article 264 of the Tax Code of the Russian Federation).

Options for accounting for software costs:

- The period of use is specified in the license agreement - expenses are taken into account evenly during this period (Letter of the Ministry of Finance of the Russian Federation dated 08/31/2012 N 03-03-06/2/95);

- Expiration date unknown:

Dangerous : the write-off can be carried out at a time - previously the Ministry of Finance gave such clarifications (Letter of the Ministry of Finance of the Russian Federation dated 06/07/2011 N 03-03-06/1/330, N 03-03-06/1/331).

Neutral : independently determine the period for straight-line write-off (Letter of the Ministry of Finance of the Russian Federation dated March 18, 2014 N 03-03-06/1/11743, dated September 10, 2012 N 03-03-06/1/476).

Safe : write-off must be done within 5 years, because According to the Civil Code of the Russian Federation, it is considered that the contract is concluded for 5 years (in paragraph 4 of Article 1235 of the Civil Code of the Russian Federation) (Letter of the Ministry of Finance of the Russian Federation dated April 23, 2013 N 03-03-06/1/14039). The Federal Tax Service adheres to this position.

Expenses of several reporting periods

Article 272 of the Tax Code of the Russian Federation states: costs are recognized in the period in which they arose, but taking into account the terms of contracts and according to the principle of uniform formation of the income and expenditure parts of the enterprise.

For example, if a company uses funds that, according to the agreement, will be allocated to several periods of time, taxable income is reduced accordingly in proportion to these periods.

These conditions may apply to rent paid in advance for the following year. A striking example is insurance, where under a one-year contract the amount is paid one-time, and the costs are written off evenly over 12 months. This also includes licensing costs.

So we have looked at what can be called "expenses" in the sense applicable to taxation.

Become an author

Become an expert

Purchasing a cooler and drinking water

The employer is obliged to provide sanitary services for the employee in accordance with labor protection requirements (Article 223 of the Labor Code of the Russian Federation). One of such measures is the acquisition of drinking water installations (clause 18 of Order of the Ministry of Health and Social Development dated March 1, 2012 N 181n). Other expenses include, in particular, expenses for ensuring normal working conditions and safety measures required by law. Consequently, the costs of purchasing clean drinking water, as well as the costs of purchasing and installing coolers can be classified as other expenses (clause 7, clause 1, article 264 of the Tax Code of the Russian Federation) (Letter of the Ministry of Finance of the Russian Federation dated November 16, 2015 N 03-03-06 /1/65965, Letter of the Federal Tax Service of the Russian Federation for Moscow dated July 31, 2012 N 16-15/ [email protected] ).

Expenses for sports, fitness

The employer is obliged to finance measures to improve working conditions and safety and allocate at least 0.2% of the amount of costs for the production of products (works, services) (Article 226 of the Labor Code of the Russian Federation). One of these measures is the cost of developing physical education and sports in the workforce (clause 32 of Order of the Ministry of Health and Social Development dated March 1, 2012 N 181n).

Costs for paying for classes in sports sections, clubs or clubs, visits to cultural, entertainment or physical education (sports) events are considered expenses not taken into account for profit tax purposes (clause 29 of Article 270 of the Tax Code of the Russian Federation).

Costs for fitness and sports are also not taken into account as part of labor costs (Letters of the Ministry of Finance of the Russian Federation dated 03/15/2012 N 03-03-06/1/130, dated 02/16/2012 N 03-03-06/4/8).

Economic content, functions and types of profit of an enterprise

Profit

as an economic category characterizes the financial result of an enterprise’s entrepreneurial activity. Profit is an indicator that most fully reflects production efficiency, the volume and quality of products produced, the state of labor productivity, and the level of cost. At the same time, profit has a stimulating effect on strengthening commercial calculations and intensifying production.

Profit is one of the main financial indicators of the plan and assessment of the economic activity of an enterprise. The profits finance activities for scientific, technical and socio-economic development and increase the wage fund.

From an economic point of view, profit is the difference between the total amount of income and the costs of production and sales of products, taking into account losses from various business operations.

Profit, as the most important category of market relations, performs certain functions.

1. Profit characterizes the economic effect

, obtained as a result of the activities of the enterprise. The meaning of profit is that it reflects the final financial result. To identify the final financial result, it is necessary to compare the cost of the volume of products sold and the cost of expenses and resources used in production.

2. Profit is stimulating

function. Its content is that profit is both a financial result and the main element of the financial resources of an enterprise. The share of net profit remaining at the disposal of the enterprise after paying taxes and other obligatory payments must be sufficient to finance the expansion of production activities, scientific, technical and social development of the enterprise, and material incentives for employees.

3. Profit is one of the sources of budget formation

different levels. It goes to budgets in the form of taxes and, along with other revenues, is used to finance the satisfaction of joint social needs, to ensure that the state fulfills its functions, and state investment, production, scientific, technical and social programs.

The following types of profit

:

· gross profit;

· profit from sales of products (works, services);

· profit from non-operating operations;

· balance sheet profit;

· net profit.

Gross profit

- this is the total amount of profit from all types of financial and economic activities of the enterprise. Gross profit includes the amount of profit from the sale of marketable products (works, services), fixed assets and other property, income from non-sales operations, reduced by the amount of expenses for these non-sales operations. In other words, gross profit is the amount of revenue from the sale of marketable products minus taxes and other obligatory payments (the amount of net revenue), reduced by the amount of the cost of products sold. The main part of gross profit is profit from sales of products.

Profit from product sales

(works, services) is defined as the difference between the amount of net revenue (i.e., revenue minus taxes) from the sale of products (works, services) and the costs of production and sales included in the cost of products sold (works, services).

Balance sheet profit

is interpreted as the final financial result identified for the reporting period on the basis of accounting of all financial and economic operations of the enterprise and the assessment of balance sheet items.

Balance sheet profit consists of:

· profit from sales of products (works, services);

· profit from the sale of fixed assets and other property of the enterprise;

· non-operating operations.

Net profit

– this is the profit that is formed after paying taxes and other obligatory payments (fees) from the balance sheet profit. The net profit remains at the disposal of the enterprise and is used for the development of production and the formation of the enterprise's cash funds.

In the financial statements, the final financial result of the reporting period is reflected as retained earnings.

Taxable income

– the amount of profit on which tax is paid. It is determined in accordance with the rules established by the Tax Code of the Russian Federation. For Russian organizations, taxable profit is the income received, reduced by the amount of expenses incurred, determined in accordance with Chapter. 25 Tax Code of the Russian Federation

Income taken into account when forming taxable profit includes income from the sale of products (work, services), non-operating income, proceeds from the sale of fixed assets and other property, income from leasing property, in the form of a balance of penalties for violations of contractual obligations, etc. .

Expenses not taken into account in NU

Expenses not taken into account for tax purposes are listed in Art. 270 Tax Code of the Russian Federation. Example: Penalties, fines and other sanctions transferred to the budget, to state extra-budgetary funds.

Also, the expenses do not include economically unjustified and undocumented expenses.

The Ministry of Finance of the Russian Federation clarified that the cost of purchasing food products for employees of an organization (tea, coffee, sugar, etc.), provided free of charge without identifying employees, cannot reduce the tax base for corporate income tax (Letter of the Ministry of Finance of the Russian Federation dated June 11, 2015 N 03-07-11/33827). In paragraphs 29 Art. 270 of the Tax Code of the Russian Federation, expenses not taken into account for tax purposes include expenses for payment for goods for personal consumption of employees, as well as other similar expenses made for the benefit of employees.

Previously, the Ministry of Finance of the Russian Federation had a different point of view and indicated that: “the cost of food provided to employees of an organization can be taken into account when determining the tax base for income tax as part of labor costs, provided that such food is provided for labor and (or) collective agreement" (Letter of the Ministry of Finance of the Russian Federation dated March 6, 2015 N 03-07-11/12142).

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Sheet 02 Appendix 2. Direct and indirect expenses in the income tax return 2021 You do not have access to view. To gain access: Complete...

- Sheet 02 Appendix 2. Non-operating expenses in the income tax return You do not have access to view. To gain access: Complete...

- In the income tax return, expenses are not divided into direct and indirect in 1C Grain Loader Company. Basic cost accounting (in the BP accounting policy...

- Sheet 2 Appendix 4 of the income tax return is not filled in. Good afternoon! We have made a loss since 2021, in...

Direct and indirect costs

Guided by Article 318 of the Tax Code of the Russian Federation, all costs associated with sales or production are conventionally divided into indirect and direct.

Indirect expenses incurred during the tax period can be included in full. As for direct expenses, they are considered as expenses for tax authorities (with the exception of those that fall on the remains of products and production not yet completed).

Taking into account the peculiarities of some manufacturing enterprises, for accounting purposes, expenses are included in the cost of production, while for tax purposes they will be recognized as indirect.