Templates and forms An advance report for a business trip is a special document in which an employee who received funds in advance reports on their use. In this article we will look at the procedure in force in 2021 and a current example of how to prepare an advance report for a business trip. September 14, 2019 Evdokimova Natalya

If an employee of an organization is given accountable funds, then after a certain period of time the specialist is obliged to report how and for what purposes he spent the allocated advance. Basically, money is given to employees when they are sent on business trips.

So, in accordance with Art. 168 of the Labor Code of the Russian Federation, the employer is obliged to pay:

- Travel expenses.

- Housing rental costs.

- Per diems or expenses that compensate for the inconveniences associated with an employee living outside his place of residence.

- Other expenses that are made with the approval of the company management.

Please note that the company sets its own standards for payment of travel expenses. Read in detail about all the intricacies of the situation in the article “How to properly pay for a business trip in 2019.”

Therefore, the employee must report on how he spent the travel money. Moreover, for reporting you will have to fill out a special form: advance report for business trip 2019 (JSC).

Document form

A non-profit organization, like representatives of the commercial sphere, has the right to develop a reporting form for advances received independently. State employees are recommended to use unified forms, which are presented in instruction No. 52n.

Thus, the advance report form for a business trip has OKUD code 0504505. It was adjusted in 2015. The current form of the expense report is a two-sided form.

The front side reflects information about the institution, the seconded employee, his full name. and positions.

Also on the front side is the amount that the employee received as a report, how much he spent and what balance is listed as of the reporting date.

The reverse side of the expense report is filled with information about the supporting documents provided, as well as information about the accounting entries that were reflected in the accounting.

Current form

Download

Filling out the front part

Before presenting a ready-made sample of how to fill out an advance report for a business trip, we will analyze the current algorithm for filling out the document. So, let's start with the front side of the form:

- The header of the document (upper right corner) is filled out at the very last moment, only after the advance report for the business trip has been approved, the transactions have been registered in accounting and the document has been checked by the chief accountant. Therefore, do not fill out the AO header.

- We indicate the number and date of the document itself. Then we write down the name of the institution (let’s say an abbreviated version), indicate the TIN, and fill in the registration codes of the organization in the table on the right. Now we register the structural unit and full name. an employee who was sent on a business trip. We indicate the position of the employee and the purpose of the advance. In our case, “travel expenses”.

- Let's fill out the table. We indicate how much money the employee received in advance, how much he spent, and what the balance is. Accounting records (entries) are filled out by a representative of the institution's accounting service.

- The remaining lines and columns must be filled in by the relevant accounting specialists. The head of the structural unit must confirm the feasibility of the costs incurred.

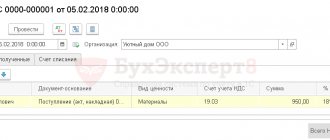

An example of filling out an advance report for a business trip (front side):

Filling out the back part

Let's move on to filling out the back of the document:

- In the table, columns 1-6 should be filled in one by one. Here list all documents confirming the purpose and expediency of the costs incurred. In column 4, describe which document (check, order, receipt) became the basis for the expenses.

Please attach all documents that confirm expenses incurred on a business trip to the advance report. Otherwise, the expenses will be considered unconfirmed, and therefore the money will have to be returned.

- Cross out the empty lines as required when preparing accounting documentation (shown in the figure).

- Summarize the results in the bottom section of the table.

- Columns 7-10 are filled out by the accountant responsible for recording settlements with accountable persons.

- The accuracy of the specified information at the bottom of the reverse side of the JSC is confirmed by the accountable person, that is, the seconded employee.

After making accounting entries, the document is checked by the chief accountant and only after control is submitted for approval to the head of the institution. The approved JSC, together with supporting documentation, is filed with similar reports and stored in the organization’s archives.

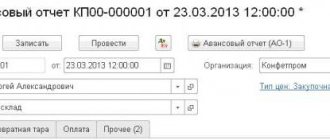

A ready-made sample of filling out an advance report for a business trip will look like this:

Download the completed sample

Download

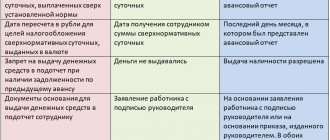

Important information about deadlines

Money in the morning, chairs in the evening

The principle that was practiced by the hero of the film “12 Chairs” also applies to the expense report. Judging by clause 6.3 of Directive No. 3210-U and clause 10 of the “Regulations...” you first need to give the money to the employee so that he can then account for it. But Article 168 of the Labor Code of the Russian Federation talks about reimbursement of travel expenses (which can be considered as compensation without prior issuance of funds). It is recommended that local regulations provide for the possibility of compensation, since the law does not clearly regulate this point.

To receive money, you need to submit an application indicating the amount and period for which they are issued, or obtain an order from the manager (another person with authority) for such a payment.

Important! If the transfer is made to a personal bank card, then you should obtain the consent of the accountable person for such an operation. For example, when submitting an application for salary transfer, include in the text the phrase: “I ask you to transfer wages and other income, as well as accountable funds to my bank card.”

How to fill out an advance report: instructions and sample filling

An advance report confirms business expenses in tax accounting. The accountant and accountant must fill out the document correctly so that companies do not charge additional taxes.

September 18, 2021 23339

An advance report confirms business expenses in accounting and tax accounting. It is important to draw up the document correctly and support the data in it with checks and invoices so that the tax office does not have questions or reasons to charge additional taxes.

An advance report is a primary document that confirms the amounts of money spent by accountable persons. Accountable employees are employees who received money for business needs from the employer. They draw up an advance report.

Employees receive cash for business trips, the purchase of office supplies, fuels and lubricants, payment for services of third-party companies, and other things. Such money can only be spent on the purposes for which it was received. If there is any money left, it must be returned to the cashier.

So, the employee returns the balance and reports on the amounts spent. And the accountant checks the expense report and fills in the remaining lines.

The advance report is drawn up in one copy, and is filled out by the accountable person and the company’s accountant. How to properly conduct advance reports in 2019–2020 is described in the order of conducting cash transactions. We have collected report formatting rules for accountants who work with them.

Rule #1:

The company independently establishes the form of the advance report. This may be a unified or original form; the manager approves it by order to the accounting policy.

As a basis for the form, you can take the unified form No. AO-1, add the necessary lines and secure a convenient version of the form in the accounting policy.

Important: the form must contain the details required for primary registration; they are listed in Part 2 of Law No. 402-FZ.

Rule #2:

the manager approves the period after which the employee must report on the advance. When the deadline expires, the employee must submit the report to the accounting department within three working days or after returning to work. When purchasing goods for an organization in cash, you also need to prepare documents that will justify expenses and VAT deductions.

Rule #3:

The manager sets the period within which the accountant must check the expense report. Then the chief accountant, accountant, and in their absence, the manager himself approves the report and makes the final calculation on it.

Rule #4:

The accountant signs the report from the head and chief accountant of the organization. Without these signatures, the document is invalid, which means the company will not be able to accept the amounts from such a report for tax accounting.

You can simplify the preparation of reports by setting up electronic document flow. This is especially true if employees work in one department, and the accounting department works in another. We'll tell you why now.

To the accountant.

On the front side of the document indicate the name of the organization or full name of the entrepreneur and division. The employee enters his full name, position and personnel number, as well as the purpose of the advance.

The column “Purpose of advance payment” must be filled in, but without details. It is enough to indicate the category of expenses: travel expenses, purchase of consumables for office equipment, entertainment expenses.

On the reverse side, in columns 2 to 4, the employee lists in chronological order the details of documents confirming expenses, and in column 5 indicates the amount of expenses.

Expenses are confirmed by: cash and sales receipts, invoices, cash receipt orders, transport documents (travel tickets, coupons), and other similar documents. The employee must attach them to the report, otherwise the company will not be able to reflect the expenses in the tax base and deduct VAT.

Accountant.

When an accountant receives a report, he assigns a number to it and sets the date the document was received. He also fills out a tear-off receipt confirming the acceptance of the report for verification. In it you need to write the full name of the accountable person, the details of the advance report, the amount of money issued and the number of supporting documents. The accountant issues the completed receipt to the accountant.

Results

Standards for processing documentation related to sending employees on business trips have become more flexible since 2021 and have reduced the amount of paperwork for the enterprise’s personnel department.

However, a company’s expenses are not only cash costs, but also an item that reduces the tax base for calculating income tax, which is under the close attention of the Federal Tax Service. That is why the employer fights for every penny, sometimes becoming conservative: for example, using the previous rules for processing documents related to sending on a business trip. The main condition for this is the consolidation of all controversial issues in an internal regulatory document - the accounting policy of the enterprise. This will make it much easier for the tax authorities to prove that you are right regarding business trip expenses. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Filling out an advance report for a business trip

If the business trip is planned in advance and is part of the travel plan, the employee can write an application for an advance on business expenses. These include accommodation, travel to and from the business trip, and meals. It is these expenses that he must report upon arrival back to his workplace.

Having compiled a report on the business trip, the final amount of funds spent is indicated. If the amount is greater than the advance payment, the accounting department must transfer the difference. For lower costs, the employee must deposit funds into the cash register.

An advance report is one of the documents, the preparation of which is clearly regulated by law. It is drawn up by the posted employee as confirmation of all expenses incurred during the business trip.

Along with it, original documents for expenses must be provided to the accounting department. In general terms, an expense report is a document that lists travel expenses.

Is it required?

The purpose of the advance document is to confirm the expenditure of the advance issued before the trip or to receive the funds spent after the trip. From this it follows that drawing up a report is mandatory.

Legal acts:

- Article 252, paragraph 1 of Article 264 of the Tax Code of the Russian Federation: travel expenses are production and sales expenses related to other expenses.

- Article 313, Article 314 of the Tax Code of the Russian Federation: information must be confirmed by primary documentation. This also includes a business trip report. Without it, it is impossible to confirm expenses incurred, including advances issued to an employee. Expenses are taken into account according to the date the report is issued.

Tax Code of the Russian Federation (part two)

The advance report is the basis for accounting:

- transfer funds to cover business expenses;

- confirmation of financial expenses when issuing funds in advance before a business trip.

How to fill out an advance travel report 2021?

The business trip report is the final stage of the entire procedure: from drawing up the departure order to the return of the employee.

A properly compiled report should confirm financial expenses, which, in turn, affect taxes.

An advance report must be prepared by an employee sent on a business trip. Once completed, it is sent to the accounting department for verification.

At the final stage, the document is signed by the manager. The funds spent (in the absence of an advance) or the difference if the expense is greater than the advance are listed.

Document requirements

How to prepare an advance report correctly so that it is accepted during a tax audit?

The report is a strictly reporting document. It is filled out according to form No. AO-1 and is used to account for funds that were issued to the traveler.

Advance report-ao-1

The document is drawn up in one copy on paper or filled out electronically.

Note that in the new form of the form, only the lines appeared: a receipt from the accountant that he received the report from the employee. The rest of the document has not undergone any changes.

Form and sections

How to fill it out correctly:

- Front side: personal data of the employee, a document confirming the issuance of money, information on the previous advance are filled in.

- Reverse side: dates of expenses, document number, name, amounts, documents confirming transactions are indicated (columns 1-6).

All expenses must be documented. The list of documents is given below. They must be stored and glued to a separate A4 piece of paper upon arrival.

The amount payable will directly depend on the receipts and checks provided.

Sample filling (example)

An example of preparing an advance report for a business trip 2020:

Example of filling out an advance report

Who signs and agrees?

Each document must be signed by the person completing it. Only after this is it possible to transfer the report to the accounting department. She checks that it is filled out correctly.

The head of the enterprise and the chief accountant must put their signature on the document. Only after this can the funds that the employee paid independently be transferred.

Due dates

After arriving from a business trip, the employee must draw up and submit an advance report within 3 days.

Accompanying documents

Resolution No. 749 of October 13, 2008 established a certain package of travel documents:

- Travel certificate of the established form. Issued for every business trip in the Russian Federation. The form is dated, stamped and signed upon departure from the organization. The receiving party affixes a stamp, signature and date of entry, similarly for departure. When the employee returns, the accounting department enters the date of arrival.

- Checks, receipts confirming payment for accommodation on a business trip.

- Receipts, tickets – all expenses associated with travel to and from the business trip location (train tickets, travel life insurance, toll road receipts, etc.)

- A report on the completed business trip, approved by the manager.

- Other expenses related to business travel.

Decree of the Government of the Russian Federation of October 13, 2008 N 749

All documents must be completed accordingly. When attaching them to the expense report, each document is glued to an A4 sheet with glue.

If the requirements are violated or the original documents specified in the report are missing, the accounting department has the right not to pay the expenses incurred by the employee. In cases of entry, a tax audit will reveal a violation and impose a fine.

- The accounting department should carefully review the documents that the employee provides to confirm his expenses.

- The most common one is a cash receipt.

- If it does not indicate what product was purchased, it must be provided with a sales receipt or receipt.

- Types of documents confirming expenses incurred:

- A cash receipt is required during a tax audit; it confirms the fact of payment. When storing a check, you must follow certain rules. If you get wet or stay in the sun for a long time, the information may disappear. Such a check cannot be attached to reimbursement of expenses. Some organizations operate without a cash register or only print the total amount on the cash receipt. In these cases, you must request a sales receipt.

- Sales receipt - it indicates a detailed description of the business transaction, quantity, price, total amount, name of the organization, date, signature and position of the person filling it out. The advance report is attached along with the cash receipt. In the absence of the latter, the PM must bear the seal of the selling organization. Please note that the amount and date on the sales receipt must match the cash receipt.

- Strict reporting forms . The document must indicate the name, details of the legal entity, business transaction, price, amount, date, position and signature of the person completing it.

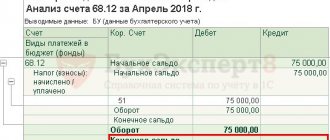

Postings

The following accounts will be used:

- 71 – “settlements with accountable persons” (applies to Active-Passive accounts);

- 70 – “settlements with personnel for wages”;

- 51 – “current account”;

- 50 – “cash desk”;

- 94 – “shortages and losses of the enterprise.”

When the report is approved, the transactions look like this:

- When issuing an advance: the accountant draws up a settlement account and funds are issued. Upon receipt, the employee signs the consumable. Dt71-Kt50

- When transferring funds from a current account to an employee's current account: entry Dt71-Kt51 is drawn up. In this case, a payment order is issued to the bank. Confirmation of receipt of funds is a bank statement.

- The funds have been issued and the amount needs to be closed. This is possible after the employee arrives from a business trip and the expenses are confirmed with relevant documents. Postings: Dt10-Kt71 – purchase of materials, Dt41-Kt71 – purchase of goods, Dt20-Kt71, Dt26-Kt71, Dt44-Kt71 – trade or production activities of the enterprise.

- When the amount of funds spent is greater than the amount issued, a reverse transaction is made and the money is returned to the cash desk. The PKO is issued: Dt50-Kt71 or Dt51-Kt71 (to the current account).

- If the advance payment for a business trip is insufficient, the money is transferred to the employee from the cash desk. RKO is issued: Dt71-Kt50 or Dt71-Kt51 (from the current account).

- In the event that an employee has lost checks or spent money on personal purposes that are not related to a business trip, the following entry is drawn up: Dt94-Kt71 - funds from the reporting person are written off as the company's shortfalls. Dt70-Kt94 - the amount of the shortfall must be deducted from the salary of the employee who was unable to report on the advance payment.

Corporate card - an accountant's headache

The reason that accountants' teeth clench at the mention of a corporate card is simple: it is mainly used by managers. It is not easy to prove to the director - the only participant or owner of the majority of the assets - that the funds in the company account and his personal ones should be separated. Out of habit, the boss uses the corporate card as a simple debit card, including for personal needs.

Considering that the card is special and payments on it are reflected directly in the statement, it is necessary to correctly document the costs. There are two options for this.

The first is when you have constant access to the bank, statements are posted every day and you can control the movement of funds:

- D 55 K 51 (analytics is carried out for each card and user) – we reflect the transfer of money to the corporate card;

- D 71 K 55 – reflect the transferred funds to the accountable person;

- D 20, 26, 44, 60, 76 K 71 (depending on the type of expense) – the report was received and approved.

Second, when it is not possible to track the movement of money promptly, there is no bank data on payments:

- D 71 K 57 – we reflect the money “in transit”, i.e. the employee received and spent them, but this is not yet reflected in the statement;

- D 20, 26, 44, 60, 76 K 71 – we approve the costs according to the report;

- D 57 K 55, D 55 K 51 – the money transfer or withdrawal operation was recorded in the bank statement.

Whoever uses the corporate card must provide supporting documents: checks, invoices, receipts, acts, etc. It would be good if they were issued to an organization, and not to a private individual – the accountable person.

It’s true to warn the seller that payment is not made with a regular debit card; they usually forget and just take cash receipts to the accounting department (we’ll talk about the features of online cash registers below). Can such expenses be taken into account? Yes, you can, in this case everything happens by analogy with ordinary accounting calculations.

Note! If purchases or services are paid for under an agreement concluded with a company, then the documents are drawn up for it, and not for an individual.

The deadline for submitting an advance report on a business trip is no later than 3 working days after returning from it. For other cases, the time is limited to the same three working days, but the countdown starts from the end of the period for which the funds were issued. The latter is set by the manager, which means it can be a month, two, or a year.

Until August 2021, it was necessary to report for the previous advance in order to receive the next one. Violation was followed by a fine of up to 50,000 rubles for an organization and up to 5,000 rubles for an official. Afterwards, one of the paragraphs of Directive No. 3210-U was removed, and penalties no longer apply.

Filling out an advance report for a business trip: sample 2020

Employee business trips are commonplace for both large and small companies. They increase the efficiency of the enterprise and solve the tasks assigned to it.

Each returnee needs to draw up an advance report for the business trip . He will confirm the expenses incurred and the very fact of being on a business trip.

Let us consider in detail the rules for filling out this important document, the composition of costs, their justification and reflection in accounting in 2020.

Content

First, let's look at the general mechanism of how to fill out a sample advance report for a business trip .

- In the form issued by the accounting department, the employee fills out:

- name of company;

- your full name;

- job title;

- structural subdivision;

- purpose of issuing funds (business trip).

However, these details are usually already indicated if the company uses accounting software.

- Then the employee writes the date of the report and fills in the lines on his other sheet. There he writes:

- names of supporting documents;

- the amount of expenses for them.

That is, in order for the accounting department to accept the document, you just need to save all the receipts and make the correct arithmetic calculation. there is nothing complicated about how to draw up an advance report for a business trip using the sample

On our website, the form of the report in question can be downloaded here (+ rules for filling it out).

Travel expenses

Before a business trip, an employee knows approximately how much he will need for the trip. Or the advance payment will be calculated by the accounting department, in accordance with the standards approved by the enterprise and past prices for a similar business trip.

In many organizations, the accounting department independently orders tickets on behalf of the enterprise. Accounting for such expenses will be different from the situation when an employee purchases tickets himself.

Regardless of who will calculate future and past expenses, the composition of travel expenses included in the advance report will remain unchanged. These include:

- daily allowance;

- travel;

- hotel accommodation;

- other expenses approved in the internal regulations of the organization.

Also additionally taken into account are the costs of:

- registration of a foreign passport, visa;

- fees for the right of passage and departure of transport;

- if an employee is sent on a business trip in a personal car, gasoline is paid accordingly.

What to include

Upon returning to the enterprise, the employee must attach the following documents to the advance report for the business trip : evidence:

- cash receipts (the most common document);

- strict reporting forms (SSR);

- counterfoils of cash receipt orders (issued by other organizations/individual entrepreneurs when paying for certain services/goods);

- invoices.

We recommend checking receipts and BSOs carefully. And even more so – don’t lose! Otherwise, the accounting department may refuse to reimburse business trip expenses if they are not available.

One of the most common “mistakes” when checking documents is the absence of a cash receipt. However, conducting trade or providing certain services without using a cash register is quite acceptable. The main thing is to ask the seller to fill out the BSO according to all the rules or put his stamp, write “We work without cash register machines” and sign it.

Also see “Online cash registers: who, how and when should use them.”

Electronic documents as BSO

In fact, strict reporting forms are practically the most important documents of a business trip: train ticket, bus ticket, plane ticket, etc.

These receipts will be used to count the days of the business trip. They confirm transport, and therefore the main expenses of any business trip.

The employee (or the accounting department for him) can issue a ticket via the Internet. Then an electronic boarding pass will be generated for him. The advance report must subsequently be accompanied by this receipt.

Also see “What documents relate to BSO”.

Also see “What details must be on the BSO”.

What's in accounting

After checking the expediency of expenses, whether they were targeted or not, the arithmetic side of the documentation, the accountant checks the documents attached to the report.

Professions for which a resume is not usually needed

In accounting, when the advance report for a business trip is approved, the postings will be as follows:

| Situation | Wiring |

| Employee purchase of materials | Dt 10 – Kt 71 |

| When purchasing goods | Dt 41 – Kt 71 |

| Writing off daily allowances | Dt 20 Kt 71 |

| Return of unclaimed money to the company's cash desk | Dt 50 – Kt 71 |

| Return of unclaimed money to the current account | Dt 51 – Kt 71 |

| Additional payment of money to the employee if he had to invest his own | Dt 71 – Kt 50 or Dt 71 – Kt 51 |

| The employee did not provide supporting documents or incurred inappropriate expenses. The amount is written off as a deficiency | Dt 94 – Kt 71 |

| The shortfall is withheld from the employee | Dt70 – Kt 94 |

Using the information provided in the article, you will not have to experience difficulties in drawing up an advance report for a business trip , and the accounting department will not have difficulty reflecting transactions in accounting.

The following is a sample of how to fill out an advance report for a business trip in 2020 .

Example of filling out an advance report 2020

In the line “Purpose of advance payment” write “Travel expenses”.

On the back, the daily allowance for all days of the business trip is indicated and all expenses paid by the posted worker are listed, as well as the date, number and name of the supporting documents. These documents must be attached to the report.

Postings on the advance report for a business trip

A business trip is a business trip of a company employee, the basis for which is an order from the manager.

The company covers all expenses incurred by the employee (travel, accommodation, food), giving the employee an advance on travel expenses.

Upon return, within three days he is obliged to report on expenses by drawing up an advance report and submitting it for approval to the chief accountant. Let's get acquainted with the stages of accounting for travel expenses.

Issuing an advance for travel expenses: postings

The presence of a business trip order is the basis for issuing an advance amount to cover upcoming expenses. The accountant calculates their approximate cost and issues an advance payment, documenting its issuance with the following posting:

D/t 71 K/t 50 (51) for the accountable amount.

The same entry is used to accrue an additional advance if the business trip is reasonably extended and the funds issued to the employee were not enough. However, cases when an employee has to lend to a company, that is, use his own funds for work needs, are not uncommon.

Advance reports in accounting

The returning employee who has completed his official assignment draws up a report on expenses made on the standard form AO-1. Note that business trip expenses in terms of daily allowance are normalized - the tax base is reduced by the established limits. The standard per day is 700 rubles. when traveling within the Russian Federation, 2500 rubles.

– on business trips abroad (clause 3 of Article 217 of the Tax Code of the Russian Federation). The company has the right to set its own daily allowance rates. Exceeding the limits means for the company attributing excess amounts to profit, for the employee - taxation of the difference with income tax.

Let's consider various options for travel expenses listed in advance reports and their accounting.

Business trip under a GPC agreement

Business trip expense write-off accounts depend on the company's area of activity and the purpose of the trip. In this case, the account is credited. 71 in correspondence with account. 20 (if expenses relate to core activities), inc. 26 (for general business expenses, including postal expenses in the advance report), inc. 44 (for expenses associated with the sale of products).

In addition, it is necessary to take into account that the costs listed in the advance report (for example, the cost of travel tickets or a hotel room) include VAT, which must be allocated.

The purpose of preparing a report is to organize costs and determine their actual amount.

If it coincides with the amount of the advance payment issued, then 71 accounts are closed, the balance of funds on the advance report indicates the need to deposit it in the company’s cash desk, and overspending indicates the employee’s own expenses incurred, which, after approval of the advance report, are returned to him from the company’s cash desk or by transfer to map. The overexpenditure is reflected in the advance report by posting: D/t 71 – K/t 50, 51.

Accounting entries accompanying the acceptance of costs on the advance report:

| Operations | D/t | K/t |

| The expense report has been approved and the travel expenses have been written off by posting: | ||

| - in a trading company (if its goal was to promote the product) | 44 | 71 |

| — in a manufacturing enterprise (work-related trips) | 20 | 71 |

| - general business purposes, such as postage | 26 | 71 |

| Assets or materials purchased during the trip | 08,10 60 | 60 71 |

| VAT has been deducted from the cost amount | 19 | 71 |

| VAT is accepted for deduction | 68 | 19 |

| The balance of unused travel expenses is returned to the cashier, to the current account or deducted from the payment with the consent of the employee | 50, 51, 70 | 71 |

| Cost overrun paid to employee | 71 | 50 |

Let's illustrate accounting for business travel costs with examples.

Example 1:

Employee of Troya LLC, engineer Deryabin A.Yu. in April 2021, I received an advance on a business trip for a period of 5 days in the amount of 160,000 rubles. to travel to another region.

The purpose of the trip was to purchase filter equipment for production. Deryabin A.Yu. departed by plane on April 15, and returned on April 19 by supplier’s transport, accompanying the purchased equipment. 23.04.

2019 they were provided with an advance report that lists the expenses:

- the cost of “there” tickets is 18,000 rubles. (including VAT – 3000 rub.);

- The cost of a hotel room is 21,600 rubles. (including VAT - 3600 rub.) for 3 days;

- daily allowance - 3500 rub. (700 x 5 days);

- payment for consulting services of the equipment manufacturer – 15,000 rubles;

- purchase of the installation – 108,000 rubles. (including VAT 18,000 rubles).

The engineer attached all documents confirming expenses to the advance report. In the final line of the report, the amount of expenses is 166,100 rubles, i.e. there was an overexpenditure of issued funds. The accountant checked the report and approved the expenses incurred. According to the advance report, the following accounting entries were made:

| date | Operations | D/t | K/t | Sum |

| 15.04 | An advance payment for a business trip is transferred to the employee’s card | 71 | 51 | 160 000 |

| 23.04 | Accepted expense report, approval transactions and write-off of costs: | |||

| - daily allowance | 20 | 71 | 3500 | |

| — for hotel accommodation | 20 | 71 | 18 000 | |

| VAT on hotel account | 19 | 71 | 3600 | |

| — for travel (air ticket) | 20 | 71 | 15 000 | |

| VAT on air ticket | 19 | 71 | 3000 | |

| Consultation on the use of equipment | 08 | 60 | 15 000 | |

| Installation cost | 08 | 60 | 90 000 | |

| VAT on installation cost | 19 | 71 | 18 000 | |

| Expenses for the purchase of the installation are written off from accountable amounts | 60 | 71 | 105 000 | |

| Accepted for VAT deduction (3600 + 3000 + 18,000) | 68 | 19 | 24 600 | |

| Deryabin A. Yu. was issued an overexpenditure on the advance report (166,100 – 160,000) | 71 | 50 | 6100 |

In the example, the amount of overexpenditure according to the advance report (posting D/t 71 - K/t 50) was issued from the cash register. Depending on the company’s system of settlements with personnel, money could be transferred to his card by posting D/t 71 K/t 51. As a result, the account. 71 for the accountable amount issued to Deryabin A.Yu. closed.

Example 2:

How to prepare an advance report for a business trip?

Do you need to show where the funds received for a business trip were spent? Three days are allotted for this after returning. You will need to fill out a special form and attach documents confirming the costs.

The paper can be drafted by hand or using a computer. In commercial structures, instructions are developed by management, and public sector employees follow the Methodological Recommendations established by Order of the Ministry of Finance of the Russian Federation dated March 30, 2015 N 52N.

Basic moments

To cover official needs during a business trip, a subordinate may be provided with a sum of money.

The following documents are the basis for issuance:

- director's order;

- written request from the employee.

To receive funds, an application with a manager’s visa is submitted to the accounting department. The money is transferred on account for the entire period of the business trip, at the end of which it is necessary to draw up a report on the expenses incurred or return the amount received.