Legal basis for the formation and use of reserve capital

In accordance with paragraph 1 of Art. 35 of the Law on JSC, joint-stock companies are required to create a reserve fund in the amount provided for by the company’s charter, but not less than 5% of its authorized capital.

The reserve fund of a joint-stock company is formed through mandatory annual contributions until it reaches the size determined by the charter of the joint-stock company. The amount of annual contributions is provided for by the charter of the joint-stock company, but cannot be less than 5% of net profit until the amount determined by the charter of the joint-stock company is reached. The reserve fund of the joint-stock company is intended to cover the losses of the company, as well as to repay the bonds of the joint-stock company and repurchase the shares of the joint-stock company in the absence of other funds. The reserve fund cannot be used for other purposes.

Article 30 of the LLC Law provides that the company may create a reserve fund and other funds in the manner and in the amounts determined by the company's charter. Since Art. 30 of the LLC Law does not establish the target nature of the reserve capital; the LLC remains guided by clause 69 of the Regulations on accounting and financial reporting in the Russian Federation . Despite the fact that this paragraph focuses on the procedure for dividing reserve capital into subaccounts, it provides an exhaustive list of areas for spending the reserve. In relation to an LLC, reserve capital can be used:

- to cover losses;

- to pay off bonds;

- to buy out shares.

Thus, reserve capital is created in JSCs and LLCs, and JSCs do this on a mandatory basis, and LLCs do it on a voluntary basis.

Formation of a reserve fund through contributions

Most non-profit organizations (including credit, agricultural, consumer and housing savings cooperatives) are required to create a reserve fund, including through contributions from their members (shareholders) (clause 16, part 3, article 1, clause 1 h 4 Article 6 of the Law of July 18, 2009 No. 190-FZ, paragraphs 6–7 of Article 34 of the Law of December 8, 1995 No. 193-FZ, Part 1 of Article 53 of the Law of December 30, 2004 No. 215-FZ).

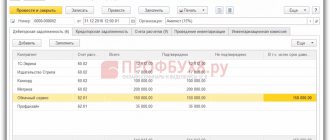

Contributions received from members (shareholders) are initially recognized as targeted and accounted for in the credit of account 86 “Targeted financing”. To control the debt of members (shareholders), you can use account 76 “Settlements with various debtors and creditors”. Make the following entries in your accounting:

Debit 76 Credit 86

– reflects the debt of members (shareholders) to make contributions to the reserve fund;

Debit 55 (50, 51) Credit 76

– contributions from members (shareholders) to the reserve fund have been received;

Debit 86 Credit 82

– contributions of members (shareholders) were sent to the reserve fund.

This follows from the Instructions for the chart of accounts (accounts 82 and 86).

Make entries on the basis of documents confirming the debt of members (shareholders) for contributions to the reserve fund, and documents confirming the transfer of these contributions (Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ).

If an organization applies a general taxation system (simplified), then do not include received membership (share) contributions in taxable income. Such amounts are recognized as targeted revenues for the maintenance of non-profit organizations and the conduct of their statutory activities and are not taken into account when calculating income tax (single tax). This follows from subparagraph 1 of paragraph 2 of Article 251 and subparagraph 1 of paragraph 1.1 of Article 346.15 of the Tax Code of the Russian Federation.

Reflection of reserve capital in accounting

According to clause 66 of the Regulations on accounting and financial reporting in the Russian Federation, reserve capital is included in the equity capital of the enterprise. To summarize information about the state and movement of reserve capital, the Chart of Accounts and instructions for its use provide for passive account 82 “Reserve Capital”.

Based on clause 69 of the Regulations on accounting and financial reporting in the Russian Federation, the reserve fund created in accordance with the legislation of the Russian Federation to cover the losses of the enterprise, as well as to repay the company’s bonds and repurchase its own shares, is reflected separately in the balance sheet.

Characteristics of account 82

Accounting for reserve capital (hereinafter referred to as RK) is maintained using account 82, designed to collect all information about the state and movement of this type of capital.

To account for the formation of reserve capital, account 82 corresponds with account 84. In special cases, account 82 corresponds with account 75, for example, when forming the Republic of Kazakhstan in non-profit organizations and agricultural enterprises. In order to reflect operations on the use of accumulated reserve capital, the account corresponds with accounts 66 (67).

By studying the features of account 82, you can create the following characteristics of it. This is the account:

- passive, since with its help the sources of the enterprise’s property are taken into account; RK is one of the components of the capital of a joint-stock company and, like all sources of assets, is reflected in the liability side of the balance sheet;

- balance sheet, because its indicators are reflected in the balance sheet;

- stock, since it is intended to account for the sources of formation of funds belonging to the joint-stock company - the capital of the company;

- the main one, because it is intended to control the state and movement of sources of formation of the company’s property (in this case).

You can read about the sources of capital formation in our article “Main sources of equity capital formation.”

The procedure for forming reserve capital

Reserve capital is formed from the retained earnings of the enterprise.

Deductions to reserve capital from profits are reflected in the credit of account 82 “Reserve capital” in correspondence with account 84 “Retained earnings (uncovered loss)”. Example 1

The size of the enterprise's reserve capital, provided for by its constituent documents, is 5% of the authorized capital. The amount of annual contributions is 5% of net profit. At the time of the meeting of the board of directors (03/12/2014), the authorized capital was 20 million rubles, reserve capital was 834,890 rubles; The company’s net profit for 2013 was RUB 4,862,120.

According to the charter, reserve capital should be 1 million rubles.

(RUB 20 million × 5%). Using the net profit of 2013, the company can create reserve capital in the amount of 243,106 rubles. (RUB 4,862,120 × 5%). Before reaching the amount provided for by the charter, it is necessary to accrue additional reserve capital in the amount of 165,110 rubles. (1,000,000 - 834,890). The Board of Directors decided to allocate RUB 165,110 to create reserve capital. net profit for 2013.

The following entries were made in accounting:

| Contents of operation | Debit | Credit | Amount, rub. |

| 12.03.2014 | |||

| Reserve capital has been formed from profits | 84 | 82 | 165 110 |

In order to increase net assets, shareholders (participants) of an enterprise can contribute property, property rights or non-property rights by forming funds (

clause 3.4, clause 1, article 251 of the Tax Code of the Russian Federation ).

If the option of replenishing reserve capital is chosen for these purposes, then the operation is reflected in the debit of account 75 “Settlements with founders” and the credit of account 82 “Reserve capital”. Example 2

The shareholders of the CJSC decided to contribute 5 million rubles in order to increase the company's net assets. to the reserve capital of the company (minutes of the meeting dated 02/21/2014). Contributions were made by shareholders from 03/03/2014 to 03/06/2014.

The following entries will be reflected in the accounting records:

| Contents of operation | Debit | Credit | Amount, rub. |

| 03.03.2014 – 06.03.2014 | |||

| Funds were received from shareholders for the formation of reserve capital | 51 | 75* | 5 000 000 |

| 06.03.2014 | |||

| Reserve capital was formed from shareholder contributions | 75 | 82 | 5 000 000 |

in the Instructions for using the Chart of Accounts can be opened , for example 75-3 “Other settlements with founders”.

General procedure for using reserve capital

As noted earlier, the reserve capital of a joint-stock company has a strictly designated purpose. In accordance with the Instructions for using the Chart of Accounts, the use of reserve capital funds is accounted for by the debit of account 82 “Reserve capital” in correspondence with accounts 84 “Retained earnings (uncovered loss)” (in terms of the amounts of the reserve fund allocated to cover the loss of the enterprise for the reporting year) and 66 “Settlements on short-term loans and borrowings” or 67 “Settlements on long-term loans and borrowings” (in terms of amounts used to repay JSC bonds).

Typical wiring

By debit of the account

| Business transactions | Debit | Credit |

| Reserve capital allocated to repay short-term bonds | 82 | 66 |

| Reserve capital allocated to repay long-term bonds | 82 | 67 |

| Reserve capital used to cover losses | 82 | 84 |

By account credit

| Business transactions | Debit | Credit |

| Reserve capital has been formed (increased) at the expense of net profit | 84 | 82 |

Using reserve capital to cover losses

According to paragraphs. 12 clause 1 art. 65 of the Law on JSC, the use of reserve capital falls within the competence of the board of directors (supervisory board) of the JSC. With the preliminary approval of the annual report of the joint-stock company by the board of directors (supervisory board), a decision may be made to repay the loss from reserve capital. For accounting purposes, the use of reserve capital to pay off a loss qualifies as an event after the reporting date ( PBU 7/98 “Events after the reporting date” ).

According to clause 5 of PBU 7/98, an operation to repay a loss from reserve capital refers to an event after the reporting date, indicating the economic conditions in which the enterprise operates that arose after the reporting date. This category of events is disclosed in the notes to the balance sheet and income statement. At the same time, no entries are made in accounting (synthetic and analytical) accounting during the reporting period. That is, if an enterprise repays an uncovered loss for 2013 from reserve capital, then the postings are made in 2014. The explanations to the annual report for 2013 will indicate that the board of directors (supervisory board) decided to allocate reserve capital funds to repay the loss incurred in the reporting year 2013, and the amount of the transaction will also be reflected.

Example 3

According to data for 2013, the uncovered loss amounted to 275,456 rubles. Reserve capital – 721,340 rubles. On March 12, 2014, the Board of Directors decided to cover the loss using reserve capital funds.

In accounting, the organization made the following entry:

| Contents of operation | Debit | Credit | Amount, rub. |

| 12.03.2014 | |||

| Reserve capital is used to cover losses | 82 | 84 | 275 456 |

The reserve capital funds used to cover losses in subsequent periods are restored in order to bring the reserve capital to the amount provided for by the charter of the enterprise.

Using reserve capital to pay off bonds

In the absence of other funds, reserve capital is used to pay off bonds. At the same time, the Instructions for using the Chart of Accounts propose to reflect this by making an entry in the debit of account 82 “Reserve capital” and the credit of account 66 “Settlements for short-term loans and borrowings” or 67 “Settlements for long-term loans and borrowings”.

However, such an entry does not reduce the bond debt, but, on the contrary, increases it. To repay bonds, you need property, primarily cash, and the largest reserves created by the enterprise, accounted for as liabilities, will not save if the enterprise does not have money. Generally speaking, it can be considered fair that funds and reserves strengthen the financial strength of the enterprise. Since part of the profit is not spent on paying dividends or other purposes, but is reserved, the financial situation indirectly improves. However, a company can easily lose its liquidity by excessive purchases of real estate, granting deferments to counterparties, and issuing loans. Therefore, in order for an enterprise not to have difficulties in repaying its own bonds, it is necessary, first of all, to ensure that liquid assets are available at the time of payments.

However, we will not completely write off such an area of using reserve capital as paying off bonds. The fact is that, along with the main debt in account 66 “Settlements for short-term loans and borrowings” and 67 “Settlements for long-term loans and borrowings”, interest debt is taken into account ( clause 73 of the Regulations on accounting and financial reporting in the Russian Federation ). According to clause 11 of PBU 10/99 “Expenses of the organization” , interest paid by an enterprise for providing it with funds (credits, borrowings) for use are recognized as other expenses, which are recorded in account 91 “Other income and expenses”, subaccount 91-2 “ Other expenses". If an enterprise states that its current profit is not enough to accrue interest, then it has the right to use reserve capital, and the accounting entry will take the following form: Debit 82 “Reserve capital” Credit 66, 67, a separate sub-account for accounting for accrued interest.

There will be no contradiction with the logic of accounting in this case. However, how justified is such a posting from the point of view of the interests of the enterprise? Will this entry become a basis for tax authorities to challenge the accrual of interest on bonds to reduce the tax base? Of course, writing off interest in accounting at the expense of reserve capital does not prevent this operation from being reflected in tax accounting at the expense of expenses, but there is no guarantee that the regulatory authorities will not attempt to charge additional taxes. In addition, the problem of a lack of profit to repay interest on bonds can be solved by the more usual first method of spending reserve capital, directly restoring the uncovered loss at its expense. Therefore, despite the fact that the accrual of interest on bonds at the expense of reserve capital will comply with the spirit of the Law on JSC and the letter of the Instructions for the Application of the Chart of Accounts , there is no particular need for such an operation.

Example 4

The company's balance sheet contains 5,000 issued bonds. with a nominal value of 1,000 rubles. for a total amount of 5 million rubles. with a maturity date of 03/12/2015. The coupon rate on bonds is 8% per annum. Due to the lack of other sources for paying the coupon, the company decided to use reserve capital funds for these purposes from 10/01/2013 to 03/31/2014. Coupon payment dates (from 10/01/2013 to 03/31/2014) – 12/12/2013, 03/12/2014.

Tax accrual for the period from September 13, 2013 to September 30, 2013: RUB 1,000. × 8% × 18 days. / 365 days = 3.95 rub.

At the time of making a decision on the use of reserve capital, the balance in account 67 “Settlements for long-term loans and borrowings”, subaccount “Coupons on issued bonds”, is recorded in the amount of 19,750 rubles. (5,000 × 3.95 rubles), which represents interest for the period from 09/13/2013 to 09/30/2013.

Tax accrual for the period from September 13, 2013 to October 31, 2013: RUB 1,000. × 8% × 49 days. / 365 days = 10.74 rub.

Coupon for accrual for the period from 10/01/2013 to 10/31/2013: 5,000 × (10.74 - 3.95) rub. = 33,950 rub.

Tax accrual for the period from September 13, 2013 to November 30, 2013: RUB 1,000. × 8% × 79 days. / 365 days = 17.32 rub.

Coupon for accrual for the period from 01.11.2013 to 30.11.2013: 5,000 × (17.32 - 10.74) rub. = 32,900 rub.

Tax accrual for the period from September 13, 2013 to December 12, 2013: RUB 1,000. × 8% × 91 days. / 365 days = 19.95 rub.

Coupon for accrual for the period from 12/01/2013 to 12/12/2013: 5,000 × (19.95 - 17.32) rub. = 13,150 rub.

Tax accrual for the period from December 13, 2013 to December 31, 2013: RUB 1,000. × 8% × 19 days. / 365 days = 4.16 rub.

Coupon for accrual for the period from December 13, 2013 to December 31, 2013: 5,000 × 4.16 rubles. = 20,800 rub.

Tax accrual for the period from December 13, 2013 to January 31, 2014: RUB 1,000. × 8% × 50 days. / 365 days = 10.96 rub.

Coupon for accrual for the period from 01/01/2014 to 01/31/2014: 5,000 × (10.96 - 4.16) rub. = 34,000 rub.

Tax accrual for the period from December 13, 2013 to February 28, 2014: RUB 1,000. × 8% × 78 days. / 365 days = 17.10 rub.

Coupon for accrual for the period from 02/01/2014 to 02/28/2014: 5,000 × (17.10 - 10.96) rub. = 30,700 rub.

Tax accrual for the period from December 13, 2013 to March 12, 2014: RUB 1,000. × 8% × 90 days. / 365 days = 19.73 rub.

Coupon for accrual for the period from 03/01/2014 to 03/12/2014: 5,000 × (19.73 - 17.10) rub. = 13,150 rub.

Tax accrual for the period from 03/13/2014 to 03/31/2014: 1,000 rubles. × 8% × 19 days. / 365 days = 4.16 rub.

Coupon for accrual for the period from 03/13/2014 to 03/31/2014: 5,000 × 4.16 rubles. = 20,800 rub.

For the period from 01.10.2013 to 31.03.2014, the following entries will be made in accounting:

| Contents of operation | Debit | Credit | Amount, rub. |

| 31.10.2013 | |||

| The reserve capital is used to pay coupon income on own bonds for October 2013 | 82 | 67 | 33 950 |

| 29.11.2013* | |||

| The reserve capital is used to pay coupon income on own bonds for November 2013 | 82 | 67 | 32 900 |

| 12.12.2013 | |||

| The reserve capital is used to pay coupon income on own bonds for the period from 12/01/2013 to 12/12/2013 | 82 | 67 | 13 150 |

| The coupon was paid to bondholders (19,750 + 33,950 + 32,900 + 13,150) rubles. | 67 | 51 | 99 750 |

| 31.12.2013 | |||

| The reserve capital is used to pay coupon income on own bonds for the period from December 13, 2013 to December 31, 2013 | 82 | 67 | 20 800 |

| 31.01.2014 | |||

| The reserve capital is used to pay coupon income on own bonds for January 2014 | 82 | 67 | 34 000 |

| 28.02.2014 | |||

| The reserve capital is used to pay coupon income on own bonds for February 2014 | 82 | 67 | 30 700 |

| 12.03.2014 | |||

| The reserve capital is used to pay coupon income on own bonds for the period from 03/01/2014 to 03/12/2014 | 82 | 67 | 13 150 |

| The coupon was paid to bondholders (20,800 + 34,000 + 30,700 + 13,150) rubles. | 67 | 51 | 98 650 |

| 31.03.2014 | |||

| The reserve capital is used to pay coupon income on own bonds for the period 03/13/2014 – 03/31/2014 | 82 | 67 | 20 800 |

* Last working day of the month.

As can be seen from the entries, reserve capital replaces account 91-2 “Other expenses” and thereby leads to an increase in current profit, while being spent itself.

Using reserve capital to repurchase company shares

Similarly, the problem of the impossibility of recording a transaction in accounting arises when using reserve capital to repurchase shares. The Instructions for using the Chart of Accounts do not answer the question of how to use reserve capital to repurchase shares Shares purchased from shareholders are recorded on account 81 “Own shares (shares)”. If the company does not have enough money to buy back shares, then reserve capital cannot help with this. But reserve capital can become an alternative source of profit to offset the negative result from the repurchase of shares.

When redeeming shares in the event that the redemption price exceeds the nominal value of the shares, and the current profit of the enterprise is not enough to carry out the operation, the use of reserve capital for these purposes is reflected as follows:

1) repurchase by the enterprise from the shareholder of shares owned by him in the amount of actual costs - Debit 81 “Own shares (shares)” Credit to cash accounting accounts;

2) cancellation of own shares repurchased by the enterprise in the amount of the par value of the redeemed shares - Debit 80 “Authorized capital” Credit 81 “Own shares (shares)”;

3) attributing to reserve capital the excess of the actual costs of repurchasing shares over their nominal value - Debit 82 “Reserve capital” Credit 81 “Own shares (shares)”.

Example 5

The general meeting of shareholders of the OJSC adopted a decision to reduce the authorized capital by 3 million rubles. by purchasing 3,000 shares from shareholders with a par value of RUB 1,000. for the purpose of their subsequent repayment. The shares were purchased from shareholders at a price of RUB 2,500. in the period from 02/05/2014 to 02/10/2014. Registration of changes in the charter was made on March 28, 2014. Due to the lack of profit from current activities, the board of directors of the OJSC decided to repurchase shares at the expense of reserve capital, the value of which is 8.7 million rubles.

The following entries were made in accounting:

| Contents of operation | Debit | Credit | Amount, rub. |

| 05.02.2013 – 10.02.2014 | |||

| Own shares were purchased from shareholders (3,000 × 2,500 rubles) | 81 | 51 | 7 500 000 |

| 28.03.2014 | |||

| The authorized capital of the JSC was reduced by redeeming repurchased shares (3,000 × 1,000 rubles) | 80 | 81 | 3 000 000 |

| The excess of the redemption price over the par value of the shares (7,500,000 - 3,000,000) rubles is included in the reduction of reserve capital. | 82 | 81 | 4 500 000 |

Reducing reserve capital

An enterprise has the right to reduce the authorized capital, which will lead to an excessively accrued amount of reserve capital, or to reduce, within the limit established by law, the size of the reserve capital itself. In these cases, the operation of reducing reserve capital is legal, which is reflected in accounting after state registration of changes in the constituent documents with the following entry: Debit 82 Credit 84 – reserve capital is reduced to the amount provided for by the charter.

Example 6

The authorized capital of the CJSC is 36 million rubles, reserve capital is 5.4 million rubles. The general meeting of shareholders of the CJSC adopted a decision to reduce the authorized capital by 3 million rubles. The amount of reserve capital established by the constituent documents is 15% of the authorized capital. Registration of changes in the charter was made on March 28, 2014.

| Contents of operation | Debit | Credit | Amount, rub. |

| 28.03.2014 | |||

| The reserve capital was reduced to bring its value to the amount determined by the charter (RUB 5,400,000 - (RUB 36,000,000 - 3,000,000) × 15%) | 82 | 84 | 450 000 |