All enterprises must make tax payments to budgets of various levels. The Russian Federation provides for several types of taxation regimes. The simplified taxation system ( STS ) is designed to reduce the burden on organizations and individual entrepreneurs (IP). Under this regime, a minimum amount of documents is submitted, but it does not relieve the need to report to the state. Reports to the regulatory authority must be submitted in a timely manner.

Conditions for applying the simplified tax system

The simplified taxation system has a number of limitations:

- the number of employees of the organization should not exceed 130 people;

- the residual value of fixed assets of the LLC must be within RUB 150,000,000;

- the amount of income for the previous tax year should not exceed 200,000,000 rubles. (for organizations working on the simplified tax system) and income for 9 months of the previous year should be within 112,500,000 rubles. for LLCs that plan to switch to the simplified tax system;

- the share of participation in the LLC of other legal entities cannot exceed 25%;

- the company should not have branches;

- The organization cannot engage in any of those listed in paragraph 3 of Art. 346.12 Tax Code of the Russian Federation types of activities.

The application of the simplified tax system is permitted from the date of registration of the LLC in the current year. To do this, you need to submit an application to the tax office within 30 calendar days from the date of tax registration. Go to the “simplified” legal form. a person can only from the beginning of the next calendar year. In this case, you can submit an application for transfer until December 31 inclusive.

If the deadline for submitting an application is violated, the newly registered company will keep accounts and report to the Federal Tax Service on the OSN, and the existing organization will remain on the current taxation system (subclause 19, clause 3, article 346.12 of the Tax Code of the Russian Federation). Organizations will be able to switch to the simplified tax system starting next year if they do not exceed the restrictions established by law.

Balance sheet for simplified tax system - example

Usually, when drawing up a balance sheet, small companies have difficulty with where to include certain income and expenses. In order to understand more clearly how to draw up a balance sheet for an LLC using the simplified tax system, we will do without “debits/credits”, but will try to explain as simply as possible how to draw up a balance sheet in a simplified form.

Vympel LLC is engaged in wholesale trade. The company was organized at the beginning of 2021. The organization uses the cash method of accounting. Authorized capital 10 thousand rubles. The company spent the entire amount of money received from the founder as a contribution to the management company on the purchase of goods. At the end of the year, the LLC has the following indicators:

- fixed assets (fixed assets) with a useful life of 4 years were purchased - 160 thousand rubles;

- expenses include 50% of the cost of fixed assets (depreciation) - 80 thousand rubles;

- there are goods worth 120 thousand rubles in the warehouse;

- there are 78 thousand rubles in the current account, there is no cash left in the cash register;

- purchased goods from suppliers in the amount of 5,320 thousand rubles;

- goods were sold for the amount of 6,410 thousand rubles (5,200 rubles plus a trade margin of 1,210 thousand rubles); at the same time, the buyers have a debt in the amount of 141 thousand rubles;

- received for goods delivery services from customers - 37 thousand rubles;

- spent on gasoline and fuels and lubricants - 50 thousand rubles;

- transport tax paid - 15 thousand rubles;

- staff salaries were accrued in the amount of 600 thousand rubles, the balance of wages unpaid at the end of the year was 60 thousand rubles;

- personal income tax accrued - 78 thousand rubles, the balance of unpaid tax - 8 thousand rubles;

- compulsory insurance premiums were accrued - 195 thousand rubles, 25 thousand rubles remained unpaid at the end of the year;

- other expenses of the company (stationery, bank commission for maintaining and servicing a current account, household goods) amounted to 40 thousand rubles;

- debt to suppliers for goods at the end of the year - 73 thousand rubles;

- to replenish working capital, the organization took out a short-term loan for 6 months, the outstanding balance on which at the end of the year was 112 thousand rubles;

- At the end of the year, tax under the simplified tax system was not paid - 6 thousand rubles.

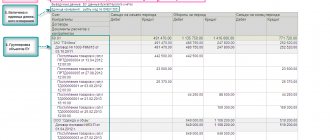

How to group these indicators in the balance sheet of Vympel LLC?

Assets:

- Tangible non-current assets (line 1150) include installation equipment and fixed assets at their residual value. The residual value of fixed assets is: 160 – 80 = 80 (acquisition cost minus depreciation expensed).

- There are no intangible, financial or other non-current assets (for example, licenses, shares) in the LLC, so line 1170 is not completed.

- Inventories on line 1210 (goods, materials, finished products) included goods and materials in the warehouse - 120 thousand rubles.

- Cash and cash equivalents on the current account and in the cash register (line 1250) – 78 thousand rubles.

- Financial and other current assets include accounts receivable from third parties (for example, accountable persons, buyers for goods and services supplied but not paid for, advances to suppliers), therefore line 1230 includes the debt of buyers - 141 thousand rubles.

Passive:

First, let's calculate expenses and profits.

- Expenses from ordinary activities of the company amounted to 6,260 thousand rubles. (5320 (payment to suppliers) + 80 (depreciation of fixed assets) + 50 (fuel and lubricants) + 15 (transport tax) + 600 (salary) + 195 (insurance contributions for wages)).

- Other expenses for the year – 40 thousand rubles.

Total expenses for the year: 6260 + 40 = 6300 thousand rubles.

- Revenue from activities: 6447 thousand rubles. (6410 (products sold) + 37 (delivery services).

- The tax under the simplified tax system for the year was: (6447 – 6300) x 15% = 22 thousand rubles.

- Net profit from activities amounted to: 125 thousand rubles. (6447 – 6300 – 22).

In the liability side of the balance sheet we wrote:

- Line 1300 “Capital and reserves” included the authorized capital (10 thousand rubles) and profit from operating activities (125 thousand rubles), for a total of 135 thousand rubles.

- Short-term borrowed funds with a repayment period of less than 12 months (line 1510) included a bank loan - 112 thousand rubles.

- Accounts payable (line 1520) includes the company’s debts: wages (60 thousand rubles) + personal income tax (8 thousand rubles) + insurance premiums (25 thousand rubles) + debt to suppliers (73 thousand rubles). ) + simplified tax system (6 thousand rubles) = 172 thousand rubles.

Since the company does not have long-term borrowed funds or obligations, a dash is placed on lines 1410 and 1450.

There are also no other short-term liabilities (deferred income, expense reserves) (line 1550) - put a dash through.

The data in the balance sheet is presented for three years - for the reporting year and for each of the two preceding it. Since the company in the example was created in 2021, it does not fill out the balance sheet columns for the previous 2 years.

At the end of the balance sheet, the manager’s signature and his last name are indicated, and the date of completion is indicated. For submission to the Federal Tax Service, a balance sheet form with line codes is used, which can be downloaded below.

Sample balance sheet for simplified tax system:

Taxation of the simplified tax system: “income” and “income-expenses”

All payers of the simplified tax system are exempt from payments:

- income tax;

- property tax, with the exception of taxation of real estate at cadastral value in accordance with Art. 346.11 Tax Code of the Russian Federation;

- VAT, except for the import of foreign goods and when performing the duties of a tax agent.

Only tax is paid that corresponds to the selected regime of the simplified taxation system:

- simplified tax system “income” - from 1% to 8%;

- STS “income-expenses” - from 5% to 20%.

Zero balance under simplified tax system

Even if a company does not conduct business activities, it still provides reporting. There can be no balance. Even in the complete absence of activity, the authorized capital of the LLC must be formed and reflected in the form of a balance sheet, therefore, at a minimum, two lines will be filled in - in the liability the line “Capital and reserves”, and in the asset “Cash” or another line, depending on the form in which the authorized capital was contributed by the founders.

The balance sheet for the simplified tax system (form with and without line codes) can be downloaded below.

How to conduct accounting for an LLC using the simplified tax system

According to Federal Law No. 402 FZ “On Accounting”, all legal entities must maintain accounting records and submit reports. LLCs using the simplified tax system can maintain abbreviated accounting.

The organization needs to draw up an accounting policy and specify the accounting rules in it. When drawing up this document, you must be guided by the recommendations of PBU 1/2008 (approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n). The accounting policy must include information that the organization:

- operates under a simplified taxation system;

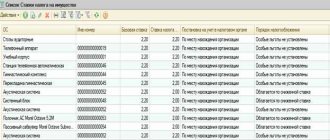

- uses an abbreviated chart of accounts (the plan for combining accounts is indicated);

- establishes accounting rules from those for which the law allows for the possibility of choice;

- applies the procedure for document flow and processing of credentials.

The preparation of an abbreviated chart of accounts is carried out on the basis of data provided by the Ministry of Finance of the Russian Federation No. PZ-3/2012.

Legal entities using the simplified tax system are not required to submit interim financial statements

Date of publication: 07/15/2013 12:37 (archive)

When conducting seminars with taxpayers, as well as oral consultations, organizations that apply the simplified taxation system are often asked the question of whether they need to submit interim financial statements to the tax authority in 2013?

Until 2013, organizations using the simplified taxation system (hereinafter referred to as the simplified taxation system) did not submit financial statements to the tax authority and were exempt from accounting in accordance with paragraphs 1, 3, article 4 of Law N129-FZ of November 21, 1996 (in edition dated November 28, 2011). However, if an organization combined the simplified tax system and UTII, it was obliged to keep accounting records and submit financial statements to the tax authorities.

On January 1, 2013, the Federal Law of December 6, 2011 came into force. N402 “On Accounting”, according to which all organizations, including those using the simplified tax system, must keep accounting records and also submit annual financial statements to the tax authority no later than three months after the end of the reporting year.

The reporting date for the preparation of financial statements is considered to be the last calendar day of the reporting period (Part 6, Article 15 of Law N402-FZ, paragraph 4, 12 PBU 4/99).

The reporting period is the period for which the organization must prepare financial statements (clause 4 of PBU 4/99). The reporting period for annual accounting (financial) statements (reporting year) is the calendar year - from January 1 to December 31 inclusive, with the exception of cases of creation, reorganization and liquidation of a legal entity (Part 1 of Article 15 of Law N402-FZ).

If the state registration of an organization was carried out after September 30, the first reporting year is, unless otherwise established by the organization, the period from the date of state registration to December 31 of the calendar year following the year of state registration, inclusive (Part 3 of Article 15 of Law N402- Federal Law). Thus, an organization registered on October 1 or later has the right to choose the period that is its first reporting year:

- from the date of state registration to December 31 of the year in which state registration was made, inclusive;

- from the date of state registration to December 31 of the year following the year of state registration, inclusive.

The organization's financial statements must be signed by the head of the organization (Part 8, Article 13 of Law N402-FZ).

Taxpayers are liable for failure to submit financial statements to the tax authorities in accordance with Article 126 of the Tax Code of the Russian Federation.

At the same time, from January 1, 2013, the obligation to submit interim accounting statements to the tax authority for legal entities using the simplified tax system is no longer provided (Article 18 of Law N402-FZ).

LLC reporting on the simplified tax system

The organization must report to the Tax Inspectorate, the Pension Fund and the Social Insurance Fund. The number of reports directly depends on the availability of employees in the organization.

LLC tax reporting using the simplified tax system, which is submitted to the Federal Tax Service:

- Declaration under the simplified tax system – annual reporting until March 31;

- 2-NDFL – annual reporting is submitted to the Federal Tax Service before March 1;

- 6-NDFL – quarterly reporting: 1st quarter. – until April 30, 2nd quarter. – until July 31, 3 quarter. – until October 31, 4th quarter. – until March 1;

- accounting (financial) statements are submitted within 90 days from the end of the reporting year - until March 31;

- Data on the unified social insurance tax are submitted quarterly: 1st quarter. – until April 30, 2nd quarter. – until July 31, 3 quarter. – until October 31, 4th quarter. – until January 30.

A taxpayer using the simplified tax system must keep a book of expenses and income (KUDiR) in paper or electronic form. The pages of the book must be numbered and stitched. A Federal Tax Service stamp is not required. The tax inspector can request a book reconciliation at any time.

List of LLC reporting on the simplified tax system, which is submitted to the Pension Fund (PFR):

- SZV-M – information about insured persons is submitted monthly before the 15th day of the month following the reporting month;

- SZV-experience and EDV-1 - information about the experience is submitted once a year before March 1;

- SZV-TD - information on hiring and dismissal of employees is submitted no later than the next working day from the moment the order is signed.

List of LLC reporting on the simplified tax system, which is submitted to the Social Insurance Fund (SIF):

- Form 4-FSS for contributions for “injuries” is submitted quarterly: 1st quarter. – until April 20, 2nd quarter. – until July 20, 3 quarter. – until October 20, 4th quarter. – until January 20;

- The application and certificate confirming the main type of economic activity are submitted annually before April 15.

Filling out the balance under the simplified tax system

Rules have been established for reporting (approved by order of the Ministry of Finance dated July 29, 1998 No. 34n), for violation of which the company can be fined. For example, you must comply with the following requirements:

- about the reliability and completeness of the report;

- filling out lines without collapsing items on assets and liabilities, profits and losses.

The amount of assets and liabilities indicated in the final lines of the balance sheet under the simplified tax system must match. If there is a discrepancy between the totals of assets and liabilities, the form is filled out incorrectly.

How to fill out a balance sheet using the simplified tax system in 2021

To draw up a balance sheet, data is taken on the last day of the reporting year from the balance sheet. To reflect assets (current and non-current assets), 5 main indicators are used, for liabilities (liabilities) - 6. All row data is indicated in thousands of rubles. To make it easier to understand how to reflect information in the balance sheet, we will give an example of how to fill it out.

Transfer of other taxes and LLC contributions to the simplified tax system

Personal income tax – from 13% for employees (withheld on the day of salary payment). The employer is required to remit income tax no later than the day following the day of actual payment to the employee.

Contributions to the Pension Fund : 22% - insurance part and 5.1% - compulsory medical insurance. Payments are transferred for hired workers monthly - until the 15th of the next month.

Contributions to the Social Insurance Fund are also paid for workers until the 15th of the next month and amount to 2.9% for temporary disability; from 0.2% per injury rate.

How to report personal income tax to employers >>>