Oleg Ibragimov

I help with choosing services. Extensive experience in marketing and analytics. I work with both clients and agencies. Grew up from being an assistant to a regular SEO specialist...

Share

Share this article with friends and colleagues

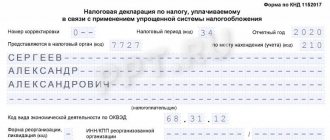

To send reports to the Federal Tax Service, the Pension Fund of the Russian Federation, Rosstat and other structures, it is no longer relevant to use traditional methods and paper media - everything can be done via the Internet. Special services will help you with this.

Today we will look at 3 popular products for submitting reports - VLSI, Kontur.Extern and 1C Reporting - and find out which one is better.

Click.ru: Receive up to 18% of your clients’ spending on context and target!

- Larger budget means higher reward:

for large advertisers - special conditions, for freelancers and small agencies - no minimum threshold for accruing funds under the affiliate program - The fastest payment of rewards on the market:

withdrawal to WebMoney and to a bank card. - Much less routine:

all advertising on one screen, one contract for all advertising systems for each client, a single balance, direct access to advertising accounts. - Easy start in 1 day:

quickly connect accounts in Yandex, Google and social networks.

Go to website

Main features of Contour.Exten

Send reports quickly and without errors

When using Kontur.Extern, you don’t have to worry about the report getting lost or being delivered late. It will be accepted the first time - the built-in verification system will track possible errors already when filling it out. And you don't have to install or update anything yourself - everything happens automatically. 24-hour technical support will answer any question quickly and competently at any time.

Monitor the reporting of service organizations

An interactive table for tracking the reporting of organizations under maintenance - a convenient alternative to Excel tables. The update occurs automatically in accordance with the reporting history. It helps you easily navigate reports for each service organization.

Receive notifications about requirements from the tax office

Receive requests from the tax office on time and respond to them electronically within the deadlines established by law. This will avoid fines and blocking of your current account. You can work from any computer by connecting using your login and password. Send requests for clarification to the tax office, receive notifications about changes in legislation, request certificates, reconciliation reports, extracts and other documents.

SMS notifications about the need to submit reports

By choosing to send SMS notifications in the settings of the personal account of the Kontur.Extern service, the user, regardless of his location, will be aware of all events occurring with the reports. Just about those document flows for which you want to receive alerts, and the information will be promptly sent to your mobile phone. You won't miss any important changes. If desired, you can easily unsubscribe from the service or enable it again.

Work with electronic sick leave

In Kontur.Externe you can download, fill out and send electronic sick leave to the Social Insurance Fund. Including quarantine sick leave for persons 65+ years old. In addition, for regions where direct payments are provided, it is possible to create a register based on data from electronic certificates of incapacity for work with subsequent sending to the Social Insurance Fund.

Generate documents for paying taxes

In a couple of clicks, create payment orders and receipts PD (tax) and PD-4sb (tax). Payment orders and tax receipts are created automatically. The user just needs to select a current account, after which the system will independently perform all the steps to fill out the document. The finished receipt can be downloaded as a file for online banking or the payment order can be printed.

Report to the Pension Fund of the Russian Federation using the form SZV-TD

Submit the SZV-TD form for employees who experienced personnel events during the reporting period. Before submitting the SZV-TD for the first time, submit an application to the Pension Fund to connect to the electronic document flow of the Pension Fund.

Results

You can submit reports electronically in different ways: using special computer software or using web services.

The main aspect that you need to pay attention to is reliability and security, since the company’s reporting is its trade secret and must be carefully protected. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Additional features of Kontur.Extern

Kontur.Extern means not only submitting reports to regulatory authorities, but also additional services and modules that are available free of charge, since part of their functionality is built into Kontur.Extern.

Hot legislative news in the reference and legal system Standard

You no longer have to use expensive legal reference services. The Standard contains articles and comments from experts, as well as real cases from arbitration practice, and answers to complex questions from accounting, taxation and legal issues. In a single interactive directory, find the necessary accounting entries with the author’s analysis of typical business transactions.

Receive extracts from the Unified State Register of Legal Entities and Unified State Register of Individual Entrepreneurs - in one click

Users of the basic version of the Kontur.Extern service can, with a few clicks, order an extract from the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs, as well as obtain all the information of interest about the counterparty from open sources. Information is available on all individual entrepreneurs and legal entities registered in the Russian Federation.

Electronic document management

With your certificate, you will be able to send 50 electronic documents (invoices, trade-12, invoices, etc.) to your counterparties for free without duplicating them on paper. Electronic documents have the same legal force as their paper counterparts, but have a significant advantage - instant delivery to the addressee. This is a very convenient way to send invoices, delivery notes and other types of documentation.

Reconcile invoices with counterparties

Users of the Extern system can download sales books and compare data with invited counterparties. To take advantage of the opportunity to download purchase books, compare purchase and sales books with counterparties, you must purchase access to the Kontur.VAT+ service.

Calculation of the probability of administrative and tax audits

When sending reports through Kontur.Extern, clients can use the Expert analytical service, which is made available to them free of charge. In automatic mode, the program conducts a financial analysis of the organization based on data from the statements, and then, using the methodology used by the Federal Tax Service, determines the likelihood of the time of inspections.

Watch webinars on accounting and tax topics

In the areas of tax accounting and accounting, there are always risks and other nuances associated with complex legislation - therefore, it is necessary to constantly be aware of all innovations and changes. Experienced experts at Kontur.School conduct webinars every week that will help you easily understand all the intricacies. Training can be carried out both at home and in the office - all you need to do is register and select a topic of interest.

Integrations

“Reporting via the Internet” from VLSI supports integration with other VLSI services. For example, EDI, Retail, HR management, CRM and so on. By connecting the necessary configurations, you will be able to work with the system in a single and convenient interface.

Kontur.Extern supports integration with other SKB Kontur, 1C products, as well as API integration into accounting systems, which will allow you to quickly process reports.

1C Reporting works within 1C programs, so it does not require separate integrations. If you need to connect any third-party service, you will have to do it directly in the 1C you are using.

Additional modules

Reporting from 1C Preparation and sending of reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat from 1C

Zero reporting Preparation and submission of zero reporting to the Federal Tax Service, Pension Fund of Russia, Social Insurance Fund and Rosstat

VAT+ (Reconciliation) Reconciliation of invoices with counterparties

Alcohol reporting Generate, verify, sign and send Form 7 and 8 declarations to FSRAR

Reporting to the RPN For organizations and individual entrepreneurs required to report to Rosprirodnadzor

Traffic light Automatic verification of counterparties and identification of material facts

Control of business risks Control the risks of account blocking and receive notifications of risk events

Prices

VLSI tariffs

When connecting to any tariff in SBIS, you first of all pay for an account in the system. Cost – 500 rubles. VLSI operates a system of regional tariffs - the cost of the same modules in different regions differs. Next, we will consider tariffs for Moscow (the most expensive, for the regions prices are 1.5-2 times lower).

There are 2 groups of tariffs available for sending reports:

- Easy - reports to the Federal Tax Service, Pension Fund, Social Insurance Fund, electronic sick and work records, calendar, help with reports, etc. Cost - 2000 rubles/year (for individual entrepreneurs), 4600 rubles/year (for budget organizations), 4600 rubles/year ( for companies with simplified tax system, UTII) and 7,000 rubles/year (for OSNO);

- Basic – reports to Rosstat, budget reconciliation, VAT reconciliation, etc. Cost – 4500 rubles/year (for individual entrepreneurs), 7900 rubles/year (for budgetary organizations), 7900 rubles/year (for companies on the simplified tax system, UTII) and 13500 rubles/year (for OSNO).

Separately, you can connect additional directions for delivery (from 550 to 1000 rubles), super reconciliation (employees, VAT, 6-NDFL - 5000 rubles), state audits and analysis of finances and taxes (4000 rubles), as well as personal support (25000 rubles).

Reports are charged separately for:

- Rosprirodnadzor – 1200 rubles/year;

- Rosalkogolregulirovanie – 2000 rubles/year;

- Ministry of Internal Affairs - 7000 rubles/year;

- Central Bank – 3500 rubles/year.

The minimum payment period is 1 year; when paying tariffs for 2 and 3 years in advance, discounts of 5% and 10% apply, respectively.

Tariffs Kontur.Extern

In Kontur.Extern, as in VLSI, regional coefficients apply. Let's consider prices for Moscow (in the regions, prices are similarly lower). The following rates are available:

- The optimal plus is 1 workplace, basic system capabilities. The cost for individual entrepreneurs on the simplified tax system/UTII is 5,290 rubles/year, on OSNO—11,280 rubles/year; for legal entities on the simplified tax system/UTII – 12,540 rubles/year, on OSNO – 23,220 rubles/year.

- State employee plus - similar opportunities for budget organizations. Cost – 17,500 rubles/year.

- Maximum – 2 workstations, full SMS package, AutoION, risk control. The cost for individual entrepreneurs on the simplified tax system/UTII is 10,630 rubles/year, on OSNO—16,620 rubles/year; for legal entities on the simplified tax system/UTII – 17,880 rubles/year, on OSNO – 28,560 rubles/year

- State employee maximum - similar opportunities for budget organizations. Cost – 22,400 rubles/year.

Discounts apply when paying tariffs for 2 years. SKB Kontur regularly holds promotions that allow you to use products on favorable terms. For example, a “Test Drive” of Kontur.Extern is available - free use of the system for 3 months.

Tariffs 1C Reporting

To use 1C Reporting, you must be the owner of a suitable 1C product - for example, 1C: Accounting, 1C: ERP. Enterprise management, 1C: Entrepreneur's reporting and so on. The reporting service operates within these programs.

The product is charged according to tariff zones (“1500”, “3900”, “4900”, “5900” and “6900”). Rates available for:

- Legal entities – 6900 rubles/year (Moscow, zone “6900”)

- Individual entrepreneur – 3200 rubles/year (Moscow, zone “6900”)

Discounts apply when paying a plan for 2 years. Special conditions apply for groups of companies.

Technical support

Opening hours stated on the website:

Just out of curiosity, we called the indicated support numbers at 19.00 Moscow time. They got through to Kontur.Diadoc, although not very quickly. In Kaluga.Online / 1C: EDF, Synerdocs - no problem, in E-COM - silence, but an interesting thing happened with VLSI - they got to the regional partner of the company (no one answered the phone at that time). They also recruited on the night from Saturday to Sunday those who claim 24/7 service. Result: we only reached Taxcom/1C: EDF.

What else we managed to find out about technical support:

Contour.Diadoc

Diagnostics and setup of the workplace is carried out using the Contour.Plugin. Other settings with the connection of a specialist are paid separately - from 2600 rubles. at one o'clock.

Taxcom/1C: EDF

There is an online assistant on the site. You can select the time of the call (depending on the workload of the support engineers).

VLSI

There is software for remote connection of a VLSI specialist.

Synerdocs

The utility for setting up the workplace (Helper) is used. Initial setup is free.

Kaluga.Online/1C: EDO

The workplace is set up by the partner. Departure or remote connection are paid separately.

Sphere Courier

There is a single software installer that allows you to install and configure the utility necessary to work with electronic signatures and the Courier and Reporting services. There are 3 tariffs for technical support. One is free, the rest are for additional money. Although for them the deadline for resolving issues is stated to be shorter.

E-COM

One of the perks: a separate manager is assigned to the company for free (they give him a mobile phone number).

Advantages and disadvantages

Strengths of VLSI : you can separately connect the necessary reports (Rosprirodnadzor, etc.), integration with the VLSI system and other modules;

Weaknesses of VLSI : there are no separate applications directly for working with reports

Strengths of Kontur.Extern : integration with other Kontur products, a separate application for working with reports.

Weaknesses of Kontur.Extern : high price, terms of cooperation are negotiated individually.

Strengths of 1C Reporting : work in the familiar 1C interface, low price of the service.

Weaknesses of 1C Reporting : the 1C program is required, there are no separate applications for working with reports.

Comparison table

| VLSI | Contour.Extern | 1C Reporting | |

| Possibilities |

|

|

|

| Integrations | With other VLSI modules | With other Kontur services 1C API | Supported integrations of 1C itself |

| Applications | Multiple apps for Android and iOS | Report checking app for Android and iOS | Several applications for 1C programs for Android and iOS |

| Free plan | No | "Test drive" 3 months | No |

| Prices | From 2500 rubles (500 rubles – SBIS account, 2000 rubles – tariff) | From 5290 rubles | From 3200 rubles (you need a 1C license) |

| Interface | Russian | Russian | Russian |

| Ratings | Here | Here | Here |

| Who uses | Lazurit, Management Company Business People, MAN, Inkom Real Estate, Lukoil, Gazprom Astrakhan, Yasnye Zori, etc. | Yandex, Rosatom, Alfa Insurance, MTS, Auchan, Russian Railways, Detsky Mir, etc. | |

| Editorial rating | 6 | 7 | 5 |

What services are there for submitting electronic reports?

Services are divided into two broad categories: desktop and cloud. Desktop services, or programs, must be installed on a computer. They have their advantages and disadvantages.

| pros | Minuses |

| Automation of tax and accounting in one program. This is especially true for those who keep records in 1C software products. | Such programs are expensive. |

| When creating reports, you can use data from the commodity accounting system rather than making separate downloads. | To install the program, your computer must meet the technical requirements. If it doesn't match, you'll have to buy new hardware. |

| Developers regularly update the software components themselves and report forms. | All documents are stored on the computer, so you need a large amount of memory on your hard drive. |

| Such programs always have technical support and many step-by-step operating instructions. | Such programs can be complex to operate and require employee training, which involves additional financial and time costs. |

Cloud services work online, that is, the user only needs a computer or laptop with a CEP certificate installed on it and Internet access.

| pros | Minuses |

| Simple, intuitive interface. | Not all services can be linked to an accounting system to fill out forms automatically. Sometimes a report needs to be created in a third-party program and only then uploaded to the service. |

| There is technical support 24/7. | Conditional freedom of the workplace - CIPF and an EDS certificate must be installed on the work computer, otherwise it will not be possible to send a report. |

| All data is stored on the server and does not take up space on your computer. | The work depends on the Internet: if there are problems with it, you will not be able to fill out a report in the service itself. |

| Regular updates of the service and reporting forms. | |

| When purchasing a service, a CEP will also be produced for the client. |

Demo access available

It is not possible to see what work in the service looks like from the inside in all cases. On some sites the service is clearly stated (Kontur.Diadoc, Synerdocs, SBIS), but on others we had to try: Sfera.Courier - requested via online chat, in E-COM the login/password for the test version was provided after a phone conversation . Failed to test Kaluga.Online/1C: EDO and Taxcom/1C: EDO.