The enterprise balance sheet is the main source of data for analytical activities. The information obtained using its indicators makes it possible to determine the financial stability of the company, the efficiency of its work, and even assess development prospects. This information is needed both by the company’s management itself to develop strategies for the organization’s functioning and identify problems that interfere with maximizing profits, and by counterparties (clients, investors, regulatory authorities, banks) as a guarantor of the solvency and reliability of the partner.

How to assess the financial condition of an enterprise

To begin with, an initial assessment of the company's position is carried out. For this, two main reporting forms are used - Balance Sheet and Profit and Loss Statement.

Take our proprietary course on choosing stocks on the stock market → training course

At this stage, changes in the size of property and its sources that have occurred over the year are simply stated, and relationships between the lines of reporting forms are identified.

The so-called express analysis also involves the calculation of the most indicative values that allow us to draw conclusions about the position of the company, as well as the dynamics of its development. Such indicators, in particular, include:

- The security of the assets on the company's balance sheet with its own property: the difference between the result of the first section of the liability side of the balance sheet (sources of property) and the first section of the asset side of the balance sheet (the actual value of fixed assets and non-current assets);

- The amount of immobilized working capital (in particular, the amount of receivables is considered);

- The provision of actual material property with sources of its formation;

- Solvency of the company (the ability to quickly pay off urgent debts, which is determined by the presence of sufficient amounts in current accounts and the absence of overdue debts to creditors).

Also, when assessing the financial condition, the coefficients of financial stability and liquidity are necessarily studied.

Liquidity is the ability of a company to pay debts to creditors in a fairly short time by selling working capital (in this case, violation of deadlines is acceptable).

Analysts use the following three liquidity measures.

1. Current liquidity (coverage ratio) is a value demonstrating the sufficiency (or lack) of the enterprise’s assets to pay short-term debts during the year. The indicator is calculated using the following formula:

Current assets: Short-term liabilities

2. Quick liquidity (“critical assessment”) - the indicator reflects the ability of the enterprise to repay urgent debts with the liquid part of the property. Those that are not so easy to sell (for example, inventories) are excluded from liquid assets. The formula looks like this:

Liquid assets: Short-term liabilities

3. Absolute liquidity - this indicator provides information about the amount of debt that can be paid immediately with the company’s maximum liquid funds (that is, money). The value is calculated as follows:

(Money in accounts and on hand + short-term financial investments): Short-term liabilities

Financial stability indicators are included in a special group.

In practice, the following are most often calculated:

- Autonomy coefficient (Equity: Total capital) - shows what part of accounts payable can be reimbursed with one’s own funds and should normally exceed 50%;

- Dependency coefficient (Total capital: Equity capital) is the inverse of the autonomy coefficient, showing the participation of borrowed funds in ensuring the functioning of the company;

- Gearing Ratio (Liabilities: Equity);

- Investment coverage ratio ((Equity capital + Long-term liabilities) : Total capital);

- The ratio of coverage of current assets with own working capital, showing what part of these assets is covered by own property (Own property: Current assets);

- The coefficient of provision of the MPZ with its own property, showing the degree of independence of the MPZ from borrowed funds (Own property: MPZ).

Important!

All indicators characterizing the financial condition of the company are calculated at the beginning and end of the year. They are compared both in dynamics and with standard values. Based on the results of such an analysis, conclusions are drawn about the prospects for the company’s development given existing trends, the reasons that caused the changes, and problems are identified that interfere with maximizing profits and increasing the risks of a financial crisis.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

Why is it necessary to evaluate balance sheet items?

The preparation of a balance sheet, as well as other reports included in accounting, is subject to a number of specific requirements and rules.

Such rules also include a method for assessing the amount that will fall into a specific line of the balance sheet, regardless of whether it is located in its assets or liabilities. ATTENTION! From 2021, financial statements will be submitted exclusively in electronic form. Paper forms will no longer be accepted. Read more about changes to the rules for presenting financial statements here. We also remind you that in 2021 the reporting forms have been updated.

Knowledge of the rules and methods for valuing balance sheet items helps to correctly formulate all the amounts on the balance sheet lines.

For more information about what requirements apply to the balance sheet, read the article “What requirements should accounting records satisfy?” .

The concept of liabilities on the balance sheet of an enterprise

The liability side of the balance sheet is that part of Form No. 1, which reflects the sources of formation of property. This includes the company's liabilities and its capital.

Passive sections

The passive part of the form includes three sections. They are described below.

| Section number | Name | Content |

| I | Capital and reserves | Here you can find information about the share capital (the initial contribution of the founders), additional and reserve funds (created during the operation of the company), profit (loss). |

| II | long term duties | Fee-based loans provided to the company for a long term (that is, for a period longer than one year). |

| III | Short-term liabilities | Short-term debts to counterparties of various types: the tax office and government funds, own employees, suppliers, credit institutions, etc. Usually, by the end of the year, enterprises try to pay off this type of debt, so often there are no amounts in the annual balance sheet for the corresponding lines. |

Liability accounts

The liabilities side of the balance sheet presents the totals for the following groups of accounts:

- Active-passive: 60, 62, 68, 69, 71, 75, 76, 84, 90, 99;

- Passive: 66, 70, 80, 98.

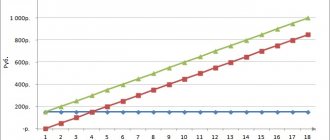

Composition and structure of capital (liabilities) - diagram

The diagram shows the composition of the liabilities side of the balance sheet. During analytical activities, special attention is paid to the proportions of equity and debt capital.

Having a sufficient amount of own funds ensures the financial stability of the company. At the same time, it is inappropriate to finance activities exclusively from your own sources - this way you can miss out on many benefits. For example, the fee for using borrowed funds may be much lower than the profit that the enterprise will receive from investing in the business.

Therefore, finding the optimal ratio between equity and debt capital (as well as between short-term and long-term liabilities) is an important task for managers and analysts.

Valuation of balance sheet liability items

- Line 1310 “Authorized capital”

This line reflects the amount specified in the constituent documents. If the founder has not fully contributed, his debt must be shown separately on the balance sheet.

- Line 1370 “Retained earnings (uncovered loss)”

If there is no retained earnings from previous years (activities started in the reporting period), only the profit of the reporting year will be reflected in this line - it is given in a net estimate, which is gross profit minus accrued income tax and other payments made from profits (for example, tax sanctions).

- Line 1520 “Accounts payable”

It is filled out if at the reporting date there are debts: to counterparties, the budget or others - in the amount of obligations reflected in the accounting (the numbers will be more reliable if the debt is confirmed by creditors, for example, by issuing reconciliation reports).

About some features of filling out the asset and liability lines of the balance sheet

Analysis of liabilities of the enterprise balance sheet

The main tasks of analyzing the liability side of the balance sheet include:

- Study of the dynamics of the size of equity and debt capital;

- Study of capital structure;

- Analysis of the use of funds;

- Identification of reserves for growth of equity capital;

- Search for the optimal relationship between the structural parts of capital.

By examining the passive part of the balance sheet, you can understand in what amount and from whom the company raised funds in the analyzed year.

The financial stability of the company increases the share of equity capital in the total amount of property. This indicator demonstrates the company's ability to repay debts on its own and makes it attractive and reliable in the eyes of creditors and investors.

The analytical activities themselves are carried out by compiling tables in which the proportions of all structural parts of capital to its total value are calculated (indicators are taken at the beginning and end of the year). Changes in ratios are identified and assessed, conclusions are drawn and recommendations for further action are formulated.

Company Balance Sheet

An organization's balance sheet is the summary of its activities for a specific period of time. This form most clearly demonstrates the principle of double entry accepted in accounting - the results of the active and passive parts of the balance sheet are always equal.

There are many types of balance sheets:

- By moment of filling: introductory and final;

- By degree of consolidation: single or consolidated;

- By period: annual or intermediate;

- According to the filling method: balance or reverse.

For analysis in practice, the annual balance sheet is most often used - form number one, filled out at the end of the year.

Example of analysis of balance sheet liability items

It is most convenient to consider the analysis of passive balance sheet items using an example.

Example. The results of the functioning of CONTINENT LLC are as follows.

| Article title | For the beginning of the year | Specific gravity | At the end of the year | Specific gravity | Change in value | Share change |

| ||||||

| Authorized capital | 9,95 | 0,09 | 10,61 | 0,1 | + 0,66 | + 0,01 |

| retained earnings | 20,92 | 0,2 | 22,39 | 0,22 | + 1,47 | + 0,02 |

| Total for the section | 30,87 | 0,3 | 33 | 0,33 | +2,13 | +0,03 |

| ||||||

| Loans and credits | 2,48 | 0,02 | 5,63 | 0,05 | + 3,15 | + 0,03 |

| Total for the section | 2,48 | 0,02 | 5,63 | 0,05 | + 3,15 | + 0,03 |

| ||||||

| Debt to creditors, including: | 69,83 | 0,68 | 65,21 | 0,63 | – 4,62 | – 0,05 |

| suppliers | 59,07 | 0,57 | 57,33 | 0,55 | – 1,74 | – 0,02 |

| staff | 5,42 | 0,05 | 2,66 | 0,03 | – 2,76 | – 0,02 |

| Tax office and funds | 4 | 0,04 | 3,2 | 0,03 | – 0,8 | – 0,01 |

| Other creditors | 1,34 | 0,01 | 2,02 | 0,01 | – 0,68 | – |

| Total for the section | 69,83 | 0,68 | 65,21 | 0,63 | – 4,62 | – 0,05 |

| Balance | 103,18 | 103,84 |

The table shows that in absolute terms the amount of equity capital has increased. His share in the total property of the company also increased. There was an increase in long-term borrowings in the same proportions.

But the size of short-term liabilities has decreased significantly (mainly due to debt items to suppliers and personnel).

In general, the current situation is assessed positively: the financial stability and independence of the company is growing, borrowed funds with a long repayment period are being attracted into circulation in order to expand the activities of the LLC and maximize profits.

Basic approaches to filling out a balance

In order not to make a mistake in assessing balance sheet items, you must adhere to the following rules (clause 5 of PBU 1/2008 “Accounting Policies of Organizations”, approved by Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n):

- the company's assets and liabilities should not be mixed - they should be accounted for separately;

- it should be assumed that the company does not intend to cease its activities;

- it is assumed that the adopted accounting policies will be applied consistently in the future;

- transactions are recorded at the time they actually occurred, regardless of the receipt or payment of money associated with them.

Now let's decide on those balance sheet items that need to be assessed. Business operations carried out by the company can affect any accounts: accounting for cash, property, settlements with customers and personnel, with the budget and funds, as well as capital accounts.

Detailed line-by-line comments and a sample balance sheet for 2021 can be found in the manual on annual financial statements from ConsultantPlus. Trial access to the legal system is free.

Some of the accounts will be reflected in assets (fixed assets, accounts receivable, cash), and some - in liabilities (authorized capital, profit, accounts payable).

NOTE! When filling out the balance sheet, offsetting between asset and liability items is not allowed; the indicators must be in a net assessment (PBU 4/99 “Accounting statements of an organization”, approved by order of the Ministry of Finance of the Russian Federation dated 07/06/1999 No. 43n) and comparable with the indicators of previous periods.

Let's consider the rules for evaluating the most frequently filled out balance sheet items.

Read about the structure of the balance sheet in the material “Balance Sheet (Assets and Liabilities, Sections, Types).”

Indicators characterizing the market stability of an enterprise

During the analysis, a number of indicators are calculated that allow one to judge the financial autonomy of the company. Let's take a closer look at them.

Financial autonomy coefficient (share of equity capital in total capital)

The autonomy coefficient shows what part of the debts can be repaid with one’s own funds. Normally, this figure should exceed 50%. It is calculated like this:

Equity: Total capital

Financial dependence ratio (share of borrowed capital)

The dependence coefficient is the inverse value of the autonomy indicator, showing the participation of borrowed funds in ensuring the functioning of the company. The indicator is calculated as follows:

Total capital: Own capital

Leverage of financial leverage (financial risk ratio)

This coefficient reads as follows:

Debt capital / Equity capital

Obviously, the lower the level of financial leverage, the greater the financial stability of the company.

In-depth structural analysis of the enterprise’s capital (stages, tasks)

A deeper structural study of the passive part of the balance sheet involves studying the relationship between borrowed and own sources of financing activities, a detailed assessment of changes in their levels with a study of the reasons for these changes, and searching for the optimal relationship between long-term and short-term debts.

Assessment of short-term and long-term sources of borrowed capital

When examining the structure of long-term and short-term debts, it is the growth of long-term liabilities that is positively assessed, since they have a number of advantages:

- Providing the company with prolonged financial sources necessary for investing in capital transformations;

- Increasing current solvency;

- Increased financial stability.

As for short-term accounts payable, the proportions between bank loans and debts to personnel, counterparties, tax and funds, etc. are examined here.

Bank loans are considered more expensive sources of financing compared to cheap (and sometimes free) other short-term obligations. However, you need to be careful here: sometimes penalties for late payment of taxes or late payment under an agreement can be quite significant.

Assessing the balance for signs of “good” balance

The final stage of the analysis is to evaluate the balance sheet for signs of a “good” report. It is considered that the position of the company is favorable and stable if:

- The amounts in the balance sheet totals are growing, and the rate of their increase exceeds the rate of inflation;

- The size of current assets increases faster than the amount of non-current assets;

- Current assets exceed short-term liabilities in value terms by at least 1.5 times (this also applies to their growth rate);

- In the active half of form No. 1 there is the minimum required amount of maximum liquid assets (that is, cash);

- The size, growth rate and shares of receivables and payables are approximately the same;

- The size and growth of long-term sources are greater than similar indicators for non-current property;

- The share of equity capital in the sum of all sources is at least 50%;

- There is no item in the balance sheet that directly indicates the financial ill health of the company - an uncovered loss.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

Methods for valuing balance sheet asset items

- Line 1150 “Fixed assets”

When assessing fixed assets, it is necessary to take into account the requirements of PBU 6/01 “Accounting for fixed assets” (approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n). Fixed assets are reflected in the balance sheet at their residual value. At the same time, assets that meet the criteria of the concept of fixed assets (clause 4 of PBU 6/01) and have a cost of no more than 40,000 rubles per unit can be reflected in the balance sheet as part of inventory (clause 5 of PBU 6/01).

ATTENTION! From 2022, FAS 6/2020 “Fixed Assets” and FAS 26/2020 “Capital Investments” are mandatory. PBU 6/01 will no longer be in force. The norms of new standards can begin to be applied earlier, by consolidating the provisions of the standards in the accounting policies of the enterprise.

ConsultantPlus experts explained how the standards of the new FSBU differ from PBU 6/01. Get free demo access to K+ and go to the review material to find out all the details of the innovations.

- Line 1230 “Accounts receivable”

Debts of counterparties in the balance sheet are shown in the amount of total debt (including accrued interest and other sanctions for violation of contract terms). Overdue and unsecured debts must be indicated minus the reserve created according to PBU 21/2008 “Changes in estimated values” (approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n).

- Line 1250 “Cash and cash equivalents”

Using this line, you need to collect all balances on the cash register and current accounts (including foreign currency and special ones).