All employers submit monthly reports to the Pension Fund. This applies to every employer who has officially employed employees who receive income. Their earnings are subject to insurance contributions. A special form has been approved by government decree for submitting information to the fund. But many entrepreneurs work independently and are not sure whether they need to take the SZV-M IP without employees in 2021.

Questionable situations when passing the SZV-M

There are cases when an entrepreneur may think that he has no employees, but in reality this is not the case. Please note the following situations:

- If you have employees who are currently on maternity leave or child care leave, you need to submit a report because... they have an employment contract;

- the employee was not paid a salary in the reporting month (for example, he was on unpaid leave) - we submit the report;

- you entered into a civil contract with the contractor in one month, and paid the remuneration in another - submit the report in the month when the contract was concluded, the time of payment does not matter;

- you rent property and an individual does not need to submit a report, because payments to a person are not subject to insurance premiums;

- the employee quit - submit a report on the employee for the month of dismissal; next month it no longer needs to be included in the report.

When to take it

Legal entities, entrepreneurs and self-employed people who work with:

- hired personnel;

- individual performers with a GPA conclusion;

- individual authors;

- citizens who have exclusive rights to intellectual property in the field of science, art, literature under licensing agreements or agreements for the alienation of rights;

- publishers based on a license.

If any types of contractual relations listed above were present in the reporting month, you need to submit SZV-M. This applies even to cases where no payments were made to individuals or the individual entrepreneur did not conduct business during the period for which the report is being submitted.

What information to include in the SZV-M report

To fill out the SZV-M form, you need the following details:

- details of the policyholder (your registration number in the Pension Fund of Russia - it is indicated in the notice of registration of you as an insured in the Pension Fund of Russia, full name, INN);

- leave the “checkpoint” field blank;

- indicate the reporting period - the month for which you are submitting the report;

- indicate the type of report: “out”—initial, “add”—additional, “cancel”—cancelling;

- information on employees: individual personal account number, full name, tax identification number (if any).

Results

Should individual entrepreneurs take the SZV-M:

- yes, if during the reporting period he had labor relations with employees;

- no, if the individual entrepreneur works without hired employees and is not registered as an employer-insurer.

The question of the need to submit a zero form SZV-M for individual entrepreneurs registered as employers in the temporary absence of valid employment contracts remains open.

It is better to check the answer with your Pension Fund branch. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

When should the original and supplementary SZV-M be submitted?

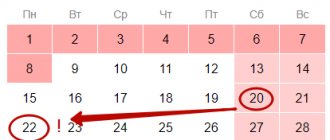

The report is due by the 15th of the next month. If this day falls on a holiday or weekend, the deadline for submitting the report is shifted. If you forgot to include one of your employees in the report, you must submit a supplementary report: enter the code “additional” in the “Form Type” field and enter into the form only those employees who were not included in the original report. The supplementary form must be submitted by the same deadline, and the original form must be submitted by the 15th of the next month.

Read the recommendations for filling out the SZV-M

It is convenient to submit reports on employees from the web service. In the cloud service Kontur.Accounting, you can easily keep records, pay salaries, submit reports - tax, accounting and employee reports. The first month of use of the service is free for all new users.

Try for free

How to choose the right type of SZV-M form for individual entrepreneurs with employees

There are three types of SZV-M form:

- original;

- complementary;

- canceling.

The original form is filled out during the initial submission of the SZV-M. If the Pension Fund returns a report with error code 50, it means that it has not passed format-logical control and the file has not been fully accepted. The correction report must also contain the form type "ISH".

If errors are identified in the original report, it is necessary to submit a corrected report with the “additional” form type, including information only about those employees for whom incorrect information was indicated in the original SZV-M.

If the employee was included in the original SZV-M report by accident, it is necessary to submit a report with the “Cancelling” type. In this case, in the tabular part of the form you only need to indicate the extra employee.

Find out what penalties are provided for failure to submit the SZV-M or errors in the report in ConsultantPlus. Trial access is available for free.

Position of the Pension Fund on how to take SZV-M if there are no employees

So, is it necessary to take SZV-M without employees in 2021? The question is interesting and still controversial.

| Position 1 | Position 2 |

| In principle, there cannot be a zero SZV-M if the LLC has no employees. If not a single person is included in the form for the reporting month, then submitting such an empty SZV-M loses all meaning. No one needs blank forms because they do not contain the necessary information. | The PFR branch in the Altai Territory on August 1, 2017 said this: even when there are no hired employees, the policyholder still needs to take the SZV-M without employees. But without a list of insured persons. |

On the other hand, you may come across technical difficulties in how to fill out the SZV-M if there are no employees. Thus, the electronic format of the report requires filling out at least one line of the list of insured persons. It is impossible to send a report without the “Information about insured persons” block at all. Therefore, it will not be possible to submit a completely blank form.

It is not clear from the current legislation whether it is necessary to take the SZV-M if there are no employees in 2021 or not. Passing the zero form is still a controversial issue. The position of only one territorial division of the Pension Fund of Russia is presented above. But there is no clear position on this issue of the fund’s central apparatus.

What is SZV-M without employees

The SZV-M report is a form of personalized accounting. It is intended to reflect data about the insured employees of an organization or individual entrepreneur. Roughly, this designation stands for: Information about the Insured Incoming for the Month - SZV-M. The preparation of this report is carried out by the responsible person appointed by the manager.

As a general rule, if there are no employees at the enterprise and an employment agreement has not been signed between the manager and the organization itself, then we are talking about the need to pass the SZV-M if there are no employees. Accountants also call it a zero report.

Rules for filling out the form

The form is filled out in sections. In the first section you need to provide information related to the policyholder:

- Registration number in the Pension Fund of Russia - this information can be found in the notification from the fund, which was issued to the businessman at the time of registration. The second option to find out the number is to contact your local Pension Fund branch. You can also contact the Federal Tax Service, they will provide information on the TIN.

- Short name (“IP Ivanov V.V.”).

- TIN - registered in the tax registration certificate.

- Checkpoint - this field is filled out only by organizations; they receive this code from the tax authorities. Individual entrepreneurs do not write anything in this field.

The second section is devoted to the tax period. This includes the figure corresponding to the reporting month for which the form is submitted (for example, “reporting period 06 calendar year 2019”).

In the third section, the individual entrepreneur must write the form code. There are several options here:

- The letters ISDH indicate the initial (original) form that the businessman submits for the first time during the reporting month).

- An additional form is a supplementary form in which new information is added in addition to what was previously submitted.

- OTMN is a cancellation form; it is submitted to cancel previously submitted erroneous data.

The fourth section provides information about the insured persons who received income in the form of payments in the reporting month. It is necessary to register for each employee his full name (nominative case), SNILS, as well as TIN, if such information is available.

Below all the data, the individual entrepreneur puts his signature and seal (if he has one). You must also indicate the date the form was signed.

Important! The names of employees may be entered in any order: alphabetical or any other sequence.

DOC file

SZV - M for founder - director, but what about individual entrepreneurs?

Some entrepreneurs working without employees are confused by the fact that legal entities need to submit a report for the sole founder - the director of the company, even if he is not employed. Many entrepreneurs doubt whether they need to submit a SZV-M for themselves.

The individual entrepreneur himself does not work under an employment or any other contract. The fact that he has or does not have employed employees plays absolutely no role.

In this particular case, there is a significant difference between a legal entity and an entrepreneur, so legal entities submit a report, but individual entrepreneurs do not.

Full-time employees: does it make sense to hire?

The activities of individual entrepreneurs are varied. An entrepreneur may have a modest business, or may own, for example, a chain of stores. He can work alone or employ employees.

Let's imagine that Maria Sergeevna is registered as an individual entrepreneur. She is a smart accountant with extensive experience. Maria Sergeevna services 8 micro-enterprises with minimal turnover and 2 larger companies. She manages to complete all the work and does not require outside help. Personally, it makes no sense for her to hire workers, pay them wages and make additional contributions to the budget. Therefore, all after-tax profits remain at her disposal. It’s so nice to do what you love and receive a stable income for it.

But Pyotr Semyonovich is the owner of two auto parts stores, and he physically cannot be in two places at the same time and work alone. Like it or not, he had to hire salespeople and storekeepers. Employees ensure the continuous operation of stores, business grows, and therefore income increases. Of course, you have to spend money on paying wages and deductions for employees, but it’s worth it.

Individual entrepreneurs can work as they wish - with or without employees. It's a matter of convenience or necessity. This issue is not regulated by law.

Responsibility for failure to provide a report

Responsibility for failure to submit or late submission of the form is the same for both individual entrepreneurs and legal entities.

The Pension Fund punishes violators with rubles. If the employer does not submit the form or submits it late, then the organization will be fined in the amount of 500 rubles for each employee insured in the pension system.

Since the zero form is not provided and does not need to be submitted, a fine cannot be imposed on the entrepreneur.

What has changed in the report

The most important amendment is that the function code has become mandatory for all employers.

The SZV-TD report itself also added information about the successor employer and codes for workers in the Far North. And on the title page the “Reporting period” section was removed.

The report must be submitted using the new form from July 1, 2021.

All amendments were approved last year by Resolution of the Board of the Pension Fund of the Russian Federation dated October 27, 2020 N 769p “On amendments to the Resolution of the Board of the Pension Fund of the Russian Federation dated December 25, 2019 N 730p”

Employers who use professional standards have been filling out the code since the beginning of 2021; for them only the format changes (previously it was from professional standards, now according to the occupational classifier).

The code of the function performed is indicated when there is a position in the SZV-TD event:

- Recruitment

- Dismissal

- Transfer to another position

- Assignment of qualifications

- Prohibition by the court to hold office

If the employee has decided on the format of the work book or the company’s name has changed, the labor function code will not be required.