The authorized capital of an LLC is part of the company’s funds contributed during its creation in the amount established by law. In the future, the company can use them in its activities along with other sources of financing.

In this publication, we will look at the operation of forming the authorized capital in the accounting of an LLC and find out what staffing document is provided in 1C for these purposes.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Rules for accounting entries

The establishment of accounting begins with the registration of founding contributions. Information is reflected in debit and credit. The main accounting account becomes “Authorized capital” (No. 80). The balance on it is considered a liability and is reflected in the third section of the balance sheet. The final value of this account must correspond to the constituent documents of the company.

Before the actual payment of contributions by the owners, the debt is formed in account No. 75. Subsequently, operations on the fulfillment of their obligations by the participants are reflected here. If necessary, the accountant opens additional accounts. Thus, transactions involving the formation, increase or decrease of capital are classified as subgroup 75.1. The payment of dividends is recorded in subaccount 75.2.

The rules for registering founding contributions depend on the form of receipts.

| Contents of operation | Debit | Credit |

| Registration of a company with an authorized capital (debt of founders for contributions) | 75 | 80 |

| Making a monetary contribution by a participant to a current account | 75.1 and 75 | |

| Payment of a contribution to the company's cash desk | 75.1 and 75 | |

| Transfer of property (fixed assets, materials, other valuables) as a contribution | , , , , , , , , | 75.1 and 75 |

Note! After full payment, account No. 80 remains unchanged throughout the entire activity of the company. Exceptions are cases when the founders decide to change the charter capital.

Step-by-step instruction

Success LLC is established. In accordance with the constituent agreement, shares in the management company are distributed as follows:

- 20% - founder Pushkarev A.S.;

- 80% - founder of Pegasus LLC.

On January 11, the state registration of the Company in the Unified State Register of Legal Entities took place.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Formation of authorized capital | |||||||

| January 11 | 75.01 | 80.09 | 150 000 | Formation of the management company | Formation of authorized capital | ||

Increase and decrease of capital

The owners of the company have the right to increase the authorized capital of the business company. The decision is made at the general meeting, and the entries are drawn up after new data is entered into the constituent documents. The registration of such transactions in accounting is based on the principles of double entry - debit and credit. The determining factor is the method of replenishing capital.

| Contents of operation | Debit | Credit |

| Payment via cash register | 50 | 75 |

| Non-cash transfers from owners | 51 | 75 |

| Entering material assets into the Criminal Code with subsequent recognition of the property as a fixed asset | 8 | 75 |

| 8 | ||

| Contribution of materials | 10 | 75 |

| Replenishment of capital with goods | 41 | 75 |

| Granting the company rights of use | 97 | 75 |

The debit of receipts from the founders can also be displayed in other accounting positions. The registration procedure depends on the type of asset. Thus, the increase in capital capital at the expense of the company’s income has its own characteristics reflected in the reporting. The accountant will have to make the following entries:

- Retained earnings – Dt84.

- Capital increase – Kt80.

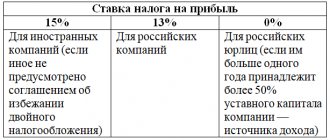

There will be no settlements with the founders. When using this method, it is necessary to take into account some nuances. Since as the capital of the company increases, the value of the shares increases, the owners will have to make contributions to the budget. The Ministry of Finance of the Russian Federation recognized the difference as an object of taxation in letter No. 03-03-06/1/53816 dated 08.22.17.

Making contributions by founder-organizations requires compliance with additional rules. The fact of transfer of funds or alienation of property must be reflected in the accounting records of both companies. Examples of filling out registers by a participating company can be found in free directories. So, the asset transfer scheme will look like this:

- Recognition of debt for making a contribution to the capital of another company – Kt76/Dt58.

- Transfer of fixed assets as a founding contribution – Kt01/Dt76.

- Reflection of the positive difference between the residual value of the transferred asset and its independent assessment – Kt91/Dt76.

- Recovering VAT from the residual value – Kt68/Dt19.

- Write-off of accumulated depreciation – Kt01/Dt02.

The authorized capital can be reduced in several ways. In most cases, the founders themselves become the initiators. The decision is made at a general meeting, taking into account the requirements for a minimum of 10 thousand rubles (Article 14 of Law 14-FZ). The wiring looks like this - Kt75/Dt80.

In addition, Art. Art. , and the same normative act provides for the grounds for a mandatory reduction of the criminal capital. Accounting entries are made according to other schemes:

| Contents of operation | Debit | Credit |

| The net asset value was lower than the registered authorized capital | 80 | 84 |

| Redemption of a share in an LLC or evasion of the founder from paying for it | 80 | |

| 81 | 75, 50, 51, | |

| Payment of part of the capital when a participant leaves the company | 80 | 75 |

All business transactions related to the company's authorized capital are recorded in special registers. They reflect summary data from analytical and synthetic accounts. Such journals allow you to quickly navigate through records and transactions.

GLAVBUKH-INFO

A limited liability company is a business company established by one or more persons, the authorized capital of which is divided into shares of sizes determined by the constituent documents; The participants of the company are not liable for its obligations and bear the risk of losses associated with the activities of the company, within the limits of the value of the contributions they made.The formation of the authorized capital of a limited liability company is carried out in accordance with the requirements of Federal Law dated 02/08/1998 No. 14-FZ “On Limited Liability Companies”.

If a company is founded by one person, the constituent document of the company is the charter approved by this person. If the number of company participants increases to two or more, a constituent agreement must be concluded between them.

The memorandum of association and the charter of the company are the constituent documents of the company. The authorized capital of a company is made up of the nominal value of the shares of its participants.

The size of the company's authorized capital must be no less than one hundred times the minimum wage established by federal law on the date of submission of documents for state registration of the company.

The size of the authorized capital and the nominal value of shares of company participants are determined in rubles.

The share of each participant in the company is determined as a percentage or as a fraction and must correspond to the ratio of the nominal value of his share and the authorized capital of the company. The actual value of the share of a company participant corresponds to a part of the value of the company's net assets, proportional to the size of his share.

Each participant in the company must make a full contribution to the authorized capital of the company within the period determined by the constituent agreement and which cannot exceed one year from the date of state registration of the company.

At the time of state registration of the company, its authorized capital must be paid by the founders by at least 50%.

Contributions to the authorized capital of a company can be money, securities, other things or property rights or other rights that have a monetary value.

The agreed monetary value of non-monetary contributions to the authorized capital of the company made by the company's participants is approved by a decision of the general meeting of the company's participants, adopted by all company participants unanimously.

Accounting for the receipt of monetary and non-monetary contributions to the authorized capital of a limited liability company (hereinafter referred to as the MC of the company) is carried out in the same manner and on the same accounts as when forming the authorized capital of a joint-stock company.

In general, transactions involving the receipt of contributions to the authorized capital of a limited liability company can be reflected in accounting with the following entries:

No.

| Contents of business transactions | Corresponding accounts | ||

| Debit | Credit | ||

| 1 | The Company's Criminal Code has been announced, as recorded in the constituent documents | 75-1 | 80 |

| 2 | The cost of the fixed asset item received as a contribution to the company's management company is reflected Next: the fixed asset item received as a contribution to the company’s management company is accepted for accounting | 08-4 01 | 75-1 08-4 |

| 3 | The value of the intangible asset object received as a contribution to the company's management company is reflected Next: the object of intangible assets received as a contribution to the company’s management company is accepted for accounting | 08-5 04 | 75-1 08-5 |

| 4 | The cost of materials received as a contribution to the company's management company is reflected | 10 | 75-1 |

| 5 | The cost of animals for growing and fattening received as a contribution to the management company of the company is reflected | 11 | 75-1 |

| 6 | The cost of goods received as a contribution to the company's management company is reflected | 41 | 75-1 |

| 7 | The receipt of cash deposited by participants in the deposit account in the management company of the company is reflected in the cash register | 50 | 75-1 |

| 8 | The receipt of funds deposited by participants in the deposit account in the management company of the company is reflected in the current account | 51 | 75-1 |

| 9 | The receipt of funds deposited by participants in the deposit account in the management company of the company is reflected in the foreign currency account | 52 | 75-1 |

The capital of the company can be increased or decreased. An increase in the authorized capital of a company is permitted only after its full payment.

An increase in the company's capital is carried out by decision of the general meeting of the company's participants, adopted by a majority of at least two-thirds of the total number of votes of the company's participants, unless the need for a larger number of votes to make such a decision is not provided for by the company's charter.

An increase in the company's capital can be achieved through:

- company property;

- additional contributions of company participants;

- deposits of third parties accepted into the company.

An increase in the size of the company's capital at the expense of its property can be done at the expense of additional capital (account 83) or net profit, including profit allocated for these purposes from the income of participants (account 84).

When increasing the capital of a company at the expense of its property, the nominal value of the shares of all participants in the company should increase proportionally without changing the size of their shares.

An increase in the company’s capital in the second and third cases is reflected by entries in the credit of account 75 “Settlements with founders” and the debit of the cash and property accounts (50, 51, 52, 08.10, etc.) and at the same time in the debit of account 75 and the credit of the account 80 “Authorized capital”.

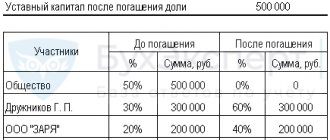

A decrease in the company's capital can be carried out by reducing the nominal value of the shares of all company participants in the company's authorized capital and/or redeeming shares purchased by the company. Reducing the capital of a company by reducing the nominal value of the shares of all participants in the company must be carried out while maintaining the size of the shares of all participants in the company.

The company does not have the right to reduce its authorized capital if, as a result of such a reduction, its size becomes less than the minimum amount of authorized capital determined by the Federal Law “On Limited Liability Companies” on the date of submission of documents for state registration of the relevant changes in the company’s charter.

A decrease in the capital of a company by repayment of shares repurchased by the company is reflected in accounting in the same way as a decrease in the authorized capital of a joint-stock company by canceling repurchased own shares:

| No. | Contents of business transactions | Corresponding accounts | |

| Debit | Credit | ||

| 1 | Shares purchased by company members have been accepted for accounting | 81 | 51 |

| 2 | A decrease in the authorized capital due to the redemption of purchased shares is reflected | 80 | 81 |

| 3 | The negative difference between the nominal value of the repurchased shares and the actual costs of their repurchase was written off | 91 | 81 |

If at the end of the second and each subsequent financial year the value of the company's net assets is less than its authorized capital, the company is obliged to announce a reduction in its authorized capital to an amount not exceeding the value of its net assets and register such a decrease in the prescribed manner.

The value of the company's net assets is assessed according to accounting data in the manner established by the Ministry of Finance of the Russian Federation. There is currently no procedure for assessing the value of net assets of limited liability companies.

Before the release of this procedure, these companies may use the procedure for assessing the value of net assets of joint stock companies, set out in clause 1.1 of this chapter.

If, before the end of the second and each subsequent financial year, the value of the company’s net assets is less than the minimum amount of the authorized capital established by the Federal Law “On Limited Liability Companies” as of the date of state registration of the company, the company is subject to liquidation.

| < Previous | Next > |