All tax agents must report in Form 6-NDFL for the 4th quarter of 2021. In the article you will find the current Calculation form, instructions and samples of filling out all its sections.

To submit reports for the Ⅳ quarter of 2021, you must use Form 6-NDFL, which was introduced by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/450 as amended by Order No. ММВ-7-11 dated January 17, 2018/ [email protected] This form was used when submitting reports in the previous reporting period. The new form was not approved. In this regard, both the procedure for filling out the calculation and the format required for submitting it to the Federal Tax Service continue to apply.

This form and procedure for filling out the report for 2021 will be used for the last time . As of reporting for the 1st quarter of 2021, it is necessary to use a new form (approved by order of the Federal Tax Service dated October 15, 2020 No. ED-7-11 / [email protected] ).

Download the current 6-NDFL form for the 4th quarter of 2021.

Let's look at how to fill out 6 personal income taxes for 2021. The filling procedure is given in Appendix 2 of Order No. ММВ-7-11/ [email protected]

The current form of payment includes:

- title page;

- section 1 “Generalized indicators”;

- Section 2 “Dates and amounts of income actually received and withheld personal income tax.”

Who is required to submit the 6-NDFL report in 2020

As before, in 2020, a personal income tax report in Form 6 must be prepared and submitted to personal income tax agents. And this concept includes companies and individual entrepreneurs making payments subject to personal income tax to individuals. Form 6-NDFL was ratified by order of the Federal Tax Service dated October 14, 2015. Since 2021, a new form 6-NDFL has come into force, with amendments made to it by Order of the Federal Tax Service of Russia dated January 17, 2021 No. ММВ-7-11/18.

Unlike the 2-NDFL certificate, in the calculations for the 6-NDFL it is not necessary to highlight data for each person separately. You must enter information about the income of individuals, as well as information about withheld and paid personal income tax.

The components of form 6-NDFL are the title page and sections 1 and 2. The address and other general information about the company or individual entrepreneur are entered on the title page. The reporting period is also indicated there. Section No. 1 displays summary data, and section No. 2 contains the entire list of detailed data with exact amounts and dating.

Below we will consider what rules must be followed so that Form 6-NDFL 2021 is filled out correctly.

Title page - the face of the document

Don't forget to indicate the period for which the report is provided. It is entered in a special column: “Representation field”. Lines 21, 31, 33 or 34 are selected depending on the month in which the relevant documents are sent to the tax authorities. Next, go to the item “Provided to the tax number.” Here you will need to indicate the code of the tax office where the reports are submitted.

In the “Location” column, it is necessary to emphasize who exactly is the author of the report: a company or an individual entrepreneur, what the tax system is: UTII, simplified tax system or another.

In the field “At location (accounting) (code)”, you must indicate the appropriate code. Codes for 6-NDFL due to changes made in 2021 have been updated:

- 120 - At the place of residence of the individual entrepreneur;

- 124 - At the place of residence of the member (head) of the peasant (farm) enterprise;

- 125 - At the lawyer’s place of residence;

- 126 - At the notary’s place of residence;

- 213 - At the place of registration as the largest taxpayer;

- 214 - At the location of a Russian organization that is not the largest taxpayer;

- 215 - At the location of the legal successor who is not the largest taxpayer;

- 216 - At the place of registration of the legal successor, who is the largest taxpayer;

- 220 - At the location of a separate division of a Russian organization;

- 320 - At the place of activity of the individual entrepreneur;

- 335 - At the location of a separate division of a foreign organization in the Russian Federation.

In the new form 6-NDFL, which is submitted starting in 2018, two new columns have appeared to indicate the code of the reorganization form and the TIN/KPP of the reorganized company. We list the new codes of reorganization and liquidation forms for filling out 6-NDFL 2020:

- 0—liquidation;

- 1 - transformation;

- 2 - merger;

- 3 - separation;

- 5 - connection;

- 6 - separation with simultaneous joining.

The first section of 6-NDFL is for total amounts

As mentioned above, specification for each hired employee is not required here; you will only need to record the total indicator of all employees. But when different personal income tax rates are applied, you will have to differentiate them by filling out several lines in section No. 1 - from 010 to 050.

Let's say employees have income taxed at rates of 13, 30, 35 percent. This means that during the calculation, three sections No. 1 will be filled out, each on a separate sheet. And the remaining lines, from 060 to 090, will be common. In this way, information is entered only on the first copy.

The personal income tax rate is entered in line “010”, and income is entered in line “020” on an accrual basis at the beginning of the year. We must also remember about the existence of the option of carry-over wages, when the final result of income in sections No. 1 and No. 2 may turn out to be different. In line “025” we display income in the form of dividends, if any occurred in the company.

For tax deductions, including social, child, property, field “030” is reserved. The amounts of calculated and withheld tax are entered in lines “040” and “070”. There is also a special line “050”, intended for similar data of foreign workers who work in a company under a patent.

Line “060” contains the figure for the total number of employees at the enterprise (everyone who received income). Line “090” is for the amount of tax that was returned to the organization. And in special cases, when the company was unable to withhold this type of tax, the personal income tax amount must be entered in line “080”; most often this practice is used for rolling salaries.

Fields “060–090” are filled in with the total amount for all available bets and only on the first page. On other sheets we put “0”, and then dashes. Because all the essential data will be displayed in the second section.

Control ratios in calculation: how tax authorities check the declaration

Be sure that the fiscal regulator will check the data provided in the calculation. Let us remember that income tax collections consistently hold one of the leading places in the formation of the state budget.

The audit is carried out using control ratios (CRs) established by the tax service. And taking into account the points that relate to the CS, the declarant, already during the preparation of the calculation, has the opportunity to immediately double-check specific data and, if necessary, correct them. This allows you to mitigate the risks of returning your declaration and penalties from tax authorities.

Let us note right away that sections 1 and 2 of the declaration do not correspond with each other at all, that is, there are no interrelations between them, and accordingly, the figures indicated in them do not pass through the prism of control ratios.

According to the calculation, all CS can be divided into several large blocks:

- First, the tax regulator will check the data on the title sheet, in particular, the correctness of the deadline for submitting the form. And regarding the correctness of registration: are all lines filled out correctly, in the form regulated by the above-mentioned Order of the tax authorities. We will talk further about sanctions for late submission of the calculation or submission of it in the wrong form. Believe me, the fiscal officers will not teach anyone, take into account that the report is being submitted for the first time and other points, so you need to pay maximum attention to filling it out.

- The next thing is the correctness of arithmetic formulas. When tax deductions exceed income or the amount of collection “does not fit” with the calculation of the tax rate and income, there are elementary errors in the declaration, such a calculation will not be accepted even for verification under the Constitutional Code.

- One of the key points of the CS is checking against internal control indicators:

- Section No. 1: the amount on the one hundred and fortieth line minus the figure on line “090” (deductions) must “fight” with the total indicator of the income tax paid to the state treasury.

- The dates of tax payments to the state budget under section No. 2 (line 120) will also be checked.

- KS on line “040” (accrued personal income tax) is a special item. Few declarants, when checking themselves, notice discrepancies of several rubles that appear in the formula when calculating the amount of income multiplied by the rate. This is acceptable, especially in enterprises where there are many employees, because when rounding, pennies can affect the result.

- Inter-document control ratios are a more in-depth analysis of indicators. A reconciliation with the figures reflected in the 2NDFL certificates for the enterprise will be sure to be checked:

- Thus, according to the final annual calculation, the data on the indicators of calculated income (on line “020”) and the final total figure for all 2 personal income taxes will be checked. If inconsistencies are found in the calculation, the report will be considered incorrect.

- The amount entered in line “025” (dividends received) must correspond to the corporate income tax. faces and again with numbers for 2NDFL.

- Lines “040” and “080” should also match the indicators for 2NDFL and corporate income tax.

- The number in line “060” should correlate with the number of people for whom 2NDFL and Appendix No. 2 to the corporate income tax were submitted. And please note that what is important here is not the number of certificates, but the number of people (we already mentioned this when analyzing the filling algorithm).

- The final block of verification under the KS can be carried out using a reconciliation of advance mandatory payments of the agent enterprise.

Video instruction: what tax authorities pay attention to when checking 6-NDFL

Details of data in section No. 2

Data for the past three months is described in more detail in section 2 of form 6-NDFL. Here the exact dates are necessarily recorded and a breakdown of income is given. Operations are reflected in the document in the same sequence in which they occurred in reality.

Line “100” - “Date of actual receipt of income” is entered into the form in accordance with Article 223 of the Tax Code of the Russian Federation. It is important to record the last day of the month to correctly reflect wages. But payments for sick leave and vacation pay are recorded on the actual date of their receipt.

In field “110” you need to reflect the date of income withholding. And the current law prescribes: deductions are made on the day the income is received (except for wages). Line “120” - “Term for transferring income” - is filled out depending on the type of income received. As a rule, vacation and sick leave are issued before the end of the reporting month. In some cases, data is recorded the next day after receiving funds.

“The amount of income actually received” (line “130”) is accurate, with kopecks, data on income before the moment personal income tax was deducted. And in 2021 we will enter the already withheld tax in column “140”.

If the start of an operation occurred in one reporting period, and it ended in another, then in section No. 2 you need to enter data about the period of its completion.

Bonuses, vacation pay and sick leave

If we are talking about a monthly bonus, then it is reflected in the report in the same way as salary . The date of receipt of income will also be considered the last day of the billing month . If the bonus is paid along with the monthly salary, both amounts are added up and entered into one block in section 2. If a separate day is set for the transfer of the bonus, then it must be shown in a separate block of the second section.

When a premium is accrued for a period exceeding a month (quarter or year), the date of receipt of income should be considered the date of actual payment of the premium (letter of the Ministry of Finance dated October 23, 2017 No. 03-04-06/69115). In this case, on pages 100 and 110 sections. 2 you need to enter the date of payment of the bonus, and on page 120 - the next working day.

When paying vacation pay and sick leave, personal income tax must be transferred no later than the last working day of the month of payment. It is this date that should be entered on page 120 of section. 2 for such payments.

A special case is when vacation pay is paid in the last month of the reporting period, and the ending date of this month is a day off. For example, if vacation pay was paid in December 2017, then the date of transfer to the budget is postponed to the first working day of the new year - 01/09/2018. Therefore, this amount will be reflected in section. 1 report for 2021 and in Sect. 2 - report for the half year 2021. In this case, the date 01/09/2018 should be shown on page 120.

Deadlines and fines

When filling out the report on Form 6-NDFL, you must be extremely careful. Any mistake or blot is a distortion of reporting data. And it entails the imposition of fines on the entrepreneur or company.

The deadline for submitting 6-NDFL for 2021 in 2021 was reduced by one month. Earlier submission of the report is established by Law No. 325-FZ of September 29, 2019. Amendments to Art. 230 will come into force on January 1, 2020. The deadlines for submitting 6-NDFL for the periods of 2021 remain the same:

- for 2021 - until March 1, 2021

- for the first quarter of 2021 - until April 30, 2021;

- for the first half of 2021 - until July 31, 2021;

- for nine months of 2021 - until November 2, 2021;

- for the twelve months of 2021 – until March 1, 2021.

conclusions

Form 6-NDFL for the 2nd quarter (first half of the year) 2021 serves for operational control over the fulfillment by tax agents of their duties to transfer income taxes. It shows the amount of income, accrued and withheld tax and the established deadlines for transfer. If difficulties arise in its preparation, you should first of all pay attention to the established date for transferring personal income tax for this type of income. If the question still remains, you need to be guided by letters from regulatory authorities explaining the relevant provision of the instructions.

Submission format 6-NDFL

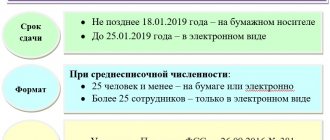

Until 2021 inclusive, submitting a report on Form 6-NDFL was allowed in two formats:

- on paper (if the number of employees does not exceed 25 people);

- in electronic form (if the number of employees exceeds 25 people).

Starting from 2021, only organizations and individual entrepreneurs that employ no more than 10 people will be able to submit 6-NDFL on paper. Others need to report on TCS through EDI operators.

According to the explanations of the Federal Tax Service (letter of the Federal Tax Service of Russia dated May 4, 2016 N BS-4-11/7928), if you did not accrue or pay income on which you need to pay tax, you do not need to provide a zero calculation of 6-NDFL. However, it is necessary to explain in writing to the Federal Tax Service the reason for not submitting the report. Otherwise, there is a danger of blocking the current account. The Federal Tax Service cannot refuse to accept a zero report. Therefore, you are left with a choice: send to the INFS a zero form 6-NDFL or a letter explaining the reasons for not submitting the calculation.

Undisciplined members of the business community who submit tax returns late will be subject to fines. If the delay is up to one month, the fine will be 1000 rubles. Plus another 1000 rubles for each subsequent month of delay. There is also a penalty for errors in 6-NDFL; a fine of 500 rubles is imposed for false data.

If the calculation is not submitted within 10 days from the due date, then the tax inspectorate also has the right to block the bank account of the tax agent (clause 3.2 of Article 76 of the Tax Code of the Russian Federation).