Many successful enterprises, in the course of their activities, open various facilities both in the region where they themselves are registered and in other entities. Moreover, such expansion is called differently: branches, divisions or representative offices. Often these concepts are mixed. For this reason, when opening a new office, it is necessary to clearly understand what functions the newly opened facility will perform. And after the functions have been defined, it is worth thinking about the status. To do this, it is necessary to note the following.

In accordance with the current civil legislation, a branch is a separate division of an organization located outside its location and performing all or part of its functions, including as a representative office.

A representative office, in turn, is also recognized as a separate division of a legal entity located outside its location, but with narrower powers than a branch. In particular, a representative office has the right to exclusively represent the interests of the legal entity that created it and protects them.

The procedure for conducting the activities of branches and representative offices is determined in the regulations of the organization. The fact of the existence of a separate division in any of the forms (branch, representative office) is subject to state registration in the Unified State Register of Legal Entities by making a record of creation in the constituent documents.

Thus, the legislation provides a distinction between a branch and a representative office. It comes down to the scope of assigned functions and tasks.

At the same time, we note that the legislation on taxes and fees does not distinguish between a branch and a representative office. It contains only the concept of “separate division”.

Thus, the Tax Code establishes that a separate division of an organization is any territorially separate division from it where stationary workplaces are equipped (clause 2 of Article 11 of the Tax Code of the Russian Federation). In this case, a workplace is recognized as stationary if it is created for a period of more than one month.

For your information

A workplace is a place where an employee must be or where he needs to arrive in connection with his work and which is directly or indirectly under the control of the employer (Article 209 of the Labor Code of the Russian Federation).

In addition, the reflection of information about the creation of a separate division in the constituent documents of the “parent” company is not necessary to recognize the existence of a separate division in terms of the rights and obligations to pay taxes and submit reports.

Thus, for an organization carrying out business activities at the place of registration, a warehouse located in another area under the jurisdiction of another tax office will be a separate division, provided that at least one stationary workplace is equipped there. The presence or absence of an entry in the constituent documents does not matter in this case.

In order to apply tax legislation regarding the conduct of activities using economic units that are geographically distant from each other, it is necessary to use the term “separate division”. In this case, it is necessary to take into account the characteristics that it must have in order for certain tax consequences to occur.

Such tax consequences include, in particular, the submission of appropriate tax reports by organizations that have separate divisions.

Personal income tax

As follows from the legislation on taxes and fees, Russian organizations making payments to individuals must calculate, withhold and pay the amount of taxes on personal income. In this case, organizations are recognized as tax agents.

Tax agents with separate divisions are required to transfer calculated and withheld tax amounts to the budget both at their location and at the location of each of their separate divisions.

In addition, tax agents are required to provide information on the income of individuals to the tax authority at the place of registration. This reporting is submitted annually no later than April 1 of the year following the expired tax period, in form 2-NDFL (approved by order of the Federal Tax Service of Russia dated November 17, 2010 No. ММВ-7-3 / [email protected] ).

It is worth noting that the obligation to pay personal income tax at the location of a separate division can be fulfilled by the division itself, but only if it has a separate balance sheet and current account.

If a separate division is not allocated to a separate balance sheet and does not have a current account, then the obligation to pay tax is fulfilled by the parent organization. In this case, the submission of information on the income of employees of such a separate division at the place of its registration can be made by the parent organization (letter of the Ministry of Finance of Russia dated August 28, 2009 No. 03-04-06-01/224).

However, a situation may arise in which an employee of an organization works for a month both in a separate division and in the parent organization. In this case, personal income tax on the income of such an employee must be paid both at the location of the separate unit and at the location of the parent organization, taking into account the time worked.

Information about the income of such an employee must be submitted to both the tax authority at the location of the separate division and the tax authority at the location of the parent organization (letter of the Ministry of Finance of Russia dated March 29, 2010 No. 03-04-06/55).

This option is also possible: several separate divisions of the organization are located in the same municipality, but belong to different tax authorities. In this situation, the organization can be registered at the location of one of its separate divisions, determined by the organization independently. Personal income tax is transferred to the tax authority at the location of one of the separate divisions in which the organization is registered. Accordingly, the information is presented in a similar manner.

What is a separate division and how to open it

If you are a legal entity, then you have the right to create a separate division (one or several; Russian legislation has no restrictions on their number), while individual entrepreneurs are deprived of this right.

A separate division is considered to be a premises, building or other piece of real estate where the company has created at least one stationary workplace for a period of more than one month and the location address does not coincide with your legal address according to the Unified State Register of Legal Entities extract.

In other words, have you opened a business in another district, city or municipality? Please, register it with the Federal Tax Service within a month (if the data on an existing separate division has simply changed, notify the tax authorities within three days).

Important!

Be sure to register a separate division. Otherwise you will have to pay a fine. But to what extent, you will most likely have to deal with the tax authorities in court.

If the inspectors believe that you submitted an application to the inspectorate untimely, you will pay a fine of 10 thousand rubles under clause 1 of Art. 116 of the Tax Code of the Russian Federation. In the worst case, they may believe that you were operating and did not pay taxes. Be prepared for more severe measures - you will have to give 10% of your income, but not less than forty thousand rubles (read about this in paragraph 2 of Article 116 of the Tax Code of the Russian Federation).

Interesting!

If you nevertheless made such an oversight as untimely registration of a separate unit, we recommend that you go to court, pointing to the letter of the Federal Tax Service dated February 27, 2014 No. SA-4-14/3404, in which the inspectors came to the conclusion that the offenders in the above In this case, a fine must be applied under clause 2 of Art. 126 of the Tax Code of the Russian Federation - namely, you will have to pay only 200 rubles. But in practice, it is often difficult to challenge in court the decision of the Federal Tax Service on a much larger fine.

Important!

The fine will have to be paid not only by the organization, but also by the director (from 300 to 500 rubles). If, in addition, you did not register with the Federal Tax Service on time, you will be fined from 5 to 10 thousand rubles (if the delay in registration is less than or more than 90 calendar days).

Registration of a separate division does not mean that it is a separate legal entity (separate organization). This means that you will pay taxes on income received in a separate division to another tax office on a territorial basis. In all other respects, the separate division is subordinate to the goals and objectives of the parent one; they also have a single accounting policy. The principles and features of accounting and tax accounting are also determined by the head department. Read more about this.

Income tax

Organizations that have separate divisions pay income tax (advance payments) to the federal budget based on the results of the tax (reporting) period at their location without distributing these amounts among separate divisions.

Payment of the tax amount (advance payments) to the revenue side of the budgets of the constituent entities of the Russian Federation and the budgets of municipalities is made by taxpayers at the location of the organization, as well as at the location of each of its separate divisions.

Thus, corporate income tax conditionally consists of two parts. One part is credited to the federal budget. This part is paid by the parent organization to the tax authority at the place of its registration. The other is credited to the budget of the constituent entity of the Russian Federation and is paid both at the place of registration of the parent organization and at the place of registration of each of the separate enterprises.

In this case, it does not matter whether a separate division is allocated to a separate balance sheet or not. It also does not matter what result is obtained by a separate division - profit or loss. The main indicator is the tax base as a whole for the legal entity, which is distributed between the parent organization and separate divisions.

If a taxpayer has several separate divisions on the territory of one constituent entity of the Russian Federation, then the distribution of profit for each of these divisions may not be made.

In this case, the taxpayer independently selects the separate division through which the tax is paid to the budget of this entity. To do this, it is necessary to notify the tax authorities in which the separate divisions are registered with tax authorities before December 31 of the decision.

If a taxpayer creates new or liquidates separate divisions, he is obliged to notify the tax authorities of the relevant constituent entity of the Russian Federation within 10 days after the end of the reporting period about the choice of the division through which the tax will be paid.

Notification forms No. 1 and No. 2 were approved by letter of the Federal Tax Service of Russia dated December 30, 2008 No. ШС-6-3/986.

Let's consider the order of presentation of notifications No. 1 and No. 2 in tables 1 and 2.

Table 1. Sending notifications when changing the procedure for paying income tax

| Grounds for giving notice | Place of presentation of the notice | Recommended form of notification |

| If income tax is paid to the budget of the subject at the location of the responsible “isolator” | Inspectorate of the Federal Tax Service at the location of the responsible “isolator” | Notice No. 1 |

| Inspectorate of the Federal Tax Service at the location of the remaining “isolated” | Notice No. 2 | |

| Federal Tax Service Inspectorate at the location of the organization | Copy of notice No. 1 | |

| If income tax is paid at the location of each “isolated” | Federal Tax Service Inspectorate at the location of the organization | Notice No. 1 |

| Federal Tax Service Inspectorate at the location of each “isolated” person (including the person responsible) | Notice No. 1 |

Table 2. Sending notifications when the number of structural divisions changes

| Grounds for giving notice | Place of presentation of the notice | Recommended form of notification |

| When creating a new “separate unit” in a constituent entity of the Russian Federation, which already has a responsible unit | Inspectorate of the Federal Tax Service at the location of the new “isolated” | Notice No. 2 |

| Inspectorate of the Federal Tax Service at the location of the responsible “isolator” | Notice No. 2 | |

| Federal Tax Service Inspectorate at the location of the organization | Message in form No. S-09-3 | |

| When creating new “isolates” and choosing a person in charge in a constituent entity of the Russian Federation, in which there was (or was not) only one division | Inspectorate of the Federal Tax Service at the location of the selected responsible “isolator” | Notice No. 1 |

| Federal Tax Service Inspectorate at the location of the organization | Copy of notice No. 1 | |

| Inspectorate of the Federal Tax Service at the location of the remaining “isolated” | Notice No. 2 | |

| When closing a “separate enterprise” that did not pay taxes | Inspectorate of the Federal Tax Service at the location of the responsible “isolator” | Free form notification |

| Federal Tax Service Inspectorate at the location of the organization | Message by form No. S-09-3 | |

| When closing (replacing) the responsible “isolator” and choosing a new one | Inspectorate of the Federal Tax Service at the location of the new responsible “isolator” | Notice No. 1 |

| Federal Tax Service Inspectorate at the location of the organization | Copy of notice No. 1 | |

| Federal Tax Service Inspectorate at the location of the remaining “isolated” (including closed or formerly responsible) | Notice No. 2 | |

| When all “isolation centers” are closed on the territory of a constituent entity of the Russian Federation | Inspectorate of the Federal Tax Service at the location of the responsible “isolator” | Free form notification |

| Federal Tax Service Inspectorate at the location of the organization | Message by form No. S-09-3 |

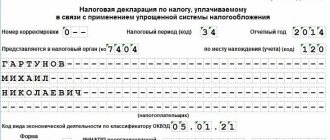

In addition, organizations must submit an income tax return at the end of each reporting and tax period both at the location of the organization itself and at the location of each of the separate divisions. In this case, the parent organization submits a declaration drawn up for the organization as a whole with the distribution of profits among separate divisions.

At the location of the separate division, organizations submit a declaration that includes the title page (sheet 01), subsection 1.1 of section 1 and subsection 1.2 of section 1 (if monthly advance payments are made during the reporting (tax) periods), as well as calculation of the amount of tax (Appendix No. 5 to sheet 02), payable at the location of this separate division.

Transport tax

Transport tax is a regional tax. Taxpayers are persons to whom vehicles are registered.

The procedure and rules for registering vehicles were approved by Order of the Ministry of Internal Affairs of Russia dated November 24, 2008 No. 1001 “On the procedure for registering vehicles.”

According to paragraph 20 of the Rules, vehicles are registered only under their owners - organizations or individuals indicated in vehicle passports.

Moreover, registration of vehicles for legal entities is carried out at the location of organizations, determined by the place of their state registration, or at the location of their separate divisions.

The legislation on taxes and fees stipulates that payment of transport tax and advance payments on it is made by taxpayers to the budget at the location of vehicles in the manner and within the time limits established by regional laws.

Thus, if the transport is registered at the location of the organization, then the tax is paid at its location. If the vehicle is registered at the location of a separate subdivision, then the tax will be paid at the place of registration of the “separate unit”

The actual payment of tax to the budget at the location of the separate division can be made by both the parent organization and the division itself, which has a current account and the appropriate powers.

After the expiration of the tax period, which for transport tax is a calendar year, a tax return is submitted to the tax authority at the location of the vehicles. It is submitted no later than February 1 of the year following the expired tax period.

If the vehicle is registered at the location of a separate subdivision, then the tax return is submitted to the tax office at the location of this subdivision. In this case, the tax return must indicate the checkpoint of the separate division.

Attention

From January 1, 2011, calculations for advance payments of transport tax are not submitted to the tax authority.

It is also worth noting that if the activity through a separate division at the location of which the vehicles were registered is terminated, then the organization submits a transport tax declaration and pays the tax at the location of the closed division.

Closing a separate division correctly

Have you decided to close a separate division? Be aware that the closing order is similar to the opening order. The order of your actions is as follows:

- Draw up an application for the closure of a separate division to provide to the tax authorities. The application must indicate the necessary details of the parent organization, list the divisions to be closed, indicating their addresses, and certify it with the seal of the organization and the signature of the head. Don't forget to indicate his personal TIN.

- Collect a package of documents: changes to the organization’s Charter and the Unified State Register of Legal Entities, a certified copy of the decision of the board of directors (or order, instruction) on the closure of a separate division.

- Provide the collected documents to the Federal Tax Service at the place of registration of the separate division within three days from the date of termination of the division’s activities.

Organizational property tax

The property tax of organizations, like the transport tax, is a regional tax. Moreover, for this tax the base is determined separately in relation to property:

- subject to taxation at the location of the organization;

- each separate division of the organization with a separate balance sheet;

- located outside the location of the organization or a separate division that has a separate balance sheet.

Thus, the calculation of tax is “tied” to the balance sheet of the organization and its separate divisions, that is, separate divisions pay tax in respect of property on the balance sheet of this division and located at the place of registration of the division.

Organizations independently decide on the allocation of a separate division to a separate balance sheet. But the parent organization can transfer the necessary property to its division without putting it on the latter’s balance sheet. In this case, such property will be taken into account when calculating the tax of the parent organization. Therefore, it is she who must submit the declaration.

It is worth noting that for corporate property tax there is no summary calculation (declaration) for the legal entity as a whole. Consequently, calculations and declarations are drawn up separately for the parent organization, for each separate division allocated to a separate balance sheet, and for each property.

Land tax

Land tax is a local tax. Considering that land tax is paid at the location of the land plots, there are practically no specifics for its calculation and payment in the presence of separate subdivisions.

It is only worth noting that organizations submit tax declarations at the location of the land plot. Tax returns are submitted no later than February 1 of the year following the expired tax period.

In the declaration submitted in respect of a land plot, the location of which coincides with the location of the organization, the checkpoint is indicated in accordance with the certificate of registration with the tax authority.

When submitting a tax return for land tax in relation to a land plot located at the location of a separate subdivision, the checkpoint is indicated in accordance with the notification of registration with the tax authority of a legal entity at the location of the separate subdivision.

For your information

From January 1, 2011, calculations of advance payments for land tax are no longer submitted.

It is also worth noting that an organization can assign a separate division the functions of paying taxes and submitting reports on behalf of the organization. This option is possible only if the location of the land plot coincides with the location of a separate division, allocated to a separate balance sheet and having its own current account.

If a separate subdivision does not have a separate balance sheet, then the payment of land tax and submission of reports is carried out by the organization on the basis of information from the separate subdivision at the location of the land plot.

Accounting procedure

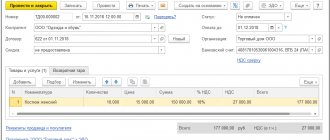

Subdivisions fill out all primary documentation on behalf of their parent company. If the invoice is prepared by an invoice-based division, then it should be taken into account that it must indicate the serial number of the division, and not the parent company.

If a department carries out activities related to accepting cash, then a cash book must be maintained. Moreover, this will not depend on whether the unit has a balance sheet or not. 2-NDFL is provided at the place of registration of the separate entity in the manner prescribed by the Tax Code of the Russian Federation (288-289 Tax Code of the Russian Federation).

Small branches with a small staff only process information, which is then transmitted to the head office. This work is carried out subject to certain conditions that are required for accurate analysis and the elimination of any errors. All this is required to ensure that all operations of the department are accounted for in subaccounts. In this case, it will be possible to avoid unnecessary things and not “inflate” the amount of work in small departments. This also allows the parent company to be freed from the need to create separate accounts, which leads to optimization of all work as a whole.

Financial statements

The financial statements of organizations must include performance indicators of all branches, representative offices and other divisions (including those allocated to separate balance sheets). At the same time, separate divisions allocated to a separate balance sheet must generate internal accounting reports. Such reporting may include:

- balance sheets for operations of a separate division for the reporting period and from the beginning of the year;

- Form No. 1 (balance sheet);

- Form No. 2 (profit and loss statement).

Law No. 129-FZ of November 21, 1996 does not regulate the submission of financial statements to the tax authorities at the location of separate divisions with a separate balance sheet. Thus, the organization submits financial statements, which include indicators of internal reporting of representative offices, only at the location of the parent organization.

Cancel quarterly reports

There will no longer be quarterly property tax payments. Such amendments to the Tax Code were introduced by Law No. 63-FZ of April 15, 2019.

However, advance payments must still be made.

These innovations are taken into account in the new declaration form.

In connection with the cancellation of the submission of tax calculations while maintaining the obligation to calculate advance tax payments, Section 1 of the Declaration has been supplemented with lines containing information on the calculated amount of tax payable to the budget for the tax period, and on the calculated amounts of advance tax payments.

Lines containing information on the amounts of advance tax payments calculated for the reporting periods are excluded from sections 2 and 3 of the Declaration.

“VAT, Income Tax, Property Tax, taking into account the latest clarifications from the Ministry of Finance, the Federal Tax Service and court decisions” is the topic of the seminar, which will take place on January 30.

The host of the event is A.M. Rabinovich, author of more than 600 articles and 9 books on tax topics.

Insurance premiums

For organizations that have separate representative offices, there are specific requirements for submitting reports to funds.

Thus, the responsibilities for paying insurance premiums and submitting reports are assigned to the corresponding separate division if it meets the following requirements:

- has a separate balance;

- has a current account;

- accrues payments and other remuneration to individuals.

Thus, these organizations should register with extra-budgetary funds, pay contributions and submit reports to the funds at the location of the separate unit.

If a separate division does not meet at least one of the specified conditions, then insurance premiums must be calculated and paid by the parent organization for all employees as a whole. Accordingly, reporting on them should also be submitted only at the location of the organization.

D. Nacharkin, expert editor