Why doesn't the tax office accept VAT returns?

To figure out why the tax office does not accept a VAT return, it is better to contact the inspectorate directly with a similar question.

At the same time, it is important to navigate the tax legislation yourself and comply with its requirements so that there are no grounds for refusing to accept the declaration. Note! Starting from the report for the 4th quarter of 2021, it is necessary to use the new VAT declaration form as amended. Order of the Federal Tax Service dated August 19, 2020 No. ED-7-3/ [email protected]

You can find out what has changed in the report in the Review material from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Now the reasons for refusing to accept a declaration are listed in the order of the Federal Tax Service dated 07/08/2019 No. ММВ-7-19/ [email protected] Thus, controllers may not legally accept a declaration if:

- it is not submitted in the prescribed form (for a VAT return this is almost impossible: you can make a mistake with a paper form, but almost everyone submits VAT electronically);

- it is handed over by an unauthorized person;

- in the paper declaration there is no signature of the person certifying it (also not a VAT reason);

- the electronic declaration is not signed by UKEP;

- the declaration is submitted to the wrong Federal Tax Service;

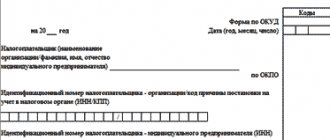

- the declaration does not indicate the name or TIN of the organization, does not indicate the type of document (primary/corrective), and does not include the name of the Federal Tax Service.

In addition, controllers may not accept reports if the director who signed them:

- disqualified (IP - deprived of the right to engage in business);

- died;

- in court he declared his non-involvement in the management of the organization, and the tax office has a corresponding judicial act that has entered into force;

- recognized by the court as missing, incompetent or partially capable in terms of presentation and confirmation

- reliability of reporting;

- “marked” in the Unified State Register of Legal Entities with a record of unreliable information.

Are technical errors the reason for the tax authority’s refusal to accept a declaration in electronic form and the basis for holding an organization liable for its failure to submit it? You will find the answer to this question from the actual state adviser of the Russian Federation, 3rd class, S.V. Razgulin in ConsultantPlus. If you do not already have access to this legal system, a full access trial is available for free.

But inspectors do not always refer to regulations. Taxpayers often receive a refusal to accept a return for unexpected reasons. For example, the invited manager repeatedly failed to appear at the inspection, or the company’s inspectors found several signs of fictitious activity.

Why do controllers do this? It turns out that they are following special instructions.

We have problems

Starting from December 25, 2021, the tax service is experiencing problems when accepting reports via telecommunication channels (TCC), reports one of the operators, Astral Group of Companies. Namely, response transactions from the Federal Tax Service are delayed: receipts and protocols for receiving reports do not arrive. All operators have problems.

The failures are associated with the next stage of the planned transition of the Federal Tax Service to the automated information system AIS3 (AIS “Tax 3”). Right now, regional bases in this system are being replaced by federal ones. Tax officials promise to later send users receipts, protocols and documents awaiting their turn.

Another special operator, Taxnet, writes that technical problems in the Federal Tax Service should be resolved by February 1, but not everywhere. In many regions, a response from the tax office should be expected no earlier than February 11.

Meanwhile, the official website of the tax service does not comment on the failures. On the contrary, the head of the Federal Tax Service, Mikhail Mishustin, speaks of a high level of provision of digital services and the operation of data processing centers.

AIS "Tax-3" is a unified information system of the Federal Tax Service of Russia, which ensures automation of the activities of the Federal Tax Service for all functions performed. The cost of its development and implementation is 832 million rubles. at the first stage and 950 million rubles. on the second, a total of almost 1.8 billion rubles.

Are there instructions for resetting/cancelling declarations?

Yes, such an instruction existed - it was given in a joint letter of the Ministry of Finance and the Federal Tax Service of Russia dated July 10, 2018 No. ED-4-15/13247, but it was subsequently withdrawn.

The Federal Tax Service letter No. ED-4-15/13247 dated July 10, 2018 was recalled by the Federal Tax Service letter No. ED-4-15/21496 dated November 2, 2018.

The procedure described in this document had three features:

- Application to declarations for two types of taxes: VAT and income tax.

- The reason for canceling the declaration is that it was signed by an unauthorized or unidentified person.

- The provisions of the instructions are not applicable to declarations for which the desk audit period has expired.

That is, VAT or income tax declarations that formally complied with the requirements of Art. 80 of the Tax Code of the Russian Federation, could be canceled by the tax authority if only one of its details aroused suspicion among inspectors - signature.

In this letter, the tax authorities were instructed to identify taxpayers who have signs of one-day companies - companies and individual entrepreneurs not involved in financial and economic activities:

Tax officials are required to prove a violation of clause 5 of Art. 80 of the Tax Code of the Russian Federation, which defines the procedure for signing a declaration by the head of an organization or an authorized representative. To do this, as part of a desk audit, inspectors must carry out a set of measures, which includes:

A VAT or income tax return submitted by a taxpayer may be canceled if, as a result of control activities carried out, tax authorities have identified violations of the requirements of clause 5 of Art. 80 Tax Code of the Russian Federation. Read the next section to see how cancellation works.

What the Federal Tax Service says and what to do

The Federal Tax Service of Russia has previously explained that various errors may occur in connection with the transition to a new tax administration program. In particular, failures and delays in sending payers the resulting receipts for processing the reports they submitted.

In this regard, the Federal Tax Service drew attention to the fact that timely sent electronic reporting is considered submitted even in situations where, due to technical reasons, this reporting was received by the Federal Tax Service with a delay.

The main and sufficient evidence of the timely submission of tax and accounting reports is the date of confirmation of the sending of documents, generated by the electronic document management operator.

Therefore, if tax authorities have any complaints regarding reporting, you must contact the technical support of your EDF operator and request confirmation of the date of submission of the declaration.

There is no need to re-submit reports for which the tax authorities have not provided the resulting receipts. These are technical errors and taxpayers do not bear any responsibility for these errors.

According to the Federal Tax Service, the relevant clarifications have already been communicated to the territorial tax authorities. We have no reason not to trust the Federal Tax Service, so tax officials will neither fine nor seize bank accounts for late receipt of declarations due to failures.

How do tax authorities cancel a VAT return?

How does the tax office reset VAT returns? The process is as automated as possible - the software package for receiving electronic declarations allows controllers to:

- transfer the declaration to the Register of declarations of legal entities that are not subject to processing using a special code;

- generate and send to the taxpayer a notice of invalidation of the declaration.

Tax authorities have the right to transfer a declaration to the category of non-processable in the following cases:

The procedure for canceling a declaration begins after receiving official permission from a higher tax authority in the form of a report (official) note.

The notification requirements are as follows:

- it is generated in .xml format (or on paper);

- the period for generating a notification and sending it to the taxpayer is no more than 5 working days.

After completing the cancellation procedure:

- the declaration is considered not submitted;

- information about cancellation is transferred to the VAT ASK.

Find out what to do if you received a notice of refusal to accept a tax return electronically in ConsultantPlus. A free trial of full access to the legal system is available.

The fine for failure to submit calculations for insurance premiums must be distributed among three BCCs

In connection with incoming questions about the distribution of proceeds from fines among extra-budgetary funds under Art. 119 of the Tax Code of the Russian Federation, the tax service reported the following.

In accordance with this article, failure to submit a calculation of insurance premiums to the tax authority on time entails the collection of a fine in the amount of 5 percent of the amount of insurance premiums not paid on time, subject to payment (surcharge) on the basis of the calculation, for each full or partial month from the date established for its presentation, but not more than 30 percent of the specified amount and not less than 1,000 rubles.

Based on the provisions of the Budget Code of the Russian Federation, the amounts of this fine must be credited to budgets according to the standards of deductions established by budget legislation in relation to the corresponding insurance premiums. However, the standards for such deductions in relation to insurance premiums have not been established.

In this regard, according to the Federal Tax Service of the Russian Federation, the amount of the fine is calculated separately for each type of compulsory social insurance. That is, to credit the amounts of penalties, you must use the following BCCs:

- 182 1 0210 160 – in proportion to contributions to compulsory pension insurance;

- 182 1 0210 160 – in proportion to contributions to VNiM;

- 182 1 0213 160 – in proportion to contributions to compulsory medical insurance.

So, as for a fine of 1000 rubles, it should be distributed to the budgets of state extra-budgetary funds based on the standards for splitting the basic tariff of 30% into certain types of compulsory social insurance:

- 22% (733.33 rubles) – to the Pension Fund of Russia;

- 2.9% (96.67 rubles) - to the Social Insurance Fund;

- 5.1% (170 rubles) - to the FFOMS.

LETTER of the Federal Tax Service of the Russian Federation dated 05.05.2017 No. PA-4-11/8641

Consequences of canceling a VAT return

It happens that the tax office has reset the VAT return. What to do?

VAT returns can be reset (cancelled) both by the taxpayer himself and his counterparty. Both cases are fraught with negative consequences and are accompanied by their own set of actions.

- Taxpayer declaration canceled

In this case, its counterparties may lose VAT deductions, and the company or individual entrepreneur must urgently eliminate the reasons why the submitted declaration was recognized by the inspectors as not submitted.

- The counterparty's declaration has been canceled

In such a situation, the taxpayer himself may face obstacles to obtaining VAT deductions. You will have to explain things to the tax authorities, who may offer to voluntarily pay additional VAT to the budget.

First of all, you should find out from the counterparty the reason for canceling his declaration. If the reason can be eliminated, it would not be a bad idea to hurry the counterparty to correct the shortcomings and submit the declaration. If the counterparty, in the opinion of tax authorities, has signs of being a one-day company, it is safer to remove deductions for transactions with it from your declaration and pay additional tax.

Find out how to fill out an updated VAT return here.

If the counterparty suddenly turns out to be neither a friend nor an enemy, but... clarified the declaration

Indeed, due to the fact that the tax office has adjusted the concept of “interdependence” and introduced a new concept of a “controlled person,” the only remaining official way to escape taxes suggests that the counterparty must “cover the lid of the coffin,” but not everyone agrees with this.

Now, the task of the tax office comes down to one thing - to determine the figure in the tax audit report, and then it’s a matter of “technique”. I believe that everyone understands everything with the “technique”, but if not, then I recommend reading the book “Tax Audits: How to Come Out a Winner!” or play a board game with a similar name. And that’s why for many, there seems to be only one solution - to reset the declarations and go abroad or hide (that’s the effect of AKS VAT-2).

But what should those who in good faith bought a product and took VAT credit on it do, and then, out of nowhere, a call from the tax service or a requirement under the TKS - to pay as a result of an “update” from the counterparty for the past few years?

The first possible action is to submit the “clarification” yourself. At the same time, you need to understand the consequences and be prepared for them. Namely, if your customers use a special mode or are individuals, then there will be no problems. But if your customers are the same VAT payers as your company, then they can either refuse to cooperate with you or also submit an updated declaration. According to the legal position of the Presidium of the Supreme Arbitration Court of the Russian Federation, set out in Resolution No. 668/04 of May 25, 2004, if it is impossible to establish one of the components (expenditure or revenue part), “the amount of taxes should be determined by calculation, creating additional guarantees for the taxpayer and ensuring the balance of public and private interests..." Simply put, if the tax office removes VAT from your expenses and purchases, then it should remove VAT from your revenue. This point of view is indirectly confirmed in a more recent court decision, set out in the Resolution of the Federal Antimonopoly Service of the East Siberian District dated January 28, 2011 No. A19-25394/09.

The second possible action is to try to prove the reality of the transaction. In this matter, of course, the new Article 54.1 of the Tax Code of the Russian Federation is indispensable. Its usefulness lies in the fact that it contains a list of specific actions of the taxpayer, which, in the opinion of the tax service, are recognized as abuse of rights, and the conditions that must be met by the taxpayer in order to be able to account for expenses and claim a tax deduction for transactions (operations) that have taken place. What to do if your suppliers and counterparties do not communicate? If the amount of expenses or purchases is more than 5 million rubles, one of the options would be to write a statement to the police (it is not a fact, of course, that it will be accepted). The second possible solution is to hire a private detective who will conduct interrogations and prepare a report that will describe the entire supply chain and name its participants. A private detective can use a polygraph during interrogations to increase the level of confidence of the tax authorities in the results of such an audit.

If you want to know more about VAT, I recommend the new books “250 tax decisions on VAT” and the best-selling tax consulting book, a book that passed a prosecutor’s audit and linguistic examination (it turned out that it does not contain calls for tax evasion) - “Black and White Tax Optimization - 3800", 2021 release.

I cannot help but note the increasingly growing role of the company's internal security service. Taxes cannot be left only to the chief accountant. A completely new system of tax collection, based on total control and mutual responsibility, has been built against taxpayers. Our chief accountants may simply not be able to cope with this alone (they may not be ready either psychologically or physically). So times have changed. Today we live in a new reality, which requires a rethinking of what is happening and the development of a different model of existence, this is what I will talk about at my upcoming seminars.

Evgeniy Sivkov

Evgeniy Sivkov, Ph.D., certified auditor, general director of Audit, author of more than 90 books and manuals on accounting and taxation, author of several hundred articles on taxes (sivkov.biz). He has more than 20 years of experience as a chief accountant, auditor and consultant, and has extensive experience in arbitration practice. Former chairman of the political party "Party of Taxpayers of Russia", chairman of the arbitration court. Developer of the software product “Intelligent tax consulting system “Sivkov NK” (esivkov.com). The founder of the new literary genre “tax thriller”, author of the widely known books “Auditor”, “Consultant”, “Advisor”. Winner of the National Golden Phoenix Award in the Tax Consultant of the Year category.

* Advertising

What to do if the VAT return has been reset/cancelled?

Please note that the actions of tax authorities to reset/cancel declarations are sometimes based only on internal departmental instructions. According to tax legislation, controllers currently do not have the right to reset declarations.

At the same time, this does not make it any easier for taxpayers - they can be fined for failure to submit a declaration or have their account blocked (Part 1 of Article 119, Subclause 1 of Clause 3 of Article 76 of the Tax Code of the Russian Federation). In addition, cancellation of the declaration postpones indefinitely the possibility of receiving VAT deductions. All this can negatively affect the activities of the company or individual entrepreneur.

To reduce the possible consequences of such zeroing procedures, the VAT payer should protect himself in advance - organize a personal meeting with the head of a potential counterparty (or his authorized representative), ask for his passport and check it with an extract from the Unified State Register of Legal Entities.

Considering that VAT returns are subject to desk audits every quarter, it is also necessary to take care to regularly update information about the head of the counterparty.

If you are sure that the nullification/cancellation of the declaration is not justified, you can go to court. There are already examples of decisions that are positive for taxpayers (see, for example, decision of the Tomsk Region Administrative Board dated January 23, 2018 No. A67-8529/2017).

What to do if refused

If the refusal came for legal reasons, correct the error and submit an adjustment.

If the tax office did not accept the report illegally, send a written request asking to clarify the reason for the refusal. If there is no adequate response, send a complaint to a higher inspection. Justify your arguments:

- the buyer's right to deduct VAT is granted regardless of whether the counterparty fulfills its tax obligations;

- delivery and shipment of goods or services is confirmed by invoices and certificates of work performed, testimony of witnesses;

- The tax authorities have no evidence of a criminal relationship between the counterparties.

Rely on the decision of the Arbitration Court of the Rostov Region dated March 13, 2017 No. A53-31426/16, the resolution of the Fifteenth Arbitration Court of Appeal dated February 13, 2017 No. 15AP-20848/2016.

Compromise of an electronic signature key: consequences for the taxpayer

The VAT return is submitted in electronic form, and accordingly, it can only be signed with an electronic signature. Consequently, any problems with the electronic signature may result in refusal to accept the declaration. One possible problem is compromise of the electronic signature key.

Compromise of an electronic signature key means a loss of trust that the key can ensure the security of information. This may occur:

- in case of violation of storage rules or loss of key media;

- leakage or distortion of information;

- dismissal of employees with access to key information.

The occurrence of such circumstances always leads to negative consequences:

- damages and losses due to information leakage;

- the risk of unexpected disappearance of money from the company’s accounts;

- other consequences.

For a taxpayer, compromising an electronic signature key may result in the impossibility of filing tax returns on time or lead to distortion of information in submitted declarations (for example, their cancellation by unidentified persons).

If tax authorities receive evidence confirming the compromise of the electronic signature key, they are ordered to follow the procedure described in the letter of the Information Technology Department of the Federal Tax Service of Russia dated August 28, 2017 No. 6-3-04/0154dsp@.

What should a taxpayer do in this case? If an electronic signature key is compromised, you must immediately notify the operator of the certification center to suspend the electronic signature and reissue the certificate.

We talk about the purpose of the EDS key certificate in this material.

How to make an adjustment to the daily allowance. Contributions are calculated for 1 person

If these deadlines are met, the initial calculation is considered to be submitted on time, and the policyholder will not face sanctions (clause 7 of Article 431 of the Tax Code of the Russian Federation). Please note: even when sending a notice on paper, the period is counted from the date the notice was sent, and not from the date it was received by the policyholder. That is, the policyholder who submits the DAM in paper form and, accordingly, receives a “paper” notification from the Federal Tax Service by mail, risks not receiving the notification on time and “running into” fines. To minimize the risks of receiving fines and receive competent advice from specialists around the clock, we recommend using the professional service for filling out and submitting reports Kontur.Extern.

Info When submitting an updated Calculation, in which the amount of insurance premiums payable has been increased, the policyholder will be released from liability in the form of a fine if he submits an adjustment Calculation before he learned that the tax inspectorate had discovered an error in the form of an understatement of tax or that a visiting tax office had been appointed. checks on insurance premiums for the adjusted period. And at the same time, before submitting the updated Calculation, the policyholder must pay the missing amount of insurance premiums and the corresponding penalties (clauses 3, 4 of Article 81 of the Tax Code of the Russian Federation). It is also necessary to remember that if errors are identified in section 3 of the Calculation, as well as a discrepancy discovered by the tax inspectorate between the consolidated amount of accrued insurance premiums for compulsory health insurance and the amount of contributions for compulsory health insurance for each of the insured persons, the Calculation must be retaken within a specific time frame.

Results

Is it possible for tax authorities to reset a VAT return? Yes, this is possible if the declaration was signed by an unauthorized person or inspectors find signs of a shell company in your company. In addition, inspectors may refuse to accept a declaration in cases described in special administrative regulations.

To avoid the negative consequences of canceling a declaration, it is important to check in advance the reality of the existence of your counterparties and verify the authority of their managers.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated July 2, 2012 No. 99n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The tax office explained how to generate corrective reports on insurance premiums

This error must be corrected

- Incorrect organization phone number

- The calculation will not be accepted if the contributions to compulsory health insurance for each insured person in the amount do not coincide with the total amount of the specified contributions

- How can I correct errors in the report? To correct various errors in the report you must:

- To correct an error in an employee’s SNILS, you must indicate the serial number of the adjustment “001” on the title page, also attach section No. 1, as in the initial calculation, and this will also include section 3, filled out for the employee in whose SNILS there was an error. It is worth paying attention that for the same employee you must attach a copy of the insurance certificate, TIN and passport.

Important: the updated section No. 3 in relation to other employees who have not made mistakes does not need to be submitted.

The employee was not included in the calculation. If any insured persons were not included in the primary calculation, the updated calculation is included in section 3, containing information regarding the specified individuals with an adjustment number equal to “0” (as primary information). If necessary, the indicators in section 1 of the calculation are adjusted. An extra employee was included in the calculation. In case of erroneous submission of information about the insured persons in the initial calculation, section 3 is included in the updated calculation, containing information regarding such individuals, in which the adjustment number is different from “0”; in lines 190–300 of subsection 3.2 “0” is indicated ", and at the same time the indicators of section 1 of the calculation are adjusted.