Home / Services and prices / Accounting services / Preparation and submission of reports /

Preparation of zero reporting for LLC - from 1,500 RUR Preparation of zero reporting for individual entrepreneurs - from 1,000 RUR Submission of zero reporting - from 300 RUR Consultation - free

PRICE LIST for legal entities (LLC, NPAO)

PRICE LIST for individual entrepreneurs without employees

PRICE LIST for reporting

DOCUMENTS for legal entities (LLC, NPAO)

DOCUMENTS for individual entrepreneurs without employees

The consulting company offers the service of drawing up and submitting zero reports on behalf of the principal. Exact timing of service provision, confidentiality, competitive prices are our main advantages for entrepreneurs in Moscow and Zelenograd.

If a registered enterprise (LLC or individual entrepreneur) is not currently carrying out any activities, this does not mean that representatives of the Federal Tax Service have forgotten about the legal entity. There will be no concessions here and the company will be subject to penalties if the company ignores reporting quarters. In this case, the paper is called “zero report” or “zero balance”. The document includes all tax, statistical and financial information for the period during which the enterprise was idle.

Important: the timing and correctness of filing such a document are controlled by the territorial Federal Tax Service.

How to prepare and submit a zero report

As a rule, the owner of the company is the main person of the enterprise. But more often he does not have the skills of an accountant to prepare the necessary tax papers. And if the enterprise is idle, the staff is reduced, then difficulties generally arise with this. To properly prepare a zero report, it is advisable to enlist the help of an experienced outsourcer. offers professional services in the preparation of accounting documentation. It takes only one day to provide such a service, regardless of the company’s taxation system.

Important: enterprises of various forms of ownership are provided with a specific package of documents for their submission to statistical authorities, all funds and the tax office.

A document prepared by professionals can be delivered to the Federal Tax Service in three ways:

- Standing in line in person;

- By entrusting this to the “Audit PRO” specialist;

- By sending by registered mail with notification;

- By email.

The finished document will contain the original signature of the principal. This is all that is required of you after the preparation of the papers by the accountant “Audit PRO”.

Zero declaration 3-NDFL

Individual entrepreneurs can submit Form 3-NDFL with zero indicators based on order No. ММВ-7-11 dated December 24, 2014 / [email protected] This declaration indicates basic information about the taxpayer, and dashes are entered in all fields. If the individual entrepreneur decides to close, he must submit a report within 5 days after submitting the relevant application. The form must be filled out manually or using computer technology. An individual entrepreneur can submit a zero declaration in person, by mail, through an authorized representative or via the Internet.

What is important to remember

The need to submit zero reports is imposed on both operating enterprises and companies that are idle. That is, the company does not move funds through accounts, does not produce products, does not provide any services and, accordingly, does not make a profit. Remember, ignoring the need to submit a report will result in penalties. And this is an additional financial burden on the company’s budget.

The form of the report depends on the taxation system of the company (USN, OSNO) and on the company of its ownership (IP, LLC).

Features of the work of Audit PRO specialists when preparing zero reports

The consulting department contains a staff of practicing professionals (accountants, lawyers) who provide services to individuals and legal entities in Moscow and Zelenograd. We work according to the following principles:

- Regular monitoring of tax laws, knowledge of amendments that have entered into force, etc.;

- Prompt response to the slightest changes in the tax system of the Russian Federation;

- Ability to quickly establish feedback with representatives of territorial Federal Tax Service;

- Confidentiality;

- Providing consultations on any issues of civil, labor and other Codes of the Russian Federation during cooperation.

We work for the benefit of our clients!

Sample of filling out the simplified tax system declaration, taxable base “Income”

Individual entrepreneurs and LLCs in the “Income” mode fill out sections 1.1, 2.1. Let's look at the design of section 1.1 using the example of IP Gartunov. At the top of the sheet we enter the INN/KPP and number the page.

Let's look at the table:

| Fields | Information |

| 001 | 1 – indicates the applicable tax regime “Income” |

| 010 | The OKTMO code denotes the code assigned to the territorial municipal formation of the place of residence of the individual entrepreneur or the official address of the LLC, used instead of OKATO from 01/01/2014. Finding this code is easy: go to the Federal Tax Service website and enter the OKATO code in the field provided. If in the reporting year the company did not change its address (and individual entrepreneur’s place of residence), the OKTMO code can only be written in line 010 without indicating it in lines 030, 060, 090. |

| 030 | |

| 060 | |

| 090 |

All other cells are crossed out.

The preparation of section 2.1 begins with the INN/KPP and the sheet number.

| Fields | Intelligence |

| 120 | 6 – percentage of deductions |

| 102 | 1 – denotes an individual entrepreneur or LLC working with hired personnel and paying remuneration to employees; 2 – individual entrepreneur without hired personnel. |

In our example, the individual entrepreneur operates without hired personnel, so field 102 contains attribute 2.

The price of preparing zero reports for legal entities (LLC, NPAO) using the simplified tax system and OSNO

| What is included in reporting | Where is it served? | Reporting deadlines* | Price** |

| Zero reporting for organizations on OSNO - QUARTERLY | 3,000 rub. | ||

| VAT declaration | Inspectorate of the Federal Tax Service | Until the 20th day of the month following the quarter | |

| Income tax return | Until the 28th day of the month following the quarter | ||

| Property tax declaration (if any) | Until the 30th day of the month following the quarter | ||

| Calculation according to form 4-FSS | FSS | Until the 15th day of the month following the quarter | |

| Calculation according to the RSV-1 form | Pension Fund | Until the 15th day of the second month following the quarter | |

| Zero reporting for organizations on OSNO - ANNUAL | 3,500 rub. | ||

| Financial statements | Inspectorate of the Federal Tax Service | Within 90 days from the beginning of the year | |

| VAT declaration | Until January 20 | ||

| Income tax return | Until March 28 | ||

| Property tax declaration (if any) | Until March 30 | ||

| Information on the average number of employees | Until January 20 | ||

| Confirmation of types of economic activities | FSS | Until April 15 | |

| Calculation according to form 4-FSS | Until January 15 | ||

| Calculation according to the RSV-1 form | Pension Fund | Until February 15 | |

| Zero reporting for organizations on the simplified tax system/UTII - QUARTERLY | 1,500 rub. | ||

| Calculation according to form 4-FSS | FSS | Until the 15th day of the month following the quarter | |

| Calculation according to the RSV-1 form | Pension Fund | Until the 15th day of the second month following the quarter | |

| Zero reporting for organizations on the simplified tax system/UTII - ANNUAL | 2,500 rub. | ||

| Financial statements | Inspectorate of the Federal Tax Service | Within 90 days from the beginning of the year | |

| Tax return for tax paid in connection with the application of the simplified tax system | Within 90 days from the beginning of the year | ||

| Information on the average number of employees | Until January 20 | ||

| Confirmation of types of economic activities | FSS | Until April 15 | |

| Calculation according to form 4-FSS | Until January 15 | ||

| Calculation according to the RSV-1 form | Pension Fund | Until February 15 | |

* - In cases where the last day of the period falls on a day recognized in accordance with the legislation of the Russian Federation as a weekend and (or) a non-working holiday, the end of the period is considered to be the next working day following it.

** — The cost of preparing a complete set of zero reporting for independent submission to the regulatory authority is indicated.

Zero declaration - what is it?

After receiving individual entrepreneur status and registering as a tax payer, a businessman has certain obligations to the Federal Tax Service. Based on the results of each reporting period, entrepreneurs must submit declarations to regulatory authorities, for which specific deadlines are established by law. If during this time the businessman did not conduct commercial activities, he must still submit reports, thereby proving the absence of financial income.

Please note : if an individual entrepreneur, after the suspension of activities, decides to close his business, he must submit zeros before submitting the appropriate application.

At the time of submitting documents to obtain the status of a business entity and making the appropriate entries in the Unified State Register of Entrepreneurs, you must select a tax regime. If the individual entrepreneur does not do this, he will automatically be transferred to the general taxation system. In the event that an entrepreneur has no activity, he must submit a zero declaration in the form provided for the tax regime he has chosen.

Please note : for failure to submit a zero statement within the period established by law, the entrepreneur will be subject to penalties (minimum 1,000 rubles).

It is worth noting that regulatory authorities closely monitor not only individual entrepreneurs who show high turnover in their reports, but also those who systematically lose money. That is why entrepreneurs who are temporarily not conducting commercial activities should be prepared for a visit from tax authorities. Some businessmen who do not want to pay taxes to the state try to hide their income with the help of zeros. They should understand that the regulatory authorities do not employ amateurs, but highly qualified specialists who do tremendous work to bring small businesses out of the “shadow.” When dealing with each “zero account”, analysts carefully study their current and card accounts, inspect the place of business, and schedule counter and unscheduled inspections. If the fact of concealment of income is revealed, the individual entrepreneur faces criminal liability.

The price of preparing zero statements for individual entrepreneurs (IP) without employees

| What is included in reporting | Where is it served? | Reporting deadlines* | Price** |

| Zero reporting for individual entrepreneurs on OSNO - QUARTERLY | 2,500 rub. | ||

| VAT declaration | Inspectorate of the Federal Tax Service | Until the 20th day of the month following the quarter | |

| Income tax return | |||

| Property tax declaration (if any) | |||

| Zero reporting for individual entrepreneurs on OSNO - ANNUAL | 2,500 rub. | ||

| Financial statements | Inspectorate of the Federal Tax Service | Within 90 days from the beginning of the year | |

| VAT declaration | Until the 20th day of the month following the quarter | ||

| 3-NDFL | Within 90 days from the beginning of the year | ||

| Information on the average number of employees | Until January 20 | ||

| Calculation according to Form 4-FSS (if there are employees) | FSS | Until January 15 | |

| Calculation according to the RSV-1 form (if there are employees) | Pension Fund | Until February 15 | |

| Zero reporting for individual entrepreneurs on the simplified tax system - ANNUAL | 1,000 rub. | ||

| Tax return for tax paid in connection with the application of the simplified tax system | Inspectorate of the Federal Tax Service | Until April 30 | |

| Information on the average number of employees | Until January 20 | ||

| Calculation according to Form 4-FSS (if there are employees) | FSS | Until January 15 | |

| Calculation according to the RSV-1 form (if there are employees) | Pension Fund | Until February 15 | |

* - In cases where the last day of the period falls on a day recognized in accordance with the legislation of the Russian Federation as a weekend and (or) a non-working holiday, the end of the period is considered to be the next working day following it.

** — The cost of preparing a complete set of zero reporting for independent submission to the regulatory authority is indicated.

Title page design

Let's look at how to correctly fill out a zero declaration using the example of the reporting of individual entrepreneur M.N. Gartunov.

We start filling out from the top of the first page, entering the necessary information in each field.

| Field name | Information |

| INN/KPP | Information is entered from registration documents issued for opening an individual entrepreneur or company |

| Correction number | Designation 0 – when submitting a form for the year, 1 – when submitting an amended declaration, 2, 3, etc. – with subsequent adjustments |

| Taxable period | 34 – when submitting annual reports, 50 – when changing the tax regime, reorganization or any other changes in the status of the enterprise, or its closure before the end of the year |

| Reporting year | The period for which information about the work is presented |

| Tax authority code | The first four digits of the TIN, or those indicated in the registration documents. In the example presented - 7404 |

| At the location of registration | 120 – for individual entrepreneurs, 210 – for companies. If there was a reorganization of the enterprise, then the code is 215 |

| Taxpayer | Full name of the company or full name of the individual entrepreneur |

| Type of activity code according to OKVED | To be entered from the Unified State Register of Legal Entities (for LLC) or Unified State Register of Individual Entrepreneurs (for individual entrepreneurs) |

| Reorganization form | To be completed only by reorganized or restructured enterprises, as well as those subject to liquidation. The codes used (from 0 to 6) indicate the degree of change in the organization's status. For individual entrepreneurs, these fields are not relevant. |

| TIN/KPP of the reorganized enterprise | |

| Contact phone number | The current phone number is entered |

| On... pages | Number of pages of the submitted form, usually 3 sheets |

| With supporting documents or copies thereof | The number of sheets of documentary annexes confirming certain information. If there are no applications, dashes. |

usn2

Next, we proceed to filling out the information block “Confirmation of the accuracy of the specified information.”

Important: The right part is filled out by a tax authority employee; you do not need to fill it out yourself; otherwise, when submitting reports, it will be returned as incorrectly filled out.

In this block, in our example, only the signature of the entrepreneur and the date of compilation of the form are placed. An individual entrepreneur who personally submits a declaration has the right not to enter his full name, but only confirm the data with a signature.

| “Reliability of information...” | If an individual entrepreneur or the head of a company certifies the data personally, enter 1 in the first field, 2 - upon confirmation of the information provided by a trusted person. When filling out the form, the director of the LLC indicates his full name, signs and seals, and the document is dated. If the declaration is submitted by an authorized person, then in addition to all the information listed, you must indicate the name of the document confirming his representation of the interests of the company. |

This completes the design of the title page. Next, different form sheets are drawn up for enterprises of different tax regimes.

Documents required for submitting zero reports for legal entities (LLC, NPAO)

- Certificate of entry into the Unified State Register of Legal Entities (OGRN);

- TIN;

- Statistics codes (Rosstat letter);

- Extract from the Unified State Register of Legal Entities;

- Notifications of registration in extra-budgetary funds (FSS, Pension Fund, Compulsory Medical Insurance Fund);

- Charter;

- List of accounts opened in banks;

- Information on payment of the authorized capital in cash (bank statements, cash receipt orders) or property (transfer and acceptance certificates);

- Full name and TIN of the manager and chief accountant (if any), decision on appointment (in the absence of TIN - passport details);

- Reporting for the previous period;

- Notification of the possibility of using the simplified tax system (if available) or Application for transition to the simplified tax system with a mark from the tax authority on acceptance.

General rules for filling out the form:

- All individual entrepreneurs and LLCs without exception must fill out the title page;

- each cell corresponds to only one character - a number or a letter;

- if there is no information in the cell, a dash is placed;

- sections 1.1 and 2.1 are intended for entering information by enterprises operating in the “Income” mode;

- sections 1.2 and 2.2 are registered by companies and entrepreneurs on the simplified tax system according to the formula “Income minus expenses”;

- the first and second sections begin with the code of the taxation object: number 1 corresponds to the object “Revenue”, number 2 – “Revenue minus costs”;

- Page numbering is continuous; numbers are entered in the “Page” fields located at the top of each sheet.

Documents required for submitting zero reporting for individual entrepreneurs without employees

- IP passport details;

- Certificate of state registration of an individual as an individual entrepreneur (OGRNIP);

- TIN;

- Statistics codes (Rosstat letter);

- Extract from the Unified State Register of Individual Entrepreneurs;

- Notification of registration of an individual with the Pension Fund of Russia;

- List of accounts opened in banks;

- Reporting for the previous period;

- Notification of the possibility of using the simplified taxation system/UTII (if any) or an application for transition to the simplified taxation system with a mark from the tax authority on acceptance;

- Copies of receipts for the transfer of a fixed payment to the Pension Fund.

In what cases does it become necessary to submit a zero declaration?

To prevent the emergence of disagreements and conflicts with regulatory authorities, individual entrepreneurs need to know in what cases it is necessary to submit zero reporting:

It is important to know! A catalog of franchises has opened on our website! Go to catalog...

- The individual entrepreneur manages his business ineffectively, as a result of which he has no income in the reporting period;

- an entrepreneur works seasonally, so he only has turnover in a few periods;

- the businessman just passed state registration and registered with the Federal Tax Service as a taxpayer, but did not have time to start commercial activities;

- The individual entrepreneur decided to close, but has not yet collected the necessary documents.

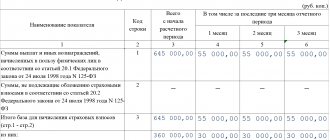

UTII

Sample zero UTII declaration

example and zero tax return form

You will not find a sample for filling out a zero UTII declaration. Because This tax is paid for activities falling under UTII. On May 28, 2009, the Ministry of Finance issued an explanation that it is impossible to submit zero declarations, or to adjust their coefficient by the number of non-working days. No UTII activity? Then the taxpayer is deregistered as a UTII payer, but at the same time he can switch to the simplified tax system from the next month (Sample application for the simplified tax system - Form 2621_1.xls).

You have the right not to pay UTII for a calendar month, but provided that you did not conduct any activity for a single day this month. It is also necessary to deregister UTII; to do this, fill out the UTII-4.xls form for individual entrepreneurs or UTII-3.xls for Organizations.

You can generate a declaration using the UTII Declaration Calculator.

There are no penalties for providing a zero declaration or a zero imputation report; they simply will not accept your zero declaration. Although some tax authorities still accept “zero” UTII, despite the fact that the Ministry of Finance considers such declarations to be unlawful. For delivery not on time - 1000 rubles.

How to fill out zero UTII reporting

You will not be able to submit a completely zero declaration, but you can exclude one or two months from it (if you deregister during this time). Then in line 050, 060 or 070 of section 2 of the UTII calculator you write zero.

Deadlines for submission and payment of the UTII declaration

Deadline for payment of UTII tax: Q1. — until 25.04, II quarter. — until 25.07, III quarter. — until 25.10, IV quarter. - until 25.01

Deadline for submitting the UTII declaration: Q1. — until 20.04, 2nd quarter. — until 20.07, III quarter — until 20.10, IV quarter. — until 20.01