Many Russian firms prefer to enter into commercial contracts with domestic partners in foreign currency. Legislatively, this possibility is provided for by Federal Law No. 173-FZ “On Currency Regulation and Control” of December 10, 2003. However, it is prohibited to make payments under an agreement between residents of the Russian Federation in euros and dollars (Article 9 of Law No. 173-FZ).

Residents and non-residents can pay bills in foreign currency (Article 6 of Law No. 173-FZ). Therefore, all payments for contractual obligations between domestic companies are made in Russian rubles.

What is the difference between an account in foreign currency and an account in rubles?

Issuing an invoice in foreign currency is no fundamentally different from issuing a similar document in rubles. It should indicate all the required details:

- date of issue;

- number;

- name of the payer;

- identifiers, name and address of the company receiving the funds;

- her bank details;

- name of paid goods (services, works), units of measurement;

- unit price and cost;

- condition for including VAT in the price.

As the account currency, you must indicate the currency of the agreement: if the agreement is in euros, then the invoice is in euros. A sample of such an invoice can be downloaded from the link below.

invoice form in euros

It would be useful to indicate in the invoice a sample of filling out the “Purpose of payment” field in the payment order. For example: “Payment for equipment according to invoice No. 1-OB dated April 27, 2017 in accordance with equipment supply agreement No. OB-0417 (in euros), including VAT of 10,000.00 rubles.”

In addition, you can add a “reminder” to the counterparty about the terms of the contract to the invoice. For example: “Payment of the invoice is made at the euro exchange rate established by the Bank of Russia on the day of payment.” Or: “Payment of the invoice is made at the euro exchange rate established by the Bank of Russia on the day of payment, increased by 1%.”

In this regard, there is no point in duplicating invoice amounts expressed in foreign currency in rubles. The counterparty can pay a foreign currency invoice in rubles on any of the following days after it is issued. The ruble equivalent of the presented invoice is likely to change during this time.

The payment document must be signed by an authorized person(s) of the organization. It will be stamped if available.

Currency transaction type code

Since this code is a specific feature established on the basis of the currency legislation of the Russian Federation, and not the general rules for conducting international banking transactions, we will dwell on it in more detail.

The code is entered into the payment slip in cases of settlements for foreign trade transactions in Russian currency. That is, the presence of a currency transaction code in a payment order is a signal to currency control structures (whose agents are banks) that the currency of the Russian Federation is being transferred outside the Russian Federation.

Read more about currency transaction codes: “How to indicate a currency transaction code in a payment order?”

ConsultantPlus experts explained how to properly process a foreign currency payment and what documents to provide to the bank. If you have access to the system, check that you have prepared the paperwork correctly. If you don’t have access, sign up for trial online access and proceed to the Ready Solution.

Features of paying bills in foreign currency

What should an accountant follow when making payments under an agreement concluded by residents in foreign currency? For example, if the counterparty issues an invoice for payment in euros (a sample of such an invoice for downloading is available at the link in the text).

First of all, the provisions of the contract.

As a rule, it stipulates at what rate and on what date the currency is converted into rubles.

For example, an agreement may include the following clause: “Payment of obligations under the agreement is made at the official euro exchange rate established on the date of invoice.” Or: “Payment under the contract is made at the official euro exchange rate established on the date of payment by the Buyer, increased by 1.1%.”

What should you follow when the contract does not contain conditions for converting foreign currency obligations into rubles for payment? For example:

- it is not indicated at what rate the conversion takes place,

- it is not indicated on what date the conversion rate is set,

- Both of the above circumstances are not specified.

In this case, conversion into rubles for payment must be made at the official exchange rate of the contract currency on the date of payment.

The same should be done if the contract does not contain a reference to the fact that payment is made in rubles.

A similar procedure applies when residents enter into contracts in dollars. Payment of advances and obligations under such agreements will not be in the currency of the agreement: invoices issued will be in dollars, and payment will be in rubles.

Topic: How to issue an Invoice for payment to a foreign counterparty (partner)?

Quick transition Foreign economic activity Up

- Navigation

- Cabinet

- Private messages

- Subscriptions

- Who's on the site

- Search the forum

- Forum home page

- Forum

- Accounting

- General Accounting Accounting and Taxation

- Payroll and personnel records

- Documentation and reporting

- Accounting for securities and foreign exchange transactions

- Foreign economic activity

- Foreign economic activity. Customs Union

- Alcohol: licensing and declaration

- Online cash register, BSO, acquiring and cash transactions

- Industries and special regimes

- Individual entrepreneurs. Special modes (UTII, simplified tax system, PSN, unified agricultural tax)

- Accounting in non-profit organizations and housing sector

- Accounting in construction

- Accounting in tourism

- Budgetary, autonomous and government institutions

- Budget accounting

- Programs for budget accounting

- Banks

- IFRS, GAAP, management accounting

- Legal department

- Legal assistance

- Registration

- Inspection experience

- Enterprise management

- Administration and management at the enterprise

- Outsourcing

- Enterprise automation

- Programs for accounting and tax accounting Info-Accountant

- Other programs

- 1C

- Electronic document management and electronic reporting

- Other tools for automating the work of accountants

- Clerks Guild

- Relationships at work

- Accounting business

- Education

- Labor exchange Looking for a job

- I offer a job

- Club Clerk.Ru

- Friday

- Private investment

- Policy

- Sport. Tourism

- Meetings and congratulations

- Author forums Interviews

- Simple as a moo

- Author's forum Goblin_Gaga Accountant can...

- Gaga's opusnik

- Internet conferences

- To whom do I owe - goodbye to everyone: all about bankruptcy of individuals

- Archive of Internet conferences Internet conferences Exchange of electronic documents and surprises from the Federal Tax Service

- Violation of citizens' rights during employment and dismissal

- New procedure for submitting VAT reports in electronic format

- Preparation of annual financial/accounting statements for 2014

- Everything you wanted to ask the electronic document exchange operator

- How to turn a financial crisis into a window of opportunity?

- VAT: changes in regulatory regulation and their implementation in the 1C: Accounting 8 program

- Ensuring the reliability of the results of inventory activities

- Protection of personal information. Application of ZPK "1C:Enterprise 8.2z"

- Formation of a company's accounting policy: opportunities for convergence with IFRS

- Electronic document management in the service of an accountant

- Time tracking for various remuneration systems in the program “1C: Salary and Personnel Management 8”

- Semi-annual income tax report: we will reveal all the secrets

- Interpersonal relationships in the workplace

- Cloud accounting 1C. Is it worth going to the cloud?

- Bank deposits: how not to lose and win

- Sick leave and other benefits at the expense of the Social Insurance Fund. Procedure for calculation and accrual

- Clerk.Ru: ask any question to the site management

- Rules for calculating VAT when carrying out export-import transactions

- How to submit reports to the Pension Fund for the 3rd quarter of 2012

- Reporting to the Social Insurance Fund for 9 months of 2012

- Preparation of reports to the Pension Fund for the 2nd quarter. Difficult questions

- Launch of electronic invoices in Russia

- How to reduce costs for IT equipment, software and IT personnel using cloud power

- Reporting to the Pension Fund for the 1st quarter of 2012. Main changes

- Income tax: nuances of filling out the declaration for 2011

- Annual reporting to the Pension Fund. Current issues

- New in financial statements for 2011

- Reporting to the Social Insurance Fund in questions and answers

- Semi-annual reporting to the Pension Fund in questions and answers

- Calculation of temporary disability benefits in 2011

- Electronic invoices and electronic primary documents

- Preparation of financial statements for 2010

- Calculation of sick leave in 2011. Maternity and transition benefits

- New in the legislation on taxes and insurance premiums in 2011

- Changes in financial statements in 2011

- DDoS attacks in Russia as a method of unfair competition.

- Banking products for individuals: lending, deposits, special offers

- A document in electronic form is an effective solution to current problems

- How to find a job using Clerk.Ru

- Providing information per person. accounting for the first half of 2010

- Tax liability: who is responsible for what?

- Inspections, collection, refund/offset of taxes and other issues of Part 1 of the Tax Code of the Russian Federation

- Calculation of sick sheets and insurance premiums in the light of quarterly reporting

- Replacement of unified social tax with insurance premiums and other innovations of 2010

- Liquidation of commercial and non-profit organizations

- Accounting and tax accounting of inventory items

- Mandatory re-registration of companies in accordance with Law No. 312-FZ

- PR and marketing in the field of professional services in-house

- Clerk.Ru: design change

- Building a personal financial plan: dreams and reality

- Preparation of accounting reporting. Changes in Russia accounting standards in 2009

- Kickbacks in sales: pros and cons

- Losing a job during a crisis. What to do?

- Everything you wanted to know about Clerk.Ru, but were embarrassed to ask

- Credit in a crisis: conditions and opportunities

- Preserving capital during a crisis: strategies for private investors

- VAT: deductions on advances. Questions with and without answers

- Press conference of Santa Claus

- Changes to the Tax Code coming into force in 2009

- Income tax taking into account the latest changes and clarifications from the Ministry of Finance

- Russian crisis: threats and opportunities

- Network business: quality goods or a scam?

- CASCO: insurance without secrets

- Payments to individuals

- Raiding. How to protect your own business?

- Current issues of VAT calculation and reimbursement

- Special modes: UTII and simplified tax system. Features and difficult questions

- Income tax. Calculation, features of calculus, controversial issues

- Accounting policies for accounting purposes

- Tax audits. Practice of application of new rules

- VAT: calculation procedure

- Outsourcing Q&A

- How can an accountant comply with the requirements of the Law “On Personal Data”

- The ideal archive of accounting documents

- Service forums

- Archive FAQ (Frequently Asked Questions) FAQ: Frequently Asked Questions on Accounting and Taxes

- Games and trainings

- Self-confidence training

- Foreign trade activities in harsh reality

- Book of complaints and suggestions

- Diaries

How to issue invoices correctly

Invoicing a foreign client is not an easy task for a young business. Errors, inaccuracies and “uncertain” English will all cause mistrust. You can't make mistakes. To give you something to start with, we have translated an article about what the correct count should be. At the end you will find a link to download 10 invoice templates in English. We will be glad if this helps your business become more global. Transferred to Alconost. Congratulations! You got the project, you worked hard, you produced a great product, the client is delighted. Now it would be nice to get paid! While invoicing may not seem like the most exciting topic, it is undoubtedly one of the most important issues in any business. Your account reflects your corporate identity, reinforces your professionalism, is an additional point of sale that allows you to receive more orders, and most importantly, it brings you money. Once you get it wrong, you won't last long in business. Many freelancers and small business owners have difficulty preparing invoices—especially those who do everything for their business themselves. In this note, I will try, avoiding professional accounting vocabulary, to clarify this process, its practical aspects and some terms. Plus, I'll provide you with 10 beautiful invoice templates that you can customize and put into action right away. I'll also show you some great techniques that will make your life easier and help you invoice like a pro.

Partnership

One of our clients opened a company in Germany, and then found a partner there, and it turned out that it was more convenient to accept payments through him, plus the partner takes on part of the customer support functionality. This is really a working option: in the chosen foreign jurisdiction, find a company that will accept and transfer money to you, and also, possibly, accompany clients and provide them with support.

Of course, this raises the question of the transparency and correctness of the formalization of relations between the two parties, but this is still simpler than maintaining a structure in a foreign jurisdiction.

I repeat: there is no universal option for all companies - all four methods discussed above have the right to life. The main thing is to make informed choices, taking into account the factors that matter to you, calculate the risks and costs on shore, and ensure compliance with the rules.

Account: what is it?

An invoice, or invoice, is a commercial document issued to a buyer by a seller and containing information such as the price and quantity of goods, methods of payment and the maximum period within which the buyer must make payment. A seller is a provider or performer of services; and the buyer is the customer or client. This document is important for both parties, since the seller needs a copy of it for record keeping, and the client needs to have a copy of it to record the purchase. If you issue an invoice, it means someone owes you. If you receive a bill, it means you owe someone.

Invoice for VAT payers

Legal entities and other VAT payers use an invoice : a responsible financial document that is issued not in advance, but upon completion of work, services provided or goods shipped. It is no longer needed to speed up payment, but to confirm that excise duties and VAT have been paid in full, so that VAT can be withheld from the payer (buyer). This document has a prescribed form; it may also contain information about the origin of the goods, and if it is imported, then the number of the customs declaration for it.

The invoice is issued in two copies.

What should the invoice look like?

The look and language of the invoices should be consistent with your branding and the message you would like to convey. The invoice should match your business card design, letterhead, advertising slogan, and even the colors of your website. Even though account structure varies by industry, there are some common elements and rules that must be followed. To make it easier to remember these rules, you can divide the bill into 6 parts.

Part 1: Your data

This contains your company information (or, if you're a freelancer, your full name), logo, contact information, payment information, etc.

If your company has a specific legal form—for example, a corporation in the US or a public limited company in the UK—then you will need to include information based on where you do business. This is usually your registered address and registration number, but rules vary, so check with your local tax office. In Europe, if you are registered for VAT, you must also add your VAT registration number.

Part 2: rules of the game

Here you can indicate such characteristics of the account as the date of statement, full name, date no later than which payment must be made, currency and order number. The term "net 30" is used in business to mean payment within 30 days, but it is quite common to see the designation "10/15, net 30": in other words, this means a 10% discount if payment is made within 15 days and payment due within 30 days. However, people less versed in business terminology may not know what this means. So, depending on who your customer is, it might be better to use everyday language instead: “Please note that payment is due no later than 09/07/2013.” Also keep in mind that date formats vary from country to country. The phrase “Payment due date is 09/07/2013,” depending on the client’s location, may mean payment in either July or September. To avoid ambiguity, try using an unambiguous expression such as “July 9, 2013.” Another term that can be confusing is “upon receipt”. The company Freshbooks (developer of a cloud accounting service - approx. Transl.) conducted an interesting study, as a result of which it turned out that many people seem to understand this term as “when it is convenient for you.” “It’s as if they received an invoice with the words: “Payable upon receipt” and immediately threw it into the “no matter when” pile. Instead, using a specific time frame—such as “21 days”—focuses the client's eyes on a specific period of time and will actually allow you to get paid faster than asking for immediate payment." — Zach Mathew

Part 3: Your Client

This part contains the name and address of the customer you are invoicing. If you are approaching a company with multiple locations, you will need to identify the correct person or department. This may not be the same person with whom you communicated while completing the order. Therefore, in order to pay you faster, be sure to ask who will handle the settlement with you.

Part 4: title and document number

As a rule, the name includes the word “invoice”, but depending on the type, it can be “bill”, “tax invoice”, “pro-forma”, “quick” quick invoice and so on. When in doubt, stick to the word "score." The account number is a unique identifier used to establish a match. Make it a rule to never use the same number for more than one document. Some countries require that account numbers must be ascending in chronological order. But they don't have to be consecutive. If you don't want the customer to know how many orders are going through you, consider increasing the invoice number by a random number each time you issue a new invoice. So, your first account will be numbered “00007”, the next one will be numbered “00012”, then “00014” and so on. You can also embed codes into your account number that will remind you that it’s time to pay taxes. For example, “2013-06-WDD-002” could be translated as: “Second invoice for Webdesigner Depot in June 2013.” It depends on you; Use your creativity to find a numbering scheme that works best for you.

Part 5: list of goods and/or services

This itemized list should clearly describe what exactly you are charging for: name (description) of the product or service, quantity, unit price, discount (usually stated as a percentage), tax charge, and total amount due. This description must be consistent with the terms agreed upon with the client, so be as specific as possible. Always double check your invoice for typos, grammar and calculation errors as they create a bad impression and can damage your reputation. In fact, triple check the invoice before you send it. Another thing to pay attention to is the quantity and unit price records: check the rules. For example, if a business in the UK is registered for VAT, HM Revenue and Customs' invoice regulations state that the invoice must include the unit price of the goods. If you charge hourly, you can indicate the number of hours spent and the rate per hour. Subtotal and final amounts, taking into account and decoding all taxes, should be calculated at the bottom of the table. Make sure everything on the bill is clear as day. Because if the client cannot determine what they are being asked to pay for, then your invoice will most likely end up in the “deal with it later” pile.

Part 6: gobbledygook

This is a place for your personalized message or note that describes the payment terms in more detail. For example, if you can accept payments in more than one way, you can indicate here which method you prefer (check, bank transfer, PayPal...). Above all, this is a great place to express gratitude. Remember that politeness matters and it can really help you get paid faster. Some studies claim that a simple “thank you” can increase the number of bills that are paid right away by more than 5%. While late fees aren't my favorite way to ask for on-time payment, keep in mind that it can be specifically mentioned here. For example: “Thereafter, a penalty of 5% will be charged monthly.”

Finally

Your account is an invisible marketing tool. Imagine how great it would be if you could make your document stand out from hundreds of others. Personally, I'm more interested in working with clients who send me creative invoices. A well-designed invoice can make paying you a pleasure.

To help you get started, we've prepared 10 free templates for download. Don't forget to incorporate your branding and personalize your wording for effective invoices that will actually work for you! About the translator The article was translated by Alconost. Alconost localizes applications, games and websites into 60 languages. Native translators, linguistic testing, cloud platform with API, continuous localization, 24/7 project managers, any string resource formats. We also make advertising and training videos - for websites, selling, image, advertising, training, teasers, explainers, trailers for Google Play and the App Store.

The invoice is in euros, but the payment is in rubles: how to issue an invoice?

Question from Clerk.Ru reader Tatyana (Moscow)

Account in EURO. Payment in rubles. Should the invoice be issued in rubles?

In accordance with paragraph 7 of Art. 169 of the Tax Code of the Russian Federation, if under the terms of the transaction the obligation is expressed in foreign currency, then the amounts indicated in the invoice can be expressed in foreign currency. Thus, tax legislation provides for the possibility of indicating amounts in foreign currency on the invoice.

Please note that in paragraph 7 of Art. 169 of the Tax Code of the Russian Federation refers to the currency of the obligation, and not to the currency of payment. According to the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 4, 2002 No. 70, the concepts of currencies are separated: in which a monetary obligation is expressed (debt currency) and in which it must be paid (payment currency) (clause 1 of the Information Letter).

A monetary obligation may stipulate that it is payable in rubles in an amount equivalent to a certain amount in foreign currency or in conventional monetary units (clause 2 of Article 317 of the Civil Code of the Russian Federation). According to the Federal Tax Service of the Russian Federation, expressed in Letter No. 3-1-07/674 dated August 24, 2009, it is impossible to issue an invoice in foreign currency or in conventional monetary units (under an agreement for which the obligation to pay is provided in rubles in the amount , equivalent to a certain amount in foreign currency (conventional monetary unit)). Invoices can be issued in foreign currency only if, under the terms of the transaction, the obligation is payable in foreign currency.

Previously, the tax authorities took a different position. For example, in the Letter of the Federal Tax Service for Moscow dated April 12, 2007 No. 19-11/33695 it is explained that in paragraph 7 of Art. 169 of the Tax Code of the Russian Federation, we are not talking about payment in foreign currency, but about assessing the obligations of the parties. That is, the named norm of the Code applies not only to contracts with foreign partners, but also to contracts between Russian organizations, under which the cost of goods sold (work, services), transferred property rights is expressed in foreign currency (or in conventional units equivalent to foreign currency ), and payments are made in rubles, so the seller has the right to issue invoices in foreign currency.

A similar opinion is expressed in the Letter of the Federal Tax Service for Moscow dated December 6, 2007 No. 19-11/116396.

The courts, referring to paragraph 7 of Art. 169 of the Tax Code of the Russian Federation, adhere to the point of view that if, under the terms of the transaction, the obligation is expressed in foreign currency or conventional monetary units (and is payable in rubles), then the invoice can be issued in foreign currency or in conventional monetary units. For example, Resolution of the Federal Antimonopoly Service of the Ural District dated March 17, 2008 No. F09-1590/08-C2 in case No. A47-3561/07, Resolution of the Federal Antimonopoly Service of the Northwestern District dated January 11, 2008 in case No. A56-5204/2007. Thus, the issue is currently controversial.

If the buyer receives an invoice in foreign currency or in conventional monetary units (if the monetary obligation stipulates that it is payable in rubles in an amount equivalent to a certain amount in foreign currency or in conventional monetary units), there is a risk that the tax authorities will not accept VAT for deduction.

In this case, the issue of the buyer’s acceptance of VAT for deduction will have to be defended in court, or the seller (in accordance with the recommendations given in the Letter of the Federal Tax Service of the Russian Federation dated August 24, 2009 No. 3-1-07/674) should make corrections to the invoice data : from columns 4, 5, 8 and 9 of the invoice, exclude indicators in foreign currency (conventional monetary units) and replace them with rubles.

These corrections are made in accordance with the procedure set out in clause 29 of the Rules for maintaining logs of received and issued invoices, purchase books and sales books for value added tax calculations, approved by Decree of the Government of the Russian Federation of December 2, 2000 N 914.

It is very easy to get personal advice on any tax online - you just need to fill out a special form. Every day two or three of the most interesting questions will be selected, the answers to which you can read in Natalia Lobanova’s consultations.

What is an account?

An invoice for payment is a document from the Seller to the Buyer, which contains payment details and a list of goods and (or) services. Invoices for payment are usually sent to the Buyer by email.

The following details are required in the Account:

- name of the organization or individual entrepreneur;

- TIN (and checkpoint for legal entities);

- bank details, current account, cor. account, bank name and BIC;

- list of goods and services;

- total payment amount;

- the amount of VAT or an indication that VAT is not subject to VAT (without VAT).

Blank invoice form for manual filling

Recommendations for filling out an invoice for payment

(form option No. 1)

You can place a logo in the invoice header and in the list of goods and services there is a column with VAT.

- The logo is located in the header, the name of the organization, OGRN, INN, KPP, as well as the address of the organization with an index are filled in. Additionally, telephone and fax are indicated.

- The full name of the organization is indicated under the heading.

- Then the details of the Seller and Buyer are indicated. The seller's details must contain the name of the organization, address, INN, KPP, OGRN, current or personal account, bank name, BIC and correspondent account. Additionally, you can specify telephone, fax, e-mail and company website.

- The Buyer's details can be filled in completely by analogy with the Seller's details.

- The account number is indicated in accordance with the accounting policies of the organization. This can be a simple serial number (from the beginning of the year) or a special composite accounting number. The date of the invoice is indicated.

- Under the invoice number and date on the right, a short general name of the goods or services in the invoice is indicated. For example, “computer components”, “laptop”, “repair of office equipment”, “production of printed products”.

- The table lists goods and services, cost, quantity, unit of measurement, VAT.

- After the goods, you can indicate important features of the invoice, for example, “delivery time of the goods”, “due date for payment of the invoice”, etc.

- At the end of the account, you must indicate the head of the organization and the chief accountant. A signature and seal are not required, but many companies require that the invoice be signed and stamped.

(form option No. 2)

This form is simplified and is used by default in many accounting programs.

- At the beginning of the invoice, a table resembling a payment order is filled out. It indicates the payment details of the Seller (payment recipient). This is the name of the organization, INN, KPP, current or personal account, name of the bank, BIC and correspondent account.

- Next, indicate the account number, which corresponds to the accounting policy of the organization. This can be a serial account number (since the beginning of the year) or a special composite number. The date of the invoice is indicated.

- The Seller's details must be provided in full. Name of the organization, INN, KPP, OGRN, address, current or personal account, bank name, BIC and correspondent account. You can also indicate telephone, fax, e-mail and company website.

- The Buyer's details are indicated in full or abbreviated form. It is enough to indicate only the name of the organization.

- The table lists goods and services, cost, quantity, unit of measurement.

- After the list of goods and services, you can specify the invoice details, for example, “payment period for the goods,” “delivery or pickup conditions,” etc.

- At the end of the invoice the full name of the head of the organization and the chief accountant are indicated. A signature and seal are not required, but some companies will not consider invoices without a signature and seal.

Instructions for filling out the form

Like calculating the autonomy coefficient, creating and filling out an invoice form for payment for services or goods is carried out by the company as necessary and based on the originator’s considerations about the optimal structure of the document. There are no mandatory conditions or a single form of document preparation.

However, in order to avoid unnecessary confusion and give the counterparty the opportunity to process the application and send the transfer as soon as possible, it is recommended to adhere to the following scheme for filling out the invoice form for payment of inventory items or services:

- At the top of the document you need to indicate (in the summary table or in separate lines) the details of the recipient bank of the money transfer.

- Next is the full name of the sender of the invoice for payment, his taxpayer identification number, OGRN, KPP and significant statistics codes.

- In the title line you should indicate a serial number in accordance with the sender’s accepted numbering of outgoing documents and the date of signing the paper.

- In the next block - information about the contractor or supplier of goods (full and abbreviated official names; if necessary - last names, first names and patronymics of responsible persons), recipient or customer (official names - both full and short, and names of authorized persons) and the basis for issuing an invoice (usually this is the number of the supply or purchase agreement and the date of its preparation).

- In the main summary table you need to provide:

- in the first column - the number of each position in order;

- in the second - the name of the goods sold (delivered) or services provided, each type separately;

- in the third - the number of units of measurement (kilograms, liters, bales, packs, units, man-hours);

- in the fourth - the name of the units used to estimate the number of units in Russian and, if necessary, international formats;

- in the fifth - the price (market value) of a unit of each type of product (previously given units of measurement are used: kilograms, liters, hours, and so on);

- in the sixth - the final cost of each product or each service, obtained by multiplying the price of a unit of measurement by the total number of units.

- Below the main table (under the final column “Amount”) you should indicate:

- the total cost obtained by summing up the positions;

- the amount of value added tax (VAT);

- amount to be paid.

- Next (optionally), the invoice preparer can enter the following data:

- amount to be paid in words (rubles and kopecks);

- clarifying information and notes;

- deadlines for transferring funds - for each position separately or for all together.

- At the end of the document must contain the signatures of the chief accountant and director of the enterprise. If the invoice for payment is issued by an individual entrepreneur who does not have an accountant on staff, he will only need to put his signature with a transcript.

- Under the signatures is the seal or stamp of the individual entrepreneur or organization. If the document is sent electronically, the originator should use a previously obtained qualified electronic digital signature.

- In the final block of the invoice for payment for services or inventory items, you can once again indicate the date of drawing up the document or the addressee’s contact information.

Tip : in order not to waste time entering the same data, it makes sense to save the seller’s (supplier’s) data in the invoice template, including name, contact information and main codes. But when changing them, it is important not to forget to make the appropriate adjustments to the document.

What is an Account?

An invoice for payment is a document from the Seller to the Buyer, which contains payment details and a list of goods and (or) services. Invoices for payment are usually sent to the Client by email.

- The following details are required in the Invoice:

- name of the organization or individual entrepreneur;

- TIN (and checkpoint for legal entities);

- bank details, current or personal account, cor. account, name of the bank and its BIC;

- listed goods (and services);

- total payment amount and VAT rate.

Let's sum it up

An invoice for payment for services or goods is drawn up by the supplier or seller and sent to the buyer or customer. There is no single form of the document: each organization can develop its own form. The invoice can be transmitted in person, through an intermediary, sent by regular mail or email, or delivered using other modern means of communication.

The document should indicate the full names of the seller and buyer, payment details, a list of goods supplied or services provided and the total amount to be paid. If an agreement was previously reached, the deadline for transferring funds should also be specified. The invoice must be certified by the signatures of the chief accountant and director of the enterprise, as well as a seal or stamp - or, if sent electronically, a qualified electronic digital signature.

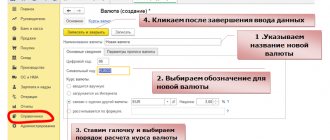

How to quickly and easily issue invoices in foreign currency?

Invoicing in foreign currency is an important part of transactions with domestic and foreign partners. To quickly process them and send them on time, you need good software. The online service Officeoff will cope with this task perfectly.

Ofisoff is a convenient program for creating foreign currency accounts. Thanks to its simplicity and intuitive interface, even a beginner can handle it. You just need to configure ready-made templates in euros and dollars, this is done in a few seconds. If you constantly cooperate with a foreign company, you can issue an invoice once and set a sending interval. After this, the invoice will be sent automatically at the required time. Moreover, to create invoices you don’t even need to install a program on your computer; you can create them in your browser. This can be done from your smartphone in any place equipped with the Internet.

The Officeoff program will greatly facilitate the creation of foreign currency accounts, simplify cooperation with business partners and help save a lot of time.

Conditions of currency control in Sberbank for legal entities

Each foreign trade participant is accompanied by a personal bank manager who will help with the preparation of documents for a foreign exchange transaction and advise on legislative issues.

The bank provides the following services:

- Registers import/export contracts, loan agreements with assignment of a number (UNK).

- Accepts documents (contracts, certificates, invoices, etc.) in electronic and paper form.

- Conducts examination of foreign trade contracts.

- Prepares documentation on currency control without errors (certificate of supporting documents (SPD), statements, etc.).

- Controls the timing of passing currency control.

- Gives recommendations on choosing the optimal financial scheme with a foreign partner.

- Informs about the current state of settlements between counterparties.

- Notifies about the receipt of funds to the transit account.

- Conducts payments between Russian and foreign parties.

- Issues copies of currency control files.

- Reports possible violations of the law when drawing up a contract.

- Organizes consultations, individual and general seminars.

- If necessary, provides services for comprehensive support of foreign trade activities (monitoring of deadlines, preparation of documentation, etc.).

Go to the bank's website