General provisions

Companies are required to report on “interim” payments 3 times a year - for 3, 6 and 9 months. The deadline for submitting the form is the 30th day of the month following the reporting period.

Before filling out the calculation, you should find out a number of important nuances:

- the need to submit it in principle, since regional authorities have the right to cancel advances on property taxes on their territory;

- the rate in your region, which is set by the authorities of the subject;

- availability of tax incentives, which allows you to reduce the amount of tax;

- category of property: the method of calculating tax depends on this - by residual or cadastral value;

- cadastral numbers of taxable objects - by their first digits you can understand which territorial inspection the form should be sent to.

General rules for calculating property tax advances

The procedure for calculating and paying property tax for organizations is regulated by Chapter 30 of the Tax Code of the Russian Federation.

In general, the object of taxation is movable and immovable property, recorded on the balance sheet as fixed assets.

The tax period is the calendar year, and the reporting period is periods that are multiples of a quarter.

Before you begin calculating your advance property tax payment for the 3rd quarter of 2021, you should do the following:

- Check whether you need to make this calculation at all. The Tax Code gives the authorities of the constituent entities of the Russian Federation the right to cancel advance payments for property tax both in the region as a whole and for certain categories of taxpayers (clause 3 of Article 379, clause 6 of Article 382 of the Tax Code of the Russian Federation).

- Specify the category of property. For some types of objects, the tax base is determined in a special manner (based on cadastral value).

- Consider the location of objects. If they are located in territories under the jurisdiction of different Federal Tax Service Inspectors, then they should be “segregated” into different reports.

Also see “Calculation of advance payment on property for 2 sq.m. 2021."

Determination of the tax base

The tax is calculated according to the residual value (Section 2 of the form) or according to the cadastral value (Section 3). We'll look at what this depends on next.

The principle is the same in both cases: the value of the property is multiplied by the tax rate and divided by 4 (by the number of quarters). However, tax bases are calculated differently.

In Sect. 2 for the 3rd quarter of 2021, indicate the residual value of the objects as of the first day of each month, including October 1. Next, calculate the average property value over 10 months. This amount will be the tax base for calculating advances.

Moreover, it can be reduced if the company has preferential property that is not taxed. To do this, you need to calculate its average value for 10 months and subtract it from the average value of all property.

In the second option for calculating tax - based on cadastral value - you should clarify the list of “cadastral” objects approved in the region. If the property (and these are mainly office and retail buildings) is on the regional list, then just put it in Section. 3 cadastral value at the beginning of the year, which will be the tax base.

Example

Radius LLC, operating in Veliky Novgorod, owns an office building, the cadastral value of which is 14,851 thousand rubles. at the beginning of 2021. This will be the tax base for Section. 3.

The residual value of other objects of Radius LLC, which are subject to property tax, and the value of preferential objects are shown in the table:

| date | Residual value | Cost of preferential property |

| 01.01.18 | 78 900 | 10 250 |

| 01.02.18 | 76 008 | 10 090 |

| 01.03.18 | 75 851 | 9 989 |

| 01.04.18 | 79 852 | 11 560 |

| 01.05.18 | 78 820 | 11 020 |

| 01.06.18 | 77 001 | 10 801 |

| 01.07.18 | 76 520 | 10 020 |

| 01.08.18 | 75 006 | 9 985 |

| 01.09.18 | 73 005 | 9 020 |

| 01.10.18 | 71 006 | 8 540 |

The tax rate based on cadastral value in Veliky Novgorod is set at 2%. Let's calculate the advance payment for the 3rd quarter for the object based on its cadastral value (Ak):

Ak = KS x 2% / 4 = 14,851 x 2% / 4 = 74.2 thousand rubles.

The tax rate for property with residual value is 2.2%.

Thus, the advance payment for the 3rd quarter on property based on the residual value (Ac) will be calculated as follows:

Ac = (Co - Cl) x 2.2% / 4,

Where:

- Co - average residual value of objects for 10 months:

Co = (78,900 + 76,008 + 75,851 + 79,852 + 78,820 + 77,001 + 76,520 + 75,006 + 73,005 + 71,006) / 10 = 76,197 thousand rubles.

- Sl - average cost of preferential property:

Sl = (10,250 + 10,090 + 9,989 + 11,560 + 11,020 + 10,801 + 10,020 + 9,985 + 9,020 + 8,540) / 10 = 10,127 thousand rubles.

Ac = (76,197 – 10,127) x 2.2% / 4 = 363.4 thousand rubles.

The total advance amount for Radius LLC will be:

A = Ak + Ac = 74.2 +363.4 = 437.6 thousand rubles.

A sample calculation based on our example data can be downloaded here.

How to calculate the advance amount

The amount of contributions for the 3rd quarter to be paid to the budget is determined in two ways:

- At average annual cost based on balance sheet data.

- At cadastral value.

Calculation based on the average annual value is carried out if the taxpayer does not have recorded information about the cadastral value.

The formula for calculating the advance is as follows:

Advance payment = (average annual value of assets × % tax rate) / 4.

The average annual value is the basis for calculating property taxes. It is determined by summing the residual value of fixed assets as of the first day of the month, and then dividing by the number of calculated months. The calculation formula for the 3rd quarter of 2021 takes data on the residual value from 01/01 to 10/01/2019. The resulting amount is divided by 4.

If the payer knows the cadastral value of the property, then the advance payment is calculated according to the cadastre registers.

To determine the amount of the advance, the value according to the cadastre as of 01/01/2019 is multiplied by the tax rate established by the regional authorities (but not higher than 2.2%). The resulting value is divided by 4.

This calculation takes into account the period of ownership and use of the fixed asset during the calculation period. You will also need information about the technical, functional and quantitative condition of the asset at the reporting date.

Information about the cadastral value is located in the official open data source, which is generated based on the results of the cadastral valuation. Such information is also provided at the local branch of Rosreestr.

How to fill out the form

The form, which has been used since the beginning of 2021, was approved by order of the Federal Tax Service of the Russian Federation dated March 31, 2017 No. ММВ-7-21/ [email protected] . He also approved the procedure for completing the calculation (hereinafter referred to as the Procedure). The full version of the form, which all Russian and foreign organizations working through permanent missions are required to submit, consists of the following sections:

- Title page - contains all the information about the taxpayer and the reporting period.

- Sec. 1 - reflects the entire amount of tax to be paid into the budget.

- Sec. 2 - shows the amount of tax, which is calculated based on the average value of the property.

- Sec. 2.1. — contains information about objects, the tax on which is calculated at the average annual cost.

- Sec. 3 - shows the amount of tax calculated based on the cadastral value of objects.

If there are no objects that have any characteristic, dashes are placed on the form, but all pages are submitted. The shortened form of the report can only be submitted by foreign companies that do not operate through post-representative offices.

Changes for 2021

IMPORTANT!

In 2021, taxpayers will no longer have to submit advance property tax reports. They are officially cancelled. In April 2021, we report for the 4th quarter of 2021 and submit not a calculation, but a final property tax declaration for the entire 2021.

Canceling advance reports does not mean canceling the advance payments themselves. If legislators in your region have established a rule for mandatory advance payment of property taxes, then you will have to pay every quarter.

There is one more innovation. It concerns the procedure for calculating tax advances. In 2021, it is allowed to calculate the advance according to the changed cadastral value of the real estate, and not according to the value determined as of January 1 of the reporting period.

Title page

The design of the title card is practically no different from the design of other reports filled out by organizations for submission to the Federal Tax Service. It includes all the basic information about the taxpayer:

- TIN code.

- Checkpoint code.

- Page number: 001.

- Correction number. If the form is original, “–0” is entered. When the data is clarified, “–1” is entered, and for subsequent clarifications, the number of the submitted version is indicated. When submitting clarifications for periods before 2021, use the form that was valid in that period.

- Reporting period code. In the form for the 3rd quarter of 2021, enter the value “18”.

- Reporting year: value “2018”.

- Code of the tax authority where the taxpayer is registered.

- The code at the location (registration) is entered in accordance with the sign of submission to the tax office. In a standard situation, when an organization submits a form to the Federal Tax Service at its location, the value “214” is entered.

- Full name of the organization.

- Reorganization form. Fill out only when the form is handed over by the legal successor of the company. Codes for this field can be selected in Appendix. 2 to Order.

- TIN/KPP of the reorganized organization: indicate if the previous indicator is completed. They enter the data that the organization had initially.

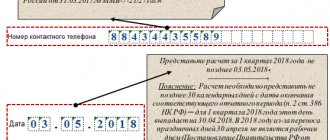

- Contact phone number in 11-digit format.

- Number of pages. They are entered last, when all pages of the report are completed.

- Taxpayer identification. If he submits the form in person, the value “1” is entered; if through a representative, then the value is “2”.

- Full name.

- The date the form was filled out.

- Name of the document confirming authority. Fill in only if the value “2” is entered in the “Taxpayer Attribute” field.

- The field “To be filled in by a tax authority employee” is not for the report preparer, but for Federal Tax Service employees.

How to fill out the calculation

We have compiled an algorithm for generating tax calculations for property taxes, taking into account the innovations of 2021. The advance property tax report consists of a title page and three sections. Section 2 has an additional block - section 2.1. Here's how to complete your 3rd quarter 2019 property tax advance estimate:

Step 1. Fill out the title page.

It reflects the taxpayer’s registration data:

- TIN;

- KPP and name, and, if necessary, TIN and KPP of the reorganized organization (if available);

- contact number;

- FULL NAME. manager or authorized person;

- date of application.

The first page indicates the adjustment number (for the original form - 0) and various codes - tax period code (for the 3rd quarter of 2021 - 18), territorial Federal Tax Service code, code at the location or registration (in normal cases - 214).

The title page is certified by the signature of the head and the seal of the reporting institution.

Step 2. Fill out section 1.

Here the specialist indicates the OKTMO of the reporting organization, the calculated advance amount for property tax and the budget classification code by which the payment is distributed.

Step 3. Fill out section 2.

Calculation procedures are carried out here. This advance calculation block is filled out separately for each immovable property on the taxpayer’s balance sheet. The form contains the code for the type of property according to the nomenclature from Order No. ММВ-7-21/ [email protected] For basic cases, this code has a value of 0.

Then OKTMO is indicated.

The contractor enters the residual value of the asset in strict accordance with the accounting data.

Column 4 of the calculation is intended to reflect the OST on property subject to contributions at a preferential rate. In the report for the 3rd quarter, lines from 020 to 110 are filled in, which corresponds to information from 01.01 to 01.10. After entering the basic data, the advance amount is calculated.

In line 120 the average value for OST is calculated.

Field 130 indicates the tax benefit code (determined by regional authorities) in the case of accounting for preferential assets, and field 140 indicates the average cost of preferential property.

The estimated tax rate is entered on line 170.

The calculated advance amount at book value is given in field 180.

The new reporting form does not contain line 210, which accumulates the results as of the reporting date.

Step 4. Fill out section 2.1.

This block is intended for entering information about cadastral registration. In the first field, enter the code for the cadastral or conditional number.

Line 020 contains the name of the property according to the cadastre.

In the new calculation form, the address of the asset is also filled in; lines with code 030 are provided for this.

Address fields are generated for those funds that have an inventory number, but at the time of submitting the report, a cadastral or symbolic designation was not assigned. If the address has not been assigned by the reporting date, then dashes are placed in the fields.

Step 5. Fill out section 3.

The third section of the advance calculation is filled out similarly to the second block - only according to cadastral data. Here you indicate the code of the type of property, OKTMO and the encoding of the type of information for the reporting fixed asset. Then the cadastral number (line 015) and cost data (line 020) are given. The specialist indicates the tax benefit index, if any (field 040) and the rate at which the property is taxed (field 070), on the basis of which the amount payable to the budget for the 3rd quarter of 2019 is calculated. The value is entered in cell 090. The total data on calculated contributions from section 2 and section 3 are summed up and entered in section 1 as the amount of the property tax advance for transfer (line 030 of section 1).

Section 1

Contains summary information on the amount payable to the budget. Filled in after calculating the tax base and the amount payable in the remaining sections. Contains several blocks in which information is entered based on OKTMO codes assigned to the property:

- OKTMO code. They put a code at the location of objects subject to taxation. If the code is less than 11 characters, empty cells are crossed out.

- KBK to which the payment is transferred.

- Calculated tax, which is determined as follows:

Where to submit the payment

To correctly determine where to submit the calculation of advance payments for property taxes, answer three questions:

- Is your organization the largest taxpayer?

- Based on what value was calculated the tax base for the property for which you are submitting calculations: from the average or cadastral?

- Does the organization have separate divisions with property on their balance sheet? And if so, how is the tax distributed among local budgets?

If your organization is the largest taxpayer, then for all objects, even those that are taxed at cadastral value, submit a single report at the place where the organization is registered as the largest taxpayer. This is stated in paragraph 1.5 of Appendix 6 to the order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895.

But if the organization is not one of the largest, then for each property with a cadastral tax base, submit separate calculations at the location of these objects. The Federal Tax Service of Russia sent such clarifications to the tax inspectorates by letter dated April 29, 2014 No. BS-4-11/8482.

Let's move on to the next question. Does the organization have separate divisions? If not, then submit the calculation for the property, the tax base for which you calculate from the average cost, to the inspectorate at the location of the organization.

For the property of separate divisions (the tax base for which is calculated from the average cost), report depending on the budget structure of a particular region. Property tax amounts or advance payments may:

- go entirely to the regional budget;

- partially or fully go to the budgets of municipalities;

- distributed among the settlements included in the municipality.

If in your region there is no distribution of property taxes between municipal budgets, then calculations of advance payments can be submitted centrally - at the location of the organization. But this needs to be agreed upon with the inspectorate. This is stated in paragraph 1.6 of Appendix 6 to the order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895.

Is property tax in the region credited (in whole or in part) to local budgets? There are several options, all of them are in the table below:

| Where is the organization, its separate branches with a separate balance sheet or geographically distant real estate located? | Which tax office should I submit reports to? | How many reports to submit? | How to reflect tax in reports |

| In several municipalities under the jurisdiction of different tax inspectorates | By location of each separate division with a separate balance sheet or geographically remote real estate | For each division with a separate balance sheet and for each geographically remote property, submit separate calculations | In the submitted forms, reflect only the tax, the payment of which is controlled by the tax office of the relevant municipality |

| In several municipalities under the jurisdiction of one tax office | By location of the organization's head office | Submit a single report for all property on which you pay tax in the territory of the municipality | Calculate the reporting tax separately for each municipality |

| In one municipality | In your reports, reflect all property taxes under one OKTMO code - the municipality at the location of the organization's head office |

Similar explanations are contained in paragraph 7 of the letter of the Ministry of Finance of Russia dated February 12, 2009 No. 03-05-04-01/08.

At the same time, the following is provided for municipalities such as districts. It will not be possible to provide a single calculation if, by decision of local legislators, part of the property tax is transferred to the budgets of the district’s settlements. Then you will have to submit separate calculations.

All these rules are spelled out in paragraphs 1 and 5 of Article 386 of the Tax Code of the Russian Federation, and are also set out in the letter of the Federal Tax Service of Russia dated April 29, 2014 No. BS-4-11/8482. The diagram below and the table will help you not to get confused about where to pay property tax (including advances) and where to submit reports.

Section 2

It is devoted to the calculation of advances based on the average cost of property:

- Page 001 is filled in from Appendix. No. 5 to Order.

- Page 010 is filled in with the OKTMO code, according to which the tax will be paid.

- Data for calculating the average value of property for the reporting period. For the 3rd quarter of 2021, it is necessary to fill out pages 020-110, which contain the residual value of the property according to accounting data as of the 1st day of each month of the year until October inclusive. In gr. 3 indicate the value of the property, and in gr. 4 – cost of preferential objects, if any. If the enterprise does not use the benefit, gr. 4 are not filled in.

- On page 120, the average value of property is calculated by adding all pages 020-110 gr. 3 and dividing them by 10.

- On page 130 indicate the tax benefit code. The second part of the line is filled in only if the first part has the value “2012000”. It contains information about the norm of the regional law (number of article, clause and subclause).

- On page 140 the average cost of the preferential property is indicated, which is calculated by adding all pages 020-110 gr. 4 and dividing them by 10.

- Page 150 is filled out only if the value “02” is entered in line 001. This field contains the share of the book value of the object related to this constituent entity of the Russian Federation.

- Page 160 is filled out if the law of a constituent entity of the Russian Federation establishes a tax benefit in the form of a rate reduction. In the first part of the line, the benefit code 2012400 is indicated, and in the second part - data on the corresponding article of the regional law, similar to page 130.

- Page 170 contains data on the tax rate.

- Page 175 is filled in only regarding the railway property.

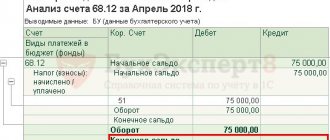

- Page 180 shows the total advance amount for the 3rd quarter of 2018, which is calculated by multiplying the difference between lines 120 and 140 by page 170 and dividing the resulting value by 4.

- Page 190 is filled out only if a benefit is established in the region. Indicate the benefit code 2012500, and then - information about the norm of the regional law, similar to pages 130 and 160.

- Page 200 reflects the amount of the tax benefit.

- On page 210 you need to indicate the residual value of fixed assets as of 10/01/2018.

Who should not submit the calculation?

If an organization does not have fixed assets recognized as objects of taxation, it is not necessary to report property taxes. The grounds for this are clause 1 of Art. 373, art. 374, paragraph 1, art. 386 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated September 23, 2011 No. 03-05-05-01/74.

There is also no need to submit settlements in relation to preferential property related to oil production at offshore fields (paragraph 2, paragraph 1, article 386, paragraph 24, article 381 of the Tax Code of the Russian Federation). Include the remaining property that is subject to taxation in the calculation. Read more in the article on what property is subject to tax. Even if other benefits apply to this property. For example, movable property that belongs to 3–10 depreciation groups must be included in the calculation. Even if it was acquired after January 1, 2013 (letter of the Federal Tax Service of Russia dated December 17, 2014 No. BS-4-11/26159).

And of course, the calculation of advance payments for property tax (as well as the declaration for this tax) is not submitted by entrepreneurs and citizens. They do not pay such a tax in principle (clause 1 of Article 373 of the Tax Code of the Russian Federation).

Situation: who must submit calculations of advance payments for property tax - the founder of the trust management or the trustee?

Founder of trust management.

Taxpayers are required to submit tax calculations (subclause 4, clause 1, article 23, clause 1, article 386 of the Tax Code of the Russian Federation). And for objects transferred to trust management, the payer of the property tax is the founder of the trust management (Article 378 of the Tax Code of the Russian Federation). That is, an organization that has transferred its property to a manager. Thus, it is she who must prepare and submit tax reports on property tax. A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated September 23, 2008 No. 03-05-05-01/58, paragraphs 3–4 of paragraph 3 of the letter of the Ministry of Finance of Russia dated August 2, 2005 No. 07-05-06/216.

Situation: is it necessary to submit calculations of advance payments for property tax if the residual value of fixed assets is zero? The organization applies a general taxation system.

Yes need.

Calculations of advance payments for property tax must be submitted by all payers of this tax (Article 386 of the Tax Code of the Russian Federation). And these are all organizations that have fixed assets that are taxed (clause 1 of Article 373, Article 374 of the Tax Code of the Russian Federation). The amount of the residual value of the property is not important - there is no such restriction in the Tax Code of the Russian Federation.

If the residual value of fixed assets recognized as an object of taxation is zero, the tax base and the amount of tax that must be indicated in the calculations will be equal to zero. However, the organization is required to submit estimates of advance property tax payments. This is confirmed by letter of the Federal Tax Service of Russia dated February 8, 2010 No. 3-3-05/128.

An organization may also have real estate objects, the tax base for which is their cadastral value. The amount of the advance payment for property tax on such objects does not depend on their residual value. This means that in this case the organization must also submit calculations of advance payments for property tax.

Section 2.1

This contains information about property, the tax on which is calculated based on the average annual value:

- On page 010 indicate the cadastral number.

- On page 020 a conditional number is given in the absence of a cadastral number.

- The inventory number is entered on page 030 if pages 010 and 020 are empty.

- On page 040 indicate the object code in accordance with the OKOF classifier.

- Page 050 contains information about the residual value of the object as of 10/01/2018.

If, as of 10/01/2018, the object was withdrawn for any reason, then Sec. 2.1 is not filled out according to it.

Procedure for submitting the form and paying tax

The form must be submitted within 30 days after the expiration of the reporting period (clause 2 of Article 386 of the Tax Code of the Russian Federation). For the 3rd quarter of 2021, the deadline is October 30, 2018.

Small companies may submit the form on paper. If the number of employees of the organization exceeds 100 people, the calculation must be submitted electronically.

The fine for late provision of payment is 200 rubles (Clause 1, Article 126 of the Tax Code of the Russian Federation). In addition, officials may be fined from 300 to 500 rubles. (Article 15.6 of the Administrative Code).

Tax payment deadlines are not set at the federal level, so be sure to find out what regulations exist in your region.