Organizations and individual entrepreneurs, acting as tax agents, are required to withhold and pay personal income tax on income paid to each of their employees.

Whether your employees work under an employment contract or individuals under a GPC (civil law) agreement does not matter, personal income tax is withheld from payments to both.

In some cases, income is exempt from personal income tax, for example, gifts and material assistance up to 4,000 rubles, payments to individual entrepreneurs, compensation payments, maternity benefits, etc. (Article 217 of the Tax Code of the Russian Federation).

Object of taxation and taxpayers

In Art. 226 of the Tax Code of the Russian Federation, personal income tax payers are individuals, who for tax purposes are divided into two separate groups. They are usually called residents and non-residents of the Russian Federation. The difference is this:

The first category is persons who are actually on the territory of the Russian Federation for at least 183 days within 12 consecutive months. The second category is citizens who are not staying for the period specified in the first case on the territory of the Russian Federation, but who receive income of any kind in the country.

Due to changes in tax legislation, some formalities were introduced into the reporting documentation in the declarative format. The changes also affected the 3-NDFL form, which reflects the income of individuals. All this is necessary to determine accuracy in connection with work and tax payments.

Who needs to submit a declaration

It is necessary to submit a declaration in form 3-NDFL for private entrepreneurs used by OSNO, heads of peasant farms, specialists, practicing other citizens (notaries, lawyers, attorneys, etc.), as well as persons who receive income from whom personal income tax has not yet been withheld, including number:

- From organizations and individuals who do not perform the main function of tax agents.

- Under property rental agreements.

- From the sale of property owned for at least three years, as well as real estate acquired before 2016, if it was owned for less than three years, and property acquired after that date and owned for at least five years.

- Won in various lotteries, slot machines or sweepstakes.

- When receiving deeds of gift or inheritance, especially if it concerns a vehicle, shares, or real estate.

- From income received in the process of creative and scientific activities.

Moreover, citizens who claim to receive the corresponding deduction will have to file an income tax return. Employees who work for hire do not have to file a declaration, since the tax is paid for them by the official employer.

And if tax is withheld in a certain amount, you will have to notify the Federal Tax Service about this by drawing up a 2-NDFL certificate. The tax officer will notify the payer in writing of the need to pay the tax by a certain date.

Accountant calendar for March 1, 2021

Who rents and pays?

Organizations that are participants in the gambling business.

Where?

To the tax office at the place of registration of gambling business facilities.

What's the fine?

For late submission of a declaration, a fine of 5% for each month, not more than 30% of the amount, but not less than 1000 rubles.

For late payment of a penalty in the amount of 1/300 of the Central Bank refinancing rate for each day of delay. For organizations, the penalty rate is doubled for debts exceeding 30 days.

Delivery form:

Who rents and pays?

Organizations that are participants in the gambling business.

Where?

To the tax office at the place of registration of gambling business facilities.

What's the fine?

For late submission of a declaration, a fine of 5% for each month, not more than 30% of the amount, but not less than 1000 rubles.

For late payment of a penalty in the amount of 1/300 of the Central Bank refinancing rate for each day of delay. Delivery form:

| Last date according to the calendar | What reports does the accountant have in February (legal legal acts, reporting period), type of payment | Terms of provision: who is obliged to report | Where to deposit or pay |

| 1st of February | Calculation of insurance premiums for compulsory pension, social, and medical insurance, including information on the average number of employees for 2021. | SZV-M, SZV-TD for December 2021* | All policyholders |

| January 20th | Inspectorate of the Federal Tax Service | Unified simplified tax return for 2021 | Legal entities that have no objects of taxation and no turnover at the bank or cash desk |

| Inspectorate of the Federal Tax Service | Water tax declaration for the 4th quarter of 2021 | Water tax payers | |

| FSS | 4-FSS for 2021 in paper format | Policyholders with an average number of employees of less than 25 people who have chosen the paper format | |

| Inspectorate of the Federal Tax Service | Declaration on UTII for the 4th quarter of 2021 | Payers of UTII | |

| The 25th of January | Inspectorate of the Federal Tax Service | VAT return for the 4th quarter of 2021 | VAT payers and tax agents |

| FSS | 4-FSS for 2021 in electronic format | Policyholders:

| |

| 1st of February | Inspectorate of the Federal Tax Service | Calculation of insurance premiums for 2021 at the Federal Tax Service | All policyholders |

| February, 15 | Pension Fund | SZV-M, SZV-TD for January | All policyholders |

| March 1 | Inspectorate of the Federal Tax Service | Income tax return for January | Companies on OSNO that report monthly |

| Inspectorate of the Federal Tax Service | Tax calculation for income tax for January | Tax agents calculating monthly advance payments based on actual profits received | |

| Pension Fund | SZV-STAZH | All policyholders | |

| Inspectorate of the Federal Tax Service | 6-NDFL for 2021 | Tax agents | |

| March 15th | Pension Fund | SZV-M, SZV-TD for February | All policyholders |

| March 29 | Inspectorate of the Federal Tax Service | Income tax return for 2021 | Companies on OSNO |

| Inspectorate of the Federal Tax Service | Income tax return for February | Companies on OSNO that report monthly | |

| Inspectorate of the Federal Tax Service | Tax calculation for income tax for February | Tax agents calculating monthly advance payments based on actual profits received | |

| 30th of March | Inspectorate of the Federal Tax Service | Organizational property tax declaration for 2021 | Companies that have property on their balance sheet |

| March 31 | Inspectorate of the Federal Tax Service | Accounting statements for 2021 | Companies that have property on their balance sheet |

| Inspectorate of the Federal Tax Service | Declaration under the simplified tax system for 2021 | Organizations on the simplified tax system |

Deadlines for filing income tax returns for individuals

The declaration must be submitted to the Federal Tax Service no later than April 30 of the following year. Each individual receives a corresponding notification at their address about the need to pay a tax deduction. In addition, all subtleties and conditions are taken into account. For example, if the last day for receiving the form falls on a holiday or weekend, then the deadline should be considered the previous day or the first working day after the holiday.

Citizens who have declared their right to receive a tax deduction are not limited by the general deadline for filing a declaration and can submit it throughout the entire calendar year. Payment of the tax specified in the declaration is made no later than July 15 of the year in which the declaration is submitted.

Accountant calendar + changes 2021: table – reporting deadlines

The deadline for paying the property tax of organizations and the deadline for paying advances on this tax are established by the laws of the constituent entities of the Russian Federation.

Deadline for payment of transport tax in 2021

From 2021, the deadlines for payment of transport tax and advance payments on it will change. If before 2021 payment deadlines were established by the laws of regional authorities, then from 2021 specific deadlines have been established in the Tax Code. So, transport tax/advance payment in 2021 is paid within the following terms:

| Period for which tax/advance is paid | Payment deadline |

| For 2021 | No later than 03/01/2021 |

| For the first quarter of 2021 | No later than 04/30/2021 |

| For the second quarter of 2021 | No later than 08/02/2021 |

| For the third quarter of 2021 | No later than 01.11.2021 |

| For 2021 | No later than 03/01/2022 |

From 2021, the deadlines for paying land taxes will also change. Tax/advance payments must be paid no later than the following dates:

| Period for which tax/advance is paid | Payment deadline |

| For 2021 | No later than 03/01/2021 |

| For the first quarter of 2021 | No later than 04/30/2021 |

| For the second quarter of 2021 | No later than 08/02/2021 |

| For the third quarter of 2021 | No later than 01.11.2021 |

| For 2021 | No later than 03/01/2022 |

Reporting deadlines in 2021: table

Reporting changes in 2021

Deadlines for submitting reports for the 3rd quarter of 2021

Deadline for submitting 3-NDFL for individual entrepreneurs

Electronic reporting from 2021

In 2021, taxpayers will no longer have to submit a number of declarations and calculations due to the cancellation or merging of forms. We offer an up-to-date accountant calendar for 2021, the reporting deadlines in which comply with current legislation.

| Deadline | Where to rent | Report name | Report period | Who rents | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Month | Number | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1st quarter 2021 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| January | 15 | Pension Fund | SZV-M | December 2020 | Individual entrepreneurs and legal entities that entered into GPC agreements and employment contracts with individuals | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 15 | Pension Fund | SZV-TD | December 2020 | Employers who have entered into employment contracts - if there were personnel events for the employee in the previous month; when hiring and dismissing employees - submitted no later than the working day following the day of issuance of the relevant order/order | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 20 | FSS | 4-FSS | 4th quarter 2020 | Legal entities and individual entrepreneurs submitting reports on paper | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 20 | Inspectorate of the Federal Tax Service | Logs of received and issued invoices (VAT) | 4th quarter 2020 | Organizations and individual entrepreneurs that are not VAT payers (if there are taxable transactions with intermediaries who have entered into a commission, commission, agency, transport expedition agreement or performing the functions of a developer) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 20 | Inspectorate of the Federal Tax Service | Single simplified tax return | 2020 | Taxpayers who do not have taxable objects and movement on the current account and cash register | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 20 | Inspectorate of the Federal Tax Service | Declaration of single tax on imputed income | 4th quarter 2021 | Payers of UTII (including those combining the simplified tax system or OSNO with UTII) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 20 | Inspectorate of the Federal Tax Service | Water tax declaration | 4th quarter 2020 | Taxpayers using water bodies | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 20 | Inspectorate of the Federal Tax Service | Gambling tax return | December 2020 | Taxpayers involved in gambling business | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 20 | Pension Fund | DSV-3 | 4th quarter 2020 | Policyholders who transferred additional insurance contributions to employees' funded pensions | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 25 | FSS | 4-FSS | 4th quarter 2020 | Legal entities and individual entrepreneurs submitting reports electronically | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

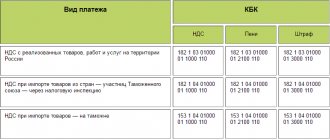

| 25 | Inspectorate of the Federal Tax Service | VAT declaration | 4th quarter 2020 | Legal entities and individual entrepreneurs on OSNO and Unified Agricultural Tax, tax agents, tax evaders who issued VAT invoices | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 25 | Inspectorate of the Federal Tax Service | Excise tax declaration | December 2020 | Legal entities and individual entrepreneurs (if there are transactions with excisable goods) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| February | 01 | Inspectorate of the Federal Tax Service | Calculation of insurance premiums | 2020 | All policyholders are individual entrepreneurs and legal entities that make payments and other rewards to individuals Reporting to the Pension Fund and the Social Insurance Fund is submitted on personnel and the calculation of contributions. If a company enters into an agreement with an individual entrepreneur or a civil partnership agreement with a citizen who is registered as self-employed (tax payer), the customer does not have obligations to pay taxes and fees, as well as to submit reports.

Declarations can be sent by mail , by a valuable letter with an inventory of the contents in two copies. The report (declaration) is also enclosed in 2 copies. Along with the documents, the Pension Fund must include a floppy disk. The day you send the letter (specified in the letter description) will be considered the day the reports are submitted. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

How did the changes affect filling out the declaration?

From 2021, citizens are forced to fill out completely new forms. Now the procedure for filling it out will be carried out electronically and approved in accordance with the order of the Federal Tax Service. Due to this, the person submitting the declaration will be able to resolve their issues related to accounting for income in a new format, and only need to declare in the updated version.

The structure of the document itself has also changed, the volume of pages has become smaller, that is, out of 20 pages, only 13 will have to be filled out. From now on, the declaration consists of: a main (title) page, several sections, eight appendices, which must be filled out by the taxpayer himself or the deduction applicant, if this turns out to be the case necessary, also calculations for two applications. Moreover, the letter roll has now been replaced with numeric values, meaning everything will be viewed in a numeric format from 1 to 8.

Changes were made to simplify the declaration form. Moreover, federal legislation took into account everything that seemed inconvenient in the previous fragment. In addition, the new amendment includes citizens who are exempt from taxation when receiving income from a foreign company. The most important changes:

- The section on calculating income and additional deductions for transactions with securities and derivatives, especially in investment partnerships, has been noticeably reduced, which is available in Appendix No. 8.

- In Appendix No. 1, where income from Russian sources is considered, additional lines have been eliminated. Where previously the amount of tax already calculated, including the amount of taxable income, was indicated, now you will have to enter it a little differently.

- The full calculation of social, standard, and investment deductions is combined in one single application under number 5.

- The barcodes of each page were also changed in the document, but the semantic content remained the same.

Examples of filling out the form are posted on the official website of the Federal Tax Service. Tax authorities provide advice on filling out reporting documentation if an individual encounters difficulties in the process.

Advance amount in 6-NDFL: types and dates

The concept of “advance” is used everywhere in business. In general, an advance is an amount prepaid (before final income is determined). This can equally apply to:

- “salary” advance paid by force of law to an employee drawn up under an employment contract;

- advance payment under a GPC agreement, the payment of which is determined by the terms of the agreement at the will of its parties;

- fixed advance payments - paid due to the requirements of tax legislation by foreigners working on a patent.

Despite the unambiguous interpretation of the term “advance”, the reflection of the tax date on advance payments in 6-NDFL in these cases has its own characteristics.

Date of UN when paying a “salary” advance

When setting the UL date for a “salary” advance, you must proceed from the following:

- advance payment is part of earnings;

- for the purpose of calculating personal income tax, a salary is considered income, the date of receipt of which falls on the last day of the month for which the salary is accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation).

In this regard:

- the advance is not yet considered income;

- The Tax Code of the Russian Federation does not require withholding personal income tax from advance amounts.

Consequently, the fact of payment of an advance is not reflected separately in 6-NDFL and is included in this report only as part of the accrued salary, that is, on the last day of the month. The UN date for income in the form of salary (including “salary” advance) is the day of payment of earnings at the end of the month worked.

Date of UN for GPC advance

An advance paid by the customer to a contractor - an individual, is regarded by tax legislation differently than “salary”. The fact is that a GPC agreement may provide for various payment schemes:

- step by step (based on completed work completion certificates);

- after the full scope of work provided for in the contract has been completed (with or without advances).

Phased acceptance and payment means the contractor receives payment for part of the work performed accepted by the customer, i.e., income actually received. The same approach applies to advances - officials of the Ministry of Finance insist on this (letter dated May 26, 2014 No. 03-04-06/24982), based on the Tax Code of the Russian Federation (subclause 1, clause 1, article 223).

The analogy with a “salary” advance is inappropriate here, since the nature of the income received differs.

Thus, the UN date in 6-NDFL occurs every time an advance is issued to the contractor - this is the day the money is transferred to his card or cash is received at the cash desk.

For more information on reflecting advances under a GPC agreement in 6-NDFL, see here.

UN date and fixed advances

The UN date in 6-NDFL has features in one more case - if the company paid income to a foreigner working on the basis of a patent (subject to certain conditions).

In this case, the fixed advance payments paid by the employee are reflected in line 050 of the 6-NDFL report and reduce the personal income tax calculated from the earnings of “patent” foreigners.

The “Date UN” parameter in 6-NDFL will appear if the “foreign” advances turned out to be less than the personal income tax calculated from the foreigner’s salary. Until the advance payment is exhausted, “0” is placed in the line with the date of the UN.

“Nuances of filling out 6-NDFL for “patent” foreigners” will help in filling out the lines of the personal income tax report on “foreign” advances .

How to fill out a personal income tax return correctly

As before, when filling out the declaration, it is mandatory to fill out the title page and two main sections:

- The first is considered to reflect the tax amount due for subsequent payment.

- The next one is a complete tax calculation, which will be based on the specified applications.

All other calculation applications will be drawn up depending on what kind of income will be declared, or what deductions will be declared later. Thus, the first few sheets of the application will reflect the following data:

- Appendix 1 - considers the issue of income received in Russia.

- Appendix 2 - is intended to determine income from sources located on the territory of foreign states.

- Appendix 3 - considers the income of individual entrepreneurship, but also privately practicing citizens, the calculation of the next taxation.

- Appendix 4 - is intended to consider non-taxable income.

The following pages are designated for claiming deductions:

- Appendix 5 - defines standard, social, but also investment income.

- Appendix 6 - taxation of income received from the sale of property.

- Appendix 7 - property taxation regarding the construction and purchase of residential premises, houses.

- Appendix 8 - taxation of expenses and deductions associated with transactions with the Central Bank and derivatives.

The calculation regarding appendices No. 1 and No. 5 are intended to fix the real estate object, as well as calculate the amounts for pension contributions in accordance with the NPF agreement or when making an additional pension contribution.

about the author

Anatoly Darchiev - higher education in economics with a specialty in “Finance and Credit” and higher education in law in the direction of “Criminal Law and Criminology” at the Russian State Social University (RGSU). Worked for more than 7 years at Sberbank of Russia and Credit Europe Bank. He is a financial advisor to large financial and consulting organizations. Engaged in improving the financial literacy of visitors to the Brobank service. Analyst and banking expert. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Anatoly Darchiev

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya