How to show compensation from the Social Insurance Fund in the RSV

Starting from 2021, when filling out the DAM, the Form and Procedure approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. MMV-7-11/ [email protected]

The procedure for filling out the RSV 2021 (reimbursement from the Social Insurance Fund) states that the amounts of insurance premiums for VNiM (insurance in connection with temporary disability and in connection with maternity) are reflected in Appendix 2 to Section 1 of the Calculation.

In accordance with clause 11.14 of the Procedure, in line 080 of Appendix 2, you must indicate the amount of compensation from the Social Insurance Fund in the column corresponding to the month of actual compensation.

Thus, if the Fund reimbursed the employer’s expenses for paying benefits in August 2021, then this should be reflected on line 080 in the column for the 2nd month of the 3rd quarter. We will describe in detail how to do this in an example.

In the final line 090 of Appendix 2, you must indicate the amount calculated using the following formula:

This reflects the difference between accrued contributions and expenses for payment of benefits plus the amount of compensation from the Social Insurance Fund for the reporting period.

Calculating the difference can result in either a negative or a positive number.

IMPORTANT!

There is no need to indicate the amount with a minus sign in front in the calculation! Only the difference is indicated, and you need to show whether it is negative or positive using the numbers 1 or 2, entered in the “sign” columns:

- 1 - premiums are greater than the cost of insurance payments to employees;

- 2 - the cost of insurance payments is greater than the accrued premiums.

So, if you get a negative value, put the number 2 in the “sign” column. This will mean that the amount of benefits you transferred is greater than the amount of insurance premiums.

Please note that at the end of the reporting period, the result will be either an amount payable to the budget (positive) or reimbursement from the budget (negative). They will be indicated with attributes “1” and “2” respectively. In this case, you cannot simultaneously fill in the calculation lines:

- 110 and 120;

- 111 and 121;

- 112 and 122;

- 113 and 128.

When you receive the amount to be paid, fill out line 110, and for reimbursement, fill out line 120, and so on.

Form 4-FSS, instructions for filling out, due date in 2021

August 26, 2020

3890

1C-Start

Since 2021, the tax service has been administering insurance premiums and accepting reports on them. The only exceptions are contributions for insurance of employees against injuries and occupational diseases - they still remain under the responsibility of the Social Fund. To report on contributions paid, all employers submit Form 4-FSS, you will learn about it from our article.

Who submits 4-FSS

4-FSS is represented by everyone who uses the labor of individuals and pays “injury” contributions for them. This category includes organizations and entrepreneurs, as well as citizens without individual entrepreneur status who hire personnel, for example, a personal driver.

4-FSS is submitted quarterly. Its type - paper or electronic - is selected depending on the number of insured people. If there are more than 25 people, then it is necessary to send the calculation to the Social Insurance Fund in electronic form. With fewer employees, you can choose the submission form yourself.

Composition and procedure for filling out the form

Currently, Form 4-FSS is in force, approved by order of the fund dated September 26, 2016 No. 381. The same document also provides instructions for filling out the calculation. In accordance with it, it is mandatory to fill out the following sections: title page, Table 1, Table 2 and Table 5. Data in the remaining tables are indicated if there are relevant transactions in the reporting period:

- Table 1.1 – if personnel are temporarily sent to another employer (contributions are calculated according to its tariffs);

- Tables 3 and 4 - if there were cases of occupational diseases or injuries.

Let's take a closer look at the current Form 4-FSS and instructions for filling it out in 2021.

Title page

On the first sheet the following fields are filled in:

- number of the policyholder in the Social Insurance Fund;

- subordination code – 5-digit code of the FSS department;

- adjustment number – for initial submission “000”;

- reporting period. The field is filled out as follows: if the form is submitted for 1 quarter, “03” is written in the first two cells, “06” for six months, “09” for nine months, “12” for a year. If the form is submitted for reimbursement of expenses, then the serial number of the application in the format “01” is entered in the last two cells.

- reporting year;

- termination of activity - if the policyholder is liquidated, the letter “L” is indicated;

- name of the company or name of the entrepreneur;

- main codes – TIN, KPP (for organizations), state registration number, OKVED. If the enterprise is budgetary, the corresponding code is entered;

- telephone and address;

- average number of personnel, highlighting disabled people and people employed in hazardous and hazardous industries;

- number of calculation pages and applications.

In the lower block on the right, the policyholder confirms the accuracy of the information entered, puts his signature and indicates the date. Here you need to reflect:

- code of the person who signs the document: 1 – director of the company or the entrepreneur himself, 2 – authorized representative, 3 – legal successor;

- Full name of the person signing the form;

- in the last lines - details of the power of attorney (if the signature is signed by a representative).

Table 1

Let's look at how to fill out the first table. It calculates the basis for calculating contributions. Lines 1-4 are filled out in total for the period and broken down for each of the last three months. They need to indicate:

- amounts of payments to individuals;

- non-contributory amounts;

- base, that is, the difference between these indicators;

- payments in favor of disabled people.

In lines 5-9 the insurance rate is calculated:

- 5 – basic tariff;

- 6 – discount for it;

- 7 – allowance;

- 8 – date of assignment of the allowance;

- 9 – final tariff amount.

Table 1.1

If during the period the policyholder sent its employees to other companies, then in Table 1.1 it reflects the data that is needed to calculate premiums for them. Information is entered line by line for each entity where workers were sent. Columns 1-5 of the table indicate:

- 1 – serial number of the record;

- 2 – registration number of the receiving entity;

- 3 – his TIN;

- 4 – its OKVED code;

- 5 – number of sent workers.

In columns 6-12 the base for insurance premiums is calculated. The following information is entered:

- 6 – base from the beginning of the period;

- 7 – database for disabled people;

- 8-13 – breakdown of amounts for each of the last three months, highlighting amounts for disabled people.

Column 14 indicates the base tariff, and column 15 the final tariff (including discounts and surcharges).

table 2

This table, consisting of two parts, reflects calculations for contributions “for injuries”. The following information is entered on the left side of the table:

- 1 – debt of the policyholder to the Social Insurance Fund at the beginning of the period;

- 1.1 – debt to the liquidated person;

- 2 – the amount of contributions accrued for payment: at the beginning of the period, in total for the last 3 months and broken down by month;

- 3 – additionally accrued contributions after inspections;

- 4 – amounts that the FSS did not accept for offset;

- 5 – accrued contributions for previous periods;

- 6 – amounts of compensation received from the Social Insurance Fund;

- 7 – amounts returned to the fund or offset;

- 8 – the sum of all the above indicators;

- 9 – fund debt at the end of the period, including: 10 – amount of excess expenses;

- 11 – the amount of overpayment of contributions by the policyholder.

The second part of the table reflects the fund's debt to the policyholder. Here you need to reflect line by line:

- 12 – debt at the beginning of the period, including:

- 13 – due to excess costs,

- 14 – due to overpayment;

- 14.1 – amount of debt from the Social Insurance Fund to the policyholder;

- 15 – insurance costs “for injuries”: total for the period, for the last 3 months in one amount and broken down for each of them;

- 16 – the amount of contributions paid at the beginning of the period and for the last 3 months in a single amount, as well as for each month separately (you must indicate not only the amount, but also the number and date of payment);

- 17 – the amount of debt that the Social Insurance Fund wrote off;

- 18 – the amount of the insured’s debt for the period (you need to add up the indicators from lines 12, 14.1, 15-17);

- 19 – debt due to the policyholder at the end of the period;

- 20 – arrears on contributions (included in the amount of line 19).

Tables 3 and 4

Table 3 calculates the amounts of benefits for occupational diseases and accidents, if any. The lines need to reflect:

- 1 – sick leave for accidents, including part-time workers (line 2) and persons who were injured in another organization (line 3);

- 4 – sick leave for occupational diseases, including part-time workers (line 5) and employees assigned to other insurers (line 6);

- 7 – payment for sanatoriums (in addition to annual leave), including for those injured on the territory of other employers (line 8);

- 9 – costs of paying for measures to reduce injuries and occupational diseases;

- 10 – the amount of expenses from lines 1, 4, 7 and 9;

- 11 – the amount of benefits that are accrued but not paid.

When filling out Table 3 on lines 1-8, not only the amount, but also the number of days is indicated.

Table 4 reflects the number of people affected during the reporting period. The following data is entered into the lines:

- 1 – victims of accidents;

- 2 – including the dead;

- 3 – victims of occupational diseases;

- 4 – total number of victims (line 1 + term 3);

- 5 – including the number of victims who received temporary disability.

Table 5

When filling out Table 5 of Form 4-FSS, you must indicate the results of a special assessment of working conditions. In line 1, in columns 3-6, the results of the SOUT are entered:

- 3 – total number of jobs;

- 4 – the number of places in respect of which a special assessment was carried out, including those classified as hazard classes 3 (line 5) and 4 (line 6).

In line 2, only columns 7 and 8 are filled in:

- 7 – the number of employees who must undergo medical examinations (harmful and dangerous working conditions);

- 8 – the number of employees who underwent such medical examinations at the beginning of the year.

When to submit 4-FSS

The deadline for submitting 4-FSS depends on the form of submission. There are two deadlines for submitting calculations: the 20th and 25th of the month following the reporting month. If the form is submitted on paper, then it must be submitted to the Social Insurance Fund by the 20th, if electronically - by the 25th. If the reporting deadline falls on a weekend or holiday, the period is extended to the next working day.

However, in 2021, coronavirus made its own adjustments to the reporting periods. In this regard, 4-FSS for the 1st quarter had to be submitted before May 15. The remaining deadlines for submitting the form are as follows: for half a year – July 20/27, for 9 months – October 20/26, for 2021 – January 20/25, 2021.

If the data in the DAM differs from the accounting data

Reflecting the reimbursement of expenses by the Social Insurance Fund when filling out the DAM, accountants notice a discrepancy in the amount of insurance premiums indicated in line 090 of the calculation with the accounting data. This discrepancy raises doubts and a logical question: is the form filled out correctly? For example, in fact, the Social Insurance Fund reimbursed the company’s expenses, but when filling out the calculation, it turns out that the company owes the Fund a larger amount than it actually did. Since the money that the Fund has already reimbursed is added to the contributions accrued for the period.

In fact, there is no mistake in this. And you need to fill out the calculation exactly as indicated in the Procedure.

Despite the fact that a large amount will be indicated in the final line 110 of Section 1, as well as in line 090 of Appendix 2, only the amount of the contributions themselves will need to be paid to the Fund.

After transferring all the information to the budget settlement card, tax authorities will see which amounts are arrears and which are overpaid. And the money reimbursed by the Fund to the policyholder will be indicated as an overpayment. You will not have any debt to the Social Insurance Fund.

If expenses for payment of benefits were taken into account last year, and compensation was received in the current year

In this case, the filling order is also observed and the above formula is used. Regardless of the period for which the Social Insurance Fund reimburses costs, for the previous quarter or for the previous year, this must be reflected in the calculation directly in the month of receipt.

This is stated in the explanatory Letter of the Federal Tax Service of Russia dated 04/09/2018 No. BS-4-11/ [email protected]

In addition, such a conclusion can be drawn from the norms of Chapter 34 of the Tax Code of the Russian Federation, which, starting from January 2021, provides for the offset of expenses spent on VNIM benefits against upcoming payments.

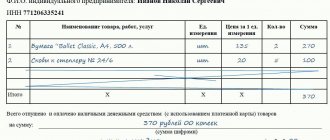

Sample of filling out the DAM with compensation from the Social Insurance Fund

Let's give an example of filling out the RSV when reimbursing the Social Insurance Fund.

Initial conditional data for our example:

Contributions accrued for the half-year:

| Total (RUB) | April | May | June |

| 150 000 | 50 000 | 50 000 | 50 000 |

Benefits paid for the 2nd quarter:

| Total (RUB) | April | May | June |

| 350 000 | 100 000 | 100 000 | 150 000 |

The excess of benefits over contributions was: 350,000 - 150,000 = 200,000 rubles.

The lines of Appendix 2 to Section 1 in the DAM for the 2nd quarter that interest us, when filled out for this example, look like this:

Let's assume that we have reimbursed the payment of benefits to the organization in August 2021.

Let's consider where the DAM reflects compensation from the Social Insurance Fund when filling out Appendix 2 of Section 1 for 9 months, if contributions were accrued for the 3rd quarter:

| Total (RUB) | July | August | September |

| 150 000 | 50 000 | 50 000 | 50 000 |

In total, since the beginning of the billing period, accrued (we consider it as a cumulative total: since the DAM is for 9 months, we add up the amount of contributions for the 1st, 2nd and 3rd quarter): 150,000 + 150,000 = 300,000 rubles.

Benefits paid for the 3rd quarter:

| Total (RUB) | July | August | September |

| 120 000 | 45 000 | 40 000 | 35 000 |

In total, since the beginning of the billing period, accrued (we consider it as a cumulative total: since the DAM is for 9 months, we add up the amount of benefits paid for the 1st, 2nd and 3rd quarter): 350,000 + 120,000 = 470,000 rubles.

In the 3rd quarter there was compensation from the Social Insurance Fund:

| Total (RUB) | July | August | September |

| 100 000 | 0 | 100 000 | 0 |

Then the lines of Appendix 2 of Section 1 of the RSV for 9 months of 2021 that interest us will look like this:

Please note that at the end of 9 months, the amount to be reimbursed from the budget was obtained.

When filled out, it is indicated with the sign “2” in column 1. This means that for 9 months the amount of benefits paid to employees exceeded insurance accruals.

And at the end of the third quarter, the amount due was paid to the budget. It is indicated with the sign “1” in column 3. That is, for the 2nd quarter, the amount of insurance accruals exceeded the amount of benefits.

For clarity, we will show in the pictures how the values indicated in lines 090 were calculated.

In just 9 months, benefits exceeded contributions by 170,000 rubles. (300,000 - 470,000 = -170,000). If we add the funds transferred to the FSS in August 2021 in the amount of 100,000 rubles, it turns out that the FSS still owes the organization 70,000 rubles. We indicate this value in line 090 with the sign “2”.

For the third quarter, insurance accruals, taking into account the compensation received from the Social Insurance Fund, exceed the costs of benefits. To be paid to the budget - 130,000 rubles. We enter this value when filling in with the sign “1”.

In July 2021, the Social Insurance Fund has not yet reimbursed the organization’s expenses, so in the calculation of 100,000 rubles. they don't take it. We indicate contributions payable in the amount of 5,000 rubles.

In August 2021, we will add the reimbursed 100,000 rubles. to the difference between lines 060 and 070, since it was in this month that they were listed.

In September we indicate only the difference between lines 060 and 070.

We hope that now filling out the RSV when receiving compensation from the Social Insurance Fund 2020 will be a simple task for you.

Let us remind you that the DAM based on the results of 9 months of 2021 must be submitted no later than October 30.

You can read more about filling out the RSV in this material.

Reimbursement of expenses to the Social Insurance Fund in 2021, list of documents - Case

By mid-2021, all citizens of the Russian Federation who are entitled to social payments will receive them directly from the Social Insurance Fund budget. For employers, changes in Social Insurance reporting came already in the fall of this year. Starting from October 2021, policyholders will report accrued insurance premiums using a new form.

Expenses will exceed income

The draft budget of the Social Insurance Fund for 2020-2022 has already been adopted by deputies of the State Duma in the first reading. No significant changes were adopted during the consideration of the document.

As previously predicted, the income of the extra-budgetary fund in 2020 will amount to 811.6 billion rubles. Most of them - 604.348 billion rubles. These are contributions for compulsory social insurance for temporary disability and in connection with maternity.

The rest is money for insurance against accidents at work and occupational diseases.

By 2022, revenues will increase significantly and reach 936.5 billion rubles. According to forecasts, Social Insurance Fund expenses will also continue to grow. In 2020, payments to citizens of the Russian Federation will require 788.1 million rubles, and in 2022 already 873.9 million rubles.

Thus, for the first time in several years, revenues will exceed expenses in 2021. But by 2022, the fund's budget will again become deficit. As deputies note, the deficit estimate will in no way affect citizens.

By redistributing funds at the expense of profitability on other insurance items, “holes in the budget” will be thoroughly patched.

Direct Payment Table

The list of benefits paid from the state extra-budgetary fund in 2021 will not change. It will include, as before, all “women’s benefits”, temporary disability benefits and funeral assistance.

When calculating social payments from January 1 of the new year, the new minimum wage will be taken into account. Presumably, the minimum wage will rise by 850 rubles. and will amount to 12,130 rubles. An increase in the minimum wage will affect the minimum amount of payments; they will increase.

In addition, from February 1, 2021, annual indexation will be carried out. According to preliminary data, its coefficient will be 1.038.

The list of benefits and their amount for 2021 is given in the table.

Name of benefit Amount of benefit in 2021

| Amount from January 1 | Amount from February 1 | |

| For registration in the early stages of pregnancy (one-time) | RUB 655.49 | 680.4 rub. |

| Maternity benefits for pregnancy and childbirth | 100% of the average daily earnings for the previous two years of work, minimum 398.79 rubles, maximum amount 2301.37 rubles. | |

| For the birth of a child (one-time) | RUB 17,479.73 | RUB 18,143.96 |

| Child care allowance up to 1.5 years old | 40% of average earnings for the last two years | |

| for the 2nd and subsequent children at least 6554.89 rubles. | ||

| maximum for all categories RUB 27,984.66. | ||

| Social benefit for funeral (one-time) | Paid in an amount equal to the cost of services provided according to the guaranteed list of funeral services, but not more than 5946.47 rubles. |

At the initiative of the Ministry of Labor, in 2021, the conditions for payment of benefits for child care up to one and a half years old may change. According to the draft, the person directly caring for the child will be entitled to receive benefits.

That is, if a mother, while on maternity leave, starts working, even part-time, then she loses the right to receive payments.

Let us remind you that not only the mother, but also immediate relatives can apply for parental leave.

FSS pilot

The pilot project of the state extra-budgetary fund “Direct Payments” will cover the entire territory of Russia in 2021. The program, which began its work in 2011, has been successfully implemented in more than 50 constituent entities of the Russian Federation. From January 1, 2021, the project will be launched in the following regions:

- Komi Republic;

- The Republic of Sakha (Yakutia);

- Udmurt republic;

- Kirov region;

- Kemerovo region.;

- Orenburg region;

- Saratov region;

- Tver region;

- Yamalo-Nenets Autonomous Okrug.

And starting from July 1, 2021, the new procedure for paying benefits will begin to apply in 9 more constituent entities of Russia:

- Republic of Bashkortostan;

- The Republic of Dagestan;

- Krasnoyarsk region;

- Stavropol region;

- Volgograd region;

- Irkutsk region;

- Leningrad region.;

- Tyumen region;

- Yaroslavl region

After all regions of Russia begin to work according to the new scheme, the pilot project will cease to be “experimental”. From 2021, direct payments of benefits from the Social Insurance Fund, without an employer as an intermediary, will become the usual working norm. The Ministry of Labor has prepared the corresponding amendments to the existing laws on compulsory social insurance.

Only one function remains assigned to organizations - to transfer to the social insurance fund the necessary information and documents that are the basis for payments. According to the text of the bill, the FSS will have new powers. In addition to direct transfer of funds directly to citizens’ accounts, the fund will be able to conduct verifications of documents and information.

The essence of the direct payment mechanism is the ability of the insured person to receive the money due, regardless of the financial situation of the employer.

It is not the organization’s accountant who calculates and transfers benefits, but the social insurance fund. Therefore, errors and inaccuracies in calculations are minimized.

This scheme is also convenient for policyholders - they do not need to withdraw money from circulation to pay benefits.