We live in the age of information technology, where from year to year companies, private entrepreneurs and the state try to automate as many processes as possible and increase the efficiency of their activities. One example of such automation is the introduction of electronic sick leave and direct payments from the Social Insurance Fund (SIF).

From July 1, 2021, it has become possible to generate both paper sick leave and electronic certificates of incapacity for work (ELS).

What is ELN?

ELN is an analogue of a regular sick leave. Filled out in specialized programs or directly in the personal account of the Social Insurance Fund. The innovation significantly simplifies the work of an accountant and his interaction with the Social Insurance Fund, and also allows you not to worry about possible errors and the presence of unreliable documents. In this regard, many organizations are gradually switching to ENL.

In this material we will tell and show how to generate an electronic sick leave and set up direct payments to the Social Insurance Fund in the program “1C: Salaries and Personnel of a Government Institution 3.1” (“1C: WKSU”).

You will learn:

- Why is an electronic sick leave better than a paper one?

- Key functions of ELN.

- How does the electronic sick leave system work?

- What is needed to work with electronic information in the program “1C: ZGKU 3.1”?

- How to set up electronic document management with the Social Insurance Fund?

- How to create a sick leave certificate in 1C?

- How to set up direct payments to the Social Insurance Fund in 1C:ZGKU 3.1?

Conditions for successful data exchange

In order for ELN processing to work like a clock:

- install and configure software;

- obtain electronic digital signatures for managers or authorized representatives;

- medical institutions obtain written consent for electronic monitoring;

- train personnel interacting with electronic certificates of incapacity for work. Each of the institutional stakeholders must have a clear understanding of the work.

By carefully including parties in the new sick leave processing system, their effective implementation will be guaranteed.

Why is an electronic sick leave better than a paper one?

Electronic sick leave is generated in a medical institution in a special program, which allows:

- minimize errors that a medical employee may make when filling out the paper version;

- ELN cannot be lost, falsified or damaged, no special place is required for its storage;

- information from the electronic tax record is automatically loaded into the 1C program - the accountant does not have to waste time filling out sick leave manually, and the percentage of errors, and therefore FSS refusals when reimbursement of expenses, is also reduced to a minimum;

- After formation, the ELN falls into the single FSS database; to confirm expenses at the expense of the FSS, the employer will not need to provide supporting documents.

How does the electronic sick leave system work?

When registering an ELN, the employee must sign a written agreement at a medical institution, which, in turn, must be connected to the exchange of information with the Social Insurance Fund in order to be able to generate certificates of incapacity for work.

The operating algorithm of the FSS ELN is as follows:

- the doctor fills out the ENL, sends it to the FSS and gives the visitor the sheet number;

- the employee transfers the personal identification number to the accounting department of his company;

- an accountant in the 1C program sends a request to the Social Insurance Fund using the sick leave number;

- In response to the request, the FSS sends an electronic sick leave;

- the 1C program automatically downloads data from the electronic tax record and calculates the amount of the benefit;

- the employer pays the employee sick leave.

It is also worth mentioning separately the deadlines for paying sick leave. As soon as an employee has submitted the slip number to the company’s accounting department, it is required by law to calculate it no later than 10 calendar days. The amount of sick leave is subject to reimbursement with the withholding of income tax.

The payment, as already mentioned, is paid directly by the Social Insurance Fund if the company participates in the social insurance pilot project, which we will discuss in the article.

Brief usage algorithm

- A sick employee applies to a medical institution to obtain an ELN with a passport or other identification document.

Filling out the EDN by a medical professional is carried out after examining the patient, establishing a primary diagnosis and obtaining signed voluntary consent for its issuance.- The doctor informs the patient of a unique ELN number, consisting of 12 digits.

- The employee notifies the employer about the ELN number in any way available to him (by phone, e-mail, in person).

- At the end of treatment, the ELN is signed with enhanced qualified electronic signatures of the doctor and the medical organization and sent to Social Insurance.

- The employer checks the information received, signs it with his electronic signature and pays temporary disability benefits.

So, what is needed to work with ELN in the 1C:ZGKU 3.1 program?

Let's move from theory to practice. Next, we will show how to generate an electronic sick leave and set up direct payments to the Social Insurance Fund in the 1C: Salaries and Personnel of a Government Institution 3.1 program.

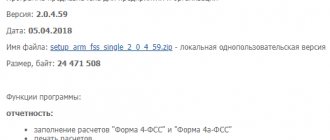

If you submit reports through the 1C-Reporting service, then you already have insurance certificates and the Social Insurance Fund. All that remains is to download the FSS ELN certificate from the official website. Configuration and subsequent updating of FSS certificates will be performed automatically, without user assistance.

If you do not have a connection to the service and submit reports through other operators, in this case it is enough to connect electronic document management with the Social Insurance Fund.

Connecting to the system and registering in the Unified Identification and Logistics System

Employers gain access to electronic sick leave databases through the “Employer Personal Account” of the Social Insurance Fund. To make processing of electronic tax records more convenient, you can use accounting programs such as “1C: Salary and HR Management”, “Simplified 24/7” and others.

To connect to the ELN issuing system and work with it:

- Medical institutions and the employer must have special software, log in to the Unified Identification and Authentication System (USIA), have an electronic signature, and enter into an agreement with the Social Insurance Fund on information interaction.

- The patient must register on the government services website and, when applying for an electronic tax record, provide his passport and other data, SNILS and written consent to receive an electronic tax record.

The unified identification and authentication system ensures access of different categories of users to information stored in government information systems and its protection.

Users with a registered account of any type can log in to the ESIA. To go to the registration page, click the “Login” button in the information system integrated with the ESIA.

To authorize using an electronic signature (ES), you should:

- select the option “Log in using electronic means”;

- connect an electronic signature medium;

- select a digital signature verification key certificate;

- indicate the PIN code for access to the digital signature carrier and click the “OK” button.

For successful authentication , it is necessary that the SNILS of an individual is indicated in the certificate .

Data for calculating disability benefits in ELN are confirmed by enhanced electronic signatures of competent persons: chief accountant, manager and policyholder.

It should be noted that an electronic signature does not work without an installed crypto provider .

How to set up electronic document management with the Social Insurance Fund?

To start document flow with the Social Insurance Fund, you must:

- on the main panel in the “1C: ZKGU 3.1” program, go to the “Settings” block;

- then select “Organizations”;

- in the window that opens, select the “EDO” tab;

- then go to the “Electronic document flow with the Social Insurance Fund” tab;

- the required certificates will be filled in in the window that appears;

- check the box “Use electronic document management with FSS authorities”—after that, we will then have the opportunity to fill out the data (Fig. 1).

Fig.1. Exchange settings with FSS

The policyholder certificate is a personal certificate of the responsible person of the organization. For example, directors or accountants who have the right to sign reports to the Social Insurance Fund.

The FSS ELN certificate is downloaded from the official website. The resulting certificate must be installed and opened. After that, click the “Save and Close” button.

How to create a sick leave certificate in 1C?

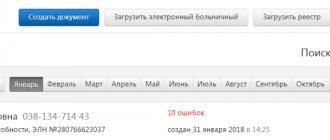

To check the operation of the electronic sick leave in 1C, you need to create a new document “Sick Leave”. You can find it in the “Salary” or “Personnel” block in the “1C: ZKGU 3.1” program (Fig. 2).

Fig.2. Creating a new document “Sick leave” in “1C:ZKGU 3.1”

We fill out standard fields, such as: “Month”, “Employee” and “LN number” (certificate of incapacity for work). After that, using the “Get from the Social Insurance Fund” button, we receive data on disability (Fig. 3).

Fig.3. Button “Receive from FSS” in “1C:ZKGU 3.1”

Data about the medical organization is loaded automatically. In order to view this information, you need to click on the link (Fig. 4).

Fig.4. Link “Information about the medical organization” in “1C:ZKGU 3.1”

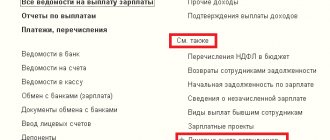

To create an “ELN Register”, you need to go to the “Reporting, Certificates” tab, then go to “1C-Reporting” (Fig. 5).

Fig.5. Creation of an ENL register in the 1C-Reporting service

Next, the report should be filled out, checked for completion of the required fields and sent to the Social Insurance Fund.

Ready! At this point, setting up and sending the ENL to the FSS from 1C is completed. This function will allow you to significantly reduce the time required to enter primary documentation and eliminate possible errors in calculations. Now let's move on to direct payments to the Social Insurance Fund.

Benefits for employer and employee

If we talk about the advantages of this system for employers, we cannot fail to note one of the obvious ones - filling out documents electronically saves time and makes work easier. That is, cases where accountants are faced with sick leave issued incorrectly by a doctor are gradually becoming a thing of the past, and there is no longer any need to fear claims from the Social Insurance Fund, which is why compensation payments should be guaranteed. In addition, the possibility of loss or damage to the document is eliminated, not to mention the fact that the accountant no longer has to think about the color of the ink and possible errors when filling out the information on the sick leave sheet manually.

For employees, this system is also of no less interest - it is assumed that an employee on sick leave has the opportunity to independently check what data the doctor entered when drawing up an electronic sick leave. This will allow you to promptly contact a medical institution if any error is found on the sick leave certificate so that the information found can be corrected.

How to set up direct FSS payments?

First, let's figure out what the “FSS Pilot Project” is and what is it used for? In essence, this is an experimental innovation that involves the payment of social benefits without the participation of the employer.

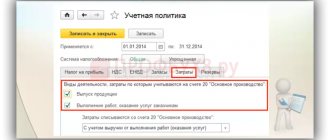

If your organization is a participant in the pilot project, then to start working with this function it must be activated in the organization's accounting policy. To do this, let's go to:

- section: “Settings – Organizations – Accounting policies” (Fig. 6);

- in the subsection “Benefits at the expense of the Social Insurance Fund”, put a tick, confirming that your organization is registered in the region;

- We indicate the date from which payments will be valid.

Fig.6. Setting up Social Insurance Fund Payments in the organization’s accounting policy in “1C:ZKGU 3.1”

After completing this setup, when generating a sick leave certificate, you will see that the line where the benefit was previously calculated at the expense of the Social Insurance Fund is empty (Fig. 7).

Fig.7. Certificate of incapacity for work in “1C: Salaries and personnel of a government institution 3.1”

In addition, another tab “FSS Pilot Project” has appeared. In it, you can create an employee’s application for payment of benefits and give it for signature (Fig. 8).

Fig.8. Processing “Application for payment of benefits” in “1C:ZKGU 3.1”

Then go to your “workplace” for FSS payments. This section allows you not only to record data on sick leave and applications, but also to track the status of sent registers, as well as enter information about reimbursed funds into the information database.

To do this, open the section: “The main thing is Benefits from the Social Insurance Fund.” Next you will see 3 columns:

- sick leave;

- employee statements;

- registers of applications (Fig. 9).

Rice. 9. Workplace “Benefits at the expense of the Social Insurance Fund” in “1C:ZKGU 3.1”

You have already done the first and second points. All that remains is to create a register of applications and send it directly, if you have 1C-Reporting connected, or upload it and send it through other programs.

It is worth noting that not all benefits will be paid from the Social Insurance Fund. The exceptions are:

- funeral benefit;

- allowance for caring for disabled children.

The benefits listed above will be paid at the expense of the employer, so you will need to enter data in your “workplace” on the “Reimbursement of organization expenses” tab (Fig. 10)

Fig. 10. Tab “Reimbursement of expenses of the organization” in “1C:WKGU 3.1”

Is there a future for the ELN system?

Analyzing this issue in perspective, one cannot help but consider it from the point of view of profitability for the state as a whole. According to experts, in the next three years - from 2021 to 2021. – through the implementation of the ENL system, it is planned to save about 42 million rubles. In addition, the implementation of this solution can be called, in a sense, inevitable against the backdrop of global computerization, when many processes have already moved and continue to move from “paper” to an electronic version.

This is interesting: Agency fee for air tickets

But we cannot ignore the fact that while in large cities there are no problems with computers and Internet access, in the outback the technical equipment is not adequately provided at the moment. That is, regions simply may not be ready to switch to a new ENL system, since this requires additional costs.

However, the very first electronic sick leave certificates as an innovation first began to be actively used in some Russian cities back in 2014 - these are Moscow, Novosibirsk, as well as Sevastopol and a number of other cities. Thus, the technology has already been tested and there are no plans to cancel it - it has successfully proven itself and continues to function stably, currently gradually simplifying the exchange of electronic data.