Firstly, it should be noted that traffic police officers have the right to draw up reports of administrative offenses not only for violation of traffic rules (traffic rules). Violations of other rules provided for by the laws of the regions, committed with the use of vehicles, also have the right to be recorded and processed by a traffic police inspector or technical means in automatic mode.

Secondly, no organization, that is, a legal entity, can, for obvious reasons, independently drive a car that belongs to it (it). But an organization can be held accountable for violating traffic rules. How could it be otherwise if the offense was recorded by special equipment? In this case, it is not known exactly who was driving. A special article was introduced into the Code of the Russian Federation on Administrative Offenses for this purpose.

"1. Administrative liability for administrative offenses in the field of traffic and administrative offenses in the field of landscaping, provided for by the laws of the constituent entities of the Russian Federation, committed with the use of vehicles, if these administrative offenses are recorded by special technical means operating automatically, having photo and filming functions , video recordings, or by means of photography, filming, and video recordings, the owners (owners) of vehicles are involved.”

However, it is not uncommon for a protocol to be issued to the driver of a car belonging to an organization. In this case, it is also better to pay the required amount from the company’s account so that a debt does not inadvertently arise on the legal entity. And later, collect the amount of the fine from the employee, or just withhold personal income tax and forgive the fine. Or hold nothing back at all. The decision is yours. But the execution of payment orders for the payment of a traffic police fine will be somewhat different in these cases. We provide both samples of filling.

Payment order fine from traffic police for organizing video recording

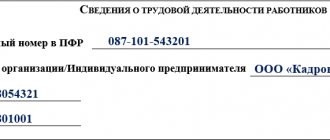

If a receipt from a photo and video recording center has been sent to the address of a legal entity, and the organization has decided to pay for it, you need to pay attention to the following point. On the receipt, immediately below the Russian Post barcode, there is a line “Resolution”. This is not the number of the fine decision, but the UIN identifier code, which, however, encrypts the data of the decision itself. You must indicate this code in detail “22” of the payment order.

Basic details of the order form for the payment of a traffic fine by an organization

| Field no. | Props name | Contents of the props |

| 101 | Payer status | 01 |

| 18 | Type of operation | 01 |

| 21 | Payment order | 5 |

| 22 | Code | Take from the line “Resolution:” |

| 104 | KBK | 18811630020016000140 |

| 105 | OKTMO | OKTMO code of the municipality in which the Department of the Ministry of Internal Affairs that issued the fine is located (available on the receipt) |

| 106 | Basis of payment | |

| 107 | Taxable period | |

| 108 | Document Number | |

| 109 | Document date | |

| 110 | Payment type | (from March 28, 2021, the value of attribute 110 is not indicated) |

Sample payment order for payment of a traffic police fine in 2014 for an organization

in Word or Excel format

Professional accounting for organizations and individual entrepreneurs in Ivanovo . We will relieve you of the problems and daily worries of maintaining all types of accounting and reporting. LLC NEW tel. 929-553

The fine is paid for the driver by the organization

Traffic police officers always draw up a report on traffic violations in relation to a specific driver, even if he was driving a company car and is not its owner. However, the data of the organization who owns the car will also be included in the protocol. If the employer decides to pay a fine for the driver, then the payment slip must indicate the details of the offender and the protocol details in the “Purpose of payment” field.

The usual option for filling out a payment order

20 UIN characters should be found in the protocol and rewritten in the “Code” field of the payment order. If you can’t find anything, or you are tormented by doubts about this, as a last resort, put a zero (“0”) there. Then, after some time, do not be lazy to check through electronic services whether this fine has been paid off in the traffic police database.

Sample payment form to the traffic police; a fine for a driver is paid by an organization in 2014 with a UIN

in Word or Excel format

Fine for an employee indicating document details

In some regions, the State Traffic Safety Inspectorate still requires information in the “Purpose of payment” details, starting with region codes, series (00 – decree-receipt, 01 – protocol, 07.09 – video recording, etc.) and document number which served as the basis for paying the fine, its date. And only then should you write down the details of the driver - the offender, including his Taxpayer Identification Number, if the employee has such an identifier. We list all details separated by commas. Don’t forget to take the UIN from the decree-receipt or protocol. Then a sample payment order to pay a fine to the traffic police will look like the photo below.

How to fill out a payment order for taxes and contributions in 2021

- authorization on the site;

- activation of the service for checking the presence of debts on traffic fines;

- selecting the search option for the information you need - by order number or by vehicle data;

- after displaying the requested information, go to an additional service called “Addresses and Receipts” or similar;

- filling out the form that opens;

- printout of the receipt created by performing the described activities.

Fines are issued for violations of federal legislation on taxes and fees, as well as for administrative violations. A complete list of violations that entail a fine is contained in the Tax and Criminal Code of the Russian Federation.

The most widespread type of fines. The accrued fine must be paid on time (within 2 months), otherwise there is a new offense, which in turn is also punishable by a fine and additional unpleasant measures against the defaulter.

- For violation of budget legislation at the federal level 1 1600 140. For arrears to the Pension Fund - 1 16 20010 06 0000 140.

- For failure to pay contributions to the Social Insurance Fund on time - 1 16 20020 07 0000 140.

- For non-payment of contributions to the FFOMS - 1 1600 140.

- The fine for violations of cash handling, cash transactions, and the use of special bank accounts identified by the inspection (if this was due to the requirements) is 1,1600,140.

- For violations related to the use of currency 1 16 05000 01 0000 140.

When issuing a payment order to transfer payments to the budget system of the Russian Federation, you must be guided by the Rules, approved. By Order of the Ministry of Finance of Russia dated November 12, 2021 No. 107n, as well as the Regulations, approved. Bank of Russia 06/19/2021 No. 383-P.

For committing a tax offense, an organization or individual may be subject to tax sanctions in the form of a monetary penalty - a fine. We will tell you how to issue a payment order for the payment of a fine (clauses 1.2 of Article 114 of the Tax Code of the Russian Federation) in our consultation and give an example of such a payment order.

- Rules for filling out payment orders

- Changes in KBK

- Filling in the details of the Federal Treasury bank according to the BIC classifier

- Payments to the budget to treasury accounts from 01/01/2021

- Change in payer status and payment grounds when transferring to the budget from 10/01/2021

- Other payments to government contractors

In this table we will look at budget classification codes for the Tax and Criminal Code, as well as for articles of the Code of Administrative Offences.

| Grounds for imposing a fine | Fed. state authorities, Bank of Russia, government authorities. off-budget funds | Fed. government institutions | KBK |

| According to the articles of the Tax Code | |||

| Violations under Articles 116, 118, 119.1, 125, 126, 128, 129, 129.1, 132, 133, 134, 135, 135.1 and paragraphs. 1, 2 tbsp. 120 | 18211603010016000140 | ||

| Violations described in Article 129.2 | + | 18211603020026000140 | |

| + | 18211603020027000140 | ||

| Violations in the payment of taxes and fees specified in Art. 129.6 | + | 18211603050016000140 | |

| Violations in the use of cash registers (cash, cards) | + | 18211606000016000140 | |

| Fictitious or deliberate declaration of bankruptcy | + | 18211670010016000140 | |

| According to articles of the Criminal Code | |||

| Non-payment of tax, concealment of income and property from taxation, neglect of the duties of a tax agent | + | 18211603040016000140 | |

| Under articles of the Code of Administrative Offenses and others | |||

| Violations specified in Art. 20.25 | + | 18211643000016000140 | |

| + | 18211603030016000140 | ||

| Violations in the state registration of legal entities and individual entrepreneurs under Art. 14.25 | + | 18211636000016000140 | |

| + | 18211636000017000140 | ||

| Violations in the contract system in the field of procurement for the state. and municipal needs | + | 18211633010016000140 | |

| + | 18211633010016000140 | ||

| Violation of the rules for handling cash, conducting cash transactions, requirements for the use of special bank accounts | + | 18211631000016000140 | |

| + | 18211631000017000140 | ||

| Other amounts collected from persons who committed crimes (to the federal budget) | + | 18211621010016000140 | |

| + | 18211621010017000140 | ||

From January 1, 2021, payments for insurance premiums will be placed under the control of the Federal Tax Service, which means penalties for late payments and arrears will now be imposed in a manner similar to taxes and fees.

Now organizations will not have to pay penalties for the day when they made payments on contributions; previously, penalties were assigned for this date as well. It follows that if payment is made one day later than the deadline, there will be no consequences in the form of penalties. The amount of the penalty for that day can be refunded as an excess payment. If the amount is insignificant, then it is not worth it.

The Federal Tax Service will fine an enterprise only when the company's accountant deliberately underestimated the base subject to insurance contributions.

Changes in details for paying fines and penalties in Moscow and the Moscow region

6.02.2017 Changes to the Federal Tax Service details in payment orders for the city of Moscow and the region have come into force:

- Account number for accounting for cash receipts divided by the Federal Treasury between the budgets of Russia within the borders of Moscow: 40101810045250010041

- bank name : Main Directorate of the Bank of Russia for the Central Federal District of Moscow

- BIC: 044525000

Changes in payment documents issued in the Moscow region are due to the fact that the accounts of the Fed. Treasuries for the Moscow Region in Branch 1 Moscow are sent for processing to the Main Directorate of the Bank of Russia for the Central Federal District:

- Account number: 40101810845250010102

- The bank and its BIC are the same as in payment cards in Moscow.

This table describes the legislative acts of the Russian Federation.

| Appendix 6 to the order of the Ministry of Finance dated 07/01/2013 No. 65n | Current KBK |

| para. 7 p. 4 sec. II Order of the Ministry of Finance dated July 1, 2013 No. 65n | On the use of income subtype code 3000 (14-17 digits of the code) for fines |

| Appendix 2 to Order of the Ministry of Finance of the Russian Federation No. 107n | Rules for filling out payment order details for paying fines |

| clause 6 art. 32 Tax Code of the Russian Federation | On the obligation of the tax service to provide information to taxpayers about filling out payment orders for the purpose of paying taxes, fees, fines and penalties |

| Part 5 Art. 15 of the Law of July 24, 2009 No. 212-FZ | About the deadline for paying insurance premiums |

| Part 3 Art. 25 Federal Law of July 24, 2007 No. 212-FZ | On the accrual of penalties for late or partial payment of insurance premiums |

| Art. 47 of Law No. 212-FZ | About fines for incomplete payment of insurance premiums |

| Ruling of the Supreme Court of the Russian Federation dated March 13, 2015. No. 310-KG15-1761, Resolutions of the Federal Antimonopoly Service of the Central District dated December 19, 2014 No. A64-8264/2013 and dated November 27, 2014 No. A64-8265/2013 | About the absence of grounds for imposing a fine on an enterprise if the calculation of insurance premiums contained errors, but payment for the year was made in full |

| Letter of the Federal Tax Service dated November 7, 2016 No. ZN-4-1/21026 | About the transition period of payment orders with old details to new ones (in Moscow and Moscow Region) |

Error No. 1: In the payment order, a zero value was entered in the “Code” field, when the debt on penalties was repaid by the enterprise independently, without waiting for a request from the Federal Tax Service. The next time the tax office received a notice of payment of a fine, the accountant automatically entered “0” in the “Code” column.

Comment: When a company receives a document requesting the Federal Tax Service to pay penalties or fines, a unique accrual identifier specified in the request is entered in the “Code” field of the payment. And only if it is not specified there, you can leave a zero value.

Error No. 2: Indication by the organization that received a request from the tax service to pay penalties, the code “ZD” in the “Base of payment” field.

Comment: When an official request from the Federal Tax Service has already been received, the payment is considered to have been made not on a voluntary basis, but at the insistence of the tax inspectorate, therefore the code “TP” must be indicated in the “Base of payment” field.

Error No. 3: Indication in the KBK payment order of the tax period in which the tax arrears arose and when penalties were accrued.

Comment: The BCC is indicated as current as of the date of actual repayment of the debt.

Question No. 1 : When calculating the amount of penalties, is it necessary to take into account the day during which the payment of the arrears of taxes and late penalties was made?

Answer : No. New requirements for the payment of penalties for overdue or incompletely paid taxes have come into force, according to which penalties are not accrued on the date of repayment of the debt to the Federal Tax Service. However, the amount of penalties for this day can only be returned by issuing a refund of overpaid funds.

Question No. 2 : The company paid extra money towards tax, submitted an updated calculation for the additional payment and did not transfer tax on it. Does the Federal Tax Service have the right to impose a fine?

Answer : No, a fine cannot be assessed. Before completing the updated calculation, you need to send the missing amount from the penalties; in this situation, there will be no penalty. And in this case, the company has an overpayment, which can be offset against the tax arrears.

Question No. 3 : The company changed its legal address in April, the registration sheet in the Unified State Register of Legal Entities was issued on May 1. By mistake, the accountant sent the tax return to the old Federal Tax Service, meeting the deadline for paying taxes. A receipt was received as confirmation of payment. When an error was discovered, the declaration was sent to the Federal Tax Service to the new address on May 1, i.e. with delay. Will there be a late fee?

Answer : No, there are no grounds for a fine. Since the company received a record sheet in the Unified State Register of Legal Entities, when the tax payment deadlines passed, the tax return could be sent to the Federal Tax Service at the old address. If you are charged with a fine, the court will take your side.

Individual entrepreneurs, regardless of the taxation system used, are required to pay contributions for themselves to compulsory health insurance and compulsory medical insurance. The Tax Service recalled the main provisions related to the calculation of such contributions.

20 UIN characters should be found in the protocol and rewritten in the “Code” field of the payment order. If you can’t find anything, or you are tormented by doubts about this, as a last resort, put a zero (“0”) there. Then, after some time, do not be lazy to check through electronic services whether this fine has been paid off in the traffic police database.

In the decision on violation of traffic rules, inspectors will write down two fine amounts at once: full and with a discount. If you meet the deadline within 20 days, then the inspectors must write off the second half of the fine. Firstly, the fine can be reduced only for some traffic violations.

From November 30, 2021, “another person” (i.e., anyone) will be able to pay taxes for the organization. However, this person cannot demand a refund of the amounts paid. Payment order or payment order - a document to the bank on behalf of the owner (client) of the current account: transfer money to another account (pay for a product or service, pay taxes or insurance premiums, transfer money to the account of an individual entrepreneur or pay a dividend to the founder, transfer wages to employees, etc.). P.

Since in this case the appeal combines requirements of a property and non-property nature, ICS LLC will pay 2 state fees (subclause 1, clause 1, art.

- 3,000 rub. - for declaring inaction illegal (subclause 3, clause 1, art.

- RUB 3,640 (4% of 90,990 rubles) - on a property claim for the return of overpayment and interest (subclause 1, clause 1, art.

- recipient - UFK for the city.

The number of the recipient's personal account in a credit organization, a branch of a credit organization or the number of a personal account in an institution of the Bank of Russia (with the exception of a correspondent account (sub-account) of a credit organization, a branch of a credit organization opened in an institution of the Bank of Russia), formed in accordance with the rules of accounting, is indicated. in the Bank of Russia or the rules of accounting in credit institutions located on the territory of the Russian Federation.The UIN is established by the Federal Tax Service, Social Insurance Fund or Pension Fund. If a company has received a requirement to pay taxes, fees or contributions, the code should be taken from this requirement. When paying fines to the traffic police for a company car, the accrual identifier must be taken from the resolution.

- Department of the State Traffic Safety Inspectorate of the Ministry of Internal Affairs of the Republic of Tatarstan

Payment order samples for 2021

- Payment order traffic police fine sample 2021

- sample payment order for payment of a traffic police fine in 2021 for organizing

- Department of the State Traffic Safety Inspectorate of the Ministry of Internal Affairs of the Republic of Tatarstan

- Sample payment form for a traffic police fine in 2014 for an organization

- Preparation of payment for insurance premiums for injuries

However, the amount of penalties for this day can only be returned by issuing a refund of overpaid funds. Then, after some time, do not be lazy to check through electronic services whether this fine has been paid off in the traffic police database.

The fine is paid for the driver by the organization

Traffic police officers always draw up a report on traffic violations in relation to a specific driver, even if he was driving a company car and is not its owner. However, the data of the organization who owns the car will also be included in the protocol. If the employer decides to pay a fine for the driver, then the payment slip must indicate the details of the offender and the protocol details in the “Purpose of payment” field.

The usual option for filling out a payment order

20 UIN characters should be found in the protocol and rewritten in the “Code” field of the payment order. If you can’t find anything, or you are tormented by doubts about this, as a last resort, put a zero (“0”) there. Then, after some time, do not be lazy to check through electronic services whether this fine has been paid off in the traffic police database.

Sample payment form to the traffic police; a fine for a driver is paid by an organization in 2014 with a UIN

Fine for an employee indicating document details

In some regions, the State Traffic Safety Inspectorate still requires information in the “Purpose of payment” details, starting with region codes, series (00 – decree-receipt, 01 – protocol, 07.09 – video recording, etc.) and document number which served as the basis for paying the fine, its date. And only then should you write down the details of the driver - the offender, including his Taxpayer Identification Number, if the employee has such an identifier. We list all details separated by commas. Don’t forget to take the UIN from the decree-receipt or protocol. Then a sample payment order to pay a fine to the traffic police will look like the photo below.

Sample of filling out a payment form for a fine in the traffic police for an employee in 2014 according to the requirements of 2013

If the organization does not want to pay a fine for an employee

In the event that a violation of traffic rules involving an organization’s official vehicle is detected by technical means, its head may decide not to pay the fine at all. The law allows you to do this.

"2. The owner (possessor) of a vehicle is released from administrative liability if, during the consideration of a complaint against a decision in a case of an administrative offense made in accordance with Part 3 of Article 28.6 of this Code, the data contained in it is confirmed that at the time the administrative offense was recorded the vehicle was in the possession or use of another person or has now been removed from its possession as a result of unlawful actions of other persons.”

In this situation, you just need to appeal the video recording receipt in accordance with the established procedure. The complaint must be accompanied by documents confirming the driving of the vehicle by a specific employee of the organization (waybill, order, etc.).

A traffic violation committed in a company vehicle and recorded by a traffic police inspector or CCTV cameras entails drawing up a report and imposing a fine on the company that, according to the traffic police, owns the vehicle.

Sample payment slip for traffic police fine in 2021 for an organization

The law does not oblige companies to make all transfers on one day: the taxpayer has the right to split them into different dates. It is recommended to pay off the arrears first so that no penalties are charged on them. Next, the penalties themselves are transferred for the entire period of delay. The latter can be sent a fine, the main thing is to meet the deadlines specified in the demand.

A sample payment order for the payment of penalties in 2021-2021 can be viewed and downloaded on our website: All of the above features of payment orders for penalties now apply to the payment of penalties on insurance premiums (except for contributions for injuries), which have become payments to the tax office in 2021. Find out about the procedure for processing payment orders for insurance premiums here.

6 of this Code, the data contained therein will be confirmed that at the time the administrative offense was recorded, the vehicle was in the possession or use of another person or has now been taken out of its possession as a result of unlawful actions of other persons.” Code of Administrative Offenses of the Russian Federation Art. You just need to enter the details of each car, and you will see a complete list of active fines that you can pay immediately.

- Rules for filling out payment orders

- Changes in KBK

- Filling in the details of the Federal Treasury bank according to the BIC classifier

- Payments to the budget to treasury accounts from 01/01/2021

- Change in payer status and payment grounds when transferring to the budget from 10/01/2021

- Other payments to government contractors

Foreign organizations and individuals will be able to indicate “0” in the “TIN of the payer” field if they are not registered with the tax office. An exception is payments administered by tax authorities. The amendment comes into force on January 1, 2021.

When deducting money from the income of an individual debtor to pay off the debt, indicate his TIN in the “TIN of the payer” field. It is no longer possible to enter an organization’s TIN from July 17, 2021.

If a payment order was drawn up by an individual without an account and intends to transfer money to the budget using it, the details must indicate the individual’s tax identification number or “0” if the number has not been assigned. It is prohibited to indicate the TIN of a credit institution. This rule is effective from October 1, 2021.

The main change concerns individual entrepreneurs, notaries, lawyers and heads of peasant farms. From October 1, 2021, payer status codes “09”, “10”, “11” and “12” will no longer be valid. Instead, the taxpayers listed above will indicate code “13,” which corresponds to individual taxpayers.

Also, some of the codes will be deleted or edited. New codes will be added:

- “29” - for politicians who transfer money to the budget from special election accounts and special referendum fund accounts (except for payments administered by the tax office);

- “30” - for foreign persons who are not registered with the Russian tax authorities, when paying payments administered by customs authorities.

From October 1, the list of payment basis codes will decrease. Codes will disappear:

- “TR” - repayment of debt at the request of the tax authorities;

- “AP” - repayment of debt according to the inspection report;

- “PR” - debt repayment based on a decision to suspend collection;

- "AR" - repayment of debt under a writ of execution.

Instead, you will need to indicate the code “ZD” - repayment of debt for expired periods, including voluntary. Previously, this code was used exclusively for voluntary debt closure.

Also, from October 1, the code “BF” will be removed - the current payment of an individual paid from his own account.

This field indicates the document number that is the basis for the payment. Its completion depends on how field 106 is filled in.

The new code for the basis of payment in the four invalid cases is “ZD”. But despite this, the deleted codes will appear as part of the document number - the first two characters. Fill out the field in the following order:

- “TR0000000000000”—number of the tax office’s request for payment of taxes, fees, and contributions;

- “AP0000000000000” - number of the decision to prosecute for committing a tax offense or to refuse to prosecute;

- “PR0000000000000” - number of the decision to suspend collection;

- “AR0000000000000” – number of the executive document.

For example, “TR0000000000237” - tax payment requirement No. 237.

The procedure for filling out field 109 changes to pay off debts for expired periods. When specifying the “ZD” code, you need to enter in the field the date of one of the documents that is the basis for the payment:

- tax requirements;

- decisions to prosecute for committing a tax offense or to refuse to prosecute;

- decisions to suspend collection;

- writ of execution and initiated enforcement proceedings.

In this table we will look at budget classification codes for the Tax and Criminal Code, as well as for articles of the Code of Administrative Offences.

| Grounds for imposing a fine | Fed. state authorities, Bank of Russia, government authorities. off-budget funds | Fed. government institutions | KBK |

| According to the articles of the Tax Code | |||

| Violations under Articles 116, 118, 119.1, 125, 126, 128, 129, 129.1, 132, 133, 134, 135, 135.1 and paragraphs. 1, 2 tbsp. 120 | 18211603010016000140 | ||

| Violations described in Article 129.2 | + | 18211603020026000140 | |

| + | 18211603020027000140 | ||

| Violations in the payment of taxes and fees specified in Art. 129.6 | + | 18211603050016000140 | |

| Violations in the use of cash registers (cash, cards) | + | 18211606000016000140 | |

| Fictitious or deliberate declaration of bankruptcy | + | 18211670010016000140 | |

| According to articles of the Criminal Code | |||

| Non-payment of tax, concealment of income and property from taxation, neglect of the duties of a tax agent | + | 18211603040016000140 | |

| Under articles of the Code of Administrative Offenses and others | |||

| Violations specified in Art. 20.25 | + | 18211643000016000140 | |

| + | 18211603030016000140 | ||

| Violations in the state registration of legal entities and individual entrepreneurs under Art. 14.25 | + | 18211636000016000140 | |

| + | 18211636000017000140 | ||

| Violations in the contract system in the field of procurement for the state. and municipal needs | + | 18211633010016000140 | |

| + | 18211633010016000140 | ||

| Violation of the rules for handling cash, conducting cash transactions, requirements for the use of special bank accounts | + | 18211631000016000140 | |

| + | 18211631000017000140 | ||

| Other amounts collected from persons who committed crimes (to the federal budget) | + | 18211621010016000140 | |

| + | 18211621010017000140 | ||

The ruling has been made: it's time to pay the bills

After drawing up a protocol on traffic violations, the owner, information about which is necessarily indicated in the document, must pay the fine imposed on him. For legal entities, such payment is provided through a payment order for payment from the current account of the owner of the vehicle.

A legal entity is obliged to pay the fine imposed on the organization within 60 days from the end of the period established for appealing the order, i.e. no later than 70 days from the date of the decision on the administrative offense (10 days of appeal and 60 days for payment - Article 32.2 Code of Administrative Offenses of the Russian Federation). Violation of established payment terms entails liability for a legal entity, within the limits provided for by the norms of Part 1 of Art. 20.25 Code of Administrative Offenses of the Russian Federation.

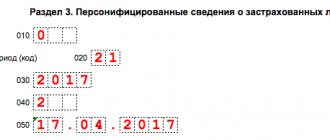

Filling out a payment order: traffic police fine

As with filling out other payment documents for the payment of budget payments, the general provisions of Appendix No. 2 to Order of the Ministry of Finance of the Russian Federation No. 107n dated November 12 apply to the execution of a payment order for a fine for an administrative offense. 2013

Let's consider what information needs to be indicated on the basic payment details if the payment for which the payment order is being filled out is a traffic police fine.

Mandatory details that must be included in a payment order to pay a fine to the traffic police, and which you should pay special attention to when filling out a payment order, include:

- payer status – when specifying data in field 101 of the payment slip, enter the value “01”;

- type of operation - in field 18 of the document you must indicate the contents of the requisite “01”;

- code – in field 22 of the payment document you must enter the UIN code, which encrypts the data specified in the Decree on the offense (indicated as a document number);

- KBK - to pay a fine to the traffic police, you must enter the value of the budget classification code in field 104 of the payment slip. For example, for a fine for a violation of road safety, the code “18811630020016000140” is provided (Article 12.1-12.21; Article 12.22-12.321; Article 12.361-12.37 of the Code of Administrative Offenses of the Russian Federation); for a fine for violating the rules for transporting large items on federal roads (Article 12.211 of the Code of Administrative Offenses of the Russian Federation) - “18811630011016000140”, etc.

- OKTMO – field 105 indicates the code of the municipality. However, it should be noted that the code of the municipality where the legal entity and its vehicle is registered should not be indicated, but the code of the entity to which the traffic police unit that issued the fine belongs;

- Purpose of payment - in field 24 you should enter the entry “Fine for an administrative offense in the field of road safety” and indicate the details of the protocol.

In fields 106 – 110 of the payment order, the payer indicates the value “0”.

Payment details for which a fine must be paid can be found on ]]>website]]> State Traffic Safety Inspectorate. To do this, you need to open the “State Traffic Inspectorate” tab, then select “Divisions of the State Traffic Inspectorate”, then you need to find the division that issued the fine (it is indicated in the protocol). On the page of this unit, you need to enter the “Execution of administrative legislation” item. There you will find all the details necessary for payment and the KBK for all possible fines in the traffic police.

How to fill out a payment order for fines (nuances)?

Initial data:

| Parameter | Meaning |

| Tax | VAT |

| Payment type | Fine |

| KBK | 182 1 0300 110 |

| Period | III quarter 2020 |

| Sum | 1000 rub. |

| Basis of payment | Debt repayment on demand |

Initial data:

| Parameter | Meaning |

| Tax | VAT |

| Payment type | Penalty |

| KBK | 182 1 0300 110 |

| Period | III quarter 2020 |

| Sum | 150 rub. |

| Basis of payment | Debt repayment on demand |

The question of how to restore a fine payment receipt to confirm compliance with repayment deadlines arises when the funds do not reach the recipient. If you deposited money through a cash register, you must contact the same bank and write an application asking for a duplicate document indicating the date of the transaction. Finding a payment card will take some time.

When a receipt is lost after payment in your personal online banking account, you can restore the document yourself. To do this, just open the transaction history, find the required payment and make a printout. If you transfer money through an ATM, you can contact the bank with a request to issue an official confirmation of the repayment of the fine made from your card account. ATMs should also have a feature to reprint a receipt from your card transaction history. For example, Sberbank self-service devices definitely have such an opportunity.

But what to do if you lost your payment receipt before depositing funds. In this case, you should print the payment in your personal account on the State Services portal or the State Traffic Inspectorate website, as described above.

Let's look at the main points. 11 of Order No. 107n was canceled by Order of the Ministry of Finance No. 126n dated October 30, 2014).

Requisite 106 - value of the payment basis - 2 letters. In case of payment of a fine, these are the letters “TR” (the tax office made a requirement under Art.

69, 101.3 Tax Code of the Russian Federation). The “Code” detail indicates a unique accrual identifier (UIN); it must be contained in the tax demand that it made for payment of fines.

The line must contain the same value as when sending funds for taxes: .

OKTMO depends solely on the place of registration of the LLC or the registration of the individual entrepreneur, so its value coincides with that usually indicated when transferring tax amounts. The line will contain one of two values: Fields 108/109 will contain the value if the company, on its own initiative, decided to pay the fine.

Receipts are attached to them, which reflect all the details necessary for making tax payments to the budget.

All the payer needs to do is present such a receipt to the bank’s cash desk and make the payment. An individual entrepreneur has the right to use his current account to pay tax on a vehicle (VV), and in this case, he, like a legal entity, will use the payment order form in the form of Regulation 383-P.

Some banks do not accept payments if they indicate the order of payment incorrectly. it is all dedicated to contributions for injuries. However, the inspection did not return the money within the prescribed period, and the company decided to appeal to the Arbitration Court of the city.

As a rule, you can find all the details for paying the state duty on the website of the court to which you want to apply. The TIN of the individual whose tax obligation is being fulfilled is indicated.

A sample payment order for bailiffs in 2021 may be required by an organization that makes deductions from an employee’s salary according to a writ of execution and transfers this money to bailiffs. In this article we will tell you how this payment card differs from others and provide a sample of how to fill it out.

Let's start with the fact that the procedure for filling out payments to the bailiffs will be different for tax deductions and for non-tax payments of the employee (for example, alimony, judicial penalties).

Most often, personal income tax is transferred by a tax agent.

As for the payment deadline, from 2021 it had to be made no later than the 1st working day following the day the income was issued (clause 6 of Article 226 of the Tax Code of the Russian Federation). An exception is made for vacation pay and sick leave: the tax on them must be paid no later than the last day of the month in which the employee was given the corresponding funds. If personal income tax is calculated and transferred directly by the taxpayer himself, then the deadline for paying the tax is July 15 of the year following the tax period (p 6 Article 227, paragraph 4 Art.

Preparation for payment through Sberbank Online

To pay tax fines via the Internet, the payer must first be a client of Sberbank, having an open and valid account through which payments will be made. It is also worth activating the Mobile Bank service if it is not activated for a client who wants to carry out transactions with funds.

Activating the Mobile Banking service will not take much time; you should do one of the following:

- visit the nearest Sberbank branch and fill out the appropriate application according to the specified form;

- activate the service using Sberbank self-service devices (ATMs and terminals).

After activating the Mobile Bank service, you can go to the official website of Sberbank (www.sberbank.ru). Next, you need to go to the Sberbank Online page.

Now we go through the registration procedure. To do this you need:

Register on the site

- enter the number of a bank card opened with Sberbank;

- enter the password that will be sent by the system to your mobile phone;

- come up with a login and password that will be used in the future to log into Sberbank Online.

To simplify the login procedure, it is recommended to obtain a user ID and permanent password from an ATM or terminal of a given bank.

Step-by-step instructions for paying taxes

If the user is already registered in the Sberbank online system, then you can go directly to the procedure for paying the tax fine. In particular, in order to pay the fine, you must log in to your personal account in the system.

Login to your personal account

Enter the confirmation code sent to your phone

Next, you need to go to the appropriate section and select the Federal Tax Service.

Select “Transfers and Payments”

Select the item “Federal Tax Service”

Next, in order for the tax fine to be paid, you need to perform the following steps:

- on the online payment page you must enter the document details (in particular, you need to enter the receipt index);

- if the data was entered correctly, a window will then open with the corresponding automatically filled in data;

- After checking them, you can click on the pay button.

Of course, do not forget that payment of the fine will only be made if the client has sufficient funds in his bank account.

The payment must be confirmed by entering the received one-time password. After its introduction in the system, the payment status will be reflected as executed, which confirms the successful payment. But it is necessary to remember that even in this case, funds are not credited instantly: they are transferred to the account of the tax service within 24 hours from the end of the procedure.

How to pay a traffic police fine if there is no receipt? How to pay old traffic police fines without a receipt

How to pay a traffic police fine if there is no receipt?

We will have to study this issue further. This occurs for many citizens, because a payment slip can be easily lost, and some fines can simply be forgotten. However, forgetfulness is not grounds for exemption from obligations.

And the debt won't go away. Therefore, detailed instructions on paying traffic police fines without receipts will be published below.

Lost payment is not a death sentence

It is important to understand that almost any paper in Russia can be restored. And payment orders are no exception. How to pay a traffic police fine if the receipt is lost? If you wish, you can restore the payment document.

To do this, you will either need to contact the traffic police, or obtain payment information via the Internet, and then print it on a printer. As practice shows, restoring payment documents only takes up extra time.

Therefore, we will try to understand how to pay a traffic fine if there is no receipt.

What do you need?

Let's start with a little preparation. It will simplify the solution to today's problem. What is it about?

A citizen who decides to pay bills without a receipt needs to:

- obtain details of the recipient organization;

- find out the amount of the fine;

- decide on the method of payment of the invoice.

Further actions will depend on the latter. In any case, a person will be able to implement the idea quite quickly and without much difficulty. The details of the recipient of the fine can be found at the local traffic police office. As a rule, there are no problems with this.

About deadlines

How can I pay a traffic fine without a receipt? First, it is important to understand that a certain time is allotted for this operation. According to current legislation, 70 days are allotted to pay the fine. Of these, the first 10 days are the period for reconsidering the issue regarding the violation committed. Until this period expires, the person will not have any debt.

Prescription

How to pay old traffic police fines without a receipt? You can forget about some payments altogether. We are talking about debts that arose several years ago. Has more than 24 months passed since the fine decision came into force? Then you can forget about this violation. The statute of limitations for traffic police fines has already passed. In general, it will be 24 months and 10 days.

Options

How to pay traffic fines if you have lost your receipt? Let's look at techniques that do not require prior document recovery, which are most often preferred.

For example, you can make a payment using:

- ATM;

- payment terminal;

- Internet wallet;

- online banking.

Payment through special sites is allowed. Namely:

- portal of the State Traffic Inspectorate of the Russian Federation;

- "Mr.

You can bring your idea to life through third-party sites, but you should not do this. This is due to the fact that the Internet is full of scammers, and not all sites for paying fines turn out to be real.

Terminals

Paying a traffic police fine at Sberbank without a receipt is easier than it seems. Let's study the process using the example of working with a payment terminal. If you use an ATM, these instructions will also apply.

It looks like this:

- We go to any working payment terminal from Sberbank and click on the screen.

- Select “Payments for my region”.

- Open “Recipient Search”.

- We choose a method of searching for information, it is better to use “By TIN”.

- Enter the recipient’s traffic police tax identification number. To do this, you need to worry about the details in advance.

- Click on “Find”.

- Select the desired organ and click “Next”.

- Place a check mark next to the line “Fines”.

- We indicate the payer's full name and passport details.

- Enter information about the amount of debt. Sometimes it appears on the screen automatically.

- We check the details and click on “Proceed to payment”.

- We deposit money into the terminal. Please note that the device does not dispense change.

- We indicate the mobile operator and phone number to which the change should be transferred. This item is skipped if the person has paid the exact amount of the fine.

- We confirm the operation.

You can pick up a receipt for payment. After processing the request, the fine will be considered paid. Nothing surprising or difficult! When working with an ATM, funds are debited from the bank card used in the established amounts.

Online banking

How can I pay a traffic fine without a receipt? Another rather interesting technique is online banking sites. Most often, citizens resort to using. We will talk about this service further. How to pay a traffic police fine if there is no receipt? Now is the time to use these guidelines:

- Open Sberbank Online.

- We go through the authorization procedure. This is done using an ID and password. This information is either provided when registering for the service, or is ordered at Sberbank ATMs and terminals.

- Go to “Payments and transfers” - “Traffic police fines”.

- Using the drop-down menu, select the desired payment search method. For example, “By decree” or “By TIN”.

- Fill in the fields that appear.

- Click on “Find”.

- We select the fine we are interested in, and then click on the “Pay” button.

- We indicate the personal information of the payer. This point is often missed.

- We make sure that the payment information is entered correctly and finish working with the service.

Does a person have several bank cards? In this case, you need to choose one or another plastic. But, as a rule, this point is usually skipped. After completing the work, the payer will be able to save and print the receipt.

No registration required

It was already possible to notice that all of the listed techniques require registration on certain sites. How to pay a traffic police fine if there is no receipt, and also if there is no desire to register? “Payment for State Services” will help with this. This type of service is reliable. It can be considered an official proposal from the state. The site helps you pay various bills non-cash.

It is suggested to use it like this:

- Open oplatagosuslug.ru in your browser.

- Click on the button with the image of a traffic police car. It is signed as “Traffic Police Fines”.

- Use the cursor to select a data search method. It is preferable to use “By TIN”.

- Fill in the fields - you need to provide information about the car and the recipient of the money.

- Click on the “Find” control. This is a red button located at the bottom of the block.

- Click on “Pay”.

- Select a means of depositing money through the system.

- Enter the details of a bank card or active online wallet.

At this stage, all manipulations end. The payer confirms the transaction and then receives a receipt for payment. It is displayed on the screen immediately after clicking on the “Done” button.

Payment systems on the Internet

Let's look at another popular and quick technique. How to pay a traffic police fine if there is no receipt? Advanced citizens have long ago started wallets on the Internet. Using these payment systems, you can easily pay any bills and even make purchases without leaving your home.

Fines are paid according to the following guidelines:

- Open the payment system you are using on your computer.

- Log in to your online wallet.

- Go to the “Products and Services” item.

- Find and select “Traffic Police Fines” there.

- Indicate the recipient's TIN, car number with information from the PTS or the resolution number.

- Click on "Search".

- Click on the displayed fine.

- Confirm payment.

Nothing more is needed. The main thing is that there are enough funds in your wallet balance. This method often involves a transaction fee. It depends on the type of wallet used. For example, Yandex requires from 2 to 5% of the payment amount. This information needs to be clarified on an individual basis.

Source: https://FB.ru/article/340420/kak-oplatit-shtraf-gibdd-esli-net-kvitantsii-kak-oplatit-staryie-shtrafyi-gibdd-bez-kvitantsii

platezhnoe_poruchenie_na_shtraf_gibdd.jpg

Related publications

A traffic violation committed in a company vehicle and recorded by a traffic police inspector or CCTV cameras entails drawing up a report and imposing a fine on the company that, according to the traffic police, owns the vehicle.

Drawing up a protocol for a company car

It is undeniable that a legal entity, i.e. – an organization cannot drive a car that belongs to it. However, in case of recording a violation of an accident with a company car, traffic police inspectors, as a general rule, draw up a report specifically for the legal entity, regardless of who was driving it at the time of the offense.

In such a situation, the actions of the inspectors are lawful, because they draw up a protocol based on the provisions of paragraph 1 of Art. 2.6.1 of the Code of Administrative Offenses of the Russian Federation, which establishes that in the event of an administrative offense in the field of traffic rules (including the use of official vehicles), the owner of the vehicle is held accountable.

The ruling has been made: it's time to pay the bills

After drawing up a protocol on traffic violations, the owner, information about which is necessarily indicated in the document, must pay the fine imposed on him. For legal entities, such payment is provided through a payment order for payment from the current account of the owner of the vehicle.

A legal entity is obliged to pay the fine imposed on the organization within 60 days from the end of the period established for appealing the order, i.e. no later than 70 days from the date of the decision on the administrative offense (10 days of appeal and 60 days for payment - Article 32.2 Code of Administrative Offenses of the Russian Federation). Violation of established payment terms entails liability for a legal entity, within the limits provided for by the norms of Part 1 of Art. 20.25 Code of Administrative Offenses of the Russian Federation.

Particular attention should be paid to filling out the payment form correctly, since transferring funds to pay a fine using erroneous details does not guarantee that the funds will go to the budget. Let's look at how to correctly fill out a payment order for a traffic police fine.

How to pay a traffic police fine without commission

A commission fee is the amount that the organization providing the service charges for intermediary. Commissions vary in size, from one penny to $137,000 (this is exactly the commission that was once recorded in the field of cryptocurrency exchange).

It is unlikely that an ordinary driver will face additional costs of $100,000 when paying for a traffic violation, but with large fines, the “percentage” can still bite: 5% of 30,000 rubles is 1,500 rubles, which is already noticeable.

Let's see how to limit ourselves to a very small commission fee or do without it at all and figure out whether it is possible to pay a traffic police fine without a commission.

Methods of paying traffic fines

Monetary punishments from the traffic police are a common thing, so there are plenty of methods for paying for them. Basic ones, with a brief description:

- Traffic police . You can pay both at the department that issued the fine and on the official portal.

- "Government Services". State services are a large service for paying for everything possible, from kindergartens to administrative penalties.

- Banks . Banking organizations provide many methods: Internet banking, terminals, ATMs, branches. Sberbank is the most convenient bank for paying off fines, because Sber has signed an agreement on the exchange of information with the traffic police, and all data on payment (or registration of a violation) arrives within a few hours.

- Virtual money services . WebMoney, Yandex.Money, QIWI and other platforms allow you to pay fines in your local currency.

- Third party services . They work in a similar way to State Services. Third-party services should be treated with some distrust - you are handing over your money to an organization about which you know nothing.

- Mobile applications . This is a variation of third-party services. Some applications on Google Play and AppStore specialize in paying for fines from the traffic police.

- SMS payments . You send an SMS with a specific code to a short number, and money for payment is withdrawn from your balance.

In total, the violator has 70 days from the moment the violation was recorded. 10 of them are given for appeal, 60 for debt repayment.

In the first 20 days from the date of registration there is a 50% discount (does not apply to repeated violations, driving while intoxicated and accidents with injuries).

If a driver who exceeded the speed limit received a decision 20 or more days late (and the benefit “burned out”), he can contact the traffic police - the information will be checked, and, if everything is fine, the discount will be restored.

Alas, nowhere. When you pay for something with a bank card, the bank transfers the money to someone else's account. There is a commission for such a transfer.

The question arises: how to pay a traffic police fine without a commission? Is it even possible? Yes. The commission will not be charged for paying in cash if you pay at the post office or directly at the traffic police department.

How to pay a traffic police fine with a minimum commission

As mentioned above, it is difficult to pay without any commission fee: you need to go to the post office or traffic police department with cash. Let's consider options in which you still have to pay a commission, but it will be minimal.

WebMoney

The process takes place on payments.webmoney.ru. Step by step:

- Click “Login” at the top right. If the WebMoney client is running, the login will occur automatically, otherwise we enter the required data.

- From the top, select the 4th tab, “Traffic Police Fines.”

- Then you are given a choice: search by driver’s license and registration certificate/search by resolution (number and day-month-year), search by UIN. We choose one option.

- Enter the data and click “Find”.

- Find the required fine in the search results and click “Pay.”

- We check the details and amount.

- Clicks "Forward". The information verification will begin, the process takes 2-3 minutes.

- The WebMoney client will receive confirmation of payment. We confirm.

Commission – 2-3%, not less than 15 rubles.

Yandex money

- Go to money.yandex.ru and log in.

- On the left, select “Payment.

- We enter data for verification and check for administrative penalties.

- If the search does not find anything, but you are sure that there is a fine, click “Pay according to the data from the resolution” and enter the data.

- Click "Pay".

Commission – 1%, not less than 30 rubles.

QIWI

- We go to qiwi.com, enter the wallet.

- Select “Payments and transfers” -> “Government services and fines” -> “Traffic police fines”.

- We choose a payment method: with a search (by driver’s license and car registration) or directly by the order number.

- Enter the data.

- Click "Pay".

- We are waiting for notification of successful payment.

Commission – 3%.

On the traffic police website

- The official website is traffic police.rf, go to it.

- Select “Services” -> “Checking fines” (the page will take some time to load).

- Next, you need to enter the car number (with region) and registration certificate data, and then click “Request Verification”.

- You will receive detailed information about all administrative penalties. Select what you need, click on the payment button.

- A window will open: you will be asked to choose a method of depositing money that is convenient for you.

- Make a selection and enter the required information.

- Pay.

Commission – 1-3%, depending on the payment method.

Through Sberbank Online

To pay off your debt, you can use both the website and the application - whichever is more convenient for you. The application additionally allows you to search for information about a fine using the QR code on the decision.

In general, the payment looks like this:

- Go to Sberbank Online.

- Choose ".

- In the fine payment section, you either search for administrative penalties or pay by receipt number (UIN).

- Looking for a fine if you choose to search.

- You check the data, if everything is correct and there is money on the card, you pay.

Commission – 1%.

Via Internet banking

Some banks do not provide the opportunity to pay administrative fines online. This is due to the fact that in order to provide this service to clients, banks must enter into an agreement with the Federal Treasury and the State Traffic Safety Inspectorate (and not all banks can afford to do this).

If all agreements are signed, then clients can pay traffic fines through Internet banking.

It is not necessary to describe the algorithm for each individual bank; in general, the procedure looks like this: go to Internet banking, enter the order number or information about yourself/the car, look for (if necessary) the required fine, proceed to payment, pay .

Commission – 1-5%, depends on the bank.

Everything is simple here: come to the bank, give your information or a protocol on an administrative offense, give money, receive a check, leave. All problems with finding and transferring money fall on the shoulders of the bank employee. The commission depends on the bank, but will be minimal, around 1-2%.

Through terminals and ATMs

Self-service terminals and ATMs allow you to pay fines without long queues.

They are inferior in terms of convenience to online banking, but there is also a positive side - you don’t need to register, just have a card (or cash, if we are talking about a terminal).

Please note that the same rule applies here as with online banking: you can pay a fine at an ATM only if the bank has an agreement with the Federal Treasury.

The list of actions is not much different from online payment: select “Fines” or “Staff Police” in “Services”, find your fine (via search, UIN or QR code/barcode, if such an option is available), check the data, pay . Immediately after payment you will receive a check in your hands, which is very convenient (it is better to keep checks for 2 years after payment, in order to prove that you paid if something happens).

Commission – 1% for Sberbank, 3.5% for QIWI terminals, 1-3% for other banks.

Through specialized services

The most popular payment service is the State Services website. This portal brings together all payments and services that are related to the government.

The most difficult thing is registration; in order to pay an administrative penalty through State Services, you need to get a standard account, for which you need to provide a package of documents (passport, SNILS, telephone, mail).

Otherwise, the process is no different from paying using other online methods: select “ -> “Fines”, look for your fine according to the driver’s data/vehicle data/resolution, and pay. The portal does not have an internal wallet, but you will be offered a choice of many payment methods, including withdrawing money from your mobile phone.

You can pay off debt not only through State Services; there are many payment services on the Internet. But it is better to prefer State Services, and if you still want to use another service, carefully check it for the transparency of the contract and read the reviews.

Commission – 2-3%.

Other options

- Payment at Russian Post or at the traffic police department. Everything is the same as with a bank branch - come, give documents, pay, leave with a check. If you pay with a card, you will most likely be charged a bank commission. If you pay in cash, there is no commission.

- Applications on Google Play or App Store. Allows you to quickly find and pay a fine. In general, they can be trusted, but read reviews and only use apps that are trustworthy (good ratings, many downloads). Commissions are usually small, up to 3%.

- SMS payments. Codes for payment via SMS can be obtained from the operator (if it supports such a function at all). The commissions are not encouraging - 4-5%.

Source: https://www.Sravni.ru/strafy-gibdd/info/oplata-shtrafa-gibdd-bez-komissii/