Russian companies hire employees from Kazakhstan, supply goods to customers from this country, and cooperate with Kazakh suppliers.

When this happens for the first time, accountants have a lot of questions.

We decided to make a selection of materials from the website and forum on the topic of accounting and personnel aspects in Kazakhstan.

Features of using a zero rate in export operations

The application of this tax rate in export operations to Kazakhstan is possible only if a complete package of documents is provided, the composition of which is given in paragraph 4 of the Protocol on the collection of indirect taxes.

If supporting documents are not provided, the standard rate of 10 or 18% is applied instead of the zero rate.

The zero rate for export operations from Russian territory also applies to the export of goods not subject to VAT.

The exporter prepares an invoice, in which he enters the rate of 0% in column 7, after which he transfers one copy to the buyer from Kazakhstan, keeps the second one for himself and enters its data in the Sales Book. The invoice is issued within 5 days from the shipping day, and the details are entered into the Sales Book in the quarter when all the documents required to justify the right to this rate are completed, executed and collected.

The 0% rate also applies to the removal of valuables for storage in warehouses in Kazakhstan with their subsequent sale by Russian sellers.

Typical violations of currency legislation under contracts with Kazakhstan and liability for them

The transaction passport has not been issued:

– a resident of the Russian Federation did not submit the relevant documents, did not submit them on time, did not submit them in full, etc. – liability under Part 6 of Art. 15.25 of the Code of the Russian Federation on Administrative Offenses in the form of a fine, for officials - 4 - 5 thousand rubles, for organizations - 40 - 50 thousand rubles.

Repeated similar violation - officials - 14 - 15 thousand rubles, organizations 120 - 150 thousand rubles.

The transaction passport has not been reissued:

If such re-registration is mandatory - liability under Part 6 of Article 15.25 of the Code of Administrative Offenses of the Russian Federation - for organizations from 40-50 thousand rubles,

Repeated – 120 – 150 thousand rubles.

Failure to submit a certificate of currency transactions (for organizations):

– according to Part 6.3 of Article 15.25 of the Code of Administrative Offenses of the Russian Federation up to 40-50 thousand rubles.

If repeated – up to 120-150 thousand rubles.

As of October 09, 2021

Moscow

Tax lawyer in Moscow

Gordon A.E,

The procedure for confirming the right to 0%

To apply a 0% rate to valuables exported from the Russian Federation, you need to collect a set of documentation, the list of which is strictly defined by the Protocol, and then send the prepared set to the tax office no later than the 180th day from the date of actual shipment of goods and materials. Days are taken as calendar days.

The list of documents itself is listed in clause 4 of the Protocol, and the procedure, timing and place of their transfer to the Federal Tax Service in clause 5 of the Protocol.

These statements are true for exports from Russian territory to Kazakhstan. These countries are members of the EAEU, between which an agreement has been concluded establishing special rules for interaction in trade matters. The above Protocol serves as an annex to the agreement concluded between the participants of the EAEU.

Insurance

If customs risks are insured when transporting goods produced in the Russian Federation from Russia to Kazakhstan, then their amount is determined depending on what type of transport is used. Of course, factors such as the amount of insurance, complexity, length of the route, the existence of possible overloads, etc. play a role. If long-distance road freight transportation is used, the price of insurance in Kazakhstan is determined by 0.2% of the customs payment. In Russia, the cost falls in the range from 3 to 10% of the cost of road transportation.

List of documents to justify the 0% rate

If an export transaction is carried out between two parties to the agreement on the EAEU (in this case, between Russia and Kazakhstan), then when collecting the necessary documentation, the exporter should rely on the following list: (click to expand)

- A contractual agreement concluded between participants in a supply transaction;

- An application for the import of goods and payment of indirect taxes is prepared by the buyer from Kazakhstan, submits it to his tax office, where a mark is placed on the fulfillment of the obligation to pay additional tax (or exemption from it), and then passes it to the Russian seller;

- Documents evidencing the export of valuables from Russian territory (consignment note, goods and transport bill).

The list of item 4 also indicates a bank statement confirming receipt of proceeds from the export transaction, but it should be provided if required by the tax laws of the exporter’s state. In the Russian Federation, the list of documents for using the zero rate is specified in clause 1, article 165 of the Tax Code of the Russian Federation. The list of this item does not require the mandatory submission of an extract. Therefore, Russian exporters do not need to submit it to the tax authorities in connection with the export procedure to the EAEU countries.

To this list you need to add a VAT return to be completed for the quarter when the above documentation is prepared. To fill out, take a standard declaration form intended for submitting VAT information in a standard situation.

Since the indicated declaration is submitted before the 25th day of the month following the reporting quarter, the last day for filing documents will correspond to the 25th day of the month following the quarter of the end of the allotted 180-day period.

Submission of a statistical report to the Federal Customs Service in electronic form

When exporting to the EAEU, the Organization is obliged to submit to the Federal Customs Service (Federal Customs Service) a statistical form for recording the movement of goods (approved by Decree of the Government of the Russian Federation of June 19, 2020 N 891).

The statistical form in the Federal Customs Service is drawn up using the regulated report Statistical form for accounting for the movement of goods in the section Reports - 1C-Reporting - Regulated reports - the Create button - the All tab - the By Recipients folder - the Federal Customs Service folder.

The report is filled out manually by exporters. PDF

The report period must be selected before the report is recorded. If an incorrect period is selected, you must close the report without saving it and then create a new one.

Yellow cells are filled in manually. Data in green cells is calculated automatically based on the information entered into the report.

After filling out the Statistical form for accounting for the movement of goods, you should Write it down , then using the appropriate buttons, the report can be:

- unload,

- check the unloading,

- type,

- send to the Federal Customs Service.

The statistical form is submitted to the customs authorities by the 10th day of the month following the month of shipment or receipt of goods. It can be downloaded from 1C and sent from your personal account on the FCS portal

For failure to submit or untimely submission of a statistical form for recording the movement of goods to the Federal Customs Service, a fine will be charged (Administrative Code of the Russian Federation, Art. 19.7.13):

- for officials - from 10,000 rubles. up to 15,000 rubles;

- for legal entities - from 20,000 rubles. up to 50,000 rub.

An example of determining the date for filing documents

The consignment note for export was generated on 05/04/2016.

Documents must be collected by October 31, 2016 inclusive.

The last date for submitting documents is 01/25/2017.

Method of submitting a set of documents:

- Paper (if the forms are in the form of copies, then they must be properly certified);

- Electronic via TKS (sent as scanned files).

It is better to check the available method of filing with the tax office where the documentation in question is submitted.

Trade turnover between countries

Russia is the leading supplier of goods to Kazakhstan. According to 2021 data, products from the Russian Federation account for 38.7% of total imports. The country is supplied with: food products, tobacco products, industrial equipment, cars, and metallurgical products. In monetary terms, imports amount to about $12 billion per year.

Kazakhstan imports goods to Russia in much smaller volumes: the Russian Federation is not one of the three main recipient countries. However, the nearest neighbor still receives the following categories of goods:

- crude oil (due to the insufficient industrial base for processing within Kazakhstan itself);

- diamonds;

- natural gas;

- grain, mainly wheat;

- wool;

- coal.

When importing goods from Kazakhstan to Russia, the first country is most often used as a transit country. Goods come to it from China and then go to the Russian Federation. The fact is that, thanks to existing agreements, products that have passed customs clearance in the republic are considered “domestic consumption goods.” It is exempt from duties and is imported into Russia on preferential terms. This direction of cargo transportation is due to the geographical location of Kazakhstan, which borders both China and Russia.

What to do if documents are not collected on time

Violation of the established deadline of 180 days for submitting supporting documentation entails loss of the right to a preferential rate. If the tax office does not receive the necessary documents, then the exporter will have to add a tax to the shipping cost either at a rate of 10% for goods listed in clause 2 of Article 164 of the Tax Code of the Russian Federation, or 18% for other goods.

The calculated tax is payable for the tax period in which the shipping procedure for exported valuables to Kazakhstan was carried out.

If the exporter still wishes to later exercise the right to a preferential zero rate, then he must collect the required set of documents and send them to the tax office as soon as possible. In this case, the previously paid added export tax will be offset - sent to deduction.

From 07/01/16, the procedure for deducting the added tax is carried out on the day of the subsequent calculation of VAT at a zero rate, subject to the presence on this date of the necessary supporting documents confirming the possibility of using 0%.

VAT is sent for deduction in the amount determined by the exporter's tax form, which served as the basis for the transfer of the tax amount, calculated as a result of multiplying the cost by a rate of 10 (18%). This s/f was included in the Sales Book at the time of compilation. After collecting the necessary documentation, at the time of accepting for deduction the previously paid additional tax on exports, the same tax is entered into the Purchase Book, thereby carrying out the procedure for offsetting the transferred VAT.

Receipt of payment from a foreign buyer

In our example, postpayment is made. At the time of sale, a receivable from the foreign buyer was formed under Dt 62.21, calculated as of the date of transfer of ownership.

At the moment the buyer repays the debt under the contract in foreign currency, the receivables are revalued at the rate of the Central Bank of the Russian Federation on the day of payment (clause 7 of PBU 3/2006, clause 8 of Article 271 of the Tax Code of the Russian Federation). As a result, exchange rate differences arise.

Receipt of payment from a foreign buyer is registered with the document Receipt to current account transaction type Payment from buyer in the Bank and cash desk section – Bank – Bank statements – Receipt button.

Let's look at the features of filling out the document Receipt to a current account using our example.

Bank accounts must first be filled out : information about the Organization's currency account to which payment is received from the buyer must be entered.

Payment in foreign currency is credited to a transit foreign currency account.

In our example, settlements under the contract are carried out in foreign currency. PDF As a result of selecting such an agreement in the Receipt to Current Account , settlement accounts with the buyer are automatically set in the field:

- Settlement account - 62.21 “Settlements with buyers and customers (in foreign currency)”;

- Advances account - 62.22 “Calculations for advances received (in foreign currency).”

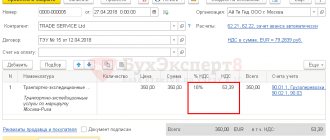

Since payment by the buyer is made in foreign currency, the document states:

- Bank account - a transit currency account in USD, into which funds are received from the buyer;

- Accounting account - “Currency accounts”, is installed automatically when selecting a foreign currency bank account;

- Amount - payment amount in currency according to the bank statement;

- VAT rate — 0%.

Postings according to the document

The document generates transactions:

- Dt Kt 62.21 - receipt of postpayment from the buyer to the transit currency account;

- Dt 62.21 Kt 91.01 - revaluation of receivables in foreign currency.

Control

Calculation of exchange rate differences when revaluing accounts receivable

Income tax return

In the income tax return:

Positive exchange rate differences are reflected in non-operating income: PDF

- Sheet 02 Appendix No. 1 page 100 “Non-operating income.”

Accounting for input VAT on exports to Kazakhstan

The tax declared by suppliers of goods that are later exported to Kazakhstan is credited as a deduction, reducing the final VAT payable.

This operation is possible if the supplier has transferred a tax in which the amount of added tax appears as a separate column. For goods purchased after 07/01/16, this amount is accepted for deduction after they are accepted for accounting.

Input tax on so-called raw materials, specified in paragraph 3, paragraph 10, Article 165 of the Tax Code of the Russian Federation, is accepted for deduction on the day of calculating the base for calculating the added tax, defined in Article 167. In relation to the transactions under consideration, this moment will correspond to the last day of the quarter, when a package of documents confirming the possibility of using the zero rate has been prepared. If the documents are not collected, then the day the base is calculated will correspond to the shipment date.

The above rules prescribed for raw materials are also valid for valuables, services, works purchased and accepted for accounting before 07/01/16.

The moment of acceptance of input VAT for deduction on goods, services, works intended for export:

| Until 07/01/16 | From 01.07.16 | |

| Goods | At the time of calculating the base for the added tax:

| In the quarter of acceptance for accounting. A prerequisite is the presence of an invoice. |

| Services, works | ||

| Commodities | At the time of determining the tax base:

| |

In the quarter in which the exporter exercised the right to deduction, he has an excess of the tax added amount to be reimbursed over the amount to be paid. That is, in this situation, the tax office must reimburse the tax; the amount to be reimbursed is written down in the VAT return in section 1, field 050.

The refund procedure is standard. The tax can be offset against other federal taxes, against fines, penalties, and arrears on added tax. In this case, you can submit an application indicating how the offset should be made. If such an application is not submitted, the tax authorities will independently carry out the offset.

It is also possible to offset the refundable amount against future VAT payments.

If there is a need to receive this amount in cash, then an application must be submitted to the tax office with a corresponding request so that the tax authorities do not offset the amount of the refunded amount on their own.

Export of finished products in 1C 8.3

In our example, the transfer of ownership of finished products occurs not at the time of shipment, but at the time of delivery of the product to the buyer’s warehouse. Such a shipment is formalized by the document Sales (acts, invoice) transaction type Shipment without transfer of ownership in the section Sales - Sales - Sales (acts, invoices) - button Sales - Shipment without transfer of ownership).

Let's look at the features of filling out the Implementation document (act, invoice) following an example.

Document header

- Counterparty is a foreign buyer with whom a contract has been concluded. Selected from the Contractors directory.

When entering the Contractors of a buyer from the Eurasian Economic Union into the directory, you must provide the following data: PDF

- Country of registration - select KAZAKHSTAN from the drop-down list. Important for auto-filling the tabular part of the document Implementation (act, invoice) ;

- Tax number;

- Reg. number ;

- The TIN is filled out only for a foreign company that has registered for tax purposes in the Russian Federation. This is not our case.

- Agreement is a contract under which mutual settlements are carried out with a foreign buyer.

The agreement with the buyer in foreign currency must be completed as follows:

- Type of agreement - With the buyer ;

- Price in - USD , i.e. the currency in which the contract was concluded;

- Payment in - switch USD , i.e. payment currency.

In the Prices form in the document, the exchange rate is set from the Currency on the date of the document Sales (deed, invoice) .

Tabular part of the document

On the Products , information about the products being shipped is indicated (name, quantity, price, VAT rate, as well as accounting accounts, HS code, item group in the Subconto ):

- Nomenclature - products shipped to a foreign buyer are selected from the Nomenclature .

For goods (products) intended for export, be sure to fill out the following field in the nomenclature card:

- Commodity Nomenclature of Foreign , according to the Decision of the Council of the Eurasian Economic Commission dated July 16, 2012 N 54 - if the product (product) is a raw material , then the card with the Commodity Nomenclature of Foreign Economic Activity code should have the Commodity Commodity .

The unit of measurement of the nomenclature must correspond to that established by law for a given HS code. In our example, the Unit is par .

This is important for filling out the report Statistical form for recording the movement of goods (approved by Decree of the Government of the Russian Federation of June 19, 2020 N 891). The upload file is checked, among other things, for the correctness of the unit of measurement of the item according to the HS code.

- Commodity nomenclature code - the product code can be entered manually by selecting from the Commodity Nomenclature of Foreign Economic Activity Classifier or pre-filled in the item card. Then the value will be inserted into documents automatically.

- Price and Amount - the columns are filled in in currency, since the agreement was concluded in USD.

- % VAT - 0% , the VAT rate applied when selling goods for export.

- Transfer account - account 45.02 “Finished products shipped” is used to reflect movements of shipped finished products when the proceeds from their sale are not immediately recognized in accounting. In our example, this is due to the fact that ownership of the goods does not pass from the seller to the buyer at the time of shipment.

a member country of the EAEU is selected in the Counterparty card in the Country of Registration the following columns will be automatically filled Sales document (act, invoice)

- % VAT with a value of 0%;

- The HS code is a code from the nomenclature card.

Postings according to the document

The document generates the posting:

- Dt 45.02 Kt - shipment of finished products without transfer of ownership at actual cost.

The document is filled out in the currency based on the contract. The amounts in the entries are reflected in rubles. This is due to the fact that accounting in the Russian Federation is carried out in rubles. The value of assets or liabilities in foreign currency is subject to conversion into rubles (clause 4 of PBU 3/2006).

Revenue in accounting and accounting records has not yet been recognized, since there is no transfer of ownership of the products from the seller to the buyer (clause 12 of PBU 9/99, clause 3 of Article 271 of the Tax Code of the Russian Federation).

The tax base for VAT in foreign currency is recalculated into rubles at the rate of the Central Bank of the Russian Federation on the date of shipment, i.e., the preparation of the first primary document addressed to the buyer (clause 3 of Article 153 of the Tax Code of the Russian Federation, clause 5 of the EAEU Protocol).

Control

Calculation of the tax base for VAT

Documenting

The organization must approve the forms of primary documents, including the document for the sale of goods. In 1C, for internal document flow, a consignment note in the TORG-12 form is used.

The form can be printed by clicking the Print button – Consignment note (TORG-12) of the Sales document (act, invoice) . PDF

As a rule, a foreign buyer is issued:

- invoice-proforma;

- invoice;

- invoice (VAT-invoice), etc.

Documents are prepared with translation into a foreign language. Such forms are not implemented in 1C and can be modified independently.

What does an exporter need to know when exporting to Kazakhstan?

The relationship between the Russian Federation and Kazakhstan in the export procedure is regulated by the Protocol attached to the agreement on the EAEU. This Protocol contains all the nuances of the relationship.

What the exporter needs to pay attention to: (click to expand)

- It is possible to adjust the tax base for added tax, the reasons for this are determined by the Protocol - an increase or decrease in the price of exported assets, a decrease in the quantity of goods, as well as others. In this case, adjustments due to an increase in the number of exported valuables are not allowed;

- Among the documents submitted to the Federal Tax Service to justify the right to a 0% tax rate is an application for the import of goods and payment of indirect taxes. They are provided by the buyer from Kazakhstan with his tax stamp. If there are several such applications, then you do not have to submit all of them to the Russian tax office, but provide a list of them, the format of which is standard and approved by Order No. ММВ-7-15 / [email protected] dated 04/06/15, prepared and approved by the tax office of the Russian Federation.

Sales of shipped products

Sales of shipped products for export in 1C 8.3 Accounting is prepared with the document Sales of shipped goods in the Sales – Sales – Sales of shipped goods section – Create button.

The document reflects the transfer of ownership of goods based on a previously completed shipment. It is convenient to enter it on the basis of the document Sales (deed, invoice) type of operation Shipment without transfer of ownership .

Let's look at the features of filling out the document Sales of shipped goods using the example.

- Number - the serial number of the document in 1C, assigned automatically when saving the document;

- from - the date of transfer of ownership of the product from the seller to the buyer under the contract. In our example, the date the carrier transfers the goods to the buyer’s warehouse;

- A shipment document is a Sales document (act, invoice) , which was previously issued for the shipment of products without transfer of ownership.

Postings according to the document

The document generates transactions:

- Dt 90.02.1 Kt 45.02 - write-off of production costs;

- Dt 62.21 Kt 90.01.1 - revenue from sales of products, where: the unpaid portion is assessed at the exchange rate on the date of sale from the Currency .

Control

Calculation of the ruble amount of revenue from the sale of finished products for export.

Please note that revenue in foreign currency is converted into rubles at the exchange rate of the Central Bank of the Russian Federation on the date of recognition of income, i.e., sale, but the rate also depends on the payment procedure.

In our example there was no prepayment. Revenue in accounting and accounting records is calculated at the exchange rate on the date of sale (clause 9 of PBU 3/2006; clause 8 of Article 271 of the Tax Code of the Russian Federation).

Tax base for VAT

According to the legislation, the tax base for VAT in foreign currency is recalculated into rubles at the rate of the Central Bank of the Russian Federation on the date of shipment (clause 5 of the EAEU Protocol), the rate on the date of transfer of ownership is not taken into account. Therefore, revenue in accounting and NU may differ from the tax base for VAT.

When converting revenue from foreign currency into rubles for:

- BU and NU rate is applied by the Central Bank of the Russian Federation on the date of the advance and on the date of sale (transfer of ownership) (clause 9 of PBU 3/2006, clause 8 of Article 271 of the Tax Code of the Russian Federation);

- To calculate the tax base for VAT, only the exchange rate of the Central Bank of the Russian Federation on the date of shipment (transfer) of goods is used (clause 3 of Article 153 of the Tax Code of the Russian Federation).

The tax base for VAT is determined at the rate of the Central Bank of the Russian Federation on the date of shipment, so it will differ from the sales amount in accounting and tax accounting in ruble equivalent if:

- there was an advance payment;

- the date of transfer of ownership does not coincide with the date of shipment.

In our example, there was no prepayment, and the revenue in accounting and accounting records does not coincide with the VAT tax base because the USD exchange rate is different on the date:

- shipments - 62 rubles;

- sale (transfer of ownership of products) - 63 rubles.

Income tax return

In the income tax return:

Revenue from the sale of finished products for export is reflected in the income from sales:

Sheet 02 Appendix No. 1:

- page 010 “Proceeds from sales - total”, including: page 011 “revenue from sales of goods (works, services) of own production.” PDF

Learn more about Setting up Accounting Policies in NU

The cost of finished products sold is reflected in direct expenses:

Sheet 02 Appendix No. 2:

- page 010 “Direct costs related to goods sold...”. PDF