Many owners of urban real estate located in apartment buildings decide to create an HOA. This is done not only to optimize utility costs, but also to maintain residents’ property in proper technical condition. Each partnership of real estate owners must be organized in accordance with the regulations of Federal law. At the same time, the HOA is required to maintain accounting records and submit reports generated based on the results of the reporting periods to the tax office.

Features of creating an HOA

The main purpose of creating an HOA is the following:

- effective management of real estate, which legally belongs to the participants of the partnership;

- timely repair and maintenance of utilities;

- calculation of utilities according to real and not inflated tariffs;

- improvement of the area adjacent to apartment buildings, etc.

Federal law does not prohibit property owners' associations from engaging in commercial activities whose purpose is to generate income. In this case, we are not talking about running a business in its direct sense, but about providing small services on a paid basis for the participants of the partnership:

- construction of additional real estate;

- advertising placement;

- rental of real estate;

- carrying out repair work, etc.

When concluding any agreements, the management of the HOA must respect the interests of the homeowners. All proceeds received go to the current account of the partnership. After this, the funds are distributed to special funds. The HOA can spend it only in those areas that were reflected in the statutory documentation approved by all property owners. All funds that will be credited to the current account in the form of membership fees can only be used to pay for utilities, as well as to maintain real estate in proper technical condition.

Russian legislation allows not only owners of city apartments to unite in HOAs, but also owners of private houses located on adjacent land plots.

The procedure for generating funds

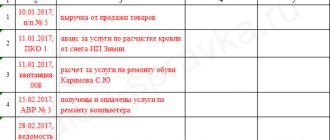

Accounting in an HOA involves recording all transactions that are directly or indirectly related to the partnership. The specialist who will be entrusted with accounting is required to draw up primary documentation, the data from which must be posted to the appropriate registers.

When organizing accounting in a partnership, incoming funds from which capital is formed must be registered in a separate accounting register:

- contributions for major repairs;

- receipts in the form of entrance and membership fees;

- penalties for late paid utilities (the full amount of rent is not included);

- subsidies;

- the difference between received utility payments and their actual cost;

- income received while conducting commercial activities, etc.

Accounting for direct settlements in the posting management company

- Lawyer consultation

- Articles

In the accounting of a housing and communal services management company, if transactions under the simplified tax system are taken into account, then 3 and 7 will not be included in the accounting. As for VAT benefits for management companies located on OSNO, they are reflected in accounting as follows (there will be no postings 3 and 7): D20 K19 – VAT on purchased resources is reflected as part of their cost.

This is how accounting will be carried out in the housing and communal services management company; the postings for OSNO are written above. The entries listed above are most often found in the accounting of management companies, however, of course, accounting in management companies is not limited to them only.

If questions arise regarding other accounting objects, the accountant can refer to the Instructions for the chart of accounts, which is part of the above-mentioned Order of the Ministry of Finance of the Russian Federation No. 94n.

In the last article we looked at the activities and accounting in HOAs, in this article we will pay attention to the following questions: what is the main activity of the Management Company (MC) and what are the features of accounting in the Management Company? The management company buys housing and communal services from suppliers and sells them to the public. Let's look at how accounting is organized in the Management Company. Accounting entries in the Criminal Code. D-t 20 K-t 60 – invoices received from housing and communal services suppliers. D-t 19 K-t 60 – incoming VAT from the accounts of housing and communal services suppliers. Dt 26 Kt 60 – invoices received from the Unified Center for services to the population. D-t 19 K-t 60 – incoming VAT from the Unified Center. D-t 76 “ERC” K-t 90.1 – accrued housing and communal services according to the ERC certificate for the current month. Analytical accounting separately for each payer (payment and accrual) is carried out in the Unified Center.

Rules for accounting in housing and communal services (nuances)

Important

Do you want to know which property manager is servicing the house? By following the link, you can do this! We have articles on how to refuse and change the property code, refusal to maintain a house, registration in the GIS after transfer from the developer, as well as on the provision and disclosure of information. Surely it will be useful for you: Housing and communal services management company: OKVDE

- When registering a management company, there is another important issue - the choice of code for the All-Russian Classifier of Economic Activities. The OKVED code is intended to ensure that regulatory authorities are aware of what the organization does.

In the case of a management company, the most acceptable activity code is 70.32.1

- Management of housing stock activities.

- directly to the management organization or the payment agent indicated by it (bank payment agent);

Attention

If the house is put into operation, but the apartment is not transferred under the transfer deed, the citizen has no obligation to pay for utilities (see, for example, the decision of the Arbitration Court of the Krasnoyarsk Territory of March 7, 2013 No. A33-15279/2012). There are several options for making utility payments by the consumer:

- directly to the resource supplying organization (with the exception of payments for utility resources for general house needs).

To apply the second option, the owners must decide on this at a general meeting. This procedure is established in paragraph 63 of the Rules, approved by the Decree of the Government of the Russian Federation of May 6, 2011.

No. 354, and parts 7.1 of Article 155 of the Housing Code of the Russian Federation.

Principles of accounting in housing and communal services

D-t 76 K-t 90.1 - accrued debt of citizens for housing and communal services. D-t 90.3 K-t 68 “VAT” - accrued VAT on services. D-t 90.2 K-t 20, 26 - write-off of costs. D-t inc. . 90.9 Set count. 99 (or D-t account 99 K-t account 90.9) – the financial result from the activities of the management company is calculated. Based on clause

13th century 40 of the Tax Code of the Russian Federation, when selling goods, works, services at regulated state prices, state prices are accepted for taxation.

If organizations sell taxes to citizens at preferential prices, then they are required to reflect revenue for services at state prices without applying benefits that are established for certain categories of citizens. Those.

preferential amounts are included in sales and VAT is charged on them. In this case, an entry is made: D-t 76 “Budget debt for benefits” K-t 90.1D-t 90.3 K-t 68 - VAT has been charged to the budget.

Prednalog.ru

Management companies receive from budgets When the Management company receives targeted funds from the budget, for example, for major repairs or other subsidies, then to account for them, account 86 is used. Account 86 - Targeted financing (Passive) “Targeted financing” and the following entries are made:

- Debit 51Account 51 - Current accounts (Active) Credit 86Account 86 - Targeted financing (Passive) - target funds received from the budget.

- Debit 20 Credit 10Account 10 - Materials (Active) (60) - materials written off (services received) to perform targeted work.

- Debit 86Account 86 - Targeted financing (Passive) Credit 20 - actual costs incurred are reflected in target funds.

Management companies can delegate part of their responsibilities to unified cash settlement centers (USCC).

Forum burmistr.ru - forum about housing and communal services (management of apartment buildings)

- 1 Calculation of fees for utilities

- 2 Notification of consumers about changes in tariffs and standards

- 3 Accounting

In order to provide residents with utility services, the management company enters into contracts with resource supply organizations for the purchase of utility resources (clause 13 of the Rules approved by Decree of the Government of the Russian Federation of May 6, 2011 No. 354). Calculation of fees for utility resources Owners of premises in an apartment building pay for cold and hot water, electricity, gas and heat, as well as for sewerage. The payment should be calculated according to the formulas given in Appendix No. 2 to the Decree of the Government of the Russian Federation of May 6, 2011 No. 354: Payment for consumed utilities = Volume of consumed services × Tariff Tariffs are set by the resource supplying organization (clause 38 of the Rules approved by the Decree of the Government of the Russian Federation dated May 6, 2011

Accounting entry for penalties for housing and communal services

For the purpose of correct generation of VAT reporting, the management company must issue an invoice for the Unified Center, which will be re-issued to the tenant. The management company does not have direct payments to residents. We draw up the “Implementation” document as follows: We draw up the “Report to the Principal” document.

On the “Main” tab we will indicate the counterparty - RSO, contract, on the “Goods and Services” tab - the services provided, the amount, VAT and buyer - SRC, the date of sale: The document “Report to the principal” should not generate transactions, it is required for entry based on “Invoice received” from RSO. Dt 76 (ERC) / Kt 90 (UK) – Management services accrued In the already created “Realizations” document, in which the “Agency services” tab is filled in, fill in the “Services” tab: Document postings: For the purposes of correct VAT accounting, the posting should be Dt 76 (ERC) Kt 90 (Dt 90.03 Kt 68.02).

Situation: how can the management company notify consumers about changes in tariffs and utility consumption standards? Write a notice to each consumer in any form.

The management company must convey information about changes in tariffs and utility consumption standards to the consumer in writing no later than 30 days before the date of issuance of payment documents.

This rule applies if the contract for the provision of utility services does not regulate a different procedure.

This is stated in paragraph 68 of the Rules, approved by Decree of the Government of the Russian Federation of May 6, 2011 No. 354. The legislation does not directly state the need to send a written notice to each tenant and each owner of non-residential premises in an apartment building. RSO), as well as the organization of the work of the management company and reflection of its work with the SRC and RSO.

The table shows the transactions and postings by which the completed transactions will be reflected in the Accounting: Postings in accounting (Dt Kt) Reflected transactions Amount, rub Dt 76 (Resident) / Kt 76 (Management Company) Accrual of services 2,100.00 Dt 51 / Kt 76 (Resident) Receipt of payment to the current account 1,000.00 Dt 76 (UK) / Kt 51 Transfer of payment to the Criminal Code (for the management service) from the current account 200.00 Dt 76 (RSO) / Kt 51 Transfer of payment to the RSO (for RSO services) from the current account 800.00 Dt 76 (UK) / Kt 76 (RSO) Offsetting between RSO and UK 800.00 Final balance on accounts Dt Kt 51 0.00 0.00 76 (Resident) 1,100.00 0.00 76 (UK) 0.00 1,100.00 76 (RSO) 0.00 0.00 Dt 76 (Resident) / Kt 76 (UK) - Accrual of services This operation reflects the accrual of services of the Management Company and RSO by the Unified Settlement Center to the resident, with the SRC is an agent of the management company and is not directly associated with RSO.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

- How to conduct accounting in a housing and communal services management company?

- Simplified tax system or OSNO – which taxation regime should a management company choose?

- Postings in the accounting of the management company

- Housing and communal services management company: OKVDE

How to conduct accounting in a housing and communal services management company? The activities of a management company most often come down to two processes: the acquisition of resources from suppliers and their subsequent resale to tenants.

The first process forms accounts payable and expenses of the organization, the second - accounts receivable and income.

Source: //vip-real-estate.ru/2021/05/02/uchet-pryamyh-raschetov-v-upravlyayushhej-kompanii-provodki/

How should utility bills be accounted for?

If utility payments have been accrued to the owners of real estate, they must be reflected in the appropriate accounting accounts. The difference that arises between the actual and nominal cost of utility bills is subject to taxation at rates approved by current legislation. If payment for utility services is received into the current account from property owners who have not entered into a partnership and have not entered into an agreement with it for the provision of agency services, then the HOA accounting department must accrue taxes on them in full.

Features of accounting

Features of accounting in HOAs are as follows:

- Based on the results of the reporting period (as a rule, this is a calendar year), financial statements of the HOA are compiled, which are transferred to the members of the partnership for study. The reports must contain reliable information from which property owners can learn about the activities of the partnership, as well as what profit the HOA made.

- Accountants prepare an estimate of expenses and income for the next year, which must be approved at a general meeting of members of the partnership. In the future, it is this document that specialists will rely on when maintaining accounting and tax records in the HOA.

- Information related to the execution of the approved estimate for the reporting period must be posted on the official website of the HOA. The responsibility for checking such estimates is assigned by Federal legislation to the housing supervision inspection (territorial).

Basic accounting entries in the HOA:

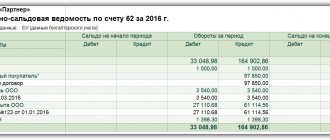

| Debit | Contents of business transactions | Credit |

| 76 | Debt in contributions, which is registered with a member of the company | 86 |

| 62 | Debt owed by the owner of a property who refused to join the company | 90 |

| 26 | Expenses that arise during the maintenance of property owned by the company | 70, 69, 02, 10 |

| 26 | Tax calculation under the simplified taxation system | 68 |

| 26 | Costs incurred by the partnership in maintaining its premises in proper technical condition, as well as payment for the services of third-party organizations providing their maintenance | 60 |

| 86, 20 | Distribution of society's costs associated with property maintenance among property owners who have refused membership in the HOA | 26 |

| 90 | Write-off of costs incurred by the company for the maintenance of property that is not the property of the HOA participants | 20 |

| 90 | Expenses associated with servicing the current account, accrued commissions, etc. | 51 |

| 99 | Carrying out balance sheet reformation if the company made a profit based on the results of the reporting period | 84 |

| 84 | Use of the company's retained earnings for targeted financing | 86 |

| 76, 62 | Presentation of company losses for compensation | 84 |

| 86, 20 | Creation of a special fund, the funds of which can be spent on repair work | 96 |

Accounting entries of a partnership operating on the simplified tax system:

| Debit | Contents of business transactions | Credit |

| 76 | Accrual of mandatory contributions to members of the company, which must be made within the time limits approved at the general meeting, in particular contributions that are submitted by all owners for major repairs | 86 |

| 50, 51 | Receipt of contributions from property owners to the current account or cash desk (with the exception of contributions for major repairs, since these amounts must be accumulated in a special account) | 76 |

| 55 | Receipt of contributions from members of the society intended for major repairs | 76 |

| 20, 26 | Reflects the costs of the current period that are associated with the maintenance and management of HOA property | 60, 76 |

| 86 | The costs incurred by the company in managing and maintaining the property are written off (the costs were borne from funds from the fund created for targeted financing) | 20, 26 |

Account of wiring for repairs from capital repairs in the homeowners association

Debit 60 Credit 51 (55) – payment was transferred to a third-party contractor performing repairs; Debit 20 Credit 60 – expenses for repairs performed by third-party contractors are reflected; Debit 19 Credit 60 – input VAT presented by contractors is taken into account; Debit 20 Credit 19 – the amount of VAT claimed by contractors is attributed to the costs of repairs carried out by contract; Debit 20 Credit 70 (69, 10...) – reflects the costs of repairs carried out by the homeowners association (TSN) on their own; Debit 86 Credit 20 – reflects the expenditure of targeted financing; Debit 86 Credit 68 subaccount “Calculations for VAT” – VAT is charged for repair work carried out by the HOA (TSN) on its own.

We recommend reading: How much do inheritance registration services cost?

Entry, membership, share fees, donations, and funds in reserve for repairs are not subject to taxation. Tax accounting of amounts received as income in HOAs is no different from accounting in other organizations engaged in commercial activities.

How are reports generated and submitted?

Accounting in HOAs requires the mandatory generation of reports that must be submitted both to the Federal Tax Service and to statistical authorities and extra-budgetary funds. Accounting statements in such partnerships are prepared for the year (even if the HOA does not carry out commercial activities and is on the simplified tax system), and includes:

- Balance.

- Report on the intended use of funds.

- Register of members of the partnership.

- Income statement.

In addition to accounting reports, the partnership must submit the following forms related to the calculation and payment of wages:

| Federal Tax Service | Form 6-NDFL Form 2-NDFL Average number of employees |

| Pension Fund | Form SZV-M Form RSV-1 |

| FSS | Form 4-FSS |

If the activities of the HOA are carried out on a simplified basis, then it is necessary to submit a corresponding declaration to the Federal Tax Service. It is worth noting that HOAs under the simplified tax system are exempt from paying the following taxes:

- at a profit;

- on property;

- VAT.

Taxation under the simplified tax system provides for the opportunity for a partnership to independently determine its own rate:

- A 6% rate is applied to income.

- A rate of 15% is applied to the difference between income and expenses.

The HOA on OSNO is obliged to accrue and pay to the budget all taxes and fees provided for by law, as well as submit the relevant declarations to the regulatory authorities. For late submission of reports, the responsible persons of the partnership will be subject to penalties and interest.

Accounting in HOAs: how to generate an annual report in a simplified manner

There are many different ways to manage multifamily housing. One such way is to create a homeowners' association. This is an independent legal entity that must meet the requirements imposed on it by the legislation of the Russian Federation. In the article you will find information on how to generate a simplified annual report and consider the main accounting entries.

We recommend reading: Documents for Income Tax Reimbursement When Purchasing an Apartment

Accounting in an HOA is essentially no different from accounting in another non-profit organization. The reporting consists of a balance sheet, a report on the intended use of funds and a statement of financial results. At the same time, the HOA maintains accounting records regardless of whether the organization conducts commercial activities or not. The simplified taxation system in itself is also not a reason for an HOA not to keep accounting records.

Taxation

Each HOA created by the owners of real estate has the right to independently choose a taxation system for itself. Federal legislation provides for the following tax regimes for such partnerships:

- USN.

- BASIC.

During the process of state registration of an HOA, its owners can choose a simplified taxation system. If they do not indicate this in the appropriate application, the HOA will be automatically transferred to the general taxation system. Specialized Internet resources contain step-by-step instructions that will allow property owners to avoid mistakes when carrying out registration activities.

When determining the tax base, accountants of such partnerships must clearly distinguish which of the funds received can be considered income and which will not be taxed. If funds from property owners in the form of contributions for major repairs are transferred to the current account, they will not be subject to taxation. But, at the same time, if funds for the same purposes come from property owners who refused to join the HOA, then they will be considered income of the partnership.

All funds received to the accountant's current account or to the cash desk of the accountant's partnership must be accounted for separately. Also, separate records should be kept in the appropriate registers of all costs that were incurred at the expense of earmarked revenues. Based on the results of each period, accountants must prepare reports that are submitted to regulatory authorities. They must transfer all taxes to the budget within the deadlines established by law. If the requirements of the Tax Code of the Russian Federation are violated, penalties will be applied to the HOA.