Taxes on premiums | Is the premium taxable - Kontur.Accounting

Employees are given bonuses as incentives for quality work and length of service. It can be paid annually, monthly or quarterly. The employer decides how often to stimulate employees. Taxes are collected on employee salaries, and many people wonder if bonuses are taxable.

A little theory: accounting concepts and types of bonuses

The bonus is an optional payment. This is a monetary reward for an employee for special merits. There are several types of incentives:

- by form of payment: in cash or in the form of a gift;

- by frequency of payments: one-time or for a certain period;

- by appointment: for performing special tasks;

- according to the indicator: for the anniversary, for length of service.

According to Article 191 of the Labor Code of the Russian Federation, bonuses can be awarded for:

- high qualifications;

- high labor achievements;

- active in the development of the company.

Bonus and salary

The bonus is not the main component of employee salaries, although according to Articles 129 and 191 of the Labor Code of the Russian Federation, the employer has the right to do so.

Bonus payments are credited to employees' bank accounts or issued along with wages. With the help of a bonus, the employer encourages the employee to work more efficiently.

The bonus also affects the amount of income tax: it increases labor costs.

Conditions for awarding bonuses

There are several official conditions for bonuses for employees:

- Federal Law No. 208. If one of the founders of the organization decides to award a bonus to employees, he makes this decision together with his colleagues.

- Article 129 of the Labor Code of the Russian Federation. The procedure for calculating monetary remuneration must be specified in the employment contract.

- Article 135 of the Labor Code of the Russian Federation. All issues of bonuses for employees must be agreed with the trade union, if there is one at the enterprise

Taxation procedure for bonuses

Employers ask whether the bonus is subject to personal income tax. Their doubts are justified: firstly, such remuneration is always the employee’s income, and the income is taxed; secondly, the bonus is not remuneration.

The answer to this question lies in the first point: the premium is income. According to Article 209 of the Tax Code of the Russian Federation, personal income tax and insurance payments are paid from it. Income tax on remuneration is calculated as standard. Awards received for high achievements in scientific activities, employee rewards in honor of a holiday, and monetary rewards not exceeding 4,000 rubles are exempt from personal income tax.

Why is it profitable to pay taxes on employee bonuses?

Articles 255 and 272 of the Tax Code of the Russian Federation state that all monetary remuneration accrued to employees is included in labor costs.

This reduces the amount of income tax (for organizations using the OSNO) or the single tax (for organizations using the simplified tax system). To avoid misunderstandings with the tax office, keep documents confirming your right to a tax reduction.

Everything related to the premium and its inclusion in costs must be regulated by regulations:

- In the employment contract, specify the conditions for calculating remuneration. It is prohibited to deduct incentive amounts from income tax if this condition is not met (Article 270 of the Tax Code of the Russian Federation).

- Any organization must have a “Regulation on employee bonuses”.

Insurance premiums from premium

According to Federal Law No. 212, payments to employees working on the basis of an employment contract are subject to insurance contributions. Deductions for insurance premiums from remuneration proceed in the same manner as with wages. Contributions must be paid to the Federal Tax Service, Social Insurance Fund and Compulsory Medical Insurance Fund.

Important! Insurance premiums are accrued in the same month in which the monetary reward was accrued.

Taxes on a one-time employee bonus

All one-time cash awards are subject to taxation in the form of insurance contributions and personal income tax in the following cases:

- payment of a one-time bonus is fixed by internal regulations;

- all expenses are recorded in documents;

- one-time payments are related to production.

What happens if you don’t pay taxes on your premium?

In accordance with the Criminal and Tax Codes, penalties and fines are provided for tax evasion, penalties are possible from responsible persons (accountant, director of the organization) and blocking of the company's current account. According to paragraph 3 of Art. 110 of the Tax Code of the Russian Federation, in case of accidental violation of tax legislation, a fine of 20% of the missing amount is provided. And for intentional violation of the law - 40% of the missing amount.

So, all employee bonuses, regardless of whether they are paid permanently or one-time, are subject to income tax and insurance payments. Exceptions may include rewards for special achievements in science, as well as incentives, the amount of which per year does not exceed 4,000 rubles.

Alexandra Averyanova

Pay taxes on premiums automatically in the cloud service Kontur.Accounting. The service will help you correctly reflect the premium and pay taxes on it. Use the support of our experts and use the service for free for the first 14 days.

Source: https://www.b-kontur.ru/enquiry/453-nalogi-s-premii

Results

According to the current norms of tax legislation, the taxpayer has the right to take into account in income tax expenses, including accruals of an incentive nature, namely bonuses for production results, high achievements in work and other similar indicators.

An exception to this rule are bonuses that are paid not on the basis of an employment contract and at the expense of special-purpose funds or targeted revenues. Representatives of the Ministry of Finance in their explanations fully adhere to the norms established by paragraph 2 of Art. 255 and paragraphs 21, 22 270 of the Tax Code of the Russian Federation, noting that these expenses must be recognized as economically justified and documented expenses incurred to carry out activities aimed at generating income.

When considering controversial issues regarding the accounting of bonuses (of various types and with different names) in income tax expenses, the courts proceed from the following:

- the employer has the right to establish various bonus systems, incentive payments and allowances;

- the conditions, terms and amounts of bonus payment must be provided for in employment contracts and (or) collective agreements;

- the bonus must be related to work results.

Accordingly, when developing provisions for any incentive payments, the employer must keep in mind the above conclusions in order to defend its right to take bonuses into account as expenses for the purpose of calculating income tax, including in the courts.

One-time bonuses to employees: how not to make mistakes with taxes

Source: Glavbukh magazine

One-time (one-time) bonuses are paid not for a certain period, but upon the occurrence of a specific event (successful completion of a project, anniversary, etc.).

An organization may provide for the payment of one-time bonuses in its internal documents:

- employment contract (paragraph 5, part 2, article 57 of the Labor Code of the Russian Federation);

- collective agreement (part 2 of article 135 of the Labor Code of the Russian Federation);

- a separate local document of the organization (Regulations on remuneration, Regulations on bonuses, etc.) (Part 2 of Article 135, Article 8 of the Labor Code of the Russian Federation).

In this case, a one-time bonus may be an integral part of the remuneration system. Accordingly, one-time bonuses for production results can be taken into account when calculating average earnings.

However, one-time bonuses may not be part of the organization’s remuneration system and are assigned only by order (order) of the manager

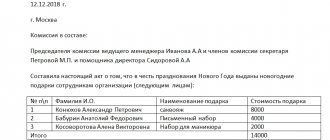

The basis for accrual of any one-time bonus is the manager’s order to reward the employee. The order is signed by the head of the organization. The employee(s) must be familiarized with the order against signature.

The procedure for reflecting one-time bonuses in accounting depends on the sources from which they are paid:

- due to expenses for ordinary activities;

- at the expense of other expenses.

Payment accounting

In accounting, one-time bonuses to employees accrued for labor performance are classified as expenses for ordinary activities (clauses 5 and 7 of PBU 10/99). Record the accrual of such bonuses as follows:

DEBIT 20 (23, 25, 26, 28, 29, 44) CREDIT 70

– the bonus was accrued at the expense of expenses for ordinary activities.

Non-production one-time bonuses (for anniversaries, holidays, etc.) are classified as other expenses in accounting (clause 11 of PBU 10/99). Reflect their accrual as follows:

DEBIT 91 subaccount “Other expenses” CREDIT 70

– the bonus is accrued at the expense of other expenses.

Personal income tax on bonuses

Regardless of the taxation system that the organization uses, personal income tax must be withheld from the entire premium amount (subclauses 6 and 10, clause 1, article 208 of the Tax Code of the Russian Federation).

At the same time, the answer to the question in which month the amount of one-time bonuses should be included in the tax base for personal income tax depends on whether the bonus is production or not.

Non-production one-time bonuses (for example, for an anniversary, a holiday) are not part of the salary and, therefore, do not relate to labor costs. Therefore, include their amount in the personal income tax tax base of the month in which they were paid (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

The calculation of personal income tax on one-time production bonuses, in turn, depends on the period for which they are accrued.

It could be:

- month;

- quarter;

- year;

- upon the occurrence of a specific event (for example, a one-time bonus for the successful completion of a project). One-time production bonuses paid upon the occurrence of a specific event should be included in the personal income tax tax base at the time of payment to the employee (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

Insurance premiums from one-time payments

From the premium amount, you need to calculate and pay contributions for insurance against accidents and occupational diseases (Article 20.1 of the Federal Law of July 24, 1998 No. 125-FZ).

Regardless of the taxation system that the organization uses, accrue contributions to compulsory pension (social, medical) insurance for the amount of one-time premiums. And don’t forget: this rule applies regardless of whether the bonus is provided for in the employment contract or not.

The fact is that insurance premiums are levied on payments made “within the framework of labor relations and civil contracts.” And any bonus to an employee, from the point of view of officials, fits within this framework. Moreover, the judges also agree with them.

As stated in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 25, 2013 No. 215/13, one-time bonuses for the New Year are related to work responsibilities and are stimulating in nature. This means that these payments are fully within the framework of labor relations. And therefore insurance premiums must be charged on them.

Tax accounting of bonuses

One-time bonuses reduce the tax base for income tax if the following two conditions are simultaneously met:

- bonuses are provided for in the employment contract (paragraph 1 of article 255 and paragraph 21 of article 270 of the Tax Code of the Russian Federation);

- bonuses were paid for labor performance (clause 2 of article 255 of the Tax Code of the Russian Federation).

Source: https://otchetonline.ru/art/buh/48014-razovye-premii-rabotnikam-kak-ne-oshibit-sya-s-nalogami.html

Reflection in accounting, postings

Reflection of the accrual of bonus payments should be based on its type and basis for accrual. In which account the bonus is reflected depends on whether it is related to the performance of labor functions or not. In accordance with the chart of accounts (Order of the Ministry of Finance 94n dated October 31, 2000), settlements with personnel for wages are reflected in account 70. Analytical accounts are opened for each employee. The bonus is part of the salary. Therefore, their accrual is reflected in the credit of account 70, and the payment in the debit. Remunerations for production indicators are attributed, as a rule, to the same cost accounts where the salary part also belongs:

Debit 20, 25, 26, 44 Credit 70

A special type is rewards for holidays (anniversaries, marriages, professional holidays, etc.). They are not related to the production activities of the organization and therefore are not taken into account as part of the costs associated with production and sales. Non-production bonuses in accounting relate to other income and expenses:

Debit 91 Credit 70

Taxation of bonuses to employees in 2021 - is the bonus taxable?

— Business organization — Personnel — Is the bonus taxable?

Allocating bonuses to subordinates is a common practice among managers of domestic enterprises.

Basically, such a material reward is awarded for labor achievements, but there is a wide range of bonuses that are not directly related to the work process, for example, one-time bonus payments upon retirement.

The essence of the concept and types of awards

A bonus is a payment to an employee in the form of additional money for special merits. In particular, for the excellent performance of their duties. Such payments are considered to be regular. In addition to the agreed conditions, the bonus is also based on a specific event (for example, a professional holiday).

The bonus must be paid to employees on the basis of the relevant provision enshrined in the company's regulations. Based on Art. 129 and art. 191 of the Labor Code of the Russian Federation, bonuses can be an incentive for:

- high labor achievements;

- special skill associated with the subject's specialty;

- length of service or high qualifications;

- proposal and assistance in the implementation of progressive ideas to improve the production process, etc.

Despite the broad theoretical basis, as well as the widespread practice of bonuses, many people wonder whether the bonus is subject to taxes and insurance premiums.

Place of bonus in salary

. Bonus payments are not a mandatory component of employee salaries. However, based on Art. 129 and art. 191 of the Labor Code of the Russian Federation, the employer has the right to do this. Including a bonus in the subject’s final earnings allows you to:

- encourage employees to improve the performance of their work activities;

- regulate the amount of income tax by increasing the amount of labor costs for employees.

The bonus can be paid from the net profit of the enterprise, if the payment is not related to labor merits, and can also be a cost for the company if it is regularly paid based on the labor merits of the subject. However, the source of its formation does not affect the right to include the bonus in the salary.

Even in the case where the bonus is not paid as an incentive amount, when it is a one-time payment or its source is considered to be pure profit, the category in question nevertheless remains the employee’s income.

All bonus payments are credited to employees in their bank accounts or issued from the company's cash desk simultaneously with their salaries.

Taxation of bonus payments

Personal income tax

Any bonus remuneration is employee income. Consequently, the employer, as a tax agent, is obliged to withhold personal income tax and transfer it to the budget.

Insurance premiums

Accruals for production indicators are fully subject to social insurance contributions (Chapter 34 of the Tax Code of the Russian Federation). They also need to pay contributions for injuries (125-FZ dated July 24, 1998).

The Ministry of Finance insists that payments for holidays are subject to insurance premiums. But the courts take a different point of view (Determination of the Supreme Court of the Russian Federation No. 310-KG17-19622 of December 27, 2017). Contributions do not have to be charged if you are ready to defend your point of view in court.

Income tax

If the accrual is a remuneration for labor, then it and the insurance premiums accrued on it are recognized as expenses of the organization in full (clause 2 of article 255 of the Tax Code of the Russian Federation).

Accruals for holidays are not recognized as expenses, since they are not related to production results.

If entries for the bonus are made in accounting using profits from previous years, then it cannot be recognized when calculating income tax. But insurance premiums accrued for such payment can be taken into account as part of other income and expenses in full (Letter of the Ministry of Finance No. 03-03-06/1/27634 dated 06/09/2014). Postings for calculating bonuses to employees

| Business transaction | Debit | Credit |

| Accrued monthly, quarterly, one-time bonus payment related to the performance of job duties | 20, 25, 26, 44 | 70 |

| Posting: Anniversary Bonus | 91 | 70 |

| Personal income tax is withheld from employee remuneration | 70 | 68 |

| Insurance premiums accrued | 20, 25, 26, 44, 91 | 69 |

| Posting: bonus issued from the cash register | 70 | 50 |

| The payment was transferred to the employee’s bank card | 70 | 51 |

Is the premium taxed and in what order does it happen?

According to Article 191 of the Labor Code of the Russian Federation, bonuses are classified as incentives for work.

It is usually called a monetary reward, an incentive payment for:

- professional achievements of a person at work;

- high skill of the employee demonstrated during a certain period of work;

- good production results for the month, quarter, or other period.

Is the premium taxed and in what order does it happen?

The bonus is included in the salary, and this fact is noted in the Labor Code, in article 129.

It says here that an employee’s salary consists of a salary determined by the level of qualifications, the volume of tasks performed and their complexity, as well as from:

- compensation payments: additional payments and allowances for harmfulness, overtime, etc.;

- incentive payments: cash accruals for certain achievements of an employee, carried out to encourage him.

Composition of wages according to Article 191 of the Labor Code of the Russian Federation

Thus, when talking about whether the premium is taxable, we can give a clearly positive answer . Personal income tax (PIT) is deducted here.

Deductions are made for the reason that the premium does not apply to non-taxable income, the list of which is strictly limited:

- maternity benefits;

- compensation payments for compensation for harm to health;

- compensation upon dismissal;

- material aid;

- payment for medical services;

- payment for professional training and retraining of an employee;

- gifts with a total value of up to 4,000 rubles per year, which are received by the employee from management;

- compensation to an employee for the costs of renting or purchasing housing.

This is a list of a worker's basic income that cannot be subject to income tax. Their complete list is given in Art. 217. Tax Code.

Important! The personal income tax rate is 13%. This figure applies to tax residents of the country.

In Russia, personal income tax is 13%, which can be returned for dental treatment, buying an apartment, training and for some other categories of expenses

If you are interested in how to return 13% for dental treatment, then read the article on our portal.

How tax is withheld from bonuses

Article 226 of the country's Tax Code states that the day the employee receives the bonus is the date of its direct payment. This time must coincide with the withholding of personal income tax. Thus, the tax must be withheld exactly within this period. How the organization pays the bonus - to the employee’s card or in cash - is not taken into account.

When personal income tax is withheld, it must be transferred to the treasury. The procedure is carried out on the same day. The deadline is the next day after the award is accrued or issued.

To be more precise, the order is as follows:

- when a person receives a bonus in cash withdrawn from a bank, the transfer of the withheld tax to the treasury must be made on the same day;

- when the amount is transferred to the employee's bank account, the tax is deducted on the same day;

- If the incentive payment is made from the company's revenue, there is a day following the date of payment for tax deduction.

When a person receives a bonus in cash withdrawn from a bank, the transfer of the withheld tax to the treasury must be done on the same day

All the above points relate to labor bonus accruals and must be complied with without fail and strictly controlled by the accounting department.

Is unearned bonus taxable?

It is worth noting that quite recently the topic of which incentive payments are taxable and which are not was constantly on the agenda in arbitration courts. The reason is that all bonus payments are divided into two categories:

- For the work.

- Peri-work incentives.

We discussed the topic of labor incentive payments above. Types of bonuses

Peripheral incentives include cash accruals in the following situations:

- anniversary dates;

- professional holidays;

- corporate holidays, for example, the day the company was founded.

Bonus tax calculator

Today, the position regarding the taxation of near-employment bonuses has become unambiguous - personal income tax, like the insurance premium in the listed situations, is collected and paid to the treasury without fail.

Personal income tax, like the insurance premium in the listed situations, is collected and paid to the treasury necessarily

When personal income tax deduction can be avoided

Despite the information discussed above, there are still situations when personal income tax is not deducted from bonus accruals. In this case, one should be guided by paragraph 28 of Article 217 of the Tax Code of the country. It is stated here: bonus remuneration with a total amount of up to 4,000 rubles for one year is not subject to taxation , just like winnings or gifts. 28, paragraph 217 of Article of the Tax Code of the Russian Federation

In order not to deduct tax, several conditions must be met:

- time the accrual of bonuses to a significant date;

- conclude a gift agreement under clause 2 of Art. 574 Civil Code of the Russian Federation. It must be in writing.

Clause 2 art. 574 Civil Code of the Russian Federation

What's good about deducting personal income tax?

If you carefully study clause 2 of Art. 255 and paragraph 4 of Art. 272 of the Tax Code, it can be noted that all bonus payments fall into the category of labor costs.

Accordingly, these expenses help reduce income tax, which the organization is obliged to pay to the budget.

This scheme can be implemented by the following types of organizations:

- on the general tax system;

- on a simplified tax system.

Types of awards

To avoid problems with representatives of the tax service, you need to take a responsible approach to registering bonus deductions. In an ideal situation, the rules for conducting them should be written down in one of the following documents:

- labor contract;

- collective agreement;

- regulations on bonuses for company employees.

The best solution is to draw up an additional annex to the employment contract, which will detail the procedure for calculating bonuses. This will allow them to be included in wages and eliminate problems with tax authorities.

By law, the employer must record the bonuses issued in all relevant documents. These include pay slips and 2-NDFL forms.

These are all the things worth knowing about the taxation of stimulus payments and the situations when it is excluded.

– Employee bonuses: “tax” and “labor” nuances, whether an employee’s bonus is taxable and the procedure for paying it

Source: https://law-world.ru/yuridicheskaya-praktika/nalogi/oblagaetsya-li-nalogom-premiya.html

Is the bonus taxable in 2021?

According to the current legislation for 2021, any cash bonus must be subject to income tax, because it is part of wages. However, in some cases it is possible to reduce the tax amount legally. How tax is withheld from bonus payments is described in detail in the material.

We advise you to read the instructions on how to correctly draw up an order for bonuses for an employee; see the details here.

How is the premium taxed with personal income tax?

The statement that the bonus relates to the employee’s salary can be found in the Labor Code.

That is why the premium is subject to taxation. The corresponding confirmation can be found in the Tax Code.

This means that the employee receiving it actually accepts income, from which the employer must calculate and withhold 13% personal income tax.

Along with this, the company also pays insurance premiums from the bonus, as well as from regular wages (salary, other payments). For example, at the end of the quarter, a bonus payment of 50,000 rubles was received.

This means that 13% of this amount must be withheld as tax, i.e. 6500 rubles. The employee is left with 43,500 rubles.

The date of receipt of this income is the date the bonus is actually accrued to the employee when he receives the funds in hand. This date is important in the sense that it is what the employer focuses on when paying personal income tax:

- If the funds were issued in cash, then the tax is transferred no later than the same day.

- If the payment is received by regular bank transfer (to a salary card), then the tax is paid no later than the day the transfer is made.

- In the case where bonus funds are paid from the company’s revenue, the tax is paid no later than the next working day from the moment the employee received (should have received) the funds.

It is important to understand that bonuses can be paid for various reasons, including those not directly related to the employee’s work achievements, for example:

- for the anniversary date;

- on a professional holiday (including company day established by the employer himself);

- for the wedding;

- to the birth of a child;

- as a measure of material support.

However, tax legislation does not distinguish these cases into a separate category. Thus, personal income tax must be withheld from the bonus payment in any case (insurance contributions are also withheld from such payments, as from a “regular” salary).

Reflection of bonuses in expenses

The company always records all its expenses, including in order to correctly pay income taxes. If the employer decides to issue a bonus, this also applies to the company's expenses, but not in all cases:

- If the bonus is related to the employee’s work achievements (fulfillment, exceeding the plan, conscientious work, active participation in new projects, etc.), then such costs can be recognized as expenses. Therefore, the payment of the premium in this case, as well as the payment of insurance premiums from it, is necessarily included in the employer’s expenses.

- If the payment is not directly related to labor merit (an anniversary, another important date), then it cannot be taken into account in the company’s expenses. The corresponding justification is given in the Letter of the Ministry of Finance of the Russian Federation.

The best option from the point of view of preventing claims from inspection bodies is a clear organization of the process of paying bonuses. To do this, you can draw up appropriate regulations on bonuses, where you can specify the grounds, amounts and procedure for their payment. The same points can be reflected in an individual and/or collective employment contract.

Reflection of bonuses in the 2-NDFL certificate and pay slip

All employee income (including those paid irregularly) are reflected in the documents:

- pay slip;

- certificate 2-NDFL.

The bonus is indicated in the month when the actual payment was made (and not when the corresponding decision was made). The following codes are used for marking.

| code | meaning |

| 2002 | payment accrued in connection with professional achievements |

| 4800 | payment accrued in connection with other (non-labor) achievements |

| 501 | gift from the company |

| 503 | providing financial assistance |

| 504 | providing assistance in purchasing medications |

The date of receipt of bonus income is the date of salary, i.e. the last day of the corresponding month. This is exactly how the premium should be reflected in the 2-NDFL certificate.

Previously, we talked in detail about liability for tax evasion; we recommend that you familiarize yourself with this information here.

How to legally avoid paying tax: 3 ways and a practical example

The tax on the bonus itself is paid in full, even if the employee belongs to preferential categories (mother of many children, disabled person of any group, etc.). However, in some cases, a payment to an employee may not legally be considered a bonus, but rather be defined as:

- Financial assistance in connection with difficult life circumstances in the life of an employee and his family.

- Compensation for the cost of medications for the employee or his family members.

- Receiving a valuable gift for a significant date.

EXAMPLE

A former employee of the company retired and is currently undergoing treatment for a chronic illness. His son works in the same company, constantly fulfills the plan and treats the performance of his duties exclusively in good faith. The director decides to reward the employee with a bonus of 30,000 rubles at the end of the year.

In this case, personal income tax can be calculated not from the entire amount, but only from its part, since:

- 4000 rubles can be considered as a valuable gift for the New Year. This amount can be divided into several parts - for example, gifts for a birthday, professional holiday, etc. But the total amount for 1 calendar year should not exceed 4000 rubles.

- Financial assistance can also reach a maximum of 4,000 rubles. The employer makes the decision to pay it voluntarily, depending on the specific circumstances that have occurred in the employee’s life.

- Finally, a certain part within the same amount (4000 rubles) can also be used to pay for medicines. If the drugs are expensive, then the entire amount above this limit is still subject to taxation.

Thus, the amount of 12,000 rubles is exempt from personal income tax, so it can only be withheld from the remaining portion. those. from 18,000 rubles, i.e. 2340 rub.

Therefore, the employee receives 30,000-2,340 = 27,660 rubles. If we consider this entire amount as a bonus for labor achievements or payment for a significant date, then the personal income tax would be 13% of 30,000 rubles, i.e.

3900 rubles, and the employee would receive 26100 rubles.

A complete list of grounds for tax exemption is listed in the Tax Code (Article 217). It is indicated that for each item the maximum non-taxable amount is 4,000 rubles.

It is important to understand that in these cases the employer is actually gifting a certain amount to the employee. Therefore, it is necessary to draw up a gift agreement between the parties. This agreement is drawn up in any form and does not need to be notarized.

We previously talked about the rate and procedure for paying tax on winnings, we recommend that you read this information here.

Thus, bonus payments are always subject to income tax, even if they are unearned in nature.

However, there are some cases where an employer may legitimately consider a cash payment to be a benefit or gift rather than a bonus. Then the tax is not paid within the above amounts.

link:

Loading…

Source: https://2ann.ru/oblozhenie-premii-nalogom/