The article describes the KBK for monetary penalties - fines in 2021 for failure to comply with the norms of the tax code, the code of administrative offenses and codes that indicate payments for failure to comply with road safety.

Individuals and enterprises sometimes violate the law unintentionally, but in any case, non-compliance entails punishment in accordance with the Code of Administrative Offenses and the Tax Code of the Russian Federation. Before paying penalties, you must fill out a payment slip indicating the BCC for the fine. The code will tell the recipient what kind of payment it is and will help to credit the money to the appropriate budget in a timely manner.

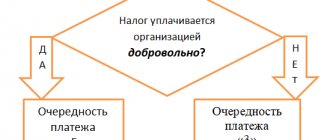

Payments and methods of accepting them.

Traffic police fines are accepted according to the KBK indicated below. It is also worth noting that if the payment is made with the BCC indicated below, then it is usually accompanied by entering the series, number and date of the resolution. When accepting such a payment in accordance with the federal law. 210, a credit institution or post office must generate a so-called UIN - a unique accrual identifier. This UIN must appear on the payment receipt. Information on your fine is transferred to the GIS GMP system and the fact of payment of the fine is timely reflected according to the generated UIN.

18811629000016000140 18811630011016000140 18811626000016000140 18811690010016000140 18811625050016000140 18811630012016000140 18811630013016000140 18811630014016000140 18811630015016000140 18811630020016000140 18811630030016000140 18811643000016000140 18811690020026000140

Expert judgments

on the receipt for paying a fine for incorrect parking there is kbk 78011630020018000140, and on the traffic police website for the same offense there is another kbk 18811630020016000140. How to check which is correct?

Elena, you can see from the income administrator code. All decisions addressed to the traffic police begin with 188. In your case, if this is a fine of 18811630020016000140 - for violating the legislation of the Russian Federation on road safety. Used for video recording of violations (usually speed limits). See articles of the Administrative Code 12.1 – 12.21, 12.22 – 12.32, 12.35 – 12.37. If KBK 78011630020018000140, then in this case the payment goes to the department of transport and road improvement complex of the city hall, and not to the traffic police. Is the recipient of the receipt from the Ministry of Internal Affairs (State Traffic Safety Inspectorate) or still the local government body?

Thanks for the answer. The recipient on the receipt is the Department of Transportation.

Can you tell me what is the charge for illegal parking?

To pay fines I need BCC for Art. 12.2ch1 12.16h2 Art.12.25ch2 Please help

Previously, the traffic police website provided a list of KBKs that are used for issuing and further payment of fines. If the KBC is not known, then it is always better to check with the traffic police. For information

Table of correspondence of budget income classification codes to articles of the Code of Administrative Offenses of the Russian Federation,

| KBK traffic police | Decoding | Regulated by articles of the Code of Administrative Offenses | Where does the income from traffic police fines go? |

| 18811630020016000140 | for violation of the legislation of the Russian Federation on road safety. Used for video recording of speed violations | 12.1 – 12.21, 12.22 – 12.32, 12.35 – 12.37 | to the budget of the constituent entity of the Russian Federation, at the location of the body or official who made the decision to impose a fine |

| 18811625050016000140 | for violation of environmental legislation | 8.22, 8.23 | to the budgets of municipal districts, city districts, federal cities of Moscow and St. Petersburg at the location of the body or official who made the decision to impose a fine |

| 18811626000016000140 | for violation of advertising laws | 14.37 | to the federal budget |

| 18811629000016000140 | for violation of legislation on state control over international road transport | 11.23 | to the federal budget |

| 18811630011016000140 | for violating the rules for transporting large and heavy cargo on public roads of federal significance | 12.21 | to the federal budget |

| 18811630012016000140 | for violating the rules for transporting large and heavy cargo on public roads of regional or intermunicipal importance | 12.21 | to the budget of the subject of the Russian Federation, at the place where the offense was committed |

| 18811630013016000140 | for violating the rules for transporting large and heavy cargo on public roads of local importance in urban districts | 12.21 | to the budget of the city district, at the place where the offense was committed |

| 18811630014016000140 | for violating the rules for transporting large and heavy cargo on public roads of local significance in municipal districts | 12.21 | to the budget of the municipal district, at the place where the offense was committed |

| 18811630015016000140 | for violating the rules for transporting large and heavy cargo on public roads of local significance in settlements | 12.21 | to the budget of the settlement, at the place where the offense was committed |

| 18811630030016000140 | for traffic offenses | 11.21, 11.22, 11.29, 12.21, 12.33, 12.34 | to the budgets of municipal districts, city districts, federal cities of Moscow and St. Petersburg at the location of the body or official who made the decision to impose a fine |

| 18811690020026000140 | Other amounts of fines and damages paid to the budgets of the constituent entities of the Russian Federation | 17.7, 17.9,19.3 – 19.7, 19.13, 19.22,20.18, 20.25 | to the budgets of cities at the location of the authority |

| 18811690030036000140 | Other amounts of fines and damages credited to the budgets of intra-city municipalities of federal cities of Moscow and St. Petersburg | 5.43, 14.43,20.18, 20.25 | to the budgets of the federal cities of Moscow and St. Petersburg at the location of the body or official who made the decision to impose a fine (in practice, one of the specified income codes is used in accordance with the requirements of the territorial body of the Federal Treasury) |

| 18811690040046000140 | Other amounts of fines and damages credited to the budgets of city districts | 5.43, 14.43,20.18, 20.25 | to the budget of the city district at the location of the body or official who made the decision to impose a fine |

| 18811690050056000140 | Other amounts of fines and damages credited to the budgets of municipal districts | 5.43, 14.43,20.18, 20.25 | to the budget of the municipal district at the location of the body or official who made the decision to impose a fine |

Usually on a traffic police receipt, if one of the listed BCCs is present, then it is accompanied by a 20-digit UIN. Since 2013, all departments of the State Traffic Safety Inspectorate ensure the formation of the UIN, and the banks ensure its timely transfer to the federal GIS GMP system. This allows you to timely reflect the fact of payment and not lose citizens’ payments for their fines.

Alisultan, if you do not have a receipt, but only the numbers of articles of offenses, then I would not pay for it myself. It is better to take a receipt from the traffic police so that later there will be no incidents with bailiffs and unpaid fines. Or at least requested information about unpaid fines on the traffic police website.

KBC for payment of monetary penalties (fines)

| PENALTIES, FINES | KBK |

| Monetary penalties (fines) for violation of legislation on taxes and fees, provided for in Art. 116, 118, paragraph 2 of Art. 119, art. 119.1, clauses 1 and 2 of Art. 120, art. 125, 126, 128, 129, 129.1, art. 129.4, 132, 133, 134, 135, 135.1 Tax Code of the Russian Federation | 182 1 16 03010 01 6000 140 |

| Monetary penalties (fines) for violation of legislation on taxes and fees provided for in Article 129.2 of the Tax Code of the Russian Federation | 182 1 16 03020 02 6000 140 |

| Monetary penalties (fines) for administrative offenses in the field of taxes and fees provided for by the Code of Administrative Offenses of the Russian Federation | 182 1 16 03030 01 6000 140 |

| Monetary penalties (fines) for violation of the legislation on the use of cash register systems when making cash payments and (or) payments using payment cards | 182 1 16 06000 01 6000 140 |

| Monetary penalties (fines) for violation of the procedure for handling cash, conducting cash transactions and failure to fulfill obligations to monitor compliance with the rules for conducting cash transactions | 182 1 16 31000 01 6000 140 |

| Monetary penalties (fines) for violation of the currency legislation of the Russian Federation and acts of currency regulatory authorities, as well as the legislation of the Russian Federation in the field of export control | 182 1 16 05000 01 0000 140 |

Administrative offenses

Administrative violations are illegal actions in relation to laws and the charter of the Code of Administrative Offenses of the Russian Federation Federal Law No. 195 of December 30, 2001 (as amended on December 27, 2018). According to ch. 2 of the Code of Administrative Offenses of the Russian Federation, both individuals and legal entities, including foreigners, are held administratively liable.

The legislation of the Russian Federation provides a list of illegal acts for which citizens and legal entities are held accountable before the law and pay penalties. A complete list is provided in section II of the Code of Administrative Offenses of the Russian Federation. The amounts of fines are approved in Art. 3.5 Ch. 3 Code of Administrative Offenses of the Russian Federation.

If it so happens that an individual entrepreneur, an organization or a citizen committed any of the listed acts and were subject to sanctions, then when paying penalties in the payment order, you must indicate to the KBC the administrative fine.

| Payment | KBK |

| Violations of taxes and fees provided for by the Code of Administrative Offenses of the Russian Federation (federal government agencies, the Central Bank, management bodies of state extra-budgetary funds of the Russian Federation) | 182 1 1600 140 |

| Violation of the legislation of the Russian Federation on administrative offenses provided for in Article 20.25 of the Code of Administrative Offenses of the Russian Federation (federal bodies, the Central Bank, management bodies of state extra-budgetary funds of the Russian Federation) | 182 1 1600 140 |

A little more about paying fines and monetary penalties

Fines for violation of laws on taxes and fees

Fines are issued for violations of federal legislation on taxes and fees, as well as for administrative violations. A complete list of violations that entail a fine is contained in the Tax and Criminal Code of the Russian Federation.

Each type of offense punishable by a fine is regulated by government agencies at various levels, so the recipients of the fine will be different. This is why it is so important to indicate the correct BCC in the payment order when paying a fine .

- For violation of budget legislation at the federal level 1 1600 140. For arrears to the Pension Fund - 1 16 20010 06 0000 140.

- For failure to pay contributions to the Social Insurance Fund on time - 1 16 20020 07 0000 140.

- For non-payment of contributions to the FFOMS - 1 1600 140.

- The fine for violations of cash handling, cash transactions, and the use of special bank accounts identified by the inspection (if this was due to the requirements) is 1,1600,140.

- For violations related to the use of currency 1 16 05000 01 0000 140.

Other fines

- 18811643000016000140 – for administrative violations. 18811690010016000140 – compensation for damage to the federal budget.

- 18811690050056000140 – compensation for damage to the budgets of municipal districts.

Payment of traffic fines

The most widespread type of fines. The accrued fine must be paid on time (within 2 months), otherwise there is a new offense, which in turn is also punishable by a fine and additional unpleasant measures against the defaulter.

The 60 days provided for payment begin to count from the issuance of a receipt for a fine or after receiving a letter of receipt issued according to the recording cameras.

Innovations adopted in 2021 threaten defaulters of traffic police fines with the following penalties:

- Late payment will result in a double fine;

- a persistent defaulter may be arrested for 15 days;

- You may be forced to perform community service for up to 50 hours.

Everything depends on the decision of the judge, who takes into account, first of all, the seriousness of the committed traffic violation.

Payment details

If you have received a notice of a fine from the traffic police, you must pay it using the correct details. Please note that the budget classification codes for this type of fine are the same for all regions of the Russian Federation; they depend on what kind of car you have and what exactly you violated with it. Look for the CBC you need among those listed below.

- 18811630020016000140 – for administrative offenses in the field of traffic.

- 18811630010016000140 – for violating the rules for transporting large and heavy cargo on public roads:

- 18811630011016000140 – for the same violation that occurred on a federal road;

- 18811630012016000140 – if the road was of regional or intermunicipal importance;

- 18811630013016000140 – public road of local importance for urban districts;

- 18811630014016000140 – public road of local significance in municipal districts;

- 18811630015016000140 – public road of local significance for settlements.

- 18811625050016000140 – for violation of legislation in the field of environmental protection.

- 18811626000016000140 – for violating the legislation on advertising on vehicles;

- 18811629000016000140 – for violations in the field of international transportation (federal budget).

- 18811630030016000140 – for all other fines imposed by a municipal body, federal city, urban district.

Violation of legislation on taxes and fees

Sometimes citizens and legal entities evade paying fees, do not deposit tax funds on time, or violate other laws of the tax legislation of the Russian Federation. For these actions, Federal Tax Service employees impose penalties on the culprit, which are paid indicating the corresponding codes classifying the payment in the receipt.

| Payment | KBK |

| Violation of legislation on taxes and fees | 182 1 1600 140 |

| Violation of the legislation on taxes and fees, provided for in Articles 116, 1191, 1192, clauses 1 and 2 of Art. 120, art. 125. 126, 1261, 128. 129, 1291, 1294, 132, 133, 134. 135, 1351, 1352 Tax Code of the Russian Federation | 182 1 1600 140 |

| Evasion of taxes and/or fees, concealment of funds or property of an organization or individual entrepreneur, at the expense of which taxes and/or fees should be collected, for failure to fulfill the duty of a tax agent (federal government bodies, the Central Bank, management bodies of state extra-budgetary funds of the Russian Federation) | 182 1 1600 140 |

| Violation of the legislation on taxes and fees provided for in Art. 129.6 of the Tax Code of the Russian Federation (federal state bodies, the Central Bank, management bodies of state extra-budgetary funds of the Russian Federation) | 182 1 1600 140 |

How to decipher KBK, what is the fine for?

Many people are issued a decree for a specific offense, but the question is which specific KBK number to indicate when paying the fine. Or vice versa, we know the KBK number, but we don’t know what the fine is for.

KBK 18811630020016000140 Explanation - Fine for violating the legislation of the Russian Federation on road safety (Art. 12.1-12.21; Art. 12.22-12.321; Art. 12.361-12.37)

KBK 18811630030016000140 Explanation - Other fines for traffic offenses (Articles 11.21, 11.22, 12.212, 12.33, 12.34)

KBK 18811630011016000140 Explanation - Fine for violating the rules for transporting large and heavy cargo on public roads of federal significance (Article 12.211)

KBK 18811630020016000140

In the event that any payment needs to be sent to the state budget or extra-budgetary fund, all payers, invariably, are faced with a search for certain codes that indicate its direction. These numerical values are Budget Classification Codes. For example, KBK 18811630020016000140 is used to pay a fine imposed for violating traffic rules.

What is the code for?

Budget classification codes have to be used when payments need to be transferred to the state budget or various funds. Payers are faced with entering a code when filling out a receipt, since it is the code that determines the direction of the payment being made.

This goal is achieved due to its special structure. After all, not a single digit of the code was chosen just like that. All numbers are arranged in a special order, and each of them has its own meaning.

Code structure

The code itself consists of two dozen digits. But these are not just numbers. They are divided among themselves into parts, each of which has its own meaning:

- The administrative part - represented by three numbers - this part determines the recipient of the payment, depending on its affiliation.

- The income part consists of ten figures, defined in subgroups. The first number indicates the type of profit. The next two show the purpose for which the payment is made. Then, two numbers defining the purpose of the direction. The next three determine the income item. The last two are a reflection of the recipient's budget level.

- The software part contains four numbers that specify the payment being made. This part is sometimes called the "program".

- The last three digits form the classifying part, which determines affiliation in the systematization of financial work.

Specific code

Thus, individuals and legal entities always have to make some payments to the state budget. An excellent example of such payments are fines. After all, the purpose of funds is certain sectors of the budget, which may differ both in meaning in a general sense and in belonging to a certain level: territorial, regional, etc. Moreover, often, or rather always, the inspector issuing a fine does not indicate the required BCC and the payer must independently search for it.

KBK 18811630020016000140 is the code that is indicated as part of the receipt, or more precisely, on line 140, if it is necessary to pay a fine for a traffic violation. More precisely, in case of a violation of the Law of the Russian Federation on Road Safety.

In addition to the fact that the code itself must be indicated in the receipt, it is also necessary to fill out in text the column about the purpose of the transferred amount. In the event that these two columns contradict each other, bank employees use the KBK to transfer the payment.

As for the code itself, the payer needs to independently verify its correct indication, since the KBK is a priority in choosing the direction of payment.

So, the KBK consists of 20 numbers, which are not located in a random order, but rather are grouped in a special way in order to give the payment a special and precise direction. The code consists of four parts, each of which is, to some extent, a cipher for certain information that the treasury needs for the correct acceptance and distribution of funds. KBK 18811630020016000140 is used to pay a fine in case of violation of road safety.