Step-by-step instruction

On April 2, a Ford Mondeo was purchased.

On April 3, the car was insured by PJSC IC Rosgosstrakh: an insurance premium of MTPL was paid in the amount of 14,820 rubles. for the period from April 4 of the current year to April 3 of the next year

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Payment of insurance premium | |||||||

| April 03 | 76.01.9 | 51 | 14 820 | 14 820 | Payment of MTPL insurance premium | Write-off from current account - Other write-off | |

| 013 | 14 820 | Accounting for MTPL insurance policy | Manual entry - Operation | ||||

| Reflection in accounting for insurance premium costs for April | |||||||

| April 30 | 26 | 76.01.9 | 1 096,27 | 1 096,27 | 1 096,27 | Accounting for compulsory motor liability insurance costs | Closing the month - Write-off of deferred expenses |

| Reflection in accounting for insurance premium costs for May | |||||||

| May 31 | 26 | 76.01.9 | 1 258,69 | 1 258,69 | 1 258,69 | Accounting for compulsory motor liability insurance costs | Closing the month - Write-off of deferred expenses |

For the beginning of the example, see the publication:

- Purchasing OS (auto)

CASCO

If an organization wants to insure its car against a risk that is not covered by the MTPL agreement (DSAGO) (for example, the restoration of its car, the driver of which was found guilty of an accident), it can enter into a voluntary car insurance agreement (CASCO). Such insurance is one of the types of property insurance (Articles 929, 930 of the Civil Code of the Russian Federation). Depending on the terms of the contract, the organization can insure the car against various risks (for example, damage, theft, fire, etc.). The amount of insurance compensation under the CASCO agreement, as well as the cost of the insurance policy, are established by each insurer independently.

The list of documents that must be provided to the insurer for concluding a voluntary insurance contract and issuing CASCO insurance is determined by the insurance company.

Features of cost accounting under compulsory motor liability insurance

Regulatory regulation

Payment of the insurance premium to the accounting department should be taken into account as part of advances issued (clause 3, 16 of PBU 10/99). Costs for paying premiums are not recognized as deferred expenses, since this is a “continuing” service (clause 3, 16 of PBU 10/99). The organization has the right to terminate the contractual relationship early and return part of the funds paid in proportion to the remaining period of insurance.

In the 1C program, a special account 76.01.9 “Payments (contributions) for other types of insurance” is provided for calculations of insurance premiums. Despite the fact that the premium paid cannot be attributed to deferred expenses, account 76.01.9 has a sub-account Deferred Expenses PDF for automatic even recognition of expenses when performing the Month Closing procedure. Therefore, there is no need to create an additional cost accounting document, for example, a Receipt document (act, invoice) .

Insurance costs are recognized as expenses for ordinary activities evenly in the reporting period in cost accounts (clause 5 of PBU 10/99).

In NU, the costs of paying insurance premiums for compulsory insurance (including compulsory motor liability insurance) are included in indirect costs, like other costs associated with production and (or) sales (clause 5, clause 1, article 253 of the Tax Code of the Russian Federation, p. 2, paragraph 3 of Article 263 of the Tax Code of the Russian Federation).

Under insurance contracts valid for more than one reporting period, the insurance premium paid at a time is taken into account in expenses evenly during the term of the contract, in proportion to the number of calendar days (clause 6 of article 272 of the Tax Code of the Russian Federation, clause 1, clause 2 of article 263 Tax Code of the Russian Federation):

- within the limits of insurance rates, if they are provided for by law;

- in the amount of actual expenses, if limits on insurance rates are not provided.

Analytics for insurance premiums account

In the 1C program, you need to enter analytics for account 76.01.9 subconto Deferred Expenses - this is the name of the reference book for accounting for expenses subject to straight-line write-off. The procedure for filling it out for insurance premiums is as follows:

- Type for NU - Other types of insurance ;

- Type of asset in the balance sheet - Accounts receivable ;

- Amount - the paid amount of the insurance premium, written off evenly over the term of the contract;

- Recognition of expenses - By calendar days ;

- Write-off period —insurance period;

- Cost account - account for accounting costs for insurance;

- Cost item is a cost item for which the insurance premium is reflected in expenses.

Diagnostic card

If the car has been in operation for more than three years, including the year of manufacture, then in order to conclude an MTPL agreement, a diagnostic card is generally required. It can only be obtained based on the results of a vehicle technical inspection by a specialized organization - a technical inspection operator.

This follows from the provisions of subparagraph “e” of paragraph 3 of Article 15 of the Law of April 25, 2002 No. 40-FZ, Article 15, Part 1 of Article 17, Part 1 of Article 19 of the Law of July 1, 2011 No. 170-FZ, paragraphs 5 , 9, 15 of the Rules approved by Decree of the Government of the Russian Federation of December 5, 2011 No. 1008.

In the event of an insured event (road accident), the MTPL agreement provides for compensation for damage caused to the injured party.

In this case, the victim must contact his insurance company for direct compensation for losses if:

- the accident involved two cars;

- both owners have an MTPL policy;

- damage was caused only to cars.

If the specified conditions are not met, then the procedure for direct compensation of losses under OSAGO does not apply. Then the victim can apply for compensation to the insurance company of the person responsible for the accident.

This is stated in Article 14.1 of the Law of April 25, 2002 No. 40-FZ.

The amount of insurance compensation is determined by the insurance company in each specific case.

The accident was registered with the participation of the police

The amount of compensation for damage caused to the property of each victim cannot exceed 400,000 rubles. This procedure is provided for in subparagraph “b” of Article 7 of the Law of April 25, 2002 No. 40-FZ.

The accident was registered without the participation of the police

The amount of insurance compensation cannot exceed:

- RUB 25,000;

- 50,000 rubles if the MTPL agreements of both participants were concluded after August 1, 2014.

And in the case where the accident occurred in Moscow, St. Petersburg, the Moscow or Leningrad regions, the maximum payment amount will be 400,000 rubles. But only under the following conditions:

- MTPL agreements of both participants were concluded after October 1, 2014;

- the victim provided his insurer with data on the circumstances of the accident, recorded on photo or video.

This follows from the provisions of subparagraph “b” of Article 7, paragraphs 4 and 5 of Article 11.1 of the Law of April 25, 2002 No. 40-FZ and paragraph 8 of Article 5 of the Law of July 21, 2014 No. 223-FZ.

A compulsory motor liability insurance agreement can be concluded with the condition of a limited number of persons allowed to drive a car, or without restrictions (clause 1 of article 16 of the Law of April 25, 2002 No. 40-FZ).

In the first case, the liability of only those citizens indicated in the insurance policy is insured. Therefore, only those drivers who are included in the insurance policy have the right to drive such a car. If the car is driven by a person who is not included in the insurance policy, the organization may be fined 800 rubles. (Part 1 of Article 12.37 of the Code of Administrative Offenses of the Russian Federation). In addition, if an insured event occurred when the car was being driven by a driver who was not included in the MTPL policy, the insurer can hold the organization liable for failure to comply with the terms of the contract and demand compensation for the insurance amount paid to the victim (Article 1081 of the Civil Code of the Russian Federation, resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 19, 2006 No. 9045/06).

In the second case, the civil liability of any person who will drive this car is insured. Typically, the cost of such a policy is more expensive than a policy that defines a limited number of drivers (Clause 3, Article 16 of Law No. 40-FZ of April 25, 2002). However, if such a policy is available, the insurance company will compensate the victim for the damage caused, regardless of who was driving the car at the time when the insured event (accident) occurred.

Typically, a compulsory motor liability insurance agreement is concluded for one year (clause 1 of article 10 of the Law of April 25, 2002 No. 40-FZ, clause 1.1 of the Rules approved by the regulations of the Bank of Russia dated September 19, 2014 No. 431-P). In this case, the owner's auto liability is considered insured throughout the entire period of operation of the vehicle during the year. However, when concluding an agreement, it is possible to provide for a condition for a limited period of use of transport (clause 1 of article 16 of the Law of April 25, 2002 No. 40-FZ, clause 1.2 of the Rules approved by the regulation of the Bank of Russia of September 19, 2014 No. 431-P ). Then the liability will be considered insured only during the periods specified in the policy. It is advisable to conclude such an agreement, for example, when using transport in the seasonal activities of the organization (for example, a grain harvester). Moreover, if an insured event occurs during a period not specified in the MTPL agreement, the organization faces:

- a fine of 500 rubles. (Part 1 of Article 12.37 of the Code of Administrative Offenses of the Russian Federation);

- possible legal proceedings with the insurer regarding violation of the terms of the contract (Article 1081 of the Civil Code of the Russian Federation, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 19, 2006 No. 9045/06).

Situation: is it necessary to make changes to the MTPL agreement if an organization rents a car insured by the lessor?

The answer to this question depends on the terms of the MTPL policy that the lessor handed over to the lessee along with the car. There are two options:

- the insurance policy specifies specific persons who can drive the car;

- Based on the insurance policy, an unlimited number of people are allowed to drive a car.

In the first case, it is necessary to insure the driver’s motor third-party liability if the lessee plans to allow citizens who are not included in the MTPL policy to drive the car. To do this, you need to make changes to the insurance policy (include the persons who will drive the car). The landlord must do this. The insurance company may require an additional fee for making changes to the policy. This is provided for in paragraph 3 of Article 16 of the Law of April 25, 2002 No. 40-FZ.

If an unlimited number of people are allowed to drive a car, then the lessee’s drivers do not need to insure the motor third party liability.

If the insurance policy has expired, the procedure for further auto liability insurance depends on the terms of the rental agreement. That is, by agreement of the parties, the obligation to conclude a compulsory motor liability insurance agreement can be assigned to both the lessor and the lessee. This is because the owner of the vehicle must carry liability insurance. And for insurance purposes, the owner of a car is recognized not only as its owner, but also as a person who owns the car on a rental basis (paragraph 4 of Article 1, paragraph 1 of Article 4 of the Law of April 25, 2002 No. 40-FZ).

Payment of insurance premium

Payment of the premium

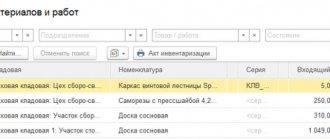

In order for insurance costs to be automatically evenly taken into account as expenses, it is necessary, at the stage of paying the insurance premium, to correctly fill out the document Write-off from the current account transaction type Other write-off in the Bank and cash desk - Bank - Bank statements - Write-off section.

The document states:

- Recipient - the counterparty to whose account the insurance premium is paid;

- Amount - the paid amount of the insurance premium according to the bank statement;

- Debit account - account 76.01.9 “Payments (contributions) for other types of insurance”: this is a special account in 1C, provided for paid insurance premiums;

- Counterparties - insurance company;

- Deferred expenses are parameters for automatic uniform recognition of compulsory motor liability insurance costs.

Postings according to the document

The document generates the posting:

- Dt 76.01.9 Kt - payment of insurance premium.

Insurance policy accounting

It is recommended to reflect the received MTPL policy on the balance sheet, since the organization must generate complete and reliable information about its activities and its property status (Article 13 of the Federal Law of December 6, 2011 N 402-FZ, clause 4, clause 32 of the Accounting Regulations and financial statements, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 N 34n).

In 1C there is no special off-balance sheet account for accounting for policies. Therefore, you need to create it yourself , for example, 013 “OSAGO, DSAGO, CASCO policies.” PDF

BukhExpert8 advises keeping records both according to the elements of the directory Deferred Expenses and according to Fixed Assets . With this set of analytics, you can, for example, analyze which vehicle your insurance is running out of.

Acceptance of an incoming MTPL policy for off-balance sheet accounting is formalized by the document Transaction entered manually, type of operation Transaction in the section Operations – Accounting – Transactions entered manually.

DSAGO

In addition to compulsory insurance, the car owner can insure his civil liability under an additional contract. Such an agreement is concluded if the policyholder considers the insurance payment provided for by the MTPL agreement to be insufficient to compensate for possible damage to the injured party (clause 5 of Article 4 of the Law of April 25, 2002 No. 40-FZ). A DSAGO policy purchased for a fee allows you to increase the maximum amount that the insurer will compensate the injured party in the event of harm. Thus, the DSAGO policy complements the compulsory insurance in case of larger damage. The maximum amounts of insurance compensation under the DSAGO policy are set by each insurer independently.

Reflection in accounting for insurance premium costs

To automatically account for the costs of the MTPL insurance premium on a monthly basis, you need to run the procedure Closing the month, a routine operation Write-off of deferred expenses in the section Operations - Closing the period - Closing the month.

Postings according to the document

Accounting for MTPL costs for April

The document generates the posting:

- Dt Kt 76.01.9 - accounting for the costs of compulsory motor liability insurance as part of general business expenses for April.

Accounting for MTPL costs for May

The document generates the posting:

- Dt Kt 76.01.9 - accounting for the costs of compulsory motor liability insurance as part of general business expenses for May.

Similarly, the costs of compulsory motor liability insurance are recorded for the following months before the end of the insurance contract.

Control

The calculation of the amount of costs for compulsory motor liability insurance can be viewed in the report Help - calculation of write-off of expenses for future periods using the Help-calculation in the Month Closing .

We will check the correctness of the calculation of the amount of costs for compulsory motor liability insurance with the program:

Test yourself! Take a test on this topic using the link >>

For the continuation of the example, see the publication:

- Acceptance for accounting of fixed assets with bonus depreciation

See also:

- Cost accounting under CASCO

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Entering vehicle data into the information database

After it has been determined that the car can be accounted for on the organization’s balance sheet as a main vehicle and there are all the primary accounting data for this, it needs to be capitalized and put on the balance sheet. Next, we will look at how non-current assets are accepted in 1C programs.

2.1 Reflection of a car in the 1C: Enterprise Accounting 3.0 program

If there is no section “Fixed assets and intangible assets” among the program sections, then it is necessary to add the ability to reflect transactions on non-current assets. To do this, open the “Administration” section and then select “Functionality”.

In the window that opens, go to the “OS and intangible assets” tab.

Check the boxes next to the corresponding functions and the one we need will appear among the sections.

Since we display the “OS and Intangible Materials” section, in functionality these sections are highlighted in gray and pink with the “full interface” mark, so they can no longer be changed or disabled.

Next, go to the “OS and intangible assets” section.

There are several ways to capitalize fixed assets in the accounting department of an enterprise: when the equipment does not require assembly, the method of calculating depreciation in this case is the one established in the accounting policy (section “Main” - “Accounting Policy”) and when the equipment requires assembly.

It is correct to bring the car in using the first method.

Let’s follow the link “Receipt of fixed assets” and in the window that opens, click the “Create” command located on the command panel. The fixed asset creation document opens.

We enter the document number and date, fill in information about the supplier, create or select an agreement. You also need to choose the method that suits you to reflect depreciation expenses and select an asset accounting group. The down arrow opens a list of OS groups available in this case:

We need to select vehicles. After that, click the “Add” button.

As a result of clicking on the button, a line will appear in the tabular part, from which a list of the last selected elements of the directory will drop out.

Here you need to click on the “Show all” command, or on the button with a green plus, which will allow you to immediately open the window for creating a fixed asset.

Clicking the “Show all” link will open a directory of fixed assets.

In it, you need to click the “Create” button to open the window for creating a new directory element.

In the window that opens, fill in the following information:

— the OS accounting group is selected from the list;

— enter the name of the accepted transport from the primary accounting documents;

- a green “Classification” link opens, where the corresponding OKOF code is selected from the OKOF directory using the down arrow - “Show all”.

Select the grouping name you need and click on the “Transfer OKOF and depreciation group” button. As a result, this data is filled into the card of the element we are filling out.

— after this you can fill in the information for the inventory card from the technical information about the vehicle. Information about the issue date is important; it will be used to determine the tax rate.

Information about the date of acceptance for accounting, location, financially responsible person, as well as accounting and accounting records will be filled in automatically after the “Receipt of fixed assets” operation.

Let's write down the directory element using the "Write" command.

Also, the vehicle registration function is immediately available to us from the card. It is needed in order to automatically calculate advance payments and transport tax for the year based on the data you entered from the vehicle title.

Click on the “Register” link.

Fill in from top to bottom:

— date of registration of the vehicle with the traffic police;

— the vehicle type code is selected from the list using the button next to the input field;

— enter the identification number, make, registration plate, engine power and environmental class from the title.

— the tax rate is selected automatically after entering all the indicators necessary for the calculation above. If, after filling in all the indicators, the line remains red with the words “not defined”, you may need to download the rate classifier from the ITS disk. To do this, you need to go to the reference book that opens by clicking on the tax rate link and click the “download rates” button.

If your car is eligible for multipliers or tax breaks, you will need to enter the appropriate values. In addition, you must provide the tax authority with documents confirming your right to tax benefits so that your calculation of the transport tax coincides with the calculation of the tax authority.

After that, click the “Write and close” command and also write down the item card after finishing editing. This completes its creation. The element we created will appear in the directory; double-clicking on it will transfer it to the tabular part of the window.

Then enter information about the cost and the amount of VAT. The invoice for fixed assets is set on 01.01, for depreciation on 02.01, for VAT on 19.01. The service life of the vehicle is also from the technical information.

The number and date of the invoice are entered and the “Register” button is used to record the receipt document and invoice. After this, it can be posted and closed, then using the command “DT CT” you can see the postings that were made by the document on the accounting accounts.

According to line 1 of the entries, we see that a truck was entered into the debit on 04/08/2, and the credit of account 60.01 reflected the debt to the supplier in the amount of RUB 408,333.33. The amount of VAT on the car in question is part of the debt to the supplier, therefore it also goes to account 60.01 and is simultaneously recorded on the debit of account 19.01 in the amount of 81,666.67 rubles. Then the non-current asset is written off from account 08.04.2 to the debit of account 01.01, which means the commissioning of the transport, that is, the beginning of its useful life.

After the transport has been accepted onto the balance sheet of the enterprise, you can look at its card, where we will see that information about the date and document of acceptance for accounting, location, MOL and method of reflecting depreciation expenses, as well as data on accounting and accounting records, on depreciation methods and current value were filled in automatically.