A power of attorney is a document that is required quite often in the current activities of enterprises and organizations. With its help, the management of a particular company entrusts the performance of certain functions to a trusted person, and also assigns a certain share of its rights and powers to him.

Examples of powers of attorney from a legal entity to an individual:

- to court - to the tax office - to receive goods/money

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

What is the “right of subrogation”

Some powers of attorney are issued with the right of substitution. This form of the document means that the principal’s representative has the opportunity, in case of some circumstances, to transfer the functions entrusted to him to another person.

Such powers of attorney are always certified by a notary, and in advance the representative is obliged to notify his principal of the need to delegate the affairs entrusted to him.

It should be noted that in practice this type of paper is not encountered very often. This is due to the fact that it is more convenient for business managers to issue powers of attorney for several people with whom they are personally acquainted rather than trusting someone with the ability to delegate delegated powers.

How to draw up a power of attorney

There is currently no single unified form of power of attorney from a legal entity to an individual. Representatives of organizations have every right to draw up a document in any form or according to a template in force in the company. It is important to follow only two basic rules: that in its structure the document complies with office work standards, and in its content it includes a number of mandatory information. These include:

- full name of the enterprise that issues the document, including its constituent details;

- number, place, date of drawing up the power of attorney;

- last name, first name and patronymic name of the person for whom it is issued and his passport details indicating registration at the place of residence.

The main part of the power of attorney must include a complete list of powers, rights and obligations that this document provides to the bearer. Maximum attention should be focused on this section of the power of attorney, spelling out all the points in detail and carefully. If the principal's representative receives the right to sign various types of papers, this must also be noted. Finally, you must indicate the validity period of the document.

Information and capabilities of the document for registering a Current Account

A power of attorney must be drawn up in accordance with legal requirements. The paper that gives the authority to register and cancel details contains the following information:

- Information about the compiler (name of organization, personal taxpayer number, information about the director);

- Information about the official representative;

- Registration number;

- Validity;

- City, region where it was compiled;

- Personal signature, stamp (seal) of the certifying specialist.

Choose carefully the list of opportunities that the official representative receives.

Basic valid operations:

- Handing over papers to bank employees, or receiving them from financial company specialists;

- Account registration or cancellation;

- Replenishment of balance, withdrawal of funds, management of interest;

- Sending, receiving transfers.

Certification of power of attorney

There are two ways to certify a document.

- Through a notary.

The choice of specialist is made at the discretion of the parties to the agreement. The region of location of the credit institution and the registration address of participants does not matter. If the drafter cannot appear at the notary’s office, a specialist can be invited home to draw up the agreement.

- At a credit company.

Both parties contact the bank, with whose participation a power of attorney is drawn up. The employee certifies it with the signature and stamp of the organization and enters it into the database. Validity period of the power of attorney for opening an account The validity period is determined by the originator.

If the validity period is not specified during registration, the document is considered valid for 12 months.

When a one-time power of attorney is issued, the validity period ranges from several days to several months.

The legislation defines a list of situations in the event of which the validity of a document is canceled ahead of schedule.

List of situations:

- The official representative refused to perform financial transactions.

- Cancellation of conditions by the principal.

- Death, loss of legal capacity of the principal.

- Termination of the company.

- Death, loss of legal capacity of an official representative.

Refusal to open a Current Account by power of attorney

The credit institution reserves the right not to register an account by proxy if there are objective reasons.

You may also be interested in this article: Why banks refuse to open a Current Account

Reasons why a credit company may refuse:

- Employees of the financial company did not accept the client.

Most often this happens if the head of the organization and the chief accountant are the same person, or if the employee is in management positions in several organizations at the same time.

- The address and region where the object is located is questionable.

The address indicated as the location of the object is listed as a public place, or other companies are registered in its name.

- Incomplete set of papers.

Among the provided kit, there are not enough of everything requested by the organization, or duplicates are of poor quality.

- The person who acts as one of the parties is incompetent.

- The manipulations for which the paper was prepared have been completed.

- If an organization or individual entrepreneur has negative experience of interaction with other credit institutions.

If one of the above reasons is present, the credit institution will refuse to conduct financial transactions under a power of attorney.

How to draw up a document

The law does not establish any special requirements regarding the execution of a power of attorney, as well as regarding its preparation. This means that it can be formed either on an ordinary sheet of any convenient format or on the company’s letterhead. It is permissible to write a document either by hand or in printed form - this does not play a role in determining its legality.

There is only one immutable point that needs to be taken into account: the power of attorney must contain two signatures, one of which must belong to the authorized person, the second - to his principal. In this case, the second signature certifies the authenticity of the first, therefore the use of facsimile autographs, i.e. printed by any method is excluded.

As for the seal or stamp, it is necessary to certify the form with their help only when the regulatory legal acts of the organization stipulate the requirement to use various types of stamp products.

The power of attorney is always made in one original copy.

Power of attorney to court

Represent the interests of a legal entity, that is, an organization. A citizen can go to court with a power of attorney granted to him. The main thing is to correctly document the powers that are vested in connection with this form of civil relations. This document will confirm the right of an individual (usually an employee) before a court to take certain actions for which the company has authorized him on its behalf.

Legislative requirements for such a power of attorney do not require its strict and unambiguous form, however, the presence of mandatory components is necessary:

- all details of the principal company (you can issue a power of attorney on its letterhead);

- place and date of drawing up the power of attorney (the date is usually written in words and not in digital format);

- identification data of the authorized person (indicating his registration);

- an indication of the powers granted (the more precise the better);

- permission or prohibition to transfer powers;

- validity period of the document (at the request of the principal, rights can be revoked at any time);

- signatures of the authorized representative and management of the organization;

- seal (if it is used in the company).

Sample power of attorney for the right of an individual to represent the interests of a legal entity in court

LIMITED LIABILITY COMPANY "LORELEYA" Samara, st. Arzamasskaya, 8, office 1 tel. e-mail

POWER OF ATTORNEY

The twenty-ninth of May two thousand seventeen

Limited Liability Company "Lorelei" (TIN 5467098312 OGRN 956784563123) represented by General Director Anton Vladislavovich Kramarsky, acting on the basis of the Charter,

TRUSTS

citizen Artsybashev Maxim Anatolyevich, staff lawyer of Lorelei LLC, born on August 16, 1998 (passport 03 10 No. 875412, issued on April 12, 2010 by the Central Regional Department of the Ministry of Internal Affairs of Krasnodar) residing at the address: Samara, st. Aeroflotskaya, d. 26, kv. with which it provides special rights: signatures of all documents necessary for the high-quality execution of this instruction, including petitions, reviews, settlement agreements; submission and receipt of certificates, copies, documents that may be required during the trial.

The power of attorney was issued without the right of substitution for a period of 3 years.

/Artsybashev/ M.A.Artsybashev Signature M.A. I certify Artsybashev. General Director of Lorelei LLC /Kramarsky/ A.V. Kramarsky M.P.

Agency agreement

In its legal structure, a power of attorney has common features with a contract of agency. Moreover, in a number of cases, the execution of an agency agreement will be an effective way to carry out legally significant actions in the interests of a legal entity.

Articles 971 of the Civil Code of the Russian Federation and 975 of the Civil Code of the Russian Federation

Article 971 of the Civil Code of the Russian Federation stipulates that an order implies an obligation to perform a number of actions provided for by the subject of the agreement, on behalf and at the expense of the principal. Based on the definition of this type of agreement, significant differences can be identified between these forms of representation of interests:

- As part of the receipt, the trustee has an obligation to perform actions included in the subject of the agreement, while the issuance of a power of attorney does not give rise to such an obligation;

- An assignment is one of the forms of civil transactions, therefore it may provide for the payment of remuneration for the representation of interests (a power of attorney cannot provide for such a condition).

However, Art. 975 of the Civil Code of the Russian Federation actually erases this difference, since the performance of actions within the framework of an order requires the presentation of a power of attorney to third parties to conduct business. Based on this, the conclusion of an agency agreement will be justified only if it is necessary to establish the obligation of the trustee to perform legally significant actions in the interests of the principal.

Example of an agency agreement between legal entities

Power of attorney to the tax office

Upon provision of such a document, a representative of the company can interact with the tax authorities: give or receive any papers, sign, make extracts and perform other actions provided for by law and listed in the power of attorney.

A power of attorney is required if the employee’s right to represent the company in the INFS is not stipulated in the Charter. A notarized declaration of such a power of attorney is required. The required components of a power of attorney are similar to any document of this type: details of the parties, a list of powers, validity period, a statement of the right to sub-power, the signature of the authorized representative and its certification by the management of the company, and, of course, the signature and seal of the management. The power of attorney will not be valid if:

- the date is not indicated or it is in the wrong format (numbers must be indicated in words);

- the signature is not personal, but facsimile;

- the signature of the individual is not certified;

- there is no seal of the organization (except for those cases when it is not used according to the charter);

- blots, corrections, erasures were made;

- there is no corresponding mark on the original power of attorney, if the document is not the primary one, but is being transferred.

Sample power of attorney to the INFS authorities

LIMITED LIABILITY COMPANY "Reconstructor" 620027, Ekaterinburg, st. Lunacharskogo, 15, office 1 tel. e-mail INN 7859306748 OGRN 165728592067486

POWER OF ATTORNEY

Twenty-third of March two thousand seventeen

By this power of attorney, Limited Liability Company "Rekonstruktor" represented by General Director Natalya Mikhailovna Antropkina, acting on the basis of the Charter,

TRUSTS

manager of the branch of Reconstructor LLC in Belorechensk, Krasnodar Territory, Bogatova Anna Vladimirovna, born on July 29, 1976, passport of a citizen of the Russian Federation, series 23 99 number 15364785, issued by the Department of the Federal Migration Service of Russia for the Krasnodar Territory in Belorechensk on October 3, 1999, registered under address: Krasnodar region, Belorechensk, st. Zarechnaya, 19,

- represent the interests of Rekonstruktor LLC in the Federal Tax Service of Russia Inspectorate No. 3 for the city of Belorechensk, for which purpose it gives it the powers to:

- receive and sign acts, certificates, demands, orders on conducting tax audits at the location of the branch, on the results of the audits and other documents addressed to the LLC branch;

- submit accounting and tax reporting, letters, requests, applications and other documents required by the Federal Tax Service of Russia;

- provide explanations to tax inspectorate employees on all issues that arise during the inspection process and as a result of the activities of the LLC branch;

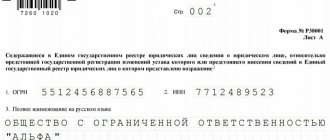

- submit documents and receive extracts from the Unified State Register of Legal Entities in relation to the LLC;

- sign and exercise other powers granted by the tax legislation of the Russian Federation to carry out this instruction.

This power of attorney has been issued for a period of 3 (three) years without the right of substitution.

/Bogatova/ A.V. Bogatova Signature A.V. Bogatova is certified by the General Director of Reconstructor LLC /Anthropkina/ N.M. Anthropkina

Where can I open a Current Account under a power of attorney?

Not all financial companies are ready to accommodate their clients and provide the opportunity to act not personally, but through a representative. This is due to possible risks, for which the bank will have to bear responsibility. However, there are credit institutions that provide services to clients through intermediaries.

List of banks:

- Sberbank;

- Alfa Bank;

- "Dot";

- Tinkoff Bank;

- SKb – bank;

- Modulbank;

- Promsvyazbank;

- Expert – bank;

- Bx Bank;

- Eastern Bank.

When choosing a financial company, you need to inquire about the set of required papers and the terms of cooperation through a power of attorney.

Power of attorney to receive goods/money

This power of attorney helps the sale and purchase transaction proceed as smoothly as possible. Completion of a transaction or delivery of purchased goods always requires the signatures of specific persons - company representatives. The company authorizes its representative to perform all actions necessary for the transaction or acceptance of goods from the supplier on its behalf. Such a document is called a “power of attorney for goods and materials,” that is, for the transfer or receipt of goods and/or material assets.

The form of such a document, unlike other powers of attorney, is not free. To issue a guarantee for receiving inventory items, you need to use form M-2 if the procedure is carried out once, and M-2a if the process occurs on a regular basis. The forms were approved by Resolution of the State Statistics Committee of Russia No. 71a of October 30, 1997.

The form must be filled out on both sides. On the front side, in specially designated columns, indicate:

- OKPO code (as it appears in the statutory documents);

- the date when the power of attorney was issued, its validity period (usually for a month, then a new one can be issued), document number;

- data on legal entities - parties to the transaction;

- bank details of the company making the payment;

- passport details of the individual for whom the power of attorney is issued;

- grounds for issuing inventory items.

The reverse side is intended for information about the inventory items to be transferred: they are listed under serial numbers, the units in which they are measured, and their quantity (in words, not numbers). Blank lines are crossed out. The signature of the authorized representative is also certified on this side.

The power of attorney for goods and materials in form M-2 also has a tear-off spine where its number, expiration date are indicated, signatures are duplicated and links to permits are provided. This counterfoil is supposed to be kept in the accounting department.

In addition to the other components characteristic of any powers of attorney, the document for receipt of inventory materials requires the signature of the organization's chief accountant.

Note! Below is an example of a free form power of attorney. Typical interindustry forms M-2 and M-2a are discussed in detail on a separate page.

Who is the Principal and Representative under the power of attorney?

The document is drawn up with three participants.

Participants:

- Compiled by.

This is a person or organization that needs to appoint a person authorized to act on its behalf.

If the compiler is a company, then the compiler may be:

Manager

The general director, his deputy, the production manager, etc. can act on behalf of the manager.

The power of attorney is drawn up on an approved form and approved by a person chosen by the manager.

Founder

The founder acts as a compiler when the company has not yet officially received permission to operate independently, but in fact it is already functioning. To conduct full-fledged activities, it is necessary to open an account and replenish it.

Individual

There may be a private entrepreneur or an executive who needs to appoint a legal representative.

- Legal representative.

A person who is vested with certain powers to perform operations with details for the period specified in the document. Exceeding these powers contributes to the annulment of the legality of the paper.

- Participant in a transaction responsible for compliance with its terms.

This is a representative of the tax service, the judiciary, or simply a third party.