The essence and meaning of accounting documents

Legislative requirements, in particular the provisions of the Accounting Law, make it mandatory to document all events in the economic sphere. Accounting documents are used to confirm the completion of any transactions and serve as written evidence of ongoing processes.

An accounting document is a form in which current events, their valuation, and other criteria that distinguish a business transaction can be recorded.

By type, financial accounting documents and their purpose can be classified as follows:

- Administrative. Based on them, business transactions are not recorded. These documents act as instructions for performing certain actions. This group includes orders and instructions from management.

- Exculpatory - confirm the completion of actual transactions in the current activities of the company. They are the basis for making records, for example, acts of acceptance and transfer of valuables, invoices for write-off, internal movement. Often their presence must be confirmed by administrative documents.

- Accounting documents are designed to simplify the accounting procedure. They are various statements, accounting certificates that explain the procedure for performing actions and their expediency.

- Combined documents bear the characteristics of administrative and exculpatory documents at the same time. They serve as the basis for the emergence of a business transaction and also contain an indication of its completion. In this case, as an example, we can consider cash documents (expenditure cash order).

Moscow State University of Printing Arts

9.

Organization of primary accounting, documentation

9.1.

The concept of primary accounting. Document

Primary accounting is a single, repeated over time, organized process of collecting, measuring, recording, accumulating, storing information, and in the conditions of automated control systems - its transmission and initial processing. In this case, the initial processing of information is understood as the differentiated accumulation of quantitative data on a certain set of characteristics characterizing business operations, production phenomena and processes. Primary accounting is the initial stage of systemic perception and registration of individual transactions associated with economic processes and phenomena.

For a complete and continuous reflection of accounting objects, it is necessary, first of all, to record each business transaction. For this purpose, an element of the accounting method is used - documentation - the main method of accounting monitoring of the economic activities of organizations, its primary control. Each operation, regardless of volume and content, is formalized in a document at the time of its completion and is the first stage of accounting.

A document (from the Latin documentum - instructive example, evidence, evidence) is written evidence confirming the fact of a business transaction and the right to carry it out.

A primary document is an accounting document that is drawn up at the time of a business transaction and is the first evidence of the facts that occurred. The primary document confirms the legal validity of the business transaction carried out and establishes the responsibility of individual performers for the business transactions performed by them.

Documentation serves as the basis for subsequent accounting entries and ensures the accuracy, reliability and indisputability of accounting indicators, as well as the possibility of their control.

Documents are the means by which financial and economic activity itself is carried out. They are used for operational management and management of the organization.

Documents have legal significance; they are used as evidence in disputes between organizations and individuals. Only correctly and timely documents have evidentiary value in arbitration and courts.

Documents have control value, as they make it possible to control the safety of valuables and prevent cases of theft. The document is of great importance when conducting documentary audits and audits of the financial and economic activities of the organization. Documents are used to analyze the results of an organization's work. It is the document that is the basis of the organization’s information system, which is used in management.

9.2.

Form and details of primary documents

Primary accounting documents are accepted for accounting if they are drawn up in the form contained in the albums of unified (standard) forms of primary accounting documentation, and documents approved by the organization, the form of which is not provided for in these albums, must contain the mandatory details established by the Accounting Regulations.

In accordance with the Federal Law “On Accounting” No. 129-FZ dated November 21, 1996, primary accounting documents must contain the following mandatory details:

- Title of the document;

- date of document preparation;

- name of the organization on behalf of which the document was drawn up;

- content of a business transaction;

- measuring business transactions in physical and monetary terms;

- names of positions of persons responsible for carrying out a business transaction and the correctness of its execution; personal signatures of officials.

In the Regulations on Accounting, the mandatory details of primary accounting documents, along with those listed, also include:

- form code;

- transcripts of signatures of officials who signed this document, including cases of creating documents using computer technology.

The absence of any of the required details in the primary accounting document is a violation of the accounting rules and may lead to the application of financial sanctions to the organization, since improperly executed documents do not confirm the fact of a business transaction, and therefore, it is possible to claim that one or no other business transaction was actually carried out.

As a rule, organizations use the following additional details:

- Document Number;

- organization address;

- the basis for carrying out a business transaction recorded by a document (agreement, order, instruction, etc.);

- other additional details, the need for which is determined by the nature of the business transactions being documented.

To simplify the processing of accounting information, a business transaction code may be provided in primary accounting documents.

9.3.

Requirements for accounting documents. Corrections of primary accounting documents

Entries in accounting registers are made on the basis of primary accounting documents, which must be compiled at the time of the transaction, and if this is practically impossible, immediately after the end of the operation, which is associated with the main purpose of primary accounting documents - recording the fact of a business transaction.

The list of persons entitled to sign primary accounting documents is approved by the head of the organization in agreement with the chief accountant. In this case, the documents used to document transactions with funds are signed by the head of the organization and the chief accountant or persons authorized by them. Without the signature of the chief accountant or an authorized person, monetary and settlement documents, financial and credit obligations are considered invalid and should not be accepted for execution.

Corrections to cash and bank documents are not permitted. Therefore, if errors are detected in them, cash and bank documents cannot be accepted for execution and must be drawn up anew. Corrections can be made to other primary accounting documents only by agreement with the persons who compiled and signed these documents, which must be confirmed by the signatures of the persons indicating the date of the corrections.

When a document with corrections is received by the accounting department, it is advisable for the accountant to also sign the correction.

9.4.

Document classification

A large number of different documents are used to reflect business transactions. For the correct use of documents, it is customary to group them, i.e. draw up consolidated accounting documents that are classified according to homogeneous characteristics: by purpose, order of preparation, method of recording transactions, place of preparation, order of filling. The classification of documents is presented in Fig. 9.1.

According to their purpose, documents are divided into administrative, executive (exculpatory), accounting, and combined.

Administrative documents contain an order (instruction) to carry out a business transaction. However, they do not confirm the fact of its implementation, and therefore are not the basis for accounts. For example, orders, payment order to the bank for the transfer of taxes, etc.

Supporting documents confirm the fact of a business transaction and serve as the basis in accounting for reflecting business transactions. For example, invoices confirming expenses incurred, acts of acceptance and transfer of fixed assets, etc.

Accounting documents are drawn up by accounting employees in cases where there are no other documents to record a business transaction, or for the purpose of preparing administrative and corroborative documents for reflection in accounting. For example, accumulative statements, calculations of the actual cost of products, various types of certificates and calculations prepared by the accounting department, etc.

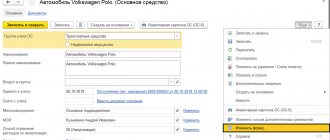

Combined documents simultaneously perform the functions of administrative and acquittal, acquittal and accounting formalities. For example, an invoice for the release of material assets contains an order to release materials from the warehouse to the workshop, as well as registration of the actual issue; cash receipt order.

According to the order in which documents are drawn up, there are primary and summary documents.

Primary documents are drawn up for each individual transaction at the time of its completion. For example, an incoming cash order, an outgoing cash order, payment requests, acts for writing off fixed assets, etc.

Consolidated documents are drawn up on the basis of previously compiled primary documents. Their use facilitates control of homogeneous operations. They can be executive, accounting or combined. For example, advance and cash reports, grouping and accumulative statements. In particular, the advance report, being a combined one, performs the functions of a supporting and accounting document. It provides a complete description of settlements with accountable persons, as well as a description of production expenses on accounts after verification and approval of the report.

Based on the method of recording transactions, documents are divided into one-time and cumulative.

One-time documents are used only once to reflect a single transaction or several simultaneously performed transactions. After registration, the one-time document goes to the accounting department and serves as the basis for reflection in accounting. For example, incoming and outgoing cash orders, payroll statements, etc.

Cumulative documents are compiled over a certain period (week, decade, month) to reflect homogeneous recurring transactions that are recorded in them as they occur. At the end of the period, the totals for the indicators used for the accounts are calculated. Cumulative documents differ from summary documents in that a summary document is drawn up on the basis of primary documents and is a summary of them, while a cumulative document is a primary document compiled gradually by accumulating transactions. Accumulation documents include limit cards, two-week or monthly orders, etc.

Depending on the place where they are drawn up, documents can be internal or external.

Internal documents are drawn up at the enterprise to reflect internal operations. For example, cash receipts and expenditure orders, invoices, acts, payroll statements, etc.

External documents are filled out outside the boundaries of the given enterprise and are received in formalized form. For example, invoices, bank statements, waybills, etc.

According to the order in which they are filled out, documents can be classified into those compiled manually and using computer technology.

Manual documents are completed by hand or on a typewriter.

Documents executed with the help of computer technology automatically record information about production operations at the time of their completion.

All documents received by the accounting department are processed to prepare their entries in the accounting registers. The main stage of accounting processing of documents in an organization is the verification of received documents in substance, form and arithmetically.

9.5.

Organization of document flow

The concept of document flow includes drawing up a schedule for the passage of documents, monitoring the correct execution of documents and the appropriate reflection of transactions on accounting accounts.

When drawing up a schedule, the following requirements must be met:

- primary accounting documents accepted by the accounting department must have all the required details;

- when accepting documents, the correctness of arithmetic calculations must be checked;

- documents must be drawn up in accordance with the requirements of laws and regulations (for example, invoices for receipt of goods must indicate the amount of VAT in order to be accepted for reimbursement);

- all corrections in documents must be certified by the signatures of the persons responsible for their preparation, indicating the date of correction;

- For any transaction, all necessary documents must be presented (agreement and amendments to it, invoice or performance certificate, invoice, payment order).

At the initial stage of drawing up a document flow schedule, the chief accountant determines the circle of persons working with primary documents; control is established over the correct execution of primary accounting documents and the reflection on their basis of business transactions in accounting accounts.

The chief accountant needs to optimize document flow. This sets:

- list of primary documents used at the enterprise;

- who among the employees of the enterprise has the right to sign these documents and is responsible for the correctness of their execution and timely submission to the accounting department;

- working diagram of existing departments of the organization;

- the order of movement of each document between departments of the organization and the deadline for submitting documents to the end user of information (for example, accounting);

- a schedule for the movement of documents within the accounting department, allowing for timely organization of tax calculations and preparation of financial statements.

The document flow schedule allows for improved control by the accounting department over the entire work of the organization, i.e. increases the efficiency of all accounting work of the organization.

When drawing up a document flow schedule, the requirements for the rational organization of document flow are taken into account: the shortest path for the movement of documents, indication of specific performers, minimum terms of passage through authorities.

Rational organization of document flow strengthens the control functions of accounting, speeds up the time frame for drawing up financial statements, and increases the efficiency of accounting necessary for enterprise management.

Document storage. The organization is obliged to store all accounting documentation for at least five years. For certain categories of primary accounting documents (for example, for documents confirming the amount of employees' wages), current legislation provides for longer storage periods.

The working chart of accounts, other accounting policy documents, coding procedures, computer data processing programs (indicating the terms of their use) must be stored by the organization for at least five years after the reporting year in which they were last used to prepare financial statements.

The head of the organization is responsible for organizing the storage of primary accounting documents, accounting registers and financial statements.

What applies to accounting documents

Documents regulating accounting are formed according to the order in which they were compiled, that is, they are divided into primary and consolidated. The basis for making accounting entries are primary accounting documents. They can be generated directly at the enterprise, or they can be received from the outside - from suppliers, buyers, and other counterparties. The main accounting documents related to the primary ones are invoices, payment, cash, bank and other documents. Summary reports are compiled on the basis of primary data and contain generalized information.

According to their content, they can take on material and monetary values. The material part reflects the presence and movement of commodity and other valuables. For example, acts of acceptance and transfer, invoices for the release of goods give an accurate idea of the types and quantities of property being moved. A cost estimate of the operation performed is also given.

Some papers relate exclusively to settlement ones. We are talking about pay slips, cash orders, bank statements. The information they carry is exclusively financial in nature - the status of settlements with contractors, wages to employees.

Until recently, the requirement for the mandatory use of unified forms in accounting remained. The entry into force of Law No. 402-FZ on accounting makes it possible for the management of organizations to independently develop forms of primary documents. But at the same time, some requirements for the presence of mandatory details remain. That is, in primary accounting, the only valid accounting document is a form reflecting the following information:

- name and date of preparation of the form;

- details of the business entity;

- the content of the operation and its characteristics in monetary and quantitative terms;

- signatures of responsible persons.

Requirements for primary documentation

Since the primary document is an important part of the accounting document flow, it is necessary to be very careful in maintaining and filling it out. There are certain requirements, norms and standards that will have to be adhered to.

What should be in the primary

Primary accounting documents must be created according to certain standards so that the tax authorities can accept them without problems, and no one will have problems in the future. Therefore, it is necessary to indicate the following information in the primary document:

- The name of a specific document.

- Date of preparation.

- The name of the subject who (or on whose behalf) this or that action is carried out.

- What is the essence of a business transaction?

- Business transaction meters. There are cash or in kind. If natural, you must indicate what is being measured.

- Persons responsible for the correct conduct of the operation and the preparation of documents for it. Be sure to indicate positions.

- Signatures of the persons involved, their full names and other information that will help identify them.

The presence of all this data is necessary not only to confirm that the operation was actually carried out. The information specified in the document will allow, if necessary, to verify all indicators, contact the actors and clarify some points.

Rules for preparing primary documentation

It is important to remember that when creating such documents, it is not enough to simply take into account the data that it should carry. The regulations establish certain rules for maintaining and creating such papers. If they are violated, or tax inspectors have doubts, you will not only have to redo the document, but also pay a large fine. Especially if the violation is not the first.

So, what recommendations should you follow in order not to anger the tax authorities:

- Write strictly without errors (including punctuation) and blots. Avoid typos in electronic documents.

- You can use any pens. But it is advisable to choose ones that will not smear when writing - this will spread dirt on the paper, which is unacceptable.

- It is necessary to draw up documents in case of assumptions that some kind of business transaction will be carried out. As a last resort (which is not recommended at all), you can draw up and submit a primary report immediately after the operation.

- Absolutely all calculated data presented in digital form must be duplicated in words.

- If there is no data to fill out the details in the initial form, you need to put a dash there. Leaving empty lines is strictly prohibited.

It is important to remember that the more responsible the accountant is in filling out primary documents, the fewer problems the organization will have in the future.

What to do if a mistake has already been made?

In a situation where it is necessary to correct one or another primary document, you need to know what can and cannot be done. So, when correcting errors you can:

- Cross out the incorrect information and indicate the correct information next to it. It is necessary to put the signature of the person who corrected the information, as well as the instruction “Believe the corrected” and the specific date when the correction was made.

- Make additional notes. It is used if the total values of transactions were executed, but as a result they turned out to be slightly higher. In this case, it is necessary to record the balances in a new document and take them into account in the current or next reporting period.

- Perform reversal. That is, correct the entry using negative values: write down the incorrect data in red paste, and then indicate the correct data next to it.

Do not use concealer under any circumstances! It is prohibited, and the tax authorities will severely punish the violator for its use.

Noticeable corrections, “dirt” and smudged hands are also unacceptable. All documentation must be completed with the utmost care.

What are accounting documents used for?

For organizations and even entrepreneurs, the importance of accounting documents is great. They not only serve as confirmation of accomplished facts of economic activity, but also help determine the current financial condition of the company. On their basis, subjects carry out tax calculations, while reducing the tax base is possible only if they have documents correctly drawn up from the point of view of legislation.

The absence of the necessary primary documents, certificates, and statements can subsequently create many problems for the organization, raising additional questions from regulatory authorities. Often this fact serves as the basis for recalculating the tax base.

What accounting documents should an LLC have to ensure the ongoing operation of the enterprise? Depending on the specifics of the work, these are documents regulating the activities of the enterprise - orders, instructions, accounting policies. Confirmation of the facts of income received and expenses made are invoices, invoices, payslips with personnel, and other cash and bank documents. To simplify the accounting procedure, turnover and accumulative statements containing general information about homogeneous transactions are widely used.

Duration of primary storage

According to Article 29 402-FZ , all necessary documents must be kept by the economic entity. He is obliged to ensure their safety for at least five years after the end of the reporting year. This is also confirmed by order of the Ministry of Culture of the Russian Federation No. 558 (dated 08/25/2010).

Tax inspectors can request documents for a specified period at any time. And the organization will be obliged to provide them. In addition, you can store documentation longer - in certain circumstances it will become good evidence in court.

Transfer of documents and storage period

Considering that the role and significance of accounting documents are undeniable for every business entity, their movement and storage must also be subject to certain rules.

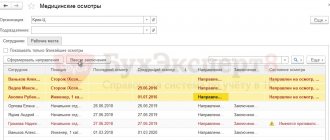

Organizations independently draw up a schedule of primary document flow, which includes the following stages:

- reception or registration;

- treatment;

- storage;

- transfer to the archive.

The specified schedule should contain the optimal time frame for processing the received data. If necessary, adjustments to the established periods are allowed.

Storage of primary documents is provided by employees of the accounting service. At the same time, when changing responsible persons, it is necessary to draw up an act of acceptance and transfer of accounting documents, a sample of which is developed taking into account the characteristics of the company. But at the same time, it is necessary to create a detailed register of accounting documents when transferring cases, a sample of which will provide complete information about the existing volume of transactions.

The storage period for documents varies depending on their purpose. Information providing data on tax calculations must be available for at least 4 years. Completed employee information forms are kept for up to 75 years.

Register of accounting documents when transferring cases (sample)

Accounting registers for primary

Each primary document received by the accounting department must be registered. Therefore, there are special accounting registers. These are special counting tables made in a specific form. They are necessary to collect information about business transactions on accounts and not get confused in a bunch of certificates, invoices, and so on.

Accounting registers are different. As a rule, they are divided into the following categories:

- By appointment. This includes chronological (documents are recorded as they appear), systematic (the primary document is recorded taking into account its grouping characteristics). The combination of these two types is called synchronistic registers - ideally this is what accounting should do.

- By summarizing the data. Integrated (from particular to general) and differentiated (from general to particular) registers fall into this category.

- By appearance. Everything is very simple - they are divided according to the physical form of the register. It can be in the form of a card, book, electronic media, and so on.

Proper maintenance of accounting registers will significantly simplify the task and protect against many problems.