The accounting policy (AP) is a “particularly important” document that contains aggregate information on the maintenance of accounting and tax accounting methods at the enterprise (primary observation, cost measurement, current grouping and generalization of the results of economic activity facts).

The purpose of creating a management program is to ensure the possibility of combining all accounting information about the situation in the company. The UP contains the financial and economic indicators of the company, the procedure for their formation and what these indicators reflect.

The regulations of the legislation of the Russian Federation stipulate that the UE is formed by the chief accountant, or the person responsible for this area of work.

Each individual economic entity independently forms its own management system, which is based on the facts/conditions of conducting business activities.

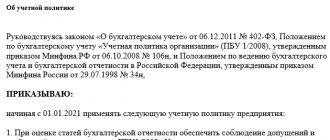

When drawing up the UE, the following regulations must be applied:

| • Law “On Accounting” dated December 6, 2011 No. 402-FZ; • PBU 1/2008 “Accounting policy of the organization”, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n; • Tax Code of the Russian Federation (Article 313); • other regulations (Standard recommendations for organizing accounting for small businesses, approved by Order of the Ministry of Finance of Russia dated December 21, 1998 No. 64n, letters and clarifications of the Ministry of Finance, etc.); |

These regulations set out the basic principles and requirements for drawing up accounting policies necessary for the implementation of certain activities of the entity.

Many companies formulate accounting policies separately, i.e. on tax accounting and accounting, but the law does not prohibit the formation of a single UP, so it is possible to form one policy with tax and accounting sections.

| It should be noted that Article 313 of the Tax Code of the Russian Federation contains requirements for the need to establish a procedure for maintaining tax accounting in the UP and approval of the UP for NU by order (instruction) of the head of the company. At the same time, Law No. 402-FZ determines that in the UE for accounting it is necessary to concentrate the accounting methods used by the entity. However, there are no clear instructions about what the structure of this document should be, by whom, when and in what form it should be approved. These issues are discussed in PBU 1/2008, but it does not mention the need for annual approval of the UP. PBU 1/2008 prescribes the application of the management program consistently from year to year, maintaining its continuity and comparability with data from previous years. That is, if there are no factors forcing the entity to change the accounting policy it has adopted (innovations in legislation, new types of activities), then there is no need to change it. UP for the purposes of tax accounting in the Tax Code of the Russian Federation (Article 11) is characterized as a system for recording indicators that are significant for the correct determination of the tax base. Accordingly, if the methodology for accounting for these indicators does not require changes, then changes in the tax management system will not be required. |

The organization's accounting policies must be changed every year

It is not true. Change accounting policies as necessary. To do this, it is not necessary to approve a new accounting policy annually. It is enough to make additions or changes to the current accounting policy by issuing an appropriate order.

Of course, if you wish, you can approve the accounting policy every year. In this case, the approval date must be no later than December 31 of the previous year. For example, the accounting policy for 2017 should be approved before December 31, 2021 inclusive. That is, the approval date must be exactly December 31 or earlier.

But let us repeat once again - it is enough to draw up an accounting policy once when creating an organization, and then only make additions or changes.

Principles for forming an order for accounting policies

The order on the accounting policy of the organization is formed in accordance with:

The Law of the Republic of Belarus “On Accounting and Reporting” (hereinafter referred to as the Law) as amended, entered into force on January 1, 2014;

National accounting and reporting standard “Accounting policies of the organization, changes in accounting estimates, errors”, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated December 10, 2013 No. 80 (entered into force on February 21, 2014) (hereinafter referred to as NAS).

It is enough to approve the accounting policy once. There is no need to approve a new accounting policy for each year or annually issue an order from the manager to extend the validity of the “old” accounting policy.

If an organization has branches, representative offices or other divisions, then all of them must be guided by a single policy adopted by the organization.

All other internal organizational and administrative documents regulating financial and economic activities must be formed precisely on the basis of accounting policies.

An organization, in accordance with the law, revises its accounting policies if:

1) changes have been made to legislation, incl. tax legislation, accounting rules, and also based on decisions of the owner;

2) it is required to change the method of accounting, the application of which will lead to an increase in the quality of information about the object of accounting.

It is not considered a change in accounting policy to approve the method of accounting for facts of economic activity that are essentially different from the facts that occurred previously, or that arose for the first time in the organization’s activities. This means that an organization can make additions to its accounting policies as new facts of economic activity that have not taken place before arise, rather than trying to predict all possible operations that will be carried out in the future when forming an accounting policy. For example, if an organization providing services begins to sell purchased goods, it will need to establish a procedure for accounting for them.

The accounting policies adopted by the organization must be applied consistently from year to year. However, in the process of functioning of an organization, it often becomes necessary to make changes to the selected accounting policies. The reasons for this may be (part 7 of article 9 of the Law, paragraph 3 of the NAS):

Additions made to the accounting policy are put into effect from the moment the fact of economic life arises that required their introduction.

Changes can be introduced into accounting policies only from the beginning of the financial year. Let’s say that an organization that evaluates inventories when writing them off at an average cost decides to switch to a method based on the cost of each unit.

Changes in accounting policies caused by amendments to legislation are applied from the moment the relevant regulatory act comes into force. Moreover, if a changed law obliges an organization to apply some method of accounting, then it is obliged to do this, even if changes have not been made to its accounting policies.

The consequences of changes in accounting policies that have had or may have a significant impact on the financial position, financial performance of the organization and (or) cash flows are reflected in the financial statements retrospectively.

When retrospectively reflecting the consequences of changes in accounting policies, we proceed from the assumption that the changed method of accounting was applied from the moment the facts of economic activity of this type arose. This reflection of the consequences of changes in accounting policies consists of adjusting the opening balance under the item “Retained earnings (uncovered loss)” for the earliest period presented in the financial statements.

In addition to adjusting the “Retained earnings (uncovered loss)” indicator, the values of related financial statements items are also recalculated for each reporting period presented in the reporting forms. These indicators are adjusted as if the changed accounting policy had been applied from the beginning of the relevant facts of economic activity.

If an assessment in monetary terms of the consequences of a change in accounting policy in relation to periods preceding the reporting period cannot be made with sufficient reliability, then the changed accounting method is applied to the relevant facts of economic activity that occurred after its introduction (prospectively).

Changes or additions to the accounting policy are approved by order of the manager.

The accounting policy of the organization is formed by the chief accountant or another person who, in accordance with the law, is entrusted with maintaining the accounting records of the organization (clause 1 of Article 9 of the Law) and is approved by the head of the organization. In this case it is stated:

the types of accounting valuation of assets and liabilities used by the organization, methods of accounting for income and expenses, capital in accordance with the provisions of Article 12 of the Law and national standards for accounting and reporting;

chart of accounts of the organization's accounting, containing synthetic and analytical accounts necessary for maintaining accounting records in accordance with the requirements of timeliness and completeness of accounting and reporting;

forms developed by the organization for the use of primary accounting documents and accounting registers, as well as documents for internal accounting reporting;

the procedure for conducting an inventory of the organization’s assets and liabilities in the part that is not determined by the Law and regulations of the Ministry of Finance of the Republic of Belarus;

other methods of assessing assets and liabilities that affect the formation of reliable financial statements.

Be sure to write in great detail about accounting for insurance premiums.

This is not true, but something will still have to be written down in the accounting policy. Undoubtedly, the most important change of 2021 is that insurance premiums will now be administered by the Federal Tax Service instead of the Pension Fund and the Social Insurance Fund. We are talking about two federal laws dated July 3, 2016: No. 243-FZ and No. 250-FZ.

Read also “Limits and base for insurance premiums for 2021”

The only thing that must be written down in the accounting policy is to approve the form of an individual accounting card for the amounts of accrued payments and other remunerations and the amounts of accrued insurance premiums. Now everyone uses the card form given in the joint letter of the Pension Fund of Russia, the Federal Insurance Fund of Russia dated December 9, 2014 No. AD-30-26/16030, 17-03-10/08/47380. The Tax Service does not plan to develop a form of the card. They say that this is a regular tax register, which each company can maintain in its own way. That is, everything is similar to personal income tax - once there was a form 1-NDFL, then it was canceled and taxpayers began to use a new register, using 1-NDFL as a basis.

Clause 4 of Article 431 of the Tax Code of the Russian Federation obliges to keep records of the amounts of accrued payments of insurance premiums and other remunerations, the amounts of insurance premiums related to them in relation to each individual recipient of payments. Therefore, it is necessary to supplement the accounting policy by issuing an order.

Read also “The accounting policies of organizations are being prepared for changes”

Sample order to make additions to the accounting policy for accounting and taxation purposes

You can take as a basis the same register that was recommended by the Pension Fund and the Social Insurance Fund. During inspections, tax officials, if necessary, will also require accounting cards from companies. For absence - a fine of 200 rubles for each register (Article 126 of the Tax Code of the Russian Federation).

One more thing. If your company does not practice types of work that affect the length of service for early retirement and are subject to pension contributions at additional rates, the card can be reduced. Leave only the sections about payments and insurance coverage.

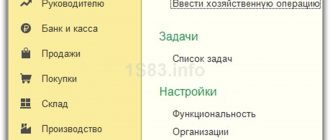

When is the accounting policy approved?

According to the general rules, each organization has 90 days or 3 months from the date of creation to develop and approve the MP. The day of creation is considered to be the registration of the organization in the Unified State Register of Legal Entities. This applies to newly created and reorganized companies.

For already existing organizations the procedure is different. The manager must issue an order to approve the new UE no later than the last day of the expiring year, since the accounting rules apply from the year following the approval. Therefore, it is not worthwhile to date the order on the UP for 2019 later than December 29, 2018.

In small companies, the UE may remain unchanged for years. It can be developed once and applied year after year, even until liquidation. There is no need to approve a new document annually. But changes and additions need to be made to the document.

Accounting policy is an ironclad argument in case of disputes

A common misconception is this: if you write down certain provisions in your accounting policies, this guarantees victory in a dispute with the tax authorities. Unfortunately, it is not.

Indeed, accounting policy can become an additional argument according to the principle “all ambiguities are interpreted in favor of taxpayers.” But in case of a dispute, it is necessary to rely on the norms of legislation.

note

Small enterprises may not create a reserve in accounting for a decrease in the cost of inventories if they stipulate this in their accounting policies (clause 25 of PBU 5/01).

For example, now there is some “controversy” around whether or not compensation for delayed wages should be subject to insurance premiums. According to the Ministry of Labor and inspectors, this is a different payment within the framework of labor relations. That is, it formally falls under the object of taxation.

Read also “Insurance contributions from compensation for delayed wages”

At the same time, the judges say in unison that not all payments in favor of the employee fall under the scope of contributions.

In particular, compensation for delayed wages is not related to how a person works. This is a payment for the fact that the employer has poorly fulfilled its obligation to pay wages on time. At the same time, regarding personal income tax, officials have long recognized that compensation is not taxed. But while there are no official letters or judicial practice, there is no need to include anything about insurance premiums and salary delays in the accounting policies.

You should be very careful: if something is prescribed in the accounting policy, be sure to strictly follow it. The same applies to norms that are applied optionally. For example, they began to use bonus depreciation or a reserve for doubtful debts in tax accounting. But the accounting policy did not mention the possibility of using this. Then even the judges will not help (resolution of the Federal Antimonopoly Service of the Moscow District dated November 19, 2013 No. A40-17925/13).

Who develops and approves accounting policies

The UP is formed by the chief accountant of the company or another employee who is entrusted with accounting. In accordance with PBU 1/2008, the UP states:

- work accounts that the organization will use for accounting;

- forms of primary documents, internal documents and accounting registers;

- inventory procedure;

- methods for assessing property and liabilities;

- document flow procedure;

- basics of operations control;

- other solutions for organizing accounting.

The manager does not participate in the development unless he wants to. But he must read and approve the finished document.

The tax office asks to show the accounting policy during the audit. And companies often have problems with regulatory authorities when it turns out that there is no order to approve the UE and there never was. At the same time, the order not only confirms the manager’s consent to the application of the management program, but also determines the persons responsible for compliance with the rules approved in the policy.

There is no standard form for an order, so you can compose it arbitrarily. But it must contain mandatory details: name of the document, date of preparation, signature. The provisions of the accounting policy are stated in the text of the order or attached to it in the form of appendices.

Small businesses may not draw up accounting policies at all

Alas, this is not true. For small businesses there are many concessions in terms of accounting and reporting. In particular, they can keep records and prepare reports in a simplified form. But the opportunity to take advantage of this indulgence should be spelled out in the accounting policy.

By the way, in the summer of 2021, new amendments and relaxations in terms of accounting came into effect. And it’s more convenient to use them right from the beginning of the year. Let us remind you that we are talking about amendments that were made to the PBU by order of the Ministry of Finance of Russia dated May 16, 2016 No. 64n.

Firstly, you can now take into account raw materials and materials at the supplier’s price. Previously, the value of assets additionally included transportation costs, fees to intermediaries, etc. Moreover, according to the new rules, all inventories can be written off at a time if the activities of a small enterprise do not involve significant balances on them. Each company determines the level of materiality independently. For micro-enterprises there are no these additional conditions; they can write off any inventories without restrictions (clause 13.2 of PBU 5/01).

Secondly, depreciation on fixed assets can be calculated once a year - on December 31. In this case, depreciation on production and business equipment can be written off at a time (clause 19 of PBU 6/01).

Read also “Small businesses will have to submit statistical form No. TZV-MP”

Accounting policies must be submitted to the tax office

In fact, there is no need to submit accounting policies to the Federal Tax Service. This does not need to be done either when creating a company or after each addition/change to accounting policies. There is simply no such obligation in tax law.

However, this does not mean that there may be no accounting policy at all. After all, the right to choose is given on many issues. This includes depreciation, write-off of goods and materials, reserves, and so on. Accordingly, without accounting policies it is impossible to control the correctness of tax calculations. Therefore, as part of an on-site inspection, the inspection has the right to require this document. The request form is given in Appendix 15 to the order of the Federal Tax Service of Russia dated 05/08/2015 No. ММВ-7-2/189. Within 10 working days from the date of receipt of such a request, it is necessary to provide the inspectors with a copy of the order approving the accounting policy (clauses 1-3 of Article 93 of the Tax Code of the Russian Federation).

Have you decided to ignore the inspectors' demands? Then get ready to pay a fine of 200 rubles for each document not submitted. This is provided for in paragraph 1 of Article 126 of the Tax Code of the Russian Federation.

In addition, at the request of the Federal Tax Service, the court may impose administrative liability measures on the responsible employees of the organization (for example, its head). The fine will range from 300 to 500 rubles (part 1 of article 23.1, part 1 of article 15.6 of the Code of Administrative Offenses of the Russian Federation).

What is accounting policy

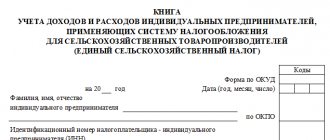

The accounting policy (hereinafter referred to as the AP) is the basis document on which the company’s accounting and tax accounting is built. Sometimes a separate UE is made for each type of accounting, but this is not necessary - you can combine them into one document. Every organization should have a management program, regardless of:

- organizational and legal form;

- type of activity;

- tax systems;

- scale of production;

- other conditions.

Accounting legislation is not always interpreted unambiguously, but on certain issues it gives the right to choose. The UP must reflect which option the organization will adhere to in its work. For example, methods of writing off inventories are by FIFO, by unit cost or by average cost. There is no need to include mandatory accounting rules in the UE.

The tax part of the UP is regulated by Art. 313 Tax Code of the Russian Federation, accounting - PBU 1/2008. The laws contain a requirement for mandatory approval of the management program by order or directive of the head of the organization.