When is UTII acceptable when selling product samples?

The imputator sold goods based on samples and catalogues.

At the same time, customers chose products in the store. Then it was delivered to the buyer directly from the factory. According to tax authorities, such a sale cannot be considered retail for the purposes of applying UTII. The entrepreneur is assessed additional taxes according to the general system. The opinion of the inspectors contradicts the letters of the Ministry of Finance of Russia dated 02/22/12 No. 03-11-06/3/12 and dated 03/31/14 No. 03-11-11/13995. Retail trade transferred to UTII does not include sales from catalogs and samples “outside the stationary retail chain” (Article 346.27 of the Tax Code of the Russian Federation). In the commented case, the buyer’s order, as well as payment, are accepted in the store - an object of a stationary retail chain. This, as the Volga District Autonomous District decided, shows the legality of the imputation. Further shipment of goods from the factory or warehouse and its delivery to the buyer’s address is not the basis for re-qualification of trade. Those who sell samples sometimes have to increase the taxable area. This is the conclusion from paragraph 13 of the appendix to the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 03/05/13 No. 157. It states: usually for tax purposes the area of the passages leading to the trading floor is not taken into account. The exception is the situation when the aisles are adapted for sales. For example, when samples of goods are displayed there. A document that will protect the right to UTII when selling goods to legal entities

Trade by samples - an “imputed” activity?

Currently, many companies are introducing online sales, when goods are ordered by phone or online and delivered to the specified address. However, not always in this case the company will be able to remain a UTII payer. Let's consider the nuances, taking into account the opinions of officials. This will help determine under which tax regime to report for the second quarter.

When “imputed” activity does not occur

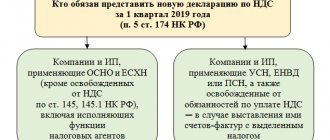

In accordance with subparagraph 6 of paragraph 2 of Article 346.26 of the Tax Code of the Russian Federation, the regime in the form of payment of UTII is applied to activities in the field of retail trade carried out through stores and pavilions with a sales area of no more than 150 square meters. m for each trade organization object. According to Article 346.27 of the Tax Code of the Russian Federation, retail trade refers to activities related to the trade of goods (including in cash, as well as using payment cards) on the basis of retail sales contracts. But please note: this type of activity does not include the sale of goods based on samples and catalogs outside a stationary retail network, including in the form of postal items (parcel trade), as well as through teleshopping, telephone communications and computer networks. On this basis, trade in which the contract is concluded in the office and the goods are delivered to the buyer’s home is not transferred to the payment of UTII. This is precisely the opinion expressed in the letter of the Ministry of Finance of Russia dated June 10, 2010 No. 03-11-06/3/80.

When can UTII be paid?

At the same time, there is an important clarification in the definition of trade based on samples and catalogs: such sales are not considered retail only if sales are carried out outside a stationary retail chain. Therefore, we need to find out what applies to a stationary retail network (when we can legally pay UTII). And this is a trading network located in buildings, structures, structures intended or used for trading, connected to utilities. For example, shops are classified as objects of a stationary retail chain. In a letter dated February 22, 2012 No. 03-11-06/3/12, the Ministry of Finance of Russia expressed the point of view that if the sale of goods according to samples and catalogs is carried out through a trade facility, which, according to inventory and title documents, is a stationary trade facility network, then such activity can be recognized as retail. And accordingly, you can pay a single tax on imputed income. Although in a letter dated December 31, 2010 No. 03-11-06/3/175, specialists from the financial department in a similar situation made a different decision. It is possible that their position has now been influenced by the established arbitration practice: judges take the side of taxpayers when considering disputes on this topic. As an example, we can cite the resolution of the Federal Antimonopoly Service of the Volga Region dated May 12, 2010 No. A57-10706/2009. In this regard, there is an option to avoid claims from tax authorities when trading via the Internet. Provided, of course, that the area of the store's sales area is less than 150 square meters. m. The trick is that the buyer can choose and order goods via the Internet, but for the goods themselves he will have to come to the store and pay for it in cash or using a card. And the seller will issue him a sales receipt or cash receipt (other document).

>|UTII payers may not use CCP for cash payments with buyers, provided that they are issued with another document confirming the receipt of money.|< In this case, financiers find no reason to refuse the seller to use UTII (letter from the Ministry of Finance of Russia dated January 24, 2011 No. 03-11-11/11).

Consider the area of the object

Special attention should be paid to trade in such specific products as building materials. After all, many types of building materials are not easy to place indoors - sand, crushed stone, brick, timber, and a host of other similar products. Therefore, most often they are placed outdoors - under a canopy, or even just in the open air. Thus, the buyer first pays for the goods and then picks them up from the warehouse. Could this be an obstacle to the use of UTII? Will this be considered trading by design? Let us recall that the place used for carrying out retail purchase and sale transactions is defined as a trading place. Retail locations include buildings, structures, structures and land plots used for retail purchase and sale transactions. The store belongs to the objects of a stationary retail chain that has trading floors. At the same time, the area of the sales floor includes, among other things, the part of the store, pavilion (open area) occupied by equipment intended for displaying, demonstrating goods, conducting cash payments and servicing customers. But the area of utility, administrative and amenity premises, as well as premises for receiving, storing goods and preparing them for sale, in which customer service is not provided, is not the area of the sales floor.

>|The area of the sales floor is determined on the basis of inventory and title documents.|< The Russian Ministry of Finance decided that in order to determine the possibility of applying UTII, the trading area of the store where small-sized goods are sold and the area of the land plot on which this product is located should be combined (letters from July 20, 2010 No. 03-11-11/203, dated November 1, 2006 No. 03-11-04/3/481). And if the retail area of the store and the area of the land used for sales are less than 150 square meters. m, you need to pay UTII. So you need to be very careful: even if the controllers do not insist that trade is based on samples, you can lose the right to use “imputation” due to the large trading area. Important to remember

If trade using samples and catalogs is carried out through fixed-line network facilities, the organization has a chance to remain a UTII payer (subject to other conditions for applying this special regime).

The article was published in the journal “Accounting in Trade” No. 7, July 2012.

When trade in samples does not allow the use of UTII

In the case under study, the taxpayer presented a registration certificate and a lease agreement, where the commercial premises were called a store. Therefore, the arbitration recognized the legality of the imputation. If there are no such documents, the court will prohibit the special regime.

Example

According to the taxpayer, samples of the goods are in the store. The evidence is a sign at the entrance to the disputed premises (“StroyKa Store”), the position of the manager (“store manager”). Referring to this, the organization calculated UTII. But the status of the premises is determined by inventory and title documents. The rooms where product samples are located are located in the entrance building. The technical passport classifies it as a building for service purposes, and not as a stationary retail chain. Sales based on samples outside such a network are not transferred to UTII (Resolution of the Federal Antimonopoly Service of the North-Western District dated December 25, 2012 No. A05-2406/2012).

How to defend yourself at the commission for the legalization of taxable objects

I recognize individual trade in samples on UTII as illegal for other sales based on samples and catalogs outside the stationary distribution network. For example, when the samples are in the office (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 28, 2012 No. 14139/11). Or in another administrative premises (resolution of the Federal Antimonopoly Service of the North-Western District dated June 26, 2012 No. A05-10626/2011). Or in a former workshop building (resolution of the North Caucasus District Administration of June 15, 2015 No. A32-21634/2014). Or in the exhibition hall (resolution of the Federal Antimonopoly Service of the Ural District dated June 29, 2012 No. F09-4404/12). Or in a warehouse (resolution of the Federal Antimonopoly Service of the East Siberian District dated April 18, 2013 No. A78-7424/2012). Or in a utility room at a parking lot (Resolution of the Federal Antimonopoly Service of the West Siberian District dated November 1, 2013 No. A45-25207/2012) or at a building materials database (Resolution of the Federal Antimonopoly Service of the North Caucasus District dated May 26, 2014 No. A53-649/2013). Or in a room that, according to documents, is classified as residential (resolution of the Federal Antimonopoly Service of the North Caucasus District dated December 10, 2012 No. A01-284/2012).

How to avoid tax losses from tightening trade laws

***

So, when conducting retail sales based on samples and catalogs, it is possible to use the imputation mode. However, it is necessary to take into account all the nuances of organizing trade, such as displaying goods, issuing them and storing them.

Similar articles

- For whom is the cancellation of UTII inconvenient?

- When is wholesale trade allowed under the UTII regime?

- UTII: retail trade in 2021

- Retail trade on the simplified tax system in 2016-2017

- Online store on UTII

When else will trade from catalogs be transferred to UTII?

If the order is placed in a store, then UTII is also legal when sold according to catalogs (samples). This is what the court said, supporting taxpayers. This, for example, can be seen from the decisions of the Federal Antimonopoly Service of the West Siberian Federal Antimonopoly Service dated October 26, 2006 No. F04-7243/2006 (27889-A45-43) and the Ural District dated December 27, 2011 No. F09-7984/11. Also in favor of the imputation, a resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 16, 2013 No. 15460/12 was issued. The arbitration also indicates: trade based on samples can be transferred to UTII even when the buyer is a legal entity (see resolution of the Federal Antimonopoly Service of the North-Western District dated March 20, 2014 No. A26-2084/2013). But three rules must be followed. Firstly, the terms of sale must be standard for retail purchase and sale (without wholesale supplies, without benefits for legal entities, etc.). Secondly, UTII is applicable only when the buyer does not plan to resell the goods or when the seller is not aware of such use*. It is undesirable to see situations where the same buyer, a legal entity, is constantly supplied with significant quantities of goods that exceed the needs for normal activities. Here the imputation may be considered illegal. And thirdly, samples or catalogs for selecting products should be in the store.

Is imputation allowed when trading by samples through a stationary retail chain?

The above list is quite extensive and covers many popular areas for small businesses. Nevertheless, some of these restrictions can be circumvented on completely legal grounds; sometimes they are suggested by the regulatory agencies themselves. This situation, for example, has developed around the trade in goods listed in catalogs or presented in samples. The Ministry of Finance of the Russian Federation in letter dated 03/07/2012 No. 03-11-11/77 explains that it is possible to pay UTII for such activities if trade is carried out in stationary retail outlets. Naturally, you will have to prove with documents that the retail outlet has all the signs of a stationary object.

Common mistakes

Error:

An entrepreneur who sells goods through a catalog outside a retail chain submits documents to transfer the business to UTII.

A comment:

If the product is sold outside the territory of a stationary retail chain, the transition to UTII is impossible.

Error:

A businessman owns a network of kiosks selling goods based on samples. He is not making the transition to UTII, since the total area of his stalls is 300 sq.m.

A comment:

The transition to UTII is possible, since the area of each stationary facility is taken into account separately - it should not exceed 150 sq.m.

Taxation of dropshipping

Direct sales from the manufacturer are a popular form of online business. The store is not an actual seller, providing only intermediary services. He does not incur any special expenses when carrying out such activities. The store receives an agency fee for its services. Its amount falls within the annual turnover limit for applying the simplified tax system. For dropshipping, the optimal choice is the simplified tax system with a 6% rate and taxation of income without taking into account expenses.

An important point: it does not matter how buyers pay for goods. Funds can be transferred to the account of the manufacturer (main seller). In this case, a reward is transferred to the store after the buyer pays for the goods. Another payment option is directly to the intermediary’s account. In this case, the store transfers the order amount to the main seller minus the agency fee.

Under what conditions can retailers apply UTII?

According to the instructions of paragraphs. 6 paragraph 2 art. 346.26 of the Tax Code of the Russian Federation, representatives of retail trade receive the right to apply the special tax regime UTII (Unified Tax on Imputed Income) provided that the area of the sales area of the store or pavilion in which visitors are served does not exceed 150 sq.m. Let's understand some concepts to make things clearer:

- Article 346.27 of the Tax Code of the Russian Federation defines the concept of retail trade

in relation to the situation with the transition to UTII. Retail trade is a type of business activity, the essence of which is the sale of goods under a retail purchase and sale agreement, incl. using payment cards and in cash. - The same article of the Tax Code contains a definition of a stationary retail chain

. This is considered a building or other structure specially adapted for trading (kiosks, pavilions, shops). - The area of a sales floor

is a part of a premises intended for trade (pavilion, store) or an open area where goods are sold, occupied by equipment used for demonstrating and displaying goods, as well as servicing and making payments (cash, non-cash) with customers. Areas are also taken into account:

- aisles for shoppers;

- cash registers;

- cash registers;

- service personnel workplaces;

- rented portion of the retail space.

Important!

If the owner of a retail chain operates several stores (pavilions, kiosks), it is not their total area that is taken into account, but the retail area of each retail outlet separately. The area of the sales area of each trade facility should not exceed 150 sq.m.

Any area of the store where customer service is not provided is not a sales area.

Warehouses from which goods arrive at the store or are directly issued to the buyer should not be taken into account. Also not taken into account are the areas of premises for receiving, storing and pre-sale preparation of goods, staff premises, utility and administrative premises.

In what cases should UTII not be used?

Whatever commercial premises the taxpayer uses in his activities, he must have the title and inventory documents drawn up for this facility.

The mentioned papers should reflect the following information:

- Proving the legality of using the outlet. Such information is written down in the following documents: contract of purchase and sale of non-residential premises, plans, explications, diagrams, technical passport, lease (sublease) agreement for the entire retail outlet or only part of it, permission to serve visitors on an open trading floor.

- About the layout, design features, purpose of the object.

In this case, the type of outlet does not matter - it can be a stationary store, a pavilion, a kiosk, a stall, a tent at a fair, a hand cart, a tray, a sales trailer, a point in a shopping center, or a vending machine.

Accordingly, if the entrepreneur does not have the listed documents, it is not possible to determine the status of the premises, and the UTII tax regime cannot be applied.

It will also not be possible to switch to UTII if the area of the retail facility exceeds 150 sq.m. That is, if an entrepreneur maintains a single pavilion with an area of 170 sq.m., UTII cannot be applied. If a businessman owns five kiosks of 90 sq.m. Everyone - UTII is affordable for him.