As established, information related to the diseases of citizens is recorded in the hospital bulletin in encrypted form using special codes. Each of them has a specific purpose, which is enshrined at the legislative level, in particular, by order of the Ministry of Health and Social Development of the Russian Federation No. 624n dated June 29, 2011 (Procedure, part 6, clause 43).

The codes are written down by the doctor and the employer (each in their own sections) on certain lines. So, for example, the employer is required to indicate the appropriate code in the “Calculation Conditions” line. The remaining codes provided by the form are recorded by the doctor. These also include code “04”.

| Current form of sick note | Lines for entering codes by a doctor | The line where the code “04” is written |

| Sick leave form | Cells for codes | Code line |

Rules for filling out the form and decoding of all used codes are available on the back of the form (Order of the Ministry of Health and Social Development No. 347n dated April 26, 2011). For your information, uniform requirements for filling out the ballot have been established for employers and doctors (clause 56 of Order of the Ministry of Health and Social Development No. 624n dated June 29, 2011).

According to the applicable legal norms, the attending physician, when filling out his section on the sick leave, must indicate the codes along the lines:

- “Cause of disability” (always indicated; when it changes, the corresponding code is written next to it in the “code change” cell).

- “Family Relationship” (recorded when a ballot is issued in connection with caring for an ill family member).

- “Notes about violation of the regime” (made if available, when the doctor’s instructions were violated, for example, if the patient did not show up for an appointment on the appointed day).

- “Other” (intended for additional information, for example, if the patient continues to be ill).

The two-digit code “04” refers to the main codes of the form. The doctor prescribes it once according to the line “Cause of disability.” The meaning of code “04,” according to the decoding indicated on the back of the form, is: “Accident at work or its consequences.” In other words, this is how a work injury is encrypted.

In what cases is a bulletin issued with code “04”

According to legislative norms, the code “04” is entered directly by the doctor if an accident occurs during work or an occupational disease worsens.

The issue related to the issuance of sick leave for work-related injuries is somewhat separate. For your information, those injuries are called industrial injuries that are classified and noted in Art. 227 and art. 230 Labor Code of the Russian Federation. Such accidents are subject to mandatory investigation and recording.

In general, this includes a significant deterioration in the employee’s well-being, noted in the process of performing his job duties as provided for in the employment agreement. For the purposes of assigning and paying social benefits (insurance compensation), the date, time, place, and cause of the incident that caused the injury are taken into account. That is, if an accident occurred during working hours on the territory of the organization, then this is an unconditional basis for registration and payment of the corresponding sick leave, as well as compensation.

Upon the fact of the incident, the employer must, as is customary, record the accident and file the appropriate materials regarding the investigation, namely:

- Prepare a report on what happened at work (indicate the reasons, set out the circumstances of the case, the guilty violators, etc. according to the standard form N-1).

All forms of documents that are used in the process of investigating industrial accidents are presented by the Ministry of Labor of the Russian Federation in Resolution No. 73 of October 24, 2002.

- After completion of the proceedings, give a copy of the act to the victim.

- A copy of this act and other investigation materials shall be handed over to the executive body of the insurer.

The investigation is carried out by a specially created commission and, depending on the severity of the incident, can last from 3 to 15 days. The procedure for documenting an accident is set out in detail in Art. 230 Labor Code of the Russian Federation. As a rule, sick leave is issued on the basis of the act, and the issue of assigning compensation payments is decided.

How should an employer respond?

Due to illness, an employee may be issued a special medical report in the prescribed form. Typically, such a conclusion informs the employer that the employee cannot perform the same job for a certain period of time.

The employer, based on Article 73 of the Labor Code of the Russian Federation, is obliged to transfer the employee to work that is not contraindicated for him for health reasons. If the employee refuses, the employer must temporarily suspend the employee from his position without pay.

However, in case of tuberculosis, the insured person suspended from work is guaranteed payment of benefits . In accordance with Letter No. 02-18/5766 of the Federal Social Insurance Fund of the Russian Federation dated September 1, 2000, the treatment period for tuberculosis is long and in severe cases reaches a year or more. In this case, the sick leave is closed upon complete recovery or achievement of stable remission - a state when the sick person is no longer dangerous to others.

Thus, until a medical report is received on the need to transfer to another job for health reasons, the employer does not need to take any special actions. The only important point is the correct calculation of sick leave payment.

Payment for sick leave with code “04”: general rules

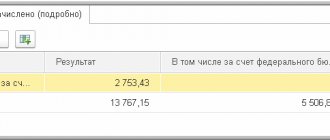

Social payments under the bulletin with code “04” are made entirely by the FSS of the Russian Federation if the insurer (organization) makes contributions for injuries.

For your information, in case of an accident at work, the following main types of payments are provided: (click to expand)

- social benefits for temporary disability;

- compensation for treatment and restoration of health (one-time);

- compensation for moral damage;

- insurance payments every month;

- financial assistance at the place of work;

- appropriate payment to relatives in the event of the death of the victim.

Social benefits are assigned in accordance with Art. 184 Labor Code of the Russian Federation. The payment amount is 100% of average earnings. Experience does not affect this amount, and it is actually calculated on the basis of average daily earnings.

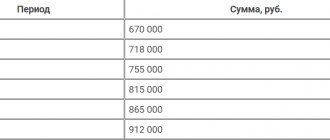

| Maximum amount of social benefits (limit for 2021) | Limit amount of one-time insurance payment for 2021 | Limit on monthly insurance payment for 2021 |

| RUB 296,390.64 | RUB 96,368.45 | RUB 74,097.66 |

When calculating social benefits (taking into account current limits), the standard formula is used: SDZ * number of days of illness. If the victim had no earnings during the billing period or was paid less than 24 minimum wages, then the calculation is made based on the minimum wage. Grounds for payment: sick leave with code “04”, act in form N-1.

Actions of the employer upon receipt of sick leave

When it is established that a citizen has a serious illness, employees of a medical institution are obliged to issue him a medical certificate on his condition in the established form. Often, such conclusions contain information for the management of the enterprise about the inability of their employee to perform the same work for a certain time. In accordance with Article 73 of the Labor Code of the Russian Federation, it is the employer’s responsibility to transfer such an employee to easier work that will not be contraindicated for his health status.

If a written refusal is received from the employee, the head of the enterprise must temporarily suspend the employee from his position without pay.

It is worth noting that in this case there are certain nuances. These include situations where an employee falls ill with a disease such as tuberculosis. A citizen suffering from this illness and suspended from work is guaranteed by the state to receive benefits. Letter of the Social Insurance Fund dated 09/01/2000 No. 02-18/5766 on sending recommendations “Approximate periods of temporary disability for the most common diseases and injuries (in accordance with ICD-10)” explains that the period of treatment and rehabilitation of tuberculosis has a fairly long period time, and in severe cases can reach a year or more. In this case, a sick leave certificate is issued only when the citizen has fully recovered or has achieved stable remission, that is, a state in which he ceases to be dangerous to others.

Based on the above, we can conclude that as soon as the employer has not received a medical report from the employee, which indicates the need to transfer the latter to lighter work for health reasons, no specific actions are required. At the same time, an important nuance is the extremely correct procedure for accruing and paying sick leave.

If the completed ballot contains errors in the codes

The presence of incorrect codes in the bulletin is a significant error. It cannot be ignored, since the FSS accepts for consideration only ballots with minor errors.

As evidenced by the example from the FSS letter No. 14-03-18/15-12956 dated October 28, 2011, these include only isolated technical flaws, such as spaces when writing the doctor’s initials. The key point, the FSS draws attention to, is the readability of the text and the absence of distortions in content.

A. P. Kaminsky.

If the code “04” or any other code indicated by the doctor is incorrect, then the sick leave form is considered damaged and must be replaced. Only the employer has the right to make corrections in the bulletin, but only in his own section and no more than 2 times.

Important! If, during an inspection, the FSS of the Russian Federation reveals serious errors that distort the meaning, or 3 or more corrections to the text made by the employer, it will recognize such a ballot as invalid.

Accordingly, the FSS will refuse to assign and pay social benefits for the above reasons. A justified written refusal, sick leave with errors in this situation is sent to the employer.

If the amount of social benefits was paid on an illegally issued ballot, then it must be returned. The onset of liability for the above violations is stated in paragraph 4 of paragraph 1 of Art. 4. 2 Federal Law of the Russian Federation No. 255 of December 29, 2006, as well as clause 18 of Resolution No. 101 of February 12, 1994.

Common mistakes on a given topic.

Mistake #1. Temporary disability benefits, if code “11” is indicated on the sick leave certificate, are paid in the amount of 100% of the average salary due to the complexity of the disease. The amount of the benefit depends on the length of service and is approved in Article 7 of Federal Law No. 255-FZ. The article does not reflect the dependence of the benefit amount on the severity of the disease.

Mistake #2 . No payment will be made to an employee suffering from tuberculosis. A citizen suffering from this illness and suspended from work is guaranteed by the state to receive benefits. Letter of the Social Insurance Fund dated 09/01/2000 No. 02-18/5766 on sending recommendations “Approximate periods of temporary disability for the most common diseases and injuries (in accordance with ICD-10)” explains that the period of treatment and rehabilitation of tuberculosis has a fairly long period time, and in severe cases can reach a year or more. In this case, a sick leave certificate is issued only when the citizen has fully recovered or has achieved stable remission, that is, a state in which he ceases to be dangerous to others.

Common mistakes when issuing a ballot with code “04”

Error 1. The following statement is correct. Generally obligatory insurance contributions are not deducted from the amount of social benefits for sick leave with code “04”.

Error 2. A bulletin issued for a domestic injury is paid differently than sick leave issued in connection with an industrial accident.

In addition, an investigation in case of domestic injury is not carried out by the employer and a report in Form N-1 is not drawn up. The amount of payment is affected by the number of days of illness, the length of service of the victim and his SZ.

Actually, social benefits for a domestic injury are paid by the employer for the first 2 days, and starting from the third day, all subsequent days are paid by the Social Insurance Fund of the Russian Federation (reference to Article 8 of the Federal Law of the Russian Federation No. 202 of December 29, 2004).

FSS of the Russian Federation (Letter No. 02-18/07-1243 dated February 15, 2005).

Error 3. An injury that an employee received while on duty while on a business trip is considered industrial. The fact that the accident occurred outside the organization is not taken into account. Justification: the incident was related to the performance of official duties.

What diseases can be encrypted under this number?

Diseases related to code “11” are listed in the List of Socially Significant Diseases. The list was approved by Decree of the Government of the Russian Federation of December 1, 2004 No. 715.

Diseases coded “11” include:

- Tuberculosis.

- Sexually transmitted infections.

- Hepatitis B and C.

- HIV.

- Malignant neoplasms.

- Diabetes.

- Mental disorders and behavioral disorders.

- Diseases characterized by high blood pressure.

Example 2. Calculation of sick leave for a domestic injury

While doing repair work at home, an employee of Sluchai LLC injured his hand. He was given a ballot for 13 days. The victim’s work experience is 6 years, which means that he is entitled to a payment in the amount of 80% of the SDZ. SDZ size for the last 2 years: RUB 2,000.

This injury is a domestic injury. Accordingly, the first 2 days are paid by the employer, and the rest - by the Social Insurance Fund. The actual calculation of social benefits is made according to the formula: SDZ * 80% * number of days of illness (2,000 rubles * 80% * 13 = 20,800 rubles).

General definition of code “11” on a sick leave certificate.

The determination of the significance of disease codes is indicated in the Order of the Ministry of Health and Social Development of Russia “On approval of the Procedure for issuing certificates of incapacity for work” No. 624-N dated June 29, 2011. So, in accordance with this legislative act, this code is assigned to one of the diseases that is included in the list of socially significant ones. This means that an employee whose sick leave contains code “11” suffers from a dangerous disease that can cause serious harm to both the sick person and his colleagues.

Payments by employer

Another reason for using disability codes on sick leave is that the citizen who received the document temporarily does not attend his workplace. After recovery and return to work, he must receive payments approved by law. The basis for this is a sick leave certificate, which can only be filled out by a doctor who has previously passed the appropriate FSS check.

If such a form is filled out correctly and submitted to the management of the organization within the allotted time, then the employee can count on full or partial compensation for the days when he did not work. To do this, the employer studies the code of the reason for incapacity on the sick leave and makes payments based on this.

In this way, it is possible to minimize errors during the preparation of a certificate of incapacity for work. Also, digital codes are much easier to read, so errors are eliminated due to the doctor’s handwriting or the fact that the diagnosis did not fit completely on the line and the specialist had to write too small.

The information contained in the sick leave certificate is intended for the manager or employee of the personnel department. However, it is not always possible to ensure that the document is not seen by third parties. If a person is not involved in deciphering codes, then it will be more difficult for him to understand what is being said in the document, which eliminates the risk that the team will find out about the employee’s illness.

In order for a citizen to receive payments, the form must be filled out correctly:

- The doctor indicates on it information about the name and address of the medical institution, his data, position, and general information about the patient. He also indicates the digital code and the period during which the employee was incapacitated.

- The HR department employee or manager must indicate on the same form the amount of the FSS request, the citizen’s length of service, his average salary and how much he should be accrued during his absence.

If deciphering the codes on the sick leave showed an error, then problems may arise in this case. However, there are several points that will help you avoid them.

What codes should an employer provide?

Disability codes on a sick leave certificate, the deciphering of which should be known to HR employees, imply some designations indicated by the employer himself. He must fill out the appropriate column on the sick leave to determine the conditions under which payments will be made. The employer must indicate the situation under which the victim should receive additional accruals. There is a certain level of disability that is associated with the conditions of the production process. These degrees are reflected in the interests of the employer. Based on this, the following codes are provided:

- 43 – disability due to radiation poisoning.

- 44 – the employee was sent to work in the North.

- 45 – disability that the citizen registered before he received a work injury. That is, this fact could play a role in the injury.

- 46 – the employee fell ill less than 6 months after employment.

- 47 – the employee received sick leave within a month after he had already been dismissed from work or resigned of his own free will.

- 48 – sick leave was issued for a valid reason. For example, this situation may include family circumstances.

- 49 is a disabled person who has been on sick leave for more than 4 months.

- 50 – disabled person on sick leave for more than 5 months.

- 51 – the employee works part-time.

Speaking about disease codes on sick leave in Russia, it is worth clarifying that a sample for filling out a sick leave should be in the accounting department, as well as in the human resources department. Employees of these departments must be proficient in deciphering all codes. It is not necessary to use them in other work reports.