Do I need to pay?

Let us repeat, personal income tax in our country is 13%. This tax also applies to income received from the sale of real estate, in particular apartments. But, in some cases, the home buyer is exempt from paying personal income tax on the purchased property.

A taxpayer is exempt from paying personal income tax when purchasing real estate in two cases:

- If the apartment has been owned for more than three years. This provision is spelled out in paragraph 17.1 of Article 217 of the Tax Code of the Russian Federation. In this case, the citizen is exempt from paying personal income tax, regardless of the cost of housing for which he sells it. The important point here is the continuous ownership of the living space for at least 36 months in a row.

- If the cost of the housing being sold is less than 1 million rubles , then personal income tax is also not paid. The period of ownership of the living space is not taken into account, since it does not affect anything. This is explained by the fact that the maximum tax deduction for the seller is 1 million rubles.

Thus, a citizen is exempt from paying tax when selling an apartment if he owned it continuously for 36 months or more (regardless of its value), and also if the cost for which it was sold is less than 1 million rubles (regardless of the period of ownership of the housing ).

An example of netting using the simplified tax system

Let's look at the reflection of offsets in accounting and tax accounting using an example.

Yasen LLC applies a simplified “income” taxation system. From April 5, it leased the production premises to Lipa LLC for a period of 11 months. And on April 10, an agreement was concluded that Lipa LLC would provide transport services for the period until December 31 of the current year.

In June, the enterprises decided to offset mutual claims and found out that, according to the agreements, the accounts payable of Yasen LLC amounted to 42,000 rubles. (under the contract for the provision of transport - 58,000 rubles (under the lease agreement). On June 15, an act of offset was signed in the amount of 42,000 rubles.

For 3 months (April, May, June), the accountant of Yasen LLC did the following for each wiring transportation service:

Dt 44–Kt 76/2 - transport costs are reflected.

As a result, as of June 15, Yasen LLC accumulated accounts payable to Lipa LLC on account 76.

As well as Yasen LLC revenue was recognized:

Dt 62/3–Kt 90/1 (revenue from renting out production premises) - 58,000 rubles.

After signing the netting act, the accountant of Yasen LLC made the following entry:

Dt 76/2–Kt 62/3 (offset of claims in accordance with the act dated June 15, 2021) - 42,000 rubles.

Since the company “Yasen” LLC is on the simplified tax system “income”, when filling out the book of income and expenses, the accountant reflected in the income the revenue in the amount of partial write-off of mutual claims.

After Lipa LLC deposited the balance of the debt into the settlement account, the accountant of Yasen LLC reflected it in his accounting with the entry: Dt 51–Kt 62/3 - 16,000 rubles, and also included it in income when calculating the single tax under the simplified tax system.

Sample act of offset

Act No.__

on carrying out mutual settlement between Yasen LLC and Lipa LLC.

Ulyanovsk June 15, 2021

As of the date of drawing up this act, there are mutual obligations between the parties:

- LLC "Lipa" (tenant) has before LLC "Yasen" (lessor) under an agreement dated 04/05/2021 No. __ (act of acceptance and transfer of production premises dated 04/05/2021 No. __) in the amount of 58,000 rubles.

- Yasen LLC (customer) has before Lipa LLC (contractor) under contract dated 04/10/2021 No. __ (Acceptance and transfer certificates for services rendered dated 04/15/2021 No. __, dated 05/15/2021 No. __, dated 06/15/2021 No. __) in the amount of 42,000 rubles.

The parties agreed to mutually offset the debt in the amount of 42,000 rubles, thereby fully repaying the obligations of Yasen LLC to Lipa LLC.

Yasen LLC Lipa LLC

_______________ _____________

M.P. M.P.

The article “Which object under the simplified tax system is more profitable - “income” or “income minus expenses”?” will help you make the right choice of taxation system under the simplified tax system.

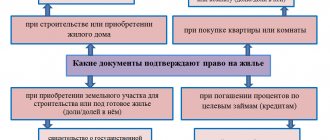

When can I get NV?

To reduce tax costs associated with the purchase and sale of an apartment in one year, certain conditions must be met, namely:

- The sale and purchase of the apartment occurred in the same calendar year.

- New housing was purchased before the old one was sold, but the citizen has not yet exercised the right to a tax deduction (for example, a two-room apartment was purchased in May 2021, and a one-room apartment was sold in September 2021. In this case, it is possible to claim two deductions at once ).

- A citizen of the Russian Federation did not exercise the right to a return of 13% before 2014, or did not exhaust the limit of two million rubles assigned to him after 2014.

- A citizen must be a home owner for at least five or three years (until 2021).

Attention! A refund of 13% of the purchased apartment, if the sale and acquisition of real estate has been carried out, is possible even for persons who do not pay personal income tax. This includes citizens who work unofficially, the unemployed, individual entrepreneurs with the simplified tax system, pensioners, etc.

In what case is it not allowed?

According to the law, it is impossible to obtain an IC if the apartment is purchased from first-degree relatives (spouse, children or parents (adoptive parents, guardians)).

Difficulties also arise if the apartment being purchased is under construction (under an equity participation agreement). In this case, the act of transferring the property into ownership of the buyer will be transferred to the new owner only after the house is put into operation. The transfer deed is one of the main documents that are required to return 13% of the cost of housing upon purchase.

Calculation of tax payment for the seller

You can calculate the tax that the seller must pay when selling housing as follows:

amount from the sale of real estate - deduction due to the seller (from actual costs or equal to 1 million rubles) - reduction to the buyer (up to 2 million rubles).

The amount received is subject to personal income tax in the amount of 13% (if the value is greater than zero) and is transferred to the state budget.

Important! If the amount is zero or has a negative value, the taxpayer is exempt from paying personal income tax.

Let's look at real calculation examples:

- The apartment was sold for 5,300,000 rubles, and a new one was purchased for 7,200,000 rubles. Taking into account the first decrease of 1 million rubles, we get the following: 5.3 million rubles. – 1 million rubles = 4.3 million rubles

Next, we reduce the amount received by 2 million rubles (the remaining 5.2 million rubles, which were received from the purchase, are not taken into account). We get the following:4,300,000 – 2,000,000 = 2,300,000 rubles, multiplied by 13% = 299,000 rubles. – this is the amount of tax that must be paid when simultaneously buying and selling an apartment in one year.

- The living space was sold for 4,000,000 rubles, and a new one was purchased for 1,900,000 rubles.

Here you can apply all the options for reducing the tax paid. We get the following: 4 million rubles. – 1 million rubles – 1.9 million rubles = 1,100,000 rubles, which we multiply by 13% = 143,000 rubles. is the amount of tax that a citizen must pay. In this situation, the costs of purchasing new housing are taken into account in full, since its cost is less than the established limit (2 million rubles). The taxpayer can take into account the unused 100 thousand rubles as a refund in the next tax period. - The apartment was sold for 800,000 rubles, and a new one was purchased for 3,100,000 rubles. There is no need to pay personal income tax on the sale, since the cost of housing is less than 1 million rubles. A citizen can receive a tax deduction in full, that is, 260 thousand rubles. (from RUB 2,000,000).

Offsetting under the simplified tax system and tax accounting

With the object “income”, this operation is reflected in the book of income and expenses as receipt of revenue. The date indicated is the moment of repayment of obligations, that is, either the date provided for in the act (agreement) on netting (this will be the basis for the operation), or the date of signing this act (agreement). This conclusion is confirmed by the letter of the Ministry of Finance dated December 28, 2011 No. 03-11-06/2/185, as well as the current judicial practice.

The obligation to accept the offset for accounting also arises if there is no act. Then the document confirming this business transaction will be a reconciliation act or any other suitable primary accounting document.

If the income from the operation was not taken into account, then it is highly advisable to submit an updated declaration under the simplified tax system and make an additional payment, otherwise the organization will face sanctions under Art. 122 Tax Code of the Russian Federation .

The act of offset in itself documents only the write-off of mutual claims and does not lead to the emergence of income or expenses. However, according to Art. 346.17 of the Tax Code of the Russian Federation, the income of enterprises under special tax regimes can be recognized not only as the receipt of funds, but also as the repayment of receivables in alternative ways, for example, by terminating a counter-obligation. Thus, in the book of income and expenses, writing off claims in any form will be reflected as income of the enterprise.

You can find out how simplifier expenses are taken into account when offsetting in the Ready-made solution from K+, having received trial access to the system.

Read more about income simplification in the article “STS-income in 2019-2020 (6 percent): what you need to know?”

Return

In this case, the buyer has two options:

- They receive a tax deduction for the purchase of housing (up to RUB 260,000).

- They reduce the tax on the sale of an apartment by using NV from the purchase.

Let's look at real calculation examples:

- The apartment was purchased for 2,700,000 rubles, and the old one was sold for 1.5 million rubles.

The buyer used 500,000 rubles. to reduce taxation, and another 1 million rubles. due to the standard reduction of personal income tax. He has 1,200,000 rubles left. (2.7 million rubles - 1 million rubles - 500 thousand rubles), from which he can receive a legal 13% refund, that is, 156 thousand rubles. The taxpayer can receive this amount (156,000 rubles) in the future, for example, as a refund of withheld personal income tax on wages. If a taxpayer receives a salary of 35,000 rubles, from which 4,550 rubles are withheld. (personal income tax amount), then he will receive a monthly amount of 4,550 rubles until the amount of funds paid reaches the threshold of 156 thousand. - The housing was purchased for 7 million rubles and registered in the name of two owners, with a 50% ownership share. Each of the owners has the right to receive a maximum deduction in the amount of 260 thousand rubles (each has the right to a refund of 13% of the cost of his half of the property, that is, from 3.5 million rubles, but the maximum limit on the amount from which the deduction is granted is 2 million rubles ).

- The apartment was purchased for RUB 1,700,000. Also this year, the taxpayer spent RUR 200,000. to pay for their children's education. He has the legal right to return 13% of the amount of his expenses, we get: 1,700,000 + 200,000 = 1,900,000 * 13% = 247,000 rubles - the amount that, according to the law, the buyer of real estate can return.

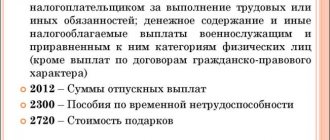

Registration of the 3-NDFL declaration

When filling out a declaration in Form 3-NDFL, the taxpayer should not have any difficulties, since this document has two sections :

- for tax deductions;

- for income that is subject to 13% tax.

Social deductions are also indicated separately, but they are not carried forward to subsequent tax periods, but are taken into account only in the current year.

Document the statement about reducing the amount by 1 million rubles. not needed when selling. Otherwise, documentation confirming the fact of acquisition and payment for living space must be presented.

Reflection of offsets in accounting

The offset procedure does not depend on the taxation system and is shown in the same way in accounting. The differences lie in how it is reflected in tax accounting.

So, in accounting, the offset of claims is reflected in subaccounts containing information about accounts payable and receivable. Most often these are accounts 60 “Settlements with suppliers and contractors”, 62 “Settlements with buyers and customers”, 76 “Settlements with various debtors and creditors”.

However, claims are rarely equivalent in monetary terms, so offsets are often carried out to partially write off obligations, and the remaining amount of debt is repaid with separate documents or money.

The posting reflecting the offset is generated on the day of signing the act or on the date specified in the document and has the form: Dt 60 (62, 76) – Kt 62 (60, 76) - partial (full) repayment of the counter obligation by offsetting mutual claims.

See also: “Dt 60 and Kt 60, 50, 51, 76, 62 in accounting (nuances).”

Disputes with the Federal Tax Service regarding double deductions

Despite the fact that the Tax Code of the Russian Federation clearly states provisions giving citizens the right to receive several deductions, as well as numerous letters from the Ministry of Finance of the Russian Federation regarding this issue, sometimes cases arise when tax officials refuse to grant such a right. They justify this refusal for various reasons, for example, that it is impossible to offset different groups of taxes.

In fact, with the simultaneous sale and purchase of an apartment, a citizen of the Russian Federation has the right to reduce the tax not only by 1 million rubles, but also by the 260 thousand rubles due to him as a buyer of real estate, as well as other groups of deductions (training, treatment, etc. .).

Attention! If the Federal Tax Service refuses to receive a simultaneous deduction for the sale and purchase of an apartment in the same year, the taxpayer has the right to appeal this decision by writing a corresponding application addressed to the head of the Federal Tax Service or file a lawsuit.

Tax inspectors are right only in one case, for example, if the sale of an apartment occurred in 2015, and the purchase in 2021. In this case, the citizen’s right to receive an income tax arises only in 2021, while he should have filed an income tax return in 2021.

How to change the legal address of an LLC

Changing the location of the LLC falls within the competence of the general meeting of participants (clause 2, clause 2, article 33 of the Federal Law of 02/08/1998 No. 14-FZ). This means that the document that is the basis for changing the legal address of the organization is the minutes of the general meeting of participants or, if there is only one participant, the decision of the sole participant of the LLC (Clause 6, Article 37, Article 39 of the Federal Law of 02/08/1998 No. 14-FZ , clause 3 of article 181.2 of the Civil Code of the Russian Federation).

The composition of other documents depends on whether changes are made to the LLC charter.

Indeed, in the charter of an organization, its location can only be indicated as the name of a locality (municipal entity) (clause 2 of article 12 of the Federal Law of 02/08/1998 No. 14-FZ, clause 2 of article 54 of the Civil Code of the Russian Federation). Let us recall that a municipal formation is an urban or rural settlement, a municipal district, a city district, a city district with an intracity division, an intracity district or an intracity territory of a city of federal significance (Clause 1, Article 2 of the Federal Law of October 6, 2003 No. 131-FZ) . For Moscow, for example, this is the Airport municipal district or the Troitsk urban district (clause 2 of article 1 of the Moscow Law of November 6, 2002 No. 56). And if the address of the organization changes within the same locality (municipal entity) (for example, within a municipal district in Moscow), then no changes are made to the charter (unless, of course, the organization now wants to indicate in its charter the full address of the location ).

At the same time, the Unified State Register of Legal Entities reflects not just the location, but the address of the organization within its location (clause 3 of Article 54 of the Civil Code of the Russian Federation). This means that the postal code, name of the subject of the Russian Federation, street, house must be indicated (clause 2.3 of the Requirements, approved by Order of the Federal Tax Service of Russia dated January 25, 2012 No. MMV-7-6 / [ email protected] ). Therefore, when changing your address, you must always reflect the changes in the Unified State Register of Legal Entities.

Thus, in the case when changes are not made to the charter, the organization only needs to declare a change in the information contained in the Unified State Register of Legal Entities. Otherwise, it is also necessary to register changes to the charter.