In 2021, non-exclusive rights of use for results of intellectual activity (RIA) - rights of use for RIA in accordance with license agreements or other documents confirming the existence of the right to RIA, including non-exclusive licenses for software products, are taken into account in accordance with the provisions of the federal standard “Intangible assets”, approved by order of the Ministry of Finance of the Russian Federation dated November 15, 2019 No. 181n.

- How intangible assets are taken into account in 2021

- The procedure for transferring non-exclusive rights of use to RIA to the balance sheet

- How to register in 1C

The concept of accounting for fixed assets

Fixed assets in accounting include: buildings, structures, work equipment, various instruments and devices (measuring, regulating, etc.), electronic computer equipment, tools, vehicles, household equipment in production, as well as livestock , perennial plantings and much more.

The main criterion for selecting assets for accounting of fixed assets at an enterprise is the simultaneous fulfillment of all conditions:

- use in the production of products (goods, services) or for the management needs of the enterprise for a period of more than 12 months;

- no further resale of these assets is expected;

- bringing income (profit) to the enterprise in the future.

The main purpose of accounting for fixed assets is to obtain sufficient information about fixed assets necessary for full disclosure in the financial statements.

The central tasks of fixed asset accounting include:

- formation, registration, as well as determination of actual costs associated with the acceptance, maintenance and write-off of fixed assets;

- accurate determination of the results of disposal (sale, write-off, etc.) of fixed assets;

- ensuring control over the safety of fixed assets;

- analysis of the literacy of their use.

The accounting procedure for fixed assets is regulated by accounting regulation 6/01 “Accounting for fixed assets,” which establishes the rules for generating information about fixed assets in accounting.

Disposal of fixed assets

Disposal is the write-off of the value of fixed assets that are disposed of or are not permanently used in the organization's activities. Fixed assets are disposed of as a result of:

sales;

write-offs in case of moral or physical wear and tear;

transfer of fixed assets in the form of a contribution to the authorized (share) capital of other organizations;

liquidation in case of accidents, natural disasters and other emergency situations;

transfers under contracts of exchange, gift;

write-off of fixed assets previously leased with the right to buy, at the time of transfer of ownership of the specified fixed assets to the lessee;

for other reasons.

To determine the feasibility and unsuitability of fixed assets for further use in organizations, commissions are created, which include officials, including the chief accountant.

The competence of the commission includes:

inspection of an object subject to write-off;

establishing the reasons for writing off the object;

identification of persons through whose fault the premature disposal of the object occurred;

the ability to use individual components, parts, materials of the decommissioned object;

monitoring the removal of non-ferrous and precious metals from decommissioned objects, determining their quantity and weight;

drawing up an act on the write-off of fixed assets (form No. OS-4), an act on the write-off of motor vehicles (form No. OS-4a) (with the attachment of reports on accidents, the reasons that caused the accident, if any). These acts are approved by the head of the organization and transferred to the accounting department.

According to the new Standard Chart of Accounts and the adopted accounting policy, the organization records the disposal of fixed assets in account 91 “Other income and expenses”.

The debit of account 91-2 records expenses incurred by the organization related to the sale and other disposal of fixed assets. Such expenses include wages of employees participating in operations to dispose of fixed assets, taxes and fees paid on proceeds from the sale of fixed assets, dismantling costs, etc. Such additional expenses are first collected in cost accounts.

Proceeds from the sale of property, that is, the amount due to the organization for sold fixed assets, is reflected in the credit of account 91-1 in correspondence with account 62 “Settlements with buyers and customers.”

Postings when selling a fixed asset

| Debit | Credit | Operation |

| 51 | 62 | We take into account the proceeds from the sale of fixed assets (money received on the account) |

| 62 | 91 | reflects the fact of OS implementation |

| 02 | 01 | accumulated depreciation written off |

| 91 | 01 | residual value written off |

| 91 | 68 | VAT charged |

| 83 | 84 | write off the accumulated revaluation |

| 91 (99) | 99 (91) | financial result reflected |

Postings when transferring fixed assets as a contribution to the authorized capital

| Debit | Credit | Operation |

| 01.disposal | 01 | write-off of original cost |

| 02 | 01.disposal | depreciation write-off |

| 06 | 76 | Cost of financial investments at residual value |

| 06 | 01.disposal | The residual value is written off |

| 83 | 84 | write off the accumulated revaluation |

Postings for gratuitous transfer (donation) of fixed assets

| Debit | Credit | Operation |

| 02 | 01 | depreciation write-off |

| 91.2 | 01 | write off the residual value |

| 91.2 | 68 | reflect VAT |

| 91.2 | 20, 60, 76 | reflect additional costs (transportation costs, dismantling, etc.) |

| 83 | 84 | write off the accumulated revaluation |

| 99 | 91.9 | financial result reflected |

Postings upon liquidation of OS

| Debit | Credit | Operation |

| 02 | 01 | depreciation write-off |

| 91.2 | 01 | write off the residual value |

| 91.2 | 70,69 | we reflect the costs of liquidating a fixed asset (wages to workers for dismantling) |

| 83 | 84 | write off the accumulated revaluation |

| 99 | 91.9 | financial result reflected |

Based on the executed acts, appropriate entries are made on disposed objects in inventory cards, which are stored for a period determined by the head of the organization.

The main point provided for in paragraph 30 of Instruction No. 26 is that when a fixed asset is disposed of, the revaluation amount accumulated in account 83 “Additional capital” is written off to account 84 “Retained earnings (uncovered loss)”.

In this case, the organization must organize the maintenance of object-by-object accounting of the movement of additional funds for each revalued fixed asset object.

When conducting an annual inventory of fixed assets, accounting data for the amounts of the revaluation fund are compared with data from inventory cards or inventory sheets.

Accounting for valuation and revaluation of fixed assets

Accounting for the valuation of fixed assets

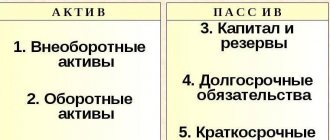

carried out according to three types of cost: initial, residual and replacement.

The initial cost is determined by the amount of actual costs for the acquisition, construction and production of fixed assets, with the exception of value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation).

The residual value of fixed assets is considered as the original cost reflected in the balance sheet, minus depreciation in monetary terms.

Replacement cost is the cost of fixed assets at market prices valid on a certain date. It is usually used during revaluation or when calculating the purchase price for long-term leases (leasing) and is determined by independent experts (appraisers).

Accounting for revaluation of fixed assets

allowed in cases of retrofitting, completion, reconstruction and partial removal of existing facilities. The organization has the right, no more than once a year (at the beginning of the reporting period), to revaluate fixed assets at replacement cost using indexation or direct recalculation at documented market prices. If differences arise, they should be classified as additional capital.

Accounting for receipt of fixed assets

Accounting for the receipt of fixed assets includes the following stages:

- execution of an act of acceptance and transfer of a fixed asset object (for objects of the same type of the same value, it is possible to issue one act; each object is assigned its own inventory number, which must be unique);

- an inventory card is created for each received object indicating the basic information on it;

- entry into the accounts is made, for example, accounting for the movement of fixed assets owned by the organization as property is carried out on account 01 “Fixed Assets”, and the reflection of individual objects acquired by the enterprise is kept in account 08 “Investments in non-current assets”, etc. .

Accounting for depreciation of fixed assets

Depreciation in this case is the accrual of the cost of physical and moral wear and tear of fixed assets.

Accounting for depreciation of fixed assets makes it possible to transfer part of the original cost of fixed assets reflected in the balance sheet to the cost of production.

The amount of such depreciation is determined monthly separately for each subject object, and its accrual occurs from the 1st day of the month following the one in which the fixed asset was put into operation.

There are several ways to account for depreciation of fixed assets. These include: linear, reducing balance method, method of writing off value by the sum of years of useful life, as well as a method of writing off value in proportion to the volume of products (goods, services).

Determination of the useful life of an object of fixed assets is based on the period in which this object brought benefit (income) to the enterprise. This period is set by the enterprise itself when entering the object into accounting.

How intangible assets are taken into account in 2021

In accordance with Instruction 157n in the Unified Chart of Accounts, rights in accordance with license agreements or other documents confirming the existence of the right to such an asset are recorded in the corresponding analytical accounting accounts. 111.60

“Rights to use intangible assets”:

- on account 111.6N

“Rights to use scientific research (research developments)” - rights to use the results of scientific research (research developments); - on account 111.6R

“Rights to use experimental design and technological developments” - rights to use the results of experimental design and technological work; - on account 111.6I

“Rights to use software and databases” - rights to use software and databases; - on account 111.6D

“Rights to use other objects of intellectual property” - rights to use other intangible assets.

In order to reflect the rights to use intangible assets (non-exclusive rights to RIA), the following sub-articles of KOSGU are applied:

- for non-exclusive rights with a certain useful life 352 and 452 KOSGU;

- for non-exclusive rights with an indefinite useful life in accordance with clauses 11.5.3 and 12.5.3 of Order No. 209n: 353 and 453 of KOSGU.

Let us note that cash expenses for the acquisition of non-exclusive rights to use RIA, as before, are subject to reflection under subarticle 226 “Other work, services” of KOSGU (clause 10.2.6 of Procedure No. 209n).

Accounting for repairs of fixed assets

Repair of fixed assets can be capital and current. Capital is more complex, more time is spent on it, and the amount of work is more serious.

Accounting for repairs of fixed assets can take place according to two scenarios:

- If the repairs are ongoing and the costs for them are small, then these costs can be included in the current expenses of the enterprise.

- Uniform inclusion of costs in the cost price. In this way, a reserve is created, from which funds for repairs are written off as needed. To maintain such a reserve, a subaccount “Reserve for repairs of fixed assets” is created to account 96 “Reserves for future expenses”.

If the actual costs of repairs exceeded the amount of funds in this reserve, then in the accounting for repairs of fixed assets, additional charges are made to the reserve from expenses for future periods. If the situation is opposite, then the remaining amounts are reversed.

When fixed assets become obsolete (moral or physical), it is necessary to carry out modernization. Accounting for the modernization of fixed assets consists of attributing the actual costs of improving an object or replacing parts to its original cost.

Accounting for write-off of fixed assets

Accounting for the disposal of fixed assets occurs for objects that are being liquidated or cannot bring economic benefits to the enterprise in the future. Disposal occurs due to the unsuitability of the object for further productive use or for the purpose of selling, donating, leasing or exchanging the object.

The enterprise records the write-off of fixed assets as part of other income and expenses. To do this, you can open a subaccount “Disposal of fixed assets” on account 01, where the debit will reflect the initial cost of the object, and the accumulated depreciation will be reflected on the credit. The residual value can be written off as a debit to account 91 “Other income and expenses.”

Accounting for the liquidation of fixed assets reflects income and expenses associated with write-off in the reporting period to which they relate.

Postings to account “01.01”

By debit

| Debit | Credit | Content | Document |

| 01.01 | 000 | Entering opening balances: fixed assets | Entering balances |

| 01.01 | 01.01 | Transfer of fixed assets | Moving OS |

| 01.01 | 08.01 | Registration of a land plot | Acceptance of fixed assets for accounting |

| 01.01 | 08.02 | Acceptance of environmental management objects for registration | Acceptance of fixed assets for accounting |

| 01.01 | 08.03 | Acceptance for accounting of buildings and structures completed by capital construction, carried out by contract or economic methods | Acceptance of fixed assets for accounting |

| 01.01 | 08.03 | Modernization (reconstruction) of fixed assets | OS upgrade |

| 01.01 | 08.04 | Acceptance for accounting of equipment that does not require installation (individual fixed assets) | Acceptance of fixed assets for accounting |

| 01.01 | 83.01.1 | Revaluation of fixed assets during the first revaluation: Change in initial value | Operation |

| 01.01 | 83.01.1 | Revaluation of previously discounted fixed assets: Change in initial cost | Operation |

| 01.01 | 91.01 | Surplus fixed assets identified as a result of inventory. Recognition of other income | Acceptance of fixed assets for accounting |

| 01.01 | 91.01 | Revaluation of previously discounted fixed assets: Change in the original cost by the amount of the previous discount | Operation |

By loan

| Debit | Credit | Content | Document |

| 01.01 | 01.01 | Transfer of fixed assets | Moving OS |

| 01.09 | 01.01 | Write-off of the initial cost of an item of fixed assets upon write-off (liquidation) | Decommissioning of OS |

| 01.09 | 01.01 | Write-off of the initial cost of an item of fixed assets upon transfer (sale) | OS transfer |

| 83.01.1 | 01.01 | Write-down of previously revalued fixed assets: Change in the original cost by the amount of the previous revaluation | Operation |

| 91.02 | 01.01 | Markdown of previously overvalued fixed assets: Change in original cost | Operation |

| 91.02 | 01.01 | Partial liquidation of a fixed asset item | Operation |

| 91.02 | 01.01 | Depreciation of fixed assets during the first revaluation: Change in original cost | Operation |

Accounting for lease of fixed assets

Accounting for leases of fixed assets differs by type of lease. There are current and finance leases.

A special feature of a current lease is that ownership of the property remains with the lessor. In this case, the lessee records accepted fixed assets in off-balance sheet account 001.

For a financial lease, an option is possible in which the tenant buys fixed assets from the lessor and pays interest for their use. In this case, accounting of leased fixed assets is carried out either on the balance sheet of the lessor or on the balance sheet of the lessee.

The main features of fixed asset accounting were discussed above. In fact, the process of generating such reporting has many nuances and individual features inherent in each enterprise. It is simply not possible to talk about all the features. It is better to entrust the organization of accounting of fixed assets to professionals. provides legal entities with the service of conducting all stages of accounting. By contacting us, you insure yourself against errors and unnecessary financial losses.

The procedure for transferring non-exclusive rights of use to RIA to the balance sheet

One example of objects recorded on account 111.60 “Rights to use intangible assets”, namely on account 111.6I “Rights to use software and databases”, are software products used in the activities of the institution on the 1C: Enterprise platform.

The delivery package for a program, for example “1C: Public Institution Accounting 8,” includes a license agreement under which the licensee is granted separate non-exclusive rights to use the program.

The license agreement for the 1C program is unlimited and is a document confirming that the licensee has the rights granted by the copyright holder to use the software product.

A document confirming that the licensee has the right to use the program on several workstations is an additional client license (licenses) for a certain number of workstations.

Until 01/01/2021, according to Instruction No. 157n, non-exclusive rights to use the results of intellectual activity, including licenses for non-exclusive rights to use software products, were recorded in off-balance sheet account 01 “Property received for use”. Account 401.50 “Deferred expenses” took into account expenses associated with the acquisition of a non-exclusive right to use intangible assets over several reporting periods.

From January 1, 2021, in accordance with the order of the Ministry of Finance of the Russian Federation dated September 14, 2020 No. 198n, such objects recorded on the balance sheet in account 01 must be taken into account on the balance sheet as part of account 111.6I “Rights to use software and databases.”

Methodological recommendations for the application of the Standard “Intangible Assets” are communicated by letter of the Ministry of Finance of the Russian Federation dated November 30, 2020 No. 02-07-07/104384.

These guidelines contain provisions for the first application of the Standard and transitional provisions. In contrast to the transitional provisions of previously implemented standards (Order of the Ministry of Finance of the Russian Federation dated February 28, 2018 No. 34n, Order of the Ministry of Finance of the Russian Federation dated December 7, 2018 No. 256n, Order of the Ministry of Finance of the Russian Federation dated December 31, 2016 No. 257n, etc.), according to which the acceptance of objects for balance sheet accounting , meeting the criteria of an asset, was reflected during the inter-reporting period in correspondence with account 401.30 “Financial result of previous reporting periods”, the transfer from off-balance sheet accounting to on-balance sheet accounting of the rights to use intangible assets is carried out in 2021 operations in the following order:

“Recognition of accounting items that were not previously recognized as part of intangible assets and (or) reflected in off-balance sheet accounting as part of the group of non-financial assets in accordance with the GHS “Intangible Assets” is carried out by operations in 2021 based on the results of an inventory, which is carried out in order to identify such accounting items accounting.

Expenses for the acquisition of non-exclusive rights, previously recorded in account 401.50 “Deferred expenses”, the useful life of which as of January 1, 2021 is less than 12 months, are charged to the financial result on the first working day of the year of application of the GHS “Intangible assets”. These expenses do not form the cost of the accounting object - the rights to use intangible assets in accordance with the GHS “Intangible Assets”.

Therefore, if as of 01/01/2021, account 401.50 takes into account the costs of acquiring a license right for intellectual property, the useful life of which is less than a year, the corresponding balance on account 401.50 should be written off to the financial result using 2021 transactions with the following entry:

D-t 0 401.20 226 K-t 0 401.50 226.

The amount of write-off and the need for write-off are determined based on the results of the inventory and are fixed in the Decision of the Commission on the receipt and disposal of assets.

From 01/01/2021, non-exclusive rights of use to the results of intellectual activity are no longer taken into account in off-balance sheet account 01 “Property received for use”, since by order of the Ministry of Finance of the Russian Federation dated 09/14/2020 No. 198n, reference to non-exclusive rights of use to results of intellectual activity from 01/01/2021.

Accordingly, simultaneously with writing off the balance of account 401 50, it is necessary to write off the corresponding object from off-balance sheet account 01, regardless of the fact that the license has not yet expired.

Methodologists of the Ministry of Finance of the Russian Federation gave explanations at the videoconference of the Federal Treasury on the issues of preparing annual budget (accounting) reporting for 2021:

“Institutions must announce in the first quarter. 2021 inventory in connection with the entry into force of the “Intangible Assets” Standard.

When conducting an inventory, the remaining useful life as of 01/01/2021 of the objects accounted for in account 01 and the corresponding amounts in account 401.50 are determined.

The write-off amount must be recorded in the decision of the admissions and departures committee. The commission must receive documents indicating that the right has been terminated or expires on time, or will be extended, and on this basis write off the balance on account 401.50 or accept the object for accounting on account 111.60 - if the period of use is more than 12 months. The Decision must record what rights and for what in order to determine the accounting account. The accountant is not a specialist in the field of property rights; accordingly, there must be a decision of the commission.

The Decision must state, for example, that this software product license will be used for more than 12 months. The useful life is such and such.

Until there is a Decision, the right to use intangible assets should not be added to the balance sheet. They should not be carried forward between reporting periods. Let’s close 2020 as it is.”

From all of the above, it follows: in 2021 and during the inter-reporting period, no entries are being made to add non-exclusive rights of use to RIA to the balance sheet.

Accordingly, if the useful life of the non-exclusive right to intellectual property is more than a year

, deferred expenses

form the cost

of the accounting object - the rights to use intangible assets, the following entries should be recorded in accounting:

- formation of the actual cost of the right to use intangible assets

D-t 0 106.60 350 K-t 0 401.50 226

- taking into account the right to use intangible assets in the same amount

D-t 0 111.60 350 K-t 0 106.60 350.

The corresponding accounting object is simultaneously written off from off-balance sheet account 01.

Depreciation should then be calculated over the remaining useful life.

Depreciation is not accrued for perpetual licenses, since clause 26 of the Intangible Assets Standard states: “For intangible assets with an indefinite useful life, depreciation is not accrued until they are reclassified into the subgroup of intangible assets with a definite useful life.”