Before applying for UTII when registering an individual entrepreneur, think about how beneficial this system will be in your case. The single imputed tax is calculated using a special formula, which takes into account the potential profitability of the business for the selected type of activity.

When should you apply for UTII when registering an individual entrepreneur, and when not?

An application to switch to UTII when registering an individual entrepreneur should definitely not be submitted if:

- Your type of activity is not included in the list of the Tax Code article dedicated to “imputation”;

- You plan to officially employ more than 100 people;

- You are opening a store or catering establishment with an area of more than 150 square meters;

- You are going to rent out gas stations.

In these, as well as in some other cases, you do not need to fill out an application for UTII when registering an individual entrepreneur - you will be refused immediately, or later you will have certain problems.

If the number of your employees exceeds 100 people, you will have to switch to a different taxation system. Income levels are not a limitation. You can earn several million a month - you still won’t provide income data to the tax office.

Do I need to apply for UTII when registering an individual entrepreneur?

It's worth doing this if you:

1) You have already been engaged in a certain type of activity, you know the approximate profitability, and the size of the UTII suits you at the moment. If you just want to legalize your business, submit an application for UTII to the tax office when registering an individual entrepreneur - and you will only benefit.

2) Local coefficients that are taken into account when calculating the amount of “imputation” are minimal. The reduction factor (K2) is determined by regional authorities and can be either 1 or 0.005. In the latter case, UTII will be very profitable.

3) You have minimal AF. A physical indicator is the number of employees, cars, area of a store or other establishment, etc. The more FP units, the higher the tax. Let's say if you have only one car that you use 24 hours a day, you will pay minimal tax.

If the coefficients are high, it is better to refuse UTII by writing an application to the simplified tax system when registering an individual entrepreneur. The simplified taxation system is beneficial in all regions, and the rates do not change from year to year.

If you nevertheless decide to switch to UTII, you can submit an application both when registering an individual entrepreneur and in the future.

When to submit an application for UTII when registering an individual entrepreneur?

There are only three options:

- When registering an individual entrepreneur (when an application for UTII is submitted along with other documents). In this case, you just need to attach the UTII-2 application to the application in form P21001, a copy of your passport and receipt. Within five days from the date of issuance of the certificates, you must be transferred to the chosen taxation system.

- Within five working days from the date of commencement of activity. This moment is considered to be the day of issue of the individual entrepreneur registration certificate. The deadline for submitting an application for UTII when registering an individual entrepreneur is limited, and if you are late, you will have to wait for the start of a new reporting period. Within five days from the date of submitting your application, you will be transferred to a special regime.

- From the new reporting period. If, when registering an individual entrepreneur, you did not write an application for UTII or another special regime, you will have to pay according to the OSNO (general taxation system). It will be possible to switch to a special system only from the beginning of a new reporting period (new year). There is no need to wait for it to submit an application - you have the right to come to the tax office and express a desire to switch to the special regime at any convenient time.

The most convenient way is to fill out and submit an application for the use of UTII directly when registering an individual entrepreneur.

In this case, you will not need to additionally go to the tax office. This is especially true for those who register an individual entrepreneur while in another region. How to apply for UTII and simplified tax system when registering an individual entrepreneur?

And to the simplified tax system, and to UTII, and to any other taxation system, if your activity meets the requirements of the Tax Code, you have the right to switch immediately - upon registration, within five days or from a new reporting period. None of the special regimes have been mandatory since 2013. Now it's voluntary.

To become one of the payers of UTII or the simplified tax system, it is enough to write an application and submit it simultaneously or after registering an individual entrepreneur. The transition procedure is identical for all special modes, with the exception of some nuances.

In particular, if you can switch to the simplified tax system, PSN or unified agricultural tax when registering your place of residence (permanent or temporary registration), then when switching to UTII, the place of activity itself is taken into account. It may or may not coincide with your registration.

At the place of registration, an application for registration as an individual entrepreneur with UTII is submitted in two cases:

- delivery trade;

- transport services.

The reason is simple: an entrepreneur can engage in similar activities in several localities and regions at once.

In other cases, an application for registration of a UTII payer for individual entrepreneurs is submitted exclusively at the place of activity. If you are already an individual entrepreneur and previously used another special regime, you will have to contact the tax office again. Please note: if your place of registration does not coincide with the place of business, you will have to contact another tax office - the one that operates in the region in which you receive income. Thus, you will be registered with two tax inspectorates at once.

If, as a UTII payer, you will operate in several regions at once, you will have to submit an application when registering an individual entrepreneur or afterwards to all local Federal Tax Service. In this case, it is enough to register as an individual entrepreneur in one branch. Applying: General Questions

- When do you need to apply for UTII when registering an individual entrepreneur?

As we have already said, they do this either directly when submitting an application for registration of an individual entrepreneur, or within five days from the date of receipt of the certificate, or at any other period (in this case they are transferred to the special regime from the new reporting period);

- Where do you submit an application for UTII when registering an individual entrepreneur?

Unless otherwise specified in the Tax Code of the Russian Federation, they are transferred to UTII at the place of business. The property that you use to make a profit must be registered in the region. This could be cars or other equipment, real estate, equipment. The application must be submitted in all regions in which you will work.

- What UTII application is needed to register an individual entrepreneur?

There are only two forms of applications - UTII-1 and UTII-2, the first is used by legal entities, the second is necessary when registering an individual entrepreneur. Two more similar forms (UTII-3 and -4) are used for deregistration. You will need them if you decide to switch to a different tax system.

- Where can I find the form?

The easiest way is to download an application for registering an individual entrepreneur as a UTII payer online (this applies to the simplified tax system and any other special regime).

Make sure it is valid, otherwise the tax office may not accept it. On the official website of the Federal Tax Service you can find up-to-date information on all changes. You can also pick up the form at the tax office, if you can get there in person. If you can't, download and print the form and then show it to a lawyer (for example, at Rigby's office). In this case, you will definitely make sure that it meets current requirements.

How to fill out an application for registration of an individual entrepreneur as a UTII taxpayer?

The application form for an individual entrepreneur for registration under UTII consists of three blocks.

The first block is at the top of the page. It must be filled out by the entrepreneur himself. The following data is indicated here:

- Tax authority code (this can be clarified in the inspectorate itself, or on the official website of the Federal Tax Service) - at the place of activity;

- Full surname, first name and patronymic (patronymic name is indicated only if available);

- OGRNIP (this number must be indicated if available; if you are submitting an application simultaneously with documents for registration of an individual entrepreneur, you do not need to fill out this field);

- Code of the activity for which you plan to pay UTII (if there are several codes, you will have to prepare the same number of applications; the type of activity itself must be indicated in the documents for registration of individual entrepreneurs and contained in the Unified State Register of Individual Entrepreneurs if you are already an entrepreneur);

- Number of pages of annex to the application and sheets of copies.

The entrepreneur himself does not need to fill out everything else.

The second block is drawn up by a trusted person. If you plan to submit an application for UTII on the day of registration of an individual entrepreneur using a power of attorney, this block must be completed. You must specify:

- Full name of the representative;

- Contact phone number;

- Signature and date of the application;

- The name of the document confirming the authority of the official representative of the individual entrepreneur.

The third block is filled out by the tax inspector himself.

No notes should be made on this part of the page. Please note: annexes are required in the application for UTII when registering an individual entrepreneur. These can be copies of documents identifying the entrepreneur or his representative, a power of attorney, papers confirming the fact of conducting business in a particular region.

Is it possible to refuse transfer to UTII?

The single tax on imputed income is a rather specific regime. Before collecting documents, check whether you need to submit an application for UTII when registering an individual entrepreneur in your chosen region and with the selected activity codes. The tax office may find a lot of reasons for refusal:

1) Absence of an activity code, according to which “imputation” can be applied, in your application for registration of an individual entrepreneur or the Unified State Register of Individual Entrepreneurs. In this case, you can find a simple way out of the situation: indicate in the application the code by which UTII is possible, or make appropriate changes to the Unified State Register. The second is necessary if you have been registered as an individual entrepreneur for a long time.

2) Irrelevance of UTII in your region. If you live and work in a city where there is simply no “imputation”, you will be denied permission to cross. There is no way out of this situation, except for moving to another region.

3) Work in another region. If you do not work at your place of registration, but submit an application to the Federal Tax Service, to which you were assigned when registering an individual entrepreneur, you will be denied. In this case, you simply register with another tax office and be registered in two branches of the Federal Tax Service at once. In the first (at the place of registration of the individual entrepreneur, if you did this earlier) your data is stored, using the details of the second you pay the tax.

4) Errors, typos, misprints in the application. The execution of such a document should be taken as seriously as the execution of an application for registration of an individual entrepreneur. Any blot will invalidate it. Before you submit your application, make sure it meets all legal requirements.

The application for registering an entrepreneur on UTII must be filled out in block letters using a pen with black ink, if you do it by hand. When using a computer and further printing, black ink is used.

5) Submitting an application for the use of UTII when registering an individual entrepreneur by a third party without a power of attorney. Only the entrepreneur himself (applicant) or his authorized representative - the person for whom the power of attorney was issued - can submit any documents. The power of attorney must be certified by a notary.

How to simplify the transition to UTII?

Follow a few simple rules - and you will not have refusals or other problems in the future.

- Before choosing “imputation”, make sure that you have the right to use this special regime and that it is valid in the region in which you plan to operate. Also calculate how beneficial this tax system will be. In many cases, the simplified tax system is the most convenient.

- When filling out the application, use the services of lawyers if you have never submitted documents to the tax office before. Lawyers will advise you on all issues and help with registration. They can also handle all registration activities.

- Please double check your documents before submitting. Everything must be flawless.

Switching to UTII is not difficult if you take into account all the nuances.

Experts have launched real battles around simplified taxation systems; some fully support it; others believe that this practice is harmful and helps to hide taxes. By and large, each side is right in some way, which is probably why this dispute has no logical end and the truth will never be found. At the same time, the realities of entrepreneurial activity tell us that we need to listen to the voice of reason and not aggravate problems with the tax authorities, and for this we need to pay taxes. Another thing is that you can pay taxes in different ways and, by and large, using the mechanisms laid down in the Tax Code of the Russian Federation, you can, if not reduce the tax burden, then significantly reduce it. One such simplification mechanism is UTII. Of course, the imputed income system has a number of disadvantages that the smallest entrepreneurs feel, but taking into account the possibility of minimization, it is obvious.

I will not repeat the essence of the imputation; we have already talked about the specifics of calculating and paying insurance premiums in 2014. Today we will move on to consider the issue of registering single tax payers; we discussed how to submit a declaration in 2014.

When is it necessary to register as a single tax payer?

There are three options for registering as a payer of a single tax on imputed tax, the actual variations of filing an UTII-2 application.

- Option one - in cases of registration of individual entrepreneurs. After registering a business, you must decide on the choice of taxation system (of course, taking into account the types of activities that you declared during registration), you have 5 working days to do this. Within 5 days you must submit an application, in cases with imputation this is an UTII-2 application.

- Option two - when organizing a new point or opening a new type of activity. In this case, the UTII-2 application is submitted to the tax authority in whose territory the activity will be carried out. In fact, in this tax individual entrepreneur you stand as a tax payer with all the rights and obligations to pay tax and file a declaration.

- Option three - an individual entrepreneur submits an application before the start of the new year if, from the next period, he plans to switch to a simplified system with the payment of a single tax on imputed income.

The UTII-2 application form was approved by the Federal Tax Service of the Russian Federation: Order No. ММВ-7-6/ dated 12/11/12.

Filling out the application itself should not cause any particular difficulties; if you look at it, the form consists of two parts.

Title part

, which reflects general information about the taxpayer and, most importantly, indicates the date of commencement of tax activities. Taking into account the changes in the imputation, you will be able to subsequently pay taxes from this moment; in 2014, you can calculate the tax for the time actually worked, of course a trifle, but nice. An example of how to calculate a single tax, for actual days, is given

As the name already suggests, these forms are closely linked to the taxation regime in the form of a single tax on imputed income. Or, more simply put, UTII.

Let us remind you that UTII is applied to certain types of activities (retail, transport, catering, personal services, etc.). The full list is given in paragraph 2 of Article 346.26 of the Tax Code of the Russian Federation.

Each region determines for itself which types of activities are subject to UTII. In Moscow and St. Petersburg, as you know, there is no UTII.

The taxpayer himself subsequently chooses whether to apply UTII for a separate business or not. Sometimes this is economically beneficial, for example, a retail store with a large turnover on UTII, and wholesale trade - on a simplified regime.

To start applying UTII, organizations must submit a tax application in the form of UTII-1, and individual entrepreneurs - UTII-2.

When and where to submit UTII-1 and UTII-2?

The application should be submitted to the tax service area where it is intended to conduct activities subject to UTII. If the store is in Alapaevsk, and the legal entity. LLC address in Yekaterinburg, then you need to register under UTII in Alapaevsk.

The application deadline is 5 days from the date of the decision to switch to UTII according to the type of activity.

In fact, when you feel the need, then you can apply.

If you want to switch from the simplified tax system to UTII, you can switch only from the beginning of next year. This is directly stated in paragraph 6 of Article 346.13 of the Tax Code of the Russian Federation.

How to switch to UTII when registering an individual entrepreneur

In order to switch to “imputation” when registering an individual entrepreneur, you must simultaneously submit an application for the use of UTII along with the package of documents for registering an individual entrepreneur.

If it was not possible to submit such an application when registering an individual entrepreneur, then it can be submitted within five working days from the date of commencement of activities falling under UTII.

To obtain a sample application for the transition to UTII, you should use Appendices 1 and 2 to Order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/ [email protected]

Also, the mentioned Order provides the opportunity to send an application in electronic form and contains the procedure for filling out such an application.

The period of time for issuing a notification to the applicant about registration as a single tax payer is five days from the date the tax inspectorate receives the application for the transition.

A relevant question may be how to switch to UTII from the “simplified” version. The answer is the following. This can be done no earlier than the beginning of the calendar year, for which you must submit a notice of refusal of the “simplified tax” no later than January 15 and send the tax authorities an application for the transition to UTII within five working days in the new year.

If you use the general system, then you don’t have to wait for the new year and apply for “simplified” on any day of the month.

↑ to contents

We write a notification about the transition

After the adoption of this taxation system or if you want to switch to “imputation” after 01/01/2013, you must submit an application to the tax authority. It is not difficult to write, you need to fill out the application form approved by Order of the Federal Tax Service No. MMV-7-6/941 dated December 11, 2012. The form is filled out in two copies, typewritten or by hand, using blue, purple or black ink. Or you can save time and use a special service - in it, in wizard mode, you can fill out any document necessary for the registration and further operation of a legal entity, everything is very simple. And the specified date of transition in the future will be the starting point of your organization’s activities under UTII.

↑ to contents

Appendix to the UTII-1 application

Contains information about the type of activity that we transfer to UTII. You must indicate the type of activity code. The code can be found in Appendix No. 5 to the Procedure for filling out the UTII declaration.

You also need to fill in the address where the activity will be carried out.

If there are several types of activities (for example, a store and a taxi, or 2 stores in different parts of the city), then you need to indicate each of them separately. For taxis, as a rule, there is no specific address. In this case, we indicate the address of the organization's location.

The transition to UTII in 2021 is possible if:

- household services are provided;

- veterinary services are provided;

- services related to motor vehicles are provided (repair, maintenance and washing);

- parking spaces for motor vehicles and their storage in paid (but not penal) parking lots are provided;

- passengers and cargo are transported by road (if the total number of vehicles for such services is no more than 20);

- retail trade is carried out in a facility with a sales floor area of no more than 150 square meters. m;

- “small” retail trade is carried out without trading floors;

- catering services are provided with a service area of no more than 150 square meters. m, and also without a service hall;

- outdoor advertising is distributed using advertising structures, as well as advertising on the surface of vehicles;

- Hotel services are provided in properties with an area of up to 500 square meters. m;

- the lease of retail spaces or “small objects” for public catering is carried out;

- land is leased for the purpose of using it to locate retail facilities and public catering facilities.

The above types may, based on the content of the Tax Code of the Russian Federation, be subject to reduction by local authorities. The basis for this is the law, which establishes a special tax regime for UTII in a specific territory (subclause 2, clause 3, article 346.26 of the Tax Code of the Russian Federation). Also, locally, a decision may be made not to install UTII on its territory.

Interested parties should familiarize themselves not only with the provisions of Sec. 26.3 of the Tax Code of the Russian Federation, but also with the legislation of your region.

The Tax Code of the Russian Federation contains a mention of those who cannot pay UTII.

These cases can be found in paragraphs 2.1, 2.2 and 2.3 of Art. 346.26 of the Tax Code of the Russian Federation, and they apply not only to those who register for the first time, but also to those who switch to UTII from other regimes.

Among them:

- carrying out types of entrepreneurship under the conditions of a simple partnership or trust management of property;

- largest payers;

- if a trade tax is established in relation to these types of business;

- if retail sales or public catering are carried out by entities that have switched to SNR in the form of payment of “agricultural tax”;

- if the number of hired employees exceeds one hundred people;

- organizations with a share of participation in them of other organizations exceeding 25 percent;

- medical, educational and social institutions in relation to food services;

- gas station rental.

↑ to contents

How can I submit an application for UTII-1 and UTII-2?

The application can be submitted in person, by mail, or via the Internet via telecommunications channels.

If the application is submitted in person, you need to print it out in 2 copies. You will keep one copy with the tax office’s acceptance stamp, and you will give the second copy to the inspector. This is necessary so that when you submit your UTII return, the tax authorities will not have any questions as to what date you are applying for UTII and whether you even have the right to do so.

Try working in Kontur.Accounting - a convenient online service for maintaining accounting and sending reports via the Internet.

What does the single tax system give us?

This type of tax regime is mandatory for certain types of activities. Several aspects distinguish it from other modes, such as:

- the determination of the types of activities that are necessarily subject to UTII is decided by local authorities;

- a fixed estimated income is used for calculations;

- The average taxpayer is subject to the principle of average tax.

The concept of imputed income, as understood by law, means a calculation based on a combination of factors that influence the receipt of income.

The object of this type of taxation is imputed income

This special regime has been developed to simplify the mechanism for collecting taxes from individual entrepreneurs and LLCs, which have built their business activities on certain types of activities for which it is difficult to establish tax control due to the presence of a high unaccounted circulation of funds, for example, such as the provision of transport services, public catering, trade and so on.

↑ to contents

Procedure in case of an error in the application

The simplicity of filling out an application for a single tax on imputed income does not guarantee the correctness of such filling out; this process is very important, so it should not be underestimated. Why is this so serious? The answer is simple - any inaccuracy can lead to serious consequences. If the error could not be avoided, then we offer several options for solving the problem. First of all, you need to contact the tax office to which the erroneous application was submitted:

- inspections have different powers, so first of all it is important to find out whether this inspection has the right to make adjustments to the database, if so, then you need to fill out a new application correcting inaccuracies;

- if your tax inspectorate does not have such powers, and correcting errors is impossible, then there is only one way out: you must submit an application for deregistration as a UTII taxpayer by submitting the UTII-4 form to the Federal Tax Service Inspectorate, and such an application must be submitted within five days from the last day of the reporting period quarter (period).

Creation of a separate division

An organization opening separate divisions must register it at its location with the Federal Tax Service of the corresponding region. This obligation arises regardless of whether the organization is already registered for other reasons or not (in accordance with the Tax Code of the Russian Federation, Article 83, paragraph 2, paragraph 1; paragraph 1, paragraph 4). This opinion is also expressed in.

In order to register an organization for tax purposes with the Federal Tax Service at the location of its separate division (with the exception of branches and representative offices), it is necessary to submit a message approved by order of the Federal Tax Service of the Russian Federation No. ММВ-7-6/362 dated 06/09/2011. There is no need to provide additional documents confirming the creation of such a unit.

If at the time of creation of a separate division the taxpayer is already registered in this municipal entity as a single tax payer, then re-registration will no longer be necessary (described in). It is enough just to provide a message in form No. C-09-3-1.

The message can be provided as follows:

- Through a representative.

- By registered mail (with a list of attachments).

- Using telecommunications.

Example

LLC "Salut" is engaged in the wholesale trade of tools in the city of Balashikha, Moscow Region and is registered with the tax authorities according to the general taxation system in this municipality. The development department decided to open a retail point of sale as a separate division operating in the same area, belonging to the same Federal Tax Service. Therefore, the organization submitted its tax notice on the creation of a separate division in the specified form and an application in the UTII-1 form.

The following information on the single tax will also be useful:

Registration of UTII 2016-2017

is necessary for organizations and individual entrepreneurs who have chosen this tax regime. The registration procedure has some nuances, which we will consider in this article.

Is it possible to switch to imputation in all regions?

In some constituent entities of the Russian Federation, the single tax regime is not applied (for example, Moscow). Therefore, before planning a transition to imputation, check the specifics of regional legislation. To do this, on the Federal Tax Service website, follow the link “Taxes and fees in force in the Russian Federation.” After that, select the desired special mode from the list. Select your region at the top of the page. The description of the regime will contain the necessary regulations or comments and a message that a single tax system for this type of activity is allowed in your region.

From January 1, 2021, UTII will be canceled throughout Russia; it is no longer possible to switch to this regime. Choose a different tax system for your business using our free calculator. We wrote an article in which we collected expert answers to popular questions about tax regimes, the transition from UTII and online cash registers. If you haven't found the answer to your question, ask it in the comments, we will definitely answer.

Registration under UTII in municipalities

In some situations, activities within the UTII system may occur simultaneously in several municipalities controlled by different tax services. Where should one register as an imputation payer?

Provisions of Art. 346.28 of the Tax Code of the Russian Federation requires registration directly at each place where business activities are carried out under the UTII system. In addition, the value of the current coefficient K2 can take on different values depending on the decision made by the municipality. Officials of the Ministry of Finance of the Russian Federation in a letter dated September 29, 2011 No. 03-11-06/3105 and the Federal Tax Service adhere to similar positions.

If a business owner registers as an imputed person in only one branch of the Federal Tax Service, carrying out activities in various municipalities, he will have to justify his actions.

IMPORTANT! When an economic entity carries out business activities as a UTII payer in one municipality, then in another territory it has the right to use a different type of taxation in relation to the same type of activity.

Filling out the main part of the application

At the beginning of the UTII-1 form, the TIN, KPP and tax authority code are entered. If we are talking about an organization, indicate its type (Russian - 1, foreign - 2). In the following fields, enter the full name of the company and its OGRN. The OGRN is not filled out if the organization is registered abroad. The cells between the words in the company name remain empty. In the UTII-2 form for an individual entrepreneur, the TIN, his last name, first name and patronymic and OGRNIP are indicated. In this case, the full name is entered into the form line by line.

An important part of the application is the start date of imputation. It is from this that the payer is considered to have switched to imputed tax, and from this day he will be registered.

In the second part of the first sheet of the application, enter the details of the person confirming the accuracy of the information in the document. This is the head of the company (or individual entrepreneur) or her/his representative. In the second situation, also include a copy of the document confirming the authority of this person in the tax package. When the UTII-2 form is filled out and the accuracy is confirmed by the individual entrepreneur himself, the full name and TIN may not be indicated again. Enter only the phone number without spaces, signature and date.

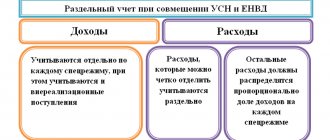

Conditions for switching from simplified tax system to UTII

To switch from simplification to imputation, the following conditions must be met simultaneously:

- the number of employees (average) for the previous calendar year does not exceed 100 people;

- the company does not fall under the category of major taxpayers, is not a member of a joint activity agreement, as well as an agreement on trust management of property;

- in the organization’s charter capital, the share of other companies should not exceed 25 percent (an exception for organizations in which the average number of disabled employees exceeds 50 percent, and they own at least 25 percent of the wage fund);

- an organization or individual entrepreneur is engaged in a type of activity for which the use of UTII is permitted;

- your region provides for the payment of UTII (this is a municipal tax, so each region makes its own decision on its use).

Where is the registration of activities on UTII carried out?

In accordance with the norms of the current Tax Code of the Russian Federation, economic entities that decide to use the special UTII regime should register with the tax office at the place of further work.

In some situations, registration of imputation payers is carried out at the place of residence of the individual entrepreneur or at the address of the organization. This rule applies when carrying out the following types of work:

- provision of advertising on transport;

- passenger and freight transportation;

- retail distribution trading activities.

If the legal address of such an organization has changed or the individual entrepreneur engaged in the above activities has changed his place of residence, you will need to independently perform a number of the following actions. It is necessary to fully report to the tax office at the previous place of registration, deregister as a UTII payer and register in this status at the new Federal Tax Service institution. The Tax Service confirms these rules in letter dated August 23, 2013 No. ND-4-14/15178.