In 2021, Rosstat launched an economic census of small businesses as part of a continuous surveillance program. We will tell you what this program is, how and in what time frame to report to Rosstat.

- About continuous observation

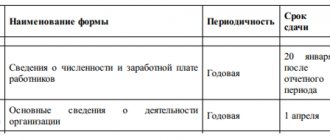

- What to report to organizations in statistics

- What to report to entrepreneurs in statistics

- How to submit a report to statistics

- Fines for failure to submit reports to Rosstat

- What about other reports to Rosstat in 2021

What is continuous observation

There are two forms of statistical observation: selective and continuous.

This follows from the article of the Federal Law of November 29, 2007 No. 282-FZ. Selective observation is the collection of information about individual companies and individual entrepreneurs. The list (sample) is compiled by Rosstat. Those included in the sample are notified on what forms, when and how they must report. Sample observations are carried out annually.

Continuous observation is the collection of data about all, without exception, organizations and entrepreneurs belonging to the group under study. Small and medium-sized enterprises fall under continuous statistical observation once every 5 years (Part 2 of Art. Federal Law No. 209-FZ of July 24, 2007).

Fill out and submit all statistical reports online Submit for free

REFERENCE

The next continuous statistical observation for small and medium-sized businesses (SMEs) is scheduled for 2021. The previous one was carried out in 2021 (see “Complete statistical observation: how exactly representatives of small and medium-sized businesses must report to Rosstat before April 1”).

When to take it

In addition to the official Rosstat resource, there is another way to find out which forms will have to be submitted this year: contact the territorial body of the department at the place of registration and clarify the list of valid reports. Statistical service employees are required to inform business entities about all reporting forms and the procedure for filling them out, in accordance with the rules approved by Decree of the Government of the Russian Federation No. 620 of August 18, 2008. Additional information is available on the official website of Rosstat.

Since administrative fines are provided for violating the deadlines for submitting statistical reports, we have made a table of deadlines for submitting reports to statistics for the 4th quarter of 2021 and the entire year 2021, which will help to submit forms on time.

| Statistical Observation Form | Reporting period and deadlines |

| No. 1-T “Information on the number and wages of employees” | For 2021 - until 02/01/2021 |

| No. 7-injuries - about injuries at work and occupational diseases | For 2021 - until 01/25/2021 |

| No.MP (micro)-nature - data on the production of products by a micro-enterprise | For 2021 - until 01/25/2021 |

| No. 1-Enterprise - about the activities of the organization | Until 04/01/2021 - for last year |

| No. 12-F - on the use of funds | Until 04/01/2021 - for last year |

| No. 57-T - on wages of workers by profession and position | The form is submitted once every 2 years, the next time - no later than November 29, 2021 for 2021 |

Who is subject to continuous surveillance in 2021

1. Organizations that, at the end of 2021, were listed in the register of SMEs on the Federal Tax Service website in the category “microenterprise” or “small enterprise” (regardless of the field of activity). If a company previously met these requirements, but in mid-2021 it was excluded from the register or assigned a different category, it does not participate in continuous statistical surveillance (for the timing and reasons for exclusion from the register, see “The Unified Register of Small and Medium-Sized Businesses will be updated monthly” ).

Get a fresh extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs

2. Everyone who had the status of an individual entrepreneur at the end of 2021 (regardless of being a small business).

Assessment of external (mainly external) factors

In Sect. 7 of the DAS form reflects an increase (at a greater, the same or slower pace when comparing data for different reporting periods), no changes or a decrease in prices:

- for building materials;

- construction and installation works.

In this case, data comparison is considered:

- for the reporting and previous quarters;

- reporting and future quarters.

In Sect. 9 reflects the key factors that limit the development of the reporting construction company - from those listed in columns 1–13 of this section. Up to 3 factors can be noted.

In Sect. 10 provides an assessment of the economic situation of the company:

- as favorable, satisfactory or unsatisfactory - for the reporting quarter;

- as having a tendency towards improvement, deterioration or having no prerequisites for changes - in the next quarter when compared with the results of the reporting one.

In Sect. 11 of the DAS form provides an assessment of the share of understatement of work in the construction industry (in general, and not for one’s own company) due to:

- refusal of companies to document work;

- companies understating the cost of work performed by the cost of customers’ unaccounted construction materials.

Both indicators correspond to the intervals given in columns 1–6 of the table in section. eleven.

In Sect. Form 12 provides an assessment of the competitive environment in the construction industry. Supposed:

- expression of the reporting company’s fundamental agreement with the theses given in pp. 1–5 of the table of the relevant section - by placing established marks in the form;

- expression by not marking these marks of disagreement (or lack of fundamental agreement) with the corresponding theses.

Section 12 of the DAS form is filled out only when generating statistical reporting for the 2nd and 4th quarters - when comparing data for the reporting quarter and the same period last year.

Reporting forms

According to Rosstat order No. 469 dated August 17, 2020, respondents must fill out one of two reports.

Form No. 1-entrepreneur “Information on the activities of an individual entrepreneur for 2021” is intended for individual entrepreneurs.

For - form No. MP-SP "Information on the main performance indicators of a small enterprise for 2021."

Fill out and submit to Rosstat all the listed forms through “Kontur.Extern”

REFERENCE

Participation in continuous statistical observation frees respondents from the need to submit some annual forms. In particular, in 2021 there is no need to submit MP (micro) “Information on the main performance indicators of a micro-enterprise” and 1-IP “Information on the activities of an individual entrepreneur.”

What to report to entrepreneurs in statistics

Individual entrepreneurs fill out form No. 1-entrepreneur for Rosstat, “Information on the activities of an individual entrepreneur for 2021” (see Rosstat Order No. 469 dated August 17, 2020).

The reporting itself, with a number of exceptions, is similar to that presented by organizations.

Section 1.

We indicate the number of months in 2021 during which the individual entrepreneur conducted business, and the address of the place of business. If the individual entrepreneur conducted activities without being tied to a specific address, indicate the address of registration as an individual entrepreneur.

In the average number of employees, we take into account not only hired workers, but also all family members who help the individual entrepreneur, including the individual entrepreneur himself. To do this, add up the number of people who worked with individual entrepreneurs in each calendar month, including those temporarily absent, and divide by 12.

Section 2.

We indicate revenue from the sale of goods, works, and services in general for all types of business activities, as well as for each of them separately, taking into account VAT, excise taxes and other similar payments. And here we mean entrepreneurial activity. Income from other activities is not indicated in the report.

If payment for goods, work, or services was not received in cash, then determine revenue based on the transaction price. If the transaction price is not determined, be guided by the market prices of the goods received.

Individual entrepreneurs on NPD determine their revenue based on the amount of checks issued for 2020.

Section 3

- for fixed assets that an individual entrepreneur uses in whole or in part for business activities and that belong to him or his family members.

Individual entrepreneurs are not indicated in the report:

- items that last 1 year or less, regardless of their cost;

- items costing less than RUB 40,000. regardless of service life;

- residential buildings and non-business vehicles;

- land;

- vehicles not designed for the carriage of goods, and passenger cars, including taxis and company vehicles. The report only includes trucks, pickups and passenger vans.

Among the “exotic” assets that do not need to be specified:

- animals raised for slaughter, including poultry, perennial plants grown in nurseries as planting material, trees grown for timber;

- plantings and animals, the cultivation of which has not been completed and they are not yet ready for sale or sale.

At the end of the report there are standard details: the date of its preparation, the signature of the individual entrepreneur, his contact information - telephone number and email address.

How to fill out reports correctly

Instructions for filling out forms for continuous monitoring of small businesses were approved by Order No. 469. Companies and entrepreneurs must reflect information about their activities for 2021. In particular, indicate the taxation system, the number of employees, revenue excluding VAT, etc.

Find out OKVED, taxation system and income of your counterparty

Errors made when filling out reports must be corrected as follows. In the “paper” form, the incorrect entry must be crossed out and the correct value written on top. If a report with an error is sent electronically, provide a “clarification”.

Do I need to report if an organization or individual entrepreneur had no activities in 2021? Need to. But not the entire form should be filled out, but only the “header” and section 3 “Fixed assets (funds) and investments in fixed capital.”

Report on the financial results of a small enterprise for 2021 – 2020

Today we will consider the topic: “report on the financial results of a small enterprise for 2021 - 2021” and will analyze it based on examples. You can ask all questions in the comments to the article.

How to draw up a balance sheet for small businesses

| Video (click to play). |

Balance Sheet Forms

and the Report on the financial results of small businesses were put into effect by order of the Ministry of Finance of Russia No. 113n dated August 17, 2012. Based on the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n “On the forms of financial statements of organizations.”

According to order No. 66n. Small business organizations prepare financial statements according to the following simplified system:

a) in the Balance Sheet and the Statement of Financial Results of a small enterprise. Indicators only for groups of articles are included (without detailed indicators for articles);

b) in the Appendices to the balance sheet and the Statement of Financial Results of a small enterprise, only the most important information is provided. Without knowledge of which it is impossible to assess the financial position of an organization or the financial results of its activities.

In your work you must also be guided by the Chart of Accounts. Provisions of the Tax Code of the Russian Federation and data from tax registers of the organization.

Before you draw up a balance, check:

Below is a detailed example of filling out the balance sheet and financial performance statement of a small enterprise. Balances and turnovers, which accounts are used to make up the Balance Sheet. And a report on financial results for small businesses (Form KND 0710098).

The company is located on the simplified taxation system (USN-D) 6% and is engaged in appraisal services. Intangible, financial and other non-current assets. There are also no financial or other current assets in the organization. The accounting policy stipulates that revenue is determined as money is received from customers. Expenses are recognized as they are paid and reduce the financial result of the current period. (clause 7 PBU 1/2008, clause 12 PBU 9/99, clauses 18 and 19 PBU 10/99).

Information disclosure service: financial statements, balance sheets. And all other forms are free.

Example REPORT on FINANCIAL RESULTS of a small enterprise

According to the law on accounting, the financial statements include precisely the statement of financial results (clause 1, article 4 of Law No. 402-FZ).

Line 2110 “Revenue, minus VAT, excise taxes.” It is calculated as the difference between the turnover on the Credit account 90.1 and the sum of the turnover on the Debit account 90.3,90.4,90.5.

Line 2120 “Expenses for ordinary activities.” Amount of turnover on Account Debit 90.2.

No video.

| Video (click to play). |

Line 2330 “Interest payable.” Turnover on Debit account 91 in terms of interest expenses.

Line 2340 “Other income”. Calculated based on the Turnover on Account Credit 91.

Line 2350 “Other expenses”. Calculated based on the Turnover in the Debit of account 91, all other expenses are indicated except for Interest payable (they are reflected on line 2330)

Line 2460 “Profit tax (income)”. The amount of income tax indicated in account 68 is indicated. For organizations using the simplified tax system, you need to indicate the simplified tax here. Because this line reflects not only income taxes, but also taxes on income. And the simplified single tax is just that.

Line 2400 Net profit = Revenue – Expenses for ordinary activities + Interest payable + Other income – Other expenses + (-) Income tax.

Table: Procedure for filling out the Financial Results Report by a small enterprise

EXAMPLE OF BALANCE SHEET of a company using the simplified tax system, How to draw up a balance sheet for a small enterprise

Line 1150 “Tangible non-current assets”. The line is calculated as the difference between the Balance at the end of the period for the Debit of account 01 and the Balance at the end of the period for the Credit of account 02.

Line 1170 “Intangible, financial and other non-current assets.” The line is calculated as the difference between the Amount of balances at the end of the period for Debit accounts 03,04,09,58. And the amount of balances at the end of the period for the Credit of accounts is 05.59.

Line 1210 “Inventories”. The line is calculated as the difference between the Amount of balances at the end of the period for Debit accounts 10,11,15,16.1,20,21,23,25,26,29,41,43,44,45,46,97. And Amounts of balances at the end of the period for Credit accounts 14, 16.1,16.2,42.

Line 1250 “Cash and cash equivalents.” The line is calculated as the sum of the Balances at the end of the period for the Debit accounts 50,51,52,55,57.

Line 1260 “Financial and other current assets”.

Line 1260 is calculated as the Sum of balances at the end of the period for Debit accounts 19,60,62,66,67,68,69,70,71,73,75,76,79,86,94 minus Balance for Credit account 63.

Line 1310 “Capital and reserves”. The line is calculated as the Sum of balances at the end of the period for Account Credit 80,82,83,84 minus Account Credit Balance 81.

Line 1410 “Long-term borrowed funds.” The line is calculated as the Balance at the end of the period for Account Credit 67.

Line 1450 “Other long-term liabilities”. The line is calculated as the sum of the balances at the end of the period for the Credit of accounts 75.77.

Line 1510 “Short-term borrowed funds.” The line is equal to the Balance at the end of the period for the Credit of account 66.

Line 1520 “Accounts payable”. The line is calculated as the sum of the balances at the end of the period for Credit accounts 60,62,68,69,70,71,73,75,76.

Line 1550 “Other short-term liabilities”. The line is calculated as the sum of the balances at the end of the period for the Credit of accounts 96.98.

Table: Procedure for filling out the Balance Sheet for a small enterprise

Table: Procedure for filling out the Balance Sheet in full

Filling out accounting (financial) reporting forms by small businesses and non-profit organizations using the new KND form 0710096

New form

accounting statements (KND 0710096) combined the two previous forms, including the balance sheet of a small enterprise. Simplified financial statements of small businesses (KND 0710098). And financial statements of socially oriented non-profit organizations (KND 0710097). It also includes additional appendices “Statement of Changes in Capital” and “Statement of Cash Flows”.

Annual financial statements – 2015, VIDEO from the seminar

Changes that affected the formation of accounting reports for 2021. Mandatory audit of annual accounting (financial) statements. Frequent violations when assessing balance sheet items and reflecting financial results. Drawing up a balance sheet. Explanations in the financial statements. Information accompanying financial statements.

The relationship between the indicators of the Balance Sheet and the Statement of Financial Results of a small business entity

Receive financial statements of any enterprise using TIN

Disclosure service: financial statements, balance sheets and all other forms for free.

Federal Tax Service, Pension Fund of Russia, Social Insurance Fund, Rosstat, RAR, RPN. The service does not require installation or updating - reporting forms are always up to date, and the built-in check will ensure that the report is submitted the first time. Send reports to the Federal Tax Service directly from 1C!

How to submit reports: deadlines and methods

Form No. MP-SP and Form No. 1-entrepreneur generally must be submitted by April 1, 2021. How to submit reports? There are several options, you can choose any:

1. Through an electronic document management (EDF) operator. This method is usually chosen by those who already submit tax returns, calculations, etc. online.

Fill out and submit all statistical reports through “Kontur.Extern” Submit an application

2. Through the official website of Rosstat. You will need to download an on-line module or install an off-line module for entering reports (for details, see the section “Frequently Asked Questions of Respondents”).

3. Send an email with the report to

4. Send a “paper” letter with a report to the territorial body of Rosstat by mail, or bring the letter in person.

If an organization (or individual entrepreneur) does not have time to report before April 1, it will have one more chance. Until May 1, 2021, it will be possible to submit forms of continuous observation through the Unified State Portal). Currently, there is no such service on the portal, but it should appear on March 1. It can be used by those who have a confirmed government services account (the easiest way is to confirm it using an electronic signature; instructions are available on the government services portal).

IMPORTANT

In most cases, to submit reports on forms No. MP-SP and No. 1-entrepreneur, you must have an electronic signature. An electronic signature will not be required if the respondent chooses to send completed forms by regular mail or in person.

Receive an enhanced qualified electronic signature certificate in an hour

Procedure for filling out the financial results report 2021

poryadok_zapolneniya_otcheta_o_finansovyh_rezultatah_2020.jpg

The financial results statement (FRS) is the second most important report after the balance sheet. With the approach of the time for the formation and submission of annual reports, the issue of correct execution of the financial financial statements becomes relevant. Let us recall the procedure for filling out the financial results report for 2021 and the criteria for checking the entered values.

The OFR is filled out in accordance with the form approved by the order of the Ministry of Finance of the Russian Federation No. 66n dated July 2, 2010, and periodically updated on the basis of relevant orders. For the reporting package for 2021, the document should be prepared on the form as amended by Order No. 41n dated 03/06/2020. You can download the 2021 financial results report below or from the Federal Tax Service.

FIR for 2021 (like the financial results report for 2021) is a familiar form that has two sections: the first provides general information about the company, the second contains a lined table containing:

explanations (the number of the corresponding explanation to the reporting is indicated);

string ciphers (codes);

the value of the indicator for the reporting and previous periods in comparable units.

The report informs the user from what sources the company's income is generated, and what expenses are taken into account when calculating net profit (NP).

Line codes for the financial results report 2021: decoding, content and formation

When preparing a report, take into account the following basic rules:

income/costs are indicated in detail;

the subtrahend/negative value is enclosed in parentheses;

empty lines are crossed out.

Fill out the report based on the data of the general balance sheet (STB) and detailed turnover for accounts 90, 91, 99.

The line codes of the latest current report have not changed compared to previous versions of the form, and the values in them are formed taking into account the same criteria:

How to submit financial statements in 2021 and what’s new in them are some of the most frequently asked questions at the end of the year. The excitement of accountants can be understood, because recently amendments were made to the Law “On Accounting” and they relate specifically to financial statements. However, there is absolutely nothing to worry about yet.

You can read about the composition of accounting statements and methods of presenting them in other materials on our website.

Will new accounting forms be introduced in 2020?

The latest changes to the Order of the Ministry of Finance, which approved the forms of financial statements, were made in March 2021 (Order of the Ministry of Finance dated March 6, 2020 N 41n). And it is impossible to say that because of this the forms have changed significantly. Most of the amendments were of a technical nature, and the rest are significant only for public sector organizations and non-profit organizations (Information message of the Ministry of Finance dated May 28, 2020 N IS-accounting-11).

So most companies will need to prepare accounting reports for 2021 in the usual form.

As they say, people are shouting about the new reporting procedure at every corner. However, we hasten to assure you that according to the new rules, it will be necessary to submit accounting reports only from 2021. And in 2021, it must be submitted as before - to the Federal Tax Service and the Rosstat body within the same deadline. That is, no later than 04/01/2020, because 03/31/2020 is Sunday (clause 5, clause 1, article 23, clause 7, article 6.1 of the Tax Code of the Russian Federation, part 1,2, article 18 of the Law of December 6, 2011 N 402-FZ).

From 2021, financial statements will need to be submitted only to the tax office, and in electronic form through an electronic document management operator, signed with an electronic signature. Only small businesses and only for 2020 will be able to submit reports either on paper or in electronic form of their choice (clause 1, clause 4, article 2, clause 2, article 2 of the Law of November 28, 2020 N 444-FZ) . The deadlines for submitting reports will remain the same.

The obligation of organizations to submit a copy of their accounting records to the territorial branch of the State Statistics Committee will be cancelled. But there are rare exceptions. For example, companies whose annual financial statements contain information classified as state secrets will still have to submit it to the statistics authority (clause 4 of article 1 of Law dated November 28, 2020 N 444-FZ).

The formats of electronic documents - accounting records and auditor's report - must be approved by the Federal Tax Service. It will also be responsible for maintaining the state information resource for accounting (financial) reporting. As the name implies, this will be a large database containing information from the accounting records of all reporting organizations.

Information from this resource can be obtained for a fee. In what cases and how much it will be, the Government of the Russian Federation must determine.

Reporting for medium-sized businesses

In theory, continuous monitoring “once every 5 years” should affect not only small but also medium-sized businesses. However, in practice in 2021, medium-sized enterprises do not participate in monitoring.

However, they were not exempt from other statistical reports. So, they need to submit Form No. 1 - enterprise (see “Form No. 1 - enterprise: Rosstat has adjusted the instructions for filling out the report”).

Exactly which statistical forms a particular organization must submit can be found on the Rosstat website using the “Obtaining data on statistics codes and list of forms” service. You should indicate the TIN (or OGRN or OKPO) and click the “Get” button. The system will generate a list of reports for statistics.

Fill out and submit to Rosstat via the Internet all reports for a medium-sized enterprise for free Submit for free

Main economic indicators

In Sect. 1 of the survey block of the DAS form records the number of staff of a construction company - in numbers. This is the only section of the document in which the indicator is recorded in a way other than putting an × sign in a particular column.

In Sect. 1.1 of the form records the predominant activity of the reporting company - in relation to columns 1–6 of this section. You only need to select one indicator.

In Sect. 2 reflects the percentage of capacity of the reporting company in the reporting period - in the intervals given in columns 1–8 of this section.

In Sect. 3 reflects how many months in advance the company is provided with orders and financing at the time of reporting - in the intervals given in columns 1–7 of this section.

In Sect. Table 4 shows the company’s assessment of the current volume of orders or the company’s production plans for the reporting quarter - as more than sufficient, optimal, or insufficient.

In Sect. Table 5 provides the company’s assessment of the current volume of available production capacity of the required quality, taking into account the tasks facing orders, as well as the expected demand for the work and services provided - within 12 months after the reporting period. It is expected to indicate 1 of 3 possible indicators - more than sufficient volume, optimal or insufficient.

In Sect. 6 reflects the fact of an increase, no change or decrease in the indicators given in pages 1–4 of the table of this section. when comparing:

- information on the reporting and previous quarters;

- information for the reporting and next quarters.

In Sect. 8 reflects the fact of improvement, lack of change, deterioration (or inability to reflect the corresponding dynamics) according to the economic indicators given in pp. 1–7 of this section. when comparing:

- data for the reporting and previous quarters;

- data for the reporting and next quarters.

Fines for those who do not report on time

Those who do not report or do so late will be subject to administrative liability. The same will happen if the information provided turns out to be unreliable.

Violators will be fined under Article 13.19 of the Administrative Code. Its size is:

- for legal entities - from 20,000 to 70,000 rubles. (for repeated violation - from 100,000 to 150,000 rubles);

- for individual entrepreneurs and officials - from 10,000 to 20,000 rubles. (for repeated violation - from 30,000 to 50,000 rubles).

To avoid a fine for false information, you must submit an updated report. This must be done within three days from the moment you discover the error yourself or receive a notification from the statistics agency. Such clarifications were given by Rosstat in a letter dated April 24, 2019 No. CE-04-4/55SMI (see “Rosstat explained how to avoid fines for errors in statistical reporting”).