Recalculation of wages for the previous period is a correction of accrued amounts for past periods. In some cases, the employer is obliged to make a re-accrual, sometimes this is his right. In any case, it is important to promptly correct the identified error in order not only to pay the employee the full salary, but also to avoid claims from regulatory authorities.

In accordance with Article 22 of the Labor Code of the Russian Federation, the employer is obliged to pay full wages to its employees. The amount of remuneration is established for the employee by the employment contract.

The need for accounting to recalculate wages arises if the employee’s wages are not paid in full or in a larger amount. Such situations arise when:

- counting error;

- payment of bonuses for previous years;

- salary indexation;

- changes in the minimum wage;

- employee illness during vacation or recall from vacation;

- receiving a court decision on additional assessments.

If, as a result, the employee received less income, then the company is obliged to recalculate wages for the previous period. If a large amount is transferred, the company is not obliged to make corrections. But in case of a calculation error, she has the right to recalculate wages (Article 137 of the Labor Code of the Russian Federation).

How are salaries formed?

According to Art.

21 of the Labor Code of the Russian Federation, cash payments for specialists in the final version consist of a salary, which is established by the employment agreement, bonuses and various deductions and deductions (alimony, fines, etc.). At the very moment when the employee decides to enter into an employment contract with the employer, it is necessary to discuss all the nuances on which the formation of pay will depend.

The following points are discussed:

- Agreement conditions. Responsibility of the boss to the worker and vice versa. What is included in the employee’s labor obligations. What wishes do the parties have for each other, what are expected from the labor relationship.

- Work and rest schedule. How many hours per day must the employee work, the number of working days per week, vacation time, and so on.

- The amount of payment, how it will be transferred (cash or non-cash).

Having discussed the terms of the employment contract, the management and the future employee of the enterprise sign it, guided by the norms of labor legislation and personal wishes. The agreement cannot contradict the norms of law.

Violation of deadlines for payment of wages

Article 136 of the Labor Code of the Russian Federation contains a requirement according to which wages are paid at least every half month.

In this case, the specific payment date is established by internal labor regulations, a collective or labor agreement no later than 15 calendar days from the end of the period for which it was accrued. An institution has the right to fix salary payment days in its internal labor regulations or in a collective or labor agreement. For the purpose of indicating the days of salary payment, all documents that are named in the law separated by commas are equivalent (Appeal ruling of the Supreme Court of the Udmurt Republic dated April 27, 2016 in case No. 33-1695/2016).

It is a mistake to simply indicate in local documents that payments are made twice a month with an interval of no more than 15 days, if specific dates for payment of wages are not established. In Resolution No. 4A-182/2017 dated June 16, 2017, the Supreme Court of the Republic of Karelia declared unlawful the actions of an autonomous institution that did not fix the days of payment of wages in any document, which could lead to its payment less than every half month, and this is a clear violation of labor legislation .

In practice, employers often do not observe the interval between payments. Thus, in the Decision of September 19, 2017 in case No. 21-723/2017, the Khabarovsk Regional Court found a violation of Part 6 of Art. 136 of the Labor Code of the Russian Federation stipulates that wages are paid to employees for the current month twice a month: before the 17th day of the billing month (advance payment) and until the 7th day of the month following the billing month (final payment). The fact is that the period between the 17th and 7th exceeds half a month.

The Ministry of Labor recognizes the possibility of paying wages earlier than the date established by the internal labor regulations, labor or collective agreement, if this does not worsen the situation of workers (letters dated July 26, 2019 No. 14-1/B-582, dated November 12, 2018 No. 14-1/OOG -8602). At the same time, when paying wages early, the employer must be careful: if you pay one salary ahead of schedule and the next one on time, then the interval between payments will be more than half a month, which contradicts the requirements of Art. 136 Labor Code of the Russian Federation. In addition, in the event that an employee does not work the salary paid for time not yet worked, it will be possible to withhold the “unworked” amount only upon his application.

Responsibility for incorrect payroll

All payments and taxes, with the exception of income taxes, are paid by the management from the personal finances of the enterprise. The period for the formation and accrual of money is established on the basis of Art. 136 Labor Code of the Russian Federation. It clearly indicates the procedure for calculating pay, types of transfers and the nuances of generating monetary resources.

Responsibility for incorrect payments lies with the person who accrues them. As a rule, this is either the boss himself or an accounting employee.

In case of violations, the organization bears several types of responsibility :

- Civil law. If the calculation of wages was made incorrectly, then the head or employee of the accounting department compensates for the monetary shortcomings with personal finances.

- Material. Compensation for losses may be covered from wages.

- Administrative. Penalties cannot be ruled out.

- Tax office. If a deliberate violation is detected, tax officials may impose a fine.

- Criminal. The consequences can be quite wide-ranging and not limited to the disadvantaged employee. They can also affect the boss.

- Disciplinary. This could be a reprimand, a severe reprimand, or something else.

It is worth mentioning that several types of liability may apply.

For example, due to the fault of an accountant, an employee was paid less wages than required under the contract. The court imposed a fine (administrative liability), the boss reprimanded him (disciplinary liability), and he also had to cover the debt with his salary (financial liability).

In order to restore your violated rights and punish the offender, you first need to fully collect a package of necessary documents, with which we will go to the appropriate authorities.

Setting wages

The monthly salary of a person who has fully worked the standard working hours during this period and fulfilled his job duties cannot be lower than the minimum wage (Part 3 of Article 133 of the Labor Code of the Russian Federation).

The salary amount includes salary, compensation and incentive payments. When comparing with the “minimum wage”, regional coefficients and percentage allowances for work in the regions of the Far North and equivalent areas are not taken into account (resolutions of the Presidium of the Armed Forces of the Russian Federation dated 02/07/2018 No. 4-ПВ17, Constitutional Court of the Russian Federation dated 12/07/2017 No. 38-P). In addition, it is not expected to include in the salary (part of the salary) of an employee, not exceeding the minimum wage, increased payment for overtime work, night work, weekends and non-working holidays (Resolution of the Constitutional Court of the Russian Federation of April 11, 2019 No. 17-P).

In Determination No. 1268-O of May 29, 2019, the Constitutional Court of the Russian Federation refused to recognize the provisions of Art. 129, 133, 133.1 Labor Code of the Russian Federation. The plaintiff, challenging the interrelated provisions of these articles, raised before the Constitutional Court the question of establishing a tariff rate (salary) in an amount not lower than the minimum wage. Meanwhile, the resolution of this issue falls within the competence of the legislator, who, as the court indicated in Resolution No. 38-P, is entitled, when improving legislation in the field of remuneration, to take into account the established practice in the social partnership system of determining the tariff rate (salary) of the first category not lower than the minimum amount wages established by federal law.

The court indicated: the current legal regulation is aimed at providing each employee with fair wages not lower than the minimum wage and cannot be regarded as violating the rights of workers (definitions of the Constitutional Court of the Russian Federation of April 12, 2019 No. 868-O and 869-O).

Labor legislation allows for the establishment of salaries (tariff rates) as components of employee salaries in an amount less than the minimum wage (Letter of the Ministry of Labor of the Russian Federation dated June 5, 2018 No. 14-0/10/B-4085).

At the same time, one should take into account the provisions of the Unified Recommendations for the establishment at the federal, regional and local levels of remuneration systems for employees of state and municipal institutions for 2021 (approved by the Decision of the Russian Tripartite Commission for the Regulation of Social and Labor Relations dated December 25, 2018, Protocol No. 12), according to which official salaries should account for the majority of the funds used to pay wages.

In particular, for employees of educational institutions, the document recommends that at least 70% of the organization’s wage fund be allocated to ensure salaries; for healthcare, this figure is 55-60%, in the cultural sector - 50-55%. In Letter dated 06/07/2019 No. 18-4/10/B-4438, the Ministry of Labor provided explanations on how to bring the amount of pay for federal civil servants filling certain positions in the federal public civil service in territorial bodies to a level not lower than the minimum wage.

In order to comply with the requirements of Part 3 of Art. 133 of the Labor Code of the Russian Federation, the employer’s representative must ensure payment to the civil servant of a monthly salary in an amount not lower than the minimum wage in accordance with the established system and conditions of remuneration.

At the same time, the guarantees enshrined in the Labor Code of the Russian Federation in terms of the minimum wage should be ensured not artificially by making an “additional payment to the minimum wage”, not provided for by the workers’ compensation system, but directly by the workers’ compensation system itself and the amounts of payments included in its composition, in connection with than the required level of monthly salary for civil servants should be ensured through payments included in the salary on the basis of Art. 50 of the Federal Law of July 27, 2004 No. 79-FZ “On the State Civil Service of the Russian Federation.”

If achieving this level for certain positions of the civil service is impossible by establishing monthly bonuses as part of the salary in the maximum amount, the amount of the monthly salary of civil servants to a level not lower than the minimum wage must be brought through incentive payments included in the salary.

Employers who do not comply with the requirements of labor legislation (including in terms of setting wages) may be brought to administrative liability under Art. 5.27 Code of Administrative Offenses of the Russian Federation. In addition, the manager may be brought to criminal liability (Letter of the Ministry of Labor of the Russian Federation dated October 09, 2018 No. 14-2/B-808).

Required documents

In order to prove that a large amount of money is subject to payment, a citizen must have a certain set of documents:

- Identity document.

- An employment contract as confirmation of the employment relationship. The salary is also specified in the employment contract.

- A payroll slip is required because the accrued amount is indicated on it.

- Application to the authority where you plan to file a complaint. It is written in any form addressed to the head of the organization.

Overpayment in excess

The inflated wages that were paid to the employee are not subject to return by the employee if he does not independently show such initiative. All waste of the organization is reimbursed by the person responsible for the increased payments. The following cases are exceptions:

- The presence of a counting error, if something extra was added when adding the daily numbers.

- The employee is guilty of failure to comply with labor standards.

- The employee is to blame for the downtime of the organization.

- The employee himself is involved in the unlawful overestimation of payments if his actions entailed such consequences.

In other cases, compensation is possible with the direct consent of an employee of the organization to voluntary compensation.

Where to contact

If the boss or employee of the accounting service made a mistake when calculating and admitted it, then it is quite obvious that they have the opportunity to return the funds when transferring another paycheck. How to correct the situation if an employee was underpaid, the boss and accountant must figure it out themselves.

If it was not possible to resolve the situation peacefully, then you have to wonder about help from the authorities.

Where should an injured employee contact? There are three government bodies where an employee has the opportunity to complain about the illegality of actions and inactions of their boss.

- Prosecutor's Office;

- Judicial authorities;

- Labor Safety Inspectorate.

The State Labor Inspectorate is a federal executive body, in accordance with Article 354 of the Labor Code of the Russian Federation. It is also an authoritative structure that can take responsibility for protecting the rights of employees.

The functions of this organization include:

- Reception and consideration of applications from company employees;

- Inspection of offending organizations;

- Issues an order to prevent violated rights

- Issues protocols on administrative violations;

- Takes into account measures to eliminate the violated labor rights of company employees.

- Reviews applications within thirty days.

Alexey Pavlov

Lawyer, ready to answer your questions.

Many employers are afraid of a labor inspector coming to their organization, so contacting the state labor inspectorate is the right decision.

The prosecutor's office is a relevant executive body where you can turn to for help with such questions. All acts issued by the prosecutor are subject to strict execution by the boss, so there is little chance of escaping responsibility.

The prosecutor's office considers applications within thirty days from the date of registration of the complaint in the office. After establishing unlawful actions on the part of the employer, the prosecutor's office issues an act of prosecutorial response, after which the boss is obliged to study the prosecutor's acts as soon as possible.

If a specialist decides to directly seek help from a court, then it makes sense to familiarize yourself with the provisions of Article 131 of the Civil Procedure Code, which details the requirements for a claim.

The statement of claim must include:

- name of the court;

- passport details of the plaintiff with registration;

- name of the offending enterprise;

- a descriptive part where the violated right is stated;

- list of attachments to the claim.

The judge will consider the claim and then force the employer to pay the missing funds.

Alexey Pavlov

Lawyer, ready to answer your questions.

If you don’t understand where it’s best to turn in which cases, take advantage of

a free consultation - contact our experienced lawyers by phone or through an online consultant. They will answer your questions and offer solutions.

Case of underpayment when going on sick leave

The peculiarities of the accrual of funds at the very moment when a person is sick or is being treated in a hospital are determined by certain reasons that directly depend not only on the amount of the transfer, but also on the peculiarities of their collection from certain authorities.

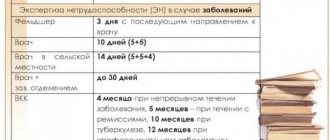

Money for temporarily disabled citizens is paid either from the fund of the insurance organization or from the social insurance fund (in case of issuing a certificate of incapacity for work for a period of more than 3 days, starting from the 4th day).

There are times when the Social Insurance Fund pays financial resources from its fund from the 1st day of sick leave. The time for payment of finances is limited to the period of temporary disability for the entire period noted on the sick leave certificate, which is provided at the place of work.

According to Federal Law No. 255-F3, a disabled citizen has the right to expect the following amount of benefit payments:

- 60% of average earnings, if the insurance period is less than 5 years;

- 80% of average earnings, if you have an insurance period of 5 to 8 years;

- 100% of earnings, if you have more than 8 years of insurance experience.

When calculating sick leave funds, they take into account not only the length of service from the last place of work, but also take into account all the years worked in other companies, with previous employers. Average earnings are calculated based on the two calendar dates preceding the start of the sick year, without taking into account the current one.

If an employee discovers an underpayment of funds, there is an opportunity to personally address the question to the boss, ask the accounting department for a payslip that lists the amount of funds for temporary disability, and receive clarification on its contents.

What to do next?

After this, the employee writes a complaint about the boss’s unlawful actions and sends it to the Social Insurance Fund. He, in turn, orders an inspection of the employer’s organization and, if necessary, eliminates the violated rights of the employee. To file a complaint against your boss with the FSS, you need to collect some documents:

- Complaint in free form.

- Sheet of temporary incapacity for work. You can just have a copy of it.

- Statement of insurance record, if available. If it is not there, the FSS has the opportunity to independently verify the employee’s length of service, based on his personal data.

- A photocopy of the employment agreement and other documents directly or indirectly related to the transfer of finances.

Alexey Pavlov

Lawyer, ready to answer your questions.

If you don’t understand where it’s best to turn in which cases, take advantage of

a free consultation - contact our experienced lawyers by phone or through an online consultant. They will answer your questions and offer solutions.

Features of underpayment of vacation pay

When assigning vacation days and payments for them, several nuances are taken into account that directly affect the amount of vacation funds. The assignment of finances for the payment of vacation days comes through the submission of:

- Statements from a specialist going on a well-deserved vacation;

- Resolutions on the statement (consent) of the boss. After which an accountant or other employee draws up a rest order;

- The accountant transfers vacation funds.

Funds for vacation are assigned no later than 3 days before the start of the vacation . If a significant and unclear underpayment of funds is detected, an employee of the enterprise has the right to file a complaint:

- To the labor inspectorate, which will order an inspection of the offending organization.

- To the court, if the boss did not deign to give the due amount of money peacefully.

If the problem is resolved peacefully, the boss has the opportunity to give the missing funds through an increase in pay or a one-time payment during vacation days.

Alexey Pavlov

Lawyer, ready to answer your questions.

If you don’t understand where it’s best to turn in which cases, take advantage of

a free consultation - contact our experienced lawyers by phone or through an online consultant. They will answer your questions and offer solutions.