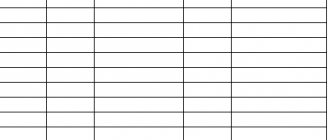

Before submitting your return, find out what safe percentage of VAT deduction is established in your region. This will help avoid unnecessary attention from tax authorities and audits.

If the company’s data is higher than the data for the region, tax authorities will be interested in the organization. The percentage of VAT reduction is one of the criteria when assigning an on-site inspection.

The calculation of the safe share of deductions for the regions of Russia is made on the basis of form 1-VAT, posted on the website of the Federal Tax Service.

| Region | Share of deductions, %* |

| Central Federal District | |

| Belgorod region | 92,0 |

| Bryansk region | 93,8 |

| Vladimir region | 84,9 |

| Voronezh region | 92,9 |

| Ivanovo region | 91,3 |

| Kaluga region | 87,3 |

| Kostroma region | 85,2 |

| Kursk region | 93,5 |

| Lipetsk region | 104,2 |

| Moscow region | 88,5 |

| Oryol Region | 91,6 |

| Ryazan Oblast | 82,0 |

| Smolensk region | 92,8 |

| Tambov Region | 94,9 |

| Tver region | 88,7 |

| Tula region | 95,8 |

| Yaroslavl region | 86,7 |

| Moscow city | 88,9 |

| Northwestern Federal District | |

| Republic of Karelia | 79,0 |

| Komi Republic | 78,4 |

| Arhangelsk region | 85,0 |

| Vologda Region | 98,7 |

| Kaliningrad region | 64,3 |

| Leningrad region | 88,4 |

| Murmansk region | 188,8 |

| Novgorod region | 96,6 |

| Pskov region | 89,7 |

| City of Saint Petersburg | 87,9 |

| Nenets Autonomous Okrug | 149,2 |

| North Caucasus Federal District | |

| The Republic of Dagestan | 82,9 |

| The Republic of Ingushetia | 92,9 |

| Kabardino-Balkarian Republic | 90,7 |

| Karachay-Cherkess Republic | 90,1 |

| Republic of North Ossetia-Alania | 86,7 |

| Chechen Republic | 96,5 |

| Stavropol region | 90,0 |

| Southern Federal District | |

| Republic of Adygea | 84,6 |

| Republic of Kalmykia | 79,5 |

| Republic of Crimea | 86,5 |

| Krasnodar region | 90,7 |

| Astrakhan region | 76,5 |

| Volgograd region | 91,6 |

| Rostov region | 92,7 |

| City of Sevastopol | 81,2 |

| Volga Federal District | |

| Republic of Bashkortostan | 91,4 |

| Mari El Republic | 88,4 |

| The Republic of Mordovia | 89,1 |

| Republic of Tatarstan | 90,8 |

| Udmurt republic | 80,7 |

| Chuvash Republic | 83,6 |

| Kirov region | 88,3 |

| Nizhny Novgorod Region | 90,4 |

| Orenburg region | 74,3 |

| Penza region | 88,8 |

| Perm region | 86,9 |

| Samara Region | 84,0 |

| Saratov region | 84,6 |

| Ulyanovsk region | 88,5 |

| Ural Federal District | |

| Kurgan region | 85,2 |

| Sverdlovsk region | 91,0 |

| Tyumen region | 84,6 |

| Chelyabinsk region | 90,0 |

| Khanty-Mansi Autonomous Okrug - Yugra | 67,0 |

| Yamalo-Nenets Autonomous Okrug | 72,4 |

| Siberian Federal District | |

| Altai Republic | 88,9 |

| Tyva Republic | 81,5 |

| The Republic of Khakassia | 87,0 |

| Altai region | 89,6 |

| Krasnoyarsk region | 76,5 |

| Irkutsk region | 78,4 |

| Kemerovo region - Kuzbass | 94,1 |

| Novosibirsk region | 88,9 |

| Omsk region | 84,9 |

| Tomsk region | 80,6 |

| Far Eastern Federal District | |

| The Republic of Buryatia | 97,3 |

| The Republic of Sakha (Yakutia) | 94,4 |

| Primorsky Krai | 94,2 |

| Khabarovsk region | 90,4 |

| Amur region | 131,2 |

| Kamchatka Krai | 92,7 |

| Magadan Region | 103,0 |

| Sakhalin region | 95,0 |

| Transbaikal region | 91,4 |

| Jewish Autonomous Region | 82,7 |

| Chukotka Autonomous Okrug | 136,5 |

| Baikonur | |

| Baikonur | 65,1 |

* The safe share is calculated for transactions that are subject to VAT at rates of 10 and 20 percent, excluding tax amounts and deductions for transactions with a zero rate.

Safe VAT deduction in your region: where to look

All necessary information is published on the websites of regional tax services.

We strongly recommend that you check the percentage of deductions in your organization's tax bill against the average for your region (read on to learn why this is important). As of 01/01/2021, the Federal Tax Service has updated regional statistics on deductions. Current data on the safe percentage of VAT deductions is shown in the table below:

| Region | Safe share of deductions as of 01/01/2021 | Safe share of deductions as of 11/01/2020 | Safe share of deductions as of 08/01/2020 | Safe share of deductions as of 06/01/2020 | Safe share of deductions as of 02/01/2020 | Safe share of deductions as of 11/01/2019 | Safe share of deductions as of 08/01/2019 |

| Republic of Adygea | 84,5 | 84,6 | 85,3 | 86,2 | 86,6 | 85,9 | 86,3 |

| Altai Republic | 88,8 | 88,9 | 90,9 | 94,0 | 101,8 | 90,8 | 91,8 |

| Republic of Bashkortostan | 91.4 | 91,4 | 92,2 | 93,2 | 94,2 | 91,1 | 89,4 |

| The Republic of Buryatia | 97,0 | 97,3 | 97,5 | 95,2 | 93,1 | 90,6 | 91,6 |

| The Republic of Dagestan | 83,4 | 82,9 | 83,6 | 83,6 | 80,4 | 83,6 | 84,6 |

| The Republic of Ingushetia | 93,0 | 92,9 | 92,3 | 91,6 | 93,0 | 93,3 | 94,3 |

| Kabardino-Balkarian Republic | 90,4 | 90,7 | 89,6 | 87,5 | 93,2 | 91,6 | 91,9 |

| Republic of Kalmykia | 79,5 | 79,5 | 84,5 | 93,3 | 71,0 | 80,9 | 83,2 |

| Karachay-Cherkess Republic | 89,9 | 90,1 | 91,3 | 92,4 | 91,6 | 92,2 | 92,3 |

| Republic of Karelia | 78,8 | 79,0 | 79,9 | 79,9 | 78,4 | 74,9 | 76,7 |

| Komi Republic | 78,5 | 78,4 | 79,4 | 79,1 | 80,1 | 76,4 | 76,5 |

| Mari El Republic | 88,5 | 88,4 | 87,9 | 88,4 | 88,3 | 87,3 | 87,1 |

| The Republic of Mordovia | 89,0 | 89,1 | 89,7 | 90,7 | 90,0 | 92,5 | 93,1 |

| The Republic of Sakha (Yakutia) | 94,3 | 94,4 | 93,4 | 89,5 | 88,7 | 91,0 | 90,1 |

| Republic of North Ossetia–Alania | 86,2 | 86,7 | 86,6 | 86,5 | 85,4 | 89,1 | 89,5 |

| Republic of Tatarstan | 90,8 | 90,8 | 90,8 | 90,9 | 91,3 | 87,9 | 87,5 |

| Tyva Republic | 81,0 | 81,5 | 80,7 | 78,9 | 78,0 | 78,4 | 77,2 |

| Udmurt republic | 80,7 | 80,7 | 80,1 | 78,0 | 78,2 | 80,0 | 79,4 |

| The Republic of Khakassia | 87,0 | 87,0 | 88,0 | 88,0 | 89,6 | 89,7 | 90,1 |

| Chechen Republic | 96,9 | 96,5 | 97,7 | 97,1 | 97,4 | 97,7 | 100,5 |

| Chuvash Republic | 83,5 | 83,6 | 83,2 | 82,9 | 82,0 | 83,7 | 84,3 |

| Altai region | 89,5 | 89,6 | 90,5 | 91,1 | 90,4 | 89,9 | 89,7 |

| Transbaikal region | 91,3 | 91,4 | 91,0 | 90,0 | 88,3 | 89,6 | 87,4 |

| Kamchatka Krai | 92,7 | 92,7 | 94,0 | 92,1 | 88,4 | 90,2 | 89,8 |

| Krasnodar region | 90,7 | 90,7 | 90,9 | 91,5 | 93,2 | 90,6 | 90,6 |

| Krasnoyarsk region | 76,5 | 76,5 | 74,2 | 73,5 | 72,5 | 78,1 | 79,6 |

| Perm region | 86,9 | 86,9 | 87,1 | 87,6 | 87,2 | 82,1 | 80,9 |

| Primorsky Krai | 94,2 | 94,2 | 94,1 | 94,7 | 96,5 | 94,6 | 93,5 |

| Stavropol region | 90,0 | 90,0 | 89,6 | 88,8 | 89,4 | 88,8 | 88,9 |

| Khabarovsk region | 90,4 | 90,4 | 90,0 | 89,8 | 91,9 | 92,9 | 92,3 |

| Jewish Autonomous Region | 82,9 | 82,7 | 82,5 | 83,2 | 89,8 | 87,2 | 90,9 |

| Nenets Autonomous Okrug | 148,9 | 149,2 | 142,6 | 139,3 | 157,7 | 148,5 | 141,5 |

| Khanty-Mansiysk Autonomous Okrug – Yugra | 67,0 | 67,0 | 67,7 | 64,6 | 64,0 | 58,7 | 57,0 |

| Chukotka Autonomous Okrug | 132,8 | 136,5 | 137,2 | 126,0 | 116,1 | 120,7 | 115,5 |

| Yamalo-Nenets Autonomous Okrug | 72,6 | 72,4 | 72,4 | 70,9 | 69,4 | 64,4 | 62,9 |

| Tver region | 88,8 | 88,7 | 87,7 | 87,9 | 88,4 | 90,2 | 89,7 |

| Tomsk region | 80,7 | 80,6 | 79,8 | 76,5 | 76,5 | 77,2 | 76,8 |

| Tula region | 95,9 | 95,8 | 96,0 | 96,1 | 97,1 | 97,0 | 97,5 |

| Tyumen region | 84,8 | 84,6 | 85,3 | 84,4 | 87,1 | 84,2 | 84,6 |

| Ulyanovsk region | 88,4 | 88,5 | 88,5 | 88,4 | 89,2 | 91,0 | 90,8 |

| Chelyabinsk region | 90,0 | 90,0 | 90,5 | 90,1 | 91,1 | 91,0 | 90,7 |

| Yaroslavl region | 86,6 | 86,7 | 90,1 | 88,3 | 86,1 | 89,3 | 89,9 |

| Moscow | 89,0 | 88,9 | 89,1 | 89,8 | 89,0 | 88,7 | 88,0 |

| Saint Petersburg | 87,8 | 87,9 | 88,1 | 88,5 | 89,0 | 87,9 | 87,7 |

| Amur region | 130,7 | 131,2 | 131,7 | 128,4 | 136,0 | 130,1 | 127,3 |

| Arhangelsk region | 85,0 | 85,0 | 91,1 | 93,7 | 108,3 | 77,0 | 83,0 |

| Astrakhan region | 76,0 | 76,5 | 74,3 | 72,0 | 71,8 | 65,9 | 64,5 |

| Belgorod region | 92,0 | 92,0 | 92,6 | 92,9 | 93,3 | 91,6 | 91,8 |

| Bryansk region | 93,7 | 93,8 | 94,5 | 94,6 | 93,7 | 90,0 | 88,6 |

| Vladimir region | 84,9 | 84,9 | 84,4 | 83,8 | 85,1 | 85,3 | 85,8 |

| Volgograd region | 91,6 | 91,6 | 92,9 | 94,6 | 96,3 | 90,7 | 88,3 |

| Vologda Region | 98,7 | 98,7 | 100,0 | 98,7 | 101,3 | 98,9 | 99,3 |

| Voronezh region | 92,8 | 92,9 | 93,0 | 92,8 | 92,7 | 93,0 | 92,8 |

| Ivanovo region | 91,3 | 91,3 | 91,3 | 92,0 | 91,9 | 92,5 | 92,5 |

| Irkutsk region | 78,4 | 78,4 | 78,1 | 77,1 | 77,7 | 77,1 | 77,2 |

| Kaliningrad region | 64,4 | 64,3 | 64,3 | 62,9 | 63,6 | 60,3 | 60,3 |

| Kaluga region | 87,3 | 87,3 | 88,0 | 87,3 | 86,9 | 90,0 | 89,9 |

| Kemerovo region - Kuzbass | 94,1 | 94,1 | 94,3 | 95,4 | 97,7 | 90,8 | 89,4 |

| Kirov region | 88,3 | 88,3 | 89,3 | 91,2 | 98,0 | 87,2 | 87,6 |

| Kostroma region | 85,0 | 85,2 | 85,8 | 86,2 | 86,0 | 86,5 | 86,2 |

| Kurgan region | 85,1 | 85,2 | 85,1 | 84,3 | 85,0 | 85,8 | 86,1 |

| Kursk region | 93,4 | 93,5 | 94,0 | 91,9 | 93,4 | 90,0 | 90,8 |

| Leningrad region | 88,9 | 88,4 | 88,9 | 90,9 | 88,8 | 86,2 | 87,0 |

| Lipetsk region | 104,3 | 104,2 | 104,8 | 103,8 | 103,2 | 104,7 | 105,6 |

| Magadan Region | 102,5 | 103,0 | 104,3 | 101,1 | 97,0 | 98,0 | 98,8 |

| Moscow region | 88,5 | 88,5 | 88,5 | 88,4 | 88,4 | 89,2 | 89,2 |

| Murmansk region | 188,8 | 188,8 | 193,3 | 193,4 | 232,4 | 122,1 | 103,2 |

| Nizhny Novgorod Region | 90,4 | 90,4 | 91,2 | 91,3 | 92,1 | 89,0 | 88,3 |

| Novgorod region | 96,6 | 96,6 | 96,0 | 95,7 | 98,6 | 95,8 | 95,1 |

| Novosibirsk region | 88,9 | 88,9 | 88,9 | 88,9 | 88,8 | 89,7 | 89,7 |

| Omsk region | 84,9 | 84,9 | 84,6 | 86,3 | 89,4 | 88,4 | 88,7 |

| Orenburg region | 74,3 | 74,3 | 74,1 | 71,6 | 73,7 | 71,5 | 69,9 |

| Oryol Region | 91,6 | 91,6 | 91,8 | 91,4 | 91,3 | 93,1 | 92,6 |

| Penza region | 88,7 | 88,8 | 89,2 | 89,9 | 90,8 | 91,1 | 91,1 |

| Pskov region | 89,6 | 89,7 | 90,3 | 89,3 | 90,7 | 89,2 | 88,1 |

| Rostov region | 92,5 | 92,7 | 92,0 | 92,2 | 91,0 | 92,7 | 92,9 |

| Ryazan Oblast | 82,0 | 82,0 | 81,8 | 81,7 | 82,2 | 82,1 | 83,9 |

| Samara Region | 84,2 | 84,0 | 82,4 | 83,5 | 84,5 | 83,4 | 83,2 |

| Saratov region | 68,4 | 84,6 | 85,2 | 85,6 | 87,6 | 84,1 | 83,6 |

| Sakhalin region | 95,2 | 95,0 | 94,9 | 93,8 | 72,0 | 98,9 | 97,2 |

| Sverdlovsk region | 90,9 | 91,0 | 91,2 | 91,0 | 91,1 | 91,7 | 91,5 |

| Smolensk region | 92,6 | 92,8 | 92,7 | 91,5 | 91,7 | 95,4 | 94,6 |

| Tambov Region | 95,5 | 94,9 | 95,3 | 95,8 | 96,6 | 96,3 | 97,2 |

| Republic of Crimea | 86,1 | 86,5 | 86,8 | 86,2 | 86,8 | 85,9 | 86,4 |

| City of Sevastopol | 81,0 | 81,2 | 81,4 | 80,9 | 81,1 | 81,4 | 81,3 |

| Baikonur city | 65,1 | 62,1 | 71,7 | 74,1 | 72,1 | 93,4 | 71,5 |

How to calculate your share of deductions? You can find out about this in ConsultantPlus. The experts not only gave the formula and comments on it, but also gave an example of the calculation. Get trial access to K+ for free and go to the Ready-made solution.

Calculation of the share of expenses for non-VAT-taxable transactions

The share is defined as the quotient of division expressed as a percentage:

Denominator: Dt 90.02, Dt 90.07, Dt 90.08, Dt 91.02 (according to items of accounting for expenses on the sale of assets minus VAT accrued upon their sale).

For a long time, tax officials disputed the right to apply the “5% rule” for expenses on activities transferred to UTII, since they did not consider it possible to extend to UTII payers the procedure approved by clause 4 of Article 170 of the Tax Code of the Russian Federation for VAT payers (letter of the Federal Tax Service dated May 31, 2005 No. 03-1-03/897/ [email protected] , letter of the Ministry of Finance of Russia dated July 8, 2005 No. 03-04-11/143).

However, judicial practice on this issue has developed in favor of taxpayers (Resolution of the Federal Arbitration Court of the Central District dated July 30, 2008 No. A23-247/06A-14-38, Resolution of the Federal Antimonopoly Service of the Volga District dated February 5, 2008 in case No. A65-28667/06 -CA2-11).

What should you keep in mind regarding the percentage of deductions?

Exceeding the above safe percentage of deductions is not a violation. However, it is fraught with increased interest of tax authorities in the data included in the declaration. At a minimum, the inspection may ask you for clarification.

Important! Recommendation from ConsultantPlus We recommend giving detailed explanations and submitting supporting documents, even if the tax authority has not requested them. This will reduce the risk of your organization being selected for an on-site audit. For an example of written explanations regarding the fact of a high share of tax deductions for VAT, see K+. This can be done for free.

Read more about transferring deductions to a later date here.

How to justify exceeding the share of deductions

So, if the share of deductions for the company is higher, you need to be prepared for the inspection to ask for clarification. You can refer to the following circumstances:

- you purchased a large volume of goods, but sales will only be in the next quarter;

- you purchased expensive production equipment;

- you were “let down” by the customer. He refused to purchase a large batch of products when all the necessary components for its production, etc., were purchased.

Of course, all explanations must be supported by documents.

Results

Tax authorities systematically process statistical information on VAT deductions.

The results of such processing make it possible, in particular, to determine the average share of deductions for each region. Exceeding the value of this share is fraught with increased interest of the INFS in the process of forming the tax base for VAT. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Transfer of deduction

In some cases, it is possible to transfer VAT deductions to subsequent periods. That is, if necessary and if possible, in order to prevent exceeding “safe” indicators, you can regulate the amounts by which you reduce the VAT accrued to the budget.

This allows you to do this in paragraph 1.1 of Article 172 of the Tax Code. A tax deduction can be claimed no later than 3 years after the purchased (imported) goods (work, services, property rights) are registered. This rule applies to VAT deductions (clause 2 of Article 171 of the Tax Code of the Russian Federation):

- presented by suppliers when purchasing goods (works, services), property rights in the territory of the Russian Federation;

- paid when importing goods into the territory of the Russian Federation in the customs procedures of release for domestic consumption, processing for domestic consumption, temporary import and processing outside the customs territory;

- paid when importing goods into the Russian Federation that are moved across its customs border without customs clearance.

Read in the berator “Practical Encyclopedia of an Accountant”

What amounts of VAT can be deducted?

The main thing you need to know well is how to correctly count 3 years for transferring VAT deductions.

Calculation of the amount of VAT included in fixed assets and intangible assets

The amount of tax to be included in the cost of fixed assets and intangible assets is determined as the product of the amount of VAT presented by sellers of these objects involved in both taxable and non-taxable activities (paragraph 4, paragraph 4, article 170 of the Tax Code of the Russian Federation) by the share of VAT (paragraph a) clause 3 of this procedure) and is included in the cost of objects by postings:

Dt 08.04 “Acquisition of fixed assets” Kt 19.01 “VAT on the acquisition of fixed assets”; Dt 01 “Fixed assets” Kt 08.04.

Dt 08.05 “Acquisition of intangible assets” Kt 19.02 “VAT on acquired intangible assets”; Dt 04 “Intangible assets” Kt 08.05.

Calculation of the amount of VAT included in expenses

The amount of VAT calculated as the product of the amount of VAT presented by sellers of works and services related simultaneously to taxable and non-taxable transactions (paragraph 4, paragraph 4, article 170 of the Tax Code of the Russian Federation), by the share of VAT (paragraph a) paragraph 3 of this procedure) and included in expenses by postings:

for manufacturing enterprises:

Dt 26.01 Kt 19.04 “VAT on purchased services”;

for trade enterprises:

Dt 44.01 Kt 19.04 “VAT on purchased services.”

Calculation of the amount of VAT included in the cost of inventory items

The amount of tax to be included in the cost of materials is determined as the product of:

the amount of VAT presented by sellers of materials recognized as expenses of the tax period and related simultaneously to taxable and non-taxable transactions (paragraph 4, paragraph 4, article 170 of the Tax Code of the Russian Federation), *

* for the share of VAT (clause a) clause 3 of this procedure.

The VAT amount is included in the materials by postings:

Dt 10 Kt 19.03 “VAT on purchased inventories.”

We recommend approving it in the accounting policy

Include in the calculation expenses recognized for the purpose of preparing the income statement.

The meaning of “total expenses” is not regulated by law; therefore, it is subject to approval by accounting policies. The recommendation to determine these expenses on the basis of accounting data is given in accordance with the letter of the Ministry of Finance of Russia dated May 29, 2014 No. 03-07-11/25771.

Expenses related to both taxable and non-taxable transactions should be distributed proportionally ( choose : expenses or income).

The issue of the participation of indirect costs in the calculation according to the “5% rule” is currently controversial. According to tax authorities, the share of expenses for non-VAT-taxable transactions must be calculated taking into account all expenses, distributing expenses related to both types of operations using the method established in the accounting policy (letter of the Federal Tax Service of Russia dated November 13, 2008 No. ШС-6-3 / [email protected] ) , letter of the Federal Tax Service of Russia dated March 22, 2011 No. KE-4-3/4475). In favor of the taxpayer, there is Resolution of the Federal Antimonopoly Service of the Volga Region dated July 23, 2008 No. A06-333/08, which recognized as legitimate the statement in the accounting policy of the calculation of the “5% rule” only for direct expenses.

1.3. When acquiring fixed assets or intangible assets used to carry out both taxable and non-taxable VAT transactions, accounting for incoming VAT is carried out in the general manner.

For fixed assets and intangible assets used to carry out both VAT-taxable and non-VAT-taxable transactions, accepted for accounting in the first or second month of the quarter, determine the proportion based on the cost of goods shipped in the corresponding month (work performed, services rendered), transferred property rights , transactions for the sale of which are subject to taxation (exempt from taxation), in the total cost of goods shipped per month (work performed, services provided), transferred property rights (clause 1, clause 4.1, article 170 of the Tax Code of the Russian Federation).

We recommend it for taxpayers who calculate monthly advance payments based on the actual profit received in accordance with clause 2 of Article 285 of the Tax Code of the Russian Federation.

1.4. For large organizations in which accounting is formalized, we recommend that in the accounting policy or an appendix to it, compile and regularly review a list of current activities, as well as expenses that “incur VAT” and are incurred in carrying out both taxable and non-VAT-taxable transactions.

Table 1. Approximate list of non-VAT-taxable transactions

| Sale of shares in the authorized (share) capital of organizations, securities | |

| Sale of scrap and waste of ferrous and non-ferrous metals | |

| Transfer of goods (performance of work, provision of services), transfer of property rights free of charge within the framework of charitable activities (**) | For calculations, the amount of consumption is accepted, Dt 91.02 Kt 10, 41, etc. |

| Receiving interest on loans issued (*) | By normal activities |

| Assignment of claims on loans in cash and interest on them | |

| Sales transferred to pay the single tax on imputed income (UTII) | By normal activities (**) in accordance with the Federal Law “On Charitable Activities and Charitable Organizations”, with the exception of excisable goods. Transactions whose income is not revenue from the sale of goods (work, services) are not taken into account in calculations for the distribution of VAT (clause 1 of Article 39 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated March 17, 2010 No. 03-07-11/64): Another option for grouping expenses related simultaneously to taxable and non-taxable transactions is to approve a list of divisions whose activities are aimed at carrying out both taxable and non-taxable VAT transactions (for example, Table 2). Table 2. Examples of divisions whose activities are aimed at carrying out both taxable and non-VAT-taxable transactions |

| Others according to organizational structure |