Natural loss inevitably accompanies the sale of some goods. It must be calculated based on the law; the indicator appears in accounting and tax accounting.

Question: How to reflect in accounting the loss of goods belonging to the organization during its transportation to the buyer (within the limits of natural loss and permissible technological losses, as well as in excess of the norms), if the culprit has not been identified? The organization delivers the goods (mixed feed) by its own vehicles to the buyer’s warehouse. The net weight of the goods at the organization's warehouse (during shipment) was 100 tons. Upon acceptance by the buyer, the net weight was 99.7 tons. The technological map developed by the organization provides for losses from discrepancies in the readings of scales at the place of shipment and at the place of receipt, not exceeding 0. 1% of the transported cargo weight. The actual cost of 1 ton of transported goods (equal to the price of its acquisition for tax accounting purposes) amounted to 80,000 rubles. “Input” VAT on a product is accepted for deduction when it is accepted for accounting. The person responsible for the excess losses has not been identified, and the organization does not have documentary confirmation from an authorized government body that there are no perpetrators. Tax accounting uses the accrual method. View answer

Natural decline

The concept of natural loss is discussed in the Methodological Recommendations for the development of norms for natural loss (Approved by Order of the Ministry of Economic Development of Russia dated March 31, 2003 N 95).

They explain that the natural loss of inventory assets (TMV) should be understood as a loss in the form of a decrease in the mass of goods while maintaining its quality within the limits of the requirements (standards) established by regulatory legal acts, which is a consequence of natural changes in biological and (or) physical -chemical properties of goods.

Accordingly, the rate of natural loss is the permissible amount of irrecoverable losses, which is determined by:

- when storing inventory items - during the storage of the goods by comparing its mass with the mass of the goods actually accepted for storage;

- when transporting goods and materials - by comparing the weight of the goods indicated by the sender (manufacturer) in the accompanying document with the weight of the goods actually accepted by the recipient.

The Methodological Recommendations specifically stipulate that natural loss does not include:

- technological losses;

- losses from marriage;

- losses of inventory and materials during their storage and transportation caused by violation of standards, technical and technological conditions, technical operation rules, damage to packaging, imperfect means of protecting goods from loss and the condition of the technological equipment used.

In addition, the norms for natural loss do not include losses of inventory and materials during repair and (or) prevention of technological equipment used for storage and transportation, during intra-warehouse operations, as well as all types of emergency losses.

Write-off of EU in the absence of losses

Write-off of loss in the absence of losses is not allowed. Such actions may be considered illegal, aimed at illegally reducing taxation.

Natural loss is reflected primarily in tax reports. It is calculated to reduce tax deductions. Widely used not only by enterprises, but also by shops and shopping centers. The standards are determined by the Government of the Russian Federation. They are reviewed every five years. You need to use the indicators that were most recently approved. You need to rely specifically on the norms established by law, and not by the enterprise.

Norms of natural loss during storage of food products and agricultural products

| N | Regulatory document | Scope of application and types of products |

| 1 | Order of Rosrybolovstvo dated July 31, 2009 N 676 | Weight of frozen unglazed fish products (when stored in refrigerators) |

| 2 | Order of the Ministry of Agriculture of Russia dated January 14, 2009 N 3 | Grain, grain processing products (cereals, bran, etc.) and seeds of various crops (by climate zones) |

| 3 | Order of the Ministry of Agriculture of Russia dated June 26, 2008 N 273 | Ethyl alcohol - during purchase, storage, supply, as well as during production and turnover of alcoholic beverages and products wine industry |

| 4 | Order of the Ministry of Agriculture of Russia dated August 16, 2007 N 395 | Meat and meat products, including: - meat and offal, fresh, chilled, frostbitten and frozen; — sausages and smoked meats; — semi-finished products |

| 5 | Order of the Ministry of Agriculture of Russia dated December 12, 2006 N 463 | Ethanol |

| 6 | Order of the Ministry of Agriculture of Russia dated August 28, 2006 N 270 | Products and raw materials of the sugar industry (granulated sugar, lump sugar, sugar- raw, sugar beet) |

| 7 | Order of the Ministry of Agriculture of Russia dated August 28, 2006 N 269 | Rabbit and poultry meat |

| 8 | Order of the Ministry of Agriculture of Russia dated August 28, 2006 N 268 | Table root vegetables (carrots, beets, radish, radish, turnip), potatoes, fruit (tomatoes, cucumbers, peppers, eggplants) and greens (lettuce, dill, parsley, green onions, etc.) vegetables |

| 9 | Order of the Ministry of Agriculture of Russia dated August 28, 2006 N 267 | Cottage cheese and cheeses |

| 10 | Order of the Ministry of Agriculture of Russia dated August 28, 2006 N 266 | Butter packed in monoliths in parchment and plastic liner bags materials |

| 11 | Resolution of the USSR State Supply Committee dated July 29, 1983 N 81 | Sunflower meal and sunflower soap stocks |

| 12 | Resolution of the USSR State Supply Committee dated 04.05.1982 N 39 | Sunflower seeds (when stored in oil and fat enterprises industry), as well as mustard powder and fresh chicory root |

At the same time, according to clause 2 of the Government of the Russian Federation of November 12, 2002 N 814, trade and public catering organizations must be guided by the standards developed and approved by the Ministry of Industry and Trade of Russia.

By order of this department dated 03/01/2013 N 252 “On approval of norms of natural loss of food products in the field of trade and public catering”, the Norms of natural loss for trade and public catering organizations were approved.

Accounting for losses

The presence of approved standards does not mean that you can automatically write off amounts calculated according to the standards as expenses.

It is necessary first to identify the actual shortage or discrepancy between the data of the accompanying documents and the actual availability of the property upon its acceptance - that is, to establish the very fact of losses and determine their total amount.

In accounting, the amounts of identified losses and shortages are debited to account 94 “Shortages and losses from damage to valuables.”

Then the maximum loss value is calculated based on established standards.

Expenses include the lesser of these values.

Nuances

To avoid problems with the tax authorities after writing off identified losses as natural loss of production, you should be guided by current regulations, taking into account the specifics of transportation, storage, and climatic zones.

Facts of shortage must be documented accordingly and confirmed:

- act of discrepancy upon receipt of goods;

- inventory act.

Order a free legal consultation

Storage

If raw materials received by an enterprise are stored for some time in warehouses (refrigerators, freezers) before they are transferred to production, their natural loss may occur.

In addition, loss may occur in relation to released but unsold food products.

The identified shortage is reflected in the debit of account 94 “Shortages and losses from damage to valuables” and the credit of the corresponding account (10 “Materials”, 41 “Goods”, 43 “Finished products”). In the first case (if a loss of raw materials is identified), the loss within the norms will be part of the cost of manufactured products and, accordingly, will be reflected in the cost accounts (25 “General production expenses”, 20 “Main production”).

In the second case (when losses of goods and finished products are identified), the loss within the norms should be reflected in the debit of account 44 “Sales expenses”.

All excess losses are reflected in the debit of account 91-2 “Other expenses”.

Example

A batch of frozen blackcurrants in wooden boxes with a net weight of 1000 kg arrived at the warehouse on August 10 and was sold in December in parts:

- 600 kg - December 14;

- 394 kg - December 21.

The storage time for currants was:

- for the first part of the batch of currants - 4 full months and 5 days of the 5th month;

- for the second part of the batch of currants - 4 full months and 12 days of the 5th month.

Actual losses - 6 kg (1000 - 600 - 394).

With a loss rate for 4 months of storage equal to 0.65%, and for 5 months - 0.77%, natural loss (EU) within the norm will be 6.78 kg (4.02 + 2.76), where:

- 4.02 kg (600 kg x (0.65% + (0.77% - 0.65%): 31 calendar days x 5 calendar days): 100) - EU of the first part of the currant;

- 2.76 kg ((400 kg - 4.02 kg) x (0.65% + ((0.77% - 0.65%) : 31 calendar days x 12 calendar days) : 100)) - EU of the second part of the currant.

As you can see, the actual shortage (6 kg) complies with EU standards and is completely written off as expenses.

Accounting for shortages within the limits of natural loss norms

According to paragraphs 58, 59 of the Guidelines for accounting of inventories, shortages and damage identified during the acceptance of materials received by the organization are taken into account in the following order:

- the amount of shortages and damage within the limits of natural loss norms is determined by multiplying the number of missing and (or) damaged materials by the contractual (sales) price of the supplier. Other amounts, including transportation costs and VAT related to them, are not taken into account. The amount of shortages and damage is written off from the credit of the settlement account in correspondence with the debit of account 94 “Shortages and losses from damage to valuables.” At the same time, missing and (or) damaged materials are written off from account 94 and attributed to transportation and procurement costs (TPC) or to the accounts of deviations in the cost of material inventories (account 16). The amount of VAT in the part that falls on losses within the limits of natural loss norms can be deducted in the general manner (Letters of the Ministry of Finance of Russia dated 08/09/2012 N 03-07-08/244, dated 01/11/2008 N 03-07-11/ 02).

Reasons influencing natural losses

The amount of inventory items may decrease under the influence of various factors.

Let's highlight the most common ones:

| No. | Type of physico-chemical, biological process | Note |

| 1 | Shrinkage, moisture evaporation, volatilization of substances | The standards do not apply to hermetically sealed products. |

| 2 | Shattering or Spraying | Taken into account when taking inventory of bulk fine-grained goods. |

| 3 | crumble | Touches sugar-dusted caramel. May occur when cutting frozen meat or fish. |

| 4 | Leakage, melting, seepage | Absorption into containers, typical for fats, halva and other goods or when packaging containers leak. When the cell juice of frozen meat and fish is lost when the product is defrosted. |

| 5 | Spill | Typical losses when pumping liquids or selling goods for bottling. |

| 6 | The battle | Standardized for products packaged in glass containers, mirrors, and various tableware products. |

Accounting for shortages in excess of natural loss norms

Shortages and damage to materials in excess of natural loss norms are accounted for at actual cost, which includes (clause 58 of the Guidelines for accounting of inventories):

- the cost of missing and damaged materials excluding VAT, for excisable goods - including excise taxes;

- the amount of TZR payable by the buyer, in the share related to missing and damaged materials;

- the amount of VAT relating to the cost of materials and transport costs associated with their acquisition.

Excessive losses must be recovered from the guilty parties, including by filing claims against carriers or applying the provisions of labor legislation on compensation for damage by financially responsible persons.

When this is not possible - for example, if the culprit is not identified or if the organization decides to forgive the culprit - excess losses are written off as a decrease in the financial result in accounting (as part of other expenses, to account 91 “Other income and expenses”) and are not accepted into reduction of the tax base for income tax.

In the event of a claim being made to the carrier, the actual cost of shortages and damage in excess of the norms of natural loss is taken into account in the debit of account 76 “Settlements with various debtors and creditors”, subaccount 76-2 “Settlements for claims”, and is written off from the credit of the settlement account.

Example.

The organization purchased 2000 kg of frozen meat in carcasses at a price of 275 rubles. per kg (including VAT - 25 rubles). Upon acceptance, a shortage of 20 kg was detected. The distance covered by the carrier is 200 km. The organization writes off deviations within the limits of natural loss to account 20 in the month of purchase of raw materials. In respect of shortages exceeding the norms of natural loss, she submits a claim to the carrier.

In accordance with Appendix 3 to Order of the Ministry of Agriculture of Russia N 425, Ministry of Transport of Russia N 138 dated November 21, 2006, the rate of natural loss when transporting frozen meat in carcasses by road over a distance of 200 km is 0.25%. Thus, the rate of natural loss of meat during transportation is 5 kg, which corresponds to 1375 rubles. (including VAT - 125 rubles). Excessive shortage of meat (15 kg) in the amount of 4125 rubles. (including VAT - 375 rubles) is presented to the carrier.

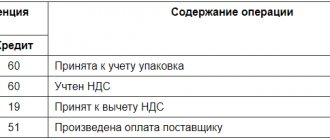

| Contents of operation | Debit | Credit | Sum |

| Meat accepted for registration in actual quantity (1980 kg x 250 rub.) | 10 | 60 | 495 000 |

| The amount of VAT presented by the supplier is reflected (1980 kg x 25 rub.) | 19 | 60 | 49 500 |

| VAT is accepted for deduction | 68-VAT | 19 | 49 500 |

| The shortage of meat is reflected within the limits of natural loss | 94 | 60 | 1250 |

| The amount of VAT is reflected in the part that falls on losses within the limits of natural loss | 19 | 60 | 125 |

| VAT is accepted for deduction | 68-VAT | 19 | 125 |

| The shortage within the limits of natural loss norms is written off to production | 20 | 94 | 1250 |

| A claim was made to the carrier for the amount of missing goods | 76-2 | 60 | 4125 |

When is a loss of goods not a natural loss?

It is excluded from accepting naturally allowable losses when calculating:

- related to production technologies, release of defective products or during repair work;

- during storage and transportation, if standard requirements, technical and technological conditions are not met;

- when the goods are accepted, recalculating the piece quantity;

- if the supplied products are hermetically sealed;

- when used for storing high-pressure tanks;

- when the need for storage services arises during transit transportation.

Value added tax (VAT)

It should be noted that, until 01/01/2015, according to the Ministry of Finance of Russia, in accordance with clause 7 of Art.

171 of the Tax Code of the Russian Federation, in the event of shortages during the storage (transportation) of goods, the organization has the right to deduct “input” VAT from the cost of the lost goods only in that part that accounts for losses within the limits of natural loss established by law (see, for example, Letters Ministry of Finance of Russia dated 08/09/2012 N 03-07-08/244, dated 01/11/2008 N 03-07-11/02, dated 08/15/2006 N 03-03-04/1/628). From 01/01/2015, clause 7 of art. 171 of the Tax Code of the Russian Federation has lost its force.

In this regard, from 01/01/2105, the organization has the right to deduct “input” VAT on the entire cost of the lost goods.

The procedure for calculating natural loss

The calculation of damage is determined on the basis of inventory data, during which the shortage was discovered. The actual volume of products stored in the warehouse is determined using the following operations:

- count;

- weighing;

- taking measurements.

An inventory report must be drawn up in the prescribed manner. The calculation is made for each product name. As a result, a Statement of Discrepancies is compiled, carried out according to form 0504092.

If the calculation is made in relation to food products, it is necessary to offset the shortages with surpluses by mis-grading. If a shortage is found after it, natural loss will only apply to the product whose volume has decreased.

Formula for calculation

The amount of natural loss is found using the following formula:

Y = T x N: 100

The following values appear in the formula:

- U is the size of natural loss;

- T – the amount of transported products or goods that entered the warehouse in another way, for the period of interest;

- N is the loss rate established by the Ministries in relation to a specific product.

You can view the loss rates for the product of interest in the relevant resolution.

Example of calculating natural loss

At the inventory date, the beef had been stored in cold storage for a week. In this case, Appendix No. 32 on natural loss is relevant. It indicates the storage standards for meat in the climatic zone of interest:

- when stored for 3 days – 0.08%;

- when stored for 3 to 10 days, the rate increases by 0.01% for each day.

Therefore, the following calculations must be made:

- From 7 we subtract 3, the result (4) is multiplied by 0.01% to determine the daily increase in the norm;

- The meat was stored in the refrigerator for three days, therefore, 0.08% has already been charged on it. To this value we add the value obtained in previous calculations (0.04%);

- The EU rate will be 0.12%.

ATTENTION! It is required to study not only the Appendix on Standards itself, but also the features indicated after the main text. For example, standards may vary depending on how the meat is stored: with or without plastic film.