Standard deductions as they are

A tax deduction is a certain personal income tax benefit. Before calculating the tax, income is reduced by the amount of tax deductions. Let’s assume that a person’s taxable income is 10,000 rubles. In this case, a person has the right to a tax deduction in the amount of 500 rubles. Tax must be paid on the amount of 9,500 rubles (10,000 – 500).

Only taxpayers whose income is taxed at a rate of 13%, that is, tax residents of the Russian Federation, have the right to tax deductions. Consequently, non-residents do not reduce the amount of their income received.

Standard tax deductions are provided monthly.

Standard deductions can be divided into two groups:

- deductions for the taxpayer;

- deductions for children.

Standard deductions per taxpayer are provided to two categories of employees in the amount of 3,000 and 500 rubles.

Standard deductions for children are not applied until the employee’s income, calculated on an accrual basis from the beginning of the year, does not exceed 350,000 rubles. Starting from the month in which this excess is reached, the deduction for children is not applied. Unlike “children’s” deductions, there is no income limit for “personal” deductions.

If people do not start working for companies from the beginning of the year, then, in order to correctly apply standard tax deductions to their income, the accountant must take into account the income they received at their previous place of work. This is done on the basis of income certificates in form 2-NDFL.

EXAMPLE 1. CALCULATION OF TAX DEDUCTION FOR A NEW EMPLOYEE

In November, the company hired an employee and set his salary at 20,000 rubles. per month. For the period from January to November at his previous place of work, he received 340,000 rubles, which was confirmed by an income certificate. The employee has one child aged 10 years.

When calculating personal income tax for November, a new employee is not entitled to a standard deduction for a child, since in November his total income since the beginning of the year will exceed 350,000 rubles. ((RUB 340,000 + RUB 20,000) > RUB 360,000).

New deduction code

In each 2-NDFL certificate, income and deduction codes must be entered. This is required by paragraph 1 of Art. 230 Tax Code of the Russian Federation. In this matter, tax agents are required to rely on the order of the Russian Tax Service dated September 10, 2015 No. ММВ-7-11/387. Its Appendix No. 1 contains income codes, and Appendix No. 2 contains codes for types of deductions.

In section 3 of the 2-NDFL certificate in 2021, tax deductions are shown opposite the corresponding income. If several deductions are allowed to be applied to one type of income, the first deduction is reflected opposite the income in the columns “Deduction Code” and “Deduction Amount”, the second – in the line below, etc. In this case, the fields “Month”, “Income Code” and “Amount” income" opposite the second and subsequent deductions are not filled in.

Section 4 shows standard, social and property deductions for the purchase (construction) of housing.

Tax authorities periodically review the composition of codes and supplement them with new codes. For 2021, amendments were made by order of the Federal Tax Service dated October 24, 2017 No. ММВ-7-11/820. It was officially published on December 21, 2021. Taking into account this date, the amendments are effective from January 1, 2021. Therefore, deduction codes in 2-NDFL for 2021 must be entered taking into account all changes and new deduction codes.

For deductions from 2021, a new personal income tax code has been introduced - 619. This code must be reflected in the certificate if there is a positive result from transactions on an individual investment account.

Let us remind you that if a person is a tax resident of the Russian Federation and invests in securities, then in order to reduce the amount of personal income tax paid to the budget, you can receive an investment deduction.

An individual investment account is an internal accounting account that is intended for separate accounting of funds and securities of a client - an individual, as well as obligations under agreements concluded at the expense of the specified client. Such an account is opened and maintained by a broker or trustee on the basis of a brokerage service agreement or a securities trust management agreement, No. 39-FZ).

A deduction for transactions on an individual investment account (IIA) can be provided at your option (clauses 2, 3, clause 1, article 219.1 of the Tax Code of the Russian Federation):

- for the amount of funds deposited into the IIS;

- the amount of the positive financial result obtained from transactions accounted for on the IIS.

Deduction of 3000 rubles

The list of those who have the right to a deduction in the amount of 3,000 rubles per month is given in subparagraph 1 of paragraph 1 of Article 218 of the Tax Code of the Russian Federation. This deduction is, in particular, provided to employees who:

- suffered at nuclear facilities as a result of radiation accidents and nuclear weapons tests (for example, at the Chernobyl nuclear power plant, at the Shelter facility, at the Mayak production association);

- are disabled during the Great Patriotic War;

- became disabled people of groups I, II and III due to injury, concussion or injury received during the defense of the Soviet Union or the Russian Federation.

EXAMPLE 2. CALCULATION OF TAX DEDUCTION FOR A PARTICIPANT IN THE LIQUIDATION OF THE Chernobyl ACCIDENT

An employee of a Russian company, Ivanov (tax resident), participated in the liquidation of the accident at the Chernobyl nuclear power plant. He has the appropriate ID. Therefore, Ivanov is entitled to a standard tax deduction in the amount of 3,000 rubles. for each calendar month.

Ivanov’s monthly salary is 10,000 rubles.

The employee's monthly income subject to personal income tax will be:

10,000 rub. – 3000 rub. = 7000 rub.

For the year, Ivanov can be provided with a tax deduction in the amount of:

3000 rub. × 12 months = 36,000 rub.

What is a property deduction?

Property deduction is the main and most significant tax benefit when purchasing or constructing housing. What is it and how can it be beneficial? Let’s try to figure it out together. In the dry language of the Tax Code a property deduction

is a reduction in the income tax base on an employee’s income by the amount of expenses incurred by him and (or) members of his family related to the purchase or construction of housing in Belarus (Part 1, Sub-Clause 1.1, Article 211 of the Tax Code )

In simple words, property deduction

– This is an opportunity provided to the employee to save on income tax.

Currently in Belarus the income tax rate is 13%, which is withheld from wages.

The property deduction can reduce or even eliminate the need for an employee to pay income taxes for months or even years, depending on the amount of expenses incurred.

The following expenses related to the purchase or construction of housing in Belarus may benefit from income tax:

- • to purchase;

- • for construction, reconstruction;

- • to repay loans from Belarusian banks, including interest on them;

- • to repay loans received from Belarusian organizations or individual entrepreneurs, including interest on them.

Deduction of 500 rubles

The list of those who have the right to a deduction in the amount of 500 rubles per month is given in subparagraph 2 of paragraph 1 of Article 218 of the Tax Code.

This deduction is, in particular, provided to employees who:

- are Heroes of the Soviet Union or Russia;

- awarded Orders of Glory of three degrees;

- have been disabled since childhood;

- became disabled people of groups I and II;

- were participants in the Great Patriotic War and partisans, and were also in besieged Leningrad, regardless of the length of stay;

- were prisoners of concentration camps and ghettos during the Second World War;

- took part in the work to eliminate the consequences of the accident at the Mayak production association;

- were evacuated from areas exposed to radioactive contamination as a result of the accident at the Mayak production association and the disaster at the Chernobyl nuclear power plant;

- are donors who donated bone marrow;

- are the parents or spouses of those killed due to wounds received while defending the Soviet Union or Russia;

- are internationalist warriors;

- took part in hostilities on the territory of the Russian Federation. These are participants in both Chechen campaigns - from 1994 to 1996 and from 1999 to the present (annex to the Federal Law of January 12, 1995 No. 5-FZ “On Veterans”). They received an increased standard deduction instead of a deduction of 400 rubles from January 1, 2007 (Federal Law of July 18, 2006 No. 119-FZ);

- suffered in atomic and nuclear disasters, but are not entitled to the standard tax deduction in the amount of 3,000 rubles.

EXAMPLE 3. CALCULATION OF TAX DEDUCTION FOR A HERO OF RUSSIA

An employee of a Russian company, Petrov (tax resident), is a Hero of the Russian Federation. He is entitled to a standard tax deduction of 500 rubles. for each calendar month. Petrov’s monthly salary is 12,000 rubles.

Petrov's monthly taxable income will be:

12,000 rub. – 500 rub. = 11,500 rub.

For the year, Petrov can be provided with a tax deduction in the amount of:

500 rub. × 12 months = 6000 rub.

Where to apply for a deduction?

The property deduction is provided to the employee by any employer who pays him income. Previously (before 01/01/19), these deductions could only be provided at the main place of work. In this case, the deduction can be applied not only to wages, but also to other income, for example:

- • taking into account internal part-time work;

- • work under a contract;

- • dividends;

- • financial assistance, etc.

If an employee quits before the property deduction is fully used, he has the right to use the remaining part of the benefit provided at subsequent places of work.

Deductions for children

All employees who have children or are guardians, trustees, foster parents, as well as spouses of the listed categories of employees are provided with a tax deduction in the following amounts:

- 1400 rubles for the first child;

- 1400 rubles for the second child;

- 3000 rubles for the third and each subsequent child;

- 12,000 rubles for each disabled child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student under the age of 24, if he is a disabled person of group I or II.

The deduction is provided for each child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student under the age of 24, if he is a disabled person of group I or II.

When determining the amount of the “children’s” deduction, the total number of children must be taken into account. That is, the first child is the oldest child, regardless of whether a deduction is provided for him or not.

The “children’s” deduction is valid until the employee’s income, calculated on an accrual basis from the beginning of the year, does not exceed 350,000 rubles. Starting from the month in which income exceeded 350,000 rubles, the tax deduction is not applied.

EXAMPLE 4. CALCULATION OF TAX CREDIT FOR CHILDREN

An employee of the Russian company Yakovlev (tax resident) is not entitled to standard tax deductions in the amount of 3,000 or 500 rubles.

Yakovlev has two children aged four and eight years. Therefore, he must be provided with a deduction of 1,400 rubles. for each child. Yakovlev’s monthly salary is 30,000 rubles.

The total amount of monthly tax deductions to which Yakovlev is entitled will be 2,800 rubles. (RUB 1,400 × 2).

In January–November, Yakovlev will pay monthly tax on 27,200 rubles. (30,000 – 2800).

In December, Yakovlev’s income will exceed 350,000 rubles. ((RUB 30,000 × 12 months) > RUB 350,000). From this month, he will not be provided with “children’s” deductions. And the amount that is taxed will be 30,000 rubles.

The “children’s” deduction applies:

- from the month of birth of the child;

- from the month in which guardianship (trusteeship) was established;

- from the month of entry into force of the agreement on the transfer of the child to be raised in a family.

The deduction remains valid until the end of the year in which:

- the child will reach the specified age;

- the agreement on the transfer of the child to be raised in a family expires or it is terminated early;

- the death of the child occurred.

The guardian, trustee, adoptive parent, spouse of the adoptive parent, who is providing for the child, is provided with a deduction in the following amounts:

- 1400 rubles for the first child;

- 1400 rubles for the second child;

- 3000 rubles for the third and each subsequent child;

- 6,000 rubles for each disabled child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student under the age of 24, if he is a disabled person of group I or II.

The only parent who is caring for a disabled child is entitled to a standard “children’s” deduction for personal income tax in double the amount, namely, in the amount of 24,000 rubles for each month of the tax period. Such clarifications are contained in the letter of the Ministry of Finance of Russia dated February 2, 2021 No. 03-04-05/4973.

What to do if you have the right to a benefit, but several years have passed since the purchase?

Receiving a property tax deduction is the right of an employee. And you can use this right not only from the moment of purchase or construction of housing, but also later.

If you did not know about the possibility of obtaining a deduction or lost time collecting supporting documents, this does not mean that the right is lost. Let's figure out what to do in this case.

Firstly, the employee has the right to apply for a deduction for expenses incurred no earlier than 2006. Those. your right to a property deduction applies to housing purchased or built starting from 2006 (provided that at the time of purchase or construction you were registered as needing improved housing conditions).

Secondly, the deduction can only be applied to income received in no more than three previous years.

Based on the results of the recalculation of income taxes for previous years, the employer must return the excess tax withheld to you or offset it against future payments.

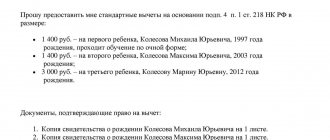

How to file deductions

Paragraph 3 of Article 218 of the Tax Code of the Russian Federation states that standard tax deductions are provided to an individual by a tax agent on the basis of a written application and documents confirming the right to such deductions. A written statement from the employee is a necessary condition for granting a deduction.

This is confirmed by arbitration courts (decrees of the FAS of the East Siberian District dated May 26, 2005 No. A69-1778/04-7-F02-2368/05-S1, decisions of the North Caucasus District dated June 21, 2005 No. F08-2649/ 2005-1065A).

Accountants often ask: is it necessary to write applications for standard tax deductions annually?

Financiers believe that it is enough to write an application once. They justify their opinion by the fact that the Tax Code does not establish the obligation to submit an application annually (letter of the Ministry of Finance of Russia dated April 27, 2006 No. 03-05-01-04/105).

A new employee who has not joined the company since the beginning of the year must submit a certificate of income from his previous place of work (Form No. 2-NDFL). A newcomer who has worked in several places this year needs certificates from each of them. These certificates contain all the necessary information about income, deductions, and the amount of tax.

If at a previous job an employee received deductions and his income was less than the maximum level, deductions can be applied further at a new place of work. But if an employee worked but did not receive deductions, then the amount of income from the previous job does not matter.

The deduction can be provided as long as the employee’s earnings in the company do not exceed the established limit.

To receive a deduction for children under 18 years of age, an employee must:

- write an application to the accounting department;

- provide a copy of the child’s birth certificate;

- provide a copy of adoption or guardianship documents.

For adult full-time students of universities (including graduate schools), technical schools, and military schools, an additional certificate from these institutions must be submitted. This certificate must be updated annually.

What are the grounds for receiving benefits?

as in need of improved housing conditions

and are registered accordingly can take advantage of tax benefits when purchasing or constructing housing

Next in line may be:

1) provided with a total living area of less than 15 square meters (in the city of Minsk - less than 10 square meters)

for one person;

2) living in residential premises recognized as not meeting the sanitary and technical requirements established for living;

3) living in dormitories;

4) living in residential premises under a rental agreement;

5) living in official residential premises;

6) belonging to young families, married for the first time (both spouses), if none of them owns an apartment or a single-apartment residential building.

The list is far from complete; the remaining grounds and features of the interpretation of each point can be found in Art. 35 of the Housing Code of the Republic of Belarus.

If you see your situation in the list and want to take advantage of income tax benefits in the future, you need to register as those in need of improved housing conditions. And this must be done before concluding an agreement for the purchase or construction of housing, as well as before concluding a loan agreement, if you plan to pay off part of the expenses with the help of loan funds. Registration of citizens in need of improved housing conditions is carried out by local executive and administrative bodies at their place of residence. From the day you submit an application with attached documents to the One Window service, you become in need and receive the right to a property deduction.

It doesn’t matter on what grounds you were registered as needy: you live in a dormitory or you only lacked 1.5 meters of space per person - a property deduction is provided for the entire cost of the housing purchased or under construction, and not just for the meters missing to the norm .

What to do if you have the right to a benefit, but there is no place to work?

The property deduction is provided to the employee by the employer, and if you do not have income subject to income tax, then you have no reason to apply the deduction.

The very fact of your purchase or construction of housing is not grounds for compensation of your expenses, even despite the presence of all the necessary documents confirming your right to benefits.

Therefore, if you are not currently working and have not received taxable income over the past three years, then your right to the deduction remains, but the possibility of application is postponed.

At the same time, it is worth carefully collecting all documents related to the purchase or construction of an apartment (house), as well as all receipts for payment of bank loans or loans, so that from the moment you (or your family members) become employed or receive other income, you were fully armed and took full advantage of your right.