Inspectors do not use the average data for Russia in practice. We need to focus on regional indicators. They will be the ones who will be looking at your declaration for the 2nd quarter of 2018.

Look at the safe share of VAT deductions for the 1st quarter of 2018

We present the safe share of deductions by region of Russia. The calculation was carried out on the basis of form 1-VAT from the website of the Federal Tax Service.

If the company’s data is higher than the data for the region, tax authorities will be interested in the organization. Demands for clarification, commissions, and even the appointment of on-site inspections are possible. Previously, tax officials openly stated this in a letter from the Federal Tax Service of Russia dated July 17, 2013 No. AS-4-2/12722. But it was canceled (letter of the Russian Ministry of Finance dated March 21, 2021 No. ED-4-15/5183). But experts say that there will be no more tax commissions in the form we are familiar with; only commissions will remain to legalize the tax base for the payment of wages and insurance premiums. Their tasks and methods of work are fixed in the letter of the Federal Tax Service dated July 25, 2017 No. ED-4-15/ [email protected]

sample explanations about the share of VAT deductions.

Safe VAT deduction

It is worth noting that the wording “safe VAT” is not included in the Tax Code of the Russian Federation, and the amount of tax depends on a list of factors: type of activity, markups used, seasonality, etc. The safe share of deductions is usually understood as a threshold, the value of which is not established by law, but exceeding which will attract the attention of the tax service to the company.

There are two values that the Federal Tax Service of Russia is guided by (Order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06/ [email protected] ):

- The VAT deduction for four quarters should not exceed 89% of the amount of tax accrued for this period.

- The VAT deduction should not exceed the average share of VAT deductions. Data on the “average share” in each region of Russia is determined by calculation from the 1-VAT report, which the Federal Tax Service publishes every quarter on its website.

Important! Compliance with a safe share of VAT deductions in 2021 does not guarantee that the company will not be included in the tax service’s on-site audit plan. A “safe” deduction is an important criterion for tax risks, but not the only one.

What to do if the share of VAT deductions is greater than the regional value?

Prepare explanations to the tax authorities: for example, the company was founded recently, so it has a large volume of purchases, but so far few sales. Explanations must be sent to the tax office electronically, however, companies that do not have to report online can send documents in paper form. And be prepared for an on-site inspection, because if the share of VAT deductions is higher than indicated in the table for the region, this means that the risk of incurring an inspection increases. Specialists will check the documents and make a decision - is everything really fair or do you need to charge additional taxes and pay a fine for non-payment.

How is a safe size determined?

To understand whether your company falls into the safe area for VAT deductions, calculate the percentage of VAT deductions in the total amount of VAT charged. To do this, you will need two parameters, which can be found in section 3 of the VAT return:

- Calculated VAT.

- VAT deductible.

The formula for determining a safe VAT deduction in 2021 looks like this:

The result obtained using this formula represents the share of VAT that the company accepted for deduction for the tax period, that is, the quarter.

Example.

Radius LLC is registered in the Rostov region. The amount of VAT accrued by the company for the 4th quarter of 2021 was RUB 1,515,820, and the amount of deductions for the same period was RUB 941,569. The share of deductions of Radius LLC will be:

Thus, the share of VAT deductions in the company is 62.12%.

To assess the risk associated with exceeding the threshold value for a tax deduction, the resulting share must be compared with the safe share of VAT deductions in the region of registration of the company - the Rostov region.

Safe share of VAT deductions in Russian regions (in%, for the 2nd quarter of 2021)

| Region | Share of deductions, % | Region | Share of deductions, % |

| Altai region | 89,6% | Primorsky Krai | 94,8% |

| Amur region | 116,8% | Pskov region | 89% |

| Arhangelsk region | 88,5% | Republic of Adygea | 86,5% |

| Astrakhan region | 58,3% | Altai Republic | 90,4% |

| Belgorod region | 89,4% | Republic of Bashkortostan | 87,7% |

| Bryansk region | 92,3% | The Republic of Buryatia | 85,3% |

| Vladimir region | 84,6% | The Republic of Dagestan | 87,2% |

| Volgograd region | 87% | The Republic of Ingushetia | 94% |

| Vologda Region | 83,8% | Republic of Kalmykia | 78,8% |

| Voronezh region | 92,3% | Republic of Karelia | 84,2% |

| Moscow city | 88% | Komi Republic | 79,3% |

| City of Saint Petersburg | 90,2% | Republic of Crimea | 88,2% |

| City of Sevastopol | 82,4% | Mari El Republic | 90,4% |

| Jewish Autonomous Region | 87% | The Republic of Mordovia | 89,6% |

| Transbaikal region | 90,9% | Republic of North Ossetia-Alania | 88,2% |

| Ivanovo region | 92,6% | Republic of Tatarstan | 88,4% |

| Irkutsk region | 79,3% | Tyva Republic | 74,4% |

| Kabardino-Balkarian Republic | 94% | The Republic of Khakassia | 89,9% |

| Kaliningrad region | 65,8% | The Republic of Sakha (Yakutia) | 85% |

| Kaluga region | 86,6% | Rostov region | 92,1% |

| Kamchatka Krai | 88,9% | Ryazan Oblast | 85,2% |

| Karachay-Cherkess Republic | 93,7% | Samara Region | 84,6% |

| Kemerovo region | 81,7% | Saratov region | 85,5% |

| Kirov region | 84,9% | Sakhalin region | 93,2% |

| Kostroma region | 84,1% | Sverdlovsk region | 86,6% |

| Krasnodar region | 89,5% | Smolensk region | 91,9% |

| Krasnoyarsk region | 76,1% | Stavropol region | 88,9% |

| Kurgan region | 87,5% | Tambov Region | 95,2% |

| Kursk region | 88,3% | Tver region | 88,6% |

| Leningrad region | 86,3% | Tomsk region | 74,3% |

| Lipetsk region | 88,9% | Tula region | 91,6% |

| Magadan Region | 99,9% | Tyumen region | 83,8% |

| Moscow region | 90,6% | Udmurt republic | 80,1% |

| Murmansk region | 78,5% | Ulyanovsk region | 91,1% |

| Nenets Autonomous Okrug | 116% | Khabarovsk region | 88% |

| Nizhny Novgorod Region | 87,4% | Khanty-Mansiysk Autonomous Okrug - Ugra | 61,9% |

| Novgorod region | 87,4% | Chelyabinsk region | 87,5% |

| Novosibirsk region | 89,1% | Chechen Republic | 103,3% |

| Omsk region | 82% | Chuvash Republic | 83,2% |

| Orenburg region | 71,4% | Chukotka Autonomous Okrug | 95,8% |

| Oryol Region | 92,9% | Yamalo-Nenets Autonomous Okrug | 97,6% |

| Penza region | 90,1% | Yaroslavl region | 85,8% |

| Perm region | 79,3% |

We calculate the share of deductions

In different regions, indicators can be either higher or lower than 89%. Let us calculate, for example, the indicator of the safe share of deductions in the Vladimir region. It is 85.55% (138,633,101: 162,037,843). As you can see, it turned out to be lower than the federal figure (85.55% < 89%).

You will also need an indicator for the company. To determine it, you need to make calculations based on declarations for the last four quarters: add up the amount of accrued VAT, add up the amount of deductions, divide the total amount of deductions by the total amount of accrued VAT.

This way you will determine the share of deductions in the total amount of calculated VAT for four quarters. It needs to be compared with the share of deductions established by the Federal Tax Service of the Russian Federation, as well as with the indicator for your region.

Blog

During the reporting period, everyone with bated breath summarizes report data and analyzes the tax burden in the organization.

Each taxpayer must assess the likelihood of including an organization in the plan of on-site tax audits (TAP). For this purpose, the Federal Tax Service published 12 GNP criteria.

One of the criteria is the low tax burden of VAT (value added tax).

If an organization reflects a significant share of tax deductions in its declaration, this will attract the attention of tax department specialists, and as a result, it may become one of the grounds for conducting an IRR.

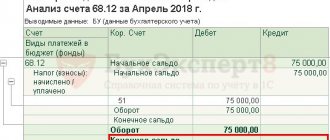

For the reporting period (quarter), the taxpayer must submit a VAT return to the Federal Tax Service. If the amount of VAT subject to deduction to the amount of calculated tax from the tax base amounted to the established percentage for the region (in Krasnoyarsk 77.5% for the 3rd quarter) or more, then the tax burden for VAT is considered low.

A VAT tax deduction is the amount of input VAT tax by which the taxpayer has the right to reduce the amount of VAT payable. In order to receive a tax deduction for VAT, it is necessary that the acquired assets (services) are used in transactions with VAT, inventory items are accepted for accounting, and VAT is confirmed by an invoice issued in accordance with Regulation 1137.

Related course

Accounting and tax accounting for beginners + 1C: Accounting 8.3

Find out more

To correctly determine the share of deductions you need to:

- Add up accrued VAT

- VAT deductible add up

- Divide the amount of VAT to be deducted by the amount of VAT to be paid.

Next, you need to compare the percentage with the table of regional indicators on the tax authority website.

The indicator of low tax burden is not evidence of tax evasion. Of course, the tax authority will not be able to assess additional taxes or fines based on arithmetic calculations.

/ “Accounting encyclopedia “Profirosta” 09.10.17

Information on the page is searched for by the following queries: Accountant courses in Krasnoyarsk, Accounting courses in Krasnoyarsk, Accountant courses for beginners, 1C: Accounting courses, Distance learning, Accountant training, Training courses Salaries and personnel, Advanced training for accountants, Accounting for beginners Accounting services, VAT declaration, Profit declaration, Accounting, Tax reporting, Accounting services Krasnoyarsk, Internal audit, OSN reporting, Statistics reporting, Pension Fund reporting, Accounting services, Outsourcing, UTII reporting, Bookkeeping, Accounting support, Provision of accounting services services, Assistance to an accountant, Reporting via the Internet, Drawing up declarations, Need an accountant, Accounting policy, Registration of individual entrepreneurs and LLCs, Individual entrepreneur taxes, 3-NDFL, Accounting organization

VAT in 2021: what's new

The Federal Tax Service of the Russian Federation commented on the changes in the procedure for calculating and paying VAT in 2021 - 2021, provided for by federal laws of November 27, 2017 No. 335-FZ and No. 350-FZ - both positive and negative for taxpayers.

Law No. 335-FZ

Federal Law No. 335-FZ of November 27, 2017, from January 1, 2018, places the responsibility of VAT tax agents on buyers of certain types of goods. We are talking about implementation on the territory of the Russian Federation:

- scrap and waste of ferrous and non-ferrous metals;

- secondary aluminum and its alloys;

- raw animal skins.

The VAT tax base for such transactions is determined by tax agents, that is, organizations and entrepreneurs who purchase this property. They also pay tax to the budget at the calculated rate and can take it as a deduction, and also submit VAT returns in electronic form using the TKS. If the acquired property is used for VAT-free transactions, the tax will have to be restored (clause 8 of Article 161, clause 4 of Article 164, clause 15 of Article 167, clauses 1, 2 of Article 169, subclauses 3, 4 clause 3 of article 170, clause 3, 12 of article 171, clause 4.1 of article 173, clause 5 of article 174 of the Tax Code of the Russian Federation).

And sellers of raw animal skins, as well as scrap and waste of ferrous and non-ferrous metals, secondary aluminum and its alloys are required to pay VAT if the buyers are individuals, as well as in the cases specified in paragraphs 7 and 8 of clause 8 of Article 161 of the Tax Code of the Russian Federation ( clause 3.1 of article 166, clause 1 of article 168 of the Tax Code of the Russian Federation).

From 01/01/2019, the procedure for VAT taxation of services provided by foreign organizations in electronic form will be clarified.

Such services are taxed only if the place of their provision is recognized as the territory of the Russian Federation. From 2021, it will be necessary to confirm the place of provision of services in electronic form using special registers of transactions (clause 5 of Article 148 of the Tax Code of the Russian Federation).

Foreign organizations registered with Russian tax inspectorates will have to pay VAT on the provision of electronic services to Russian organizations and entrepreneurs independently (clauses 2 - 4 of Article 174.2 of the Tax Code of the Russian Federation). After this, they will be able to claim a VAT deduction - if they have an agreement, a settlement document highlighting the amount of VAT and indicating the TIN and KPP of the foreign organization, as well as documents for the transfer of payment to the foreign organization, including VAT. Information about such foreign organizations will be posted on the official website of the Federal Tax Service of Russia (clause 2.1 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation).

Law No. 350-FZ

Federal Law No. 350-FZ dated November 27, 2017 established a zero VAT rate for transactions involving the sale of goods from January 1, 2018:

- exported under the customs procedure of re-export and previously placed under the customs procedure of processing in the customs territory, free customs zone, free warehouse;

- received (formed) as a result of processing of goods placed under the customs procedure of processing in the customs territory, free customs zone, free warehouse.

Also, from 01/01/2018, a zero VAT rate was established for services for the provision of railway rolling stock, containers for international transport and transportation of goods through the territory of the Russian Federation from the territory of a state that is not a member of the Customs Union, as well as the provision of forwarding services for international transport, if railway wagons and containers do not belong to a Russian organization or entrepreneur on the basis of ownership or lease (subclauses 2.1, 2.7, 3.1, clause 1, article 164 of the Tax Code of the Russian Federation).

Where to find data on the share of deductions by region

Don’t forget that in addition to the federal figure, you need to know the share of VAT deductions at the regional level. This indicator is not published, but it can be calculated based on other publicly available data.

The official website of the Federal Tax Service in the “Statistics and Analytics” section contains data on statistical tax reporting forms, including reports on the tax base and the structure of VAT charges.

These are statistical reports in form 1-VAT. In such a report, generated by region, there is data on the total VAT charges and the total share of deductions for the region you need (columns 110.1 and 210.1, respectively). The safe share of deductions for a region can be calculated by finding the percentage ratio of the amount of deductions to the amount of accruals.

note

The Federal Tax Service updates statistical data on its website, so they need to be checked periodically. Thus, statistical data as of November 1, 2021 have now been published.