Safe deduction share

The safe share is the difference between the amount of tax payable and the VAT deduction.

The main problem for the taxpayer is that the safe share is not established by law. You can claim for deduction an amount even greater than VAT, but in this case the tax office can:

- send a request for explanations and documents;

- call to the commission;

- include in the on-site inspection plan.

There is no need to be afraid of this. But be prepared to stand up for your rights.

Important! The tax office's attention is not focused only on VAT. Inspectors also look at the tax burden, wage levels, profitability, and so on. It is then compared to industry or regional averages. Any deviation will pique their interest.

Calculation rules

The question arises: how to calculate the share of VAT deductions that is safe for a particular company? For calculations, you must refer to the value added tax return. Let us remind you that it is rented quarterly. For calculations, we need two numbers from section 3 of the report:

- line 118: total tax amount calculated taking into account the restored tax amounts;

- line 190: total tax amount to be deducted.

There is a special formula for calculating the safe share of VAT deductions, which looks like this:

The resulting value must be compared with the standard indicator and with the average value for the region. We'll tell you how to recognize it further. Let us remind you that tax authorities analyze the value of the indicator not for one quarter, but for at least 12 months.

ConsultantPlus experts have prepared a ready-made solution for the safe share of the deduction. Use it for free to avoid breaking the law.

Methods for calculating the safe percentage of VAT deductions

The safe percentage of deductions is calculated in two ways. You need to choose the method that your tax office uses. You can find out by personally contacting the Federal Tax Service.

Threshold share 89%

When constructing a plan for on-site tax audits, inspectors use Order of the Federal Tax Service of the Russian Federation dated May 30, 2007 No. MM-3-06/ [email protected] Paragraph 3 of Appendix No. 2 states that one of the criteria for inspection is the share of VAT deductions, which is equal to either exceeds 89% of the accrued tax for 12 months.

Calculate your share using the formula:

Share of deductions = Deductions for the year / VAT accrued for the year * 100,

where deductions for the year are the amount from line 190 of Section 3 of the VAT Return; accrued VAT is the value in line 118 of Section 3 of the VAT Return.

VAT payers with a 0% rate take amounts from sections 4 - 6 of the declaration.

Compare the obtained value with the threshold value of 89%. If the percentage is less, the deductions will not attract serious attention. If the value is 80% or higher, be prepared for audits or document requests.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Average share of deductions by region

The Federal Tax Service looks at the average share of deductions in the region, which is often less than or more than 89%. The method was established by Letter of the Federal Tax Service dated July 25, 2021 No. ED-4-15 / [email protected] In fact, it was canceled, but in practice the tax authorities continue to adhere to it.

To calculate, we use the formula from the first method:

Share of deductions = Deductions for the year / VAT accrued for the year * 100,

where deductions for the year are the amount from line 190 of Section 3 of the VAT Return; accrued VAT is the value in line 118 of Section 3 of the VAT Return.

VAT payers with a 0% rate take amounts from sections 4 - 6 of the Declaration.

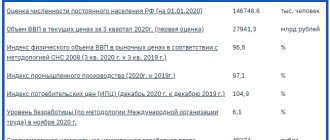

Compare the resulting value with the regional one on the Federal Tax Service website. Then use the statistical report 1-VAT. It contains data from submitted VAT returns from taxpayers. The tax office forms it separately for each region as of February 1, May 1, August 1 and November 1. To calculate the average share of deductions in the region, use the formula:

Share of deductions = Deductions for the year / VAT accrued for the year * 100,

where deductions for the year - take the value from column 2 of line 2100 of the 1-VAT report; accrued VAT - take the value from column 2 of line 1100 of the 1-VAT report.

If in doubt, check the tax calculation procedure.

Next, compare your share with the regional average. If your value is less, there should be no problem. If more, get ready to request documents and start inspections.

Now the data from 1-VAT reports has slipped a little due to postponements of reporting deadlines. To calculate the average share for the region in the second quarter, use 1-VAT as of June 1, since there is no report for May 1 in 2021.

If 1-VAT has not been issued by the time you submit your declaration, you can:

- use the 1-VAT report for the last available quarter for comparison;

- use the 1-VAT report for the same quarter last year for comparison;

- do not compare with the regional share, but take the 89% rule as a basis.

How is a safe size determined?

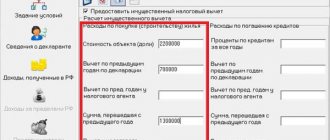

To understand whether your company falls into the safe area for VAT deductions, calculate the percentage of VAT deductions in the total amount of VAT charged. To do this, you will need two parameters, which can be found in section 3 of the VAT return:

- Calculated VAT.

- VAT deductible.

The formula for determining a safe VAT deduction in 2021 looks like this:

The result obtained using this formula represents the share of VAT that the company accepted for deduction for the tax period, that is, the quarter.

Example.

Radius LLC is registered in the Rostov region. The amount of VAT accrued by the company for the 4th quarter of 2021 was RUB 1,515,820, and the amount of deductions for the same period was RUB 941,569. The share of deductions of Radius LLC will be:

Thus, the share of VAT deductions in the company is 62.12%.

To assess the risk associated with exceeding the threshold value for a tax deduction, the resulting share must be compared with the safe share of VAT deductions in the region of registration of the company - the Rostov region.

Actions if the safe share is exceeded

If, after submitting the declaration, you consider that the share of deductions exceeds the regional average or 89%, then there are two options for action:

Submit an updated declaration

The taxpayer always has the right to submit an amended return. In it, declare for deduction an amount less than in the primary report. Most deductions can be claimed within 3 years without any problems.

Important! Make sure your deductions are transferrable.

What to do if the deduction amount is higher than the recommended standards?

If there is a lot of input VAT and it exceeds the recommended values, 2 options are possible:

- Leave your actual data and wait for a call to the commission;

- Transfer part of the deductions to later periods.

In the first case, an explanatory letter may be attached to the declaration indicating the reasons for exceeding the permissible percentage of the deduction share.

If the organization has chosen method 2, then deductions can be transferred to later tax periods, but no more than 3 years from the date of capitalization of inventory items. Taxpayers have this right since January 1, 2015, and it is regulated by paragraph 1.1 of Art. 172 of the Tax Code of the Russian Federation. The tax is claimed for deduction in the tax period when the company decided to actually declare it. In this case, the incoming invoice is recorded in the purchase book for this particular quarter.

However, there are exceptions to this rule. The tax must be deducted at one time if:

- subsequent sale of assets is taxed at a rate of 0% (Letter of the Federal Tax Service of Russia dated April 13, 2016 N SD-4-3/ [email protected] );

- fixed assets, equipment for installation or intangible assets are purchased (Letter of the Ministry of Finance of Russia dated 04/09/2015 N 03-07-11/20293);

- advances have been paid to suppliers or invoices have been received from tax agents (Letter of the Ministry of Finance of the Russian Federation dated 04/09/2015 N 03-07-11/20290). ⊕ Accounting for VAT on advances received in 2021

Let's look at an example.

How to correctly draw up explanations when the amount of VAT deductions has been exceeded?

On the Internet you can easily find an answer to the tax authority’s demand for an explanation of the high share of VAT deductions. However, the time spent searching for a template can be saved, since such a response does not require strict adherence to the form: it can be compiled in free form. As part of this article, we will provide an approximate plan for writing a response, which will give an idea of how to give an explanation to the Federal Tax Service in connection with the excess of the specific weight of the tax deduction.

So, in a written response to a request for clarification, you must indicate which specific requirement you are responding to. Next, you must inform that you analyzed the documents confirming the size of the tax base and deductions. If any inaccuracies are identified, write about them. If there were none, report that no such were identified. Next, write about whether you consider it necessary to submit an updated VAT return to the Federal Tax Service:

- Errors are identified - there are reasons, support them with an adjusted declaration;

- No shortcomings were identified - no reason.

Next, describe the situation that served to increase this indicator with references to supporting documents and legislative acts.

At the end, you say that you consider yourself a law-abiding taxpayer.

Reason 1. The company has just recently been registered

Organizations whose business is just starting do not have a sufficient market, but a “young” company has plenty of expenses. For example, invoices for office and warehouse rent, advance payment for electricity, Internet connection, telephone connection, purchase of goods to a warehouse for subsequent resale, etc. In this situation, the organization has a lot of expenses, but sales have not yet been established and do not generate enough income to cover expenses. In the explanations for the inspector, we indicate the reason for the increase in the indicator: “Due to the start of business activities, the company’s costs exceed its income. To organize the work of the office and warehouse, the necessary equipment and furniture were purchased, and the services of companies providing communication services were paid for. Advance payments have been made to connect the company to electricity and heating. Products have been delivered to the warehouse, the sale of which is planned for the next quarter.” As an appendix, we provide constituent documentation confirming the date of registration of the company, as well as all primary documents confirming the listed costs: invoices, accounting cards, contracts, invoices, acts for the provision of services, etc.

Reason 2. Replenishment of goods for subsequent resale

For example, the head of an organization issued an order to stock the warehouse with products that will become more expensive in the next quarter, so buying goods in advance means acquiring additional profit from the difference in price. As a result, the warehouse will be replenished with goods, and a high proportion of deductions will be reflected in tax accounting. In the explanations we indicate: “replenishment of the warehouse with goods for subsequent sale in a future period.” We attach documents confirming the accuracy of the information provided: accounting cards confirming the receipt and balance of goods in the warehouse, a copy of the agreement for the purchase of products, invoices.

Reason 3. Seasonality of business

Sales volumes of some types of goods depend on seasonality, for example, products for winter fishing or lawn mowers. Sales of such goods practically cease outside the season for which they are intended for use. However, costs, for example, for storage and warehouse maintenance, remain. Therefore, the deductions are high. In the explanations we indicate: “seasonality of the product.” We attach documents confirming the availability of expenses and balances in the warehouse.

Reason 4. Late receipt of invoices from counterparties

An invoice can be accepted for deduction only upon receipt of it from the counterparty. Upon receipt of the original invoice, the organization records its receipt by mail in a special journal. But, unfortunately, the post office is not always impeccable in the quality of the services provided, and correspondence is “delayed” and sometimes completely lost. It is not surprising that invoices are received by the accounting departments of organizations with a delay. As a result, we accept some invoices for deduction in the tax period following their issue. The law provides for the possibility of submitting an invoice at a later date; it is enough to attach an explanation justifying such actions on your part. In the explanations we indicate: “acceptance for deduction of invoices issued in the previous tax period due to a delay in the receipt of the specified documentation by the organization.” We attach documents confirming the accuracy of the information provided: an extract from the invoice register, a copy of the invoice itself, an extract from the purchase book about the absence of the specified invoices in the previous tax period.

Reason 5. Small trade margin (during resale) or small added value (during production)

The market sets the price level above which the organization cannot set the price of the goods it sells. Therefore, in order to maintain their position in the market, some companies set minimum markups and surcharges on products. During production, a situation may additionally arise when raw materials for production are purchased at a VAT rate of 10%, and sales at 18%. In the explanations we indicate: “a small trade margin in order to maintain the competitiveness of the organization.” We attach documentation confirming the accuracy of the information provided: copies of contracts for the purchase of goods or raw materials, invoices for the purchase and shipment of products. Of course, these are just some of the reasons that will be accepted by the inspector as an explanation to the tax office about the high share of VAT deductions (sample: reason 1).

Factors affecting the amount of VAT payable

The amount of VAT accrued for payment to the budget and reflected on line 040 of section 1 of the VAT declaration appears in this line if, as a result of arithmetic operations with the total VAT amounts formed in sections 3, 4, 5, 6 of the declaration, the final amount of these operations reflects the obligation to pay into the budget, and not to reimburse from it.

At the same time, VAT included in sections 4, 5, 6 of the declaration is associated with sales operations at a rate of 0%, and in the final amount of each section most often represents the amount of tax refundable. The final amount of section 3 of the declaration is the difference between the amount of tax accrued from taxable objects and the amount of tax deductions and most often represents the amount payable to the budget.

Accordingly, the amount accrued for payment to the budget and reflected on line 040 of section 1 of the VAT return is influenced by the following factors:

1. The amount of tax accrued from taxable objects, and, in turn, the amount of the tax base increases the amount of tax paid.

2. The amount of tax deductions based on properly executed documents received from suppliers of goods (works, services) reduces the amount of tax paid.

See also the material “What is the procedure for applying (accepting) tax deductions for VAT: conditions?” .

3. The amount of VAT on advances transferred to suppliers of goods (works, services), if all conditions for applying such a deduction are met and the organization makes a decision to use the right to apply it, reduces the amount of tax paid.

See also the material “Acceptance for deduction of VAT on advances issued” .

4. The amount of VAT accrued when performing construction and installation work for own consumption, subject to deduction, reduces the amount of tax paid.

5. The amount of VAT paid to customs authorities when importing goods into the territory of the Russian Federation reduces the amount of tax paid.

See also the material “What is the procedure for refunding VAT when importing goods?”

6. The amount of VAT paid to the tax authorities when importing goods into the territory of the Russian Federation from the territory of the EAEU member states reduces the amount of tax paid.

7. The amount of VAT on buyer advances closed during the period reduces the amount of tax paid.

8. The amount of VAT paid by the taxpayer for the period as a tax agent reduces the amount of tax paid.

See also the material “How can a tax agent deduct VAT when purchasing goods (work, services) from a foreign seller .

9. Features of the algorithm for calculating the distribution of tax deductions between transactions subject to VAT (taking into account the breakdown at different rates) and transactions not subject to VAT. Not only the amounts of deductions according to suppliers’ documents are subject to distribution, but also the amounts paid to customs and tax authorities when importing goods into the territory of the Russian Federation.

When creating an algorithm for such a calculation, it should be taken into account that VAT on advances (both received and paid), VAT of the tax agent, and VAT accrued when performing construction and installation work do not participate in the distribution. They must be accepted for deduction in full in the period when the right to apply such a deduction arose. This will allow you to reasonably reduce the amount of tax paid to the budget.

In addition, the calculation of the distribution of VAT amounts must be carried out taking into account the balances of VAT related to sales at a rate of 0%, the right to apply which has not been confirmed at the beginning of the billing period. The balances of this VAT must be reflected in accounting in a separate subaccount of account 19. The VAT received by calculation, relating to operations that are not subject to taxation or exempt from VAT, must be included in costs according to the rules of Art. 170 Tax Code of the Russian Federation.

See also: “How is separate VAT accounting carried out (principles and methods)?” .

Results

All of these factors have a rather complex impact on the formula for calculating the tax burden for VAT. A correct understanding of the mechanism of this influence will allow the organization to provide reasonable arguments in support of the correctness of the data contained in the VAT return, and even at the stage of providing additional written explanations, remove the questions that have arisen from the tax authorities due to the discrepancy between the tax burden indicators calculated using the formula given in Appendix 7 to the letter of the Federal Tax Service of Russia dated July 25, 2017 No. ED-4-15/ [email protected] , the criteria for an organization that is favorable in relation to the tax burden.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Requirement from the tax office for a high proportion of VAT deductions

We received a summons from the tax office with the following content: “. to provide clarification on the issue: - on the fact of the high share of tax deductions for VAT for the 4th quarter.

2019 (deciphering the structure of tax deductions in terms of costs) with the provision of a balance sheet for 60, 62, 76 accounts for counterparties in the context of subaccounts, a balance sheet for accounts 01, 08, 10, 12, 19, 20, 23, 25, 26, 41, 43, 44, 68, 90, 91 by subaccounts, balance sheet for NU and accounting purposes (for all accounts) by subaccounts with the name of the accounts for the 4th quarter. 2021) In the case of maintaining a simplified system of accounting and financial reporting, provide a book (journal) for recording the facts of business transactions and other registers on the basis of which tax reporting is prepared.” And secondly, 90% of invoices are not related to VAT deductions. Having considered your request, XXX LLC reports the following.

The current legislation on taxes and fees does not contain criteria by which the share of tax deductions is identified as low or high.

Indicators affecting the VAT tax burden

Based on the calculation formula, the indicators that influence the amount of the tax burden for VAT are the size of the tax base and the amount of VAT accrued for payment on the declaration.

The size of the VAT tax base is determined by the following factors:

1. The amount of turnover from sales. The greater the sales turnover, the greater the tax base.

2. The presence of sales transactions that are not subject to VAT (clause 2 of Article 146, Articles 147 and 148 of the Tax Code of the Russian Federation) or are exempt from VAT (Articles 149 and 150 of the Tax Code of the Russian Federation). The presence of such transactions reduces the size of the tax base.

3. The presence of sales operations using a VAT tax rate of 0%. The presence of such transactions affects the size of the tax base in a specific tax period due to the lack of absolute compliance with shipping periods and confirmation of the organization’s right to apply a 0% rate. The presence of this discrepancy, in addition, leads to a discrepancy between the tax base for VAT and the tax base for income tax for the same tax period.

4. The presence of operations for construction and installation work performed for the organization’s own needs. The presence of these transactions increases the size of the tax base.

5. Availability of turnover on advances received from buyers. Advances received increase the tax base.

See also materials:

- “How to determine the tax base for VAT (moment of determination)?”;

- “VAT on advance payments: examples, postings, complex situations”;

- “What is the procedure for accounting and deducting VAT during the construction of fixed assets?”.

Calculation of tax burden for VAT

In the algorithm below for calculating the tax burden for VAT, we provide links to the declaration lines in relation to the current form, approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected]

The algorithm for calculating the tax burden for VAT is based on the use of the following indicators from the VAT return.

1. BV – tax base for the domestic market – the sum of lines 010, 020, 030, 040, 050, 060, 070, column 3 of section 3.

2. BE – tax base for transactions with a rate of 0% – the sum of lines 020 for all transaction codes in section 4.

3. NU – the amount of VAT payable to the budget – the amount on line 040 of section 1.

The tax burden has two calculation formulas.

1. Regarding the tax base for the domestic market - as the ratio of the amount of tax accrued for payment to the budget to the tax base for the domestic market (in percentage).

The calculation formula in the above symbols:

NU/BV × 100.

2. Regarding the total tax base for transactions with a rate of 0% and in the domestic market - as the ratio of the amount of tax accrued for payment to the budget to the tax base calculated as the sum of the tax bases for transactions with a rate of 0% and in the domestic market (in percent ).

The calculation formula in the above symbols:

NU / (BE+BV) × 100.

Accordingly, if the indicator on line 040 of section 1 of the VAT return (the amount of tax payable to the budget) is missing, then the VAT tax burden indicator will be equal to 0.

The tax burden can be calculated either for one tax period or for a period of time covering several tax periods (usually a year). In the latter case, the relevant data on tax returns are summarized.

Formula for calculating safe VAT

There are special formulas for determining the amount of the fee and calculating the specific weight of the deduction. Calculating VAT is relatively easy. To calculate the fee for selling products, you should multiply the cost of goods by the current rate (10 or 20%).

Another formula is used if you need to determine the tax indicator that is already included in the amount. This situation arises if you need to receive advance payment to the seller for products. Then you need to multiply the tax base by the estimated rate. For a tariff of 20% it will be 20/120, for a tariff of 10% – 10/110.

To determine the accrued fee for one quarter, you need to add the collection rate from goods sold and VAT from prepayment. To calculate the indicator that should be accepted for compensation, you need to add the following values:

- Tax charged to the supplier.

- A fee charged to the buyer when he transfers the advance payment.

- A fee paid at customs upon import.

- Payment calculated from advance payment and accepted for compensation at the time of shipment of goods.

- Fee paid as agent.

The amount of the tariff that must be paid to the budget is calculated as the difference between the accrued indicator and the tax that was accepted for compensation. If the result is zero, no fees are required to be added to the budget.

To establish the percentage of deductions, the tax accepted for compensation should be divided by the accrued fee and multiplied by 100%. If the share for the year is more than 98%, this may cause increased interest of tax authorities in the organization and lead to an on-site audit.