According to Federal Law No. 54 on the use of online cash registers, companies and individual entrepreneurs are switching to electronic payment procedures. An exception to the rule are organizations and individual entrepreneurs that are geographically located and registered in remote regions of the Russian Federation. The names of the subjects are contained in the resolution of the Government of the Russian Federation. Owners of clothing and shoe repair shops are interested in the question: Do they need an online cash register to operate the studio?

- Do you need an online cash register for a clothing repair shop?

- Choosing a cash register for an atelier

- Cash register for studio

- Cash register registration

- Do you need an online cash register for a shoe repair shop?

- The emergence of online cash desks for ateliers

- Popular models

Who is required to use the online cash register?

According to the current requirements of Federal Law No. 54-FZ, in most cases, payments to clients must be made through an online cash register. In addition, starting from 2021, the check must contain mandatory details, which include the name of the services and their quantity, which is also relevant for the beauty industry.

What about deferment for individual entrepreneurs?

The deferment for the use of cash register systems is valid until July 1, 2021 and applies to the following categories of individual entrepreneurs:

- who do not have employees working under an employment contract;

- who provides the services;

- who sells their own products.

Until the specified date, individual entrepreneurs who fall under the deferment are not required to use cash registers and transmit data to the Tax Service. All they have to do is issue checks or other documents confirming payment upon the client’s request.

After July 1, 2021, they will also have to install online cash registers with a fiscal drive and work in accordance with the requirements of 54-FZ.

Does an entrepreneur need a cash register on OSNO?

The main provision of Federal Law No. 54 provides that all commercial organizations whose activities are related to cash payments must mandatory use new fiscal devices. This system provides for some nuances - entrepreneurs can use special BSO forms when providing services to the public. These forms include various subscriptions, standard receipts, as well as coupons and travel documents.

In some cases, the activities of businessmen do not fall under the BSO form established at the legislative level - in this case, if you have all the necessary details, you can fill out the form yourself according to the filling procedure regulated by government decree dated 05/06/2008.

Also, special reporting forms can be ordered from a printing house - in the documentation it is important to indicate all the main details of an individual entrepreneur, the location of the enterprise or the name of the services provided. The forms must also indicate the series and circulation number.

When issuing a special form to customers, the current date must be indicated, as well as the position and personal signature of the individual entrepreneur.

Important! Strict reporting forms established by law can be used in the provision of services and trade only in settlements with individuals. When making payments to legal organizations, the use of an online cash register is a prerequisite.

Are there categories of hairdressing salons that are exempt from using online cash registers?

Remote areas The cash register is not required for those providing hairdressing services and individual entrepreneurs and legal entities who work in remote, hard-to-reach areas. This decision is made by regional authorities: they are the ones who grant a special status to a locality within the Tax Inspectorate of their region.

This right is reserved for businesses by law if business activities are carried out in an area located at a distance from communication networks. In this case, the cash register operates in offline mode, which is configured during registration with the Federal Tax Service.

However, regardless of whether there is a cash register at all or not, at the client’s request the company must still issue some kind of document confirming payment for the service, for example, a check or form.

Self-employment

Self-employed citizens do not need an online cash register either. They report to tax authorities using a mobile application that automatically determines the amount of tax on professional income

Who may not use cash registers

For some types of activities, it is allowed not to purchase cash register equipment even after the deadline. Among them:

- trading through vending machines selling small products that operate without electricity or batteries;

- peddling (for example, on trains or airplanes);

- kiosks with newspapers and magazines.

In addition, online technology may not be used by enterprises operating in hard-to-reach areas (lists of territories are approved by the authorities of the constituent entities). These exceptions apply to OSNO and other tax payment systems.

What are the requirements for online cash registers?

From July 1, 2021, all hairdressers, beauty salons and barbershops will switch to operating using an online cash register. What can they do without?

The cash register itself

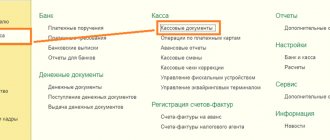

This can be a fiscal registrar connected to a computer, a stand-alone cash register, or a tablet-based smart touch terminal. You can choose your own solution for different tasks, flow and budget.

Fiscal memory block (FN)

A mandatory attribute of the cash register is a fiscal drive. This device stores information about trading operations in encrypted form.

Usually the cash register is immediately purchased with FN. For the service sector, an option with a validity period of 36 months is suitable.

Printing a receipt with certain parameters

The client must receive a check, which has a number of required details, including the name of the service, quantity, and cost. This data is pulled from a cash register program or an integrated CRM system with a database of clients and services.

For the minimum level, the basic functionality of cash register software is sufficient: built-in (as in Evotor or Sigma terminals) or purchased (for example, Frontol 6). Goods accounting systems provide a higher level with wider capabilities. For hairdressing services, there are separate solutions adapted to the specifics of such a business.

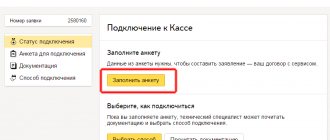

Agreement with OFD

Cash register equipment sends information about all transactions to the Tax Service through the fiscal data operator (FDO). To do this, the owner of the cash register enters into an agreement (usually it is equal to the validity period of the Federal Tax Fund, in the case of services 36 months), and makes the necessary settings.

Registration with the Federal Tax Service

To do this, you will need a qualified signature and an agreement with the OFD. The owner himself or the organization servicing cash register equipment registers the company in the personal account of the Federal Tax Service, then indicates the necessary data on the cash register and carries out fiscalization.

Individual entrepreneur - cash discipline 2021

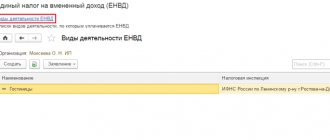

Should an individual entrepreneur keep a cash register ? A detailed response from the Bank of Russia is contained in Instructions No. 3210-U dated March 11, 2014. It defines the regulations for registering cash discipline of legal entities and entrepreneurs. According to clause 4.6 of the document, individual entrepreneurs may not maintain a cash book, subject to accounting for income transactions, as well as expense transactions, by reflecting information in the KUDiR. Or, in the absence of the need to maintain KUDiR on UTII, subject to tracking the physical indicators used in the calculations of the imputed tax.

In practice, this norm means the following - regardless of the current field of activity, the scale of the business and the tax regime used, entrepreneurs may legally not maintain a cash book. KO-4. And each businessman makes the decision on the advisability of full accounting of cash flows independently. Drawing up incoming and outgoing orders and a cash book helps to obtain reliable data on cash inflows/outflows and balances in the company's cash register. Cash discipline cannot be avoided for those individual entrepreneurs who have a large number of staff, have subordinates, pay salaries and benefits in cash, etc.

If an entrepreneur has decided on the need to draw up a cash book, he should adhere to the general regulations for cash accounting. That is, maintain primary documents daily (on cash days), stitch and certify KO-4, issue payment and payroll statements, appoint responsible persons for the timely generation of these documents. In the absence of KO-4, no sanctions are provided for the individual entrepreneur.

Who should operate the cash register?

While online cash registers were not mandatory, payments to clients could be made by any hair salon employee.

From the moment of mandatory use of the cash register, it is necessary to appoint a person who will work with it. This is due to the fact that the check requires the name of the employee who performed the payment.

The presence of such information in a fiscal receipt is not so much another requirement of the tax authorities as a necessity for competent business conduct. Having such data, you can easily determine everyone’s personal contribution in the form of revenue and find out the amount of the discount, if any.

Thanks to a cash register and inventory accounting system, a business owner can have both basic profit reports and advanced analytics on popular items, seasonality, productivity of specific craftsmen, and much more.

Who are the “self-employed”?

Self-employment is understood as a form of employment in which an individual receives income from activities related to the sale of goods, services or work produced by him, in the implementation of which he does not have an employer or hired employees.

Read the review article by portal experts about self-employment and the features of doing business as a self-employed citizen at the link.

Is any online cash register suitable for a hairdresser?

If the payment takes place in the salon through the administrator

Any type of cash register is suitable: a stationary cash register with a fiscal registrar and a separate monitor, a mobile compact cash register, a smart terminal with a touch screen and a built-in receipt printing mechanism.#

If the service is provided on-site (in a place that is convenient for the client)

It is preferable to purchase a small cash register with a capacious battery. It’s good if it also has a built-in option for non-cash payments by card.

Mobile cash register / compact smart terminal

Suitable for:

- For professionals who serve clients on the road.

- Small hairdressing salons that do not have space for a reception desk.

- Salons located in areas where there are interruptions in electricity or the Internet.

- Large salons in which payment is carried out on the spot, and not through the administrator.

This option is usually cheaper compared to stationary cash registers, so it is optimal for a start-up business or a small hairdressing salon.

POS-monoblock / smart terminal with a display larger than 8-10 inches

Suitable for:

- Hairdressing salons and salons with limited space at the administrator's workplace.

- Large salons with several rooms, in which payments take place at the reception.

- Hairdressing salons whose services are in good demand and have a large flow of visitors.

- Salons with an extensive price list and many areas of work.

The good thing about a candy bar or terminal is that it is convenient for the administrator to select items on a large monitor, and the built-in or external receipt printer prints information on the cash register tape quite quickly.

Selecting a device

Unlike stores with a large flow of customers, budget institutions, as a rule, do not carry out as many calculations. Therefore, in most cases, simpler cash registers are suitable for their work. For example, fiscal registrars or autonomous cash registers . The first ones connect to personal computers. The latter are independent devices, but are distinguished by their compact size and ease of use. An example of a popular stand-alone device is Atol 90f or Atol 91f.

As an additional equipment, it is advisable to install an acquiring terminal in order to be able to accept not only cash, but also bank cards for payment. You will also need a cash drawer to store cash.

Why opening a sewing workshop is a promising business

Evidence that this establishment will bring profit is the fact that the attributes of the wardrobe do not last forever; new things are often damaged for various reasons. Naturally, it’s a pity to throw away a beautiful branded skirt, favorite jeans, trouser suit, raincoat and other things. It is not always possible to repair this or that item yourself. For example, due to the lack of the necessary material, tools or skills necessary to solve the problem. In such situations, sewing workshops are a lifeline.

Another advantage of the idea is the presence of clients regardless of the economic situation in the country. By the way, in times of crisis, people try to make the most of old things and, accordingly, repair them.

It should be noted that the client base of the clothing repair studio also includes people with a non-standard figure.

For the sake of fairness, we note that the business idea is of particular interest to those who plan to open their own business in a metropolis. The fact is that the local population strives to individualize their wardrobe.

Material base

Acceptable places for bringing an idea to life are:

- streets with stable, rich flows of potential customers;

- residential areas.

The minimum area of the object is 20 square meters.

The practice of successful studio owners has shown that business development is facilitated by proximity to stopping points, large retail facilities, places for selling clothes, shoes, bags, and city-forming enterprises.

Typically, clothing repair shops are opened on the ground and first floors of residential buildings. A prerequisite is the presence of a separate entrance. Studios in the form of market pavilions show good results.

The interior of an establishment of the format in question assumes the presence of:

- chairs and tables for seamstresses;

- tables on which cutting is carried out;

- mannequins;

- hangers;

- mirrors;

- guides, curtains on fitting booths;

- wall sconces and table lamps (preferably).

Each seamstress will need:

- machine;

- overlock;

- hemming machine;

- ironing board.

Each worker must be provided with scissors and needles, “centimeter”, rulers, thimbles, threads, pins, etc.

Financial side of the project

Investments at the start - from 250 thousand rubles. With a monthly profit of 50 thousand rubles, the investment in the worst case is justified in a year. The return of funds spent at the start is positively affected by the expansion of the range of services. For example, you can sew bed linen, car seat covers, tablecloths, napkins and other household items.

The investment fund is presented in the table.

| Expenditure | Costs, thousand rubles |

| legalization | 2 |

| purchase and installation of a cash register | 40 |

| equipping the facility with equipment and tools | 150 |

| carrying out repair work and adding furniture to the interior | 40 |

| Consumables | 8 |

| primary advertising tools | 10 |

| Total: | 250 |

Each month funds will be sent to:

- to fulfill obligations to the lessor - 15 thousand rubles;

- wages – 45 thousand rubles;

- replenishment of materials - at least 5 thousand rubles;

- communal apartment - 5 thousand rubles.

Monthly calculations are based on the example of Kazan; in other cities the amounts may be different. In the provinces, costs will be significantly less.