First, add to the Counterparties directory the bank with which the agreement for the purchase of currency was concluded. If you already have this bank in the directory of Counterparties, then you do not need to add it again.

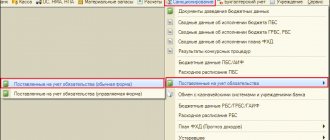

In the Full interface menu Directories - Counterparties

Create a new counterparty:

Purchasing currency - creating a counterparty - a bank

To complete currency purchase transactions, it is important to fill out the fields highlighted below:

1C counterparty card - correct filling of the bank card

Please note that you do not need to check the Buyer or Supplier flags, since we only need an agreement with the Other type. If you are using an existing counterparty and it has any of these flags, then it’s okay.

We save the counterparty using the Write button and go to the Accounts and agreements tab:

1C counterparty card - account bookmark and agreements

For currency purchase transactions, you must immediately indicate the bank account of the authorized bank to which we will transfer funds for the purchase. If this is the only bank account in the bank card, then it will be inserted into payment documents automatically.

But, most likely, you will have other accounts in your bank card. Then you will need to indicate the name of the account in such a way that it is convenient to find it in the list. Fill out the account card:

Buying currency - bank account card

The View field at the bottom is editable. I indicated (currency purchase) in this field. When you select an account for a payment document, these words will be visible in the account name.

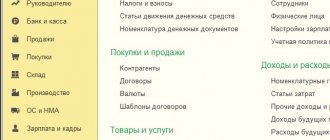

Let's move on to the contract. If you created a new counterparty, then the 1C program created an agreement with the type Other automatically. An agreement needs to be created for an existing counterparty.

It is important to fill out the contract correctly:

- Fill in the name,

- Type of agreement - Other,

- The contract currency is rubles, since we will buy currency for rubles.

Purchasing currency - Filling out an agreement with a bank in 1C

The first stage of purchasing currency in 1C: Accounting

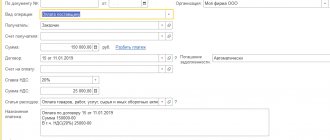

Executing a payment order, followed by sending it to the bank for the purpose of purchasing currency. In the 1C program you need to enter a Payment order.

The counterparty is the bank from which the currency is purchased; accordingly, the bank must be selected in the Buyer line. Amount – the amount of payment in rubles, for example, we need to purchase 10,000 dollars at the rate of 62 rubles, we indicate the amount of 620,000 rubles.

To display a printed form, use the Payment Order button (if it is not there, see the Print button). This document is intended specifically for preparing a printed document and is not mandatory in the 1C program, because he himself does not form any movements and does not create any postings.

The generated form can be saved on a PC for subsequent sending to the bank using the save icon, or you can send an email directly from the database if an account has been set up in it.

Account 52 in accounting: postings, examples of transactions on a foreign currency account

Account 52 of accounting is the active account “Currency accounts”. Serves to reflect information on the movement of foreign currency funds in accounting.

We recommend reading: Biysk boarding house for the care of elderly patients

Using standard transactions and illustrative examples, we will study the specifics of using account 52, as well as the features of reflecting transactions on a foreign currency account. An organization that sells goods (materials, services) to foreign buyers or purchases goods (materials, services) from foreign suppliers carries out the following operations: purchase, sale, registration of a transaction in foreign currency.

For settlement transactions, the organization opens a foreign currency account in a bank. In most cases, the bank opens for companies two foreign currency accounts - current and transit: The current foreign currency account is used to reflect credited foreign currency funds for the export sale of goods (materials, services); Transit currency account is used

Accounting and tax accounting of transactions related to the receipt and sale of foreign currency earnings

T.

KRUTYAKOVA In the accounting of organizations, the receipt of foreign currency earnings is reflected by the posting: D-t of account 52/"Transit currency account" - K-t of account 62 - foreign currency earnings were received to the transit foreign exchange account. Transactions on the sale of foreign currency earnings (both mandatory and voluntary) are reflected in accounting using account 57 “Transfers in transit”: D-t of account 57 - K-t of account 52 / “Transit currency account” - foreign currency funds subject to sale; D-t of account 51 - D-t of account 57 - funds from the sale of currency were received into the current account; D-t of account 91 - K-t of account 57 (51) - commission to the bank in connection with the sale of currency is reflected in operating expenses (clause 11 of the Accounting Regulations “Organizational Expenses” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999

N 33n); Dt account 57 (91) - Kt 91 (57) - exchange rate difference on account 57,

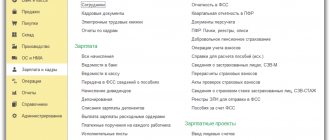

The second stage of purchasing currency in 1C Accounting

Reflections of the bank debiting from the company's account the amount specified in the payment order submitted to it. In 1C, this operation is displayed using Write-off from a current account. You can enter it in the list of bank statements using the Write Off button. When you click it, a new document form opens.

Filling features:

Type of operation in this case Other settlements with counterparties.

Some of the information (organization, counterparty, accounts) corresponds to a previously issued and transmitted order, according to which the bank carries out operations on the movement of funds belonging to the organization.

In the Agreement field, the agreement concluded by the organization with the bank is indicated, the type of agreement is Other, the currency is Russian ruble.

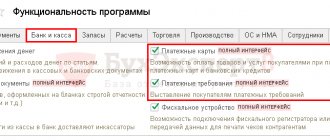

Accounts: accounting - 51, settlements 57.02. Please note that to use account 57, the option to use account 57 when moving funds must be enabled in the organization’s accounting policy. If account 67 is not used, the settlement account is 76.09 instead.

Exchange with client-bank

The method demonstrated earlier is convenient only if there are very few bank documents. Otherwise, the task is to configure the automatic creation of incoming and outgoing banking transactions. This problem is solved by the 1C exchange with the client-bank; it is turned on in the bank account settings:

The essence of the exchange is as follows: outgoing payments created in 1C are uploaded to the upload file

.

Then it is loaded into the client bank. As a result, an outgoing payment order is created in the client bank. a download file

is downloaded from the client bank , then it is loaded into 1C. In the sharing settings, you must specify the path to both files on your hard drive or local network.

Now let's create a non-cash write-off

to pay the supplier:

Fill in all the required information, leaving the banking information blank. We carry out, we close. Now we upload to the client bank:

Select a bank account and upload the data to a file:

As a result, a file like this is created:

This file is uploaded to the client bank, after which a payment order is created there. Next, you sign this payment slip and the payment goes through. After that, download the statement from the client bank to a file ( download file

from the account settings), initiate downloading of the statement in the non-cash payment journal:

To simplify loading, we will include the need to process loaded payment orders and create unfound counterparties. The completion of the download is indicated by the status:

On the Uploaded documents

you can see those payments that were created/adjusted according to the data in the download file:

As you can see, in addition to our initial payment to the counterparty, an incoming payment was also loaded - payment from the buyer. Those. The principle here is the following - we create outgoing payments in 1C, and download incoming payments automatically from the client bank.

In the initial transaction, the following banking information was filled in:

The second payment was created completely automatically, and a counterparty was created:

On the second tab we see that the payment itself is selected as the settlement object, i.e. the document is not tied to any settlement object. If this is not an advance from the buyer, you need to choose the basis for the payment yourself:

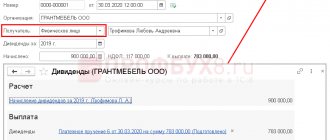

Stage three of purchasing currency in 1C

The bank purchases foreign currency. Here the amount is converted into ruble equivalent, and for correct calculation it is necessary to maintain up-to-date exchange rate data in the database. The purchase of currency in 1C Accounting is registered with the document Receipt to the current account (the same list of bank statements, but the button in this case is Receipt, not Write-off).

Filling features:

Type of transaction – Purchase of foreign currency;

The organization, counterparty, agreement are the same as those indicated when performing the write-off, but the bank account is no longer in rubles, but in foreign currency.

Settlement account 57.02

Watch video instructions on channel 1C PROGRAMMER EXPERT

EVERYONE MUST DO THEIR JOB! TRUST THE 1C SETUP TO A PROFESSIONAL. MORE →

Discuss the article on the 1C forum?

Transfer of funds from transit to current currency posting account

» The difference that arises is called the financial result from the purchase of currency. If the official exchange rate is less than the purchase rate, then in accounting the resulting difference is reflected as part of operating expenses.

(D91/2 K57 - negative difference). If the official exchange rate is higher than the purchase rate, then the difference is reflected in operating income (D57 K91/1 - positive difference). In particular, from:

- on what date is ownership of the goods transferred or when the work (services) are considered accepted by the customer (on the date of shipment, the date of signing the act, the date of payment, the date of registration of the customs declaration, etc.);

- Does the contract provide for prepayment?

We recommend reading: Who makes a technical passport for an apartment when selling

If ownership

1C: Accounting 8.2 - Sale of currency (without using account 57 “Transfers in transit”)

February 24, 2021 According to the Chart of Accounts and the Instructions for its application, account 52 “Currency accounts” is intended to summarize information on the availability and movement of foreign currency in foreign currency accounts opened in authorized banks in Russia or in banks outside of Russia.

At the time of payment for foreign goods, the supplier must recalculate the currency at the rate of the Central Bank of the Russian Federation on the date of payment: If the rate on the date of payment to the supplier is higher than that of the Central Bank of the Russian Federation on the date of crediting the currency to the account.

Analytical accounting for account 52 “Currency accounts” is maintained for each account that is opened for storing funds in foreign currency. To keep records of transactions with foreign currency, an organization has the right to use account 57 “Transfers in transit”, but if the debit of rubles from the account, their sale and crediting of currency occur on the same day, then account 57 need not be used.

In this case, the transfer of rubles for the purchase of currency is recorded in the accounting entry: Dt 76 - Kt 51, and the receipt of the purchased currency to the current account: Dt 52 - Kt 76.

Accounting for foreign exchange transactions is regulated by PBU 3/2006. Accounting entries for