An individual entrepreneur does not have to do just one thing; the law allows him, if desired and possible, to combine several types of activities. At the same time, it happens that for some activities one taxation system is more convenient, and for another type of activity another one is more convenient.

The entrepreneur has the right to choose which mode to apply. Is it possible to combine several special regimes for paying taxes? Some with each other – it’s possible.

Let us clarify the issues of entrepreneurial combination of the simplified tax payment system and entrepreneurship under a patent.

Simplified system

The simplified taxation system can be applied throughout the country; almost any activity falls under it. Therefore, the simplified tax system is the most universal tax system. But there are also limitations to its use. For individual entrepreneurs, the main ones are the limit on the amount of income and the number of employees. In 2021, these limits have been increased and are now:

- income from the beginning of the year should not exceed 200 million rubles;

- the average number of employees is no more than 130 people per year.

Note!

Along with increasing the limits for the application of the simplified tax system, additional tax rates were introduced. If the income from the beginning of the year is 150-200 million rubles and/or the number of employees is from 100 to 130 people, starting from the period in which these indicators were achieved, the individual entrepreneur must pay tax at the following rates: 8% under the simplified tax system “income” and 20% under the simplified tax system “income minus expenses”.

A complete list of criteria for the transition to the simplified tax system and the use of this system is given in articles 346.12 and 346.13 of the Tax Code of the Russian Federation.

How to account for insurance premiums

Contributions to compulsory pension and health insurance are also subject to the rules of separate accounting under two special regimes. If an enterprise with hired employees uses the simplified tax system “Income”, then the tax amount can be reduced by a maximum of 50%. An individual entrepreneur without hired staff has the right to reduce contributions by 100% of the amount. Entrepreneurs using the “Income minus expenses” version of the simplified tax system can also reduce the amount of contributions to the budget - include mandatory contributions in the expenses of the enterprise.

On the PSN, these deductions work in the same way as on the “simplified” one. In general, when combining the two modes, the following rules apply:

- Individual entrepreneur without employees. An individual entrepreneur may not distribute contributions for himself between two special regimes, but take into account all contributions when calculating the simplified tax.

- The staff works on the simplified tax system and the PSN. Contributions for yourself should be taken into account when calculating the simplified tax, and insurance contributions for hired employees should be distributed between the “patent” and the simplified tax system.

- All personnel work for PSN. Contributions for employees should be taken into account when paying off the cost of a patent, and contributions for yourself should be taken into account in calculations according to the simplified tax system.

- All personnel work for the simplified tax system. An entrepreneur must include in business expenses all contributions for himself and for hired employees (the “Income minus expenses” option) or reduce the tax amount by half (the “Income” option).

The nuances and individual situations of combining these special regimes are not clearly stated in the Tax Code, so it is necessary to take as a basis the explanations of the Federal Tax Service on this issue.

Patent

The patent tax system in 2021 for individual entrepreneurs has more stringent restrictions:

- The PSN must be introduced in the territory of doing business in relation to exactly the area of business that the individual entrepreneur is engaged in. The types of activities for a patent are determined by regional authorities. A basic list of areas that you can focus on is given in paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation. At the same time, there are activities that are prohibited by patent (clause 6 of Article 346.43 of the Tax Code of the Russian Federation);

- the maximum number of employees engaged in “patent” activities is 15 people (total for all patents, if there are several of them);

- annual income - no more than 60 million rubles for all types of patent activity;

- PSN is not applied within the framework of a simple partnership agreement or trust management of property;

- A patent cannot be used when selling goods that are subject to mandatory labeling - medicines, shoes and fur clothing.

Why is it beneficial for individual entrepreneurs to combine modes?

In Russia, it is quite common for an individual entrepreneur to apply the simplified tax system and a patent at the same time. The taxation model allows a businessman to significantly save on tax payments to the budget. And the composition of reporting on preferential treatment is minimal. For example, an individual entrepreneur using the simplified tax system submits only one declaration at the end of the year. When the PSN does not provide for declarations at all.

Even the combination of OSNO and patent is beneficial for individual entrepreneurs. This allows you to pay only 6% of income for certain types of activities instead of:

- 13% personal income tax;

- 20% VAT;

- 2.2% property tax.

As you can see, the savings are significant.

Combination conditions

When using PSN and simplified tax system together, the limitations of each system are taken into account. It turns out that they can be combined if the following conditions are met:

- The amount of income of an individual entrepreneur does not exceed 60 million rubles. According to paragraph 6 of Article 346.45 of the Tax Code of the Russian Federation, income under both special regimes is taken into account.

- The entrepreneur employs no more than 130 people, while no more than 15 employees are employed in all patent activities. This rule was introduced by Law No. 325-FZ of September 29, 2019. Before it came into force, a different procedure was applied - an individual entrepreneur could hire no more than 15 people in all areas of business. As soon as he had another employee, he lost the right to the patent system, even if he was engaged in “simplified” activities.

Thus, it is possible to combine the simplified tax system and the patent system if:

- activities within each regime meet the requirements of the Tax Code of the Russian Federation;

- the above conditions for their joint use are met.

And one more important rule: it is unacceptable to combine simplified taxation and PSN for one type of activity within one subject of the Russian Federation. This is due to the fact that the patent is valid in the region and all activities are transferred to it. Therefore, for example, it is impossible to open a retail store on a patent in one area of the city and on the simplified tax system in another.

But for certain types of activities, the Federal Tax Service still makes an exception. In particular, we are talking about renting out your own real estate. Such objects are indicated in the patent. According to letter No. SD-4-3/ [email protected] , an individual entrepreneur has the right to acquire a patent for leasing certain real estate properties. Moreover, if he has other objects, including in the same region, he has the right to rent them out and apply the simplified tax system.

In addition, in 2021, another situation has arisen when it is possible to combine simplified legislation and a patent for one type of activity. We are talking about the sale by a businessman of labeled and other goods. For example, you can simultaneously sell shoes in a store using the simplified tax system, and other goods using a patent. This follows from the letter of the Ministry of Finance dated January 15, 2020 No. 03-11-11/1277. This permission is due to the fact that the sale of goods subject to mandatory labeling for the purposes of applying PSN is no longer considered retail trade. Therefore, formally, the sale of shoes and, for example, bags are different types of activities.

General restrictions

Businessmen whose total income and number of hired personnel exceed the permitted limits do not have the right to resort to both taxation systems.

Income limit

Special regimes were introduced to support small and medium-sized businesses; therefore, they are subject to a limit on the maximum amount of income for the reporting period.

Both the simplified system and the patent should not be allowed to large entrepreneurs whose total income for the tax period will be more than 60 million rubles . If the income for the year exceeds this amount, the entrepreneur will lose the opportunity to use the special modes of the simplified tax system and the PSN.

When these two regimes are combined, income should be taken into account collectively.

That is, the profit received from types of business subject to the simplified tax system is summed up with income from “patent” activities, and this amount should not exceed the specified 60 million rubles.

NOTE! As for the simplified tax system, to determine the amount of income until 2021, indexation was in effect (multiplying by a deflator coefficient), which the Government (Ministry of Economy and Development of Russia) sets every year. Thus, the limit could not be 60 million, but slightly more than this amount. For PSN such an operation is not provided. The total value allowed for combining both modes may be higher due to indexation under the simplified tax system.

If the limit was exceeded, then from the beginning of the “profitable” quarter, the successful businessman who received such a high income will be deprived of the opportunity to use the “simplified tax”, and from that time he will be considered newly registered, that is, subject to the general tax system.

The same applies to PSN: as soon as the amount of income reaches 60 million rubles, the right to use the patent will be lost, and you will have to pay taxes according to the general system, recalculating payments from the beginning of the year the patent was issued.

IMPORTANT! If a businessman has lost the rights to a patent, but has not yet reached the limit under the simplified tax system, he will be forced to “retroactively” recalculate his tax payments - now using a combination of the simplified tax system with the general tax regime. Grounds – letters of the Ministry of Finance of Russia dated January 30, 2015 No. 03-11-12/3558, Federal Tax Service of Russia dated December 3, 2013 No. GD-4-3/21548, dated June 13, 2013 No. ED-4-3 /10628.

Number of hired personnel

Another important condition limiting the use of simplified taxation system and PSN in combination concerns the number of employees that the employer has the right to attract:

- a “simplifier” can hire no more than 100 people during the tax period;

- a “patent” entrepreneur has no right to command more than 15 employees.

- The individual entrepreneur himself is not included in the number of counted employees, and employees who are on maternity leave at the time of registration are also not counted.

For both special regimes, the tax period is a calendar year, but it happens that a patent is issued not for a year, but for a shorter period. Therefore, combining regimes in such cases will reduce the tax period to the period for which the patent was issued (the Tax Code regulates this in paragraph 1.2 of Article 346.49).

From this we can conclude that at different times different numbers of employees are available to an entrepreneur.

Therefore, their accounting by type of activity where combined tax systems are used must be kept separately. For a business that is taxed under the simplified tax system, there should be no more than a hundred personnel per year, and in the area of business for which a patent has been received - no more than 15 people. 15 units of personnel is the sum of all employees employed in “patent areas,” even if the entrepreneur has more than one patent.

IMPORTANT INFORMATION! The latest notice of the Ministry of Finance (letters dated September 28, 2015 No. 03-11-11/55357 and dated July 21, 2015 No. 03-11-09/41869) recommends adhering to “separate” rather than total restrictions when combining tax regimes . This means that if an individual entrepreneur decides to combine any tax payment system with PSN, he is not entitled to more than 15 employees, even for other types of business activities.

Combination practice

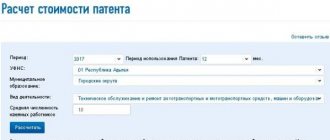

Before using the systems together, you need to make sure that for the chosen type of activity a patent will be more profitable than the simplified tax system. The tax service website has a special service for calculating the cost of a patent. It depends on the region, field of activity and scale of business.

If an individual entrepreneur already uses the simplified tax system, he can simply purchase a patent for the desired area. If a different tax regime is applied, then a transition to a simplified tax regime is made. However, this can only be done starting from the next calendar year.

The simplified tax system applies to all activities, and the patent applies to the one for which it was acquired. For clarity, here are a couple of examples demonstrating the combination of the simplified tax system and a patent in 2021.

Example 1

An individual entrepreneur from Moscow provided services under the simplified tax system with the object Income (tax rate 6%) and additionally decided to rent out an apartment that belonged to him. That is, in this example, there is a combination of the simplified tax system for services and the PSN for leasing residential real estate. Its area is 50 square meters. meters, rental cost - 40 thousand rubles per month. The income of an individual entrepreneur for the year will be 40 x 12 = 480 thousand rubles.

When applying the simplified tax system at a rate of 6%, the annual tax will be 480 * 6% = 28.8 thousand rubles. But the cost of a patent for this entrepreneur for the entire 2021 will be 18 thousand rubles. There is a tangible benefit, so combining the modes is justified.

Example 2

A Moscow resident registered as an individual entrepreneur and immediately switched to a simplified system. Then he acquired a retail patent and opened a small (48 square meters) store selling souvenirs. The cost of a patent for 2021 for him was 162 thousand rubles.

Additionally, the entrepreneur decided to sell products via the Internet. The activities of an online store are not covered by a patent, but they can be conducted using the simplified tax system. Since the individual entrepreneur switched to this system in advance, he can open an online store without additional registration. If he had not previously taken care of applying the simplified regime, he would have had to pay taxes on the activities of the online store in accordance with the main system. And wait until next year to switch to the simplified tax system.

When you can’t combine these special modes

An individual entrepreneur can apply a simplified taxation system for all areas of activity that are not listed in the list of prohibited special regimes (Article 346 of the Tax Code). The use of PSN is possible only for a limited list of areas of activity that are permitted in a particular region. Therefore, to combine these two taxation systems, you must first study the current list of approved OKVED for PSN.

If an entrepreneur plans to deal with the same OKVED in one region, then the parallel application of the simplified tax system and the PSN will be impossible.

Example:

An individual entrepreneur opened a store selling veterinary goods and providing veterinary services. He switched to the simplified tax system in both areas of activity. A year later, the entrepreneur decided to expand the business and opened another store in another area of the city and filed a tax notice for the use of a “patent” at the new outlet. The Federal Tax Service refused - the entrepreneur needs to work entirely on the PSN or choose the simplified tax system.

Features of combining the simplified tax system and a patent

The patent does not require the submission of any reports, however, in the simplified system it is necessary to submit a declaration. Therefore, applying simultaneously the PSN and the simplified tax system, the individual entrepreneur is obliged to submit this report to the Federal Tax Service. Moreover, this must be done even for those periods when “simplified” activities are not carried out. In this case, a report will be submitted without indicators (zero declaration).

Generate a simplified taxation system declaration online

If you neglect to submit a declaration under the simplified tax system, the Federal Tax Service may impose a fine under Article 119 of the Tax Code of the Russian Federation. It will be 1 thousand rubles - this is the minimum amount that is assigned if there is no tax to pay. And this is, perhaps, the only disadvantage of combining these modes compared to the independent use of PSN.

The advantages of combining these tax regimes are that individual entrepreneurs can optimize their payments. He saves by purchasing a patent in those areas of business for which its cost is lower than the tax under the simplified tax system.

Previously, combining modes had another advantage - individual entrepreneurs had the right to deduct their own insurance premiums. The tax on “simplified” activities could be reduced on them, but the cost of the patent could not, since the PSN did not involve the deduction of contributions. However, starting from 2021, a new rule has been introduced for individual entrepreneurs on PSN - the cost of a patent (several patents) can now be reduced by the amount of contributions.

The advantage of combining the regimes is that if the right to a patent is lost (for example, due to exceeding the limits), the entrepreneur will find himself on the simplified tax system. If he does not first switch to this system, that is, he uses the PSN in its pure form, if he loses the right to it, he will be considered to be applying the main tax regime.

Results

An entrepreneur, when starting a business, must decide which taxation system he will use.

The modes can be used separately if only one business area is developing, or they can be combined if several are developing at once. What is more profitable than an individual entrepreneur - a patent or simplified tax system, or perhaps a general regime, is usually determined in advance by calculation. But in the process of carrying out activities, regimes can be changed, however, this should be done strictly according to the rules enshrined in the Tax Code. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

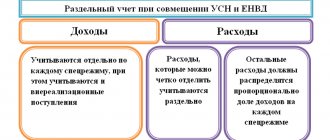

Separate accounting

An individual entrepreneur on a patent and the simplified tax system must separately keep records of property, transactions and obligations. In this case, we are talking only about tax accounting, since an individual entrepreneur is not required to maintain accounting records. It is also necessary to maintain separate personnel records for personnel engaged in activities under different tax regimes.

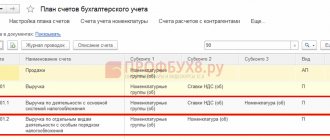

Free accounting services from 1C

The entrepreneur keeps his records in the book of income and expenses (KUDiR). An individual entrepreneur on the simplified tax system keeps this book for the simplified system, and an individual entrepreneur on a patent keeps this book for the patent system. When combined, both books are filled out.

The essence of separate income accounting is to record in the appropriate accounting book the revenue that is received from activities within the framework of a particular tax regime. Revenue control is needed in order not to miss the moment of possible loss of the right to use a patent and to correctly calculate the tax under the simplified tax system.

Similarly, when combining PSN and simplified tax system, expenses are also taken into account. But some of them cannot be attributed to one or another regime. This usually concerns the costs of paying management and support workers, rent and utility bills.

Therefore, individual entrepreneurs on a patent and the simplified tax system often have a question at the same time: how to keep track of such expenses? It's actually simple. They need to be distributed in proportion to the income received from the patent and from “simplified” activities.

For example, an individual entrepreneur received the following income:

- according to the simplified tax system - 200 thousand rubles;

- for a patent - 100 thousand rubles.

At the same time, the total costs for both systems amounted to 30 thousand rubles. They will be distributed in this way: 20 thousand will be allocated to the simplified tax system, and 10 thousand to patent activity.

How to take into account income and expenses when combining special modes

It is usually not difficult to correctly reflect income from different areas of activity in KUDiR - the funds come from buyers for the corresponding goods or services performed. If there are incomes that cannot be attributed to only one type of activity, then such income simply needs to be distributed evenly across both special regimes.

The same must be done with expenses - they are counted as expenses of the enterprise as a whole. Such costs include renting premises, accountant’s wages, utility bills, etc.

conclusions

So, we looked at whether it is possible to combine a patent and the simplified tax system. This can be done by entrepreneurs whose annual income does not exceed 60 million rubles. The number of their employees should not exceed 130 people, of which no more than 15 are involved in patent activities. At the same time, it is important to comply with other conditions for the application of these regimes, including local specifics.

The combination of simplified taxation system and PSN in one region for one type of activity is unacceptable, with some exceptions. In order to correctly calculate indicators and calculate taxes, when combining the simplified tax system and the personal tax system, it is necessary to keep records of income, expenses and personnel separately.

Who can combine these special modes

After the tax on imputed income was abolished, the following special regimes remain in force: Unified Agricultural Tax, PSN, simplified tax system and NPD (self-employed). The Unified Agricultural Tax presupposes very highly specialized activities of individual entrepreneurs, and NAP cannot be combined with any other regime. Therefore, in fact, for an entrepreneur who wants to save on contributions to the budget, the only option left is a combination - patent and simplified taxation systems.

According to the law, only individual entrepreneurs belonging to micro-businesses can apply PSN, which means they have the right to combine a patent with another system.