Olga Duminskaya’s answer

, Advisor to the State Civil Service of the Russian Federation, 2nd class of the Value Added Tax Department of the Department of Taxation of Legal Entities of the Federal Tax Service of Russia.

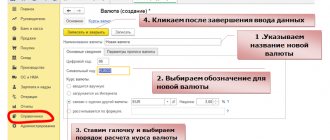

Chapter 21 of the Tax Code of the Russian Federation establishes the procedure for recalculating foreign currency (cu) in the following cases:

- determining the tax base when the currency is converted into rubles at the rate of the Central Bank of the Russian Federation on the date corresponding to the moment of determining the tax base (which in general is the date of receipt of the prepayment and the date of shipment) (clauses 3 and 4 of Article 153 of the Tax Code of the Russian Federation, clause 1 of Article 167 of the Tax Code of the Russian Federation );

- when determining the amount of tax deductions, when the currency is converted into rubles at the rate of the Central Bank of the Russian Federation on the date of registration of goods (work, services, property rights) (paragraph 4 of paragraph 1 of Article 172 of the Tax Code of the Russian Federation).

In addition, in accordance with official explanations (letter of the Ministry of Finance of Russia dated December 23, 2015 No. 03-07-11/75467, Federal Tax Service of Russia dated July 21, 2015 No. ED-4-3/12813) when shipping goods (work, services) on account previously received partial payment in rubles, the tax base is determined as the full cost of shipped goods (work, services) in rubles, including paid and unpaid parts. In this case, the unpaid part of the cost of goods (work, services) is recalculated into rubles at the exchange rate of the Central Bank of the Russian Federation on the date of their shipment.

Also, in accordance with the provisions of Chapter 21 of the Tax Code of the Russian Federation, the seller:

- in the event of an increase in the cost of previously shipped goods (work, services, property rights), the increase in the tax base is taken into account during the period of cost adjustment, which does not give rise to an independent moment of determining the tax base (clause 10 of Article 154 of the Tax Code of the Russian Federation), which makes it difficult to apply the provisions established by article 153 Tax Code of the Russian Federation;

- in the event of a decrease in the value of shipped goods, the right to a tax deduction of the difference arises in the tax period of adjustment in the absence of the circumstances of acceptance for accounting (clause 13 of Article 171 of the Tax Code of the Russian Federation).

Using what rate should the VAT amount be recalculated and the adjustment invoice indicators be filled in when the cost of shipped goods (work, services) changes?

Indeed, Chapter 21 of the Tax Code of the Russian Federation does not establish a special procedure for the recalculation of foreign currency (cu) for the purpose of applying VAT when the cost of goods shipped (work performed, services rendered) or transferred property rights changes, including in the event of a change in price (tariff) and (or) clarification of the quantity (volume) of goods shipped (work performed, services provided), property rights transferred.

It should be taken into account that changes in the cost of goods (work, services, property rights) do not affect the moment of determining the tax base, which, in accordance with subparagraph 1 of paragraph 1 of Article 167 of the Tax Code of the Russian Federation, is recognized as the day of shipment of goods (work, services, property rights), although it is taken into account in the tax period when such adjustment is made. Consequently, when the cost of shipped goods (work, services, property rights) changes, the rules for determining the tax base established by Article 153 of the Tax Code of the Russian Federation are applied. In this case, the difference between the tax amounts calculated based on the cost of goods shipped (work performed, services rendered), transferred property rights before and after such a change:

- when the cost increases, it increases the tax base for the tax period in which the documents were drawn up that are the basis for issuing adjustment invoices in accordance with paragraph 10 of Article 172 of the Tax Code of the Russian Federation (paragraph 10 of Article 154 of the Tax Code of the Russian Federation);

- when the value decreases, it is taken into account as part of tax deductions on the basis of issued adjustment invoices also during the adjustment period (clause 13 of Article 171 of the Tax Code of the Russian Federation, clause 10 of Article 172 of the Tax Code of the Russian Federation).

We will consider the application of this provision using the following examples.

Example 4. Increase in the cost of shipped goods in the absence of prepayment

On November 1, the seller shipped goods worth $180 to the buyer. e. (including VAT 20% – 30 USD). Course at e. on the date of shipment - 80 rubles.

Upon shipment, an invoice is issued reflecting the cost indicators given in Table 1.

On December 1, due to violations of the terms of the contract, the price of shipped goods was increased by 10%. Course at i.e. on the date of adjustment – 100 rubles.

In this case, the tax base is recalculated at the rate in effect on the date of shipment (Table 6).

Table 6

| Nomenclature | Price | Qty | Price without VAT) | VAT | Value with VAT) |

| Product A | 22 USD e. (1,760 rub.) | 5 pieces. | 110 USD e. (8,800 rub.) | 22 USD e. (1,760 rub.) | 132 USD e. (RUB 10,560)* |

| Product B | 11 USD e. (880 rub.) | 5 pieces. | 55 USD e. (4,400 rub.) | 11 USD e. (880 rub.) | 66 USD e. (RUB 5,280)** |

| Total | 33 USD e. (2,640 rub.) | 198 USD e. (RUB 15,840) | |||

* 132 USD e. x 80 = 10,560 rub.

** 66 USD e. x 80 = 5,280 rub.

Consequently, the issued adjustment invoice will reflect the indicators for goods A and B:

- increase in the amount of VAT on goods A and B by 240 rubles. (RUB 2,640 – RUB 2,400);

- increase in cost including VAT for goods A and B by 1,440 rubles. (RUB 15,840 – RUB 14,400).

Features of recalculation of monetary obligations from euros to rubles

The financial officer making payments in euros must first take into account the terms of the contract. Usually there are reservations regarding the date and rate of conversion of euros into Russian rubles.

If the agreement does not contain a condition for converting euros into rubles, payment of invoice obligations must be made at the exchange rate established by the Bank of Russia on the day of payment. This can be used as a guide in cases where the contract:

- There is no indication at what euro exchange rate should be recalculated;

- There is no reference to the date on which the settlement rate would be established;

- In both of the above situations.

Example 5. Increase in the cost of shipped goods A in the presence of prepayment

According to the supply agreement, the seller must ship goods worth 180 USD to the buyer. e. (including VAT 20% – 30 USD).

On October 1, a partial prepayment of 50% was received, which is 6,300 rubles. (90 USD). Course at e. on the date of receipt of the advance payment - 70 rubles.

On November 1, the seller shipped the goods. Course at e. on the date of shipment - 80 rubles.

Upon shipment, an invoice is issued reflecting the cost indicators given in Table 4.

On December 1, due to violations of the terms of the contract, the price of shipped goods A was increased by 10%. Course at i.e. on the date of adjustment – 100 rubles.

In order not to recalculate the cost indicators for product B, it seems reasonable to recalculate the indicators only for product A, taking into account the preservation of the amount of the advance payment originally related to product A, i.e., an advance payment in the amount of 4,200 rubles. (60 USD x 70). At the same time, it is obvious that if the cost of shipped goods increases, there is no possibility of maintaining the prepayment share, i.e. on the date of shipment, the prepayment percentage decreases from 50% (60 c.u./120 c.u.) to 45.45% (60 c.u. cu/132 cu).

Then the cost of shipped goods after increasing the price of product A will look like this (Table 7).

Table 7

| Nomenclature | Price | Qty | Price without VAT) | VAT | Value with VAT) |

| Product A | 22 USD e. (1,660 rub.) | 5 pieces. | 110 USD e. (8,300 rub.) | 22 USD e. (1,660 rub.) | 132 USD e. (9,960 rub.)* |

| Product B | 10 USD e. (750 rub.) | 5 pieces. | 50 USD e. (3,750 rub.) | 10 USD e. (750 rub.) | 60 USD e. (4,500 rub.)** |

| Total | 32 USD e. (2,410 rub.) | 192 USD e. (RUB 14,460) | |||

* 60 USD e. x 70 + 72 y. e. x 80 = 4,200 rub. + 5,760 rub. = 9,960 rub.

** 30 USD e. x 70 + 30 y. e. x 80 = 2,100 rub. + 2,400 rub. = 4,500 rub.

Consequently, the issued adjustment invoice will reflect the indicators for product A:

- increase in the amount of VAT on product A by 160 rubles. (RUB 1,660 – RUB 1,500);

- increase in cost including VAT for product A by 960 rubles. (9,960 rubles – 9,000 rubles).

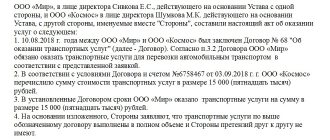

The agreement is in foreign currency, and the payment is in rubles

M. Koltakova, Financial Director of CJSC Travel Company AKTIS

Civil legislation allows you to indicate the cost of goods, works or services in conventional units or foreign currency. If the buyer pays in rubles, amount differences arise.

The amount that the buyer must transfer is determined by the exchange rate on the day of payment. True, the parties to the contract have the right to provide in the contract for another recalculation date (Clause 2 of Article 317 of the Civil Code of the Russian Federation). Total differences are divided into positive and negative. Positive ones arise for the seller if on the date of recalculation of the obligation the exchange rate has increased, for the buyer - if on the date of recalculation of the obligation the exchange rate has decreased. Conversely, negative amount differences are formed for the seller if on the date of recalculation of the obligation the currency exchange rate has decreased, for the buyer - if on the date of recalculation of the obligation the exchange rate has increased. Note that not every contract in which the cost of goods is indicated in conventional units or foreign currency leads to the formation of amount differences. For convenience, we provide a table. So, when determining the cost of goods (work, services) at the exchange rate on the day of payment in the case of 100% prepayment, the amount difference does not arise. If a partial prepayment is made, the difference will be due on the day of subsequent payment. And when the cost of goods (work, services) is determined at the exchange rate on the day of shipment, then in the case of transfer (receipt) of an advance payment, the amount difference does not arise. Amount differences for the seller The accountant reflects revenue taking into account the amount differences. This follows from paragraph 6 of PBU 9/99. Positive amount differences increase revenue. If we are talking about revenue from ordinary activities, the amount difference is reflected by posting Debit 62 Credit 90-1. When receiving other income, account 91-1 “Other income” is used. If a negative amount difference occurs, the revenue is reduced - reversed. This accounting procedure is applicable if the amount differences arise within one calendar year. If the company sold goods in one year, and payment was received in the next, the amount differences are reflected in non-operating income (expenses) as profit (loss) on operations of previous years, identified in the reporting year, in accordance with paragraph 12 of PBU 10/99 and paragraph 8 PBU 9/99. The previous year's revenue is not adjusted in accordance with paragraph 11 of the Instructions on the procedure for drawing up and presenting financial statements (approved by order of the Ministry of Finance of Russia dated July 22, 2003 No. 67n). VAT on amount differences from the seller In 2006, the moment of determining the base for this tax is the earliest of the specified dates: the day of shipment or the day of payment, partial payment on account of upcoming deliveries of goods, performance of work, provision of services (Article 167 of the Tax Code of the Russian Federation). How to calculate the base is stated in Article 153 of the Tax Code. According to paragraph 2 of this article, revenue must be determined taking into account all income associated with settlements. This means that the amount differences must be taken into account when calculating tax. Positive amount differences increase the basis. But the issue of accounting for negative amount differences is controversial. Officials insist that the company should not reduce the base by such amounts (letters from the Russian Ministry of Finance dated July 8, 2004 No. 03-03-11/114, dated December 19, 2005 No. 03-04-15/116). In our opinion, it is not necessary to agree with the point of view of the employees of the financial department. The Tax Code does not prohibit adjusting the VAT base by the amount of negative amount differences. As already noted, the tax base is determined taking into account all income associated with the calculations. Moreover, paragraph 4 of Article 166 of the Tax Code states that the amount of tax is calculated taking into account all changes that increase or decrease the base. There are examples of litigation that ended in favor of firms that adjusted the VAT base. In particular, in the decision of the Federal Antimonopoly Service of the North-Western District dated October 7, 2005 in case No. A56-6029/2005, the judges noted that the organization lawfully reduced revenue by the amount of the difference. If you decide not to take into account negative amount differences in the VAT tax base, as required by the Ministry of Finance, the procedure for recording transactions will be as follows.

Example 1 The seller sold goods worth 1180 USD. (including VAT – 180 USD). The goods were shipped in May 2006 and paid for the following month. According to the agreement 1 cu. equals 1 USD. Let’s assume that the USD exchange rate on the date of shipment is 28 rubles/USD, on the date of payment – 27.5 rubles/USD. The following entries were made in the seller's accounting: in May Debit 62 Credit 90-1 – RUB 33,040. (1180 USD x 28 rubles/USD) – the goods have been shipped to the buyer; Debit 90-3 Credit 68 subaccount “VAT calculations” – 5040 rubles. (180 USD x 28 rubles/USD) – VAT is charged on the cost of the shipped goods; in June Debit 51 Credit 62 – 32,450 rubles. (1180 USD x 27.5 rubles/USD) – payment for the goods has been received; Debit 62 Credit 90-1 subaccount “Amount Difference” – 590 rubles. (1180 USD x (28 rubles/USD – 27.5 rubles/USD)) – revenue is reduced by the amount of the negative amount difference. Since the seller does not adjust the VAT accrued at the time of shipment, the revenue reflected in the accounting records along with the amount differences will differ from the tax base. Therefore, in account 90-1 “Other income”, it is advisable to allocate a second-order subaccount “Amount differences” so that the accountant can always determine the reason for such discrepancies.

Amount differences from the buyer If you purchase property, the cost of which is indicated in foreign currency, but pay for it in rubles, you must correctly reflect the amount differences. They increase (decrease) the initial value of assets, but only up to a certain point. For fixed assets and intangible assets, this is the day of commissioning (clause 8, 14 PBU 6/01, clause 6, 12 PBU 14/2000). Amount differences that arise after the specified date are included in non-operating income (expenses). A similar rule is applied when reflecting financial investments (clause 10 of PBU 19/02) and inventories (clauses 6, 12 of PBU 5/01). True, negative amount differences that arose when purchasing goods, materials, etc. after the property was accepted for accounting are reflected as expenses for ordinary activities (clauses 5, 6.6, 7 PBU 10/99). If positive amount differences arise when purchasing inventories, they are included in non-operating income according to the general rule.

Example 2 In March, the buyer purchased a fixed asset worth 708 USD, including VAT - 108 USD. The facility was put into operation in April. The client paid for the property in May in rubles. The USD exchange rate was: on the date of purchase – 27.34 rubles/USD, on the date of payment – 28.00 rubles/USD. The accountant made the following entries: March Debit 08 Credit 60 - 16,404 rubles. ((708 USD – 108 USD) x 27.34 rubles/USD) – fixed asset purchased; Debit 19 Credit 60 – 2952.72 rub. (108 USD x 27.34 rubles/USD) – VAT included; April Debit 01 Credit 08 – 16,404 rub. – the fixed asset was put into operation; May Debit 60 Credit 51 – 19,824 rub. (708 USD x 28.00 RUR/USD) – fixed asset paid for; Debit 91-2 Credit 60 – 467.28 rub. (708 USD x (28 rubles/USD – 27.34 rubles/USD)) – a negative amount difference is reflected. We will consider the issue of adjusting input VAT below.

The procedure for recording transactions will change in the case of an advance payment.

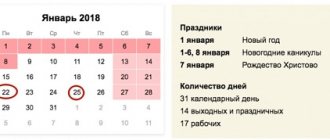

Example 3 The buyer and seller entered into a purchase and sale agreement. According to this document, the cost of goods is 300 euros (including VAT - 45.76 euros). The buyer pays for the goods in rubles at the exchange rate on the day of payment. The buyer transferred on March 23 an advance payment of 150 euros (including VAT - 22.88 euros) at the rate of 34.78 rubles/euro. Thus, the buyer paid 5217 rubles. (150 euros) 34.78 rubles/euro). The goods were received on March 30. On this day, the euro exchange rate was 34.52 rubles/euro. Some of the goods have already been paid for. Therefore, its cost will be formed from two quantities: paid cost and unpaid. The first indicator has already been determined. The second one needs to be calculated. To do this, you need to multiply the unpaid cost of the goods in euros by the exchange rate on the date of receipt of the valuables. As a result, in account 41 “Goods” the accountant will reflect the amount: (150 euros – 22.88 euros) x 34.78 rubles/euro + (150 euros – 22.88 euros) x 34.52 rubles/euro = 8809, 41 rub. The amount of input VAT will be: 22.88 euros x 34.78 rubles/euro + 22.88 euros) x 34.52 rubles/euro = 1585.59 rubles. The buyer transferred the rest of the money on April 1, the rate on that day was 34.63 rubles/euro. That is, the buyer paid 5194.50 rubles. (150 euros) ) 34.63 rubles/euro). Since the cost of the goods has already been formed, the amount difference must be included in expenses for ordinary activities. This value will be: 150 euros x (34.63 rubles/euro – 34.52 rubles/euro) = 16.5 rubles. We will consider the issue of adjusting input VAT below. The operations are reflected as follows. March 23 Debit 60/2 Credit 51 – 5217 rub. – an advance payment for the goods is transferred; March 30 Debit 41 Credit 60/1 – 8809.41 rub. – the goods are capitalized; Debit 19 Credit 60/1 – 1585.59 – VAT included; Debit 60/1 Credit 60/2 – 5217 rub. – advance payment is credited; April 1 Debit 60/1 Credit 51 – 5194.50 rub. – the remaining amount of money for the goods is transferred; Debit 44 Credit 60/1 – 16.5 rub. – the amount difference is reflected.

VAT on amount differences from the buyer What amount of tax can the buyer deduct if there are amount differences? Is it possible to adjust input VAT? There are no clear instructions in the Tax Code, therefore, one must proceed from the general rules for applying deductions. They are established by paragraph 2 of Article 171 and paragraph 1 of Article 172 of this document. Firstly, purchased goods, works, services must be used in activities subject to VAT. Secondly, the buyer must have a correctly executed invoice. The third condition: “tax amounts are subject to deductions... after goods (work, services) are registered” (Clause 1, Article 172 of the Tax Code of the Russian Federation). It turns out that the amount of input VAT that can be offset is formed on the day the assets are posted. Until January 1, 2006, a different wording of paragraph 1 of Article 172 of the Tax Code was in effect. It stated that tax amounts presented to the payer and paid by him in the event of the acquisition of valuables after the latter were registered are subject to deduction. On this basis, the capital’s inspectors came to the conclusion that the entire amount of tax transferred to the supplier can be offset (letter from the Moscow Department of Taxation and Tax Administration dated September 9, 2002 No. 24-11/41793). Unfortunately, there are no letters of clarification on the issue of how to deduct VAT in 2006 when amount differences arise. According to oral statements by specialists from the Ministry of Finance, the buyer must accept for deduction the amount of VAT calculated based on the exchange rate on the date of fulfillment of all conditions for offset. There is no need to make further adjustments, since they are not provided for by the Tax Code. We showed how to reflect a negative amount difference when purchasing goods in the last example. If a positive amount difference is formed when purchasing inventories, the accountant reverses the entry Debit 44 Credit 60/1 by the amount of the amount difference. Tax accounting of amount differences Amount differences are included in non-operating income and expenses when calculating income tax (clause 11.1 of Article 251, subclause 5.1 of clause 1 of Article 265 of the Tax Code of the Russian Federation). At what point should they be taken into account in the case of using the accrual method, it is stated in paragraph 7 of Article 271 and paragraph 9 of Article 272 of the Tax Code:

- for the seller - on the date of repayment of receivables for goods (work, services) sold, and in the case of advance payment - on the date of sale;

- for the buyer - on the date of repayment of accounts payable for purchased goods (work, services), and in the case of advance payment - on the date of acquisition.

The letter of the Federal Tax Service of Russia dated May 20, 2005 No. 02-1-08 / [email protected] considers the situation when the buyer first makes a partial prepayment and transfers the rest of the money after receiving the goods. As tax officials explained, in this case, the amount differences arise only when paying for that part of the goods that turned out to be unpaid after its receipt. In case of prepayment, there are no differences in amounts. Thus, in the situation considered, the cost of the goods will be the same in both accounting and tax accounting. The total difference that is formed when transferring the remaining money for the goods must be attributed to non-operating expenses (income) in tax accounting. Whereas in accounting, when purchasing inventories, this amount is reflected as part of expenses for ordinary activities (see example 3). Let us note that organizations that recognize income and expenses using the cash method do not take into account amount differences (clause 5 of Article 273 of the Tax Code of the Russian Federation). This rule also applies to enterprises on the simplified market (clause 3 of Article 346.17 of the Tax Code of the Russian Federation).

Date of determination of the ruble equivalent price Payment procedure The contract provides for prepayment The contract provides for payment after shipment On the date of shipment The total differences are formed There are no amount differences On the date of payment There are no amount differences The total differences are formed

Samples of standard contracts:

- Property trust management agreement

- Donation agreement

- Energy Saving Agreement

- Factoring agreement

- Storage agreement

- Individual contract

- Agreement for the sale and purchase of an apartment (residential building)

- Contract of purchase and sale of non-residential premises

- Purchase and sale agreement in the authorized capital

- Contract for the sale and purchase of bills of exchange

- Building purchase and sale agreement

- Interest-free loan agreement with collateral

- Agreement for the purchase and sale of land between individuals

- Agreement of exchange between individuals

- Barter agreement

- Office space rental agreement

- Contract for information and reference services

- Agreement for the provision of courier services

- Agreement for the provision of marketing services

- Agreement for the provision of intermediary services

- Agreement for the provision of services for the delivery of goods (shipments)

- Agreement for the provision of customs clearance services

- Contract for organizing the transportation of goods

- Contract for the supply of means of transport

- Novation agreement

- Agreement on gratuitous transfer of shares in the authorized capital

- Debt transfer agreement

- Debt transfer agreement (option 2)

- Agreement on joint activities (simple partnership)

- Deposit agreement

- Work agreement

- Agency agreement

- Guarantee agreement for the loan agreement

- Supply contract

- Rental agreement

- Warehousing agreement

- Construction contract

- Agreement on assignment of claim rights

- Contract of assignment of claims

- Deposit agreement

- Loan agreement

- Real estate pledge agreement

- Agreement for the provision of security services

Standard contracts

The website of the Law Firm "Argument" presents standard contracts and samples of standard contracts. to download standard contracts - just click on the appropriate link.

We recommend using standard agreements for reference only, since in reality the agreement must be drawn up individually and take into account the specific features of the relationship for which it is concluded.

Additionally, it is necessary to analyze the judicial practice of the branch of law under which the contract being drawn up falls.

The use of a standard agreement may lead to a controversial situation and unfavorable conditions for its conclusion for the party using the standard agreement in its activities.

Samples of corporate documents:

- GOSU protocol

- Protocol OSU_approval of transactions

- OSU protocol_subsequent approval of transactions_template

- Minutes of the General Regulations_Acceptance of a Third Party into the Company

- List of affiliates

- Application for acceptance

- Application for additional contribution

- Offer to sell shares

- The procedure for concluding a written contract for a share

- Sale of the Company's share to third parties_reference

- LLC's consent to sell a share

- Consent of an LLC participant to sell a share

- LLC application for waiver of preferential rights

- Participant’s application for renunciation of preferential rights

- Proposal 3rd letter. on the purchase of a share in LLC from the Fund

- Founder's proposal to purchase a share in LLC from the Fund