The number of individual entrepreneurs (IP) in Moscow over the nine months of this year increased by 7.8 percent. This is due to the development of a project on a patent taxation system - the simplest and most convenient for entrepreneurs. “This system has several advantages. Firstly, there is no need to have a cash register, secondly, there is no need to keep records, which means you can refuse the services of an accountant, thirdly, you can choose the validity period of the patent - from one month to a year. The system is suitable for enterprises whose annual turnover is less than 60 million rubles,” said Alexey Grigoriev, deputy head of the Department of Financial and Tax Policy of the capital’s Department of Economics.

Instructions for obtaining a patent

The right to a patent is granted to those individual entrepreneurs whose average number of employees during the tax period does not exceed 15 people, and whose income does not exceed 60 million rubles.

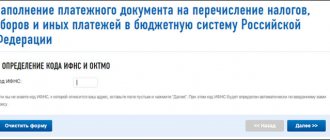

To switch to the patent system, you need to contact the tax service no later than 10 days before starting your activity. You can fill out and print the application yourself. The tax authority is obliged to issue the document within five days.

If the patent is issued for a period of up to six months, then the tax must be paid in full before its expiration. If the document is issued for 6–12 months, you can pay for it in two stages: a third of the amount - no later than ninety calendar days after the start of validity, the rest - no later than the end of the period.

Muscovites submit an application at their place of residence. Entrepreneurs who are registered in another region, but will conduct business in the capital, can contact any tax office.

Login to the site

| trademarks | inventions | utility models | industrial designs | copyright | computer programs | transfer of rights | |||

Hello, dear subscribers! Questions on the topic “Patents for inventions, utility models, industrial designs. Questions and answers"

send to [email protected]

You can find answers to current questions regarding the legal protection of various intellectual property objects on our website, in the “Consultations” section www.patent-bureau.ru/Consulting

Question 1:

Our company (patent holder) is going to offer one plant a new patented technology in Russia in 2003 (non-Eurasian patent). What is the best way to formalize such a transaction? Is it possible to conclude a license agreement in this case and where is it registered? How to protect copyright in this case? I understand that the Russian patent is not valid on the territory of Belarus, but maybe it’s worth placing publications in Belarusian specialized media in order to somehow indicate your right to the invention, or will this still not help protect yourself?

Answer:

You correctly understand that the Russian patent is not valid on the territory of Belarus, therefore the license agreement cannot be registered there. In principle, a patent-free license is possible, in fact an agreement on the provision (transfer) of know-how, which does not require registration. However, the effectiveness of technology protection with such a license is incomparably lower than with a patent license. Publications in the Belarusian media will also not provide protection, because The essence of publication is the protection of copyright for a specific text, i.e. protecting it from copying, but not protecting the technical solutions contained in the text.

I believe that in this case you can resort to a proven remedy: patenting a utility model in Belarus based on a Russian patent for an invention. The patent legislation of Belarus is structured similarly to the Russian one, essentially repeating the Russian Patent Law, which was in force until 2008. Clause 2 of Article 23 of the Law of the Republic of Belarus “On PATENTS FOR INVENTIONS, UTILITY MODELS, INDUSTRIAL DESIGNS” of 2002. it is determined that “during the examination of an application for a utility model, verification of the compliance of the declared utility model with the conditions of patentability established by this Law is not carried out,” a similar text is contained in paragraph 187 of the “Rules for the preparation, filing and consideration of an application for a patent for a utility model” of 2003 . That is, the examination does not have the right to oppose the Russian patent and, if the formal requirements are met, will issue you a patent for an almost identical solution. Considering that the examination of an application for a utility model is carried out quite quickly, or rather within 3 months from the date of receipt of the application by Belgospatent (Clause 3 of Article 23 of the Law of the Republic of Belarus), it is advisable to pre-file such an application and be guaranteed to receive a patent for it. However, it is highly desirable to at least slightly change the application materials (formula and description) so that the set of features of the formula of the Russian patent and the Belarusian patent do not completely coincide, in order to avoid the risk of possible cancellation of such a patent at the initiative of an interested party, on the grounds of lack of novelty with reference to your same Russian patent. I believe this is not difficult to do, because... design and technological nuances when introducing new technology at a plant in Belarus will require some “adjustment” of the technology. It is difficult to see any violations of laws in such patenting, because in essence, the owner of the patent extends its validity to other countries, slightly modifying and adapting the technology to specific conditions. If you need help with such patenting, write to us and we will try to help.

Sincerely, Boris Anatolyevich Vygodin

,

Patent attorney of the Russian Federation

, www.patent-bureau.ru.

Question 2:

Is it possible to patent clothing designs?

Answer:

Clothing designs can be protected by industrial design patents. The validity period of such patents is in accordance with the legislation introduced on January 1, 2008. Part 4 of the Civil Code of the Russian Federation has been increased and amounts to 25 years (the main period is 15 years with the possibility of extending the validity of the patent for another 10 years). The form, composition, color texture and other features of the artistic and design solution are protected. You can patent both individual items of clothing and accessories, and sets (for example, suits). Patenting clothing is usually advisable in the case of serial production of such clothing, because This protects the manufacturer from the possibility of counterfeiting, i.e. counterfeits from other manufacturers. Products intended for display at exhibitions, competitions, etc. As models that determine the direction of fashion development, they are usually not patented, because they are not intended for mass production and the borrowing of ideas contained in them by others without explicit copying will not make it possible to prosecute the violator.

Sincerely, Boris Anatolyevich Vygodin

,

Patent attorney of the Russian Federation

, www.patent-bureau.ru.

What types of activities can you get a patent for?

Among the types of activities for which a patent is issued are sewing and repairing clothes and shoes, repairing furniture and household appliances, and hairdressing services. Tutors, installers and welders, those who look after children, provide veterinary services and rent out apartments, non-residential premises, dachas, land plots and other areas can also qualify for payment of taxes under a simplified scheme. The full list is published on the website of the Federal Tax Service.

The Moscow government also proposed expanding the types of patent activities. These may include the development of computer programs, computer repair, collection, processing and disposal of waste, catering services, cutting, processing and finishing of stone for monuments, interpretation and translation, care for the elderly and disabled, production of leather and leather products , forestry and other forestry activities, production of fruit and berry planting materials, commercial and sport fishing and fish farming, drying, processing and canning of fruits and vegetables, production of dairy products, collection and procurement of food forest resources, provision of services for slaughter, transportation, distillation, grazing livestock.

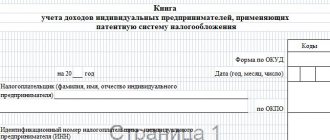

It is worth keeping in mind that if an entrepreneur conducts several types of activities, then a patent is purchased for each of them. At the same time, combining several tax regimes is not prohibited. For tax accounting, you only need to keep an income book.

Patent for repair and tailoring of clothing, fur and leather products

This type of patent is issued by entrepreneurs whose activities consist of providing household services to the population in the field of repair and sewing of products.

Also, this type of activity - repair and sewing of clothing, fur and leather products, hats and textile haberdashery products, repair, sewing and knitting of knitwear - falls under the Moscow law on tax holidays and allows you to conduct business activities for two years at a rate of 0 %.

Conditions for using PSN:

- Be registered as an individual entrepreneur

- There are no more than 15 employees on staff

- Annual turnover should not exceed 60 million rubles

Necessary documents for the transition to PSN

- Copy of the passport of an individual entrepreneur

- Copies of TIN and OGRNIP

- A copy of the premises rental agreement

The cost of a patent for repairing and sewing products in Moscow is 39,600 rubles and does not depend on the district, rental area and number of employees (most importantly, no more than 15 people)

The cost of a patent for repairing and sewing products in the Moscow region depends on the number of employees on the staff of an individual entrepreneur.

| The number of employees | The cost of a patent for 12 months. for one car |

| 0-1 employee | 57,540 rub.. |

| 2 employees | RUB 60,240 |

| 3 employees | RUB 62,940 |

further on a progressive scale depending on the number of employees, but not more than 15 people.

We also remind you that from January 1, 2021, patent tax can be reduced through fixed insurance premiums.

Order a service for registering the transition to PSN.

Select the appropriate patent registration option

| Package "Patent-1" | Package "Patent-maxi" | Package “IP + Patent” | Package “IP + Patent maxi” |

| Filing an application for a patent | Preparation of a package of documents for registration of a patent | Preparation of a package of documents for registration of individual entrepreneurs | Preparation of a package of documents for registration of individual entrepreneurs |

| Submission of documents to the Federal Tax Service (without client participation)* | Selection of OKVED, preparation of an application for the transition to the simplified tax system | Selection of OKVED, preparation of an application for the transition to the simplified tax system | |

| Receiving ready documents from the Federal Tax Service | Preparation of a document package for registration of a patent | Submission and receipt of documents to the Federal Tax Service | |

| Transfer of completed documents to the client | Assistance in opening a bank account (Sberbank, Tochka, Tinkoff) | Preparation of a package of documents for registration of a patent | |

| Filing an application for a patent with the Federal Tax Service | |||

| Transfer of completed documents to the client | |||

| Assistance in opening a bank account (Sberbank, Tochka, Tinkoff) | |||

| Issue of digital signature for individual entrepreneur registration electronically | |||

| Duration - 1 day | Duration 7-10 days (depending on the timing of the Federal Tax Service | Duration – 1-2 days | Duration – 7 days for registration of an individual entrepreneur, 7-10 days before receiving a patent after registration of an individual entrepreneur. |

| 2200 rub. | 4500 rub. | 4700 rub. | 9000 rub. |

* Additionally, you will need a notarized power of attorney for our employee (approximate cost of notary services is 1200 rubles)

| REMAINING UNTIL SUBMITTING DOCUMENTS TO THE IFTS FOR REGISTRATION OF PATENTS VALID FROM July 1, 2021 |

What do you need to do to start cooperation with us?

To order a service, call us by phone or click “Order” and we will call you back and discuss the details of cooperation.

We provide services in Moscow and the Moscow region.

Is it necessary to come to our office to receive services?

We always welcome guests and are ready to meet you in our office, treating you to delicious coffee, but if you do not have enough free time, we begin work immediately after receiving the necessary documents from you by email. If you need to receive original documents from you, our specialists will be able to meet with you at a place convenient for you.

Go back to the page about PSN >>>

How much does a patent cost?

Instead of several taxes, the entrepreneur pays six percent of the amount of expected income for the year or another period if the patent is issued for a shorter period. The size of this potential income (tax base) is different in each region. For example, if an entrepreneur decided to start repairing, painting and sewing shoes in Moscow and bought an annual patent, then he needs to pay 36 thousand rubles.

In the capital, the cost of a patent for renting out apartments within the Moscow Ring Road is planned to be reduced. Thus, the patent for renting housing with an area of no more than 50 square meters, located within the Moscow Ring Road, will be reduced from 2.5 to 1.5 thousand rubles per month. If the apartment is up to 75 square meters, the tax will be 36 thousand rubles per year, and not 60 thousand, as before. Also, the cost of a patent for transportation in vehicles with a carrying capacity of more than 10 tons will decrease from 15 to nine thousand rubles.