The role of an accounting certificate: what is it for?

Any enterprise has the right to independently develop “primary” forms, approving them in its accounting policies. But sometimes it is difficult to justify certain business transactions due to the lack of an established document form for them. For example, calculating daily allowance or expenses. An accounting certificate will help resolve this problem . It can be used in other cases (see table).

| Some cases of using accounting certificates | |

| Situation | Explanation |

| The company is obliged to apply separate accounting for VAT | Reveals the methodology for separate VAT accounting |

| Correction of data for the reporting period and previous years | To solve this problem, use an accounting certificate confirming the correction of an error. |

| As evidence in court | Duplicates information that is already reflected in accounting |

| To process postings | Explains the meaning of the operation or the inaccuracy of the initial posting |

Basically boo. a certificate is a primary document to which the law imposes its requirements. It can be compiled in any form, but certain details must be present. If executed correctly, it will become reliable evidence in conflicts with regulatory authorities.

Ideally, a competent specialist should be involved in the preparation of accounting statements . For example: an economist, accountant or other person who is responsible for the transaction being performed. But in order to successfully cope with the task, you need to know some nuances.

Also see “How to Maintain Accounting for an LLC.”

Results

Accounting statements are primary documents for business operations that do not have other supporting documents for their implementation.

Most often, such operations involve corrections, additional calculations or clarifications. An important point for drawing up a certificate is to indicate in it the mandatory details inherent in the primary document, as well as to correctly state the essence of the business transaction being justified. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What you need to know when using different forms and samples of accounting statements

You should remember the following subtleties:

- Does not replace the document that must be drawn up by the transaction partners together. Therefore, it makes sense to record some operations in the certificate only for internal purposes.

- The certificate usually only confirms the information already provided in the internal accounting system. Therefore, a specialist must distinguish how to prepare a sample accounting certificate :

Such cases include drawing up an act of acceptance of goods received without documents. The tax office will consider that the submitted sample accounting certificate does not have a legal basis. As a result, expenses may not be recognized. It is impossible to take them into account when calculating tax. And challenging such a decision can be difficult.

- as a “primary”;

- for completely different purposes (informational, etc.). For example, to record a business transaction in a document that can become evidence in legal proceedings.

- In difficult situations, the accountant runs the risk of getting confused in the corrections. To prevent this from happening, we recommend including as much information as possible in the text of the certificate and attaching copies of settlement documents, as well as incorrectly completed documents.

What is an accounting certificate and why is it needed?

All people make mistakes, accountants are no exception. In order to correct errors, as well as to reflect non-standard business transactions in accounting, you can use an accounting certificate.

An accounting certificate is an official document that reflects adjustments to various registers of the chart of accounts in the event of an error, as well as calculations for non-standard business transactions.

How to write a reference for an employee? A sample and step-by-step instructions are contained in the publication at the link.

Thus, an accounting certificate is necessary in order to make changes to the reporting , as well as in order to reflect specific business transactions in accounting (separate accounting of activities, entertainment expenses).

Structure: how to write a sample accounting statement

Regardless of its purpose, the document must be executed correctly, since it plays the role of a primary one. Then there will be no unnecessary questions from the tax inspectorate. We recommend using an in-house template, since the legislation of the Russian Federation does not provide for a mandatory accounting certificate form .

The procedure for preparing this document consists of 3 stages:

- Creating a “header” and specifying the following data:

- information about what has changed;

- previous performance;

- correct method of calculation.

The following is an example of an accounting statement with the corresponding text:

| “Economist of LLC “Guru” N.V. Kurnosova made a technical error when calculating depreciation on fixed assets. For 2021, the amount was 21,000 rubles, while it was erroneously indicated as 22,500 rubles. Detailed calculation: ……. On February 1, 2021, N.V. Kurnosova corrected the error by posting Dt 44 Kt 02 - 21,000 rubles. Corrections were made by recording Dt 44 Kt 02 – 1500 rubles. (reverse)" |

- identification of persons;

- confirmation of the need to perform a business transaction.

Also see “Details of accounting documents: basic and mandatory”.

As was said, the company’s management has the right to independently develop and approve by order a sample certificate in order to use it to solve its business problems. At the same time, it is included in the accounting policy of the enterprise.

You can take as a basis accounting certificate 0504833 , which was developed by the Ministry of Finance for public sector institutions (order No. 52n of 2015).

Typically, this document is drawn up in electronic form, taking into account standard design requirements: no typos, filling out all details, exact names of organizations, etc. It is important not to make mistakes when entering dates.

On our website for accounting information you can use the following link.

Such certificates may contain so-called red reversals - postings with a negative number. They serve, for example, for:

- bug fixes;

- write-off of trade margins;

- adjustments to indicators of material and production costs.

Below is a sample of filling out accounting certificate 0504833 .

Form and required details

Since this is a primary document, two important conditions must be met:

- The form and procedure for compilation must be prescribed in the accounting policies of the organization.

- Availability of the mandatory details provided for in Article 9 of the Federal Law of December 6, 2011 No. 402 on accounting.

If an organization can develop the form on its own or use a sample for filling out an accounting certificate (0504833), which was developed and approved by Order of the Ministry of Finance dated March 30, 2015 No. 52n for government institutions, then the requirements for the details are quite strict. The form must include:

- name of the organization;

- document number and date of its preparation;

- title of the document;

- the content of the reflected fact of economic life;

- units of measurement and method of reflection (monetary or natural);

- data from other primary documents (if necessary);

- position and full name the person who performed the operation;

- signature of the compiler.

Only if these requirements are met will the completed form be considered valid.

Varieties

There are several types of accounting statements designed for different business situations:

- settlement;

- about correcting errors;

- for the public sector;

- samples of books certificates on separate VAT accounting;

- about debt write-off;

- intended for court.

Each of them has its own compositional features that allow one to competently confirm the legitimacy of a particular fact.

Accounting statement: sample filling

This type of certificate is of a primary nature. It is distinguished by the presence of indicators that are already reflected in accounting. The accountant draws it up in the following cases:

- correction of inaccuracies in accounting or tax accounting;

- an explanation of the business transaction ( an accounting statement may be useful when writing off accounts receivable or payable);

- performing additional calculations that explain the specifics of the transaction (especially important when separately accounting for VAT or recognizing expenses).

standard form of accounting statement established by law . But it must have the following details:

- Company name;

- the essence of the operation and the calculation for it;

- date of compilation;

- FULL NAME. responsible persons.

If you are in doubt about how to correctly draw up a sample accounting certificate , follow Article 9 of the Law Certificate of Confirmation of Corrections

Let’s assume that the accountant of Guru LLC N.V. Solovyova found an error in depreciation charges for March 2021: 53,800 rubles were reflected, but according to correct calculations - 41,200 rubles. The surplus is reversed using the posting: Dt 44 Kt 02 – 12 600. A sample accounting certificate about error correction looks like this:

Please note: you must specify:

- the reason for the error;

- all options for the amount that affects accounting;

- date of correction.

At the end of N.V. Solovyova, as the compiler of the certificate, puts her signature. Adjacent to it is the autograph of the chief accountant. After this, the accounting certificate confirming the correction of the error serves as the basis for an accounting correction.

Also see Double Entry Accounting: Meaning and Examples.

Research journal

Burlakova Olga Vladimirovna, Kreker Anastasia Nikolaevna 1. Doctor of Economics, Associate Professor of the Department of Accounting, Analysis and Audit, Orenburg State University, Orenburg 2. Master's student of the Department of Accounting, Analysis and Audit, Orenburg State University Burlakova Olga Vladimirovna, Cracker Anastasia Nikolaevna 1. Doctor of Economic Sciences, Associate Professor of the Department of Accounting, Analysis and Audit, Orenburg State University, Orenburg 2. The graduate student of the Department of accounting, analysis and audit, Orenburg State University

Abstract: The need to prepare an accounting statement arises often. The legislation does not contain information about exactly how it should look. The only mention that such a primary document exists is contained in Article 313 of the Tax Code of the Russian Federation. The article says that the accounting certificate confirms the tax accounting data. When drawing up a certificate, the accountant must indicate in it all the required details of the primary document. It is more convenient to develop the certificate form once and attach it to the accounting policy. Abstract: The need to make accounting certificate occurs frequently. Information on how exactly it should look like, the legislation. The only mention of the fact that such original document exists, found in article 313 of the RF Tax code. The article says that the financial information confirms the data of tax accounting. Ac-counting help the accountant should specify any mandatory requirements for the primary document. It is more convenient to develop a form of help once and apply it to the accounting policy.

Key words: Accounting statement, details, excerpt from court decisions. Keywords: Accounting help, Bank details, an extract from the court's decisions.

In practice, the need to prepare an accounting certificate arises for an accountant quite often. Timely and correct preparation of this document will allow the organization to avoid many disagreements, for example during a tax audit.

An accounting certificate is an internal document of an organization, which is useful not only during a tax or audit, but is also necessary for the accountant himself. The fact is that often an accountant, returning to previous reporting or tax periods, does not remember the nuances, as well as the reasons for reflecting a particular transaction due to the large volume of information.

General procedure for issuing an accountant's certificate.

The form of the accounting certificate is developed by the organization independently, since its unified form is not approved by law. The exception is budgetary organizations. An accounting certificate with code 0504835 was approved for them (Appendix No. 2 to Order of the Ministry of Finance of Russia dated December 15, 2010 No. 173) [2].

At the same time, an accounting certificate based on Article 313 of the Tax Code of the Russian Federation is the primary document confirming tax accounting data. This refers to information that is taken into account in development tables and other taxpayer documents that group information about taxable objects (Article 314 of the Tax Code of the Russian Federation). In this regard, the rules established by Federal Law dated December 6, 2011 No. 402-FZ “On Accounting” must be applied to the preparation of this certificate. Thus, the accounting certificate must necessarily indicate the following details, the list of which is given in paragraph 2 of Article 9 [5]:

- name of the document (accounting certificate or accounting certificate-calculation);

- name of company;

- Date of preparation;

- Contents of operation;

- operation meters;

- the names of the positions of the persons responsible for the execution and correctness of the transaction;

- personal signatures of the above persons.

The organization must approve the developed form of the certificate in its accounting policy (clause 4 of PBU 1/2008 approved by Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n). In this case, the document must correspond to the operations for which it will be used (corrections and calculations). It may be convenient to develop your own form for certain situations. For example, an accountant can develop special tables to reflect various arithmetic calculations.

When filling out an accounting certificate, it is necessary to indicate in as much detail as possible information about the situation in connection with which it is being compiled. After all, certificates are taken into account even by the Arbitration Courts (Resolution of the Federal Antimonopoly Service of the Urals dated 09/07/2009 No. Ф09-6676/09-С3 and Central dated 09/07/09 No. Ф09-6676/09-С3 and Central dated 01/21/09 No. А48-1610/08 -8 districts).

The prepared certificate is signed by the chief accountant, as well as by the person who is responsible for its contents and the execution of the transactions in respect of which it was drawn up. Then it is filed in a separate folder “accounting statements”, and a copy of it is added to the documents that it explains, including updated reporting.

Many accountants cannot imagine their work without preparing accounting certificates: any explanations, explanations, calculations are presented in the form of documents called “Accounting certificate”. Some accountants, on the contrary, rarely use this document and do not believe that it can be the same evidentiary document as the primary ones.

According to paragraph 1 of Art. 9 of the Federal Law “On Accounting”, each fact of economic life is subject to registration as a primary accounting document. An accounting certificate containing all the details necessary from the point of view of the Federal Law “On Accounting” can be classified as primary documents, despite the fact that it is not directly named in it. The certificate form should be approved by order of the manager as the primary document used (clause 4 of PBU 1/2008) [3].

It is necessary to pay attention to Information of the Ministry of Finance of Russia No. PZ-11/2013 “Organization and implementation by an economic entity of internal control of the facts of economic life, accounting and preparation of accounting (financial) statements.” It gives recommendations on the organization of internal control at enterprises on the basis of Article 19 of the Federal Law “On Accounting”, where the accounting certificate is indicated as a primary accounting document that can be used to make entries in accounting registers [4].

In accounting, a certificate is used to justify the calculation of exchange rate differences, calculations of interest on loans and borrowings, temporary disability benefits, dividends, in this case it is already called an accounting certificate-calculation, as well as in cases where it is necessary to provide explanations for individual items of the financial statements . The calculation certificate is actively used in document flow in connection with the calculation and payment of VAT.

The Federal Tax Service of Russia, in a letter dated January 27, 2015 No. ED-4-15/ [email protected] , indicated that instead of an invoice, primary accounting documents (for example, an accounting statement-calculation) containing summary (consolidated) documents can be registered in the sales book. ) data on transactions completed during a calendar month (quarter), if, for example, the buyers are individuals and the supplier does not issue them invoices.

As can be seen from Table 1, not in all cases courts take into account accounting certificates or certificates of calculation. In situations where an organization cannot provide any other primary documents in addition to an accounting certificate, and they should be, based on the actual circumstances of the case, the courts do not consider the accounting certificate to be appropriate evidence. At the same time, in cases where an accounting certificate confirms calculations or is an addition (explanation) to primary documents, the courts regard it as a proper document [6].

Table 1

Excerpts from court decisions on the acceptance of accounting certificates

| Case/ruling number; district | Extract from the court decision / summary |

| Resolution of the Second Arbitration Court of Appeal dated April 28, 2015 No. A17-6201/2014 | An accounting certificate is considered by the court as one of the documents justifying the amount of expenses incurred. |

| Resolution of the Seventeenth Arbitration Court of Appeal dated April 27, 2015 No. A60-38733/2014 | Calculation of deviations attributable to sold products was made in accounting statements based on the calculation tables “Output of finished products at actual cost (including deviations)”, which are primary documents for tax accounting purposes |

| Decision of the Moscow Arbitration Court dated 04/08/15 No. A40-56211/2014 | The accounting certificate (attachment to the sales book) was recognized as adequate evidence of the amount of revenue received from the provision of rights to use computer programs received from individuals |

| Determination of the Arbitration Court of the Krasnodar Territory dated 05.05.15 No. A32-4521/2010 | The court indicated that the accounting certificate is not a universal supporting document. This document does not replace primary documents confirming a business transaction, but is a confirmation of transactions in the event of a need to confirm certain indicators that arose in the process of maintaining accounting and tax records |

| Resolution of the Federal Antimonopoly Service of the West Siberian District dated 02/06/06 No. F04-89/2006 | An accounting certificate signed by the taxpayer's chief accountant cannot be regarded as a document confirming the actual incurrence of expenses by the taxpayer. An accounting certificate is only the result of calculations by the chief accountant of an enterprise, which must also be based on other primary documents confirming the income and expenses of the enterprise (invoices, payment documents evidencing payment for materials, work, services, certificates of work performed) |

We can conclude: the accounting certificate and the calculation certificate are additional, but not the main arguments in court. At the same time, an accounting certificate can serve as evidence or justification for calculations (amounts of restored VAT; standardized expenses; amounts of VAT distributed between types of activities) in cases where it is necessary to draw up an internal document and provide explanations for the actions of the accountant.

We emphasize that an accounting certificate cannot be drawn up to replace a missing primary document or drawn up if the execution of other primary documents is not provided, and business transactions must be justified or confirmed.

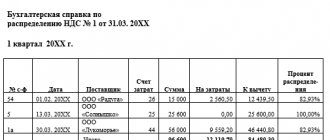

In order to make it easier to verify the correctness of calculation of the financial result from the sale of bakery products, the accountant filled out a certificate (accounting certificate No. 1 is shown in Figure 1).

Figure 1 - Accounting form for a certificate for calculating the financial result from the sale of bakery products

In the certificate, the accountant indicates the details of the primary accounting documents on the basis of which revenue from sales of products is accrued in accounting. At the same time, the actual payment for the products by the buyer is registered in it.

An accounting certificate is prepared when an accounting error needs to be corrected. To correct an accounting error, you need to add or reverse a specific amount. The basis for such posting is precisely the accounting certificate.

When conducting a desk audit of declarations, tax authorities often require that you provide them with an accounting certificate explaining certain indicators. For example, a company wants to reimburse value added tax. In this case, what is needed is not an accounting or tax accounting document, but a detailed explanation of those transactions that caused the tax to be refunded in the declaration. Then the accounting statement must indicate what transactions were carried out and what amounts were reflected. Attach copies of supporting primary documents to the certificate. In this case, the accounting certificate is an explanatory note to the tax return. An accounting certificate is also prepared when they want to submit an adjusting return. In this case, the document indicates for what reason and in which lines adjustments are made to the reporting [1].

Based on the above, we draw the following conclusions:

Firstly, an accounting certificate or an accounting certificate-calculation in the presence of the mandatory details given in Art. 9 of the Federal Law “On Accounting” can be classified as primary documents and used in document flow.

Secondly, certificates and certificates-calculations can be used in tax accounting on the basis of Art. 313 Tax Code of the Russian Federation.

Thirdly, an accounting certificate or a calculation certificate can be issued when no other primary document is provided to record a fact of economic life, or when the primary document needs to be supplemented with a calculation or explanation.

Fourthly, an accounting certificate or a calculation certificate are documents that are drawn up and signed by one person - an accountant. If, in order to record some business facts, it is necessary to draw up a document that must be signed by several persons, such a document cannot be replaced with an accounting certificate. As a rule, such documents may be called “act”, “inspection act”, “acceptance act”.

Bibliography

1 Lavrova G. Visual examples of accounting statements for all occasions // Glavbukh. − 2010. – No. 7. − P. 17-22. 2 Panina P. G. Accounting certificate: how to prepare it correctly to reduce the risk of tax claims // Russian Tax Courier. – 2012. – No. 1/2. − P. 108-114. 3 Dubyanskaya E. N. Accounting certificate: preparation and content // Accounting. − No. 8. − P. 34-39. 4 About accounting: federal. Law of December 6, 2011 No. 402-FZ // Collection of legislation of the Russian Federation. − 2011. − No. 50. − P. 7344. 5 Tax Code of the Russian Federation: part two / Reference and legal system “Consultant Plus”. − Access mode: https://www.consultant.ru/document/cons_doc_LAW_28165/ 6 Bank of decisions of arbitration courts / Federal Arbitration Courts of the Russian Federation. − Access mode: https://ras.arbitr.ru/

Certificate of write-off of the “creditor”

Overdue accounts payable, for which the time for filing a claim has passed, the enterprise is obliged to include in non-operating income. This is how clause 18 of Art. 250 Tax Code of the Russian Federation. Usually this is done during an inventory and is accompanied by the preparation of an accounting certificate for writing off accounts payable . It should include:

- full information about the debt (contract number, links to the “primary”, etc.);

- calculation of the limitation period.

EXAMPLE At Guru LLC, on March 30, 2021, an inventory of settlements with counterparties was carried out, as a result of which an accounts payable to Septima LLC was identified in the amount of RUB 143,000. The statute of limitations on it expired on March 13, 2017.

Here is an example of how to write an accounting statement for this situation:

| LLC "Guru" ACCOUNTING REPORT No. 24 DATED 03/30/2017 ON THE WRITTEN OF ACCOUNTS PAYABLE As a result of the inventory of settlements with counterparties on March 30, 2021, accounts payable to the limited liability company "Septima" were identified (TIN 7722123456, KPP 772201001, address : Moscow , Shosseynaya St., 7, building 9), for which the statute of limitations has expired (Act of Inventory of Settlements with Buyers, Suppliers, Other Debtors and Creditors dated March 30, 2017 No. 2-inv). This debt arose under the contract for the supply of goods dated April 25, 2014 No. 63-p. Clause 3.8 of the said agreement establishes the payment deadline - until March 15, 2014 (inclusive). The amount of debt for goods supplied is 145,000 rubles, including VAT - 26,100 rubles. The statute of limitations expires on March 13, 2017. Thus, accounts payable in the amount of 145,000 rubles are subject to inclusion in non-operating income for income tax for the first quarter of 2021 on the basis of paragraph 18 of Article 250 of the Tax Code of the Russian Federation and write-off in accounting. Chief accountant_____________Shirokova____________/E.A. Shirokova/ |

Remember: the accountant must correctly determine the statute of limitations, as this affects the result of calculating income tax. To avoid mistakes, refer to Articles 196, 200 and 203 of the Civil Code.

The procedure for using accounting certificates in accounting and tax accounting

Corrections are made to accounting due to identified errors or inaccuracies. The procedure for making corrections in accounting is now enshrined in the Accounting Regulations “Correcting Errors in Accounting and Reporting” (PBU 22/2010), approved by Order of the Ministry of Finance of Russia dated June 28, 2010 No. 63n, and varies depending on the significance of the error.

An error is considered significant if it, individually or in combination with other errors for the same reporting period, can affect the economic decisions of users made on the basis of the financial statements compiled for this reporting period. The organization determines the materiality of the error independently, based on both the size and nature of the relevant item(s) of the financial statements.

Minor errors are corrected in the following order:

- identified before the end of the reporting year - by entries in the relevant accounting accounts in the month of the reporting year in which the error was identified (clause 5 of PBU 22/2010);

- identified after the end of the reporting year, but before the date of signing the financial statements for this year - by entries in the corresponding accounting accounts for December of the reporting year (the year for which the annual financial statements are prepared) (clause 6 of PBU 22/2010).

An error of the previous reporting year, which is not significant, discovered after the date of signing the financial statements for this year, is corrected by entries in the corresponding accounting accounts in the month of the reporting year in which the error was identified. Profit or loss arising as a result of correcting this error is reflected as part of other income or expenses of the current reporting period (clause 14 of PBU 2/2010).

Significant errors are corrected in the following order:

- identified before the end of the reporting year - by entries in the relevant accounting accounts in the month of the reporting year in which the error was identified (clause 5 of PBU 22/2010);

- identified after the end of the reporting year, but before the date of signing the financial statements for this year - by entries in the relevant accounting accounts for December of the reporting year (the year for which the annual financial statements are prepared) (clause 6 of PBU 22/2010);

- identified after the signing of the annual reporting, but before its submission to the shareholders of the joint-stock company or participants of the limited liability company, bodies exercising the rights of the owner, and other authorized bodies, is corrected by entries in the relevant accounting accounts for December of the reporting year (the year for which the annual accounting report is compiled reporting (clause 7 of PBU 22/2010);

- identified after the signing and submission of the annual reporting to shareholders of a joint-stock company or participants of a limited liability company, bodies exercising the rights of the owner, and other authorized bodies, but before the date of its approval by the owners, is corrected by entries in the relevant accounting accounts for December of the reporting year (year, for which prepares annual financial statements) (clause 8 of PBU 22/2010).

An error discovered after the owners approve the annual statements is corrected by entries in the relevant accounting accounts in the period of its discovery (in the current reporting period). In this case, the corresponding account in the records is the account for retained earnings (uncovered loss).

The Accounting Law stipulates that correction of an error in the accounting register must be justified and confirmed by the signature of the person who made the correction, indicating the date of the correction. Therefore, in order to comply with this legal requirement, the accountant needs to draw up a document on the basis of which the identified error will be corrected.

Such a document can be an accounting certificate, in which the accountant can indicate the reasons why the error occurred, explain the meaning of corrections and changes made to the accounting, and indicate the correspondence of accounts and amounts. Based on this document, the accountant makes corrective entries to the accounting accounts with the current date indicated in the certificate.

There are two main ways to make corrections. If the cost indicators of a transaction need to be increased due to an identified distortion, and the amount of the initial entry is erroneously indicated, and not the accounting entry itself, the method of additional entries is used.

The correction is made by making an additional entry with the same account correspondence for the amount of the difference between the correct transaction amount and the amount reflected in the previous entry.

If the amount is overestimated or incorrect invoice correspondence is used for correction, the “red reversal” method is used.

Errors discovered in accounting and reporting usually affect taxation. Tax reporting is adjusted differently than accounting reporting. Unlike accounting, in which an error is corrected during the period of its discovery, in tax accounting it is necessary to correct the period in which the error occurred (Articles 54, 81 of the Tax Code of the Russian Federation). Correcting an error in tax reporting in the period in which it was discovered is allowed only in cases where it is impossible to determine the period of the error, and since 2010 also in the case when, due to an error, the tax base was overstated and the errors, in fact, led to overpayment of taxes.

If an error is discovered in tax calculations, you must submit an updated return for the period in which the error was made. The updated tax return (calculation) is submitted to the tax authority in the form that was in force during the tax period for which the corresponding changes are made. In addition, you may need to pay tax if an additional tax liability arises after the changes were made.

If an organization identifies an error that affects the calculation of VAT, in addition to drawing up an updated declaration, as a rule, there is a need to make corrections to the purchase book or sales book, for which additional sheets of the purchase book or sales book are drawn up in accordance with the Rules for maintaining logs of received and issued invoices, purchase books and sales books when calculating value added tax, approved by Decree of the Government of the Russian Federation dated December 2, 2000 No. 914. The number of additional sheets that can be attached to the sales book or purchase book for one tax period, the same as and the number of updated declarations is not limited.

Accounting certificate of debt for the court: sample

This document can be drawn up in a very general form with references to background data that the form wants to prove in court. It is not at all necessary to refer in the certificate to the fact that it is issued specifically for judicial purposes.

The following is a sample of writing an accounting statement about a “receivable”, which often has to be “knocked out” from the counterparty through the court.

| LIMITED LIABILITY COMPANY "GURU" Address: 105318, Moscow, st. Gogolya, 8, office 15. TIN 7722123456, KPP 772201001 Moscow February 06, 2021 Accounting statement No. 3-s As a result of the inventory of settlements with counterparties on February 06, 2021, receivables from Buben LLC were identified (TIN 7719456789, KPP 771901001, address: Moscow, Kvasovaya St., 9, building 6), for which the statute of limitations has not expired (inventory act dated 02/06/2017 No. 22-inv). This debt arose under the goods supply agreement No. 12/7 dated October 22, 2016. The amount of debt is 500,000 (five hundred thousand) rubles 00 kopecks. The payment deadline under the agreement is December 31, 2016 (inclusive). General Director ______________ /V.V. Krasnov/ Chief Accountant ______________ /E.A. Shirokova/ |