Transport costs in the estimate documentation

Transportation costs are the costs associated with delivering construction materials and equipment and other resources to the place where they are used.

Transport costs are taken into account in the price of construction resources as additional costs and have a clearly regulated amount in percentage terms. Transportation costs in the estimate are, in fact, an addition to the net selling price of materials and equipment from the manufacturer or supplier, without, of course, taking into account other expenses (such as the profit of the sales organization).

The percentage of transportation costs for materials in the estimate, or rather its value, is a very important issue that is often missed when calculating the total cost of construction and installation work, which leads to errors in estimate calculations.

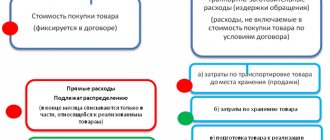

Transportation costs in estimating are often combined with other costs closely related to the delivery of materials. Such a combined group of expenses is usually called procurement, storage and transportation costs in estimates (or in other words, procurement, storage and transportation). This includes the following costs:

- — cost of containers, packaging and props;

- — cost of loading and unloading operations;

- — the cost of transporting goods.

When using materials, products, structures and equipment in estimates based on collections of estimated prices for construction resources, transportation costs are already taken into account in their cost. They are determined on the basis of average statistical data. In turn, when using at actual cost (according to price lists, supplier prices, invoices, invoices), transportation costs must be taken into account additionally, since often these costs are not included in the cost of materials, but are accepted separately at actual costs.

As mentioned above, there are average statistical data on the cost of transport costs in relation to the cost of building materials, equipment, etc. Therefore, when drawing up estimate documentation, it is customary to use fixed price premiums established by standards to resources accepted at actual cost (price lists, invoices - invoices, etc.). Thus, this makes it possible to simplify the calculation of the transport component and strictly regulate the upper thresholds of such surcharges. Let's look at these fixed limits and how they are determined for transportation cost elements.

Calculation of transportation costs when purchasing materials

From 01/01/2021, inventory accounting is regulated by the new FSBU 5/2019. Find out how significant changes the standard has made to inventory accounting in the Review from ConsultantPlus. If you do not already have access to this legal system, a full access trial is available for free.

There are several ways to reflect delivery and procurement costs (DPP) associated with the purchase of materials:

- using account 15 “Procurement and acquisition of materials”;

- using a separate sub-account on account 10 “Materials” to reflect TZR,

- direct inclusion of fuel and equipment in the actual cost of materials.

In the first two methods, TRs are distributed. In the 1st case, the difference between the accounting and actual prices or the amount of TZR is reflected in account 16 “Deviation in the cost of material assets.” In the 2nd case, the amount of TZR will be distributed from a separate subaccount of account 10.

Deviations or TZR are written off using the formulas:

K = (Off0 + Off1) / (M0 + M1) × 100,

Where:

K - percentage of deviation write-off;

Off0 - the balance of the deviation amount or TZR at the beginning of the month;

Off1 - the amount of deviation or TZR for the month;

M0 - balance of materials at the beginning of the month at book value;

M1 - the amount of materials received for the month at book value.

Off2 = K × M2,

Where:

Off2 - the amount of deviations or technical requirements written off to costs;

M2 - the amount of materials at the accounting price, written off as costs.

Example

Nika LLC is a manufacturing company. As of August 1, the balance of materials in the organization is 400,000 rubles, the balance of the amount of deviations is 25,000 rubles. In August, materials were purchased in the amount of 350,000 rubles. (1000 units), and 1,800 units were written off as production costs. The corresponding TR for August amounted to RUB 75,000. The indicated amounts do not include VAT. The accounting cost of a unit of material is 390 rubles. According to the accounting policy, TRs are included in deviations.

| Dt | CT | Amount, rub. | Description |

| 15 | 60 | 350 000 | The purchase price of materials is reflected in accordance with primary documents from the supplier |

| 15 | 60 | 75 000 | TR reflected |

| 10 | 15 | 390 000 | Materials were capitalized at the accounting price |

| 16 | 15 | 35 000 (350 000 + 75 000 – 390 000) | The excess of the actual value over the accounting value at the end of the month is written off |

| 20 | 10 | 702 000 (1 800 000 × 0,39) | Materials written off for production at book price |

K = (25,000 + 35,000) / (400,000 + 390,000) × 100 = 7.6%

Amount of deviations written off to costs:

Off2 = 7.6% × 702,000 = RUB 53,352.

| Dt | CT | Amount, thousand rubles | Description |

| 20 | 16 | 53 350 | Deviations for materials transferred to production were written off |

Read about materials accounting in the article “Accounting entries for materials accounting.”

The cost of containers, packaging, props in the estimate.

Containers, packaging and props are one of the most important components, and they are necessary to protect material assets from damage during transportation and movement, and naturally they are included in the cost of estimates.

So, according to clause 4.57 of MDS 81-35.2004, if materials, equipment, products, structures are used according to collections of estimated prices (FSSC, construction price), the cost of containers and packaging, props is already taken into account in the cost. But if the actual cost and the cost of the goods do not take into account the costs of containers and packaging, then they must be taken into account additionally in the estimate calculations. Usually, in addition to the cost of the goods, the supplier writes down the cost of packaging and containers on a separate line in the invoice or commercial proposal, but more often this is forgotten and the estimator has to separately calculate these prices. Clause 4.58 helps him with this. all the same document MDS 81-35.2004. Where it is said that in the absence of detailed information about the characteristics of containers and packaging, the cost can be calculated as a percentage of the cost of materials and equipment, namely:

- — large technological equipment – from 0.1% to 0.5%;

- — machine equipment – up to 1%;

- - electrical equipment, instrumentation and automation, tools - up to 1.5%.

The cost of loading and unloading operations in the estimate documentation

Loading and unloading work is work associated with loading into transport and unloading from transport materials, products, structures, which are carried out during the delivery of these resources to a construction site.

Loading and unloading operations can be carried out using different methods:

- 1) Manually;

- 2) Using available means - winches, rigging devices, jacks, hoists;

- 3) Using large equipment - cranes, loaders, excavators, conveyors, etc.

The cost of these works, if it is not included in the price of the goods, can be applied according to collections of estimated prices for loading and unloading operations (FSTSpg), taking into account the categories of materials, products, structures, equipment and depending on the method of loading and unloading. The cost of work on these collections is calculated in tons. These collections contain a very large list of such works.

In the absence of any work in these collections, and also by agreement with the construction customer, the actual cost of mechanisms and machinery can be applied, taking into account the time spent on work. The actual cost is determined based on the preparation of a separate calculation for these works according to the current price tags of organizations and price lists. Unlike the size of transportation costs for materials in the estimate, loading and unloading operations do not have a fixed percentage in relation to the cost of building materials and equipment.

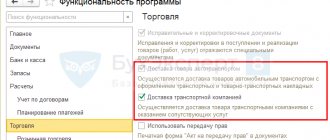

The cost of freight transportation in the estimate

When drawing up estimates for construction and installation work financed from the federal or municipal budget, collections of estimated prices for the transportation of goods by road are required. These collections were developed in databases based on the price level for 2001 (FER, TER, etc.) and are translated into the current level through indexation.

However, in the calculations between the Customer and the Contractor, the actual costs of transporting goods at current market prices in a particular region can be used, but this is only possible if there is no competitive type of transportation in the price collections or this type of work is financed from a non-state budget. In these cases, a calculation is also drawn up justifying the actual transportation costs.

The procedure for calculating estimated prices for the transportation of goods by road in 2021 is determined by Order of the Ministry of Construction of Russia No. 517/pr dated September 4, 2019 “On approval of Methodological Recommendations for determining estimated prices for materials, products, structures, equipment and prices of services for the transportation of goods for construction » section 3.

This order explains in detail how to correctly and accurately calculate the cost of transporting goods by road, depending on the class of cargo, types of vehicles, transportation distance and types of roads along which transportation is carried out.

Preparation of estimates in prices: FER, TER, TSN, NCS

Transportation expenses (costs) are one of the most important cost items in the accounting of any construction company, therefore it is necessary not only to determine, but also to be able to justify them in documents or normatively in estimates.

Understanding that these expenses take into account all the costs of the transport organization associated with organizing the delivery of cargo from the manufacturer (supplier) to the final buyer (developer), the documents confirming these expenses are very diverse - both in form and in design features. In order to justify transportation costs in estimates, you need to know the following:

- Distance of cargo transportation from the manufacturer's warehouse to the on-site warehouse;

- The method of accounting for the cost of cargo in the estimate according to the regulatory estimate base and in the current price level;

- Type of freight transport (road, rail, sea, air, etc.);

- Type of cargo (equipment, material, bulk cargo, volumetric structure, garbage, etc.);

- Cargo weight, separately broken down into classes.

1. Distance of cargo transportation from the manufacturer’s warehouse to the on-site warehouse

First of all, it is necessary to understand the term “ free ” price; it means up to what point the cost of the product takes into account its delivery. Price examples:

- “ ex-manufacturer or warehouse ” - the buyer receives the goods directly at the supplier’s factory or warehouse;

- “ free - wagon or free - railway station of departure” - the buyer receives the goods at the station of departure, loaded into the wagon;

- “ free - port of departure or free - along the side of the ship ” - the buyer receives the goods at the port of departure, unloaded at the berth in front of the ship;

- " free ship - port of destination " - the buyer receives the goods at the port of destination;

- “ free ship - port of destination and insurance ” - the buyer receives the goods at the port of destination, including insurance against the risk of loss or damage during transportation;

- “ free – consumer warehouse or on-site warehouse ” - the buyer receives the goods at his warehouse (on-site).

! Note: all costs for the delivery of materials (equipment) to the on-site warehouse are charged accordingly to the cost of materials (equipment).

As a rule, estimates take into account the distance of transportation by road up to 200 kilometers; if more, then it is advisable to use rail transport. It is possible to take into account road transportation over 200 kilometers in estimates upon agreement with the customer, for example, in the absence of a railway.

! Important. When determining the distance for transporting goods beyond 0.5 kilometers, the distance is not taken into account, and a distance of 0.5 kilometers or more is considered as a full kilometer (this explanation is contained in the technical parts of the relevant collections of estimated prices for the transportation of goods).

2. Method of accounting for the cost of cargo in the estimate according to the regulatory estimate base and in the current price level

Depending on the method of accounting for the cost in the estimate according to the normative estimate base or in the current level of cargo prices, the method of accounting for the costs of their delivery to the on-site warehouse depends.

The cost of equipment is usually taken into account at the current price level, according to current price lists or commercial offers from suppliers or using open sources (web pages). According to the current methodology for determining the cost on the territory of the Russian Federation, the limit on transport costs for equipment is up to 6% from the price “ex-manufacturer or warehouse” to “ex-consumer warehouse or on-site warehouse”.

Transport costs of material resources depend on the method of accounting for their cost in the estimate:

1. When determining the cost of material resources according to collections of estimated prices , you need to keep in mind that these standards already take into account the transportation of goods to the on-site warehouse. And the cost of delivery from the on-site warehouse to the work area is taken into account as part of the elemental estimate standards (prices) for construction and installation work, as well as as part of the resource estimate standards.

- For example:

- The estimated standards of TSNB (the cost of material resources used in the construction of the Moscow region) take into account transport costs over a distance of up to 30 kilometers (see clause 3 of the technical part of TSSC 81-01-2001).

- Estimated standards of the FSSC (Federal estimated prices for materials, products, structures and equipment used in construction) transport costs are taken from the condition of transporting goods by road over a distance of up to 30 kilometers , taking into account the gross weight (see clause 4 of the technical part).

If it is necessary to deliver material resources over distances of more than 30 kilometers, the difference should be taken into account minus the distance taken into account by the estimated standard and then, using the estimated standards for the transportation of goods according to the distance obtained, determine transport costs.

Calculation example: the distance from the supplier’s warehouse to the on-site warehouse is 65 km, which means that additional delivery of materials should be taken into account for 65 – 30 = 35 kilometers.

! Important. When developing a transport scheme, it is necessary to coordinate it in advance with the customer, taking into account the most economical and expedient schemes (routes) for supplying the facility under construction with equipment and materials, taking into account the class of cargo (information below in the text). This diagram indicates not only the location of the supplier (seller, manufacturer), but also the transportation distance.

2. When determining the cost of material resources at the current price level , according to current price lists or commercial offers from suppliers or using open sources (Internet pages), then in this case the prices provide for the actual distance of cargo transportation.

! Important. It should be borne in mind that suppliers (sellers) sometimes already include the costs of their delivery into the cost of materials, in this case, to avoid doubling the cost, pay attention to this!

3. Type of freight transport (road, rail, sea, air, etc.)

Estimated standards used and approved in the Russian Federation usually include estimated prices (rates) for the transportation of goods by frequently used road transport and are accepted in estimate calculations depending on the type of road transport, class of cargo and transportation distance.

The costs of transporting goods by other modes of transport (railway, river, sea, air, etc.) are taken into account on the basis of a separate calculation according to the translator's tariffs. This delivery scheme must be justified by the construction organization project (COP) or agreed upon by the customer.

! Important. Particular attention should be paid to this “free” delivery, since it may often be necessary to additionally take into account the costs of loading and unloading operations or additional transport.

4 Type of cargo (equipment, material, bulk, volumetric structure, garbage, etc.)

Let's consider the most common transport - road transportation, taken into account according to the relevant regulatory collections included in the federal register of estimated prices.

Depending on the type and weight of the cargo, the appropriate prices are selected:

- for transportation of equipment and materials, prices for transportation by flatbed vehicle are accepted;

- for the transportation of bulk cargo (sand, crushed stone, ASG, soil, etc.), as well as construction waste, prices for transportation by dump trucks are accepted;

! Important. Prices for the transportation of bulk materials from a quarry are accepted when the condition for ensuring the completion of loading and unloading operations is met within the time limit established for dump trucks operating in quarries , which is 0.2 minutes per ton of cargo (this loading time can be provided by loading mechanisms with a large capacity bucket). In other cases, prices for the transportation of bulk materials by dump trucks operating outside quarries .

- for transportation of volumetric structures (construction machines), it is possible to use prices for transportation by an on-board vehicle, but additional costs should be taken into account for an escort vehicle for the state automobile inspection at state approved tariffs;

5 Cargo weight, separately broken down into classes

The transportation of material resources in the estimates should be taken into account at the appropriate prices when determining transport costs (costs), which we have already discussed above; the weight of the transported cargo in tons should be indicated as the volume.

Determining the weight of various building materials is a very troublesome process since you should use technical information about the weight of 1 m2, the weight of 1 m3 of a structure, the density of materials, thickness, etc.

Density of building materials according to SNiP II-3-79:

Material | Density, kg/m3 | |

Concrete | Reinforced concrete | 2500 |

Concrete on gravel or crushed stone from natural stone | 2400 | |

Tufobeton | 120-1600* | |

Pumice concrete | 800-1600* | |

Concrete on volcanic slag | 800-1600* | |

Expanded clay concrete on expanded clay sand and expanded clay foam concrete | 500-1800* | |

Expanded clay concrete on quartz sand with porosity | 800-1200* | |

Expanded clay concrete on perlite sand | 800-1000* | |

Shungizite concrete | 100-1400* | |

Perlite concrete | 600-1200* | |

Slag pumice concrete (thermosite concrete) | 1000-1800* | |

Slag pumice foam and slag pumice gas concrete | 800-1600* | |

Concrete based on granulated blast furnace slag | 1200-1800* | |

Aggloporite concrete on fuel (boiler) slags | 1000-1800* | |

Concrete on ash gravel | 1000-1400* | |

Vermiculite concrete | 300-800* | |

Gas and foam concrete gas and foam silicate | 300-1000* | |

Gas and foam ash concrete | 800-1200* | |

Solutions | Cement-sand | 1800 |

Complex (sand, lime, cement) | 1700 | |

Lime-sandy | 1600 | |

Cement-slag | 1400 | |

Cement-perlite | 1000 | |

Gypsum perlite | 600 | |

Porous gypsum perlite | 500 | |

Gypsum slabs | 1000-1200* | |

Gypsum cladding sheets (dry plaster) | 800 | |

Brickwork | Ordinary clay (GOST 530-80) on cement-sand mortar | 1800 |

Ordinary clay with cement-slag mortar | 1700 | |

Ordinary clay with cement-perlite mortar | 1600 | |

Silicate (GOST 379-79) on cement-sand mortar | 1800 | |

Trepelny (GOST 648-73) on cement-sand mortar | 1200 | |

Slag on cement-sand mortar | 1500 | |

Ceramic with a density of 1400 kg/m3 (gross) on cement-sand mortar | 1600 | |

Ceramic hollow core with a density of 1300 kg/m3 (gross) in cement-sand mortar | 1400 | |

Ceramic hollow core with a density of 1000 kg/m3 (gross) in cement-sand mortar | 1200 | |

Silicate eleven-hollow cement-sand mortar | 1500 | |

Silicate fourteen-hollow cement-sand mortar | 1400 | |

Stone | Granite, gneiss and basalt | 2800 |

Marble | 2800 | |

Limestone | 1400-2000 | |

Tuff | 1000-2000 | |

Tree, etc.naturalmaterials | Pine and spruce | 500 |

Oak | 700 | |

Glued plywood (GOST 3916-69) | 600 | |

Cardboard facing | 1000 | |

Multilayer construction cardboard (GOST 4408-75*) | 650 | |

Wood fiber and particle boards (GOST 4598-74*, GOST 10632-77*) | 200-1000* | |

Fiberboard slabs (GOST 8928-81) and wood concrete (GOST 19222-84) on Portland cement | 300-800* | |

Reed slabs | 200-300* | |

Peat thermal insulation slabs (GOST 4861-74) | 200-300 | |

Tow | 150 | |

Thermal insulation | Mineral wool mats stitched (GOST 21880-76) and with a synthetic binder (GOST 9573-82) | 50-125* |

Soft, semi-rigid and hard mineral wool slabs with synthetic and bitumen binders (GOST 9573-82, GOST 10140-80, GOST 12394-66) | 50-350* | |

Mineral wool slabs of increased rigidity with an organophosphate binder (TU 21-RSFSR-37276) | 200 | |

Semi-rigid mineral wool slabs with a starch binder (TU 400-1-61-74 of the Moscow City Executive Committee) | 200 | |

Plates made of glass staple fiber with a synthetic binder (GOST 10499-78) | 50 | |

Stitched glass fiber mats and strips (TU 21-237275) | 150 | |

Expanded polystyrene (TU 6-05-117878) | 100-150* | |

Expanded polystyrene (GOST 15588-70*) | 40 | |

Foam plastic PVC-1 (TU 6-05-117975) and PV-1 (TU 6-05-1158-78) | 100-125* | |

Polyurethane foam (TU V-56-70, TU 67-98-75, TU 67-87-75) | 40-80* | |

Resol-formaldehyde foam boards (GOST 20916-75) | 40-100* | |

Perlite plastic concrete (TU 480-114574) | 100-200* | |

Backfills | Expanded clay gravel (GOST 9759-83) | 200-800 |

Shungizite gravel (GOST 19345-83) | 400-800 | |

Crushed stone from blast furnace slag (GOST 557876), slag pumice (GOST 9760-75) and agloporite (GOST 11991-83) | 400-800 | |

Crushed stone and sand from expanded perlite (GOST 10832-83) | 200-600 | |

Expanded vermiculite (GOST 12865-67) | 100-200* | |

Sand for construction work (GOST 8736-77*) | 1600 | |

Other | Foam glass or gas glass (TU 21BSSR8673) | 200-400* |

Flat asbestos-cement sheets (GOST 18124-75*) | 1600-1800* | |

Petroleum bitumens for construction and roofing (GOST 6617-76*, GOST 9548-74*) | 100-1400* | |

Asphalt concrete (GOST 9128-84) | 2100 | |

Products made of expanded perlite with a bitumen binder (GOST 16136-80) | 300-400 | |

Ruberoid (GOST 10923-82), glassine (GOST 2697-83), roofing felt (GOST 10999-76*) | 600 | |

Polyvinyl chloride multilayer linoleum (GOST 14632-79) | 1600-1800 | |

Polyvinyl chloride linoleum on a fabric base (GOST 7251-77) | 1400-1800 | |

Reinforcing rod steel (GOST 10884-81) | 7850 | |

Cast iron | 7200 | |

Aluminum (GOST 22233-83) | 2600 | |

Copper (GOST 859-78*) | 8500 | |

Window glass (GOST 111-78) | 2500 | |

The main criterion for assigning a particular cargo to a certain class (from I to IV) is the load capacity utilization factor. This value shows the ratio of the actual weight of the transported luggage to the rated load capacity of the machine. Below is the table

| Class | Coefficient |

| I | 1 |

| II | 0,71 — 0,99 |

| III | 0,51 — 0,70 |

| IV | 0,41 — 0,50 |

Estimated standards for road transport by flatbed vehicles or dump trucks are applied depending on the classes of goods transported, which are determined by the nomenclature and classification below

| Shipping Name | Cargo class |

| A | |

| Lamp shades in boxes | 4 |

| Vending machines (for selling water, pencils, newspapers, cologne, oil, matches, milk, etc.) | 2 |

| Children's pedal cars | 3 |

| Agloporite | 4 |

| Electric batteries | 1 |

| Apatity | 1 |

| Autogenous welding, vulcanizing, gas, galvanoplastic devices | 2 |

| Diving, control, cinematic, location, medical, optical, telegraph, telephone, physical, photographic, surgical equipment and their parts, etc. | 3 |

| Asbestos in pieces and powder in containers | 1 |

| The same, in bulk | 2 |

| Asphalt and asphaltite in slabs and pieces in bulk | 1 |

| Asphalt and liquid asphaltite in barrels | 2 |

| B | |

| Various wooden tanks | 3 |

| Same, metal | 2 |

| Battery tanks | 3 |

| All kinds of steel and reinforced concrete beams | 1 |

| All kinds of gas cylinders | 3 |

| Glass jars (in wooden boxes) | 3 |

| Glass jars (in polyethylene boxes) | 4 |

| Galvanic batteries | 2 |

| Melons (watermelons, melons, pumpkins) in bulk | 2 |

| The same, in boxes, containers | 1 |

| All kinds of linen in drawers | 2 |

| The same, in packs and boxes | 3 |

| Gas stations | 2 |

| Petroleum, coal, shale solid bitumen | 1 |

| The same, liquid (except for those transported in tank trucks) | 3 |

| The same in tank trucks | |

| Wooden door blocks, mezzanine cabinets and gates | 2 |

| Wooden window, balcony and transom blocks | 3 |

| Granite, lime-sand, marble blocks | 1 |

| Ceramic blocks, slag | 2 |

| All kinds of wall and foundation blocks | 1 |

| Borulin | 1 |

| Beans and legumes (beans, peas, lentils, soybeans, etc.) in bags | 1 |

| The same, in bulk | 2 |

| Brizol | 1 |

| Board (processed stone) | 1 |

| Pavement and transfer beams, impregnated and unimpregnated | 1 |

| Channel bars | 1 |

| Stone paving stones | 1 |

| All kinds of paper | 1 |

| Glass bottles and bottles (in wooden boxes) | 3 |

| Glass bottles (in polyethylene boxes) | 4 |

| IN | |

| Felt boots and other felt and felt shoes | 3 |

| Metal baths | 1 |

| The same, earthenware | 2 |

| Jam and jam in barrels, tubs | 1 |

| Cotton wool and batting in bales | 4 |

| The same, in packs | 4 |

| Bicycles | 4 |

| Wheelchairs for disabled people | 3 |

| All kinds of fans | 3 |

| Metal buckets | 3 |

| Vermiculite (mica) | 3 |

| All kinds of ropes | 1 |

| All sorts of scales | 2 |

| Rags (wiping ends, etc.) | 3 |

| Household things | 3 |

| Various wines in barrels, bottles (in wooden boxes) | 1 |

| Various wines in bottles (in polyethylene boxes) | 2 |

| The same in tank trucks | |

| Viniplast sheet | 1 |

| Ordinary water | 1 |

| Vodka, liquor and wine in bottles (in wooden boxes) | 1 |

| Vodka, liqueurs and bottled wine (in polyethylene boxes) | 2 |

| Water and air heaters | 2 |

| Technical felt (asbestos, slag, etc.) in rolls and bales | 2 |

| The same, without packaging | 3 |

| Glass fiber | 3 |

| Artificial and synthetic fiber (anid, lavsan, nitron, nylon, chlorine, etc.) | 3 |

| Vegetable fiber, except flax fiber and cotton fiber | 3 |

| Any hair | 4 |

| Vulcanite sheet and tile | 1 |

| Vulcanite in powder | 2 |

| Switches (carbolite, oil) | 2 |

| Mercury and selenium rectifiers | 2 |

| G | |

| Drywall (earthy gypsum) | 1 |

| Natural and associated gas in cylinders, compressed and liquefied | 2 |

| Newspapers | 1 |

| Gas generators | 2 |

| Haberdashery in boxes | 2 |

| The same, in packs and boxes | 3 |

| Rubber galoshes in boxes | 3 |

| The same, without packaging | 4 |

| Nails | 1 |

| Hydrants and water seals | 1 |

| Construction gypsum in bags and in bulk | 1 |

| Molding gypsum | 2 |

| Various clays | 1 |

| Roofing shingles | 2 |

| Metal rake | 1 |

| Horse drawn rake | 2 |

| Tractor pull rake | 2 |

| Expanded clay gravel | 3 |

| Any gravel except light aggregates | 1 |

| Gramophone records | 2 |

| Granite | 1 |

| Dried mushrooms | 3 |

| Salted mushrooms, marinated in barrels | 1 |

| The same, in glass jars | 2 |

| Any tar | 1 |

| D | |

| All kinds of motors, except electric ones | 2 |

| Electric motors and their parts | 2 |

| Iron doors | 1 |

| Same, wooden | 2 |

| Ceramic parts for sanitary products and fittings | 3 |

| Tar in barrels | 1 |

| Trees, bushes, seedlings | 3 |

| Turf | 1 |

| Natural dolomite | 1 |

| Same, burnt | 2 |

| Wooden houses, standard and non-standard, disassembled | 3 |

| Box and barrel planks | 2 |

| Parquet boards | 1 |

| Window sill boards granite, marble, limestone, mosaic and reinforced concrete | 1 |

| Wooden window sill boards | 3 |

| Roofing and plastering shingles | 3 |

| Firewood of all types of wood | 1 |

| Yeast | 1 |

| AND | |

| All sorts of cruelty | 1 |

| Large domestic animals (horses, cows, oxen, etc.) | 3 |

| The same on cattle trucks | |

| Small domestic animals (sheep, goats, pigs, various poultry, etc.) | 4 |

| The same on cattle trucks | |

| Fats, animal oils, vegetable and mineral oils in boxes and barrels | 1 |

| The same, in bottles, glass jars (boxes, baskets) | 3 |

| The same in tank trucks | |

| Cake | 2 |

| Zhom | 2 |

| Magazines | 1 |

| Z | |

| All kinds of steel blanks | 1 |

| Garden greens in lattices, baskets, boxes | 2 |

| The same, in bulk | 4 |

| All kinds of land | 1 |

| Cereals (grains, seeds) of all kinds, except oats, corn on the cob and oil seeds (peanuts, sunflower, hemp, flax, camelina, etc.) | 1 |

| Wood, peat and other vegetable ash | 2 |

| AND | |

| All kinds of toys and games in boxes | 3 |

| Ground limestone (limestone flour) | 1 |

| Lump quicklime | 1 |

| The same, slaked (fluff) | 2 |

| Abrasive products: bars, heads, grinding arcs, segments, etc.) | 1 |

| Asbestos products | 1 |

| Aluminum products in boxes | 2 |

| The same, without packaging | 3 |

| Rope products | 2 |

| Felt products in bales, boxes and bags | 2 |

| The same, in bulk | 3 |

| Clay and ceramic products in packaging | 2 |

| The same, without packaging | 3 |

| All kinds of wooden products, except those named | 3 |

| Tin products | 3 |

| Cardboard products | 3 |

| Stone products | 1 |

| Leather products, except footwear, clothing and haberdashery in boxes, bales | 1 |

| The same, without packaging | 2 |

| Flour confectionery products (wafers, biscuits, cookies, gingerbread, etc.) in trays, boxes, crates | 4 |

| Confectionery products, except flour, in boxes, barrels | 1 |

| The same, in boxes, cans | 2 |

| Plumbing products | 2 |

| Glass products in boxes | 3 |

| The same, without packaging | 4 |

| Majolica, porcelain, earthenware, crystal products in boxes | 2 |

| The same, without packaging | 3 |

| Fur products, except footwear, clothing and haberdashery | 3 |

| Flour products (pasta, noodles, vermicelli, etc.) | 2 |

| Meat products (cutlets, dumplings, semi-finished products) in boxes, boxes | 3 |

| Fish products (semi-finished products, cooking) | 3 |

| Perfume and cosmetic products | 2 |

| Plastic products in boxes | 2 |

| The same, without packaging | 3 |

| Rubber products, except shoes, in boxes | 2 |

| The same, in bulk | 3 |

| Tobacco products | 3 |

| Knitted products, hosiery | 2 |

| Tulle products | 3 |

| Fiberboard products | 2 |

| Bakery products (rolls, bagels, crackers, etc.) | 4 |

| Art products, plastic souvenirs | 3 |

| Saddlery products in boxes, bales, bales | 2 |

| The same, without packaging | 3 |

| Bristle products in boxes | 2 |

| The same, without packaging | 3 |

| Brush products, except haberdashery, in boxes and bundles | 2 |

| The same, without packaging | 3 |

| Jewelry | 3 |

| Insulators in boxes | 2 |

| The same, in bulk | 1 |

| Molds (metal molds) | 2 |

| All kinds of tiles | 1 |

| All kinds of fish roe | 2 |

| Gardening equipment | 3 |

| Small agricultural implements | 3 |

| Sports equipment in boxes, boxes | 3 |

| Abrasive tool | 1 |

| Musical wind instruments, harmonicas | 3 |

| Electric musical instruments | 3 |

| Tools for mechanics, carpentry | 1 |

| Instruments: astronomical, geodetic, location, mathematical, medical, mechanical, all kinds of scientific, optical, drawing, photographic, surgical, drawing | 3 |

| Motorized construction tools (electric drills, electric hammers, electric wrenches, etc.) | 1 |

| TO | |

| Zucchini in boxes and nets | 3 |

| Cables on wooden reels | 2 |

| Heaters | 2 |

| Various natural stones, including cube stones | 1 |

| Shell and tuff stone | 2 |

| Refrigerating chamber | 2 |

| Inner tubes for automobiles, trolleybuses, motorcycles, bicycles, etc. (new, vulcanized, scrap) | 3 |

| All kinds of ropes | 1 |

| Any cardboard | 2 |

| Fresh potatoes | 1 |

| Steel wire rod | 1 |

| Natural and synthetic rubber | 1 |

| Natural quartz, dusty | 2 |

| Facade facing ceramics | 2 |

| Film strip, film strip | 1 |

| Boilers | 2 |

| Brick, other than porous and hollow | 1 |

| Brick is porous and hollow | 2 |

| Acids in bottles (boxes) | 1 |

| Acids in tank trucks | |

| Any glue | 1 |

| Cement clinker | 1 |

| All sorts of books | 1 |

| Pure wool carpets | 1 |

| Carpets and carpet products, half-wool and made from chemical fibers | 3 |

| Food concentrates in boxes (boxes) | 3 |

| All kinds of leather in boxes and bales | 1 |

| The same, without packaging | 2 |

| Coke and coke are different | 2 |

| Sausages and sausage products | 2 |

| Asbestos brake pads | 2 |

| Water heating columns | 2 |

| Sulfur pyrite | 1 |

| Sidecars for motorcycles | 2 |

| Compound feed | 2 |

| All kinds of compressors | 2 |

| All kinds of canned food in cans (in boxes) | 1 |

| The same, in glass jars (in boxes) | 2 |

| Silkworm cocoons | 4 |

| The bone is different | 3 |

| Capacitors | 2 |

| Reinforced concrete structures | |

| Metal structures | |

| Containers: railway, sea, river, road, empty | |

| Same, loaded | |

| Tannic bark (oak, willow, vine, etc.) | 3 |

| Wooden frames for gates, balconies, windows, etc. | 3 |

| Steam and other closed boilers and their parts | 2 |

| Various coffees | 2 |

| Paints in wooden and metal barrels, plywood drums, flasks | 1 |

| Metal beds | 3 |

| All kinds of cereals | 1 |

| Corn on the cob | 2 |

| Paints in metal cans, plastic containers, wooden boxes, corrugated cardboard boxes) | 3 |

| L | |

| All kinds of varnishes in packaging | 1 |

| Ice natural and artificial | 1 |

| All kinds of steel tape (roll) | 1 |

| Timber (logs, lumber, poles, etc.) | 1 |

| Scaffolding | 1 |

| Tubular inventory scaffolding | 2 |

| Metal stairs | 2 |

| Flax fiber pressed | 2 |

| Same, unpressed | 3 |

| Linoleum | 1 |

| Corrugated and semi-wavy asbestos-cement sheets (slate) | 1 |

| All kinds of steel and cast iron castings (products), including shaped ones | 1 |

| Elevators and lifts with accessories | 3 |

| Scrap of ferrous and non-ferrous metals, except household | 1 |

| Household metal scrap | 3 |

| Metal hatches for various purposes | 1 |

| Chandeliers | 3 |

| M | |

| Magnesite | 2 |

| Tape recorders | 3 |

| Waste paper | 2 |

| Wood pulp | 3 |

| Roofing mastic | 2 |

| Abrasive materials in pieces and grains: boron carbide, green and black silicon carbide, natural corundum, monocorundum, emery, electrocorundum | 1 |

| Insulating materials | 2 |

| Hair, feather, grass, cotton mattresses | 4 |

| Reinforced concrete masts | 1 |

| Writing machines and their parts in packaging | 1 |

| The same, without packaging | 3 |

| Washing machines | 3 |

| Construction machines | 2 |

| All kinds of sewing machines and their parts | 2 |

| Any honey in barrels, tubs | 1 |

| Medicines in glass containers (in boxes), packs, boxes | 2 |

| The same, in bottles (in baskets) | 3 |

| Chalk in pieces | 1 |

| Chalk powder in bulk | 2 |

| Non-ferrous metals in ingots, ingots, blanks, blanks, strip, sheets, wire, rods, strip, rolled products | 1 |

| Furs, all kinds, including artificial fur | 3 |

| Various undressed furs (raw materials) | 2 |

| All kinds of bags | 2 |

| Milk powder | 2 |

| Fresh milk and dairy products in barrels, kegs, bottles (wooden boxes, metal mesh), boxes | 2 |

| Fresh milk and dairy products in bottles, in paper bags (in boxes, plastic nets) | 3 |

| Fresh milk in cans, flasks | 3 |

| The same in tank trucks | |

| Scooters, motorcycles | 4 |

| Carrots in boxes and nets | 3 |

| All kinds of ice cream | 2 |

| Cereal flour and all other technical flours | 1 |

| Various garbage | 1 |

| All kinds of soap | 1 |

| Meat of wild and domestic animals in carcasses (in bulk) | 2 |

| The same in barrels, boxes | 1 |

| Chilled hanging meat (on hooks) | 4 |

| N | |

| Manure | 1 |

| Non-alcoholic drinks (water, kvass, fruit juice, syrup, juices) in bottles (in wooden boxes), barrels | 1 |

| Non-alcoholic drinks (water, kvass, fruit juice, syrup, juices) in bottles (in plastic boxes) | 2 |

| The same in tank trucks | |

| Oil and petroleum products in barrels | 2 |

| The same in tank trucks | |

| Threads in boxes | 1 |

| The same, in skeins, bundles | 2 |

| Nitroenamels and enamels | 2 |

| ABOUT | |

| Fire extinguishers | 3 |

| Wallpapers are different | 1 |

| Trimmings (fabric scraps, leather and rubber ends) in bags and bales | 2 |

| The same, in bulk | 3 |

| All kinds of shoes in boxes, except felt, felt and galoshes | 2 |

| The same, without packaging and in boxes | 3 |

| Oats in bulk | 2 |

| Same thing, in bags | 1 |

| Fresh vegetables, not named in alphabet | 2 |

| Vegetables and fruits, salted and pickled in barrels, kegs | 1 |

| Dried and dried vegetables | 4 |

| All kinds of clothes in packs, boxes | 3 |

| Quilts: quilted, down, feather, etc. | 3 |

| Sawdust and wood shavings in bulk | 4 |

| The same, in bags, bags | 2 |

| Crushed sawdust and metal shavings | 1 |

| Same, aluminum and mixed in boxes | 2 |

| Nuts and acorns | 2 |

| Digested sludge (fertilizers) | 2 |

| Bran and other waste from cereal and mill production | 2 |

| All kinds of food industry waste | 3 |

| Meat waste (veins, intestines, claws, hooves, simple bone, horns, etc.) | 2 |

| P | |

| Pressed tow and hemp | 2 |

| The same, unpressed | 3 |

| Parquet | 1 |

| Syrup | 1 |

| Wood pitch | 1 |

| Petroleum pitch | 1 |

| All kinds of pumice in bulk | 3 |

| Same thing, in bags | 2 |

| Foam glass in tiles | 4 |

| Any sand (mountain, river, etc.) | 1 |

| Roofing glassine | 2 |

| Reinforced concrete window frames | 1 |

| Wooden window frames and frames | 3 |

| Bird feathers in bales and bags | 4 |

| Beer in barrels, bottles (in wooden boxes) | 1 |

| Beer in bottles (in polyethylene boxes) | 2 |

| The same in tank trucks | |

| Polyvinyl chloride sheet plastic compound | 4 |

| Plastics | 2 |

| Reinforced concrete, asbestos-cement, concrete-cement, gypsum, cement slabs | 1 |

| Gypsum fibre, wood fiber and particleboard boards | 2 |

| Marble, granite, stone slabs | 1 |

| Plastic plates for floors and walls | 2 |

| Gas stoves | 4 |

| Joiner's slabs | 1 |

| Reed and hemp slabs and mats | 2 |

| Expanded clay slabs | 3 |

| Expanded clay concrete slabs | 2 |

| Earthenware slabs and tiles | 2 |

| All kinds of carts (carts, chaises, sleighs, carts) | 4 |

| Sunflower (seeds) | 2 |

| Sunflower (heads) | 3 |

| All kinds of steel forgings | 1 |

| Tires for automobiles, buses, bicycles, motorcycles and trolleybuses, new and vulcanized | 3 |

| Andesite, diabase, fireclay powders | 2 |

| Polystyrene | 1 |

| Polyurethane | 1 |

| Magnesite metallurgical powder | 2 |

| Visual educational aids | 3 |

| Various measuring instruments (scales, watches, etc.) and their parts in boxes | 3 |

| The same, without packaging | 4 |

| All kinds of wires | 1 |

| Wire is different | 1 |

| Rolled ferrous metals, not named in the alphabet | 1 |

| Various yarns in bales and boxes | 2 |

| The same on cartridges and spools | 3 |

| Various broken poultry in boxes | 2 |

| Vacuum cleaners | 2 |

| R | |

| Radios and their parts | 3 |

| Vegetable, flower and berry seedlings without packaging | 4 |

| The same, in baskets and trays | 2 |

| Living plants (trees, bushes, seedlings) | 3 |

| Radish in boxes and nets | 3 |

| Raw rubber | 1 |

| Reinforced concrete rails | 1 |

| All kinds of metal rails | 1 |

| Ruberoid | 1 |

| All kinds of ore | 1 |

| Fish and fish products | 1 |

| Dried and dried fish | 2 |

| Live fish in tank trucks | |

| WITH | |

| All kinds of soot | 4 |

| All kinds of seedlings | 3 |

| Beet | 1 |

| Beetroot in boxes and nets | 3 |

| Sugar | 1 |

| Oil seeds (peanuts, sunflower, hemp, flax, camelina, etc.) | 2 |

| Cotton seeds | 2 |

| Compressed hay and straw | 3 |

| The same, unpressed | 4 |

| Sulfur (lumpy, gas, powder) | 1 |

| Metal mesh | 1 |

| Any ready-made silage | 2 |

| All kinds of silage | |

| All kinds of metal brackets, hooks and consoles | 2 |

| All kinds of combustible shale | 1 |

| All kinds of mica in boxes | 1 |

| All kinds of steel ingots | 1 |

| Synthetic resins | 2 |

| Natural resins (wood, coal, peat) | 1 |

| Any alcohol in barrels, bottles (in boxes) | 2 |

| The same in tank trucks | |

| Snow fresh, dry | 3 |

| Packed snow, wet | 2 |

| Matches | 3 |

| Baking and technical soda | 1 |

| Various salts | 1 |

| Rolled steel of all profiles | 1 |

| All sheet steel | 1 |

| All kinds of machines | 2 |

| All kinds of glass (including mirror glass) in boxes | 1 |

| Washing powders and other detergents | 2 |

| Wooden poles, including telegraph poles | 1 |

| Crushed metal shavings | 1 |

| Same, uncrushed | 3 |

| Meat by-products (lungs, kidneys, liver, brains, etc.) | 2 |

| Electric and gas meters | 2 |

| Any cheese | 2 |

| T | |

| Tobacco | 4 |

| Different containers: | |

| roll-and-barrel | 3 |

| wooden boxes | 4 |

| small-piece: | |

| tin cans, cans, flasks | 4 |

| linen, jute, paper bags | 2 |

| Any textolite | 1 |

| Television devices and their parts | 4 |

| Various fabrics (cotton, wool, linen, silk, artificial and synthetic fibers and special ones, leatherette, etc.) in bales, bales, rolls | 1 |

| The same, in pieces | 2 |

| Only everyone | 1 |

| Briquetted peat | 1 |

| Fuel peat and peat dust | 3 |

| Peat for the preparation of peat composts, for bedding, peat composts, peat-mineral-ammonium fertilizers (TMAU) | 2 |

| Floor lamps | |

| Crawler tractors | 2 |

| Transformers | 2 |

| Wheeled tractors | 3 |

| Trepel | 1 |

| Tresta and flax and hemp straw | 4 |

| Steel cables | 1 |

| Rubber and ebonite tubes in boxes | 1 |

| Asbestos-cement pipes and their parts | 3 |

| Clay ceramic pipes | 2 |

| Reinforced concrete pipes and their parts | 1 |

| Artificial stone pipes | 1 |

| All kinds of steel and cast iron pipes and their parts | 1 |

| Glass pipes | 3 |

| Tubing | 2 |

| U | |

| All kinds of headwear in boxes | 3 |

| Textile waste | 3 |

| Charcoal | 3 |

| Coal and briquettes made from it | 1 |

| Brown coal | 2 |

| Mineral and chemical fertilizers | 1 |

| F | |

| All kinds of plywood | 1 |

| All kinds of fiber | 2 |

| Fibrolite | 2 |

| Shaped connecting fittings made of ferrous metals (elbow, socket, branch pipe, coupling, tee, flange, etc.) | 1 |

| Fresh fruits in boxes and baskets | 1 |

| The same, in sieves and without packaging | 2 |

| Sun-dried and dried fruits | 2 |

| X | |

| Brushwood | 4 |

| Baked bread in trays | 3 |

| Hearth baked bread in trays | 4 |

| Pressed cotton fiber | 1 |

| Same, unpressed | 2 |

| Imported pressed cotton fiber | 2 |

| Household refrigerators | 4 |

| C | |

| All kinds of cellulose | 2 |

| Cellophane in packs and bundles | 2 |

| Cement | 1 |

| Citrus fruits (oranges, lemons, tangerines, etc.) | 2 |

| H | |

| Any tea | 2 |

| Spare parts for machines, machines, equipment | 1 |

| Roofing tiles | 1 |

| Various suitcases and trunks | 3 |

| All cast iron, including foundry and pig iron | 1 |

| Sh | |

| End checker | 3 |

| A checker made of rough stone | 1 |

| All kinds of steel channels | 1 |

| Shavelin (insulating material) | 4 |

| Pressed wool | 2 |

| Same, unpressed | 3 |

| Raw silk | 1 |

| Metal spikes (rims), including those covered with rubber | 1 |

| Any slate | 1 |

| Metal cabinets | 2 |

| Undressed hides and skins | 2 |

| Same, unfinished | 3 |

| Slag | 4 |

| Any slag | 1 |

| Wooden sleepers, unimpregnated and impregnated | 1 |

| Reinforced concrete sleepers | 1 |

| Dry plaster in tiles | 1 |

| Veneer | 2 |

| SCH | |

| All crushed stone | 1 |

| Bristle | 2 |

| Various chips in packs, bundles | 2 |

| The same, in bulk | 3 |

| Wooden shields | 3 |

| E | |

| Ebonite | 2 |

| Galvanic elements | 2 |

| Electrodes in packs | 2 |

| Electrical equipment | 2 |

| Eternit (asbestos-cement tiles) | 1 |

| Various extracts | 2 |

| I | |

| All kinds of fresh berries | 2 |

| All kinds of pesticides | 3 |

| All kinds of poultry eggs | 2 |

Procurement, storage and transportation costs in estimates

Most often, when calculating estimate documentation, we use the term transportation and procurement costs (TPP) - this concept, in addition to the above costs, can be divided into smaller, but important costs associated with the procurement and delivery of material assets (goods, raw materials, materials, tools). However, this term is more applicable to accounting than to budgeting, but it is often considered in this form.

Transportation and procurement costs include:

- - costs of loading, transportation and unloading, provided that they are not included in the price of the goods;

- — expenses for procurement, storage of materials, maintenance of warehouses, wages of workers associated with procurement, storage, shipment;

- — costs of paying for the services of intermediary organizations;

- — costs of payment for storage of materials at suppliers’ warehouses, railway stations, ports, marinas;

- — expenses for paying interest on loans associated with the purchase of goods;

- - and other expenses.

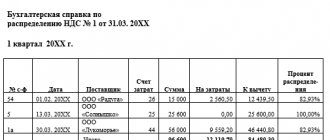

The amounts of transportation costs for materials and equipment in the estimate, procurement and warehouse, as well as packaging, containers and props can be summarized as a single reference in the following table:

Table No. 1. Amounts of procurement, storage and transportation costs in the estimate documentation

| № | Cost item | Method for determining estimated prices and the amount of transportation costs. |

| 1 | Fare | 1. Collections of estimated prices (FSTSpg, construction price). 2. Calculation of the cost of transportation costs based on actual expenses. 3. Calculation according to Order of the Ministry of Construction of Russia No. 517/pr dated 09/04/2019. 4. In the absence of standards, transport costs can be accepted in the amount of 3 - 6% of the selling price. |

| 2 | Procurement and storage costs | 1. For budget construction - 1.2% of the cost of materials and equipment. |

| 3 | Expenses for packaging, containers, props | 1. If the cost is not included in the price and in the absence of detailed information about the characteristics of the container and packaging, the cost can be calculated as a percentage of the cost of materials and equipment: - large technological equipment - from 0.1% to 0.5%; — machine equipment – up to 1%; - electrical equipment, instrumentation and automation, tools - up to 1.5%. |

Expense rate

It is possible to take into account transportation and procurement costs in full directly as part of the cost price in cases where the company has small volumes of supplies. Difficulties arise due to possible delays in the provision of primary documentation. When working with several product groups, it is recommended to keep separate records of such costs and distribute them proportionally among manufactured products. The TZR norm, which will be attributable to individual material assets, is calculated using the formula:

Distribution percentage = (Inventory and equipment recorded on the 1st day of the reporting period + Amount of Inventory and equipment for the entire analyzed period) / (Material assets at the end of the period + Material consumption for the reporting interval) * 100.

If the amount of transportation and procurement costs is within 10% of the total cost of the material assets available to the enterprise, it is recommended to write off the amount of such costs in full to expense accounts.

How are TZR taken into account when applying accounting prices ?