Where can I find financial reporting forms for business?

By law, all enterprises that issue shares must disclose their information (in accordance with the requirements of paragraph 1.7. “Regulations on the disclosure of information by issuers of equity securities”, approved by Order of the Federal Service for Financial Markets of the Russian Federation dated October 4, 2011 No. 11-46 /pz-n).

All financial statements of joint stock companies can now be viewed. Public reporting means that it is publicly available to all users. For example, on enterprise websites you can see the “Information Disclosure” section and there, as a rule, there is a “Shareholders and Investors” tab. It will contain the financial results of the year or financial reports by quarter.

The figure below, on the website of JSC Tupolev, shows the financial statements of the enterprise for 2013. There are 4 forms of financial reporting. An audit report is a fact of verification by an independent body of financial statements. There's no point in watching it for us. We also don’t really need explanations for the balance sheet to carry out financial analysis.

Forms of financial (accounting) statements of JSC Tupolev on the company website

Transformation of the old form of financial reporting into a new one (after 2011)

After 2011, new forms of financial reporting appeared. It is often necessary to convert old forms of financial (accounting) reporting to new ones. Below is a table of translation (Forms No. 1 and Forms No. 2 into the new forms “Balance Sheet” and “Financial Results”). The old lines (designated by Order of the Ministry of Finance No. 66n) are matched with new lines (designated by Order of the Ministry of Finance No. 67n).

| Indicator name | Old codes (before 2011) | New codes (after 2011) |

| Intangible assets | 110 | 1110 |

| Fixed assets | 120 | 1130 |

| Construction in progress | 130 | |

| Profitable investments in material assets | 135 | 1140 |

| Long-term financial investments | 140 | 1150 |

| Deferred tax assets | 145 | 1160 |

| Other noncurrent assets | 150 | 1170 |

| FIXED ASSETS | 190 | 1100 |

| Reserves | 210 | 1210 |

| VAT on purchased assets | 220 | 1220 |

| Accounts receivable (more than a year) | 230 | |

| buyers and customers | 231 | |

| Accounts receivable (less than a year) | 240 | 1230 |

| buyers and customers | 241 | |

| Short-term financial investments | 250 | 1240 |

| Cash | 260 | 1250 |

| Other current assets | 270 | 1260 |

| CURRENT ASSETS | 290 | 1200 |

| ASSETS total | 300 | 1600 |

| Authorized capital | 410 | 1310 |

| Extra capital | 420 | 1350+1340 |

| Reserve capital | 430 | 1360 |

| reserves formed in accordance with legislation | 431 | |

| reserves formed in accordance with the establishment. documents | 432 | |

| Retained earnings (uncovered loss) | 470 | 1370 |

| CAPITAL AND RESERVES | 490 | 1300 |

| Loans and credits (long-term) | 510 | 1410 |

| Other long-term liabilities | 520 | 1450 |

| LONG TERM DUTIES | 590 | 1400 |

| Loans and credits (short-term) | 610 | 1510 |

| Accounts payable | 620 | 1520 |

| debt to the government off-budget funds | 625 | |

| Debt to participants (founders) for payment of income | 630 | |

| revenue of the future periods | 640 | 1530 |

| Reserves for upcoming expenses and payments | 650 | 1540+1430 |

| Other current liabilities | 660 | 1550 |

| SHORT-TERM LIABILITIES | 690 | 1500 |

| LIABILITIES total | 700 | 1700 |

| Sales proceeds (excluding VAT, excise taxes...) | 010 | 2110 |

| Cost of goods, products, works, services sold | 020 | 2120 |

| Gross profit | 029 | 2100 |

| Business expenses | 030 | 2210 |

| Administrative expenses | 040 | 2220 |

| Profit (loss) from sale | 050 | 2200 |

| Interest receivable | 060 | 2320 |

| Percentage to be paid | 070 | 2330 |

| Income from participation in other organizations | 080 | 2310 |

| Other income | 090 | 2340 |

| Other operating expenses | 100 | 2350 |

| Profit (loss) before tax | 140 | 2300 |

| Current income tax | 150 | 2410 |

| Net profit | 190 | 2400 |

How will the financial statements change?

It is mandatory to fill out the amended forms at the end of 2011. Interim reports for the first quarter, half a year and nine months of 2011 can be submitted on both old and new forms at the request of the accountant. Reporting for 2010 should be done using the old form.

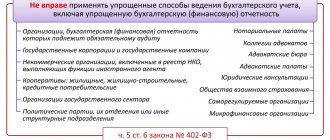

New reporting requirements

The financial reporting forms approved by commented order No. 66n are not “recommended”. This means that they are intended for all companies without exception. True, the accountant can choose the level of detail of the indicators at his own discretion. For example, he has the right to decipher what management expenses consist of by entering additional “including” lines in the profit and loss statement.

In reports intended for tax authorities and statistical authorities, you need to enter an additional column “Code”. It is needed to assign each indicator its own code according to the list given in Order No. 66n. For example, the “cash” line on the balance sheet is labeled “1250,” and revenue on the income statement is labeled “2110.”

As it was

Previously, annual reporting generally consisted of a balance sheet (Form No. 1), a profit and loss statement (Form No. 2), a statement of changes in capital (Form No. 3), a cash flow statement (Form No. 4), and an appendix to the balance sheet (form No. 5) and explanatory note. In addition, enterprises subject to mandatory audit were required to provide an audit report.

How did it happen

According to the commented order No. 66n, the annual reporting includes a balance sheet, a profit and loss account, as well as reports on changes in capital and cash flows. Plus, public organizations that do not conduct commercial activities must submit a report on the intended use of the funds received.

The supplement to the balance sheet in Form No. 5 has been cancelled. Now additional information needs to be presented in the form of so-called explanations. There is no special form provided for them; the company, at its own choice, can either group the explanations in tables or present them in text form.

The auditors' report is not mentioned in the new order. However, companies subject to mandatory audit are still required to submit this document. This rule is enshrined in paragraph 2 of Article 3 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”.

The explanatory note in the commented order is also not named. However, it should not be abandoned, because the note appears in the accounting law and in some other regulatory legal acts.

In particular, in PBU 22/2010 “Correcting errors in accounting and reporting.”

It says that if significant errors from previous periods are discovered, the explanatory note must indicate the nature of the inaccuracy and the amount of the adjustment.

Final reports must still be submitted to the Federal Tax Service within 90 days after the end of the year.

Composition of interim reporting

As before, enterprises will report on the results of the quarter, half a year and nine months. The scope of interim reporting remained the same - balance sheet and profit and loss account (clause 49 of PBU 4/99 “Accounting statements of an organization”). The deadlines for submitting to the tax office have not changed: quarterly reports must be submitted within 30 days of the end of the quarter.

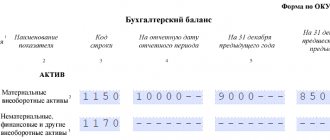

Balance

A distinctive feature of the new balance sheet is the increased number of columns dedicated to historical indicators. Previously, there were only two columns: “At the beginning of the reporting year” and “At the end of the reporting period.” They indicated data as of January 1 and March 31 (June 30, September 30, December 31) of the current year, respectively.

There are now three columns: “As of the reporting date,” “As of December 31 of the previous year,” and “December 31 of the year preceding the previous year.” Thus, when preparing a balance sheet for the first quarter of 2011, the accountant will need data as of March 31, 2011, December 31, 2010, and December 31, 2009, respectively.

An additional column “Explanations” has appeared. It should indicate the number of explanations that relate to a particular line of the balance sheet. Let's assume that information about the availability and movement of fixed assets is grouped in table 2.1. Then in the balance sheet before the line “Fixed assets” you need to put “2.1”.

Some balance sheet lines have been renamed (for example, the “Loans and Credits” indicator is now called “Borrowed Funds”). The section devoted to balances on off-balance sheet accounts has been eliminated. However, the accountant has the right to restore it if he deems it necessary.

Gains and losses report

In the new profit and loss statement, as in the well-known Form No. 2, you need to indicate information for the reporting period of the current year and for the same period last year.

The “Explanations” column has also been added here. You need to fill it out in the same way as in the balance sheet. That is, indicate the number of explanations corresponding to one or another line of the profit and loss statement. So, if explanations regarding revenue are drawn up in a table with number 10.5, then before the line “Revenue” you must put “10.5”.

The new composition of indicators is similar to what was given in form No. 2. However, there are minor differences. In particular, “Change in deferred tax liabilities” and “Change in deferred tax assets” have been added to the lines intended for permanent tax liabilities and assets.

A new indicator “Cumulative financial result of the period” has appeared. To find it, you need to add up the net profit (loss), the result from the revaluation of non-current assets and the result from other operations not included in the net profit (loss) of the reporting period.

The table where individual profits and losses were deciphered (fines and penalties, losses from previous years, debt write-off, etc.) has been abolished. But if such detail seems important to the accountant, he can leave it.

Statement of changes in equity

It consists of three sections. The first is devoted to the movement of capital in the reporting period, as well as in the two previous years.

This section lists the indicators for increasing and decreasing capital separately for authorized, additional and reserve capital, for retained earnings (uncovered loss), as well as for treasury shares purchased from shareholders. In the previous version of the report, shares purchased from shareholders were not included in a separate column.

The second section is fundamentally new; there was nothing like this in the old report. The section is called “Adjustments due to changes in accounting policies and correction of errors.”

Information about adjustments and corrections for the year preceding the reporting period is placed here.

Among other things, this table provides information on significant errors of previous years identified in the reporting period and reflected in account 84 in accordance with PBU 22/2010.

The third section - “Net assets” - consists of three columns where you need to indicate net assets as of December 31 of the current year, the previous year, and the year preceding the previous one.

The “Reserves” section, which existed in the old version of the report, has now been eliminated.

Cash flow statement

In the new form, as in the old version, there are two columns: for indicators of the reporting period and for indicators of the same period of the previous year. The report itself still consists of three blocks: cash flow for current activities, for investing activities and for financing activities. For each block you need to list the amounts received and spent.

True, the breakdown by article has changed somewhat. For example, in the previous form, accountants separately indicated such investment income as proceeds from the sale of fixed assets, from the sale of securities, dividends received, interest received, acquisition of subsidiaries, etc.

There are only three lines left in the new form: proceeds from the sale of fixed assets and other property, dividends, interest on financial investments and other income.

After filling out each block, you need to calculate the result, that is, the difference between the funds received and funds sent. Previously, such lines were called “Net Cash”.

Explanations

The purpose of the explanations is to decipher the lines of the balance sheet and income statement so that users of the statements are left with no questions about how this or that figure was derived. Previously, such transcripts were provided in form No. 5; now there is no special form for them.

The accountant has the right to format the explanations in the way that is convenient for him. If the chief accountant chooses a tabular format, he can use the sample compiled by the authors of Order No. 66n. The sample is a series of tables where data is grouped for various accounts: fixed assets, intangible assets, inventories, accounts receivable, etc.

For example, a table for “receivables” consists of columns “At the beginning of the year”, “Changes for the period” and “At the end of the period”. The columns separately indicate the amounts of short-term and long-term debts, amounts accounted for under contracts and included in the reserve, etc. Those who prefer the text format of the explanations must show in words and figures what transactions were completed during the year.

In essence, this will be a series of separate fragments of text, each of which is dedicated to its own account: fixed assets, intangible assets, inventories, debt, etc.

Regardless of the chosen format, it is important that each piece of explanation (be it a table or part of the text) has its own number. It must be indicated before the corresponding line of the balance sheet or income statement so that the user can easily find the necessary explanations.

Balance sheet: line 1150

In the balance sheet form approved by Order of the Ministry of Finance dated July 2, 2010 No. 66n, line 1150 is called “Fixed assets.”

As the name suggests, line 1150 as of the reporting date reflects the amount of the organization’s fixed assets. But here it is necessary to take into account several features.

Firstly, line 1150 does not take into account all fixed assets, but only those reflected in account 01 “Fixed assets” (Order of the Ministry of Finance dated October 31, 2000 No. 94n). Let us recall that fixed assets that are intended exclusively for provision by an organization for a fee for temporary possession or use for the purpose of generating income are accounted for in account 03 “Income-generating investments in material assets” (clause 5 of PBU 6/01, Order of the Ministry of Finance dated October 31, 2000 No. 94n). And they are reflected in the balance sheet on line 1160 “Profitable investments in material assets” (Order of the Ministry of Finance dated July 2, 2010 No. 66n).

Secondly, fixed assets in the balance sheet, like all other indicators, are reflected in a net valuation (clause 35 of PBU 4/99). In relation to fixed assets, this means that they are shown on line 1150 at their residual value.

As for accounting accounts, to fill out line 1150 you need to subtract from the debit balance of account 01 the credit balance of account 02 “Depreciation of fixed assets” for the same reporting date. Naturally, depreciation needs to be deducted only that which relates to fixed assets accounted for in account 01. After all, for profitable investments in material assets accounted for in account 03, depreciation is also accrued for account 02. And since the debit balance of account 03 is not included in line 1150 , then the depreciation related to them should also be excluded from the balance of account 02.

We talked about deciphering all the lines of the balance sheet in this material. You can see an example of filling out a balance sheet using conventional digital data.

Let's get acquainted with the balance sheet items for 2017–2018: their codes and explanations

Everyone who has ever held a balance sheet in their hands, much less drawn it up, paid attention to the “Code” column.

Thanks to this column, statistical authorities are able to systematize the information contained in the balance sheets of all companies. Therefore, it is necessary to indicate codes in the balance sheet only when this report is submitted to state statistics bodies and other executive authorities (Article 18 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, clause 5 of the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n). If the balance is not annual and is needed only by owners or other users, it is not necessary to indicate the codes. In the balance sheet, line codes from 2014 must correspond to the codes specified in Appendix 4 to Order No. 66n. At the same time, outdated codes from the expired order No. 67n with the same name, dated July 22, 2003, are no longer applied.

It is not difficult to distinguish previously used codes from modern ones - by the number of digits: modern codes are 4-digit (for example, lines 1230, 1170 of the balance sheet), while outdated ones contained only 3 digits (for example, 700, 140).

For information on what the form of the current balance sheet with line codes looks like, read the article “Filling out Form 1 of the balance sheet (sample).”