| In order to correctly calculate the amount of VAT payable to the budget, you need to correctly and timely determine the tax base. It would seem that nothing could be simpler: everything a taxpayer needs to know is in the provisions of the Tax Code of the Russian Federation (Articles 153 – 162). | Articles on the topic: —Fixed assets: assessing tax risks. —How to reflect VAT in financial statements —New in the Tax Code since 2014 |

However, oddly enough, there is still an opinion among managers that, for example, in trade this tax is levied on a markup. They firmly believe in this and use their “knowledge” when planning expenses. It can be extremely difficult to convince them, and the importance of this task often fades into the background for the accountant, but when, at the end of the period, “suddenly” the amount of VAT payable appears that does not correspond to the initial calculations of the entrepreneur, for some reason it is the accounting service employee who is to blame. To avoid such misunderstandings, in the author’s opinion, it is necessary to conduct a small educational program with the manager on the issue of determining the tax base for VAT.

Determination of the tax base.

Perhaps we should start with the basics: the tax base in accordance with paragraph 1 of Art. 53 of the Tax Code of the Russian Federation refers to the cost, physical or other characteristics of the taxable object

, which for VAT purposes is the transfer of ownership of goods, or the transfer of the results of work, or the provision of services on a paid or gratuitous basis in the territory of the Russian Federation (clause 1 of Article 146 of the Tax Code of the Russian Federation) [1]. Since we are talking about a cost characteristic, in most cases the tax is calculated based on the cost of those goods (works, services) that are sold (transferred). When determining the tax base, revenue received from the sale of goods (work, services) is determined based on all income of the taxpayer associated with payments for the specified goods (work, services), received by him both in cash and in kind, including payment securities (clause 2 of Article 153 of the Tax Code of the Russian Federation) in total for all types of transactions taxed at the same tax rate (clause 1 of Article 153 of the Tax Code of the Russian Federation).

In general, the basis for calculating VAT will be the contract price of the goods (work, services) sold, taking into account excise tax (for excisable goods) without including tax (clause 1 of Article 154 of the Tax Code of the Russian Federation), that is, VAT is charged on top of the price

goods sold, with the exception of goods accounted for by the seller at a cost including paid tax (for example, initially purchased for the implementation of VAT-free activities - clause 3 of Article 154 of the Tax Code of the Russian Federation), and certain categories of goods purchased from individuals who, as It is known that they are not VAT payers (clauses 4 and 5.1 of Article 154 of the Tax Code of the Russian Federation), in such cases the tax base is actually recognized as a markup (the difference between the selling price (including VAT) and the purchase price [2]).

An organization that applies only the general taxation system sells a consignment of goods taxed at a VAT rate of 18%. The price of the lot is 400,000 rubles, excluding tax.

In order to determine the tax base for VAT, in this case, only the place of sale of the goods matters. By default, this is the territory of the Russian Federation. Thus, on the basis of paragraph 1 of Art. 154 of the Tax Code of the Russian Federation, the tax base is the price of the batch - 400,000 rubles. The amount of VAT calculated on the sale of the specified batch will be 72,000 rubles. (RUB 400,000 x 18%). And the cost of goods will only matter for determining the income tax base. The following entries should be made in the seller's accounting:

| Contents of operation | Debit | Credit | Amount, rub. |

| Revenue received from the sale of a consignment of goods is reflected | 62 | 90 revenue | 472 000 |

| VAT is charged on the sales amount | 90 VAT | 68 VAT | 72 000 |

If a product is sold that was previously purchased for VAT-free transactions, its accounting value will be important for tax purposes.

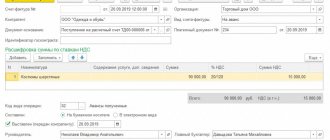

The organization sells property previously acquired to carry out VAT-free transactions, accepted for accounting at a price that includes the amount of tax, 354,000 rubles. The selling price of the property according to the agreement with the buyer is 472,000 rubles, including VAT.

In this case, the tax base is the inter-price difference [3] - 118,000 rubles. (472,000 - 354,000), but the VAT rate will be calculated (18/118) due to the direct indication of clause 4 of Art. 164 Tax Code of the Russian Federation. Thus, the seller must calculate 18,000 rubles for payment to the budget for the specified operation. (RUB 118,000 x 18/118). In case of sale of property at a price below the accounting tax base for VAT will be zero.

In addition, when planning expenses for paying VAT, you need to remember that the amounts of advance payment received by the organization on account of future deliveries of goods are also subject to tax (we are, of course, talking about those goods whose sales are not exempt from taxation by the provisions of Chapter 21 of the Tax Code RF). That is, if an organization operates on an advance payment basis, it will determine the VAT base twice: at the time of receiving the advance payment and at the time of shipment of the goods (clauses 1 and 14 of Article 167 of the Tax Code of the Russian Federation). In the event that the shipment occurs in a subsequent tax period, the planned increase in expenses for payments to the budget is possible.

VAT on prepayment is charged at the estimated rate (18/118 or 10/110), with the rate of 10/110 applied in cases where the prepayment is received for goods that are taxed at the time of shipment at a rate of 10%.

The organization received an advance payment for the future supply of goods, the sale of which is subject to VAT at a rate of 18%, in the amount of 300,000 rubles.

Regardless of whether the prepayment is full or partial, the taxpayer on the day the funds appear in his current account is obliged to calculate the amount of tax from the received amount (45,763 rubles [4] (300,000 rubles x 18/118)), and in accounting make the following entries:

| Contents of operation | Debit | Credit | Amount, rub. |

| The advance payment amount has been received from the buyer | 51 | 62 advance | 300 000 |

| VAT is charged on the amount of the received prepayment | 76 av | 68-VAT | 45 763 |

Later, upon shipment, it will be possible to reduce the calculated amount of tax by the amount of “advance” VAT, but, as already noted, this desired moment may come in another tax period.

12. OBJECT OF TAXATION OF VALUE ADDED TAXObject of VAT taxation

– operations for the sale of goods (works, services) on the territory of the Russian Federation, including free of charge; transfer of goods (performance of work, provision of services) for one’s own needs, expenses for which are not deductible when calculating corporate income tax; carrying out construction and installation work for own consumption; import of goods into the customs territory of the Russian Federation.

The Tax Code of the Russian Federation provides for exceptions from the list of objects subject to VAT. Transactions that are not recognized by tax legislation as the sale of goods (work or services) are not subject to VAT. To them in accordance with paragraph 3 of Art. 39 of the Tax Code of the Russian Federation includes operations:

– related to the circulation of Russian or foreign currency;

– transfer of property to legal successors during reorganization;

– transfer of property to non-profit organizations for the implementation of their main statutory activities not related to entrepreneurship;

– transfer of property of an investment nature (contributions to the authorized capital of business companies and partnerships, under a simple partnership agreement, share contributions to mutual funds of cooperatives);

– transfer of residential premises to individuals in houses of the state (municipal) housing stock during privatization;

– seizure of property by confiscation, inheritance of property, conversion into the property of other persons of ownerless and abandoned things, ownerless animals, finds, treasure in accordance with the Civil Code of the Russian Federation. In addition, the following are not subject to VAT:

– transfer, free of charge, of social, cultural, housing and communal services, roads, electrical networks, substations, gas networks, water intake structures and similar facilities to state (local) authorities;

– transfer of property of state (municipal) enterprises purchased through privatization;

– works, services of state (local) bodies within the framework of fulfilling their powers;

– transfer of fixed assets to state (local) bodies free of charge;

– operations for the sale of land plots;

– transfer of the organization’s property rights to its legal successor.

The place of sale of goods is recognized as the territory of the Russian Federation if one of the following circumstances exists: 1) the goods are located on the territory of the Russian Federation and are not shipped or transported; 2) the goods at the time of the start of shipment or transportation are located on the territory of the Russian Federation.

The territory of the Russian Federation is recognized as the place of implementation of works and services if:

– works (services) are directly related to real estate located on the territory of the Russian Federation;

– works (services) are directly related to movable property, aircraft, sea vessels and inland navigation vessels located on the territory of the Russian Federation;

– services are actually provided on the territory of the Russian Federation in the field of culture, art, education, physical culture, tourism, recreation and sports;

– the buyer of works (services) operates on the territory of the Russian Federation;

– when transferring ownership or assignment of patents, licenses or other similar rights; provision of consulting, legal, accounting services, etc.;

– the activities of an organization or individual entrepreneur that performs work (provides services) are carried out on the territory of the Russian Federation.

Table of contents

Increasing the tax base.

But the least amenable to planning, perhaps, should be recognized as VAT, calculated on amounts that increase the tax base in accordance with paragraph 1 of Art. 162 of the Tax Code of the Russian Federation. This article establishes a list of situations in which amounts of money received by the seller must be included in the tax base of the tax period in which these amounts were actually received [5]. And although the specific weight of this “item of tax expenses” can hardly be large, I think it still makes sense to dwell on it in detail: there is too much in connection with the application of Art. 162 of the Tax Code of the Russian Federation, questions and disputes arise.

First of all, it is important to remember that the VAT tax base increases by amounts received by the seller only if they are related to payments for goods (work, services) sold, that is, they are actually part of the proceeds received from sales. Let us carefully consider the mentioned list. According to paragraphs. 2 p. 1 art. 162 of the Tax Code of the Russian Federation, the tax base for VAT is increased by the amounts of money received for goods (work, services) sold: in the form of financial assistance; to replenish special purpose funds; to increase income; otherwise related to payment for goods (work, services) sold.

Financial assistance to the seller associated with payment for the goods purchased from him is, perhaps, stronger than Goethe’s Faust... Replenishment of funds specially created by the seller, obviously for the purpose of accumulating funds to pay off customers’ debts, is from the same opera, and within the framework We are also not particularly interested in this article. But the funds received by the seller, which increase his income from the transaction, as well as otherwise related to payment for goods sold, are closer to the topic. What do you mean by increasing income? More specifically, what buyer payments can actually increase the seller's income received from the sale? The only things that come to mind are compensation, sanctions, and bonus payments, and perhaps those associated with an increase in the price of the product. As for the increase in price, the provisions of Art. 162 of the Tax Code of the Russian Federation do not apply; they are directly regulated by clause 10 of Art. 154 of the Tax Code of the Russian Federation (but more on that later), but the remaining types of payments can be considered in the context of using precisely the rules established by Art. 162 of the Tax Code of the Russian Federation.

For example, according to financiers, VAT is imposed on funds that an organization performing work (selling goods, providing services) receives from a customer (buyer) as compensation for its expenses for the execution of a contract, including travel expenses, transport, and insurance [6 ]. But if the compensation payments are not related to the sale (for example, amounts received by the lessor of the vehicle as compensation for administrative fines paid for violations committed by the lessee [7], or as compensation for losses of the seller in connection with the buyer’s refusal of the goods [8 ], as well as the amount of compensation for damaged (lost) property [9]), they do not need to be included in the VAT tax base.

Another example: pp. 4 paragraphs 1 art. 162 of the Tax Code of the Russian Federation is prescribed to increase the base by the amount of insurance payments received by the seller, but only under insurance contracts for the risk of non-fulfillment by the buyer of contractual obligations and provided that the insured contractual obligations provide for the supply by the insured of goods (works, services), the sale of which is subject to taxation (very, by the way , a strange norm, if you think about it: the seller charged VAT upon shipment, the buyer did not pay him for the delivered goods, the insurance company compensated the seller for the cost of this goods and for some reason the seller must calculate the tax again - but the law is the law [10]), insurance payments , received by the taxpayer for other reasons, for example, upon the occurrence of an insured event as a result of an accident or theft, are not included in the tax base [11].

With bonuses, in principle, everything is clear: if the seller receives additional remuneration for the work done (service provided or, for example, for the quality (or quantity) of the goods delivered), then the amount of such remuneration and the seller’s income increases, and is associated with the sales operation directly, therefore, there is no reason not to apply the provisions of paragraphs to these receipts. 2 p. 1 art. The taxpayer does not have Article 162 of the Tax Code of the Russian Federation [12].

Now let’s move smoothly to sanction payments, that is, penalties, which, according to Art. 330 of the Civil Code of the Russian Federation includes fines and penalties. At first glance, the amount of penalties collected from buyers can be qualified as amounts related to payment for goods, work or services (which cannot be said about the same sanctions applied to the seller). And they definitely increase the recipient’s income - what’s not a reason to increase the VAT tax base? For a long time, controllers (at the instigation of financiers) were guided by precisely this logic, but now they are instructed to more carefully assess the issue of including fines in the VAT tax base: to consider the financial sanctions applied to the buyer from the point of view of their relationship to the pricing element [13 ]. Ministry of Finance officials include fines imposed on the buyer of transportation services for excess downtime of vehicles as one of these elements [14]. According to the author, this position is very controversial, since, from the point of view of the arbitrators, penalties and other types of liability provided for by civil law, by virtue of the provisions of Chapter. 21 of the Tax Code of the Russian Federation are not recognized as subject to VAT [15], therefore, the chances of proving in court the unjustified inclusion of the amounts of sanction payments in the VAT tax base are very high.

There is another type of payment to which financiers and local tax authorities are persistently trying to apply the provisions of paragraphs. 2 p. 1 art. 162 of the Tax Code of the Russian Federation. We are talking about funds received by the seller from the buyer as interest for providing a commercial loan in the form of installment payment for the property being sold [16]. It would seem that how many times have they heard in response from arbitrators that the amounts of interest accrued for the provision of installment plans are payment for a commercial loan, and not for the sale of property, and therefore are not included in the VAT tax base [17], controllers continue to tax additional assessments, taxpayers – to challenge such decisions of fiscal officials, and arbitration practice – to be replenished with decisions made in favor of taxpayers [18].

By the way, about percentages. According to paragraphs. 3 p. 1 art. 162 of the Tax Code of the Russian Federation, the tax base for VAT is increased by monetary amounts in the form of a percentage (discount) on those received as payment for goods sold (work, services)

[19] bonds and bills, as well as in the form of interest on trade credit. Moreover, these amounts are subject to taxation only when their amount exceeds the amount of interest calculated in accordance with the refinancing rates in force in the periods for which such calculations are made, and the tax is calculated only on the amount of this excess.

In general, the list of situations when the amount of funds received increases the tax base of the seller is open, but, as already mentioned, the transferred amounts are only taxed when they are associated with the sale of goods (work, services), moreover, subject to taxation (not exempt from taxes) VAT. This is stated in paragraph 2 of Art. 162 of the Tax Code of the Russian Federation. Such amounts are taxed at the calculated rate of 18/118 or 10/110 (clause 4 of Article 164 of the Tax Code of the Russian Federation), but in the case where the sales operation is subject to VAT at a rate of 0%, the amounts of money associated with the payment for these goods (works, services) are taxed at a zero rate [20].

The organization received a bonus from the customer in the amount of 295,000 rubles for early completion of work.

On the day the remuneration amount appears on the current account, the organization must calculate VAT on this receipt (45,000 rubles (295,000 rubles x 18/118)) and reflect this operation in accounting as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| Received bonus amount from the customer | 51 | 76 | 295 000 |

| The amount of the premium is reflected in other income | 76 | 91 income | 295 000 |

| VAT charged on the premium amount | 91 consumption | 68 VAT | 45 000 |

VS: Purchasing goods from a bankrupt enterprise does not deprive the buyer of the right to VAT deductions

On March 3, the Supreme Court issued Ruling No. 301-ES20-19679 in case No. A82-4848/2018 regarding the validity of the application of VAT deductions by an organization that purchased milk from a bankrupt enterprise.

The courts agreed with the position of the tax authorities on the illegality of the deduction

When calculating VAT for the second quarter of 2021, MolVest LLC accepted for deduction a tax amount of -1.7 million rubles presented when purchasing milk from Mikhailovskoye OJSC on the basis of a supply agreement. At the time of conclusion of the contract, the supplier of dairy products had already been declared bankrupt (case No. A82-3011/2013).

Subsequently, the Interdistrict Inspectorate of the Federal Tax Service No. 2 for the Yaroslavl Region conducted a desk audit of the MolVest VAT declaration for the second quarter of 2021, as a result of which the company was fined 21 thousand rubles. according to paragraph 1 of Art. 122 of the Tax Code of the Russian Federation and charged additional VAT in the amount of the tax deduction received, as well as penalties. The tax authority considered that the disputed amount of VAT was accepted for deduction in violation of the requirements of sub. 15 paragraph 2 art. 146 of the Tax Code, according to which transactions on the sale of property and (or) property rights of debtors declared bankrupt are not recognized as subject to VAT. Thus, the inspectorate indicated that there were no legal grounds for a tax deduction.

Since the regional department of the Federal Tax Service upheld the inspector’s decision, MolVest challenged it in arbitration court. However, the court refused to satisfy the demands; its decision stood on appeal and cassation. Recognizing the inspection's decision as legal, the courts proceeded from the fact that in the case under consideration, at the time of business transactions, the company was informed that the goods were being purchased from a bankrupt enterprise, and with due diligence, the taxpayer could obtain information about the financial position of the counterparty from publicly available sources . In addition, they noted that the Mikhailovskoye company did not pay to the budget the amount of VAT charged on the sale of milk, since in its updated declarations for this tax there were no corresponding accruals of tax amounts.

The Supreme Court recalled the position of the Constitutional Court

Next, the MolVest society appealed for protection of its rights to the Supreme Court of the Russian Federation, whose Judicial Collegium for Economic Disputes agreed with the arguments of the cassation appeal. At the same time, the Court indicated that the issue of the legality of applying tax deductions by buyers in cases where the supplier was declared insolvent was the subject of consideration by the Constitutional Court in Resolution No. 41-P of December 19, 2021.